What is the Tower Crane Rental Market Size?

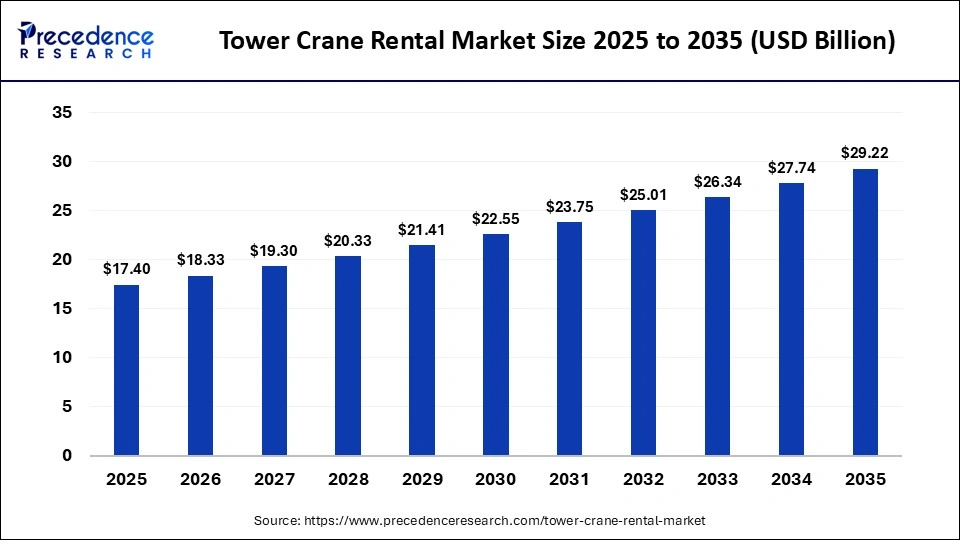

The global tower crane rental market size was calculated at USD 17.40 billion in 2025 and is predicted to increase from USD 18.33 billion in 2026 to approximately USD 29.22 billion by 2035, expanding at a CAGR of 5.32% from 2026 to 2035.The tower crane rental market growth is driven by an increase in high-rise buildings, rapid urbanization, and the cost and logistics benefits of renting cranes.

Market Highlights

- North America led the tower crane rental market in 2025.

- Asia-Pacific is expected to grow at the highest CAGR during the forecast period.

- By crane type, the hammerhead cranes segment led the market in 2025.

- By crane type, the luffing jib cranes segment is expected to grow at a notable CAGR during the forecast period.

- By application type, the commercial construction segment dominated the market in 2025.

- By application type, the residential construction segment is expected to grow at a notable CAGR between 2026 and 2035.

- By operational type, the on-site rentals segment led the tower crane rental market in 2025.

- By operational type, the long-term rentals segment is expected to expand at a notable CAGR from 2026 to 2035.

- By end user type, the construction companies segment led the market in 2025.

- By end user type, the infrastructure developers segment is expected to expand at a notable CAGR from 2026 to 2035.

What is the Tower Crane Rental Market?

The market comprises the renting of a tower crane by construction companies for the completion of a particular construction project. It helps the companies save on the high costs of the tower crane machines. Many construction projects are facilitated by the rental of these machines, including residential tower projects, commercial building projects, and industrial tower projects. The tower crane rental machines are chosen depending on the needs of the construction projects. These machines are chosen on the basis of the height of the buildings to be constructed and the working capacity of the machines.

How is AI contributing to the Tower Crane Rental Market?

Artificial Intelligence (AI) in the market is adding value to the areas of safety, efficiency, and cost management in the industry. This is due to thepredictive maintenance function that AI provides in analyzing data from the sensors in the crane, thus predicting potential failures of the crane. This helps in ensuring that the crane does not break down, thus enhancing efficiency in the operations. AI also helps in determining the appropriate type of crane for the specific task to be carried out. Computer vision facilitates enhanced safety of the people as well as the crane at the site of its use.

Tower Crane Rental Market Trends

- Collaborations & Partnerships: Tower crane companies have collaborated with construction industry firms and technology providers to enable enhanced safety, efficiency, and monitoring of their operations. For instance, Liebherr has collaborated with several construction companies in Europe to provide crane management systems that enable construction companies to monitor their tower cranes.

- Government Infrastructure: Governments have invested in infrastructure development projects, which have fueled steady demand for tower cranes. The sectors like transport infrastructure and housing projects have significantly contributed to the market growth. For instance, Metro Rail Development projects in cities like Mumbai and Delhi have seen wide-scale adoption of luffing jib cranes, especially for elevated track and rail development.

- Business Expansions: Tower crane manufacturers are stepping up their business expansion strategies by innovating in crane technologies to cater to high-rise infrastructure projects. For example, Terex, a prominent tower crane manufacturing company, has launched its range of flat-top cranes for efficient construction in densely populated areas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.40 Billion |

| Market Size in 2026 | USD 18.33 Billion |

| Market Size by 2035 | USD 29.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type of Crane, Application, Operational Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Crane Type Insights

Why Did the Hammerhead Cranes Segment Dominate the Tower Crane Rental Market?

The hammerhead cranes segment led the market in 2025. The market growth of this segment can be attributed to its high lifting capacity, long horizontal reach, and operational stability. This segment has been widely adopted in commercial building projects, infrastructure projects, and large residential developments, which drives consistent rental demand. Hammerhead cranes also work efficiently on open construction sites and are compatible with standardized components. Their versatility and cost-effectiveness compared to specialized cranes have made them the preferred choice for rental companies and contractors.

The luffing jib cranes segment is expected to grow at a notable CAGR during the forecast period. The market growth of this segment is due to its preference in densely populated areas and construction projects with limited space. The luffing jib cranes have the flexibility to move upwards with the capability to lift the load through an upward-sweeping jib. This mechanism makes it a safer option in a compact space, as there is no need for a significant turning radius. This feature facilitates widespread adoption in construction projects in densely populated city centers.

Application Type Insights

Why Did the Commercial Construction Segment Dominate the Tower Crane Rental Market?

The commercial construction segment dominated the market in 2025. The market growth of this segment can be attributed to high demand for commercial buildings such as offices and malls, which require long-term and large-scale construction projects. These commercial structures require hefty lifting operations, which makes the rental of tower cranes essential. The market growth of this segment is further driven by rapid urbanization, where there is an abundance of commercial construction projects.

The residential construction segment is expected to grow at a notable CAGR between 2026 and 2035. The market growth of this segment is due to the growing population, rapid urbanization, and demand for affordable housing. Land constraints in cities compel developers towards vertical residential developments such as apartments and high-rise housing complexes. For such construction projects, developers prefer renting tower cranes to manage costs and project timelines. Government housing initiatives, smart city projects, and private real estate investments drive the market growth of this segment.

Operational Type Insights

Why Did the On-Site Rentals Segment Dominate the Tower Crane Rental Market?

The on-site rentals segment led the market in 2025. The market growth of this segment can be attributed to strong demand from large commercial and industrial projects, which need constant access to tower cranes on-site. This segment provides the ability to utilize tower cranes without any hindrance due to crane movements or conflicts. The market growth of this segment is further driven by rapid urbanization, where there is constant demand for tower cranes due to high-rise apartments and commercial buildings construction projects.

The long-term rentals segment is expected to expand at a notable CAGR from 2026 to 2035. The market growth of this segment is due to an increase in large construction and infrastructure projects being completed in extended phases and timelines. Developers and contractors prefer renting cranes for the entire duration rather than doing it frequently on a short-term basis. This helps to reduce the complexity of logistics, decreases rental costs over time, and ensures continuity in planning and execution. This segment is being widely adopted in large-scale commercial, residential, and public infrastructure projects.

End User Type Insights

Why Did the Construction Companies Segment Dominate the Tower Crane Rental Market?

The construction companies segment led the market in 2025. The market growth of this segment is due to the rise in large-scale construction projects, where cranes play the crucial role of continuous vertical lifting. Construction companies handle the projects related to residential properties, commercial properties, and industrial properties. Tower cranes enable construction companies to optimize costs associated with crane acquisition and maintenance costs. Tower cranes ensure efficient movement of construction material within a limited space.

The infrastructure developers segment is expected to expand at a notable CAGR from 2026 to 2035. The market growth of this segment is due to the increasing number of large-scale public and semi-public projects worldwide. Governments are investing significantly in metro rail networks, highways, bridges, airports, and urban infrastructure, all of which require tower cranes for heavy lifting over reasonably long project timelines. Renting cranes is more practical for infrastructure developers since these projects are capital-intensive and spread across multiple locations.

Regional Insights

What Made North America the Leading Region in the Tower Crane Rental Market?

North America led the tower crane rental market in 2025. The market growth in this region can be attributed to the robust construction industry and the well-established crane rental market. This region has numerous large-scale commercial, residential, and infrastructure projects. The construction industry prefers rentals to capital investments and has to adhere to stringent safety and regulatory norms. The market growth in this region is further driven by the presence of established industry players and early adoption of advanced tower crane technologies.

U.S Tower Crane Rental Market Analysis

The U.S. led the market in North America because of the large-scale construction projects, which drive consistent demand. The market growth is also driven by infrastructure projects such as airports, metros, and data centers. Construction companies in the U.S prefer renting tower cranes rather than purchasing them due to high maintenance and purchase costs. This country has strict regulations regarding the usage of cranes. The presence of prominent crane rental companies further drives the market growth in the U.S.

Why is Asia Pacific the Fastest Growing Region in the Tower Crane Rental Market?

Asia-Pacific is expected to grow at the highest CAGR during the forecast period. The market growth in this region can be attributed to rapid urbanization and infrastructure expansion in emerging and developed economies. Governments have invested in residential, commercial, and smart city development projects, which generate strong demand. This region has cities that have densely populated residential areas, which leads to the adoption of crane rental services by construction contractors for optimized project operations.

China Tower Crane Rental Market Trends

China leads the market in the Asia Pacific due to the sheer enormity and verticality of its construction industry. Urban areas continue to grow upwards rather than outwards, hence tower cranes are necessary for these densely populated areas. Rental solutions are the preferred option since the projects are constantly moving from one location to another, and different stages of the project require different configurations of cranes. China has a strong construction supply chain, ensuring accessibility and availability of rental cranes throughout the country.

Who are the Major Players in the Global Tower Crane Rental Market?

The major players in the tower crane rental market include United Rentals, Sunbelt Rentals, Terex Corporation, Ahern Rentals, Zoomlion Heavy Industry Science & Technology Co., JLG Industries, Liebherr Group, Manitowoc Cranes, Soilmec S.p.A., Bigge Crane and Rigging Co., All Erection & Crane Rental Corp., H&E Equipment Services, BrandSafway, Cramo Group, KHL Group

Recent Developments

- In March 2025, Wolffkran launched WOLFF 8095 next-generation compact trolley jib tower crane aimed at rental fleets serving mixed commercial and residential construction. This crane can lift heavy loads and has a modular design that simplifies transport and on-site installation, improving utilization rates for rental providers. (Source: https://infra.tractorjunction.com)

- In February 2025, Raimondi launched T577, a large flat-top tower crane, which is suitable for heavy construction as it features an extended jib length, which leads to improved load moment capacity. This product is targeted for large infrastructure and commercial projects where rental customers need long reach with high lifting efficiency.(Source: https://vertikal.net)

Segments Covered in this Report

By Type of Crane

- Hammerhead Cranes

- Luffing Jib Cranes

- Flat Top Cranes

- Self-Erecting Cranes

By Application

- Commercial Construction

- Residential Construction

- Industrial Construction

- Infrastructure Development

By Operational Type

- On-Site Rentals

- Long-Term Rentals

- Short-Term Rental

By End-User

- Construction Companies

- Infrastructure Developers

- Engineering Firms

- Government Contracts

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting