What is the Ultra-wideband Market Size?

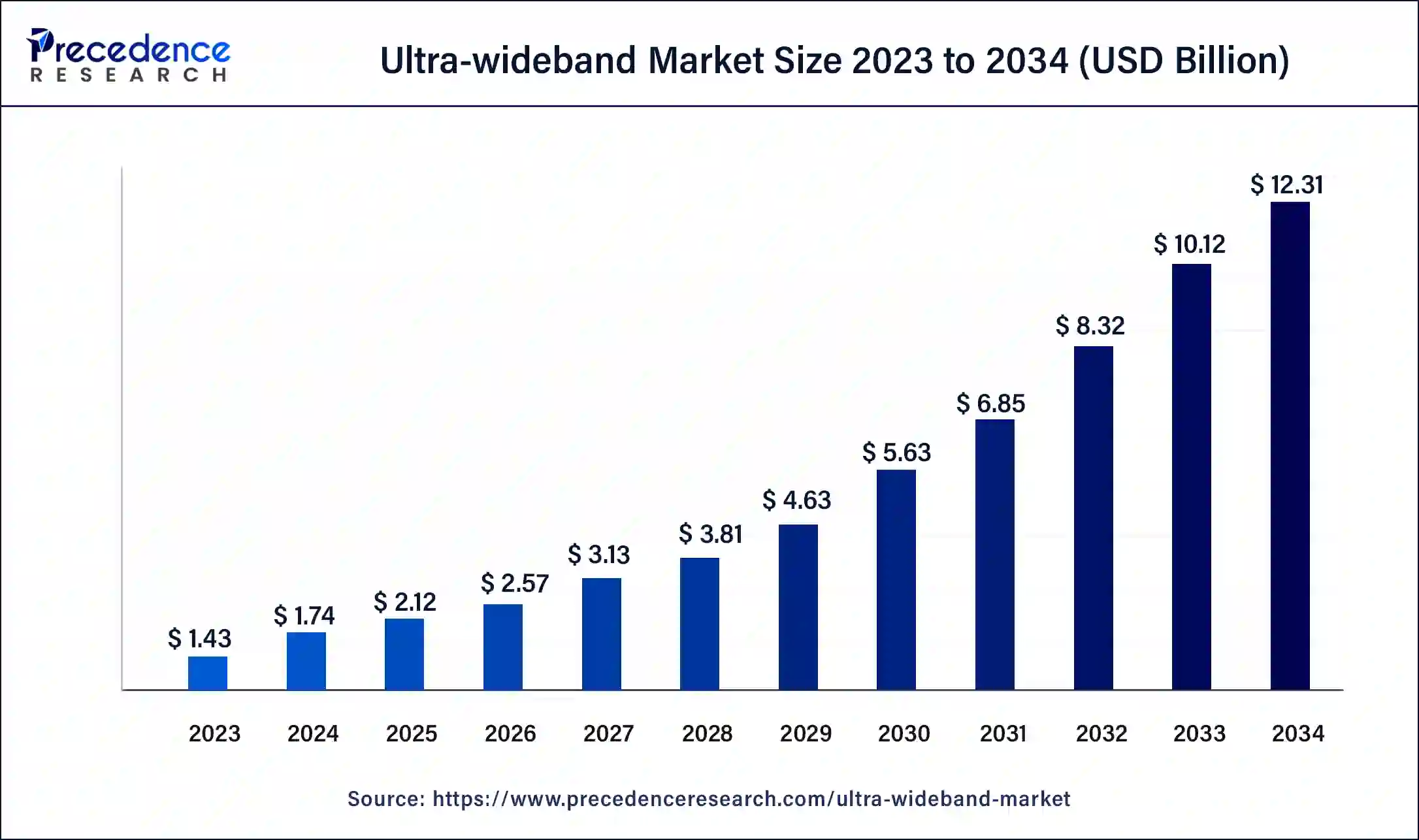

The global ultra-wideband market size is calculated at USD 2.12 billion in 2025 and is predicted to increase from USD 2.57 billion in 2026 to approximately USD 12.31 billion by 2034, at a CAGR of 21.64% from 2025 to 2034. The ultra-wideband market demand is increasing due to its specific location tracking, integration into consumer electronics and automotive systems, and its role in enhancing safety and efficiency across various industries.

Ultra-wideband Market Key Takeaways

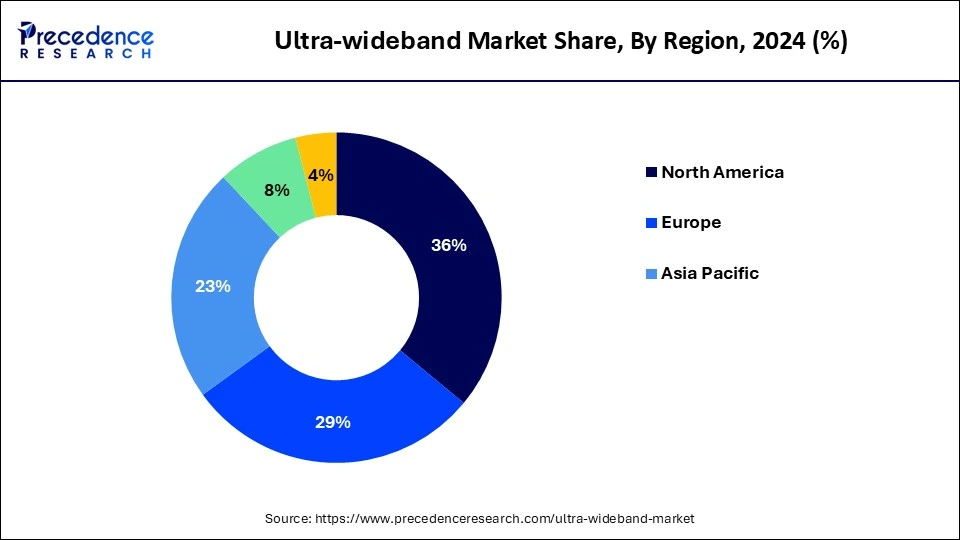

- North America dominated the ultra-wideband market with the largest market share of 43% in 2024.

- By application, the communication segment dominated the market in 2024.

- By application, the real-time satellite systems (RTLS) segment is expected to grow at the fastest rate in the market during the forecast period.

- By positioning systems, the indoor segment dominated the market in 2024.

- By positioning systems, the outdoor segment is expected to grow at the fastest rate in the market during the forecast period.

- By vertical, the consumer electronics segment dominated the market in 2024.

- By vertical, the automotive & transportation segment is expected to grow at the fastest rate in the market during the forecast period.

Ultra-wideband Innovation Driving Secure and Precise Location Tracking

The ultra-wideband (UWB) innovation is a main advantage of remote arrangement, which is recognized by its utilization of expansive radio frequency range and high data transmission. Unlike traditional Wi-Fi or Bluetooth, UWB works across higher frequency bands, offering improved precision for positioning and more security for ranging applications. It utilizes impulse-based waveforms as opposed to constant transporter waves, making it especially viable in radio communication gadgets and area frameworks.

The ultra-wideband market recently garnered significant interest in indoor positioning because of its outstanding precision in ranging and localization, combined with its adequacy in limiting multipath impedance. The integration of advanced artificial intelligence (AI) and signal processing techniques is being investigated to upgrade the accuracy and general performance of indoor positioning systems. This combination leverages artificial intelligence (AI) capabilities to analyze complex data patterns and optimize signal processing, leading to more reliable and accurate location tracking.

Market Outlook

- Industry Growth Offerings: The industry offers high-precision indoor positioning, secure short-range communication, and real-time tracking solutions. Key offerings include UWB chips, modules, sensors, and integrated systems for applications in automotive, consumer electronics, industrial automation, and IoT devices.

- Global Expansion: The ultra-wideband (UWB) market is expanding globally through adoption in automotive, consumer electronics, industrial, and IoT sectors. Companies are forming strategic partnerships, exports, and technology collaborations to meet rising demand for precise, secure, and real-time location-based solutions worldwide.

- Startup Ecosystem: The startup ecosystem is rapidly growing, driven by innovations in high-precision positioning, secure communication, and IoT applications. Startups focus on AI-enabled signal processing, automotive UWB integration, and consumer electronics solutions to capture emerging market opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.31 Billion |

| Market Size in 2025 | USD 2.12 Billion |

| Market Size in 2026 | USD 2.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 21.64% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Positioning System, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased growth in the deployment of UWB technology in devices

As wireless communication technology advances, ultra-wideband stands apart for its momentous advantages across different applications. Its capacity to help with incredibly high information rates makes it especially appealing for WAN and LAN systems, addressing the growing need for high-speed wireless networks driven by increasing data demands.

UWB technology is proving favorable for both systematic design and practical implementation in indoor systems administration and other wireless communication systems. During the construction of warehouses, shopping malls, airports, and other large areas, equipment transportation, personnel positioning, vehicle positioning, operation dispatching management, and security have great demands on location information, which in turn drives the growth of the ultra-wideband market.

- According to ABI Research, UWB-enabled devices are expected to surge from 109 million units in 2019 to over 1 billion by 2025, with a total of 3.6 billion devices projected to be shipped globally by the same year. The UWB market is anticipated to experience robust growth, with double-digit percentage increases projected for the foreseeable future, underscoring its expanding role in the wireless communications landscape.

The rising demand for UWB technology in real-time location systems (RTLS)

The ultra-wideband market is primarily driven by its effectiveness in Real-Time Location Systems (RTLS), which offer precise asset and personnel tracking. Through improved operational efficiency, enhanced worker safety, compliance, and loss prevention, this capability enables significant cost savings. UWB technology has witnessed assets communicating with anchors placed in environments such as factories, warehouses, and healthcare facilities to achieve real-time, centimeter-level accuracy. Deployments of UWB RTLS have increased significantly in recent years. UWB has a significant advantage over other technologies due to its superior performance in terms of ultra-low latency and durability in challenging conditions.

- By 2025, ABI Research had anticipated nearly 30,000 UWB RTLS deployments, supported by a wide range of UWB RTLS vendors, including Siemens, Sewio, Kinexon, TSINGOAL, Zebra, Redpoint Positioning, Ubisense, Eliko, Pozyx, UWINLOC, Litum, Intranav, Quarion, and Tracktio, among others.

Restraint

Regulatory barriers

A significant regulatory barrier for the ultra-wideband market is the requirement for approval in various target markets. This process is complicated by the differing definitions and regulations surrounding UWB across countries. It is possible for UWB technology to interfere with other wireless systems or services that use the same frequencies because it operates over a large frequency range. Many nations impose stringent regulations on the maximum transmitter power and limit the frequency bands and environments in which UWB can be used to reduce these risks. These regulatory variations and restrictions can pose challenges for companies seeking to market UWB products internationally.

Opportunity

Expansion in the automotive industry

The automotive industry's adoption of ultra-wideband technology presents significant market opportunities. UWB's growing adoption of location-based administrations, such as access control and keyless section, enhances vehicle comfort and security. For accurate wireless charging of electric vehicles, a UWB-based method that relies on precise alignment of the vehicle's ground coils has been validated for use in parking situations. Additionally, UWB enables remote car management through smartphones, facilitating features like keyless entry, autonomous parking, automatic welcome lights, and enhanced Vehicle-to-Everything (V2X) communication by exchanging beacon signals with surrounding sensors. These advancements offer substantial opportunities for ultra-wideband market growth in automotive applications.

- According to the International Energy Agency, electric car sales are expected to continue strongly through 2023. Over 2.3 million electric cars were sold in the first quarter, about 25% more than in 2022.

Segment insights

Application Insights

The communication segment dominated the ultra-wideband market in 2024. UWB wireless communication is a revolutionary technology that uses radio signals with short pulses and low power to transmit large amounts of digital data across a wide frequency range. UWB communication methods for short-range wireless mobile systems have garnered significant interest in recent years from both academia and industry. This interest is driven by UWB's striking advantages, including low power consumption, high data rates, resistance to multipath interference, simpler transceiver hardware, and minimal interference.

The real-time satellite systems (RTLS) segment is expected to grow at the fastest rate in the ultra-wideband market during the forecast period. Ultra-wideband technology is emerging as an essential Internet of Things (IoT) solution for RTLS, and there is growing global demand for real-time location tracking. Vehicles, people, animals, smartphones, materials, and equipment can all be precisely tracked in real-time using UWB. In the IoT landscape, RTLS is supported by a variety of technologies that provide wireless systems capable of determining an asset's position within a specified area almost immediately.

- In July 2024, Litum, the leader in Real-Time Location Systems (RTLS), announced the launch of its staff duress solution, available via a flexible subscription model. This innovative solution aims to significantly reduce emergency response times in healthcare, providing an efficient and cost-effective way to ensure staff safety.

Positioning System Insights

The indoor segment dominated the ultra-wideband market in 2024. More precise indoor positioning is necessary for applications like tracking objects in large warehouses and assisting visually impaired individuals in navigating unfamiliar spaces and emergency situations. For such purposes, UWB technology provides real-time tracking and tracing, helping to facilitate emergency evacuations in smoke-filled environments and increasing child safety in crowded areas.

The outdoor segment is expected to grow at the fastest rate in the market during the forecast period. In both civilian and military settings, the use of unmanned ground vehicles (UGVs), which are robotic systems that operate on land without human operators, is on the rise. UGVs are becoming increasingly important in addressing dangerous situations and improving operational safety as the demand for such applications grows.

Vertical Insights

The consumer electronics segment dominated the ultra-wideband market in 2024. There has been a surge in the availability of advanced ultra-wideband (UWB) radio chips due to the growing use of UWB technology for location-based services like access control and keyless vehicle entry, as well as its integration into new consumer devices like smartphones. This trend reflects the technology's growing role in enhancing user convenience and security, driving advancement, and growing its application across different areas.

- In September 2022, NOVELDA launched its new ultra wideband (UWB) occupancy sensor designed for enhancing light control in open offices and meeting rooms. This sensor improved energy savings by automatically turning on lights when approached and turning them off when no longer needed.

The automotive & transportation segment is expected to grow at the fastest rate in the ultra-wideband market during the forecast period. Automotive, mobile, and Internet of Things (IoT) applications all benefit from secure, precise ranging and sensing made possible by this technology. Automotive UWB applications incorporate automated trailer-hitch activation, automated valet parking, hands-free parking, lot access, and drive-through payment.

- In July 2022, NXP Semiconductors and Taiwan's Hon Hai Technology Group signed a letter of intent to develop platforms for a new generation of smart connected cars, integrating UWB technology within the NXP S32 domain. This collaboration underscores UWB's expanding role in enhancing automotive innovation and connectivity.

Regional Insights

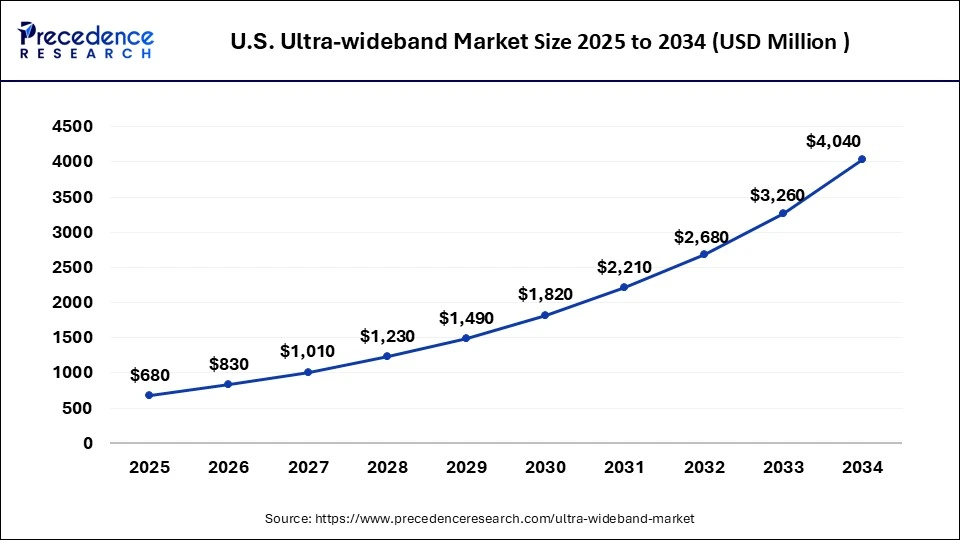

U.S. Ultra-wideband Market Size and Growth 2025 to 2034

The U.S. ultra-wideband market size is exhibited at USD 680 million in 2025 and is projected to be worth around USD 4,040 million by 2034, poised to grow at a CAGR of 21.85% from 2025 to 2034.

North America Emerges as the Ultra-Wideband Market Powerhouse

North America held the largest share of the ultra-wideband market in 2024. This is due to technological advancements supported by a strong presence of innovative technology companies and research institutions, particularly in the United States. The North America market benefits from the combination of technological innovation, regulatory support, and growing application diversity of the sector.

Precision and Innovation: Driving Growth of the U.S. Ultra-Wideband Market

The U.S. market is growing due to increasing adoption of high-precision indoor positioning and tracking systems across industries like logistics, healthcare, and smart buildings. Rising demand for secure, low-latency communication, combined with advancements in AI and signal processing, enhances accuracy and reliability. The proliferation of IoT devices, smartphones, and automotive applications further drives UWB integration, making it a key technology for next-generation location-based solutions.

Ultra-wideband Growth Soars in Asia Pacific Amid Automotive and Consumer Tech Expansion

Asia Pacific is expected to witness the fastest rate of growth in the ultra-wideband market during the forecast peirod. Ultra-wideband market rising adoption across multiple sectors. In the automotive industry, manufacturers like Toyota and Hyundai are integrating UWB for advanced keyless entry systems. Consumer electronics companies in China, Japan, and India are incorporating UWB into smartphones and smartwatches for precise location tracking and device connectivity. Overall, the growth of the ultra-wideband market in the Asia Pacific region reflects the technology's broad applicability and the region's innovative approach to leveraging advanced solutions across diverse industries.

- According to the International Energy Agency, in 2023, China experienced the most electric car sales throughout Asia-Pacific; more than half of the electric cars on roads worldwide are now in China, and the country has already exceeded its 2025 target for new energy vehicle sales.

China's Ultra-Wideband Market: Accelerating with IoT and Smart Technology Adoption

China's market is expanding due to growing adoption in smart manufacturing, logistics, automotive, and consumer electronics for precise indoor positioning and secure communication. Government support for advanced wireless technologies, rising IoT and smart device deployment, and increasing investment in AI-driven signal processing enhance UWB applications. The demand for high-accuracy tracking and secure data transmission across industries is further accelerating market growth in the region.

Europe embraces Ultra-wideband: High-Precision Tracking Fuels Market Expansion

Europe's market is expanding due to increasing demand for high-precision indoor positioning in sectors like logistics, healthcare, automotive, and industrial automation. Supportive regulations, growing IoT adoption, and investments in AI and advanced signal processing are driving technology integration. The need for secure, low-latency communication and efficient tracking solutions in smart buildings and connected devices further fuels the market's growth across the region.

UK Ultra-Wideband Market on the Rise: Smart Infrastructure and IoT Adoption Lead Growth

The UK market is increasing due to rising adoption of high-precision indoor positioning and tracking in healthcare, logistics, smart buildings, and industrial sectors. Growth is supported by IoT proliferation, AI-enhanced signal processing, and demand for secure, low-latency communication. Increasing investments in connected devices, smart infrastructure, and automotive applications are further accelerating UWB integration, driving the market's expansion across both commercial and consumer segments in the UK.

Ultra-Wideband Markets Companies

- Pulse LINK Inc. (U.S.): Develops high-speed UWB chips and wireless solutions for precise data transfer and indoor positioning.

- Apple Inc. (U.S.): Integrates UWB in devices like iPhones and AirTags for accurate spatial awareness, secure device communication, and advanced tracking.

- 3M (U.S.): Provides UWB-based sensing solutions for industrial and commercial applications, including positioning and asset tracking.

- Alereon Inc. (U.S.): Offers UWB components and communication modules for secure, low-power, high-precision wireless connectivity.

- Emerson Electric Co. (U.S.): Implements UWB in industrial automation, asset tracking, and real-time monitoring systems for improved operational efficiency.

Other major Key Players

- Taiyo Yuden Co Ltd. (Japan)

- 5D Robotics Inc. (U.S.)

- Johanson Technology Inc. (U.S.)

- Nanotron Technologies GmbH (Germany)

- DecaWave Ltd. (Ireland)

- Fractus Antennas S.L. (Spain)

- BeSpoon SAS (France)

- Zebra Technologies Corporation (U.S.)

- NXP Semiconductors (Netherlands)

- Texas Instruments Incorporated (U.S.)

- SAMSUNG (South Korea)

- Stanley Black & Decker, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Honeywell International Inc. (U.S.)

Recent Developments

- In June 2024, Motorola launched the Moto Tag with a UWB chip for precise location tracking.

- In June 2024, Google updated its Find My Device network to include ultra-wideband and augmented reality support aimed at providing precise location tracking for Android users.

- In April 2024, Easelink and NXP semiconductors developed a UWB-based positioning system for automated charging. This system, which acts as an advanced parking assistance feature, helps position electric cars for fully automated Matrix Charging.

- In February 2024, Tesla introduced a significant update to its operating system, version 2024.2.3, which incorporated Apple's ultra-wideband technology. This update significantly improved the functionality of the phone key, allowing Tesla owners to bypass less secure Bluetooth connections for vehicle access.

- In February 2024, Giant Microelectronics unveiled the GT1500 UWB chipset designed for ranging, positioning, and wireless connectivity applications.

- In March 2023, Rohde & Schwarz expanded its ultra-wideband RF amplifier family, BBA300, to offer high availability and extended range for critical test environments.

- In March 2023, Samsung announced its first ultra-wideband (UWB) chipset, the Exynos Connect U100, which provided single-digit centimeter accuracy and was optimized for mobile, automotive, and IoT devices.

- In February 2023, Quectel introduced its ultra-wideband automotive-grade module, compliant with CCC and ICCE standards, designed to support the latest generation of digital car keys with enhanced location and security features.

Segments Covered in the Report

By Application

- RTLS

- Imaging

- Communication

- Others (ranging, wireless USB, & authentication)

By Positioning System

- Indoor

- Outdoor

By Vertical

- Healthcare

- Automotive And Transportation

- Manufacturing

- Consumer Electronics

- Retail

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting