What is the U.S. Absence Management Market Size?

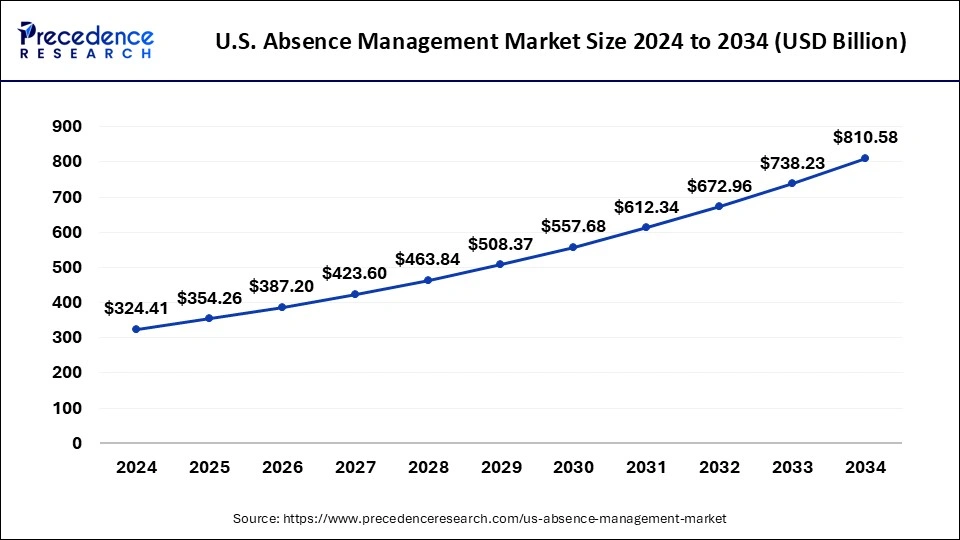

The U.S. absence management market size is calculated at USD 355.52 million in 2025 and is predicted to increase from USD 389.61 million in 2026 to approximately USD 877.37 million by 2035, expanding at a CAGR of 9.59% from 2026 to 2035.

United States

The U.S. absence management market is bursting with growth as organizations continue to wrestle with complicated coordination and compliance challenges which include the Family and Medical Leave Act (FMLA), the Americans with Disabilities Act (ADA), and finally a list of multiple paid leave laws at the state level. Organizations with compliance issues have to adopt in the latest leave tracking software, and they want their absence management software to connect with their HR and payroll systems. Improved employee well-being, increased focus on mental health, and hybrid work are also contributing to demand for AI-backed absence management solutions.

Moreover, U.S. organizations are off-loading their leave administration to third-party vendors to reduce their risks of legal issues as well as minimize the burden on their HR staff. North America and the U.S. in particular, accounted for the larger share of global revenue because it has strong technology infrastructure and was the first to adopt SaaS-based HR systems.

Market Highlights

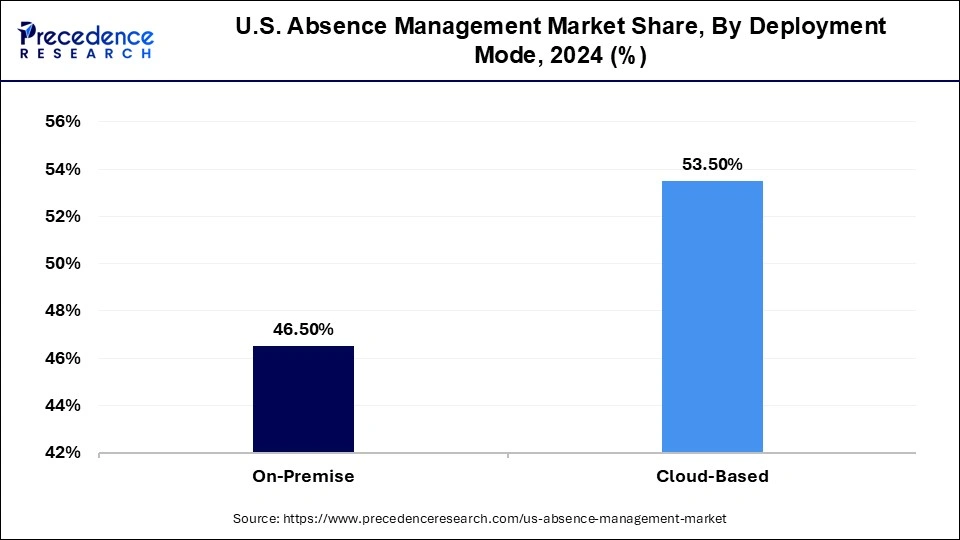

- By Deployment Mode, the cloud-based segment dominated the market and generated more than 53.50% of revenue share in 2025.

- By Application, the large enterprises segment contributed the highest revenue share of 60.50% in 2025.

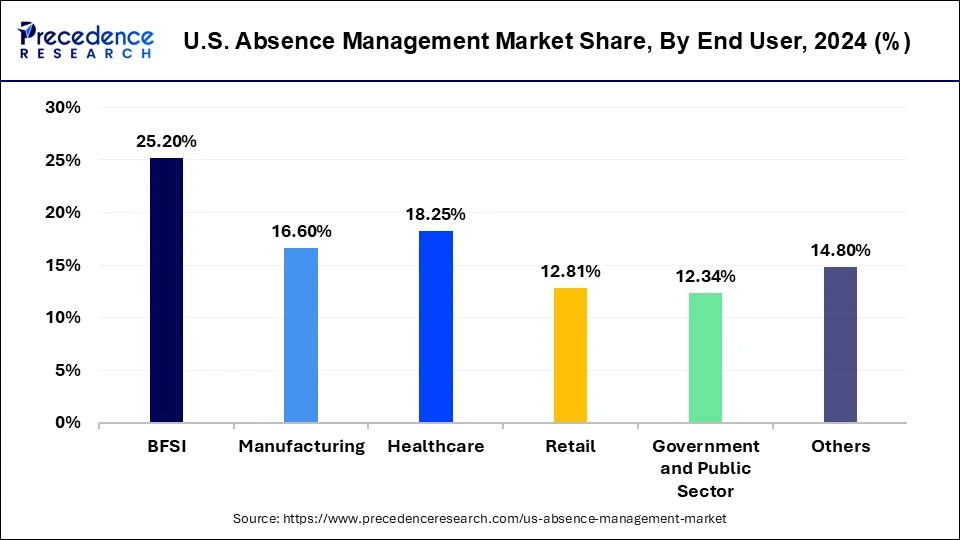

- By End User, the BFSI segment registered more than 25.20% revenue share in 20245

Market Overview

The growth of the U.S. absence management market is in overdrive due to ever-increasing focus on employee well-being, more and more compliance complexity, and a greater desire for effective workforce management tools. Organizations are seeking streamlined processes to better manage aspects of FMLA, ADA, short-term disability, and other statutory leaves as companies continue to adopt digital leave management tools as well as integrated HR platforms. The pandemic-driven shift toward hybrid workplace models and increased scrutiny on compliance have accelerated the need for automated, compliant absence tracking systems.

Employers have shown a marked interest in third-party absence management providers to reduce the administrative burden and loss of productivity. This change in absence management is producing new (or those returning to activity) competition and novel, SaaS-based solutions. More suppliers are looking to partner with firms outside their traditional ways of doing business. Overall, U.S. organizations in the public and private sectors can expect more growth in this sector.

What are the Growth Factors that Influence the Growth of the U.S. Absence Management Market?

The Demand for Better Compliance: The complexity and activity of new federal and state-mandated regulations, including the FMLA, ADA, and permissive state leave laws, in the workplace has prompted businesses to seek automated solutions that are compliant to avoid serious and costly penalties.

- The Impact of Post-COVID-19 Developments on the Workforce: The COVID-19 pandemic made employee health and absence tracking even more important, so outdated processes cannot continue to be used to track employees' absences. Modern absence management software will allow organizations to be more agile and proactive in dealing with absences.

- The Continued Growth of Workers Being Remote/Hybrid or Flexible: Flexible work arrangements have become the expected norm for many employees, and it's no surprise that employers will want to implement tools with endless scale efficiencies to track absence for a distributed workforce.

- The Focus on Employee Well-Being: Organizations have placed a stronger emphasis on employee wellness, mental health, and balancing home and work life. This emphasis has prompted many organizations to improve their absence management policies to remain transparent and supportive of their employees.

- The Rise of Technology: The growth of AI-powered HR technology and the SaaS (Software as a Service) model has made it possible to access, engage and caption absence data in real-time, generate predictive analytics, and easier for managers to make decisions regarding employee absence.

- It Makes Good Business Sense to Remain Cost Efficient and Improve Productivity: More effective use of absence management systems aids in eliminating administrative burden and limiting productivity losses related to unexpected absences.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 355.52 Million |

| Market Size in 2026 | USD 389.61 Million |

| Market Size by 2035 | USD 877.37 Million |

| Growth Rate from 2026 to 2035 | CAGR of 9.59% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Mode, Application, and End User |

Market Dynamics

Drivers

Rising awareness of the importance of employee well-being

The value of employee well-being at work has become more widely recognized in recent years. As a result, many businesses are increasingly funding absence management tools to make sure that their staff members are healthy, content, and effective. For instance, Centre Parcs U.K. & Ireland chose Dayforce in March 2022, according to an announcement by Ceridian HCM Inc., in order to optimize its workforce, increase employee engagement, and boost regulatory compliance.

Growing awareness of the impact of mental health

The rising awareness of mental health issues is one of the major factors driving the absence management industry. Novel goods, services, and technology are being developed as a result of the necessity for businesses to find ways to manage the mental health of their staff. The absence management market is increasingly focusing on mental health for a number of reasons. As per the National Institute of Mental Health, one in five Americans suffers from a mental disorder at some point each year. This states that a sizable portion of the workforce may experience mental health problems.

Restraints

High cost

The absence management industry has been expanding recently due to factors like rising labor costs, stricter laws, and the necessity for businesses to maintain efficiency and profitability. The high cost of installing and maintaining absence management systems is one of the most significant issues in the absence management market. These expenses may cover those for hardware, software, support, training, and continuous maintenance and updates. The expenses also change based on the organization's size and the degree of customization needed to satisfy particular requirements. Additionally, suppose an organization does not consider absenteeism to be a significant problem or is not influenced that the system's advantages outweigh its drawbacks. In that case, it may be reluctant to invest in absence management systems.

Opportunities

The growing trend of remote work

The market for absence management, or the systems and procedures set up to manage employee absences such as sick leave, vacation time, and other types of leave, is uniquely positioned to benefit from the expanding trend of remote work. The flexibility that remote work gives allowing employees to work from anywhere and at any time, is one of its key benefits. Absence management systems help organizations track and manage employee absences more successfully by giving them the tools and procedures necessary.

Segment Insights

Deployment Mode Insights

The On-Premises sector is expected to expand at a faster rate during the forecast period as a result of the growing adoption of enterprise application software. Additionally, the industry is growing as more businesses embrace enterprise application software. On-premises corporate application software is anticipated to give opportunities for the market's expansion due to the data privacy and security it offers. More companies are utilizing absence and leave management software since it assists them in learning about their employees' leave habits, which will help them perform better overall. This kind of software simplifies the task of H.R. management at an organization by enabling them to track and record employee attendance in real-time rather than manually updating a spreadsheet.

The Cloud-Based sector is expected to expand at a remarkable rate. The main factor driving cloud services is cost-effectiveness. By utilizing cloud services, businesses reduce their operating expenses by more than 30% to 35%. The second factor includes all the operational characteristics that enhance an organization's capacity to conduct business.

U.S. Absence Management Market, By Deployment Mode, 2022-2024 (USD Million)

| By Deployment Mode | 2022 | 2023 | 2024 |

| On-Premise | 128.22 | 139.01 | 150.85 |

| Cloud-Based | 144.58 | 158.34 | 173.56 |

Application Insights

Large Enterprises are anticipated to grow at a higher rate from 2026 to 2035. Due to their massive workforces, major businesses typically embrace workforce management software at a higher rate than small businesses. Due to their extensive investments in advanced technology and robust I.T. infrastructure, large businesses account for a significant portion of the market. However, due to the improved absence management software offerings of key companies and cost-effective alternatives, large businesses are predicted to transition from on-premises options to cloud-based ones.

The SME sector is anticipated to grow at the fastest CAGR from 2026 to 2035. The growth is due to the increasing adoption of absence and leave management programs by small and medium-sized businesses (SMEs) and the growing demand among businesses for information.

U.S. Absence Management Market, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Large Enterprises | 166.41 | 180.64 | 213.44 |

| SMEs | 106.39 | 116.71 | 140.82 |

End Users Insights

The BFSI sector is growing at the highest CAGR from 2026 to 2035. Financial organizations make sure that BFSI staff receive complete instructions on how modern financial instruments operate. In order to efficiently manage its staff and set priorities for its actions, this industry benefits from innovative technologies and a variety of management solutions and services. Furthermore, the BFSI industry has been significantly disrupted by the arrival of FinTech companies into the market. As a result, it is anticipated that many businesses will embrace absence management solutions.

The manufacturing segment is anticipated to expand at the fastest CAGR from 2026 to 2035. The expanding partnership between Original Equipment Manufacturers (OEM) and Engineering Service Providers (ESP) (ESO) is probably one of the key factors affecting the acceptability of absence management outsourcing. R&D initiatives have pushed key ESO industry players to include global delivery systems in their business plans. Additionally, it affects how employees are managed, how they are evaluated, and how well they are treated. The Centre for Disease Control and Prevention (CDC) estimates that productivity losses due to absenteeism cost U.S. companies $225.7 billion annually, amounting to about $1.684 per worker.

U.S. Absence Management Market, By End Users, 2022-2024 (USD Million)

| By End Users | 2022 | 2023 | 2024 |

| BFSI | 68.2 | 74.64 | 81.75 |

| Manufacturing | 45.83 | 49.66 | 53.85 |

| Healthcare | 48.97 | 53.82 | 59.21 |

| Retail | 34.51 | 37.85 | 41.56 |

| Government and Public Sector | 34.37 | 37.08 | 40.03 |

| Others | 40.92 | 44.31 | 48.01 |

U.S. Absence Management Market Companies

Recent Developments

- In May 2023, UKG agreed with Google Cloud to integrate GenAI (generative A.I.) capabilities.

- In April 2023, Workday partnered with Jefferson Health.

- In January 2023, ADP announced the acquisition of Securax Tech Solutions. The acquisition strengthens ADP's ability to offer combined payroll and time solutions in the region.

- In September 2022, Trinet acquired Clarus R+D Solutions LLC.

- In November 2021, AbsenceSoft acquired Presagia.

- In December 2020, SAP launched e SAP SuccessFactors Time Tracking solution. A cloud-based solution that offers organizations simple, innovative tools to record, approve and monitor the time of their workforce.

Segments Covered in the Report

By Deployment Mode

- On-Premises

- Cloud-Based

By Application

- Large Enterprises

- SMEs

By End User

- BFSI

- Manufacturing

- Healthcare

- Retail

- I.T. and Telecom

- Government and Public Sector

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting