Water and Wastewater Pumps Market Size?

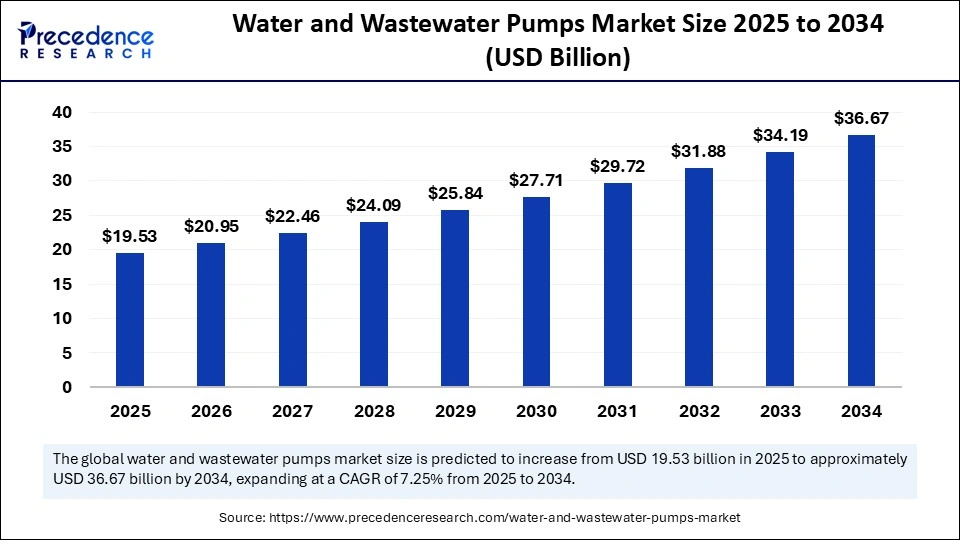

The global water and wastewater pumps market size is calculated at USD 19.53 billion in 2025 and is predicted to increase from USD 20.95 billion in 2026 to approximately USD 36.67 billion by 2034, expanding at a CAGR of 7.25% from 2025 to 2034. The market growth is primarily driven by rising demand for clean water, coupled with an increasing emphasis by municipalities on efficient wastewater treatment and infrastructure modernization.

Market Highlights

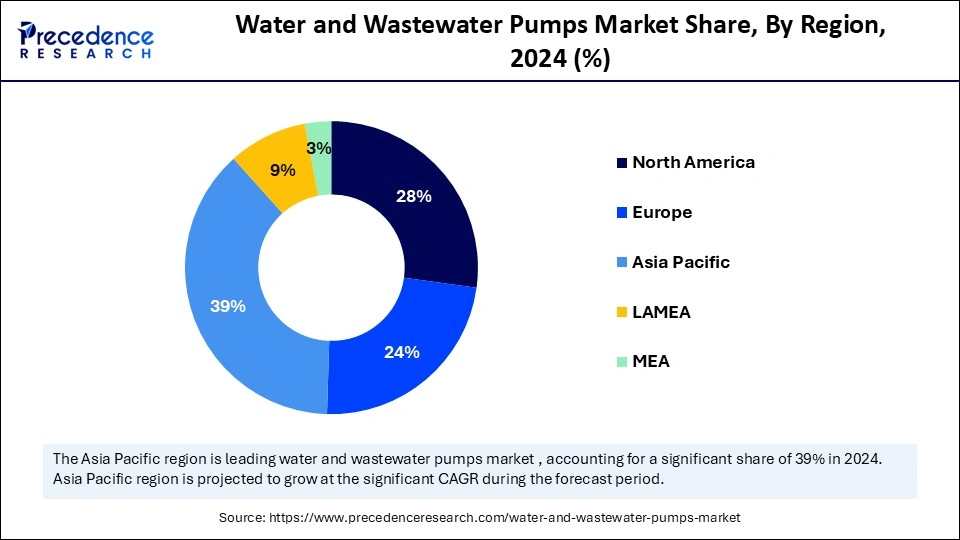

- Asia Pacific dominated the global water and wastewater pumps market with the largest share of 39% in 2024.

- The Middle East & Africa is expected to grow at a significant CAGR of 5.60% from 2025 to 2034.

- By type, the centrifugal pumps segment contributed the largest market share of 68% in 2024.

- By type, the submersible pumps sub-segment is projected to grow at a CAGR of 5.60% from 2025 to 2034.

- By material, the cast iron segment led the market while holding the largest share of 35% in 2024.

- By material, the stainless steel segment is expected to grow at a 5.50% CAGR between 2025 and 2034.

- By application, the water supply & distribution segment held the major market share of 40% in 2024.

- By application, the wastewater treatment segment is expanding at a CAGR of 5.70% between 2025 and 2034.

- By pump capacity/power rating, the medium capacity pumps (500–2,000 gpm) segment led the market while holding the largest share of 44% in 2024.

- By pump capacity/power rating, the high-capacity pumps (above 2,000 gpm) segment is expected to grow at a CAGR of 5.30% between 2025 and 2034.

- By end-user, the municipal sector segment contributed the largest market share of 49% in 2024.

- By end-user, the industrial sector segment is expected to grow at a 5.20% CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 19.53 Billion

- Market Size in 2026: USD 20.95 Billion

- Forecasted Market Size by 2034: USD 36.67 Billion

- CAGR (2025-2034): 7.25%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Middle East & Africa

What are Water and Wastewater Pumps?

The water and wastewater pumps market is driven by increasing urbanization, industrialization, and global demand for advanced water management solutions. Moreover, the increasing demand for energy-efficient pumps to reduce carbon emissions and operational costs contributes to market growth. Integration of cutting-edge technologies like sensors, data analytics, and connectivity is enabling remote monitoring, optimized performance, and predictive maintenance. Manufacturing companies are focusing on the adoption of smart and IoT-enabled phones.

The presence of strict environmental regulations and the pressure for sustainable material use in water and wastewater ponds are expanding the market, Ridge. Companies are using recyclable materials, an eco-friendly manufacturing process, and corrosion-resistant coatings to make it more prevalent. The rapid urbanization, industrialization, and focus on modernization of aging infrastructure, enhancing innovations and developments of advanced water and wastewater pumps.

Market Outlook:

- Market Growth Overview: The water and wastewater pumps market is expected to grow rapidly between 2025 and 2034, driven by increasing demand for clean water, water security, and infrastructure modernization. The rapid urbanization and industrialization, especially in emerging regions, along with a strong focus on infrastructure development, boost the markets.

- Sustainability Trends: Sustainability trends are driving investment in energy-efficient and eco-friendly pump technologies, aligning with global goals to reduce carbon footprints and optimize water resource management. Additionally, stricter environmental regulations and increased adoption of circular water systems are pushing municipalities and industries to upgrade to advanced wastewater pumps that support sustainable operations. Manufacturers are also focusing on developing pumps with a higher energy efficiency rating and a reduction of carbon emissions and operational costs.

- Major Investors: Major key vendors, including Grundfos Holding A/S, Flowserve Corporation, Xylem Inc., and KSB SE & Co. KGaA, are investing heavily in designing novel water and wastewater pumps to expand their portfolios. The innovations of cutting-edge pumps, such as reciprocating pumps, diaphragm pumps, and centrifugal pumps, are transforming the industry. The latest acquisition by Flowserve of MOGAS Industries is expanding its capabilities in the 3D sectors.

Key Technological Shifts in the Water and Wastewater Pumps Market?

The market for water and wastewater pumps is undergoing a key technological shift driven by a growing focus on the integration of smart technologies, like IoT, and energy-efficient designs. Manufacturers are creating smartphones that integrate sensors and connectivity features to enable remote diagnostics and real-time performance optimization. The integration of IoT devices in smart water and wastewater pumps is gaining significant traction across the world. The demand for energy-efficient pumps to reduce carbon footprints is further enabling significant innovations in the pump industry. Additionally, adopting cutting-edge technologies like digital twins, cloud-based analytics, and AI enhances the performance and efficiency of water and wastewater pumps.

Xylem Inc. is the major player transforming the technological shift in the water and wastewater pumps industry, with its robust innovations and the development of the Flygt Concertor, one of the first wastewater pumping systems with integrated intelligence. Grundfos Holdings A/S, Wilo SE, and Sulzer Ltd. are investing heavily in digitalization and IoT, smart control integration, and network-wide intelligence.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.53 Billion |

| Market Size in 2026 | USD 20.95 Billion |

| Market Size by 2034 | USD 36.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.25% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Aplication,Pump Capacity,End User, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Type Insights

Which Type of Pumps Lead the Water and Wastewater Pumps Market?

The centrifugal pumps segment led the market with a 68% share in 2024 due to their high efficiency for a large volume of fluids at low moderated pressures. Centrifugal pumps are more reliable compared to other types of water and wastewater pumps. These pumps are simple in design, making them easier and cost-effective for installation, operations, and maintenance. For applications like water supply, irrigation, and treatment, centrifugal pumps are the preferred choice.

The centrifugal pumps include single-stage pumps, axial flow pumps, multi-stage pumps, mixed flow pumps, submersible pumps, and end-suction pumps. The submersible pumps sub-segment is growing at a CAGR of 5.60%, driven by increased demand for treatment water supply. The rapidly growing urbanization and government investments in infrastructure projects are driving the need for submersible pumps. The adoption of submersible pumps is high in applications like groundwater extraction, sewage management, and stormwater drainage.

Material Insights

Why Did the Cast Iron Segment Dominate the Water and Wastewater Pumps Market?

The cast iron segment dominated the market while holding a 35% share in 2024 due to its high strength and durability. Cast iron is more cost-effective than other materials, which makes it suitable for heavy-duty applications. Cast iron provides sufficient resistance to corrosion for municipal and industrial use. The adoption of cast iron is widespread in conventional wastewater and general infrastructure projects. This material offers a good balance of mechanical properties and cost-effectiveness than costly specialized alloys.

The stainless-steel segment is expected to expand at a 5.50% CAGR between 2025 and 2034, driven by its durability and longer life cycle. Stainless steel is highly corrosion-resistant, making it suitable for handling aggressive fluids and wastewater. The ability of stainless-steel pumps to have a longer lifespan, reduce maintenance costs, and downtime makes them ideal for wastewater applications. Additionally, the ability of stainless steel to withstand high temperatures makes it suitable for industrial processes. With a growing focus on improving water quality, expanding industrial applications, and the demand for efficiency, the use of stainless steel is increasing in water and wastewater pumps.

Application Insights

How Does the Water Supply & Distribution Segment Lead the Market in 2024?

The water supply & distribution segment led the market, holding about 40% share in 2024. This is primarily due to rapid urbanization and growing infrastructure development. The demand for municipal water supply and distribution has increased, driven by government initiatives like AMRUT 2.0. The water supply and distribution segment is crucial for moving water from its source to treatment plants and distributing it to commercial, residential, and industrial end users. Strict government regulations for water quality and treatment, government investments in infrastructure projects, and widespread requirements for reliable water management in rapid urbanization and rural areas contribute to the growth of this segment.

The wastewater treatment segment is expected to grow at a 5.70% CAGR over the forecast period due to rapid urbanization, growing focus on public health, and strict environmental regulations. The demand for solutions for the management and treatment of wastewater has increased. The demand for municipal water supply has increased, necessitating the management of a growing population, addressing industrial demand for sustainable practices, and responding to complaints, thereby driving the need for efficient and sustainable wastewater treatment solutions. Additionally, technological advancements in the treatment process, which enable wastewater recycling and reuse, further contribute to the increased adoption of pumps.

Pump Capacity/Power Rating Insights

What Made Medium Capacity Pumps the Dominant Segment in the Market?

The medium-capacity pumps (500–2,000 gpm) segment dominated the water and wastewater pumps market with a 44% share in 2024 due to their versatility and efficiency in handling various flow rates and applications. Medium capacity pumps are ideal for water and wastewater supplies and distributions due to their simple design, ability to handle high flow rates, and low maintenance. The demand for medium capacity pumps is rising in applications like water supply, HVAC, industrial process, and wastewater treatment. These pumps provide high efficiency, reduce operational costs, and energy consumption.

The high-capacity pumps (above 2,000 gpm) segment is expected to grow at a 5.30% CAGR over the forecast period, driven by rapid urbanization and a focus on replacing aging infrastructure. The centrifugal type is primarily used for high-capacity pumps flow of more than 2,000 gpm, making it essential for handling the large volume of fluids needed for modern municipal and industrial applications. The growing concerns about water scarcity and conservation fuel demands for water management solutions with high efficiency, driving the need for high-capacity pumps (above 2,000 gpm).

End User Insights

Why Did the Municipal Sector Dominate the Water and Wastewater Pumps Market?

In 2024, the municipal sector segment dominated the market by holding a share of 49%, due to increased urbanization, stringent environmental regulations, and government investment in upgrading public water infrastructure and related initiatives. The rapidly growing urbanization has increased in demand for clean water and sanitation services, driving the need for efficient pumps in the municipal sector. Strict regulations on water quality and sanitation, along with government initiatives like ANRUT 2.0, are promoting water supply and sanitation services. The municipal sector is focusing on advanced technologies for water reuse and recycling, which is fueling the adoption of energy-efficient and sustainable water and wastewater pumps.

The industrial sector segment is expected to grow at a 5.20% CAGR in the upcoming period due to the rapid growth of industries like manufacturing, chemicals, oil and gas, and others. The need for water and wastewater supply and distribution is wide in oil and gas, power generation, chemical processing, pharmaceuticals, meaning, and food and beverage industries. This industry handles applications of process water supply, wastewater treatment, cooling systems, boiler feed water, and slurry transportation. The growing demand for efficient water management solutions in these industries has boosted the adoption of efficient and sustainable pumps.

Regional Analysis

Asia Pacific Water and Wastewater Pumps Market Size and Growth 2025 to 2034

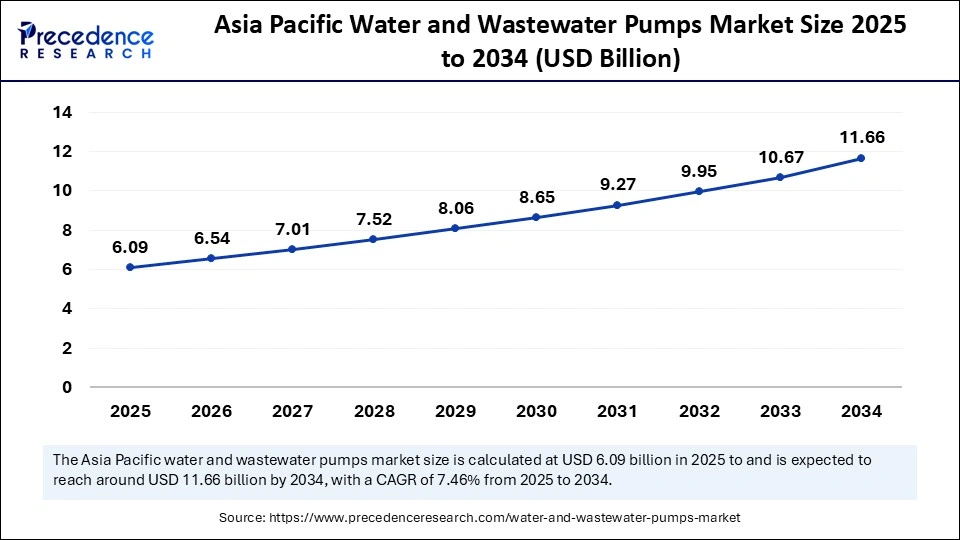

The Asia Pacific water and wastewater pumps market size is exhibited at USD 6.09 billion in 2025 and is projected to be worth around USD 11.66 billion by 2034, growing at a CAGR of 7.46% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Water and Wastewater Pumps Market?

Asia Pacific dominated the global market by holding a 39% share in 2024. This is mainly due to the rapid urbanization, industrialization, growing agricultural demand, and technological advancements. The surge in industrial and residential development has heightened the need for robust pumping systems to manage sewage and water distribution efficiently. Government-led initiatives, such as Indian government's Jal Jeevan Mission for universal tap water access and Jal Shakti Abhiyan for water conservation, along with Singapore's adoption of advanced water recycling technologies, underscore the region's commitment to sustainable water management. Furthermore, strong support from international organizations like the Asian Development Bank (ADB) for climate-resilient infrastructure is reinforcing Asia Pacific's leadership in this market.

China Water and Wastewater Pumps Market Trends

China is a major contributor to the market within Asia Pacific due to its massive infrastructure projects and urbanization, driving demand for municipal water supply and energy-efficient pumps. The demand for high-capacity and technologically advanced pumps has increased in China. The strict environmental regulations and shift toward technological innovations like IoT-driven and energy-efficient pumps are maturing the country's market. This market is projected to grow with spectacular growth due to increased demand for cutting-edge technologies, such as membrane bioreactors and Zero Liquid Discharge (ZLD) systems.

What Makes Middle East and Africa the Fastest-Growing Region in the Market?

The Middle East and Africa (MEA) is expected to expand at a CAGR of 5.60% during the forecast period, driven by rapid population growth, urbanization, and increasing water scarcity. The strong presence of the oil and gas industry, particularly in countries like Saudi Arabia, is boosting demand for energy-efficient and advanced pump technologies. Nations such as the UAE and South Africa are experiencing rising demand for water and wastewater treatment, further accelerating the need for innovative pumping systems. The region is also embracing advanced technologies, including AI, IoT, and data analytics, for smart water management, in response to industrialization and resource challenges. Additionally, a growing emphasis on water reuse and recycling to combat water scarcity is reinforcing market growth.

Saudi Arabian Market Trends

Saudi Arabia leads the regional market due to a combination of strategic government initiatives, industrial expansion, and urgent water management needs. The country's Vision 2030 plan prioritizes infrastructure development and sustainable resource use, including a national goal to treat and reuse 100% of wastewater by 2025. As one of the most water-scarce countries globally, Saudi Arabia is heavily investing in advanced and energy-efficient pumping systems to support desalination, water reuse, and smart distribution networks.

How is the Opportunistic Rise of North America in the Market?

North America is expected to grow at a notable rate in the market, driven by substantial infrastructure investments, rising climate-related challenges, and a strong emphasis on technological innovation. The region has seen increased adoption of smart, energy-efficient pumps, particularly submersible and centrifugal types, across both industrial and residential sectors. Growth in utility and sump pump applications is also accelerating, fueled by expanding infrastructure megaprojects and rising demand from the agriculture and industrial segments. These trends are fostering innovation and the integration of advanced pump technologies across the region.

U.S. Water and Wastewater Pumps Market Analysis

The U.S. dominates the North American market, supported by its expansive industrial base and large municipal infrastructure. With over 34 billion gallons of wastewater processed daily through a vast network of treatment plants, the need for efficient and durable pump systems remains critical. Government initiatives, such as the American Jobs Plan allocating $111 billion to water infrastructure and the EPA's $100 million award for system upgrades in New York, further stimulate market growth. The ongoing shift toward energy-efficient, IoT-enabled, and environmentally friendly pumps continues to shape the future of the U.S. water and wastewater sector.

Water and Wastewater Pumps Market – Value Chain Analysis

Raw Material Sourcing

Water and wastewater pumps require raw materials, including metals like ductile iron, stainless steel, high-alloy white cast iron, and cast iron, to manufacture pumps that withstand harsh operating environments.

Key Players: Siddhart Foundry, Tengkai, Cast 4 Aluminium PVT LTD, and Jindal Stainless Ltd.

Distribution and Sales

The distribution and sales of water and wastewater pumps involve a multi-channel approach that connects manufacturers with a wide range of end-users, from industrial plants and municipalities to agricultural and residential sectors.

Key Players: Grundfos, KSB, Sulzer, and Xylem.

Product Lifecycle Management

Water and wastewater pumps require management throughout their entire lifecycle, from design and manufacturing to installation, maintenance, and eventual disposal. The product lifecycle management of water and wastewater pumps enables standard product management for focusing on longevity, sustainability, and operational efficiency.

Key Players: PTC, Oracle, Aras, Dassault Systèmes, and Siemens Digital Industries Software.

Global Water and Wastewater Pumps Market – Tiered Company Landscape

|

Tier |

Companies |

Rationale / Roles |

Estimated Cumulative Share |

|

Tier I – Major Players |

Xylem Inc., Grundfos Holding A/S, Flowserve Corporation, KSB SE & Co. KGaA, Sulzer Ltd. |

These firms dominate the global market with expansive portfolios across residential, municipal, industrial, and agricultural segments. They lead in R&D, smart pump integration, global service networks, and energy-efficient systems. Often selected for large infrastructure and public utility projects. |

~45–50% |

|

Tier II – Established Players |

WILO SE, Ebara Corporation, Pentair plc, ITT Inc., SPX Flow, Inc. |

Well-established with strong regional presence and specialized offerings. Compete in both industrial and utility spaces, with increasing investments in digital and energy-efficient pump technologies. Some focus on niche sectors or mid-sized infrastructure projects. |

~25–30% |

|

Tier III – Emerging / Niche Players |

Kirloskar Brothers Ltd., Shanghai Kaiquan, Torishima Pump, LEO Group, Dab Pumps, Zoeller Company, Other regional firms |

Smaller or regionally focused companies offering competitive solutions in specific geographies or pump types (e.g., submersible, sump, irrigation). Some are expanding via innovation or cost leadership, but lack global reach or scale. |

~20–25% |

Recent Developments

- In October 2025, CRI Pumps launched its advanced and energy-efficient pumping solutions at India's Largest Trade Fair for Water, Sewage, Solid Waste, and Recycling (IFAT) India 2025. This launch showcases CRI Pumps' power in sustainable water and wastewater management initiatives.(Source: https://www.facebook.com)

- In September 2025, ABB launched its novel Baldor-Relaince SP4 close-coupled pump motor at WEFTEC, through October 1 at McCormick Place, Chicago, Illinois. ABB has engineered its NEMA super Premium (IE4) efficiency motor with a compact design to simplify installation, ensure reliable performance, and reduce maintenance.

- In July 2025, the JOS Ultra Openwell Submersible Pump was introduced by Kirloskar Brothers Ltd (KBL), created to support domestic, agricultural, and community water supply requirements. This pump is featured with a wide voltage design, dynamically balanced rotating parts, and a water-cooled motor.

Exclusive Analysis on the Water and Wastewater Pumps Market

The global water and wastewater pumps market is poised at a pivotal inflection point, underpinned by intersecting macroeconomic drivers such as rapid urbanization, intensifying water stress, and the accelerated transition toward climate-resilient infrastructure. As governments and industrial operators recalibrate their capex strategies to align with sustainable development goals and circular economy mandates, demand is tilting toward next-generation, energy-efficient pumping solutions that optimize total cost of ownership (TCO) while enhancing operational resilience.

Notably, the convergence of digitization (IoT, AI-driven monitoring) with fluid dynamics is catalyzing a new era of smart pump systems, unlocking predictive maintenance, real-time efficiency optimization, and lifecycle data analytics, particularly attractive to utilities and municipalities facing aging infrastructure. Additionally, emerging economies in Asia Pacific, Middle East, and Sub-Saharan Africa present significant white space for pump OEMs, especially in decentralized water management, rural electrification, and agriculture-led growth corridors.

From a strategic standpoint, the market offers lucrative upside for players with vertically integrated portfolios, strong aftermarket capabilities, and a commitment to environmental compliance and digital innovation. As regulatory frameworks tighten and ESG-led procurement becomes mainstream, the addressable market for advanced water and wastewater pump solutions is expected to expand substantially over the next decade.

Segment Covered in the Report

By Type

- Centrifugal Pumps

- Single-Stage Pumps

- Multi-Stage Pumps

- Axial Flow Pumps

- Mixed Flow Pumps

- Submersible Pumps

- End-Suction Pumps

- Positive Displacement Pumps

- Diaphragm Pumps

- Peristaltic Pumps

- Piston Pumps

- Screw Pumps

- Rotary Lobe Pumps

- Gear Pumps

- Other Pump Types

- Progressive Cavity Pumps

- Air-Lift Pumps

By Material

- Cast Iron

- Stainless Steel

- Bronze

- Plastic & Composites

- Other Materials (Alloys, Specialty Coatings)

By Pump Capacity / Power Rating

- Low-Capacity Pumps (Up to 500 gpm)

- Medium Capacity Pumps (500–2,000 gpm)

- High-Capacity Pumps (Above 2,000 gpm)

By Application

- Water Supply & Distribution

- Raw Water Intake

- Pressure Boosting

- Irrigation & Agriculture

- Wastewater Treatment

- Sewage Transfer

- Sludge Handling

- Dewatering

- Industrial Processes

- Cooling Water Systems

- Boiler Feed

- Chemical & Process Water Handling

- Flood Control & Drainage

- Stormwater Management

- Flood Protection Systems

- Other Applications

- Desalination Plants

- Firefighting Systems

By End User

- Municipal Sector

- Water Utilities

- Wastewater Treatment Plants

- Industrial Sector

- Power Generation

- Oil & Gas

- Chemical & Petrochemical

- Food & Beverage

- Pharmaceuticals

- Pulp & Paper

- Metals & Mining

- Other Manufacturing Industries

- Agricultural Sector

- Commercial & Residential Sector

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting