What is the Neurovascular Devices Market Size?

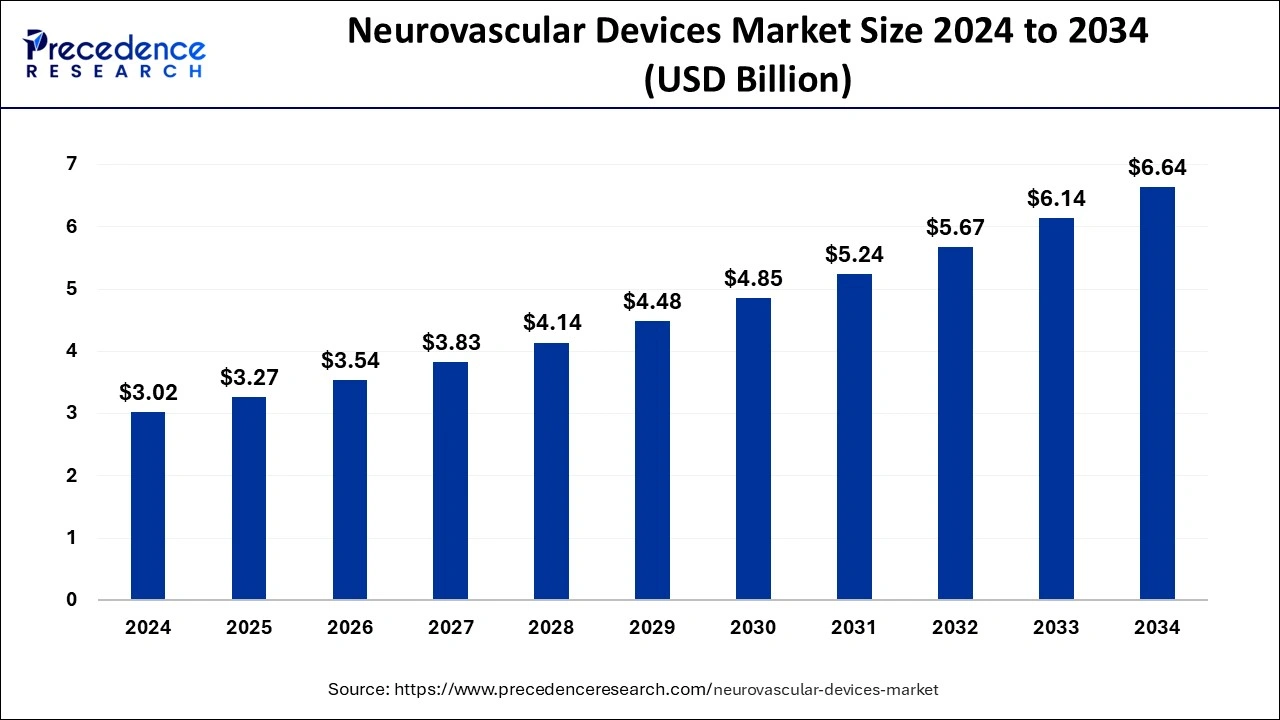

The global neurovascular devices market size is calculated at USD 3.27 billion in 2025 and is predicted to increase from USD 3.54 billion in 2026 to approximately USD 7.12 billion by 2035, expanding at a CAGR of 8.09% from 2026 to 2035. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing neurovascular devices which is estimated to drive the global neurovascular devices market over the forecast period.

Neurovascular Devices Market Key Takeaways

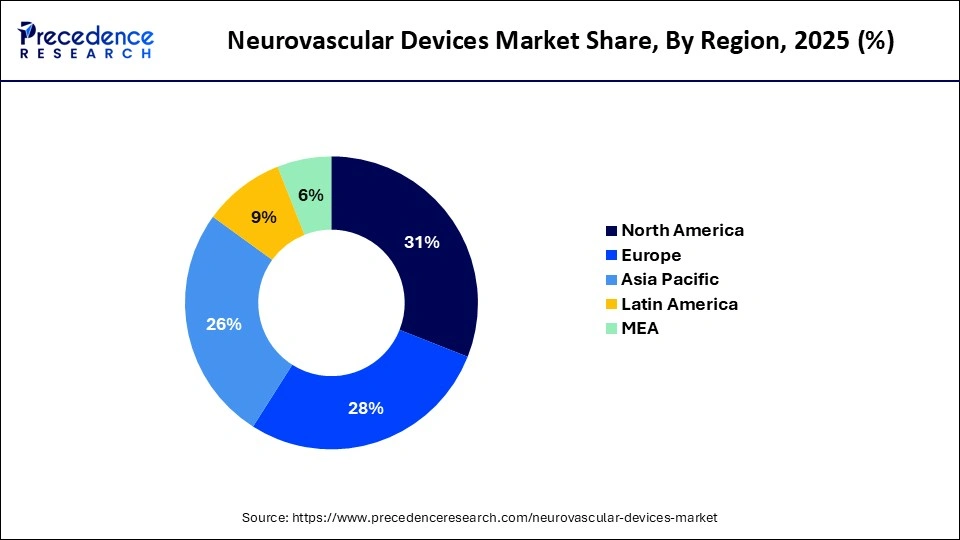

- North America dominated the neurovascular devices market with revenue share of 31% in 2025.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By device, the cerebral embolization and aneurysm coiling devices segment dominated the market with the largest share in 2024.

- By therapeutic application, stroke segment is expected to grow at significant rate during the forecast period.

- By size, the 0.021" segment dominated the market with the largest share in 2025.

- By end-use, the hospitals segment dominated the neurovascular devices market in 2025.

How Can AI Improve the Neurovascular Devices Industry?

AI can improve the accuracy and speed of diagnostics by analyzing medical images such as CT scans, MRIs, and angiograms. Machine learning algorithms can detect abnormalities like aneurysms, strokes, or other neurovascular diseases more quickly and accurately than traditional methods, aiding in early detection and treatment.

AI can assist in developing personalized treatment plans by analyzing patient data, including medical history, imaging results, and genetic factors. This can optimize surgical or endovascular interventions for better patient outcomes, reducing complications. AI can forecast patient outcomes and complications, helping healthcare providers make informed decisions. For example, it can predict the likelihood of a stroke or the risk of a clot forming post-surgery, enabling proactive care management.

Wearable AI devices can continuously monitor neurovascular health, offering real-time data to both patients and healthcare providers. This allows for better management of chronic conditions like hypertension, which is a risk factor for neurovascular events. AI can optimize clinical trial design by identifying the most suitable patients, predicting trial outcomes, and analyzing large datasets faster, thus accelerating the approval process for new neurovascular devices.

Neurovascular Devices Market Growth Factors

- The key players operating in the market are focused on geographic expansion and launching their medical device brand in other countries which is expected to drive the growth of the neurovascular devices market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

- Emerging markets and trends for neurovascular devices is expected to drive the growth of the global neurovascular devices market over the forecast period.

- Increasing regulatory support is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of neurovascular devices is estimated to drive the growth of the global neurovascular devices market in the near future.

- Technology advancements like development of minimally invasive devices that improve patient outcomes, has estimated to drive the growth of the market over the forecast period.

- Increasing demand for minimally invasive procedures has driven the growth of the neurovascular devices market in the near future.

- Rising investments in healthcare systems, particularly in developing countries, has estimated to drive the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 3.54 Billion |

| Market Size in 2025 | USD 3.27 Billion |

| Market Size by 2035 | USD 7.12 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.09% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Device, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements

Neurovascular devices are driving the market with a profound shift toward minimally invasive procedures that present advantages such as shorter recovery time and reduced risk for complications. With continuous innovations in advanced devices, including stent retrievers, coils, and balloon angioplasty systems, the treatment methods evolve further to improve efficacy and patient outcomes. From the other end,advances in genetics and proteomics allow personalized neurovascular therapies to be developed, in which treatments are made to suit a patient's profile. These technological improvements fuel the incidence of the market by rendering it safer, more effective, and acceptable to patients.

Restraint

Regulatory Hurdles

On account of rigorous regulatory challenges, the neurovascular devices market has to undergo extensive testing, conduct clinical trials, and furnish copious documentation for the acceptance of all its products. The regulations are provided for the safety and efficacy, but they stretch the development cycle and costs for the manufacturers. Protracted approval periods could curtail the timely launch of innovative devices and, thus, diminish market agility geared toward emergent clinical needs. Regulatory complexity will continue to be another major hurdle, adversely affecting new entrants and established players alike, and thus the entire undertaking may suffer slowed growth.

Opportunity

Supportive Government Initiatives and Awareness Programs

Campaigns aimed at early diagnosis and treatment of neurovascular diseases. Investments in healthcare infrastructure to ensure access to advanced devices. Increasing government initiatives for early diagnosis of neurovascular disease has estimated to create lucrative opportunity for the growth of the neurovascular devices market in near future.

- For instance, in July 2024, The Alzheimer's Association International Conference (AAIC 2024), which will take place in Philadelphia, Pennsylvania, in 2024, will feature Neurophet, an artificial intelligence (Al) solution firm for brain disorders. Neurophet will introduce "NeurophetAQUA AD," a program for prescribing treatments for Alzheimer's disease (AD) and tracking their adverse effects, at the next AAIC. An integrated solution of state-of-the-art brain image analysis technologies for AD therapies is Neurophet AQUA AD. Currently, this system is getting ready for medical device certifications in Japan, the United States, and Korea.

Expansion of Hospital Services to Support Dominance in 2024

Hospitals segment dominated the neurovascular devices market globally. The primary cause of this segment's rise is the growing number of patients with neurovascular conditions, including arteriovenous malformation (AVM), brain aneurysms, ischemic and hemorrhagic stroke, and traumatic brain injury (TB1). For instance, in August 2024, the World Stroke Organization estimates that 1 in 4 adults over 25 will have a stroke at some point in their lives. It is estimated that 13.7 million people will have their first stroke each year, with 5.5 million of those individuals potentially losing their lives. It seems likely that the annual death toll will rise to 6.7 million if appropriate action is not taken. Furthermore, it is anticipated that the growing number of patients being admitted to hospitals as a result of operations, treatments, and therapies will boost market expansion. Therefore, the introduction of technologically sophisticated goods, the ensuing rise in the number of patients worldwide, and advantageous reimbursement policies are all significant aspects anticipated to support segment expansion.

Neurovascular Devices Market Segment Insights

Device Insights

The crebral embolization and aneurysm coiling devices segment held a dominant presence in the market in 2025. Cerebral embolization and aneurysm coiling are both minimally invasive procedures, requiring only small incisions or catheter insertion, significantly reducing the risks associated with traditional open surgeries, such as infection, blood loss, or damage to surrounding tissues. The minimally invasive approach results in shorter hospital stays and faster recovery times, making these treatments more appealing to both patients and healthcare providers. Both cerebral embolization and aneurysm coiling are performed using a catheter-based technique, which is much less invasive than traditional open surgery. This reduces the risk of complications, minimizes patient recovery time, and lowers the overall burden on the patient.

By occluding the aneurysm with coils or embolic material, the devices significantly lower the risk of rupture, which is the main cause of hemorrhagic strokes. Embolization techniques are also effective for preventing re-bleeding in cases where the aneurysm has already ruptured. These devices can be used for a broad range of neurovascular conditions, including cerebral aneurysms, arteriovenous malformations (AVMs), and certain types of brain tumors, making them highly versatile and effective tools in neurovascular surgery.

By device, the neurothrombectomy devices segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035. The growing incidence of acute ischemic stroke and the growing number of growth tactics used by major market participants, including product launches and mergers and acquisitions, will propel the segment's expansion in the near future. For instance, Therma Bright Inc. invested in Inretio Inc., a startup that develops Ischemic Stroke Blood Clot Retriever Technologies, in January 2024. During the thrombectomy procedure, the PREVA basket "ensnares" the clot, enclosing it and protecting the brain from any breakoff sub-clots.

Application Insights

The stroke segment accounted largest market share in 2024. The increased prevalence of strokes among the population, especially among the elderly population has augmented the growth of this segment. According to the CDC, around 16.7% of people across the globe will have a brain stroke. As per the CDC, over 795,000 people have a stroke in the US every year and it accounts for around 140,000 deaths in the US every year. It is also considered to be the second most prominent cause of death. Hence, this segment is expected to sustain its dominance throughout the forecast period.

Moreover, the rising efforts by the government and various NGOs in spreading awareness regarding neurological disorders are fostering the segment's growth. The new product launches related to stroke solutions are boosting the market growth. For instance, in September 2020, CERENOVOUS introduced CERENOVOUS Stroke Solution which aids doctors in clot removal procedures.

Therapeutic Application Insights

The stroke segment accounted for a significant share of the market in 2024. As a result of things like the rising rates of stroke, hypertension, and other neurological conditions. Over 795,000 people in the United States experience a stroke each year, and 1 in 6 people globally will experience one at some point in their lives, according to the CDC. Strokes cause over 140,000 fatalities in the United States each year, making them the second most common cause of death worldwide. The government of the world has adopted a number of steps to avoid stroke. Additionally, the focus on minimally invasive stroke treatment approaches is driving market expansion because, in comparison to open procedures, these methods usually result in faster recovery times and fewer hospital stays.

Technological developments like real-time imaging and advanced robots are enhancing the safety and accuracy of neurovascular treatments, giving medical professionals more confidence to perform intricate procedures. Additionally, the introduction of technologically sophisticated items is fueling the expansion of this market. For example, Infinity Neuro declared in January 2024 that its Inspira aspiration catheters were now approved by the CE Mark and could be bought in Europe. This is Infinity Neuro's first buffer; in 2024 and beyond, the business plans to provide a wide range of solutions to treat ischemic and hemorrhagic stroke.

By therapeutic application, the cerebral aneurysm segment is anticipated to grow with the highest CAGR in the neurovascular devices market during the studied years. The Brain Aneurysm Foundation estimates that 6.5 million Americans have an unruptured brain aneurysm, and that 30,000 of them experience a rupture every year. Additionally, the launch of technologically advanced items and the growing number of clinical trials will support category expansion in the near future.

For example, VESALIO announced in February 2024 that its NeVa VS device has been successfully used for the first time in the United States to treat cerebral vasospasm following aneurysmal subarachnoid hemorrhage (aSH). The most frequent result of aSAH and the main cause of death and morbidity is vasospasm. Additionally, EndoStream Medical, a company that creates treatments for brain aneurysms, said in February 2024 that the first patient in the United States had been enrolled in the TORNADO-US clinical study. The trial will assess the company's Nautilus intrasaccular system's efficacy in treating cerebral aneurysms. Additionally, the FDA approved Medtronic's clot-resistant implant in April 2021 for the treatment of brain aneurysms, which is anticipated to propel segment expansion in the near future.

Size Insights

The 0.021” segment registered its dominance over the global market in 2024. The 0.021" diameter provides a good balance between flexibility and support, making the devices suitable for navigating the complex and narrow vasculature of the brain. This size allows for better maneuverability through tortuous blood vessels while maintaining the necessary rigidity to deliver therapeutic agents or implants. This size allows the catheter or device to be used effectively in small, delicate blood vessels, especially in the neurovascular system, where precision is critical.

Neurovascular Devices Market Regional Insights

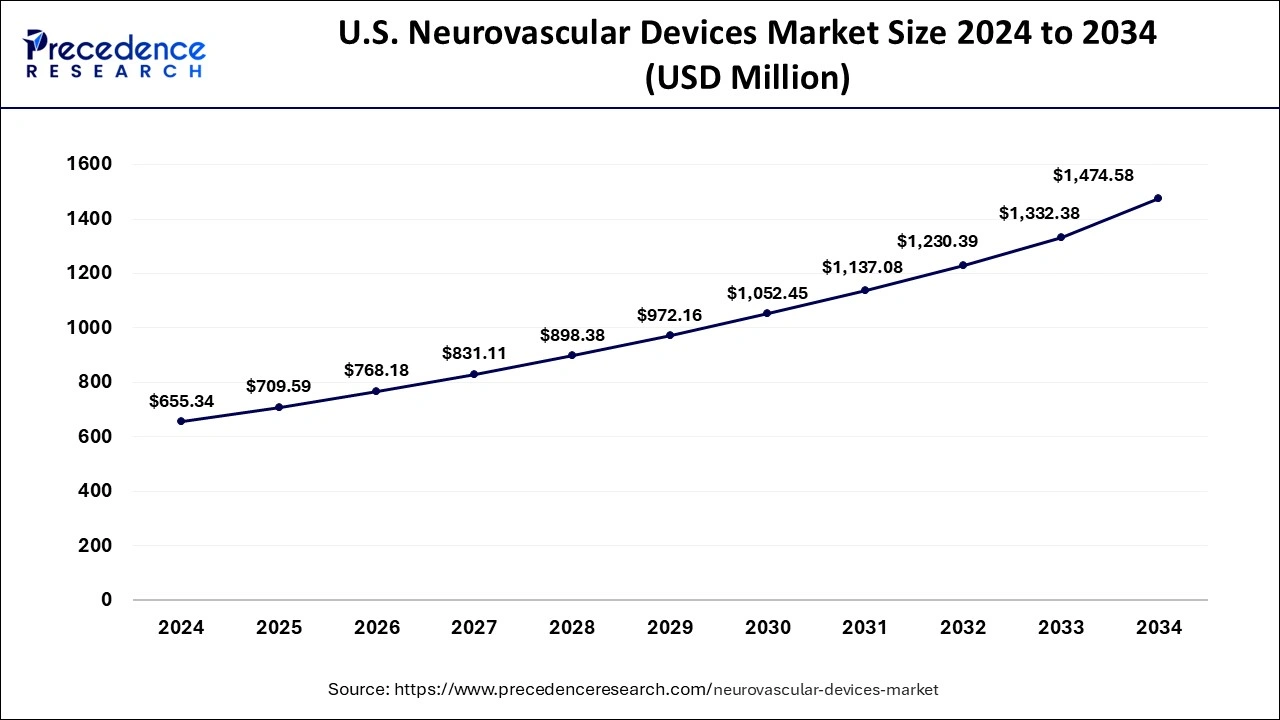

The U.S. neurovascular devices market size is evaluated at USD 709.59 million in 2025 and is predicted to be worth around USD 1,589.97 million by 2035, rising at a CAGR of 8.34% from 2026 to 2035.

North America dominated the neurovascular devices market with revenue share of 31% in 2025. North America, particularly the United States, has some of the most advanced healthcare infrastructure globally, with cutting-edge hospitals, surgical centers, and diagnostic equipment. This enables the use of high-tech neurovascular devices and supports the adoption of the latest treatment methods. The region has a robust healthcare system that supports a high level of patient care, ensuring access to advanced treatments like neurovascular surgery and endovascular procedures, which often require specialized devices. North America is home to many leading medical device companies, academic institutions, and research organizations focused on developing innovativeneurovascular devices.

Companies based in the region often drive advancements in device design, minimally invasive techniques, and improved materials, leading to the introduction of new, highly effective neurovascular devices. The region is known for the early adoption of new medical technologies. Healthcare providers are often quick to integrate the latest advancements in neurovascular treatments, such as robotic-assisted surgery, AI-powered diagnostics, and advanced imaging systems.

North America has a large number of skilled neurovascular surgeons, interventional radiologists, and other specialists who are well-trained in the use of advanced neurovascular devices. Their expertise contributes to better outcomes, which drives the continued use and preference for these devices. The region also offers robust professional development programs for healthcare professionals, ensuring that they remain up-to-date with the latest techniques and technologies in neurovascular treatments.

- In November 2024, Mentice, a medical technology startup, has introduced NV Connect, a platform designed to enhance neurovascular training, treatment planning, and rehearsal with an emphasis on increasing procedural accuracy and physician trust. In a press release, this is mentioned. The platform serves as more than just a training aid, according to Johan Lindkvist, senior product manager for neurovascular solutions at the company.

The dominance of the United States with the largest shares in the neurovascular device market is observed due to the increasing incidence of neurological disorders in the country. According to the Alzheimer's Association, in 2024 it is estimated that 6.9 million Americans age 65 and older are living with Alzheimer's dementia. The number is expected to reach 13.8 million by 2060. Alzheimer's is the 5th leading cause of death among Americans. Other than that, the United States is also growing with technological advancement including the integration of artificial intelligence which offers a significant impact on the diagnosis and treatment of neurological disorders.

China Neurovascular Devices Market Analysis

In the neurovascular device market, Chian is experiencing significant growth. The market is driven by the presence of key players and increasing the number of stroke cases in the country. The leading neurovascular industry leaders in China are developing innovative products for the procedures and treatment of neurovascular disorders. The reason for rising cases of stroke in China is credited to diabetes and hypertension, if remains poorly controlled results in stroke development.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by strategic initiatives from leading companies and the expansion of healthcare infrastructure. Government programs encourage collaboration between local healthcare providers and global device makers, supporting regional market growth. Additionally, increasing healthcare investments, expanding access to advanced medical technologies, and growing awareness of minimally invasive treatments are further fueling demand.

Europe is seeing significant growth in the neurovascular devices market due to the rising frequency of neurovascular disorders, along with positive clinical data and increased awareness. The European Union has implemented the EU Medical Device Regulation (MDR) and the European Medicines Agency (EMA) programs to support medical device manufacturers. Germany is a major contributor to the market. It has a system of certified interdisciplinary neurovascular networks, such as the Established Neurovascular Networks (NVNs), for stroke care, ensuring high-quality, nationwide treatment. Germany's new Medical Research Act aims to boost the country as a hub for medical innovation, offering potential advantages for clinical trials and medical device development.

The growth of the market in Latin America is driven by the rising prevalence of stroke and other cerebrovascular diseases, coupled with increasing awareness of early diagnosis and advanced treatment options. Collaborations and acquisitions among companies are advancing robotic systems for neurovascular interventions. The market is growing in emerging economies in this region, driven by expanding healthcare infrastructure and increasing neurovascular disease rates. Expanding healthcare infrastructure, growing investments in medical technology, and greater access to minimally invasive procedures are further supporting market expansion.

Brazil is making significant strides in the market by leveraging a growing base of stroke patients, improved hospital infrastructure, and increased access to advanced interventional technologies. In August 2025, the Brazilian government planned to invest US$480 million in health equipment, including more than 10,000 medical devices for surgical procedures and basic care. Brazil's National Health Surveillance Agency (ANVISA) released its regulatory updates for 2024-2025, including general updates for medical devices such as revisions to software regulation, e-labeling, and essential safety requirements.

The market in MEA is expected to grow due to increased awareness among healthcare professionals and the availability of treatments for neurovascular disorders. The launch of national government programs for neurovascular devices is also driving regional healthcare expansion. Saudi Vision 2030 is a major government initiative focused on digital transformation, healthcare innovation, and economic diversification, which promotes the growth of the medical devices market.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In August 2020, Stryker Corporation a flow diverter named Surpass Evolve Flow Diverter, in the US after acquiring FDA approval.

The various developmental strategies like new product launches, acquisition, partnerships, mergers, and government policies foster market growth and offers lucrative growth opportunities to the market players.

Neurovascular Devices Market Companies

- Medtronic

- MicroPort Scientific Corporation

- Penumbra, Inc.

- Stryker Corporation

- Johnson & Johnson Services, Inc.

- MicroVention, Inc.

- Codman Neuro

Latest Announcements by the Industry Leaders

- In June 2024, Joan Kristensen, head of the Europe, Middle East and Africa region for Penumbra, Inc. said, “With five innovative devices introduced in Europe in a matter of months, our dedication to improving stroke care enables us to provide physicians with customised stroke solutions, she further adds, “In all modesty, Penumbra provides physicians with the widest aspiration thrombectomy stroke portfolio on the market.”

Recent Developments

- In July 2025, Q'Apel Medical received FDA clearance for its Zebra neurovascular access system, which is being prepared for a full US launch. Available in 6Fr and 7Fr sizes, it is intended for interventional devices in peripheral and neurovascular vasculature. (Source: https://neuronewsinternational.com)

- In February 2025, Johnson & Johnson MedTech launched the CEREGLIDE 92 Catheter System, a next-generation 092' catheter designed for facilitating the insertion and guidance of interventional devices in the neurovascular system. (Source: https://medicaldialogues.in)

- In 2024, CERENOVUS, Inc., a division of Johnson & Johnson MedTech*, announced the introduction of EMBOGUARDTMM, a next-generation balloon guide catheter intended for use in endovascular operations, including those involving patients who have had an acute ischemic stroke.

- In June 2024, MicroVention, Inc., a multinational neurovascular business and a fully owned subsidiary of Terumo Corporation, declared that the LVISTM EVO™ Intraluminal Support Device, which is intended to treat wide neck intracranial aneurysms, is now commercially available in the US. Since its release in 2019, LVIS EVO has sold more than 12,000 units in Europe.

Neurovascular Devices Market Segments Covered in the Report

By Device

- Cerebral Embolization and Aneurysm Coiling Devices

- Embolic coils

- Flow diversion devices

- Liquid embolic agents

- Cerebral Angioplasty and Stenting Systems

- Carotid artery stents

- Embolic protection systems

- Neurothrombectomy Devices

- Clot retrieval devices

- Suction devices/aspiration catheters

- Vascular Snares

- Support Devices

- Micro catheters

- Micro guidewires

- Trans Radial Access Devices

By Therapeutic Application

- Stroke

- Cerebral Artery

- Cerebral Aneurysm

- Aneurysmal Subarachnoid Hemorrhage

- Others

- Others

By Size (in Inches)

- 0.027"

- 0.021"

- 0.071"

- 0.017"

- 0.019"

- 0.013"

- 0.058"

- 0.068"

- Others

By End-use

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting