What is the Neurovascular Thrombectomy Devices Market Size?

The global neurovascular thrombectomy devices market size accounted for USD 825.92 million in 2025 and is predicted to increase from USD 882.16 million in 2026 to approximately USD 1,494.32 million by 2034, expanding at a CAGR of 6.81% from 2025 to 2034. This market is growing due to the increasing prevalence of neurovascular disorders and the rising adoption of minimally invasive treatments.

Market Highlights

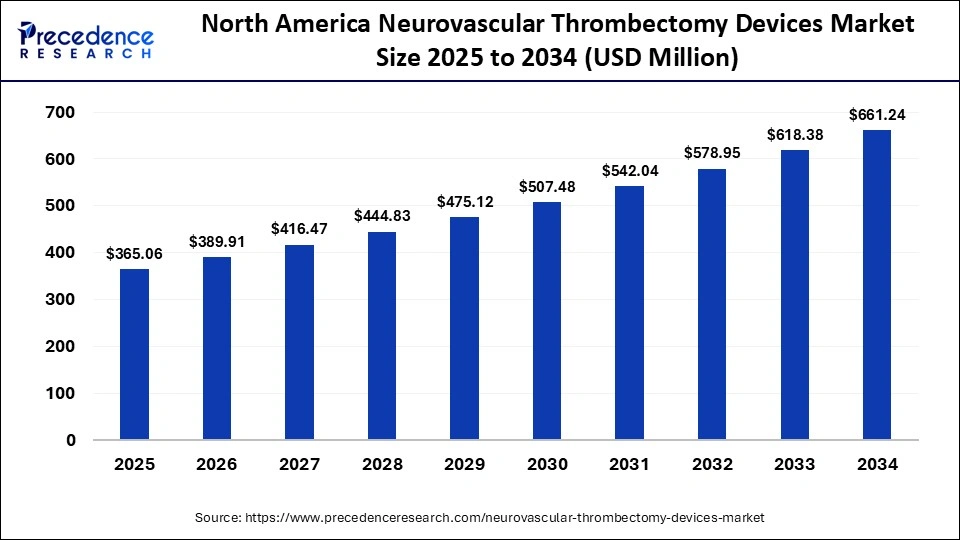

- North America dominated the sector, holding the largest market share of 44.2% in 2024.

- Asia Pacific is expected to grow at a solid CAGR of 12.6% from 2025 to 2034.

- By product type, the stent retrievers segment held the largest share of 45.8% in 2024.

- By product type, the aspiration catheters segment is growing at a solid CAGR of 11.4% from 2025 to 2034.

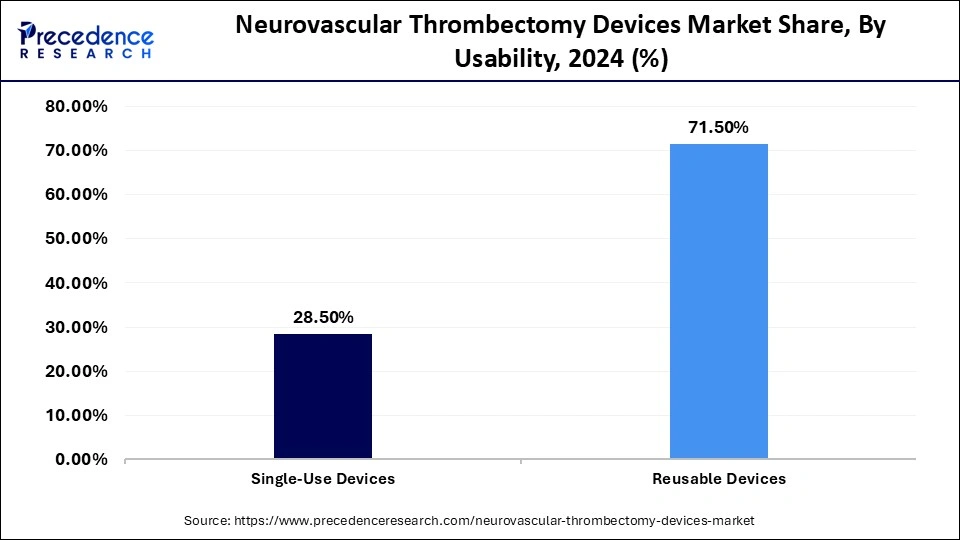

- By usability, the reusable devices segment contributed the biggest market share of 71.5% in 2024.

- By application, the ischemic stroke segment recorded the highest market share of 68.8% in 2024.

- By application, the hemorrhagic stroke segment is expanding at the fastest CAGR from 2025 to 2034.

- By end user, the hospitals segment held the biggest market share of 42.8% in 2024.

- By end user, the ambulatory surgical centers segment is poised to grow at a notable CAGR of 12% from 2025 to 2034.

Thrombectomy Devices Pulse: Thriving in the Next Decade

The neurovascular thrombectomy devices market is experiencing significant growth, motivated by the growing need for minimally invasive procedures and the increasing incidence of neurovascular disorders. Innovations in technology, like energy-based thrombectomy systems, miniaturized catheters, and improved imaging integration, are enhancing patient safety and procedure results. Along with the expansion of already existing businesses, the market is also seeing the entry of new players.

- In July 2025, Q'Apel Medical announced U.S. FDA clearance for its Zebra Neurovascular Access System. This system is designed for the introduction of interventional devices into the peripheral and neurovasculature, providing enhanced support and stability during procedures.

How to Reignite Value Creation in Large, Diversified Medtechs

- Miniaturized and Flexible Catheters: Access to complex neurovascular areas is made possible by the development of smaller, more flexible catheters, which lowers the risk of procedures. Treating complex thrombotic disorders is made possible by miniaturization, which enables easier access to previously unreachable locations and the negotiation of convoluted vessels.

- Robotic-assisted Navigation: When performing intricate neurovascular procedures, new robotic-assisted delivery systems increase precision and lessen operator fatigue. Robots make it possible to move and position devices to move and position devices precisely, which is essential in the delicate brain vasculature. Additionally, they make it possible to operate remotely, increasing access to specialized care in underprivileged areas.

Neurovascular Thrombectomy Devices Market Outlook

The market is experiencing steady growth across regions, with established healthcare systems leading adoption and emerging markets gradually catching up. One major force is technological innovation, with businesses concentrating on safer, more intelligent, and more effective thrombectomy solutions. Expanded market growth is supported by broader adoption of these devices, enabled by increased training and expertise among neurointerventional specialists.

Manufacturers in the industry are increasingly focusing on sustainability. Eco-friendly materials, reducing production waste, and creating devices that are simpler to recycle or reuse are becoming increasingly important to businesses. Additionally, attempts are being made to minimize the environmental impact of medical devices over the course of their lifetime and optimize energy use during manufacturing.

The neurovascular device startup scene is thriving with new players contributing creative ideas for catheter and thrombectomy, concentrating on specialized solutions such as tools for small or difficult to reach vessels or the integration of AI and smart monitoring for improved procedural guidance.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 825.92 Million |

| Market Size in 2026 | USD 882.16 Million |

| Market Size by 2034 | USD 1,494.32 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.81% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Usability, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Restraint

Shortage of Skilled Specialists

For the safe and efficient use of these devices, neurovascular procedures are extremely complex and call for skilled specialists. Expert neuro interventionalists are in short supply worldwide, especially in developing nations. The expansion of the thrombectomy procedures is restricted by this shortage of skilled workers, which also slows the market's growth rate. The availability of specialists and ongoing training initiatives continues to bea major obstacle.

Opportunity

Technological Advancements and Smart Devices

Robotic guidance, AI-assisted navigation, and IoT-enabled monitoring are examples of emerging technologies that are improving procedural safety and accuracy. Devices that incorporate intelligent feedback systems and real-time imaging can improve clinical outcomes, giving device manufacturers new opportunities to stand out from the competition.

Neurovascular Thrombectomy Devices MarketSegmental Insights

Product Type Insights

The stent retriever segment dominates the neurovascular thrombectomy devices market, with a 45.8% share in 2024, due to their high effectiveness in mechanically removing clots from neurovascular vessels. They have a large market share because they can provide rapid reperfusion with minimal vessel damage, and because neurointerventional specialists have widely adopted them.

The aspiration catheters segment is expected to be the fastest-growing segment in the market during the forecast period, driven by technological advancements that improve suction efficiency, flexibility, and trackability. The increased use of these devices, either alone or in combination with stent retrievers, is accelerating their adoption worldwide because they deliver better clinical outcomes and enhanced procedural safety.

The combined/integrated systems segment is notable in the neurovascular thrombectomy devices market because these systems integrate aspiration and stent retriever technologies, providing a comprehensive solution for clot removal. This combination improves procedural efficiency, shortens treatment time, and enhances patient outcomes, making it a preferred choice for many clinicians.

Usability Insights

The reusable devices segment dominates the market with a 71.5% share in 2024 because of their longevity and cost-effectiveness in busy hospitals. Reusable systems are preferred by hospitals and specialized neurointerventional centers for routine procedures because they lower overall treatment costs while preserving device performance and reliability standards.

The reusable devices segment is expected to be the fastest-growing segment in the market during the forecast period, driven by increased use of reusable devices, promoted by growing awareness of cost-effectiveness, environmental sustainability, and improvements in sterilization technologies, particularly in developed and emerging healthcare markets.

Application Insights

The ischemic stroke segment dominates the market with a 68.8% share of the neurovascular thrombectomy devices market in 2024, since the majority of stroke cases globally are caused by ischemic strokes. Since neurovascular thrombectomy devices are highly effective at rapidly restoring blood flow in ischemic situations, they are typically used in hospitals and specialty clinics.

The hemorrhagic stroke segment is expected to be the fastest-growing segment in the market during the forecast period, driven by growing research into the safety of devices for fragile vessels as well as the increased prevalence of hemorrhagic strokes in some areas. Market growth is being aided by the development of specialized tools for treating hemorrhagic stroke.

End User Insights

The hospitals segment dominates the neurovascular thrombectomy devices market, with a 42.8% share in 2024, as they can offer comprehensive neurointerventional care. They can frequently use thrombectomy devices for both ischemic and complex stroke cases because they have access to highly qualified specialists, sophisticated imaging infrastructure, and large patient volumes.

The ambulatory surgical centers segment is expected to be the fastest-growing segment in the market during the forecast period, driven by the need for portable and user-friendly thrombectomy devices, their increasing focus on outpatient care, cost-effective setups, and the growing adoption of minimally invasive neurovascular procedures.

The academic & research institutes segment plays an important role in the neurovascular thrombectomy devices market as these institutions drive innovation through clinical trials and experimental studies. They focus on evaluating device performance, improving procedural safety, and developing next-generation thrombectomy techniques. Their research also supports regulatory approvals and strengthens the scientific foundation for wider clinical adoption.

Neurovascular Thrombectomy Devices MarketRegional Insights

The North America neurovascular thrombectomy devices market size is estimated at USD 365.06 million in 2025 and is projected to reach approximately USD 661.24 million by 2034, with a 6.82% CAGR from 2025 to 2034.

What Made North America Dominate the Neurovascular Thrombectomy Devices Market in 2024?

The North America segment dominates the market with a 44.2% share in 2024, driven by the widespread use of neurovascular thrombectomy devices, increased healthcare spending, and improved healthcare infrastructure. The region's dominant market position was facilitated by a well-established network of hospitals and specialized stroke centers, as well as advantageous reimbursement policies.

The U.S. neurovascular thrombectomy devices market size is expected to be worth USD 499.23 million by 2034, increasing from USD 273.79 million by 2025, growing at a CAGR of 6.89% from 2025 to 2034.

U.S. Country-Level Insights for the Neurovascular Thrombectomy Devices Market

The U.S. market also benefits from robust clinical research activity and favorable reimbursement policies that promote early adoption of new devices and techniques. Several large-scale clinical trials, including those focused on expanding treatment windows and improving patient selection criteria, have reinforced the use of thrombectomy as a standard of care for large-vessel occlusion strokes. Furthermore, ongoing collaborations between hospitals, academic research centers, and technology developers have accelerated the integration of artificial intelligence and advanced imaging into stroke triage and intervention workflows.

With increasing stroke awareness campaigns, expanding hospital capacities, and continued innovation from domestic manufacturers, the U.S. is expected to remain the global leader in neurovascular thrombectomy device utilization and development.

The Asia Pacific region is poised to be the fastest-growing segment in the neurovascular thrombectomy devices market during the forecast period, fueled by a combination of rising stroke incidence, improving access to advanced healthcare, and strong regional investment in neurointerventional technologies. Stroke remains one of the leading causes of death and disability across Asia, with countries such as China, Japan, and India reporting a substantial burden of ischemic stroke cases, many of which are now being identified as candidates for mechanical thrombectomy due to better diagnostic and imaging capabilities. Over the past few years, governments in the region have prioritized expanding neurovascular treatment capacity through initiatives that strengthen hospital infrastructure, enhance stroke-care networks, and promote early intervention.

Japan Market Analysis

Japan represents one of the most advanced and strategically important markets for neurovascular thrombectomy devices within Asia Pacific. The country's well-established healthcare infrastructure, aging population, and high prevalence of cerebrovascular diseases have created a strong clinical demand for effective stroke interventions. In recent years, Japan's Ministry of Health, Labour and Welfare has supported rapid adoption of mechanical thrombectomy as a standard of care for large-vessel occlusion strokes, expanding reimbursement coverage and promoting nationwide access through certified stroke centers. Major hospitals and research institutions have also participated in landmark clinical studies that have helped refine thrombectomy techniques and device design for Asian patient anatomies.

Latin America emerged as a key growth region for neurovascular thrombectomy devices in 2024, propelled by rising incidence of ischemic stroke, increasing awareness of large-vessel occlusion treatments, and gradual adoption of advanced endovascular therapies across the region. In particular, healthcare systems in Brazil, Mexico and Argentina have improved imaging capabilities and stroke-care protocols, enabling more patients to become eligible for thrombectomy procedures.

Hospitals are increasingly investing in specialized interventional neurology suites, driven by growing middle-class demand for high-quality neurological care and the spread of public and private stroke-treatment networks. As a result, thrombectomy device uptake is gaining traction, supported by global device makers expanding into Latin America and local institutions training neuro-interventionalists.

Country-Level Investments/Funding Trends for Neurovascular Thrombectomy Devices Market

| Country | Funding/Investment Trend | Regulatory Environment | Key Insights |

| India | Strong push for indigenous manufacturing to reduce import dependence. Investments are supported by government bodies (TDB) and private investors to enhance affordability and accessibility. | Regulated by the CDSCO. The environment is evolving as efforts to update risk classifications for neurological devices continue. | Rapidly growing market driven by population size; challenges include high costs and a shortage of skilled professionals. |

| U.S. | Robust investment driven by high stroke prevalence and substantial healthcare spending. Favorable reimbursement policies boost the adoption of advanced devices. | Regulated by the FDA (Class II or III devices). Adherence to stringent guidelines and approval processes is mandatory. | Represents a dominant share of the global market. Neurothrombectomy devices form the largest segment within the neurovascular market. |

| UAE | Growing market with regional initiatives supporting tech adoption. The investment focuses on improving healthcare infrastructure and expanding access to advanced treatments. | Devices must be registered with the Ministry of Health and Prevention (MOHAP) before market entry. | Part of a growing regional market (Middle East and North Africa). |

| Germany | Investment focuses on modernizing healthcare infrastructure and integrating digital health solutions. Supported by a stable, high-value healthcare system. | Highly regulated by the EMA and BfArM. Stricter European regulations (MDR) influence market access | A key European market with emerging opportunities in next-generation tools like AI-driven planning and nanotechnology. |

Neurovascular Thrombectomy Devices Market Companies

- Headquarters: Dublin, Ireland

- Year Founded: 1949

- Ownership Type: Publicly Traded (NYSE: MDT)

History and Background

Medtronic plc was founded in 1949 by Earl Bakken and Palmer Hermundslie as a medical equipment repair shop in Minneapolis, Minnesota. The company developed the world’s first battery-powered, wearable cardiac pacemaker in 1957, marking the beginning of its leadership in medical technology. Over the following decades, Medtronic diversified into cardiovascular, neurological, orthopedic, and surgical devices, becoming one of the largest healthcare technology companies in the world.

In recent years, Medtronic has expanded its focus to include neurovascular and stroke intervention technologies, leveraging acquisitions and internal innovation to strengthen its presence in the neurovascular market. Medtronic’s Neurovascular division offers products for stroke therapy, aneurysm repair, and thrombectomy procedures.

Key Milestones / Timeline

- 1949: Founded as a medical equipment repair company in Minneapolis, Minnesota

- 1957: Developed the first battery-powered cardiac pacemaker

- 1998: Expanded into neurovascular treatment through targeted acquisitions

- 2015: Acquired Covidien plc, enhancing surgical and vascular portfolios

- 2018: Launched Solitaire X Revascularization Device for stroke treatment

- 2023: Introduced the next-generation React aspiration catheter for mechanical thrombectomy

- 2025: Continued investment in AI-assisted neurovascular imaging and robotic intervention platforms

Business Overview

Medtronic operates as a global medical technology leader, offering innovative products and therapies across cardiovascular, neuroscience, surgical, and diabetes care. The company’s neurovascular segment develops devices for the treatment of ischemic and hemorrhagic strokes, including stent retrievers, aspiration catheters, flow diverters, and access products. Medtronic aims to improve patient outcomes through advanced device design, digital health integration, and clinical research leadership.

Business Segments / Divisions

- Cardiovascular Portfolio

- Neuroscience Portfolio (includes Neurovascular business)

- Medical Surgical Portfolio

- Diabetes Portfolio

Geographic Presence

Medtronic has operations in more than 150 countries, with manufacturing and R&D facilities in the United States, Ireland, Israel, Puerto Rico, and China.

Key Offerings

- Solitaire X Revascularization Device for ischemic stroke

- Pipeline Flex Embolization Device for aneurysm treatment

- React Aspiration Catheters for thrombectomy procedures

- Phenom and HyperFlex microcatheters for neurovascular access

- StealthStation neuro-navigation and AI-assisted imaging technologies

Financial Overview

Medtronic reports annual revenues exceeding $30 billion USD, supported by a diversified product portfolio and strong global presence. The company’s Neurovascular segment continues to demonstrate growth driven by the rising incidence of stroke and expanding adoption of mechanical thrombectomy procedures.

Key Developments and Strategic Initiatives

- February 2023: Launched React 68 and React 71 aspiration catheters for advanced stroke intervention

- July 2023: Announced collaboration with Viz.ai to integrate artificial intelligence for stroke triage and detection

- January 2024: Introduced Pipeline Vantage with Shield Technology for enhanced aneurysm embolization performance

- September 2025: Expanded clinical trials for next-generation thrombectomy systems and robotic neurointervention technologies

Partnerships & Collaborations

- Partnership with Viz.ai for AI-driven stroke workflow optimization

- Collaboration with academic hospitals for neurovascular robotics development

- Strategic alliances with imaging technology firms for advanced neuroimaging integration

Product Launches / Innovations

- React Aspiration Catheter platform (2023)

- Pipeline Vantage with Shield Technology (2024)

- AI-based stroke detection and workflow software (2025)

Technological Capabilities / R&D Focus

- Core technologies: Neurovascular intervention devices, AI-based imaging, robotic navigation systems, and catheter innovation

- Research Infrastructure: Global R&D network with centers in the United States, Ireland, and Israel

- Innovation focus: Stroke intervention, AI integration, and precision neuro-navigation

Competitive Positioning

- Strengths: Global scale, broad neurovascular portfolio, integration of digital and robotic technologies

- Differentiators: Combined expertise in medical devices, imaging, and AI-driven clinical support

SWOT Analysis

- Strengths: Strong brand reputation, diversified portfolio, global reach

- Weaknesses: Complex regulatory landscape and high R&D expenditure

- Opportunities: Growing global demand for stroke therapies and AI-assisted interventions

- Threats: Competition from Stryker, Johnson & Johnson, and emerging neurovascular startups

Recent News and Updates

- March 2024: Medtronic received CE Mark for the latest generation Pipeline device with enhanced delivery system

- June 2024: Announced results from the Solitaire X global registry demonstrating improved stroke outcomes

- January 2025: Medtronic unveiled early-stage robotic-assisted neurovascular intervention platform under clinical evaluation

- Headquarters: Kalamazoo, Michigan, United States

- Year Founded: 1941

- Ownership Type: Publicly Traded (NYSE: SYK)

History and Background

Stryker Corporation was founded in 1941 by Dr. Homer Stryker, an orthopedic surgeon and inventor, who began developing innovative medical devices to improve patient care and surgical efficiency. Initially focused on orthopedic and hospital products, Stryker evolved into a global medical technology leader through a combination of innovation and strategic acquisitions.

Over the decades, Stryker has expanded into multiple healthcare sectors, including orthopedics, medical and surgical equipment, and neurotechnology. The company’s neurovascular division, established through the 2011 acquisition of Boston Scientific’s neurovascular business, has positioned Stryker as a global leader in stroke intervention technologies. Its comprehensive portfolio includes stent retrievers, aspiration catheters, flow diverters, and access devices for the treatment of ischemic and hemorrhagic stroke.

Key Milestones / Timeline

- 1941: Founded by Dr. Homer Stryker in Kalamazoo, Michigan

- 1979: Listed on the New York Stock Exchange (NYSE: SYK)

- 2011: Acquired Boston Scientific’s neurovascular business, strengthening stroke treatment capabilities

- 2016: Launched the Trevo Retriever platform for ischemic stroke treatment

- 2020: Acquired Wright Medical Group, expanding orthopedics and trauma offerings

- 2023: Introduced next-generation AXS Catalyst and Target Detachable Coil systems for neurovascular use

- 2025: Expanded robotic and digital guidance integration into neurovascular intervention workflows

Business Overview

Stryker operates as one of the world’s largest medical technology companies, specializing in surgical, orthopedic, and neurotechnology products. The company’s Neurovascular segment develops solutions for the treatment of stroke and aneurysms, combining device innovation with data-driven digital health platforms to improve patient outcomes. Stryker’s integrated portfolio supports clinicians throughout the full spectrum of neurovascular care, from diagnosis and access to clot retrieval and vessel reconstruction.

Business Segments / Divisions

- MedSurg and Neurotechnology

- Orthopedics and Spine

Geographic Presence

Stryker operates in over 75 countries with major manufacturing, R&D, and distribution facilities in the United States, Ireland, Germany, China, and India.

Key Offerings

- Trevo Retriever for ischemic stroke

- Neuroform Atlas Stent System for aneurysm embolization

- Target Detachable Coils for aneurysm treatment

- AXS Catalyst Aspiration System

- Surpass Evolve Flow Diverter for large and giant aneurysms

Financial Overview

Stryker reports annual revenues exceeding $20 billion USD, supported by steady growth across MedSurg, Orthopedics, and Neurotechnology segments. The company’s neurovascular business has maintained a strong global presence, driven by rising demand for minimally invasive stroke treatment devices.

Key Developments and Strategic Initiatives

- February 2023: Launched next-generation AXS Catalyst Aspiration System for improved clot removal efficiency

- October 2023: Expanded Surpass Evolve Flow Diverter clinical use in Europe and Asia-Pacific

- April 2024: Introduced AI-enhanced neurovascular imaging software for procedural planning

- August 2025: Announced development of robotic-assisted microcatheter navigation system for stroke interventions.

Partnerships & Collaborations

- Collaborations with leading stroke centers for device trials and workflow optimization

- Partnerships with AI imaging and digital health firms for procedural analytics

- Academic partnerships for advanced neurovascular robotics and micro-navigation research

Product Launches / Innovations

- AXS Catalyst 6 and 7 Aspiration Systems (2023)

- Surpass Evolve Flow Diverter global expansion (2024)

- AI-driven procedural workflow analytics software (2025)

Technological Capabilities / R&D Focus

- Core technologies: Neurovascular devices, robotic navigation, AI-assisted imaging, and catheter engineering

- Research Infrastructure: Global R&D centers in the United States, Ireland, and Germany

- Innovation focus: Next-generation stroke devices, digital guidance, and hybrid robotic navigation platforms.

Competitive Positioning

- Strengths: Comprehensive neurovascular portfolio, strong clinical data support, and global market leadership

- Differentiators: Integration of AI, robotics, and advanced catheter design within endovascular stroke therapy

SWOT Analysis

- Strengths: Global presence, innovation-driven growth, and diverse product portfolio

- Weaknesses: High R&D investment costs and competitive pricing pressures

- Opportunities: Expansion in robotic neurointervention and AI-based imaging analytics

- Threats: Competition from Medtronic, Johnson & Johnson (Cerenovus), and emerging neurovascular startups

Recent News and Updates

- March 2024: Stryker received FDA clearance for its enhanced Trevo NXT Stent Retriever

- June 2024: Published positive data from the TARGET registry on aneurysm treatment outcomes

- January 2025: Announced pilot clinical trials for robotic-assisted neurovascular navigation system

Other Companies in the Neurovascular Thrombectomy Devices Market

- Penumbra, Inc.: Penumbra, Inc. is a global leader in neurovascular thrombectomy technologies, specializing in innovative aspiration and mechanical thrombectomy systems for ischemic stroke treatment. Its Penumbra System and RED reperfusion catheters are widely adopted for rapid and effective clot removal. The company's continuous focus on expanding its Indigo and Lightning platforms underscores its leadership in neuro-interventional innovation and minimally invasive stroke care.

- Johnson & Johnson (Cerenovus): Cerenovus, a division of Johnson & Johnson MedTech, offers a comprehensive neurovascular portfolio including EmboTrap Revascularization Device and Cerenovus Stroke Solutions. The company invests heavily in stroke research, focusing on clot science and advanced thrombectomy tools designed to improve patient outcomes and procedural efficiency. Its integrated ecosystem supports both acute ischemic stroke and hemorrhagic treatment solutions.

- Terumo Corporation: Terumo Corporation develops high-precision neurovascular intervention devices, including microcatheters, guidewires, and stent retrievers. Its solutions are designed for both aspiration and stent-based thrombectomy. The company's R&D emphasis on catheter control and navigability enhances procedural safety in complex neurovascular anatomies.

- MicroVention, Inc. (a Terumo Company): MicroVention, a subsidiary of Terumo, specializes in neuroendovascular technologies for stroke and aneurysm management. Its Sofia and Trevo systems are recognized for advanced clot retrieval performance. MicroVention's integration of imaging, materials science, and catheter innovation reinforces its global influence in minimally invasive neurotherapies.

- Boston Scientific Corporation: Boston Scientific provides a robust range of neurovascular devices, including stent retrievers and aspiration systems used in mechanical thrombectomy. Its VAXTON and SYMPHONY platforms focus on improving revascularization speed and success rates. The company's strong global distribution and clinical research programs strengthen its market presence in stroke intervention technologies.

- Acandis GmbH: Acandis GmbH specializes in neuro-interventional devices such as stent retrievers and flow diverters, designed for the treatment of ischemic stroke and aneurysms. The company focuses on European markets with CE-certified thrombectomy solutions emphasizing precision and biocompatibility.

- Phenox GmbH (Wallaby Medical): Phenox, now part of Wallaby Medical, manufactures advanced neurovascular devices including pRESET and pRESET LITE stent retrievers. The company's innovation centers on enhancing vessel access, clot engagement, and procedural outcomes.

- Rapid Medical Ltd.: Rapid Medical is known for its TIGERTRIEVER device the first adjustable stent retriever designed for real-time control during thrombectomy. The company's technology provides greater adaptability to diverse clot morphologies and vessel anatomies, improving safety and efficacy in stroke interventions.

- Vesalio, LLC: Vesalio develops the NeVa platform, a proprietary stent retriever system engineered for high clot capture and full-vessel restoration. The company emphasizes mechanical innovation and simplicity for faster, more consistent stroke treatment.

- Balt Group: Balt Group designs and manufactures neurovascular access, embolization, and thrombectomy devices. Its solutions combine precision engineering and innovative materials for improved revascularization outcomes in complex neurointerventional procedures.

- Imperative Care, Inc.: Imperative Care offers a novel portfolio of stroke treatment devices, including the Zoom Thrombectomy System. Its focus on procedural efficiency, device versatility, and post-stroke recovery solutions demonstrates a comprehensive approach to neurovascular care.

- Asahi Intecc Co., Ltd.: Asahi Intecc manufactures high-performance guidewires and microcatheters essential for neurovascular interventions. Its precision engineering and wire technology are crucial for safe navigation in delicate cerebral vasculature.

- Kaneka Corporation: Kaneka produces polymer-based neurovascular devices, including microcatheters and embolization materials. The company's research-driven innovations enhance device flexibility and control for safe, effective stroke interventions.

Recent Developments

- In October 2025, Penumbra launched the SwiftSET Neuro Embolization Coil, designed for adaptive embolization in neurovascular procedures. The coil is engineered to optimize vessel wall apposition and facilitate smooth deployment, ensuring dense occlusion in small and tortuous neurovascular anatomies.(Source: https://www.penumbrainc.com)

- In July 2025, Stryker introduced the next generation in Thrill Thrombectomy System, optimized for small vessels and arteriovenous access thrombectomy. This system is purpose built to deliver fast, full luminal clot removal, improving outcomes in challenging vascular anatomies.(Source: https://www.stryker.com)

Segments Covered in the Report

By Product Type

- Stent Retrievers

- Aspiration Catheters

- Combined/Integrated Systems

- Others

By Usability

- Single-Use Devices

- Reusable Devices

By Application

- Ischemic Stroke

- Hemorrhagic Stroke

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting