What is U.S. B2B Payments Transaction Market Size?

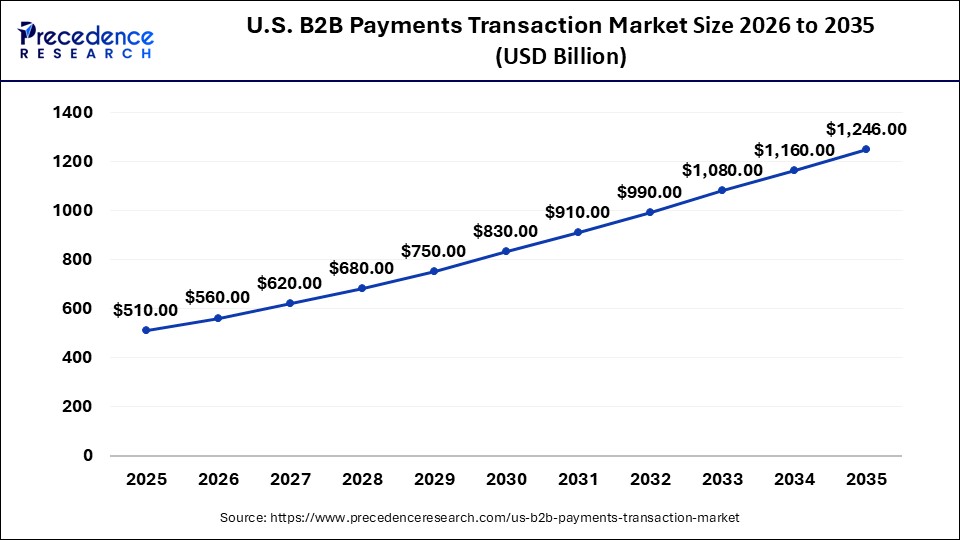

The U.S. B2B payments transaction market size is estimated at USD 510 billion in 2025 and is predicted to increase from USD 560 billion in 2026 to approximately USD 1,246 billion by 2035, expanding at a CAGR of 9.34% from 2026 to 2035. Integration of digitization and automation in the business payments are driving the growth of the market.

Market Highlights

- By payment type, the domestic payment dominated the market with the largest share in 2025.

- By payment mode, the ACH segment dominated the U.S. B2B payments transaction market with the largest share in 2025.

- By enterprise size, the large enterprise segment dominated the market in 2025.

- By industry, manufacturing segment dominated the market with the highest market share in 2025.

- By industry, the BFSI was the second largest segment while it held a considerable share of the market in 2025.

What is the Role of AI in the U.S. B2B Payments Transaction Market?

Traditional billing involves manual invoice generation, payment tracking, and error checking; AI billing automates these tasks using machine learning algorithms and data analytics. This leads to faster processing times, increased efficiency, and reduced errors. AI in accounts payable uses advanced technologies like machine learning (ML) and natural language processing (NLP) to automate tasks, including tracking expenses, managing payments, extracting invoice data from different formats, and processing invoices.

A financial professional can use Artificial Intelligence to act as a security system that continuously monitors any transactions, communication, and activities. Projects include both material generated by AI and material originally created by the author can receive copyright protection. AI-based automation speeds up payment processing, reducing transaction times and increasing efficiency. Automating routine tasks and improving operations through AI reduces operational costs for businesses.

Market Overview

B2B payments are the process of payment from business to business for the supply of services and goods. It can be the one-time payment or the recurring as per the agreement between the businesses. There are the major four type of the B2B payments methods are ACH credits, domestic wire transfer, cheque, and others. Technological adoption in the United States is transforming the payment process which is observed to supplement the market's growth. The evolution in the digital payment transforms the payment methods makes it faster, efficient, safer, and cost effective that contributed to the expansion of the U.S. B2B payments transaction market.

U.S. B2B Payments Transaction Market Growth Factors

- The increasing shift in the lifestyle and the rising adoption of the digital payment across the several industries are driving the expansion of the U.S. B2B payments transaction market.

- The digital revolution around the country with the rising demand for paperless payment methods like electronic mode of payment accelerates the growth of the market.

- The rising integration of artificial intelligence in the business operation results in the digitization in the payment process that leads to the expansion of the market.

- The digitization in the payment methods like digital wallets, cards, and bank transfer results in higher efficiency in the payment transaction methods with the rapid transfer of money in the most secure way that enhances the growth of the market.

- The integration of technologies in the businesses the rising implementation of the digital payments in the various industries like e-commerce, and retail that boosts the growth of the U.S. B2B payments transaction market.

Market Trends

- Technological innovation in B2B digital payment systems

- Rising online marketplaces and e-commerce platforms

- Rising globalization driving cross-border transactions

- Digital payments provide improved cost savings and efficiency

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 510 Billion |

| Market Size in 2026 | USD 560 Billion |

| Market Size by 2035 | USD 1,246 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.34% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Payment, Payment Mode, Enterprise Size, and Industry, and region |

Market Dynamics

Drivers

Growth of B2B e-commerce market

The rising B2B e-commerce activities in the United States is driving the demand for the B2B payment transaction process. B2B e-commerce is the online shopping experience that takes place between the two individual businesses which allows the businesses to buy or sell the products or services electronically. B2B e-commerce application transforms business operation and makes it rapid, efficient, and budget friendly. The rapidly growing B2B eCommerce industry allows the business to access new customers and suppliers, regardless of their location. The rising adoption of advanced digital technologies into the business is accelerating the expansion of the B2B e-commerce industry.

There is different type of the B2B ecommerce models as per the requirement and goals of the business, some of the popular types are direct-to-business (D2B), marketplaces, procurement, e-procurement, B2B2C, wholesale business, manufacturer business, and distributors business. The expansion of the B2B e-commerce industry is driving the requirement for the safe and efficient payment transaction process that accelerating the growth of the U.S. B2B payments transaction market.

Restraint

Security threats

Security incidents can disrupt B2B payment processes, causing delays, disruptions, and financial losses for businesses. Downtime resulting from security breaches can impact business operations, customer relationships, and revenue generation. B2B payments often involve the exchange of sensitive financial information between businesses. Data breaches can occur if security measures are not robust, leading to the compromise of sensitive data such as bank account details, credit card numbers, and personally identifiable information (PII).

Opportunity

Advancements in the payments and software solutions

The digitization and the technological advancements in the payment methods are transforming the payment and financial transaction. The evolution of digital payment enhances online shopping, paying bills, and money transfer experiences. It makes it safer, quick, efficient, and accessible. Digital payment is highly serving cross-border business and generates more financial opportunities in the growing economies. The technological development in payments and software solutions like digital wallets, IoT and connected commerce, instant cross border payments, peer-to-peer (P2P) payments, B2B payments system.

While in the B2B payment system it provides the cost effective, integrated, digital–first, and fast service with the full-service automation, system-wide security, streamlined payments functions, interdepartmental functionality, real-time tracking capabilities. These payments and software solutions can help in optimizing the business operations and sales. Thus, the ongoing research on the advancements in the payment and software solutions in the B2B payment transaction is observed to offer a set of opportunities for the U.S. B2B payments transaction market.

Payment Type Insights

The domestic payments:

- In March 2025, a domestic card scheme dubbed Jaywan through its subsidiary, AI Etihad Payments was launched by the Central Bank of the UAE (CBUAE). Developed in partnership with India's NPCI International, Jaywan serves as one of the country's nine Financial Infrastructure Transformation (FIT) initiatives and intends to increase the availability of the payment options with a specific focus on e-commerce, digital transactions and financial inclusion.

- The cross-border payments segment

In August 2025, to launch cross border payments platform in UAE- based Fintech Zand was announced a collaboration with Mastercard Move's money solution.

Payment Mode Insights

The Ach segment

- In April 2025, next generation ACH payment processing solution for financial institutions was launched by Volante Technologies, ta provider of payments as a service.

The card segment

- In August 2024, property ID cards to streamline tax payments and ownership verification was launched by the Navi Mumbai Municipal Corporation (NMMC). The card, similar in size to Adhaar card, contains a QR code enabling citizens to instantly check property tax arrears or advance and make transactions at civic facilitation centers or online.

Enterprise Size Insights

The large enterprise segment

- In February 2025, the launch of Miura Ascend, a new enterprise payment platform designed to make transactions faster, more secure, and easier to manage for businesses of all sizes, was announced by Miura, a next-gen payment solutions provider.

The small businesses segment

- In September 2024, a new product named Bharat BillPay (BBPS) for businesses at the Global FinTech Fest 2024 was launched by RBI Governor Shaktikanta Das. The product built by the National Payments Corporation of India (NPCI) aims to simplify bill systems for business-to-business transactions by creating a unified system.

Industry Insights

The manufacturing segment

- In July 2025, a payment platform that is integrated with the company's B2B eCommerce platform, OroCommerce, and purpose build for the manufacturers and distributors who use it, was launched by Oro. With the addition of OroPay, the platform includes invoicing, payments, enterprise resource planning (ERP) connectivity, and commerce.

The BSFI segment

- In November 2024, a platform for managing domestic and international business payments was HSBC.

U.S. B2B Payments Transaction Market Companies

- American Express

- Bank of America Corporation

- MasterCard

- Citigroup Inc

- PayPal Holdings Inc

- Block Inc

- Payoneer Inc

Recent Developments

- In September 2024, Seamless B2B payment solution for online hotel bookings in Thailand was launched by Mastercard, a leading technology company in the payments, NTT DATA, a leading IT infrastructure and services company, and OneHotel, a hotel management software company. (Source: https://www.mastercard.com)

- In December 2024, a blockchain based payment solution for merchants across Latin America, saying it enables these businesses to make faster cross border B2B payments and settlements was launched by Nuvei. The new solution allows businesses to use a Visa-supported physical or virtual card to make payments using stablecoins from a digital asset wallet anywhere Visa is accepted. (Source: https://www.nuvei.com)

Segments Covered in the Report

By Payment Type

- Domestic Payments

- Cross-border Payments

By Payment Mode

- Cheque And Cash

- Ach

- Card

- Wire And Others

By Enterprise Size

- Large Enterprises

- Smes

- Small Businesses

By Industry

- BFSI

- Manufacturing

- Businesses and Professional Services

- IT and Telecom

- Energy and Utilities

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content