What is the Smart Home Payments Market Size?

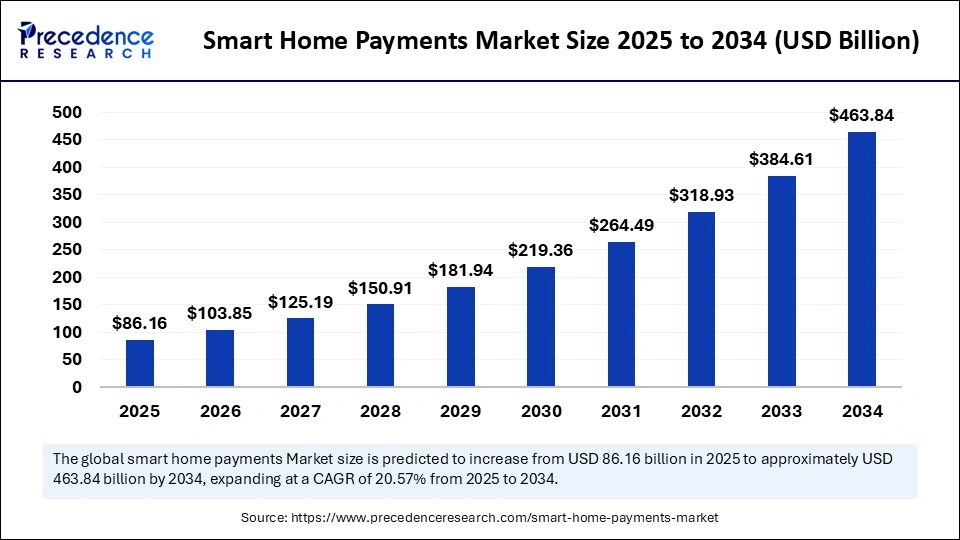

The global smart home payments market size was calculated at USD 71.49 billion in 2024 and is predicted to increase from USD 86.16 billion in 2025 to approximately USD 463.84 billion by 2034, expanding at a CAGR of 20.57% from 2025 to 2034. The market is driven by the smart-device adoption and demand for effortless, in-home, frictionless payments.

Smart Home Payments Market Key Takeaways

- In terms of revenue, the global smart home payments market was valued at USD 71.49 billion in 2024.

- It is projected to reach USD 463.84 billion by 2034.

- The market is expected to grow at a CAGR of 20.57% from 2025 to 2034.

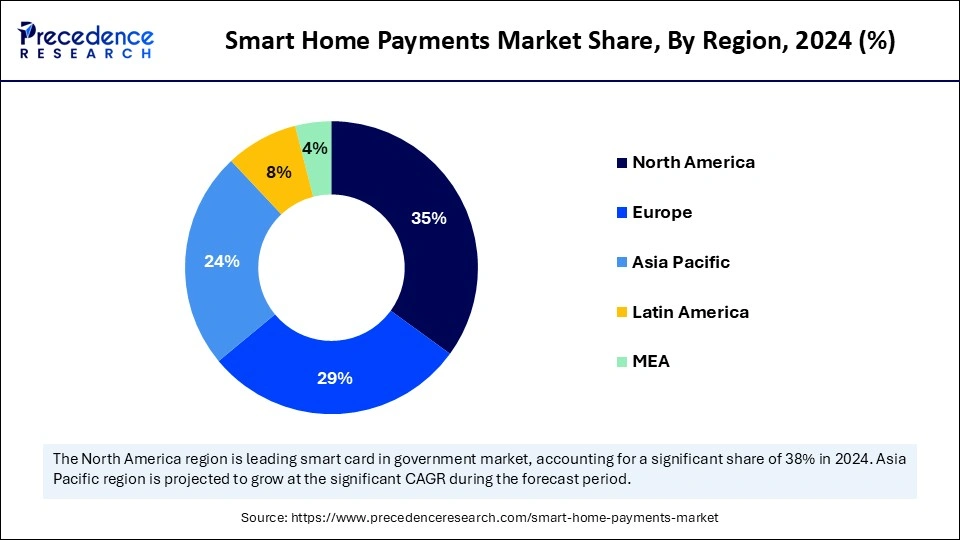

- North America dominated the global smart home payments market with the largest market share of 35% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By component, the hardware segment captured the biggest market share of 50% in 2024.

- By component, the software and platforms segment is anticipated to show considerable growth over the forecast period.

- By payment mode, the voice-enabled payments segment contributed the highest market share of 45% in 2024.

- By payment mode, the biometric payments segment is anticipated to show considerable CAGR over the forecast period.

- By deployment model, the cloud-based segment held the maximum market share of 60% in 2024.

- By deployment model, the on-device segment is anticipated to show considerable growth over the forecast period.

- By end-use application, the e-commerce and retail purchases segment accounted for the significant market share of 40% in 2024.

- By end-use application, the utility bill payments segment is anticipated to show considerable growth over the forecast period.

- By end-user, the residential users segment generated the major market share of 70% in 2024.

- By end-user, the commercial users segment is anticipated to show considerable growth during the forecast period.s

Market Overview

The smart home payments market is an innovative collision of financial technology and the Internet of Things (IoT), owning connected devices that are endowed with secure, automated, and contactless payment options. Smart home payments combine digital wallets, AI-based platforms, and biometric authentication to allow users to buy, pay their bills, and control their subscriptions to be integrated into their home system. With the proliferation of smart homes around the world, letting devices handle payments is becoming one of the primary sources of innovation in fintech and consumer electronics.

The rising penetration of smart homes and the expansion of digital wallets and contactless payments will increase. Consumer preference for frictionless, safe financial transactions is evolving and has triggered the need for voice-activated and automated payments in utilities, subscriptions, and e-commerce. The rise in 5G networks is making the connection of devices faster and smoother, therefore being used more in urban households as more investment in 5G networks and IoT ecosystems is being made. Here, the growth in the number of subscription-based services, including streaming services, home security, and energy management, increases the demand for automated recurring payment solutions.

How is AI transforming the Smart Home Payments Market?

Artificial intelligence is becoming an important factor in customizing smart home payment experiences, based on user behavior, preferences, and purchase history. The AI can be used to forecast the needs of consumers and prescribe subscriptions, services, or products directly by the use of smart devices with machine learning algorithms. With the growing need for convenience-driven solutions, AI-powered personalization is likely to be one of the most powerful growth drivers in this industry. AI is enhancing the safety of smart home payment systems. The cyber threats and digital fraud are on the increase, and AI-based algorithms can identify abnormal behavior, signal suspicious activity, and verify valid transactions in real-time.

What Factors Are Fueling the Rapid Expansion of the Smart Home Payments Market?

- Authentication Technologies: Biometric authentication, fingerprint, voice, and face recognition boost the degree of consumer trust with smart home payments. The security functions minimize the chances of fraud and increase the level of trust, and this makes digital transactions safer in networks.

- Increasing Use of Digital Wallets: Contactless payment technology and digital wallets are becoming commodity-level, and this promotes their integration into IoT-sensitive instruments. This is due to the synergy between mobile wallets and smart devices, which is facilitating the in-home purchases, and consequently, smart home payments are being implemented in day-to-day utilities, e-commerce, and subscriptions.

- Heightened Customer Demand in Frictionless Payments: Contemporary consumers demand fast and safe, and hassle-free transactions. Smart home payments can fulfill needs by providing an opportunity to have voice-activated payments, automatic payment of bills, and customized payment experiences.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 463.84 Billion |

| Market Size in 2025 | USD 86.16 Billion |

| Market Size in 2024 | USD 71.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.57% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Payment Mode, Deployment Model, End-Use Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Adoption of Smart Home Solutions

The growing popularity of smart home systems, including smart speakers, lighting, and thermostats, and smart home security systems, is one of the leading factors that contribute to the development of the smart home payments market. Connected ecosystems are becoming more attractive to consumers who want to simplify their daily routines, and adding payments to such devices provides convenience. The smart speaker and voice assistants are not just objects of entertainment and automation anymore; they are the means of secure, voice-controlled transactions, where users can pay their bills, order groceries, or renew subscriptions without any hassle. This is an increasing trend in line with the current consumer tendency of using time-saving and frictionless solutions. With the smart equipment gaining prominence in home management, incorporating financial transaction features is enhancing the usability and experience with the devices.

Restraint

Data Privacy, Security, and Interoperability Challenges

Privacy, security, and interoperability of the smart home payments market are critical barriers obstructing the growth of the market. Smart devices are interconnected, where any one cyber breach can compromise sensitive financial information that poses a lot of risks to consumers. Fear of hacking, fraud, and abuse of personal data is still a big discouraging factor to mass adoption. Meanwhile, the problem of interoperability between devices and platforms is also another problem. The interoperability of smart home systems is often missing, which leads to inconsistent user experiences, restricting the convenience and scalability.

The cost of integration also makes it difficult to access the market by small companies and this source of power is concentrated among large technology providers. Strict financial regulations and data protection structures are other operational complexities, particularly for firms that conduct their operations in various regions. The existence of these restraints highlights the need to seek collaboration with the industry and standardization, as well as the need to enhance cybersecurity measures.

Opportunity

Expanding Opportunities through Smart City Initiatives

Governments all around the world are investing in digital ecosystems to promote cashless transactions and automated billing services, which perfectly match the abilities of the IoT-enabled smart devices. Repeat billing of utility, subscription services, and pay-as-you-go are recurrent in these urban settings and can be efficiently handled by voice assistants and smart appliances. The development of blockchain and cryptocurrency payments also serves as a substantial growth opportunity, as it offers secure, transparent, and faster payments, and is attractive to tech-savvy consumers. The connection of smart home devices and e-commerce platforms increases the range of the market, providing the possibility of direct purchasing via voice-commerce.

Component Insights

Why did the Hardware Segment Lead the Smart Home Payments Market in 2024?

The hardware segment led the market while holding a 50% share in 2024. These devices will be the keystones of voice-activated payments and embedded financial transactions in the home. Voice assistance on smart speakers is also gaining popularity among consumers, especially in carrying out transactions, including bill payments and online shopping, and in terms of subscription management. This experience is further enhanced through smart displays, which offer visual assurance on transactions, increasing transparency and trust in online payments. Hardware penetration has been reinforced by the widespread use of gadgets by such brands as Amazon, Google, and Apple, and is now the foundation of the smart home payment system. Hardware development is further encouraged by the increasing affordability and the ability to be used with digital wallets.

The software and platforms segment is expected to grow at a significant CAGR over the forecast period. Artificial intelligence is highly relevant to personalization, predictive payments, and voice recognition, and devices memorize what users prefer and run financial transactions automatically. Rather, blockchain helps to enhance transparency, security, and speed of payment transactions, which would surmount such barriers as privacy concerns and fraud. The easy interoperability among the devices and services is also easily facilitated by software platforms, which reduces fragmentation within the smart home environments. Software integration requirements will increase due to the rise in digital ecosystems and implementation of automated billing, subscription, and e-commerce transaction projects in smart cities.

Payment Mode Insights

Why did the Voice-Enabled Payments Segment Capture the Highest Revenue in the Smart Home Payments Market?

The voice-enabled payments segment held around 45% share in the market in 2024. Smart assistants and home speakers like Amazon Alexa, Google Assistant, and Apple Siri have emerged as an important part of the transactional facilitation in the home. Consumers would want to know the capability to buy things, pay bills, or renew subscriptions using straightforward voice commands. More accurate natural language processing (NLP) and the use of AI to deliver voice recognition technology have made the software easier to trust and use. Moreover, voice commerce is becoming more popular among different demographics, as the idea of multi-lingual support becomes increasingly popular. As more people adopt the smart speaker status across the world, it is believed that voice-enabled payments will continue to be dominant in the market, being a foundation of connected home transactions.

The biometric payments segment is expected to grow substantially in the smart home payments market. Connected devices are increasingly being integrated with biometric authentication, such as fingerprint identification, facial identification, and voice biometrics. Such technologies provide an extra level of security. As the smart home ecosystems continue to expand, secure and seamless payment authorisation has become a central factor. Biometrics provide an efficient, quick, and simple solution where only the recognized persons can perform the transactions at home. It is also being fueled by the use of biometric-enabled smartphones, smart locks, and wearables, which are increasingly getting used as more people become familiar with the forms of authentication. As consumer expectations for safety and convenience steadily rise, biometric payment will become a significant growth measure in the smart home business.

Deployment Model Insights

Why did the Cloud-Based Segment Lead the Smart Home Payments Market?

The cloud-based segment held around 60% share in the market in 2024. Scalability, real-time updates, and cross-device continuity are the key benefits of using cloud infrastructure, and it is the favored type of deployment among service providers and consumers. Cloud solutions enable users to process and store data centrally and, therefore, manage various devices and payment systems on one platform. This enhances the convenience and easy management of subscriptions, recurring billing, and e-commerce transactions. Besides, cloud-based models will enable updating the software regularly, which will ensure better security measures and access to the most recent advances in AI and blockchain. As smart homes are becoming more connected, and the demand to have a frictionless financial interaction continues to grow, cloud-based deployment is probably going to remain the primary anchor of the smart home payments market.

The on-device segment is expected to grow substantially in the smart home payments market. Compared to cloud systems, edge processing can allow authentication of payment and transactions to execute in the device itself, minimizing the use of external servers. This significantly reduces latency, which provides quicker responses and user experience when performing real-time payments. The edge-based models are particularly handy in the case of biometric payment because the fingerprint or facial recognition information can be checked on the device without leaving the home ecosystem. The innovation in chipsets, integration of AI, and functions of IoT devices is continuing, which is enabling edge-powered pay. With consumers being focused on speed, security, and privacy, the on-device deployment model is likely to become a driving force in the next few years.

End-Use Application Insights

Why did the E-Commerce and Retail Purchases Segment Lead the Smart Home Payments Market?

The e-commerce and retail purchases segment led the market in 2024. Associated products such as voice assistants, smart screens, and intelligent home appliances are being used to directly order goods from online stores. Household needs and groceries can be ordered through simple voice orders or applications installed on the smart devices of the consumer to provide a comfortable shopping experience. Digital wallets and secure payment systems have been combined to ensure transactions are fast, frictionless, and reliable. Amazon, Walmart, and Alibaba are retail giant companies that are leveraging the innovations of the internet of things (IoT) and voice-commerce to draw consumers and encourage them to embrace it. As the smart home and e-commerce continue to grow, this segment will remain at the top of the smart home payments market in the world.

The utility bill payments segment is expected to grow at a significant CAGR over the forecast period. A smart home will allow the automatic repetitive payments to electricity, water, gas, internet, streaming services, and home security subscriptions. Through the inclusion of payment features into devices connected via RFID, consumers will be able to handle various recurring payments without manually doing so, eliminating deceleration, missed payments, or inaccuracy. This automation makes it convenient, particularly for households that have multiple subscriptions at the same time. The service providers are also optimizing platforms to enable in-device payments to go smoothly, leading to adoption.

End-User Insights

Why did the Residential Users Segment Lead the End-User Market in Smart Home Payments?

The residential users segment held around 70% shares in the market in 2024. The adoption of smart devices like voice assistants, smart speakers, smart displays, and smartened appliances by households already allows seamless in-home financial transactions. These devices are used by consumers to pay bills, subscriptions, and online shopping directly from the comfort of their homes. The convenience and automation of smart home payments, along with their personalization, would particularly appeal to residential customers. In addition, the growing applications of smart devices and smart home systems with IoT features in both the developed and emerging markets lead to increased residential adoption. Firms like Amazon, Google, and Apple are expanding their product range to home users, which combines entertainment, automation, and secure payment capabilities.

The commercial users segment is expected to grow substantially in the smart home payments market. Companies are also incorporating intelligent speakers, smart screens, and internet-based payment options to streamline their operations, automate repetitive payment tasks, and provide a better customer experience. The development of smart office space, digital connections, and retail solutions that use IoT is increasing the need to implement secure and real-time payment solutions to minimize the reliance on manual payment processes. Firms are also taking advantage of connected ecosystems to stream operations, track transactions, and enhance service delivery. With companies still focusing on productivity and customer satisfaction, commercial users will likely emerge as a huge growth engine in the market.

U.S. Smart Home Payments Market Size and Growth 2025 to 2034

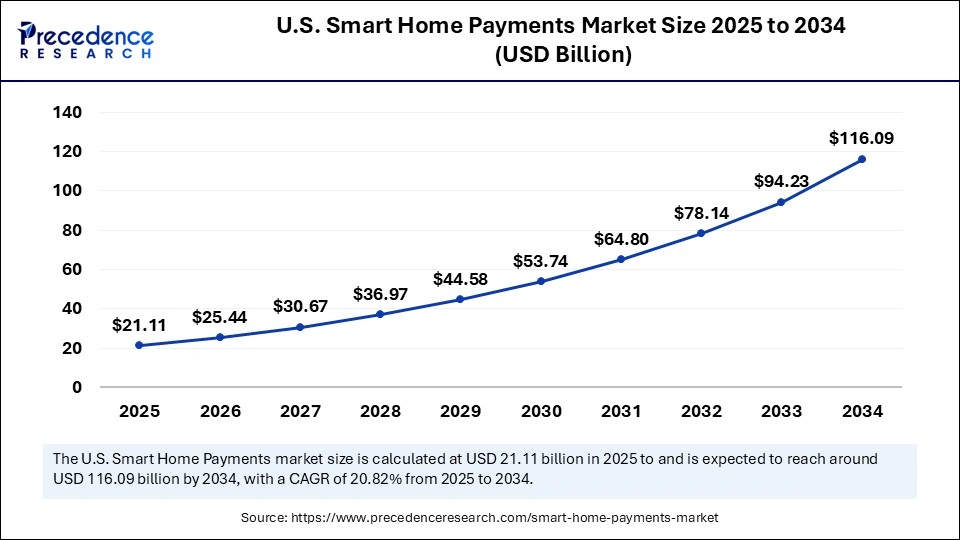

The U.S. smart home payments market size was exhibited at USD 17.51 billion in 2024 and is projected to be worth around USD 116.09 billion by 2034, growing at a CAGR of 20.82% from 2025 to 2034.

Why does North America Dominate the Smart Home Payments Market?

North America led the global market with the highest market share. The primary drivers of the region are the fast application of smart home technologies, massive consumption of the IoT infrastructure, and high awareness of consumers about digital and automated payment solutions. Voice assistants, smart speakers, and connected appliances are increasingly being integrated in countries like the U.S. and Canada, and with this, transactions in the home occur seamlessly. Furthermore, the rising popularity of smart thermostats, smart lighting systems, and smart appliances, which are energy-efficient devices, is making the general use of smart homes grow. Technological advancements, including personalization through AI and biometric verification, and secure cloud-based applications, are also helping to support the market.

The U.S. continues to be the biggest player in the market due to the high consumer demand and technological advancement. The popularity of smart home payments is growing with the widespread availability of voice-enabled gadgets in homes, which enable users to carry out payments, e-commerce, and subscriptions easily. The trends in energy efficiency and sustainability are also promoting the use of smart devices that are convenient and cost-effective. The increasing investments of tech companies and startups in IoT-based smart solutions are encouraging the innovation of payment-enabled devices, which are enhancing the market.

Why is Asia Pacific Undergoing the Fastest Growth in the Smart Home Payments Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, due to driven by the adoption of smart home technologies in this region, including rapid urbanization, increasing disposable incomes, and increasing awareness among consumers regarding smart home technologies. The new emerging markets in India, Thailand, Malaysia, and Indonesia are also experiencing the increased demand for IoT-enabled devices, smart appliances, and voice-assisted payment solutions. The movement towards subscription-based services and pay-as-you-go utility models in these nations is a boost to the adoption and use of automated and contactless payment systems. Moreover, the introduction of digital payments and smart city projects by the government is generating a good environment to grow the market.

China is the leading market in the Asia Pacific, which was driven by the high investment in smart home infrastructure and technologies. The innovation of digital wallets, biometric security, and artificial intelligence-driven payment systems is fast, and it is assisting in enabling smooth, secure, and frictionless transactions. Moreover, international technology companies and national firms are pouring huge amounts of money into IoT systems and voice-commerce applications that contribute to the rapid adoption of the market. Governmental support of the cashless payments and smart city development also facilitates the growth since it offers a robust digital payment system.

Smart Home Payments Market Companies

- Amazon.com, Inc. (Alexa)

- Apple Inc. (Apple Pay, HomeKit)

- Google LLC (Google Pay, Google Nest)

- Samsung Electronics Co., Ltd. (Samsung Pay, SmartThings)

- PayPal Holdings, Inc.

- Visa Inc.

- Mastercard Incorporated

- Alibaba Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- Xiaomi Corporation

- LG Electronics Inc.

- IBM Corporation

- Microsoft Corporation

- Stripe, Inc.

- Square, Inc. (Block, Inc.)

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- Honeywell International Inc.

- Philips (Signify N.V.)

- Huawei Technologies Co., Ltd.

Recent Developments

- In July 2024, LG Electronics acquired an 80 percent stake in Netherlands-based smart home platform Athom. The purchase is expected to support LG in its AI-powered smart home solutions, amplifying payment capabilities and combining them with other connected technology like smart displays and speakers. (Source: https://www.iotworldtoday.com)

- In May 2023, Fifth Third Bancorp purchased Rize Money, an embedded payment platform, to enhance its services in smooth financial transactions. With the acquisition, the bank will be able to offer innovative payment solutions through a single API, increasing the integration with connected ecosystems and smart devices. (Source: https://ibsintelligence.com)

- In September 2023, National Payments Corporation of India (NPCI), the creator of UPI has announced a number of new products - Credit Line on UPI, UPI Lite X, and Tap Pay, Hello! UPI - Conversational Payments on UPI, Billpay Connect - Conversational Bill Payments - seeking to build an inclusive, resilient, and sustainable digital payments ecosystem.(Source: https://www.thehindu.com)

Segment Covered in the Report

By Component

- Hardware (Smart Speakers, Smart Displays, Connected Appliances, Payment Terminals)

- Software and Platforms (AI Algorithms, Payment Gateways, Voice and Gesture Recognition, Blockchain Solutions)

- Services (Consulting, Integration, Maintenance, Managed Services)

By Payment Mode

- Voice-Enabled Payments

- Biometric Payments (Fingerprint, Facial Recognition, Iris Scan)

- Contactless/NFC Payments

- App-Based/Wallet Payments

- Others (QR Code, Gesture-Based)

By Deployment Model

- On-Device (Edge Processing)

- Cloud-Based

By End-Use Application

- E-commerce and Retail Purchases

- Utility Bill Payments

- Subscription Services (OTT, Smart Home Security, IoT services)

- Food and Grocery Orders

- Travel and Ticketing

- Others (Healthcare Services, Insurance)

By End-User

- Residential Users

- Commercial Users (Hospitality, Co-working, Smart Offices)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting