Thrombectomy Devices Market Size and Forecast 2025 to 2034

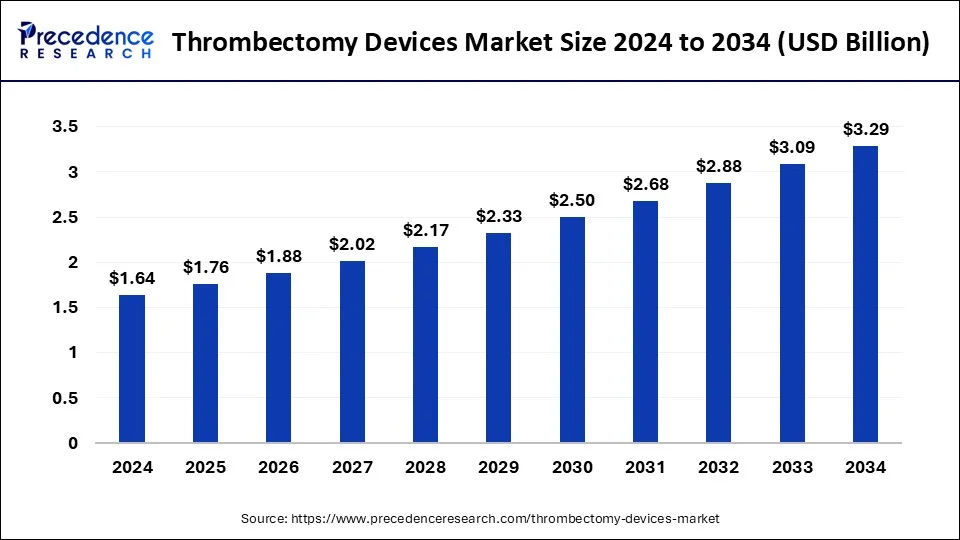

The global thrombectomy devices market size was estimated at USD 1.64 billion in 2024 and is predicted to increase from USD 1.76 billion in 2025 to approximately USD 3.29 billion by 2034, expanding at a CAGR of 7.21% from 2025 to 2034. Thrombectomy devices are helpful for the treatment of diseases that are related to blood clotting like cardiovascular diseases, and blood clots in the heart, brain, and others. These factors help to the growth of the market.

Thrombectomy Devices Market Key Takeaways

- The global thrombectomy devices market was valued at USD 1.64 billion in 2024.

- It is projected to reach USD 3.29 billion by 2034.

- The market is expected to grow at a CAGR of 7.21% from 2025 to 2034.

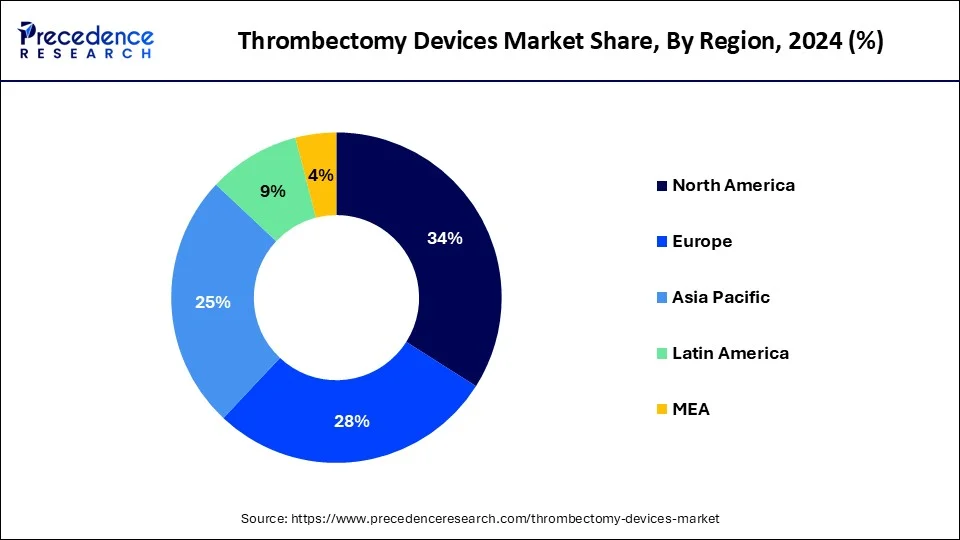

- North America led the market with the biggest market share of 34% in 2024.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034.

- By product type, the mechanical/fragmentation thrombectomy devices segment dominated the market in 2024.

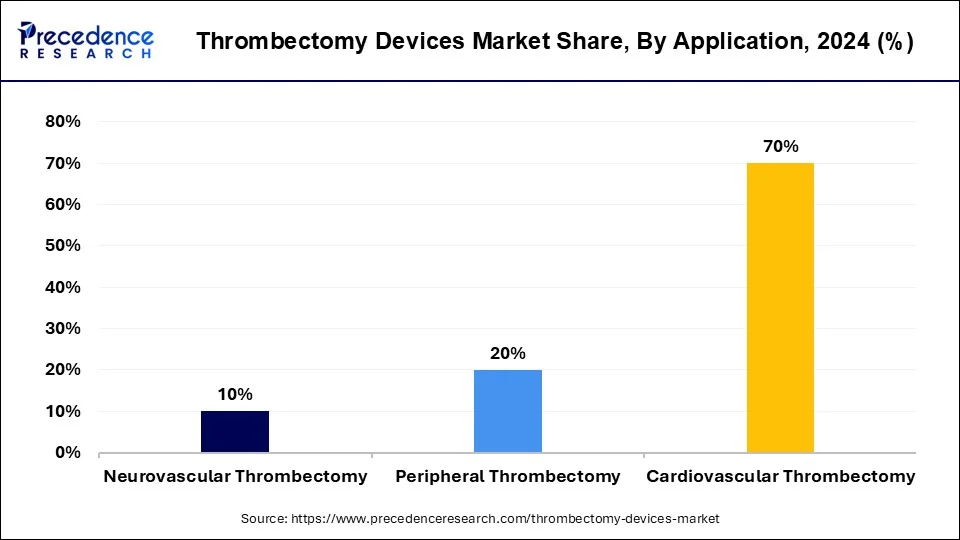

- By application type, the cardiovascular thrombectomy segment will hold the largest market share of 70% in 2024.

- By application type, the peripheral thrombectomy segment is the fastest growing during the forecast period.

- By end-user type, the hospitals segment dominated the market in 2024.

U.S. Thrombectomy Devices Market Size and Growth 2025 to 2034

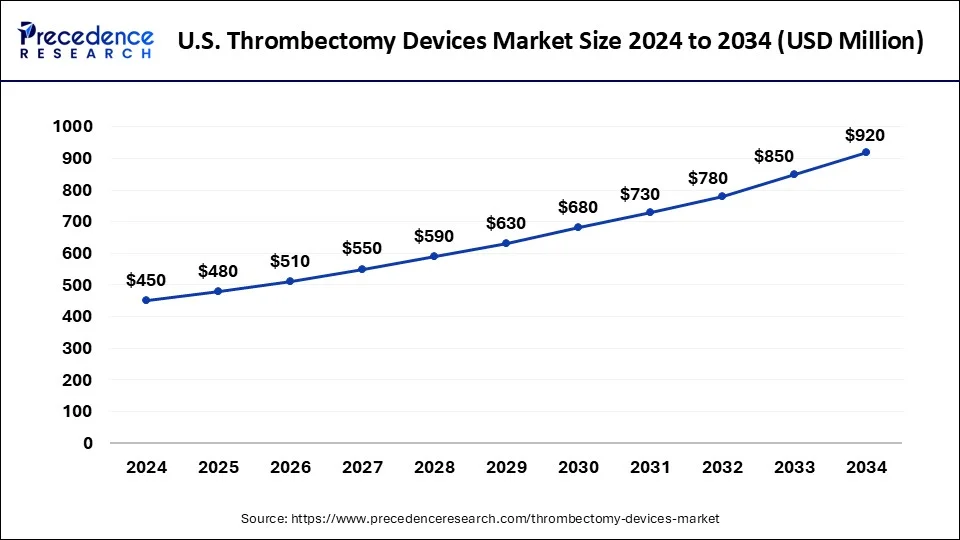

The U.S. thrombectomy devices market size was estimated at USD 450 million in 2024 and is predicted to be worth around USD 920 million by 2034, at a CAGR of 7.41% from 2025 to 2034.

North America dominated the thrombectomy devices market in 2024. The number of benefits of thrombectomy devices helps to increase the use of thrombectomy devices in the North American region. The increasing senior population, which leads to many chronic conditions, life-threatening conditions, cardiovascular diseases, and other diseases that are related to blood clotting, helps the growth of the market. The United States is the leading region for the growth of the market. Increasing deaths due to strokes are the main reason for the rising awareness about the use of advanced technologies in the United States. In Canada, to remove emboli in the lungs from pulmonary embolism disease, the heart from coronary ischemia disease, and in the brain from stroke disease, mechanical thrombectomy is used. These are the factors that help the growth of the market in the North American region.

- In October 2023, in the United States alone, about 1,40,000 deaths per year due to strokes, and to change this stat, Johnson & Johnson innovated a Stroke Awareness Month.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. In the Asia Pacific region, a new approach towards mechanical thrombectomy devices using Medtronic or solitaire devices are effective and safe for the treatment of acute ischemic stroke. The increasing patient population, rising government support in developing countries, and rising mechanical thrombectomy products contribute to the growth of the market. India and China are the leading countries for the growth of the thrombectomy devices market.

- In March 2022, India Medtronic Private Limited started PRAAN, which is India's initial registry, to analyze the blood clots of the brain recovering devices in stroke patients.

- In February 2023, an Indian doctor's group designed a modern apparatus to remove blockages in coronary arteries known as Megavac. This mechanical thrombectomy device reduces the necessity for open heart surgery.

- In August 2023, Israel-based Rapid Medical, a leading developer of advanced neurovascular devices, received approval from China's NMPA (National Medical Product Administration) for the world's adjustable TIGERTRIVER revascularization device, which removes vessel damage in ischemic stroke and facilitates clot integration.

Market Overview

The thrombectomy devices market deals with the medical device industry, which is used in the healthcare sector and designed to remove blood clots from blood vessels. A blood clot is also called a thrombus, which may interrupt the flow of blood to your organs or extremities and may be life-threatening. Common places where blood clots occur are the heart, lungs, brain, intestines, arms, and legs. To remove these blood clots, thrombectomy devices are used in veins or arteries to help restore the flow of blood through the blood vessels. These thrombectomy devices are helpful in preventing life-threatening conditions from occurring. The thrombectomy devices may limit the loss and bodily functions by restoring blood flow as fast as possible. The thrombectomy devices reduce and remove long-term disability for those who suffer severe strokes and may help to treat blood clots.

Thrombectomy Devices Market Growth Factors

- To remove these blood clots, thrombectomy devices are used in veins or arteries to help restore the flow of blood through the blood vessels. These factors help the market grow.

- Thrombectomy devices are helpful in preventing life-threatening diseases. They are also used to treat diseases like stroke, pulmonary embolism, heart attack, renal artery occlusion, acute mesenteric ischemia, acute lower or upper extremity arterial limb ischemia, and deep vein thrombosis (DVT).

- Thrombectomy devices may limit bodily activity loss and damage by restoring blood flow as quickly as possible. This helps to grow the thrombectomy device market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.64 Billion |

| Market Size in 2025 | USD 1.76 Billion |

| Market Size by 2034 | USD 3.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.21% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising cardiovascular diseases

Rising cardiovascular diseases have led to the growth of the thrombectomy devices market. In pulmonary embolism, blood clots travel in the lungs; symptoms include coughing, chest pain, and shortness of breath. In coronary thrombosis, a blood clot occurs in the heart, and the symptoms include sweating, trouble breathing, and severe pain in the arm and chest. Blood clots may occur in veins or arteries, which leads to cardiovascular diseases like strokes and heart attacks. The rising senior population is also the reason for increasing cardiovascular diseases, which leads to the growth of the market. These diseases led to increasing demand for thrombectomy procedures. These factors help to the growth of the market.

Restraint

Risks of thrombectomy devices

The high cost of thrombectomy devices may be a restraint to the growth of the market, mainly in developing regions. The lack of skilled professionals who can use advanced thrombectomy devices, which require specialized expertise and training, leads to a decrease in the use of thrombectomy devices. Thrombectomy devices have some risks, including the reoccurrence of blood clots, reaction to anesthesia, pulmonary embolism in which blood clot travels to lungs, infection, severe bruises or hematomas, bleeding, and blood vessel narrowing or stenosis or damage. Disadvantages of mechanical thrombectomy devices include technical difficulty, distal embolization, trauma to vessels, and limited access to well-trained neuro interventional. At the thrombectomy site, stenosis, vessel dissection, or perforation may occur. These factors decrease the growth of the thrombectomy devices market.

Opportunity

Advanced technologies

The rising prevalence of cardiovascular diseases and thrombotic conditions requires advanced thrombotic devices for treatment. Increasing risks of obesity, diabetes, hypertension, and changing lifestyles contribute to the growth of vascular diseases, which leads to the growth of the market. Technological advancements in thrombectomy devices include reduced treatment time, improved procedural outcomes, improved imaging mobilities, enhanced navigation capabilities, and retrievable stent systems. These are the advantages of the advanced technologies that are applied in thrombectomy devices, which help to grow the thrombectomy devices market.

Product Insights

The mechanical/fragmentation thrombectomy devices segment dominated the market in 2024. The mechanical/fragmentation thrombectomy device is an endovascular system or technique that helps reduce blood clots after an ischemic stroke from the brain. In these types of devices, an array of devices is used, such as aspiration pumps, aspiration catheters, microcatheters, stent retrievers, and guide catheters. Large bore catheters help suction out thrombus by using a negative pressure aspiration. According to European and American guidelines, a mechanical thrombectomy device is recommended for patients who have an ASPECTS (Alberta Stroke Program Early CT Score) of 6 or higher. Mechanical/fragmentation thrombectomy devices are helpful in efficient patient care, decreased complications, improved symptom relief, shorter treatment times, smaller doses of thrombolytic agents, and faster thrombus removal. These factors help to grow the mechanical/fragmentation thrombectomy devices segment and contribute to the growth of the thrombectomy devices market.

Application Insights

The cardiovascular thrombectomy segment dominated the market in 2024. The increasing number of cardiovascular conditions leads to the use of thrombectomy devices. These thrombectomy devices are highly used in the healthcare sector for cardiovascular disease treatment. In these cardiovascular diseases, thrombectomy devices are used to remove blood clots that are trapped in arteries and veins. Cardiovascular diseases include strokes, which may caused by blood clots occurring in the brain.

Arterial thrombosis which occurs in blood clots in the arteries. It is dangerous as it may stop or obstruct the flow of blood to the major organs. Pulmonary embolism occurs when blood clots travel in the lungs; symptoms include coughing, chest pain, and shortness of breath. Coronary thrombosis forms blood clots in the heart, and symptoms include sweetening trouble breathing, and severe pain in the arm and chest. In these cardiovascular diseases, thrombectomy devices are useful for treatment. These cardiovascular diseases lead to the growth of the thrombectomy devices market.

The peripheral thrombectomy segment is the fastest growing during the forecast period. Peripheral thrombectomy is the non-surgical removal of emboli and thrombi from the blood vessels. Peripheral thrombectomy diseases are treated by the use of thrombectomy devices, which provide flexibility and power to improve symptoms, restore blood flow quickly, and remove thromboses easily and quickly. Peripheral venous thrombosis and peripheral arterial thrombosis can be removed using thrombectomy devices. To restore the most challenging of DVT cases and to reduce venous thrombus. These are the factors that help the growth of the thrombectomy devices market.

- In June 2023, the Oscar Multinational Peripheral catheter at LINC 2023 was launched by BIOTRONIK, a leading global medical technology company with services and products that improve and save the millions of lives who are suffering from chronic pain, blood vessel diseases, and heart diseases.

- In April 2024, the ICE Aspiration System received 510k clearance from the USFDA (U.S. Food and Administration) for venous systems and vessels of peripheral arterial systems announced by Expanse ICE.

End-user Insights

The hospitals segment dominated the thrombectomy devices market in 2024. Thrombectomy devices are used in hospitals. Most hospitals use thrombectomy devices, which are useful in the treatment of severe stroke. Surgical thrombectomy is a surgery type used to reduce blood clots from a vein or arteries. Different types of thrombectomy devices are helpful in hospital surgical centers for the treatment of various cardiovascular and other diseases that cause blood clotting.

Mechanical thrombectomy devices are an endovascular technique used to remove blood clots after ischemic stroke from the brain. These thrombectomy devices help reduce the length of hospitalization, enhance patient outcomes, reduce the costs of thrombectomy, and give life-saving services to patients. These are the benefits of thrombectomy devices that are useful in hospitals and ambulatory surgical centers. These factors help the growth of the segment and contribute to the growth of the market.

Thrombectomy Devices Market Companies

- Abbott Laboratories

- Acandis GmbH

- Angio Dynamics

- Boston Scientific Corporation

- Cook Medical

- Edwards Lifesciences Corporation

- Johnsen & Johnsen Services Inc.

- Koninklijke Philips NV

- Lemaitre Vascular Inc.

- Medtronic Plc.

- Penumbra Inc.

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- Weigao Group (Argon Medical Devices Inc.)

Recent Developments

- In January 2023, Penumbra, a Calif-based US healthcare company, launched a lightning flash and announced USFDA (U.S. Food and Drug Administration) clearance, and the company reported to the market about highly advanced mechanical thrombectomy system to address pulmonary thrombus and venous thrombus.

- In June 2023, two new catheters, the RevCore Thrombectomy catheter and the Triever 16 Curve catheter for venous thromboembolism and venous stent thrombosis, were launched by the medical device company Inari Medical. The Triever 16 Curve catheter may be used in both pulmonary embolism and peripheral thrombectomy procedures.

- In February 2024, for ischemic stroke revascularization, the next-generation Cereglide 71 catheter was launched by Cerevenovus to access clots and to improve the navigation and flexibility of the device to help healthcare professionals.

Segments Covered in the Report

By Product Type

- Ultrasound-assisted Thrombectomy Devices

- Rotational Thrombectomy Devices

- Aspiration Thrombectomy Devices

- Mechanical/Fragmentation Thrombectomy Devices

- Clot Extraction Catheter

- Stent Retrievers

- Microcatheters

- Others

By Application

- Peripheral Thrombectomy

- Neurovascular Thrombectomy

- Cardiovascular Thrombectomy

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting