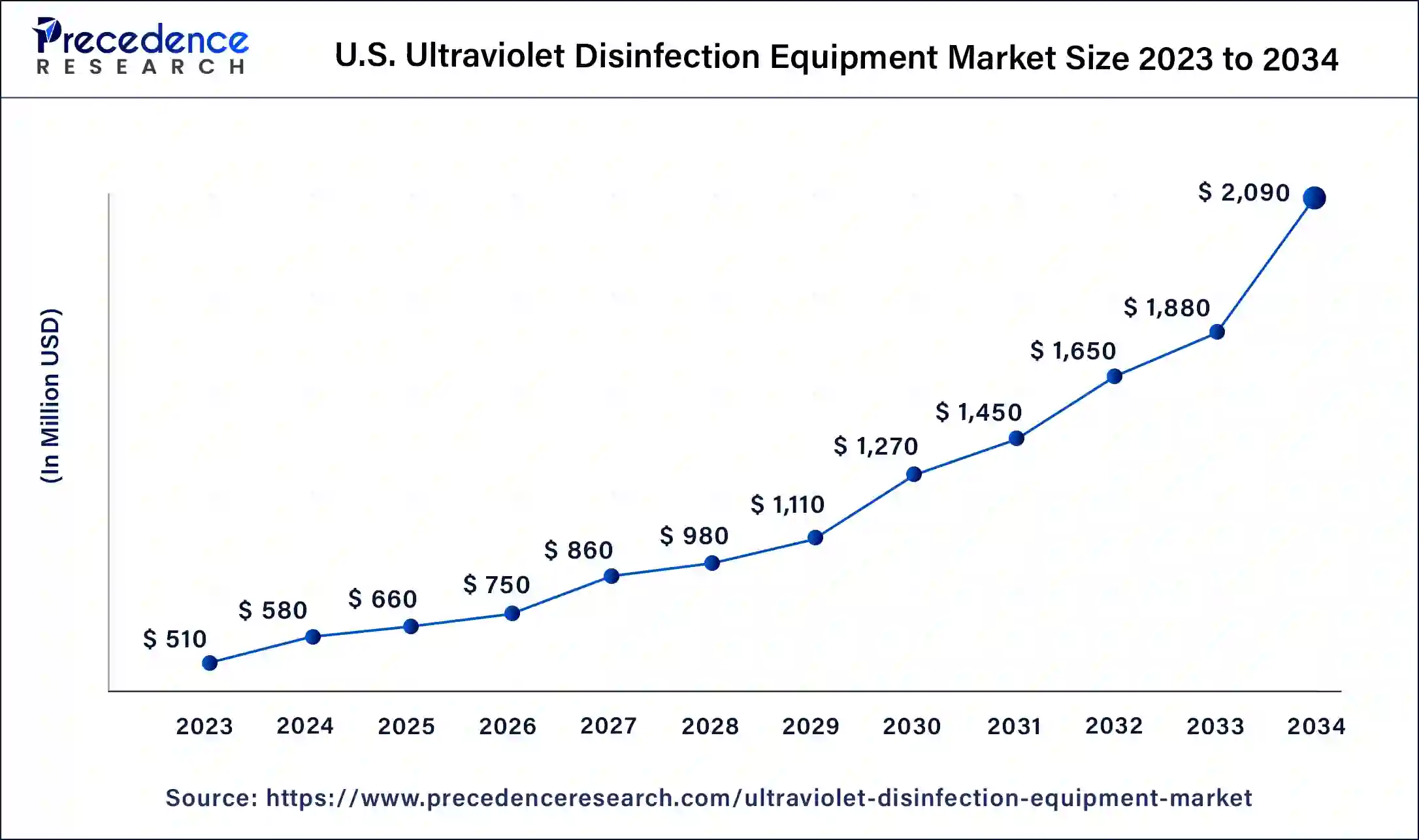

U.S. Ultraviolet Disinfection Equipment Market Size and Forecast 2025 to 2034

The U.S. ultraviolet disinfection equipment market size is estimated at USD 580 million in 2024 and is anticipated to reach around USD 2,090 million by 2034, expanding at a CAGR of 14% from 2024 to 2034. The U.S. ultraviolet disinfection equipment market is driven by the growing awareness of and concern for related healthcare issues.

U.S. Ultraviolet Disinfection Equipment Market Key Takeaways

- By component type, the UV lamps segment dominated the market in 2023.

- By application, the water & and wastewater treatment segment dominated the market in 2023.

- By application, the health facilities segment is observed to witness a significant rate of growth during the forecast period.

- By end use, the municipal segment dominated the U.S. ultraviolet disinfection equipment market in 2023.

Market Overview

The U.S. ultraviolet disinfection equipment market refers to the industry involved in the production, distribution, and sale of UV disinfection systems used for water and air purification purposes. UV disinfection equipment utilizes ultraviolet light to kill or inactivate microorganisms such as bacteria, viruses, and protozoa, making it an effective and environmentally friendly method for disinfecting water and air.

The most common application of UV-based disinfection equipment is still water treatment, which includes swimming pools and spas, domestic systems, industrial wastewater treatment, and municipal water supplies. Growing worries about new pollutants and water quality are driving demand. Aquaculture, pharmaceutical production, and cannabis cultivation all require UV disinfection. Adoption is fueled by a growing awareness of UV's efficiency, safety, and environmental friendliness compared to chemical disinfectants. Strict criteria for healthcare cleanliness and water quality require disinfection treatments, with UV preferred.

UV disinfection's low energy usage and chemical-free nature align with sustainability objectives. UV disinfection is used to sanitize food, water, and surfaces to prolong shelf life and ensure food safety. UV is becoming increasingly appealing because of advancements in LED-based UV systems, increased efficiency, and integration with smart technology. U.S. ultraviolet disinfection equipment market data and statistics.

- In January 2022, Xylem declared that it supports a new funding source for water utilities to implement exciting new technology. The collaboration with Isle Utilities, a water consultant, offers a novel strategy for financing and extending innovative water solutions known as the "Trial Reservoir." It gives innovators in water technology access to funding for experimental projects, first concentrating on solutions that lower the carbon emissions of water systems.

U.S. Ultraviolet Disinfection Equipment Market Growth Factors

- Investments in UV disinfection are driven by strict restrictions and an increasing awareness of healthcare-associated diseases (HAIs).

- Prioritize raising the water standard in homes and towns, especially regarding point-of-use disinfection.

- Utilizing UV light to disinfect surfaces, water, and air to ensure food safety and hygiene. Increasing the need for environmentally friendly cleaning products.

- Safer, longer-lasting, and more energy-efficient than conventional mercury lamps.

- Preference for environmentally friendly disinfection techniques with fewer side effects, promoting the growth of the U.S. ultraviolet disinfection equipment market.

- Clean air is becoming increasingly in demand in various places, such as public transit, commercial buildings, and educational institutions.

- Systems that are automated, portable, and easy to use meet various requirements.

- There is an increased need for UV disinfection products to fight the virus on surfaces and in the air.

US Ultraviolet Disinfection Equipment Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 14% |

| U.S. Market Size in 2023 | USD 510 Million |

| U.S. Market Size in 2024 | USD 580 Million |

| U.S. Market Size by 2034 | USD 2,090 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component Type, By Application, and By End User |

Market Dynamics

Drivers

- Heightened focus on public health and safety

The necessity of using efficient cleaning techniques to stop the spread of viruses and other infections has been highlighted by the COVID-19 pandemic. UV disinfection has shown to be quite successful in combating a wide range of bacteria, including coronaviruses. Businesses and municipalities are using UV disinfection systems more and more to clean water and wastewater. UV light is an environmentally safe method of eliminating dangerous bacteria, viruses, and protozoa without creating toxic byproducts.

Strict infection control procedures are necessary in hospitals, clinics, and other healthcare environments to protect patients and employees. Healthcare-associated infections (HAIs) can be prevented using UV disinfection systems, which provide an effective and non-toxic way to sanitize water, air, and surfaces.

- Innovation in UV lamps and systems

Technological developments in UV lamps have created more potent and efficient lamps, enabling faster and more complete disinfection procedures. Several industries, including food processing, water treatment, and healthcare, are drawn to this greater efficiency. Thanks to innovation, UV systems specifically designed to meet the needs of air purification, surface disinfection, or water treatment have been developed. This customization capacity further increases market potential, which appeals to sectors with various needs. Such innovations create significant drivers for the U.S. ultraviolet disinfection equipment market.

UV disinfection systems' operation and monitoring procedures have been simplified by integrating automation features and Internet of Things (IoT) technologies. These intelligent UV systems can optimize energy use, adjust based on real-time data, and offer remote monitoring and control, all of which increase user convenience and efficiency.

Restraint

Limitation in public awareness

Consumers and enterprises have little demand for UV disinfection technology if they aren't informed about its advantages. This lack of demand stunts the expansion of the U.S. ultraviolet disinfection equipment market. Because they are unaware of the equipment's long-term advantages, like better sanitation and a lower risk of illness, some prospective customers might think UV disinfection is needless or overpriced.

Opportunity

Expanding into emerging applications

The benefits of UV disinfection are becoming more widely recognized in several industries, including HVAC systems, food and beverage, water treatment, and healthcare. This awareness drives demand for UV disinfection solutions outside of typical applications. Regulations are starting to show how safe and effective UV disinfection is, and UV solutions are now included in industry standards and guidelines. This gives businesses aiming to grow into new applications a regulatory tailwind. Thereby, the expansion in such applications offer a significant opportunity for the U.S. ultraviolet disinfection equipment market.

UV disinfection presents an economical and ecologically sustainable substitute for conventional chemical-based disinfection techniques. UV solutions are becoming increasingly preferred in various applications as sustainability becomes an increasingly important concern.

Component type insights

The UV lamps segment dominated the U.S. ultraviolet disinfection equipment market in 2023. UV lamps are dependable for disinfection because it has been demonstrated that they can efficiently kill various pathogens, including bacteria, viruses, and protozoa. It offers chemical-free, quick disinfection while lowering the possibility of hazardous byproducts and gradually cutting operating expenses. Growing regulatory support for UV disinfection technology has been fueled by increasing worries about the quality of water and air, which has led to their adoption across a range of industries.

The ballasts/controller units' segment is the fastest growing in the U.S. ultraviolet disinfection equipment market during the forecast period. Businesses, governments, and consumers are becoming more conscious of how well UV disinfection works to eliminate dangerous pathogens, including bacteria, viruses, and protozoa. Because of this, there is an increased need for UV disinfection equipment, such as controller units and ballasts, to guarantee dependable operation and peak performance.

The need for UV disinfection equipment is driven by the growth of several industries that need water and air treatment solutions, including food processing, pharmaceuticals, and wastewater treatment. These systems' essential parts, ballasts, and controller units increase their efficacy and efficiency.

Application Insights

The water and wastewater treatment segment dominated the U.S. ultraviolet disinfection equipment market in 2023. Improving water treatment procedures has received much attention as public awareness of environmental contamination and waterborne illnesses has grown. Water can be disinfected chemical-free and sustainably with the help of UV disinfection. Municipalities and businesses are required by strict laws, such as those issued by the Environmental Protection Agency (EPA), to treat their water and wastewater properly before discharging it. Meeting regulatory criteria, UV disinfection is a highly effective way to inactivate germs found in water.

Because of its versatility, UV disinfection systems can be applied to various tasks, such as wastewater treatment, industrial process water, municipal drinking water, and swimming pool water. Their extensive use in the American market is partly attributed to their adaptability.

The health facilities segment is expected to witness a significant growth rate during the forecast period. Global healthcare needs are increasing along with population growth and aging demographics, creating a greater demand for health facilities, from clinics and hospitals to specialized care units. Increased investments in institutions equipped to handle emergencies and pandemics have resulted from recent global health disasters, such as the COVID-19 pandemic, highlighting the significance of a strong healthcare infrastructure.

The burgeoning trend of medical tourism, in which people travel overseas for medical care, is propelling the expansion of healthcare facilities in locations renowned for their cutting-edge medical facilities and reasonably priced healthcare alternatives. Governments and private investors are spending more on healthcare infrastructure to improve the availability, caliber, and effectiveness of healthcare services, especially in emerging nations.

End-use Insights

The municipal segment dominated the U.S. ultraviolet disinfection equipment market in 2023. Tight rules govern how wastewater and water are treated in municipalities. Regulatory agencies frequently need UV disinfection as a practical way to guarantee water safety. Technological developments in UV disinfection have improved system dependability, affordability, and ease of use. Municipalities are likelier to spend money on tried-and-true innovations that enhance operations and yield long-term advantages.

Municipal budgets frequently fund infrastructure related to the treatment of wastewater and water. Funds for UV disinfection systems are willingly allocated due to growing awareness of the significance of water quality to comply with regulations and guarantee citizens' access to clean drinking water.

U.S. Ultraviolet Disinfection Equipment Market Companies

- Xylem Inc.

- Atlantic Ultraviolet Corporation

- Evoqua Water Technologies LLC

- Trojan Technologies

- Halma PLC

- Kuraray Co., LTD

- Advanced UV, Inc.

- American Ultraviolet

- Atlantium Technologies LTD.

- Hoenle AG

- Lumalier Corporation

- Xenex

- ITT Wedeco

- Trojan Technologies

- Siemens Water Technologies

Recent Developments

- In January 2022, the Leading provider of mission-critical water treatment solutions, Evoqua Water Technologies, announced the completion of the previously disclosed acquisition of the renal division formerly run by STERIS Plc subsidiaries Mar Cor Purification and Cantel Medical.

Segments Covered in the Report

By Component Type

- UV Lamps

- Mercury

- Low-pressure

- Medium-pressure

- Amalgam

- Xenon/LED

- Mercury

- Ballasts/Controller Units

- Quartz Sleeves

- Reactor Chambers

- Others

By Application

- Water & Wastewater Treatment

- Air treatment

- Health facilities

- Residential and Commercial Buildings

- Bio-Terror agents

- Others

By End-use

- Municipal

- Residential

- Commercial

- Industrial

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting