What is Neurovascular Catheters Market Size?

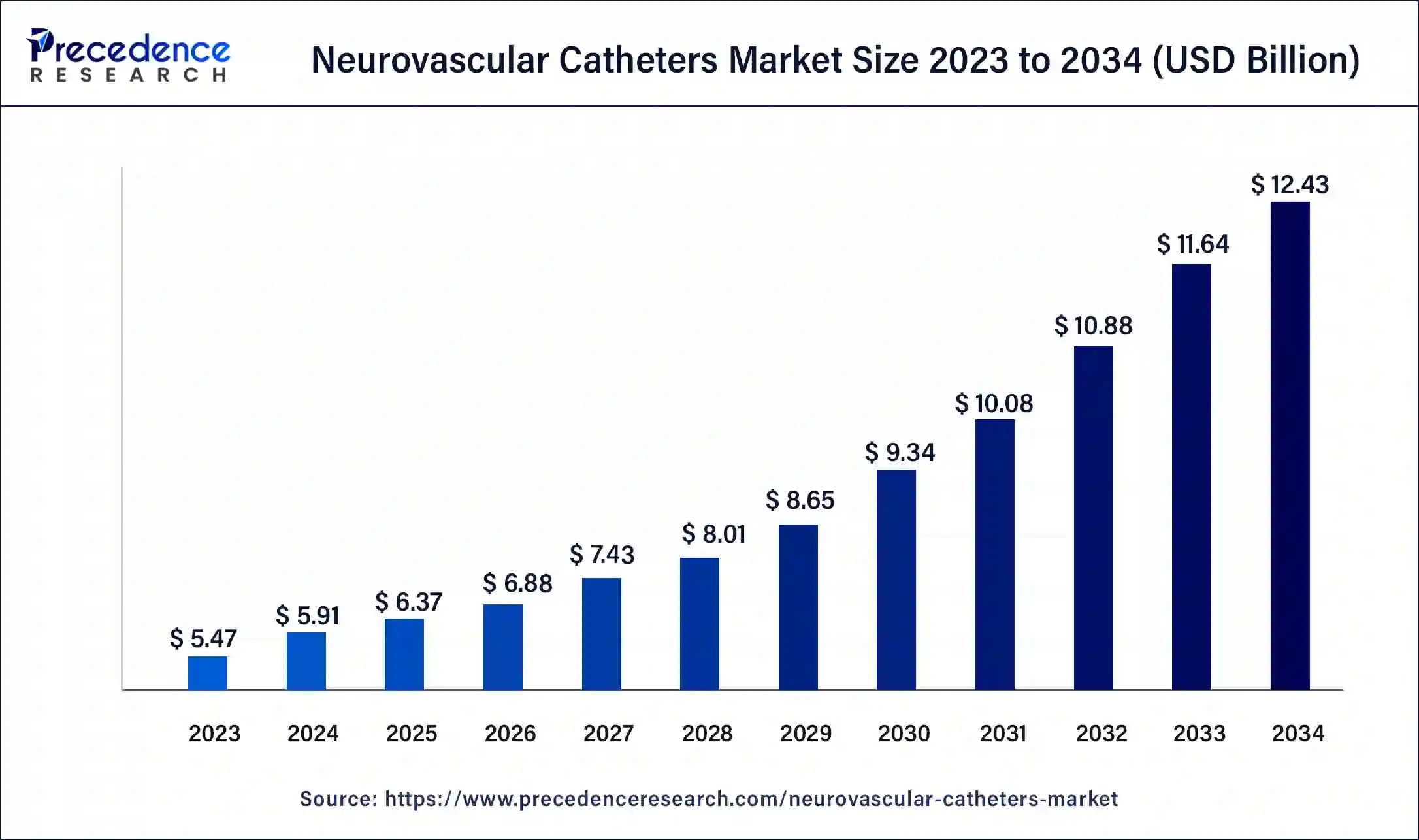

The global neurovascular catheters market size accounted for USD 6.37 billion in 2025 and is predicted to increase from USD 6.88 billion in 2026 to approximately USD 13.20 billion by 2035, expanding at a CAGR of 7.56% from 2026 to 2035. The market is driven by the rising incidence and prevalence of neurovascular diseases like strokes and brain aneurysms.

Market Highlights

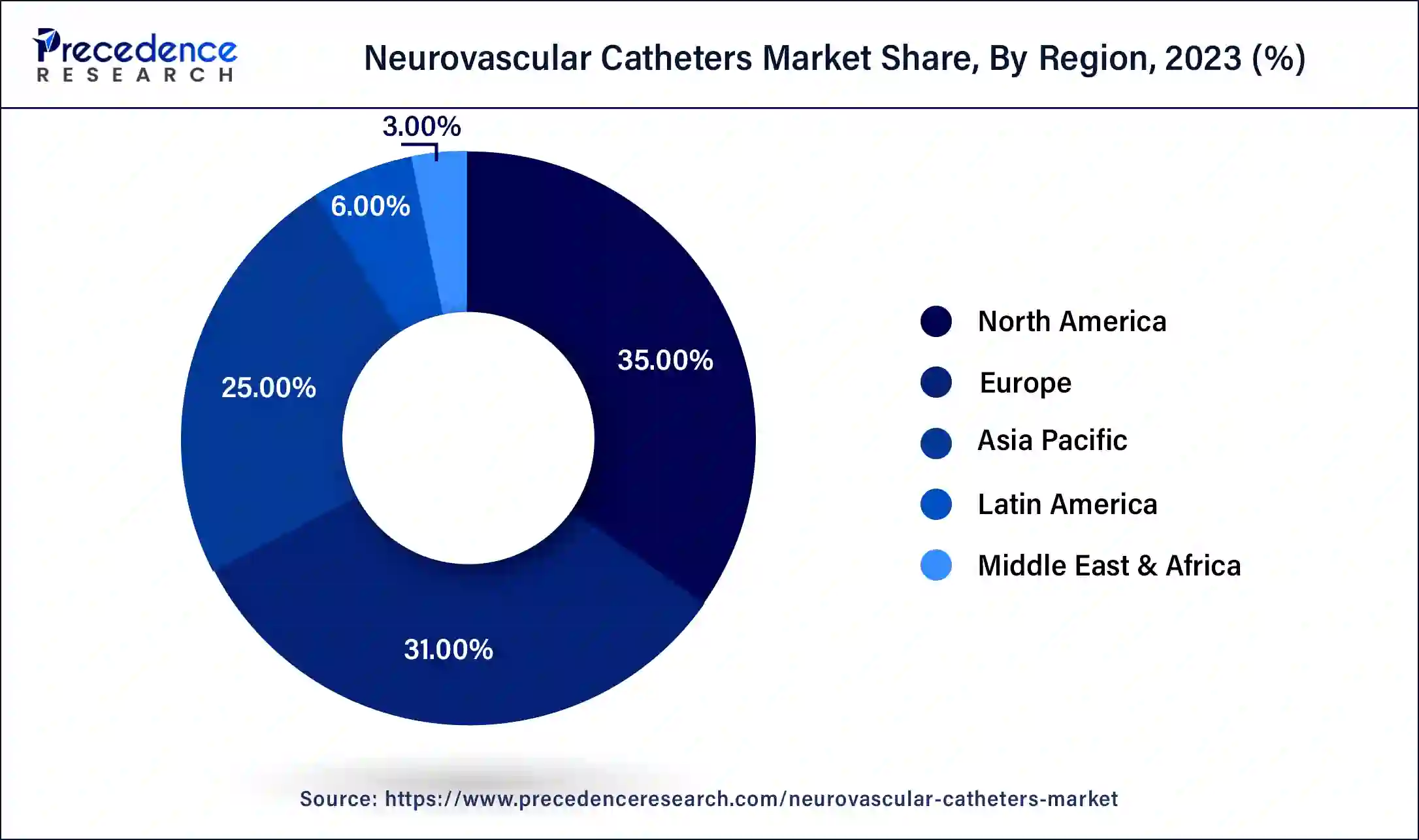

- North America dominated the market with the largest market of 35% in 2025.

- Asia Pacific is expected to witness significant market growth during the forecast period.

- By Type, the embolization catheters segment dominated the market with the highest market share of 35% in 2025.

- By Type, the microcatheters segment is expected to grow at a significant rate during the forecast period.

- By Application, the brain aneurysms segment dominated the global market with the largest market share of 34% in 2025.

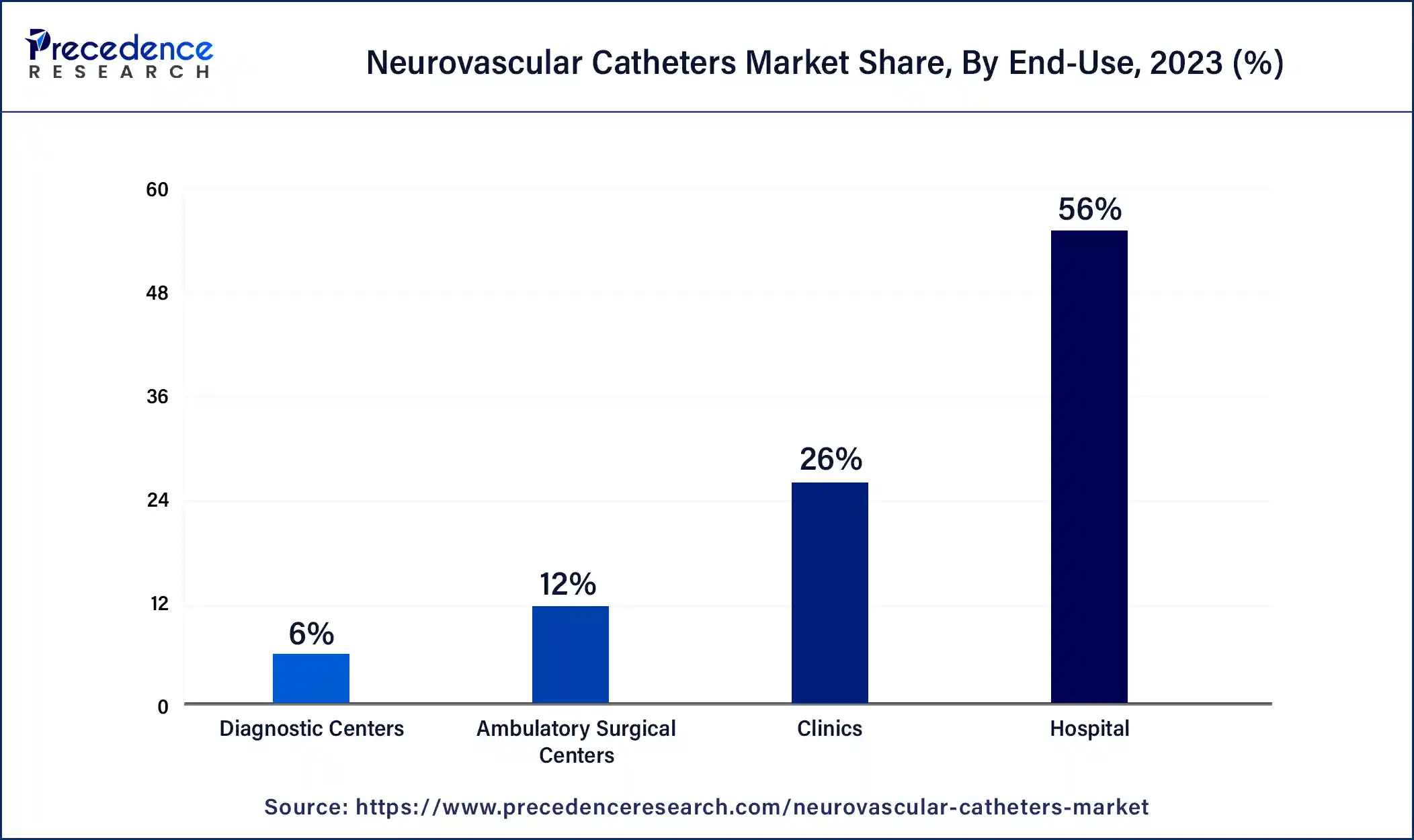

- By End-use, the hospital segment contributed more than 56% of revenue share in 2025.

- By End-use, the ambulatory surgical centers segment is expected to grow at a significant rate during the forecast period.

Market Overview

The neurovascular catheter is a medical device that is useful in the treatment of patients with neurological conditions. It is a tube-shaped device that is used during brain surgeries of patients. Catheters are used in medical devices to be inserted in the body for the treatment of a particular disease, especially during surgeries. These catheters play an important role in various medical procedures, such as monitoring intracranial pressure, administering medications and injecting contrast agents. The most common application of neurovascular catheters is to manage the condition of hydrocephalus, which helps in regulating the blood flow of cerebrospinal fluid. They are also employed during the treatment of head injuries or during neurosurgery.

Key AI Integration in the Neurovascular Catheters Market

AI-driven navigation systems offer real-time guidance, improving catheter placement accuracy and reducing human error during complex interventions. Machine learning models treatment responses, forecast complications, and even high-risk patients for proactive care. AI addresses the demand for millimeter-level accuracy in neurovascular procedures, decreasing complications. Strong expansion is projected due to rising stroke prevalence, healthcare digitization, and even investment in neurovascular infrastructure. Major companies, including Medtronic, Johnson & Johnson MedTech, Penumbra, Stryker, and MicroVention, are investing in AI-integrated solutions.

Neurovascular Catheters Market Growth Factors

Changing lifestyle in recent times tends to the higher prevalence of neurological condition such as brain aneurysms and stroke contributing to the growth of the neurovascular catheters market. In recent times minimal surgeries have increased and gained popularity due to minimizing the trauma and risk which is associated with surgical procedures. Thus, this element is accelerating the growth of the market.

The rising rate of strokes and blockages in blood vessels in the brain act as a growth factor for the market. Increasing cases of strokes or accidents result in blockage in blood vessels or injured blood vessels which results in several problems in the brain. Minimal surgeries are responsible for curing or treating this kind of brain wound by surgeries. For removing the blockage or curing the injured blood vessel in the brain there are endovascular techniques that are widely preferred. For the treatment and minimal surgeries, the neurovascular catheters are combined with other medical devices for the surgical process for the cure of stroke, aneurysm, and other injuries and blood vessel conditions.

Neurovascular Catheters Market Outlook

- Industry Growth Overview: The neurovascular catheters market is steadily expanding, driven by the rising global incidence of ischemic and hemorrhagic strokes. Hospitals and stroke units are increasingly investing in advanced microcatheter systems that provide quicker access to challenging intracranial anatomy with reduced procedural risk. Additionally, the growing use of AI-based imaging and mobile stroke units is improving early diagnosis and increasing the number of patients receiving catheter-based therapies, further fueling market growth.

- Technological Advancements: The market is undergoing a technological revolution, driven by innovations in materials, digital technology, and real-time procedural precision. Next-generation catheters feature hydrophilic coatings, tapered shafts, and multi-durometer designs, significantly improving the ability to navigate tortuous vessels. Companies like Stryker, Medtronic, and Penumbra have introduced advanced aspiration and access systems that reduce procedure time and enhance the effectiveness of clot retrieval.

- Regulatory Landscape: The regulatory landscape for neurovascular catheters remains highly stringent, with a strong emphasis on safety, efficacy, and long-term clinical validation. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) prioritize post-market surveillance and evidence-based data to ensure device performance and patient safety over time.

- Strategic Expansion and Collaborations: Global leaders are ramping up their geographic expansion and partnership strategies to maintain competitiveness in the market. Medtronic has expanded its neurovascular research and development center in Irvine, California, focusing on optimizing catheter designs and advancing data-driven, computer-assisted navigation systems. Meanwhile, Terumo Corporation, through its MicroVention subsidiary, is expanding its manufacturing and training facilities in Japan and Singapore to meet the growing demand for endovascular stroke treatments in the Asia-Pacific region.

- Major Investors: Investment in the neurovascular space is accelerating as venture capital and investors recognize the sector's high clinical value and significant entry barriers. Innovators in robotic-assisted catheter navigation, microfluidic-based systems, and hybrid access technologies are attracting investments from medical technology investors in both startups and mid-tier companies. Partnerships between medical electronics firms and leading medical centers, such as Mayo Clinic, Johns Hopkins Medicine, and Cleveland Clinic, are driving translational research and advancing innovation in the field.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.37 Billion |

| Market Size in 2026 | USD 6.88 Billion |

| Market Size by 2035 | USD 13.20 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.56% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Implementation of advanced neurovascular access (ANA)

An innovative stroke thrombectomy tool called Advanced Neurovascular Access has a self-expanding funnel component. This device is designed to restrict local blood flow while extending to the same width as the lodging artery in order to decrease the negative effects brought on by clot breakup. When the ANA device is deployed, it allows distal aspiration when combined with a stent retriever (SR) to transfer the clot into the tube, where it is caught and kept safe for extraction. With the adoption of advanced medical devices and tools, the implementation of ANA is observed to grow in the upcoming years while promoting the market's growth.

Restraint

Lack of professionals

The absence of a skilled workforce poses a significant restraint for the global neurovascular catheters market. The intricate nature of these medical devices demands specialized expertise for their successful use and maintenance. A shortage of trained professionals capable of accurately inserting and managing neurovascular catheters may lead to complications, procedural errors and reduced patient outcomes. Moreover, the need for continuous monitoring and precise adjustments necessitates proficient healthcare practitioners to ensure optimal device performance. Thus, the factor acts as a major restraint for the market.

Opportunity

AI and ML in neurovascular surgeries

Endovascular neurosurgery holds the potential to revolutionize neurovascular care with the application of robotics and artificial intelligence (AI). integration of artificial intelligence holds the capacity to interpret data and utilize the same for modeling human behavior. Machine learning models are also being heavily employed in the healthcare sector, which helps in analyzing patterns to detect associations in a dataset. Integration of artificial intelligence and machine learning can ease the decision-making during surgeries by availing the capabilities of neurovascular catheters in a more effective manner. All these capacities of AI and ML are observed to improve the overall effectiveness of neurovascular catheters for patients. Thus, the integration of AI and ML is expected to open a set of lucrative opportunities for the market.

Segment Insights

Type Insights

The embolization catheter segment dominated the market in 2023. The segment's dominance is attributed to the growing use of embolization catheters in brain surgeries. The specific medication or synthetic material placed which is called an embolic agent by the embolization catheters into the blood vessel to block the blood flow to an area of the body. The healthcare professional delivers the embolic agents through long and thin tubes. The catheter is inserted by making a puncture in the skin and it follows the blood vessels and the treatment area. There are several types of embolic agents that are used in the procedure like balloons, gelatin foam, liquid glue, liquid sclerosing agents, metallic coils, and particular agents.

The microcatheters segment is expected to grow at a significant rate during the forecast period. Microcatheters are medical devices with diameter and are used in minimally invasive procedures. The Microcatheters are used for exchanges, guidewire support, cross lesions, accessing distal anatomy, delivering therapeutic embolic, injecting contrast media, and other complex endovascular procedures.

Application Insights

The brain aneurysms segment dominated the market in 2023. A brain aneurysm is a type of brain condition or disease in which a bulge and balloon in blood vessel is formed. It is also known as a cerebral aneurysm or intracranial aneurysm. It may cause some serious issues and health problems like Subarachnoid hemorrhage, Hemorrhagic stroke, Vasospasm, Hydrocephalus, Seizures, and Coma a neurovascular catheter is used in surgeries for blockage of extra blood flow to the weak wall of the blood vessel and helps in the treatment and surgery of the disease. Multiple studies show that catheter is the most successful form of treatment for aneurysms.

End-Use Insights

The hospital segment dominated the market in 2023, the segment is expected to sustain dominance throughout the forecast period. Rising patient number in neurology section for the treatment of brain aneurysm, Traumatic brain injury (TBI), ischemic & hemorrhagic stroke, and Arteriovenous Malformation (AVM) in specialty hospitals is considered to be the major factor for the segment's dominance. Technological advancements in surgical processes along with the potential of adopting such methods rapidly has been supporting the segment's growth. Moreover, the adoption of robotics intervention by the hospitals/specialty hospitals will promote the segment's growth.

On the other hand, the ambulatory surgical centers segment is expected to be the most attractive segment of the market. Ambulatory surgical centers offer convenience for patients along with multiple advanced procedures for surgeries. Most ambulatory surgical centers allow the coverage of surgeries through health insurance, this opens door for patients to choose these focused centers for treatments.

Regional Insights

What is the U.S. Neurovascular Catheters Market Size?

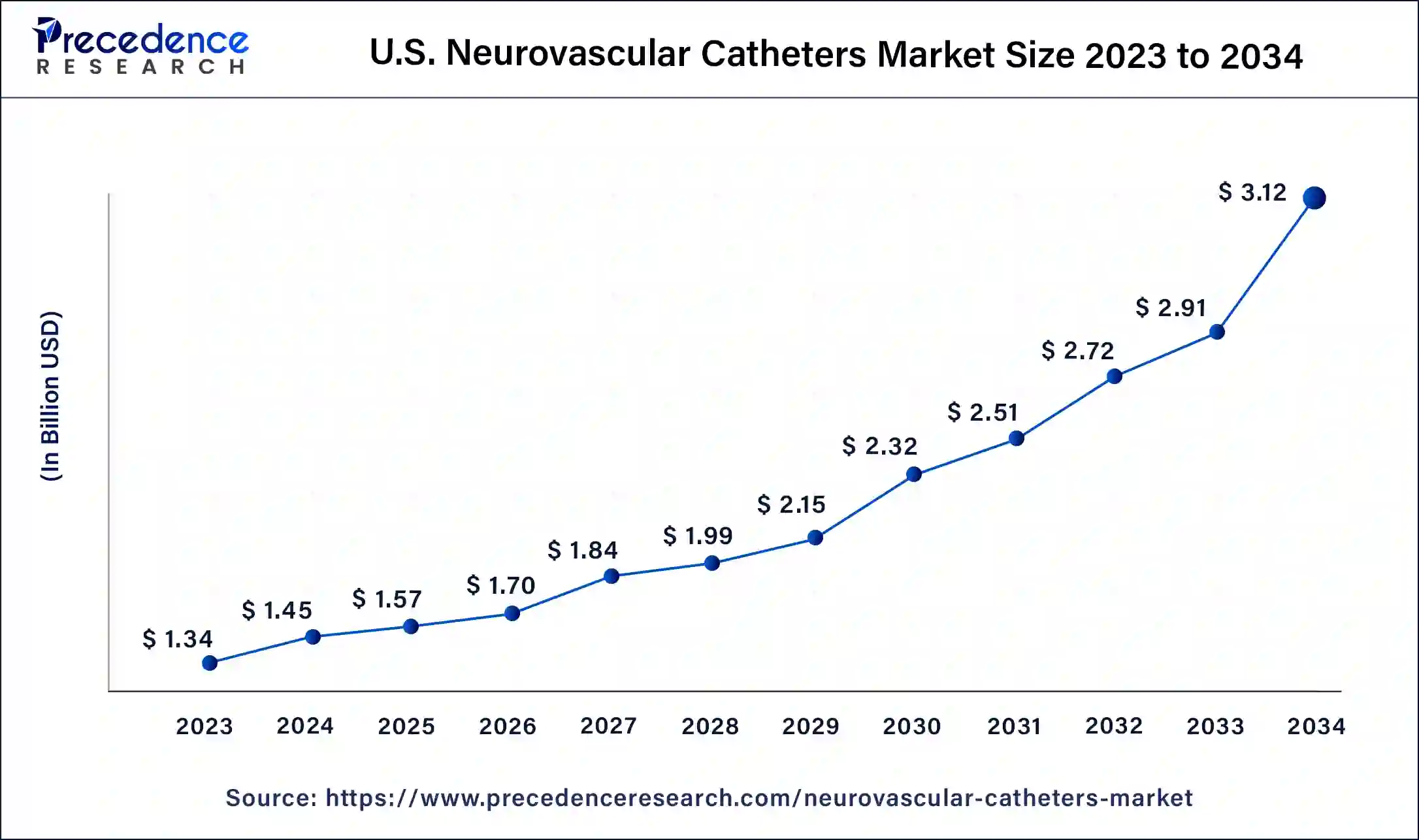

The U.S. neurovascular catheters market size is estimated at USD 1.57 billion in 2025 and is predicted to be worth around USD 3.32 billion by 2035, at a CAGR of 7.78% from 2026 to 2035.

U.S. Neurovascular Catheters Market Analysis

The U.S. is expected to maintain its dominance in the North American neurovascular market, driven by a high volume of neurointerventional procedures and rapid adoption of catheter-based stroke treatments. The presence of robust R&D pipelines from key domestic players like Medtronic, Stryker, and Johnson & Johnson is fueling product development and improving access to next-generation devices. Market growth is further supported by favorable reimbursement policies and proactive physician education programs, such as those offered by the Society of Neurointerventional Surgery (SNIS).

North America dominated the market with the largest market size in 2024, the region is expected to continue the trend during the forecast period. The growth of the market in the region is attributed to the presence of major players that are based mainly in the Unites States. With this factor, the Unites States is expected to be the largest contributor to the market, followed by Canada. The rising number of brain surgeries in the region with the availability of advanced healthcare infrastructure plays a vital role in the market's development in the region. The market in North America is expected to continue its growth trend with the ongoing advancements in the catheter design to offer more effective results. Moreover, the potential of investing in research and development activities with substantial support from the government supports the market's development.

Asia Pacific is expected to witness the fastest rate of growth during the forecast period.The rising number of neurological disorders and increasing prevalence of brain illness in the population are driving the growth of the market across the region. Moreover, rising technological advancements in the surgeries with improving healthcare infrastructure is considered to be a potential growth factor in the market's development in Asia Pacific. In addition, the rising awareness for advanced medical treatments in the region along with the presence of aging population in the region promotes the growth of the market in Asia Pacific.

Japan Neurovascular Catheters Market Analysis

Japan leads the market in Asia Pacific, thanks to its strong technological infrastructure and established expertise in neurointerventional procedures. Japan is at the forefront of adopting next-generation neurovascular catheters, including microcatheters with hydrophilic coatings, tapered designs, and enhanced crossability. These innovations are improving procedure efficiency and safety, particularly in complex neurointerventional procedures. Japan's government is focusing on controlling medical costs and improving healthcare efficiency. Reforms like the integration of electronic health records (EHRs) and the use of data-driven patient management strategies (e.g., e-prescriptions) are helping streamline neurovascular care and treatment outcomes.

What Makes Europe a Notably Growing Area?

Europe is expected to experience notable growth, driven by expanding neurointerventional capabilities across Western and Northern Europe. High-precision catheters are gaining momentum due to the increasing incidence of stroke in aging populations. Favorable reimbursement schemes within the European healthcare infrastructure and quick CE Mark approvals for neurovascular equipment are also boosting accessibility in hospitals.

Germany Neurovascular Catheters Market Analysis

Germany leads the European neurovascular catheter market due to its advanced hospital network and high adoption rates of neurointerventional procedures. The country's emphasis on clinical accuracy, supported by the German Society of Neuroradiology (DGNR) and organized stroke registries, ensures high-quality and consistent treatment. Additionally, local manufacturers like Acandis GmbH are boosting technological self-sufficiency by reducing reliance on imports and expanding regional product offerings.

Countries such as Japan, South Korea, India and China have now emerged to be leading players of the market in Asia Pacific. Moreover, collaborations and business activities between local and international players for research, development and launch of medical devices also supplement the market's development in Asia Pacific.

What Potentiates the Growth of the Latin America Neurovascular Catheters Market?

The market in Latin America is expected to grow at a consistent rate over the forecast period, driven by increased access to advanced medical technologies and the modernization of healthcare systems in Brazil, Mexico, and Chile. An increase in investments in dedicated stroke centers and neurointerventionist training programs is improving procedural capacity. Collaborations between international manufacturers and local healthcare providers are enhancing device availability and affordability.

Brazil Neurovascular Catheters Market Analysis

Brazil is a major contributor to the market in Latin America due to its expanding hospital infrastructure and gradual integration of advanced neurointerventional techniques. Brazil is significantly expanding its hospital network, especially in urban and regional areas, which is improving access to advanced neurovascular care. The construction of new specialized stroke units and neurointerventional centers is increasing the availability of catheter-based treatments for stroke patients and other neurovascular conditions.

What Opportunities Exist in the Middle East and Africa for the Neurovascular Catheters Market?

The Middle East and Africa (MEA) region offers significant opportunities for market growth, due to rising awareness of neurological disorders and growing investments in tertiary healthcare infrastructure. GCC countries are establishing modern neurology departments in major hospitals and collaborating with international organizations to offer specialized treatment. The prevalence of neurovascular diseases, particularly stroke, is rising in the MEA due to factors like an aging population, increasing lifestyle-related risk factors (e.g., hypertension, diabetes), and improved diagnosis. This trend is leading to higher demand for neurovascular interventions, including catheter-based treatments like thrombectomy and aneurysm repair.

Saudi Arabia Neurovascular Catheters Market Analysis

Saudi Arabia is expected to lead the market in the Middle East and Africa due to strong healthcare investments under Vision 2030 and expanding access to neurovascular treatment. Saudi Arabia is increasingly adopting advanced neurointerventional techniques, such as mechanical thrombectomy, endovascular coiling, and stenting for stroke patients. The country's healthcare professionals are incorporating more minimally invasive procedures to improve patient outcomes.

Neurovascular Catheters Market – Value Chain Analysis

- Raw Material Sourcing

The production of neurovascular catheters begins with sourcing high-performance materials such as medical-grade polymers (PTFE, PEBAX, polyimide), nitinol, and stainless steel, which ensure flexibility, biocompatibility, and durability for intricate vascular navigation.

Key Players: DuPont, Zeus Industrial Products, Lubrizol Life Science, Mitsubishi Chemical Group. - Component Fabrication

These raw materials are processed into precision components, such as microtubing, braided shafts, guidewires, and hydrophilic coatings, that form the structural and functional core of catheters used in neurointerventional procedures.

Key Players: Junkosha, Fort Wayne Metals, Freudenberg Medical, Polyzen. - Catheter Design & Manufacturing

At this stage, advanced design engineering and cleanroom manufacturing come into play. Companies develop diagnostic, aspiration, and microcatheters using computer-aided modeling, extrusion, and laser micromachining to ensure micro-level accuracy and safety.

Key Players: Medtronic, Stryker, Terumo Corporation (MicroVention), Penumbra, Integer Holdings Corporation. - Quality Testing & Regulatory Compliance

Finished catheters undergo rigorous mechanical, flow, and biocompatibility testing in accordance with regulatory standards (FDA, CE, ISO 13485). This phase ensures patient safety, traceability, and clinical performance before commercial distribution.

Key Players: NAMSA, Eurofins Medical Device Testing, TÜV SÜD, Intertek. - Distribution to Hospitals & End Users

Approved products are distributed to hospitals, stroke centers, and neurosurgical departments through global logistics and partnerships with medical distributors. Continuous physician education and training programs support product adoption and procedural excellence.

Key Players: Medtronic, Johnson & Johnson (Cerenovus), Stryker, Integra LifeSciences, Acandis GmbH.

Key Players in Neurovascular Catheters Market and their Offerings

- Medtronic: A global leader in neurovascular innovation, Medtronic provides a comprehensive portfolio of catheters and access devices for stroke intervention, aneurysm repair, and intracranial therapies.

- Stryker: Through its Neurovascular division, Stryker develops advanced microcatheters and guide catheters designed for precision and reliability in thrombectomy and embolization procedures.

- Terumo Corporation (Japan): Terumo's MicroVention division offers cutting-edge neurovascular catheters and coils used in minimally invasive endovascular treatment of aneurysms and ischemic strokes.

- Integer Holdings Corporation (U.S.): Integer serves as a major contract manufacturer, providing high-performance neurovascular catheter components and delivery systems for leading medical device companies worldwide.

- Penumbra, Inc. (U.S.): Specializing in neurovascular and peripheral interventions, Penumbra's portfolio includes aspiration catheters and advanced systems for mechanical thrombectomy in acute ischemic stroke management.

- Johnson & Johnson Services, Inc. (U.S.): Through its Cerenovus brand, Johnson & Johnson develops innovative neurovascular catheters and access technologies focused on improving outcomes in hemorrhagic and ischemic stroke treatment.

- Integra LifeSciences Corporation (U.S.): Integra offers a range of neurosurgical and neurocritical care solutions, including specialized catheters for intracranial pressure monitoring and cerebrospinal fluid drainage.

- Acandis GmbH (Germany): Acandis designs and manufactures high-precision neurovascular devices, including microcatheters and stent systems, optimized for the treatment of ischemic stroke and intracranial aneurysms.

- Spiegelberg GmbH & Co. KG (Germany): Spiegelberg focuses on neurosurgical catheters and monitoring systems, particularly intracranial pressure and drainage catheters used in neurocritical care and post-surgical management.

Recent Developments

- In November 2025, Integra LifeSciences Holdings Corporation declared that the FDA 510(k) clearance for usage of its CUSA Clarity Ultrasonic Surgical Aspirator System for cardiac surgeries. The current clearance for specific cardiac indications covers the debridement of unwanted tissue in cardiac surgeries, which includes valve replacement and repair. (Source: https://www.integralife.com/ )

- In June 2025, Terumo Neuro declared the commercial availability of the Sofia Flow 88 neurovascular aspiration catheter. The firm stated that the EMEA launch of the large-bore catheter develops on the legacy of the Sofia catheter line within the firm's stroke portfolio.

- In February 2025, Penumbra declared that it started the Access25 delivery microcatheter. According to the firm, Access25 is a single-lumen device programmed to aid physicians in accessing the neurovasculature for delivery of Penumbra's 0.020-inch coil platform. (Source: https://evtoday.com/ )

- In July 2023, a global leader in cardiac arrhythmia treatment “Biosense Webster, Inc.” and some part of Johnson MedTech announced the launch of the OPTRELL, mapping Catheter with TRUEref™ Technology powered by the CARTO 3 System.

- In August 2023, Ra Medical System Inc. completed its association with Catheters Precision Inc., a company which is working on the cardiac electrophysiology market.

- In August 2023, ReCor Medical announced the win FDA panel nod for its renal denervation system. The FDA approved and is in approval of the efficiency and safety of its Paradise ultrasound renal denervation for the treatment of hypertension.

- In August 2023,fast-track designation to its endovascular aneurysm stabilization treatment (EAST) system was approved by the FDA which was announced by Nectero Medical. Stabilizer mixture containing pentagalloyl glucose (PGG) and dual-balloon delivery catheter which is included in Nectero EAST.

Segments Covered in the Report

By Type

- Microcatheters

- Balloon Catheters

- Access Catheters

- Embolization Catheters

- Others

By Application

- Embolic Stroke

- Brain Aneurysms

- Arteriovenous Malformations

- Others

By End Use

- Hospital

- Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting