Warehouse Racking Market Size and Growth 2025 to 2034

The global warehouse racking market size was estimated at USD 9.80 billion in 2024 and is predicted to increase from USD 10.20 billion in 2025 to approximately USD 14.63 billion by 2034, expanding at a CAGR of 4.09% from 2025 to 2034. The increasing demand for capacity expansion in warehouses, along with the expanding online retail industry, is anticipated to benefit the warehouse racking market growth over the forecast period.

Warehouse Racking Market Key Takeaways

- In terms of revenue, the global warehouse racking market was valued at USD 9.80 billion in 2024.

- It is projected to reach USD 14.63 billion by 2034.

- The market is expected to grow at a CAGR of 4.09% from 2025 to 2034

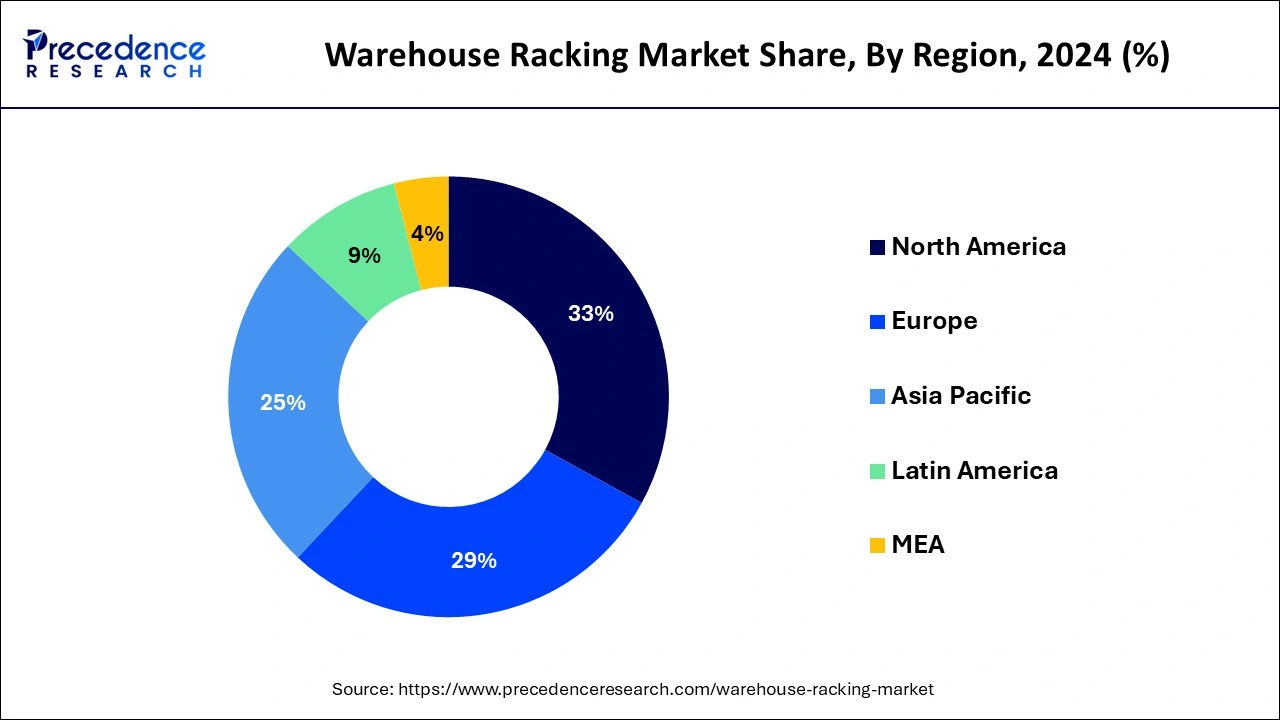

- North American region dominated the market with largest market share of 33% in 2024.

- Europe is expected to witness significant growth in the market during the forecast period.

- By product, the selective pallet segment dominated the market in 2024.

- By product, the cantilever segment is expected to show notable growth in the market over the forecast period.

- By application, the retail application segment dominated the market in 2024.

- By application, the food & beverages segment is projected to grow at the fastest rate over the forecast period.

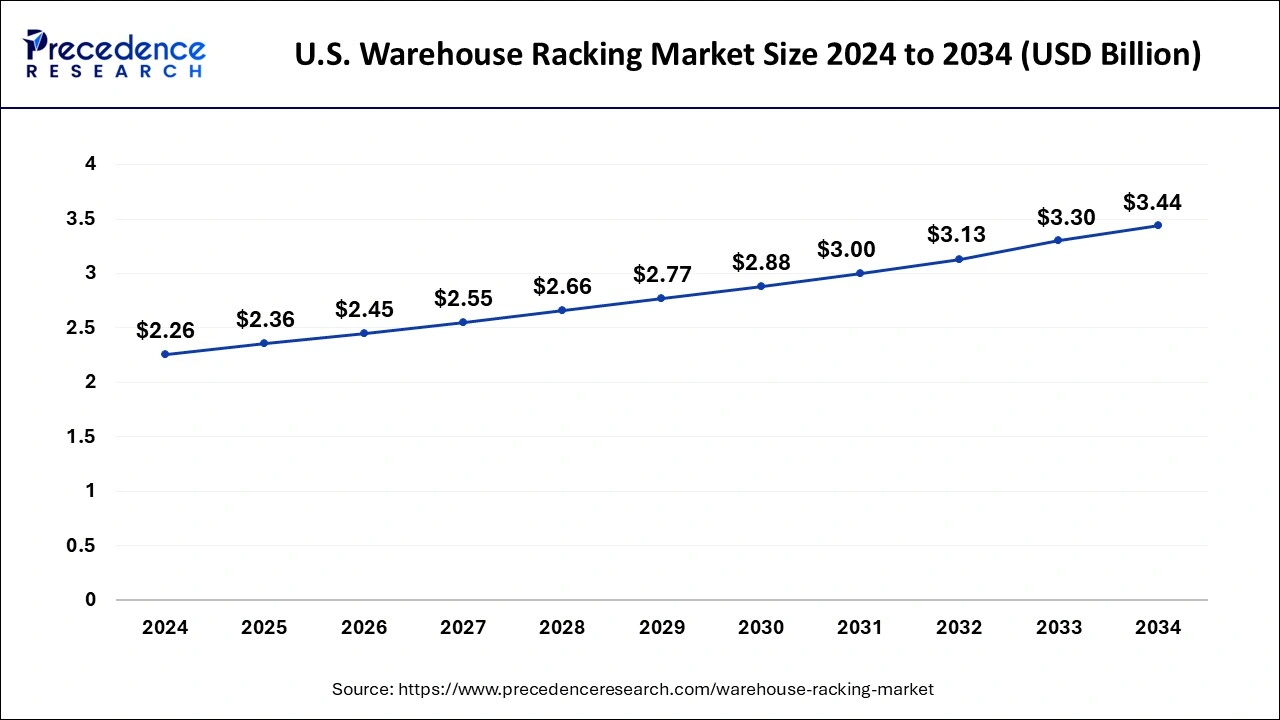

U.S. Warehouse Racking Market Size and Growth 2025 to 2034

The U.S. warehouse racking market size was estimated at USD 2.26 billion in 2024 and is predicted to be worth around USD 3.44 billion by 2034 with a CAGR of 4.29% from 2025 to 2034.

The North American region dominated the warehouse racking market in 2024. This region boasts a well-established logistics and warehousing infrastructure with a high adoption rate of advanced storage systems. The US is a significant market for warehouse racking due to its large retail sector and the presence of numerous e-commerce giants. The need for efficient inventory management and order fulfillment in North America has driven the widespread implementation of warehouse racking solutions.

- In January 2024, UNLIMEAT, a leading plant-based Korean food brand, has broadened its US retail sales, introducing a variety of Korean-inspired vegan foods like frozen Kimbap and Mandu. Starting this month, the brand is taking its commitment to K-vegan options a step further by introducing new products in Northern California.

Europe is expected to witness significant growth in the warehouse racking market during the forecast period. The market growth in Europe is driven by increased demand from the retail, automotive, food and beverage, manufacturing, and packaging sectors. The presence of large-scale warehouse racking manufacturers also contributes to the region's growth. Europe is significantly advancing automated warehouse product distribution facilities, which is expected to positively impact the regional market over the forecast period. Many retail businesses struggle to meet consumer demands due to inefficient warehouse racking systems, which will boost product adoption.

- In September 2023, Sweden's Ingka Group, IKEA's largest retailer, signed an agreement with H2 Green Steel to see it use hydrogen-produced steel in 50% of IKEA warehouse racking globally.

The warehouse racking market services are predominantly utilized in the automotive sector to store various automotive spare parts and components. The UK, Germany, Spain, and France are among the top exporters of automotive vehicles and are expected to be major contributors to the European market in the future.

Market Overview

The warehouse racking market caters to businesses with the essential for storing materials in warehouses. These systems, often made of steel structures with beams, metal frames, and connectors, are assembled using methods such as welding, clipping, and bolting. Different types of warehouse racking systems have become integral to warehouse operations and inventory management. The primary goals are to optimize warehouse floor space, enhance worker productivity, and minimize inventory handling costs.

Various industries implement a range of pallet systems tailored to their warehouse design, the type of products and materials stored, the intended capacity, and specific picking processes. These factors also influence the choice of materials for pallets. Advances in material handling systems have expanded the potential of the warehouse racking market. Common types of pallet systems include selective pallet flow racks, drive-in/drive-out racks, pallet racks, and double-deep racks.

Warehouse Racking Market Growth Factors

- The rising demand for pallet racking systems globally can drive market growth soon.

- Growing volumes of cross-border retail deliveries can fuel the warehouse racking market growth.

- An increasing number of contract logistics and services can propel the growth of the warehouse racking market further.

- Rising imports and exports between different economic belts will boost the market growth over the forecast period.

- Various emerging trends in developing economies are likely to contribute to the warehouse racking market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.20 Billion |

| Market Size by 2034 | USD 14.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.09% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Integration of AI

In recent years, the retail industry has experienced significant growth due to the integration of artificial intelligence (AI), home delivery services, discounts, a broadening product range, and product customization. This has created a substantial demand for warehouse racking systems. Additionally, rapid urbanization, an emerging middle-class population, and rising disposable incomes are driving demand for various products, further supporting market growth. Traditional brick-and-mortar retailers are leveraging e-commerce to sell their products and enhance the customer experience, aiming to increase buyer footfall. These factors have contributed to the exceptional growth of the warehouse racking market.

- In July 2023, Dexory, a company that serves warehouses with real-time inventory management data using AI software and autonomous robots, raised $19 million in a Series A round of funding led by European VC Atomico.

Restraint

Maintenance and repair costs

In the warehouse racking market, regular maintenance of warehouse racking systems is crucial for ensuring their structural integrity and safe operation. However, the costs associated with maintenance, repairs, and replacing damaged components can be a significant challenge, particularly for businesses with limited budgets. The financial burden of ongoing maintenance and repairs can hinder organizations from investing in warehouse racking solutions while operating under tight financial constraints.

Opportunity

Increasing demand for retail space

The primary trend driving the growth of the warehouse racking market in the forecast period is the rising demand for retail space. The expansion of retail spaces worldwide is expected to positively impact the global storage rack market. Strong economic growth and urbanization continue to fuel the global retail market. Additionally, e-commerce is becoming an increasingly popular medium for consumers to purchase goods, creating a substantial demand for warehousing. This is anticipated to boost market growth during the forecast period as the convenience of online shopping is attracting more consumers to digital channels. Traditional sales channels for consumer products, such as supermarkets, hypermarkets, and convenience stores, also play a significant role. These retail stores offer a variety of brands by allowing consumers to easily choose from the best available options.

- In March 2024, Delta Cycle launched a new bike storage product that maximizes floor space while minimizing any required lifting. The Pivot Rack was designed for cycling enthusiasts, commuters, and recreational riders who store and access their bicycles in any room. The rack recently won the IHA Global Innovation Award for Product Design in Home Organization and Storage.

Product Insights

The selective pallet segment dominated the warehouse racking market in 2024. Selective pallet racking is the most widely adopted warehouse racking system due to its versatility, accessibility, and cost-effectiveness. Moreover, It allows for direct access to each pallet, maximizing storage capacity and facilitating efficient inventory management. Its ability to accommodate various pallet sizes and weights makes Selective Pallet Racking the preferred choice for many industries worldwide.

- In November 2022, U.S. Pallet Racks, Inc. launched as a Premier Stocking Distributor for Nucor Warehouse Systems, providing pallet racks and other material handling equipment in the south.

The cantilever segment is expected to show notable growth in the warehouse racking market over the forecast period. The segment is driven by the ease of storage and retrieval of products with varying weights, sizes, and lengths. These racking systems exhibit easy installation and assembly, which requires only a few components to build the structure for storing and holding products.

Application Insights

The retail application segment dominated the warehouse racking market in 2024. The retail sector has experienced remarkable growth due to rising consumerism and various trends that emphasize consumer buying power. Retail chains are increasingly incorporating artificial intelligence (AI) to enhance customer experience. Developments such as Taco Bell's chatbot, Tacobot, and Amazon's market penetration with Echo and Alexa enable users to order items through voice commands, which further drives growth in the sector.

The food & beverages segment is projected to grow at the fastest rate over the forecast period. Warehouses for solid and liquid edibles require high-density storage structures, allowing materials to be stored on multiple low and high levels within a rail-based system. The segment's growth is further propelled by increasing investments and expansion plans in food and beverage warehouses and distribution centers worldwide.

- In November 2023, Associated Food Stores' new Macey's Market concept officially opened. The store opened Nov. 8 in the Pinebrook neighborhood of Park City, Utah. Macey's Market stores are designed for smaller and more centralized areas, enabling them to source specific products and tailor stores to individual neighborhoods.

Warehouse Racking Market Companies

- Daifuku Co., Ltd.

- Mecalux S.A.

- Kardex Group

- Hannibal Industries, Inc.

- Emrack International

- Jungheinrich AG

- AK Material Handling Systems

- SSI Schaefer Group

- Dematic

- Toyota Industries Corp.

Recent Developments

- In December 2023, Argosy Private Equity acquired a controlling stake in Wize Solutions, a Salt Lake City-based warehousing racking, automation, and dock & door installation company.

- In September 2023, Acrow, a renowned provider of storage and material handling solutions, revolutionized the operations at a Lusaka Cold Storage Facility in Zambia, boasting an installation that utilizes a cutting-edge mobile racking system, Acrow aims to optimize storage capacity and enhance efficiency for this prominent cold room facility.

- In March 2023, Mecalux, a well-known manufacturer of warehouse racking solutions, announced the establishment of a new manufacturing facility in Mexico. The facility is being constructed to meet the growing demand for warehouse racking solutions in the Americas.

- In June 2022, PFERD-Rüggeberg S.A., a market leader in grinding tool solutions for treating surfaces and cutting materials, expanded its logistics warehouse in Jndiz (Lava, Spain), and it entrusted the advice, design, and installation of the warehouse extension to the expert in industrial storage AR Racking.

- In June 2022, the 2022 Bronze Medal, which recognizes the organization's dedication to sustainability, was awarded to AR Racking following a review of the evaluation standards of the global platform EcoVadis.

Segments Covered in the Report

By Product

- Selective Pallets

- Drive-in

- Push Back

- Pallet Flow

- Cantilever

- Others

By Application

- Automotive

- Food & Beverage

- Retail

- Packaging

- Manufacturing

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting