What is the Traction Transformer Market Size?

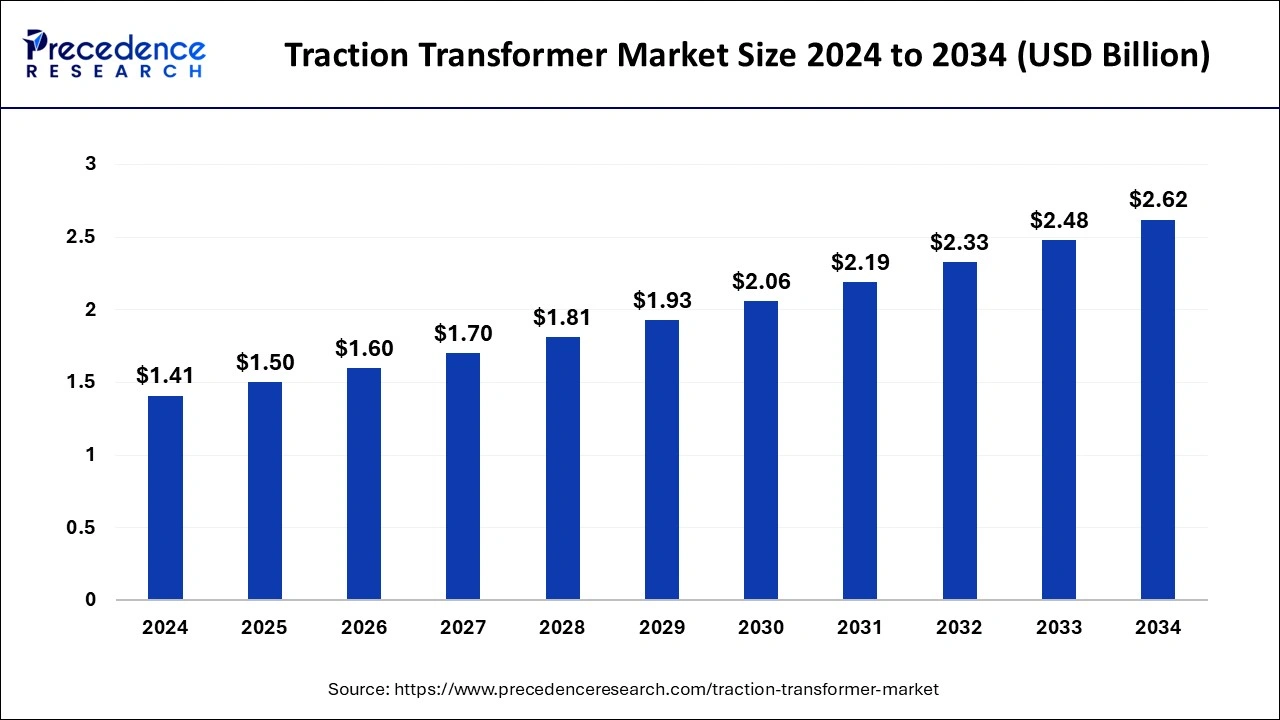

The global traction transformer market size was estimated at USD 1.50 billion in 2025 and is predicted to increase from USD 1.60 billion in 2026 to approximately USD 2.77 billion by 2035, expanding at a CAGR of 6.33% from 2026 to 2035.

Traction Transformer Market Key Takeaways

- In terms of revenue, the global traction transformer market was valued at USD 1.50billion in 2025.

- It is projected to reach USD 2.77 billion by 2035.

- The market is expected to grow at a CAGR of 6.33% from 2026 to 2035.

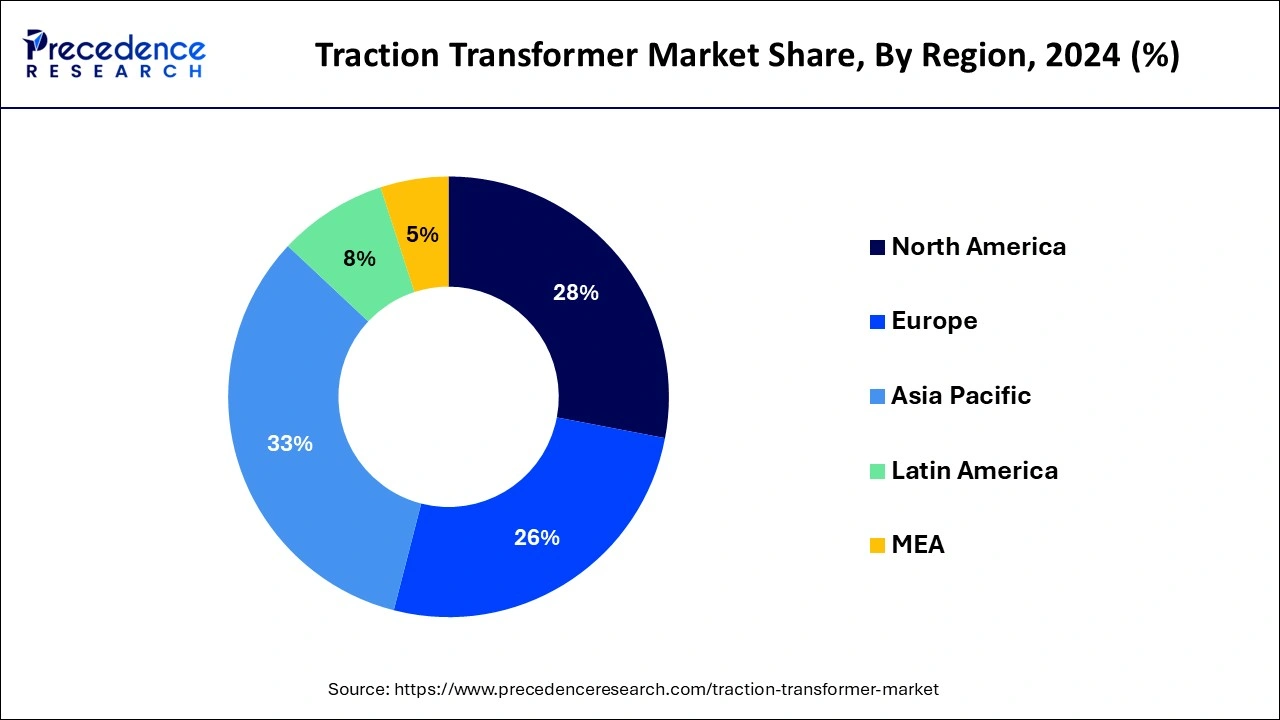

- Asia-Pacific dominated the global market with the largest market share of 33% in 2025.

- Europe is estimated to expand at the fastest CAGR between 2026 to 2035.

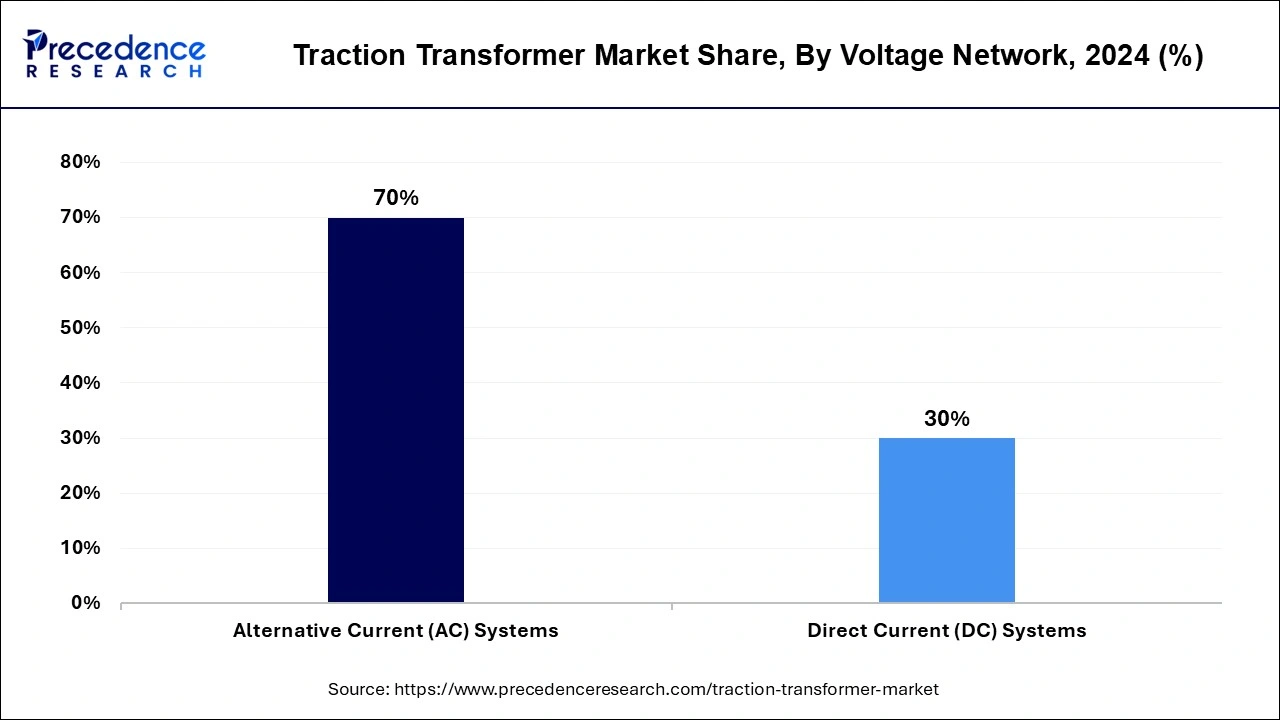

- By voltage network, the AC (alternative current) systems segment held the largest market share of 70% in 2025.

- By voltage network, the DC (direct current) segment is anticipated to grow at a remarkable CAGR during the forecast period.

- By mounting position, the under-the-floor segment generated the largest market share of 46% in 2025.

- By mounting position, the machine room segment is expected to expand at the fastest CAGR of 7.54% over the projected period.

- By rolling stock, the electric locomotives segment generated the biggest market share of 67% in 2025.

- By rolling stock, the high-speed trains segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The traction transformer market offers a technology that integrates telecommunication and informatics to enhance the functionality and connectivity of vehicles. It involves the installation of electronic devices in cars, commonly known as telematics control units, to gather and transmit real-time data. This data includes information about the vehicle's location, performance, and driver behavior. Embedded telematics systems play a crucial role in providing features such as GPS navigation, vehicle tracking, remote diagnostics, and connectivity with other smart devices. These systems not only improve driver safety and convenience but also enable advanced services like usage-based insurance and efficient fleet management. Overall, traction transformer enhances the overall driving experience by enabling smart communication between vehicles and external networks.

The increasing rate of urbanization globally is a key driver for the traction transformer market. Growing urban populations lead to higher demand for efficient and sustainable public transportation systems, fueling the expansion of electrified rail networks.

- As per World Bank data, the global urbanization rate experienced a rapid increase, ascending from 54.38% in 2019 to 54.83% in 2022, ultimately reaching 55.28% in 2032. Consequently, the surge in rail projects worldwide is driving widespread adoption and implementation of traction transformers.

Traction Transformer Market Growth Factors

- Governments worldwide are investing significantly in the expansion and modernization of rail infrastructure. Funding for rail projects, including electrification initiatives, contributes to the growth of the traction transformer market. For instance, the European Union's Connecting Europe Facility allocates substantial funds for rail transport projects.

- The shift towards electrification in the railway sector, driven by environmental concerns and the need for energy efficiency, is a major growth factor. Electrified rail systems powered by traction transformers offer a cleaner and more sustainable alternative to traditional diesel-powered trains.

- Ongoing advancements in traction transformer technologies enhance their efficiency, reliability, and safety. Innovations such as dry insulation materials and advanced cooling techniques contribute to improved performance. These technological developments attract investments and drive market growth.

- Governments and organizations worldwide are increasingly prioritizing sustainable transportation solutions. Traction transformers play a crucial role in electrified rail systems, aligning with global efforts to reduce carbon emissions and promote environmentally friendly modes of transportation.

- The expansion of high-speed rail networks across different regions stimulates the demand for advanced traction transformer systems. High-speed trains require efficient and high-performance traction solutions, presenting a significant growth opportunity for the market.

Major Key Trends in Traction Transformer Market

- Shift Toward Energy-Efficient Designs: There is an increasing need for traction transformers that reduce energy loss, enhance thermal efficiency, and support regenerative braking systems, thereby improving the overall efficiency of contemporary rail systems.

Adoption of Lightweight Materials: Manufacturers are progressively employing lightweight materials like aluminum windings and advanced composites to decrease the weight of traction transformers, promoting better fuel efficiency and faster speeds for electric and hybrid trains. - Integration of Digital Monitoring Systems: The market is experiencing a rise in transformers equipped with smart sensors and analytical platforms that facilitate predictive maintenance, real-time monitoring, and data-driven decision-making to minimize downtime and enhance safety.

- Expansion of High-Speed Rail Networks: Worldwide investments in high-speed rail infrastructure are driving the demand for compact, high-performance traction transformers capable of managing high voltage levels and challenging operating conditions in long-distance transportation.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.33% |

| Global Market Size in 2025 | USD 1.50 Billion |

| Global Market Size in 2026 | USD 1.60 Billion |

| Global Market Size by 2035 | USD 2.77 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Voltage Network, By Mounting Position, and By Rolling Stock |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Expansion of rail networks

For instance, India plans to invest $140 billion in expanding its rail network by 2028.

The expansion of rail networks around the world is a major catalyst for the increased demand in the traction transformer market. As more regions invest in the development and enhancement of their railway infrastructure, the need for efficient and reliable electrification solutions rises significantly. Electrification of rail systems, powered by traction transformers, offers a sustainable and eco-friendly alternative, aligning with global efforts to reduce carbon emissions. With governments prioritizing the expansion and modernization of rail networks, the traction transformer market experiences a surge in demand.

These transformers play a crucial role in powering electric trains, enabling smoother and more energy-efficient operations. As new rail lines are laid and existing ones undergo electrification, the traction transformer market responds to the growing requirements, providing essential components for the reliable functioning of electrified rail systems worldwide.

Restraint: Limited electrification in remote areas

The limited electrification in remote areas poses a significant restraint on the traction transformer market. In many sparsely populated or geographically challenging regions, electrifying rail networks may not be economically viable or feasible. The high costs associated with extending electrification infrastructure to remote areas, including the installation of traction transformers, act as a deterrent for widespread adoption. Limited demand for electrified rail systems in these regions inhibits the traction transformer market's growth, as the focus tends to be on more accessible and economically viable transportation solutions.

Additionally, the absence of electrification in remote areas impacts the overall market demand for traction transformers, as these regions may rely on traditional diesel-powered locomotives. This disparity in electrification efforts across different geographical areas creates a market challenge, emphasizing the need for innovative solutions and policies to address the constraints and extend the benefits of electrified rail systems, including traction transformers, to remote locations.

Opportunity

Integration of advanced technologies

The integration of advanced technologies is opening up exciting opportunities for the traction transformer market. Incorporating technologies like the Internet of Things (IoT) and predictive maintenance into traction transformers enhances their functionality and efficiency. IoT connectivity allows for real-time monitoring of transformer performance, enabling proactive maintenance measures and reducing downtime. This not only improves the overall reliability of rail systems but also contributes to cost savings for operators.

Moreover, the adoption of advanced technologies facilitates the development of smart and connected traction transformers. These innovations not only optimize energy consumption but also provide valuable insights into system health. The ability to remotely monitor and manage traction transformers contributes to streamlined operations and the potential for predictive analytics, marking a significant step forward in the industry's evolution. As the market embraces these technological advancements, traction transformer manufacturers have the opportunity to offer cutting-edge solutions that meet the growing demand for efficient and intelligent electrification systems in the rail sector.

Segment Insights

Voltage Network Insights

The AC (alternative current) systems segment held the highest market share of 70% in 2025 based on the voltage network. The AC (Alternative Current) systems segment in the traction transformer market refers to transformers designed for electrified rail systems that utilize alternating current. These systems are crucial for powering trains efficiently. A notable trend in this segment involves a shift towards higher voltage AC systems, aiming for increased energy efficiency and reduced transmission losses. The demand for AC traction transformers is growing as railway networks worldwide upgrade to higher voltage systems, enhancing the overall performance and sustainability of electrified rail transportation.

The DC (direct current) systems segment is anticipated to witness rapid growth at a significant CAGR during the projected period. The DC (direct current) systems segment in the traction transformer market refers to transformers designed for electrified rail networks that operate on direct current. These systems are commonly used in metro and light rail applications. A trend in this segment involves the increasing preference for DC systems in urban transit projects due to their efficiency in short-distance transportation. As cities worldwide invest in expanding metro networks, the demand for DC traction transformers is on the rise, reflecting a key trend in the market.

Mounting Position Insights

The under-the-floor segment held the largest share in 2025. In the traction transformer market, the mounting position segment refers to the location where the traction transformer is physically installed within a train. Common mounting positions include roof-mounted and underfloor-mounted configurations. Roof-mounted transformers are often preferred for their accessibility and ease of maintenance. However, there is a growing trend towards underfloor-mounted transformers, as they contribute to better aerodynamics and aesthetic design, addressing space constraints on the train roof. This trend reflects a shift towards more innovative and space-efficient solutions in the design and integration of traction transformers.

The machine room segment is anticipated to witness rapid growth over the projected period. In the traction transformer market, the machine room segment refers to the placement of traction transformers within the machine room of a train. This configuration is commonly employed in various rail systems, allowing for a centralized and compact design. A prevailing trend in this segment involves the continuous miniaturization and optimization of traction transformers to fit seamlessly within the limited space of the machine room. This trend aims to enhance overall efficiency and performance while accommodating the spatial constraints typically associated with the machine room configuration in modern train designs.

Rolling Stock Insights

The electric locomotives segment held the largest share in 2025. The electric locomotives segment in the traction transformer market refers to transformers designed specifically for powering electric locomotives. These transformers play a crucial role in converting electrical power for efficient train operations. A notable trend in this segment is the increasing preference for energy-efficient and technologically advanced traction transformers. As rail networks globally electrify, there is a growing demand for transformers that enhance the performance of electric locomotives, promoting sustainability and operational excellence in the rolling stock industry.

The high-speed trains segment is anticipated to witness rapid growth over the projected period. The high-speed trains segment in the traction transformer market refers to the electrified rail systems designed for rapid transportation, typically operating at speeds significantly higher than traditional trains. As a trend, the demand for traction transformers in the high-speed train segment is on the rise globally. Increasing investments in high-speed rail projects, especially in countries like Japan, China, and parts of Europe, drive the need for advanced traction solutions to ensure efficient and reliable performance in these fast-moving rail systems.

Regional Insights

What is the Asia Pacific Traction Transformer Market Size?

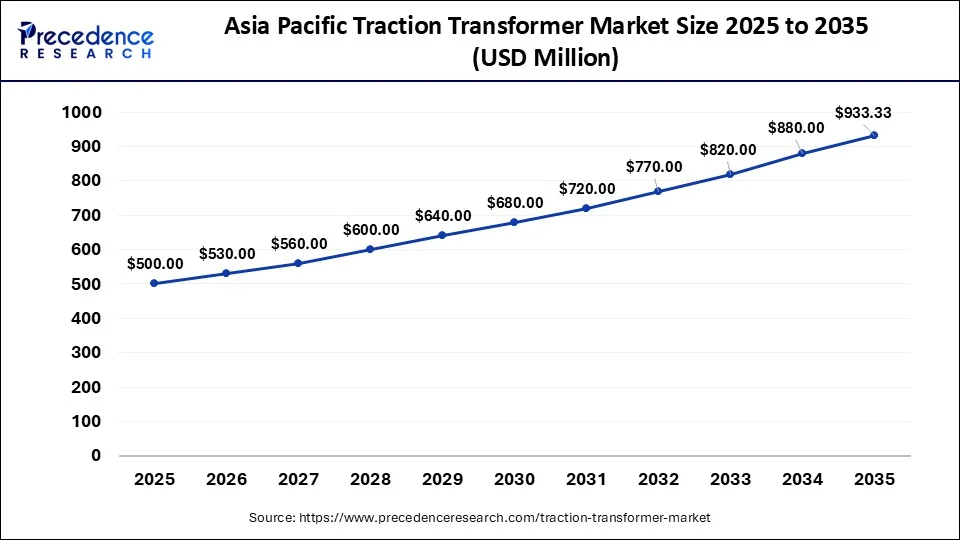

The Asia Pacific traction transformer market size was valued at USD 500 million in 2025 and is anticipated to reach around USD 933.33 million by 2035, poised to grow at a CAGR of 6.44% from 2026 to 2035.

Asia-Pacific led the market with the biggest market share of 33% in 2025. due to rapid urbanization, extensive infrastructure development, and robust investments in electrified rail systems. Countries like China, Japan, and India are spearheading high-speed rail projects, driving substantial demand for traction transformers. The region's focus on sustainable transportation and government initiatives to modernize rail networks contribute to its major market share. Additionally, the burgeoning population and the need for efficient public transportation systems further amplify the significance of Asia-Pacific in the traction transformer market.

The traction transformer market in Europe is poised for robust growth due to the region's significant investments in expanding and modernizing its rail infrastructure. Governments are increasingly focusing on electrification projects to enhance sustainability and reduce carbon emissions. The push for high-speed rail networks and the adoption of advanced technologies in rail transportation contribute to the increasing demand for traction transformers. These factors, combined with supportive policies and a commitment to sustainable mobility, create a favorable environment for the traction transformer market to thrive in the European region.

Meanwhile, North America is experiencing notable growth in the traction transformer market due to increased investments in rail infrastructure and a shift towards sustainable transportation. The region's focus on modernizing and expanding electrified rail networks, driven by environmental concerns and the need for energy-efficient solutions, contributes to the rising demand for traction transformers. Government initiatives and a growing awareness of the benefits of electrification are propelling the market forward, creating opportunities for manufacturers and suppliers in the traction transformer industry.

What are the Advancements in the Traction Transformer Market in Latin America?

Latin America is expected to witness a substantial amount of growth in the market. This growth is fueled by rapid urbanization efforts and increasing investments being made in public transportation. Government initiatives in the region help to enhance rail networks and electrification projects, which drive demand. The region is also supported by favorable regulations that promote sustainable transport solutions. The region's market appears to be evolving, creating a dynamic environment for growth and development.

Brazil Traction Transformer Market Trends: The market in the region is driven by the increasing cross-border rail connectivity, expanding electrification of freight corridors, rising government funding, and a growing adoption of smart grid technologies. Key players are focusing on innovation, including compact, lightweight designs and improved thermal management, to enhance performance and reduce maintenance costs.

What are the Key Trends in the Traction Transformer Market in the Middle East and Africa?

The Middle East and Africa are expected to witness steady growth in the market. This growth is driven by high infrastructure development and urbanization efforts. This is because governments continue to invest in rail and energy projects. Regulatory frameworks in the region are evolving in order to support sustainable transport solutions, which is expected to boost market expansion in the upcoming years. Countries like South Africa and the UAE are leading players, with high levels of investments in rail infrastructure and renewable energy projects.

Saudi Arabia Traction Transformer Market Trends: The region's landscape is characterized by a mix of local and international players, who are focusing on meeting the growing demand for efficient and reliable traction transformers. Government initiatives to modernize transportation infrastructure and promote sustainable, low-emission rail networks are key drivers of market expansion.

Traction Transformer Market Companies

- ABB

- Siemens AG

- Alstom SA

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Hitachi ABB Power Grids

- Toshiba Corporation

- CG Power and Industrial Solutions Limited

- Hyundai Rotem Company

- CAF Power & Automation

- JST Transformateurs

- Fuji Electric Co., Ltd.

- International Electric Co., Ltd. (Ingeteam)

- Wilson Transformer Company

- SPX Transformer Solutions, Inc.

Recent Developments

- In February 2024, Hitachi Energy revealed plans to invest more than USD 33.70 million to enhance and modernize its power transformer manufacturing operations in Bad Honnef, Germany. Scheduled for completion in 2026, this expansion is designed to meet the increasing demand for transformers that support Europe's clean energy transition and is anticipated to generate up to 100 new jobs in the area.

- In October 2024, Hitachi Energy declared a USD 250 million investment for the upcoming five years to fortify its activities in India. This investment encompasses substantial capacity growth for the large power transformers facility, enhancements in testing capabilities for specialty transformers, and the relocation of the bushings factory. These initiatives aim to assist with India's transmission projects and the update of its railway infrastructure.

- In September 2023, Hitachi Energy organized a seminar focused on its latest generation of dependable and sustainable transformers. The event showcased technological advancements, including the launch of the Mobile Transformer Services Unit, which is intended to augment commissioning services for new installations and maintenance of current transformers. The seminar underscored the company's dedication to innovation and sustainability in transformer technology.

- In April of 2023, the BHEL-TWL consortium marked a significant achievement by securing a major order for 80 Vande Bharat Trains in one of the largest railway tenders for manufacturing and maintaining these trains. BHEL, well-known as a leading supplier of rolling stock electrics to the Indian railways, will play a vital role in this project. Their responsibilities include providing a comprehensive propulsion system, comprising a train control management system, IGBT-based traction converter-inverter, auxiliary converter, motors, transformers, and mechanical bogies.

- In January 2023, the RATP (Parisian Autonomous Transport Administration), the operator of the Paris metro, kicked off an upgrade program on Line 6, stretching from Charles de Gaulle-Étoile to Nation. Within this program, MP89 rubber-tired trains are anticipated to be deployed. The existing MP73 fleet on Line 6 is set to be replaced by refurbished and shortened MP89 trains from Line 4, reducing their length from six cars to five.

- Back in June 2021, Hitachi ABB Power Grids introduced two new traction transformers. The RESIBLOC CRail 25 kV transformer substitutes mineral oil with dry insulation material, eradicating the risk of oil leakage and ensuring safety. The Natural Cooling Effilight Traction Transformer employs natural airflow generated by the train's motion, reducing energy consumption and enhancing efficiency.

Segments Covered in the Report

By Voltage Network

- Alternative Current (AC) Systems

- Direct Current (DC) Systems

By Mounting Position

- Over The Roof

- Machine Room

- Under The Floor

By Rolling Stock

- Electric Locomotives

- Metros

- High-Speed Trains

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content