Vascular Closure Devices Market Size and Forecast 2025 to 2034

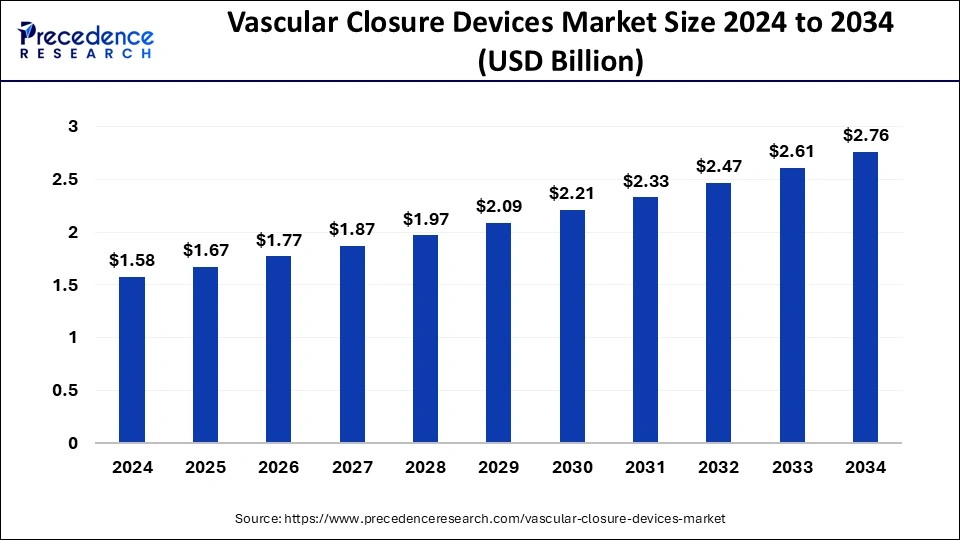

The global vascular closure devices market size was calculated at USD 1.58 billion in 2024 and is predicted to increase from USD 1.67 billion in 2025 to approximately USD 2.76 billion by 2034, expanding at a CAGR of 5.73% from 2025 to 2034.

Vascular Closure Devices MarketKey Takeaways

- The global vascular closure devices market was valued at USD 1.58 billion in 2024.

- It is projected to reach USD 2.76 billion by 2034.

- The vascular closure devices market is expected to grow at a CAGR of 5.73% from 2025 to 2034.

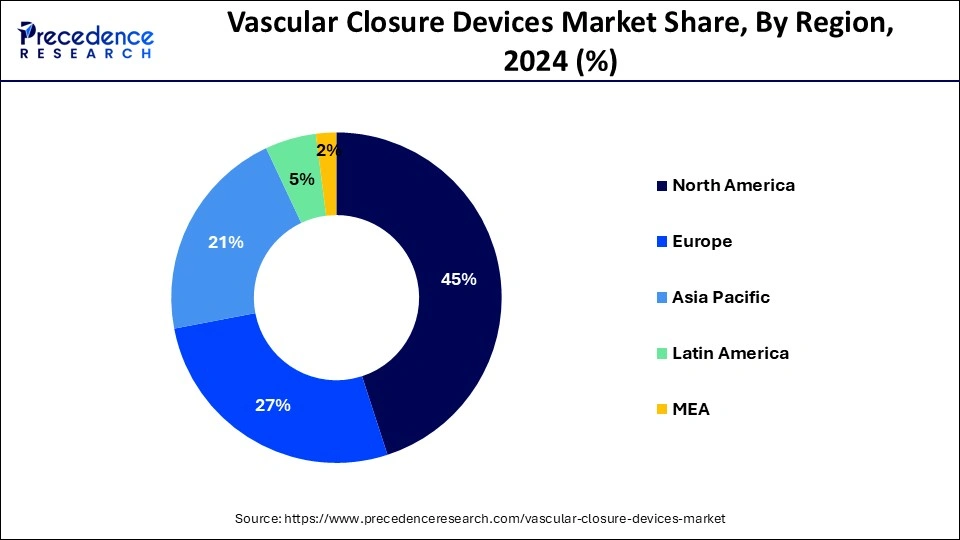

- North America led the market with the biggest market share of 45% in 2024.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By type, the active vascular closure devices segment held the largest share of the market in 2024.

- By access, the femoral segment is expected to capture a prominent market share during the forecast period while sustaining dominance.

- By end-use, the ambulatory surgical centers segment dominated the market with the largest share of 61% in 2024.

U.S.Vascular Closure Devices Market Size and Growth 2025 to 2034

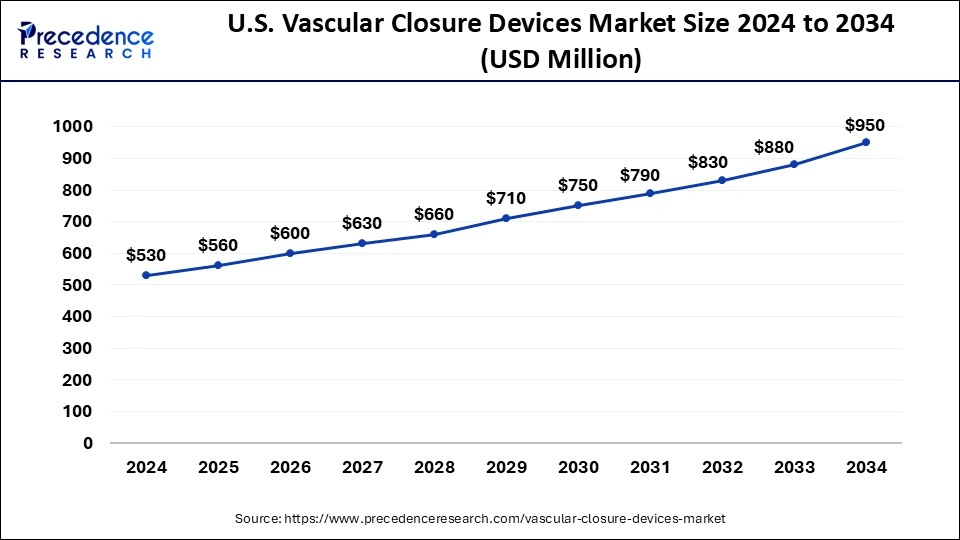

The U.S. vascular closure devices market size was exhibited at USD 530 million in 2024 and is projected to be worth around USD 950 million by 2034, growing at a CAGR of 6.01%.

North America led the global market with the highest market share of 45% in 2024. The region's market is expanding due to the nation's well-established healthcare system, rising rates of cardiovascular disease, a surge in operations involving catheterization, and a growing need for less invasive treatments. Heart disease is the greatest cause of mortality in the United States, according to an article published in February 2022 by the Centers for Disease Control and Prevention (CDC) titled "Heart Diseases Facts." Additionally, it stated that heart disease claimed the lives of around 659,000 Americans annually. Vascular closure devices are required due to the high illness pressure, which propels the market's expansion in the area.

Moreover, regulatory agencies like Health Canada and the US Food and Drug Administration provide clearance for such devices, which accelerates the expansion for vascular closure devices market. To establish hemostasis of the brachial artery following a transbronchial endovascular treatment, EnsiteVascular, for instance, acquired its second FDA market clearance in April 2021 for their SiteSeal SV (small vessel) VCD compression device. The novel closure device SiteSeal SV is intended for the closure of brachial, radial, and pedal small arteries. It mimics external compression, but it eliminates all related variables, leaving nothing in their place. Thus, this is expected to drive the growth of vascular closure devices market in the region.

The United States is a major contributor to the vascular closure devices market. The growing prevalence of cardiovascular diseases increases demand for effective vascular closure devices. The growing preference for minimally invasive procedures to reduce complications helps in the market growth. The growing adoption of new medical technologies and innovation in medical technologies increases demand for vascular closure devices. The presence of numerous hospitals and well-established healthcare infrastructures fuels demand for vascular closure devices. The strong investment in research & development for innovation and FDA approval for the device drives market growth. Furthermore, the presence of a large patient population and the rising trend of one-day surgeries increases demand for vascular closure devices, contributing to the overall market growth.

Asia Pacific is observed to witness the expansion at the fastest rate during the forecast period in the vascular closure devices market. Countries in Asia Pacific are investing in their healthcare infrastructure, expanding access to advanced medical technologies and procedures, including cardiac interventions that require vascular closure devices. Cardiovascular diseases, including coronary artery disease and peripheral vascular diseases, are on the rise in Asia Pacific due to changing lifestyles, unhealthy dietary habits, and increasing prevalence of risk factors such as obesity and diabetes. Economic growth in countries like China, India, and Southeast Asian nations has led to increased healthcare spending and improved access to healthcare services, driving the demand for vascular closure devices in these emerging markets.

China is growing in the vascular devices market. The large population and growing prevalence of cardiovascular diseases increase the adoption of vascular closure devices. The strong investment in the healthcare industry and the rising modernization of healthcare help in the market growth. The strong medical device industry and growing domestic & international distribution of vascular closure devices drive the overall growth of the market.

Market Overview

The vascular closure devices market revolves around the offering of medical devices designed to achieve hemostasis, which is the cessation of bleeding, after a catheterization procedure or other vascular interventions. These devices are used to seal the puncture site in the blood vessel through which a catheter was inserted, reducing the risk of bleeding and complications. Catheterization procedures, such as angiography or angioplasty, involve the insertion of a catheter through the skin and into a blood vessel to access the cardiovascular system.

After the procedure is complete, it is crucial to close the puncture site to prevent bleeding and minimize the recovery time for the patient. Vascular closure devices come in various types, including mechanical devices, plug-based devices, and suture-based devices. They are designed to provide a quick and efficient way to achieve hemostasis, reducing the need for prolonged manual compression or other traditional closure methods.

The selection of a specific vascular closure device depends on factors such as the size of the access site, the type of procedure performed, and the patient's overall health. These devices play a significant role in improving patient comfort, reducing complications, and expediting the recovery process following vascular interventions.

Market trends

- Growing cardiovascular disease: The growing number of cardiovascular patients increases demand for interventional procedures and diagnostics like angioplasty. These surgeries puncture blood vessels, which increases the demand for vascular closure devices to seal the site of access.

- Growing shift towards ambulatory surgical centers: The growing expansion of the variety of vascular procedures and the rising number of ambulatory surgical centers increases the adoption of vascular closure devices. These centers give priority to patient comfort and increase demand for vascular closure devices.

Trends in the Vascular Closure Devices Market

Use of innovative materials: A significant trend for the vascular closure devices market is the emergence of technological innovations in vascular closure devices to prominently support their efficacy and safety. Biodegradable polymers are one of the innovative materials that are utilized to enhance device performance and reduce the risk of complications. Techniques like sutures and hemostatic agents are highly advanced techniques that initiate more efficient and less invasive procedures. To achieve greater precision, technologies like real-time imaging and ultrasound guidance can also be included.

Increasing demand for minimally invasive methods: The growing demand for minimally invasive surgeries is another propelling factor for the vascular closure devices market on a large scale. The procedure is gaining traction due to its low maintenance, lower possibility of complications, and shorter days to stay in the hospital for complete recovery. Healthcare providers are significantly investing in these procedures, which is fueling the demand for advanced vascular closure devices on a large scale.

Market approvals with regulations: Regulatory bodies are adapting themselves at an equal pace to the vascular closure devices market to enhance the safety and efficiency of new devices that will launch on the market. In the foreseeable period, more streamlined approval processes along with mandatory guidelines will emerge that encourage the development of solutions to assist the production of vascular closure devices on a large scale. Along with this, strategic collaborations and partnerships between market players are fostering the market globally and supporting the overall growth rate to sustain the market in the long run.

Vascular Closure Devices Market Growth Factors

- The increasing prevalence of cardiovascular diseases and the corresponding rise in diagnostic and interventional procedures, such as angiography and angioplasty, contribute to the demand for vascular closure devices.

- Innovations in VCD technologies, including the development of new materials and improved closure mechanisms, drive vascular closure devices market's growth. Devices that offer enhanced safety, efficacy, and patient comfort tend to gain traction.

- The ageing population often requires cardiovascular interventions, leading to a higher demand for VCDs. Older individuals may have more complex health issues, making effective vascular closure crucial for their recovery.

- The trend towards minimally invasive procedures in the medical field has increased the use of catheter-based interventions. VCDs play a significant role in closing access sites without the need for surgical methods, contributing to market growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.73% |

| Market Size in 2025 | USD 1.67 Billion |

| Market Size by 2034 | USD 2.76 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Access, and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of cardiovascular disease

The increasing prevalence of cardiovascular disease across the globe is expected to propel the vascular closure devices market growth over the projected period. For instance, according to the World Health Organization:

- The primary cause of mortality worldwide is cardiovascular illnesses or CVDs.

- 32% of all fatalities worldwide in 2019 were attributed to CVDs, with an estimated 17.9 million deaths. Heart attacks and strokes were the cause of 85% of these fatalities.

- More than 75% of fatalities from CVD occur in low- and middle-income nations.

- In 2019, noncommunicable illnesses accounted for 17 million premature fatalities (deaths under 70 years of age) of which 38% were attributable to CVDs.

- Thus, the aforementioned stats support the vascular closure devices market.

Restraint

The increasing cost of VCDs

It is estimated that currently, vascular closure devices (VCDs) are used in about 20–25% of catheter-based operations performed worldwide to achieve access site hemostasis. The main factors impeding the market's growth are the increase in radial access interventional procedures, the skyrocketing expense of vascular closure devices, and the risks associated with these devices. The need for highly qualified individuals is impeding the vascular closure devices market's expansion. Vascular closure devices are not used in a great number of catheter-based procedures due to a lack of operator expertise, complexity risks, and expense. One device is permitted for arteriotomies up to 21F, but the majority of vascular closure devices are only authorized for those between 5 and 8F. The two main complications are limb ischemia and inclusive infection. Thus, these problems are impeding the market's growth for vascular closure devices.

Opportunity

Growing product approvals

Over the anticipated period, the vascular closure devices market is anticipated to benefit greatly from the increasing number of product approvals. For example, in September 2023, Boston Scientific Corporation declared that the US Food and Drug Administration had authorised the latest model, the WATCHMAN FLXTM Pro Left Atrial Appendage Closure (LAAC) Device. The gadget now features a polymer coating, wider size matrix, and visualisation markers to treat a greater number of patients. WATCHMAN technology, which is suggested to lower stroke risk in patients with non-valvular atrial fibrillation (NVAF) who need an alternative to oral anticoagulation medication, is expected to be further improved by this development in procedure performance and safety.

Type Insights

The active vascular closure devices segment in 2024, held the largest share of the vascular closure devices market due to their high efficiency. In addition, active vascular closure devices provide faster hemostasis compared to traditional manual compression methods. This can lead to quicker recovery times for patients. Moreover, VCDs are particularly well-suited for minimally invasive procedures, where achieving quick and efficient hemostasis is crucial.

The passive vascular closure devices segment is expected to grow at a substantial rate over the forecast period because it offers vascular access site hemostasis that is reliable as well as fast. Passive closure devices offer enhanced patient comfort compared to active closure devices, as they do not require the application of external pressure or manual compression. This can lead to improved patient satisfaction and compliance with post-procedural care instructions.

Access Insights

The femoral segment dominated the vascular closure devices market in 2024. Vascular access for coronary angiography and other interventional treatments is increasingly being provided via the femoral method. Because femoral arteries allow for larger catheters and are less likely to spasm than radial arteries, this sector is expected to increase significantly. Additionally, the ability to expand segments is improved by the creation of certain devices that offer femoral arterial access. Nevertheless, acceptability is somewhat limited by a few femoral access-site problems, including arteriovenous (AV) fistula, pseudoaneurysm, and arterial dissection. Consequently, the segment is predicted to increase well over the projection timeline given the general characteristics and high procedure volume.

Besides, the radial segment is expected to grow at a rapid rate during the forecast period owing to the rising technological advancements. Radial access procedures are often associated with shorter hospital stays and faster patient recovery times compared to femoral access. Vascular closure devices that enable efficient and reliable closure of radial artery puncture sites contribute to enhanced procedural outcomes and patient satisfaction, further driving adoption in clinical practice.

Manufacturers have made significant advancements in the design and performance of vascular closure devices tailored for radial access, including improved hemostasis, ease of use, and compatibility with different procedural techniques. These innovations address the unique anatomical and physiological characteristics of the radial artery, making radial access procedures more accessible and efficient for healthcare providers.

End-use Insights

The ambulatory surgical centers segment held the largest Market share of 61% in 2024. The segment is observed to sustain the dominance over the forecast period. The number of interventional procedures performed in hospitals directly impacts the demand for vascular closure devices. Hospitals with high procedural volumes are likely to be key consumers of these devices. Additionally, hospitals may have specialized units or departments focused on cardiovascular interventions, such as interventional cardiology units. These units often drive the adoption of vascular closure devices. Furthermore, they prioritize patient safety and efficient recovery. VCDs play a significant role in achieving faster hemostasis, reducing complications, and facilitating early ambulation, contributing to overall patient care.

Besides, the hospital segment is expected to grow at a significant rate over the forecast period. ASCs perform a significant number of outpatient procedures, including various interventional and catheter-based treatments. The volume of these procedures contributes to the demand for vascular closure devices. ASCs emphasize efficient procedures and fast patient recovery. VCDs that facilitate quick hemostasis and allow for early ambulation aligns with the goals of ASCs in providing timely care. Thereby driving the segment expansion.

Recent Developments

- In July 2024, Cordis received FDA approval for the new Mynx Control Venous Vascular Closure Device. The device includes GRIP technology and has a 100% success rate. (Source: https://cardiovascularbusiness.com)

- In August 2024, Haemonetics launched the Vascade MVP XL vascular closure system. The feature of the device is a resorbable collagen patch to promote quick hemostasis, collapsible disc technology, and proprietary technology. The device offers a closure solution for surgeries like left atrial appendage closure, cryoblation, and pulsed field ablation, which require 10-12 Fr sheaths. (Source: https://www.mpo-mag.com)

- In April 2025, the innovative system-PerQseal Elite vascular closure system, received approval for a European CE mark. It is developed by Viva-sure medical, an Ireland-based developer that provides fully absorbable technology for percutaneous vessel closure procedures such as transcatheter aortic valve replacement. (Source: https://evtoday.com)

- In February 2023, the LockeT product was introduced to the market by Catheter Precision, Inc., a wholly-owned subsidiary of Ra Medical Systems, Inc. The first shipments of the product to its distributors will start right away. When a catheter is inserted through the skin into a blood artery and subsequently removed after an operation, LockeT can be utilized in combination with the closure of the percutaneous wound site. LockeT is used to keep the sutures in place after the doctor has sutured the vessel and the location. The lockeT can be utilized in place of or in addition to closing devices. These devices are Angioseal, marketed by Terumo, Vascade, marketed by Cardiva, a division of Haemonetics, and Perclose, marketed by Abbott.

Vascular Closure Devices Market Companies

- Medtronic

- Abbott Vascular

- Biotronik GMBH & CO. KG

- COOK

- Merit Medical Systems, Inc.

- C. R. Bard, Inc.

- Boston Scientific Corporation

- ESSENTIAL MEDICAL, Inc.

- Cardinal Health

- W L. Gore & Associates

Segments Covered in the Report

By Type

- Active Vascular Closure Device

- Passive Vascular Closure Device

By Access

- Radial

- Femoral

By End-use

- Ambulatory Surgical Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting