What is the Pressurized Water Reactors Market Size?

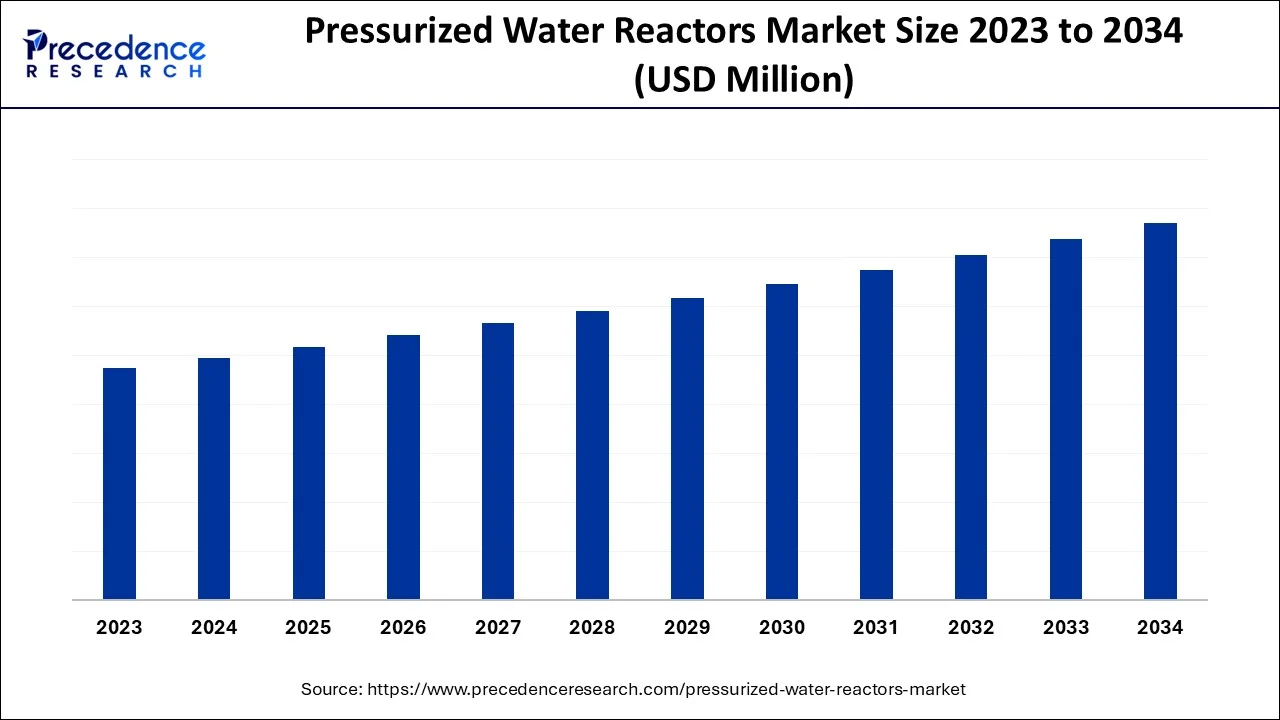

The global pressurized water reactors market is surging with an overall revenue growth expectation of hundreds of millions of dollars from 2026 to 2035.

Pressurized Water Reactors Market Key Takeaways:

- North America generated the largest market share in 2025.

- By Application, the power plants segment held the maximum market share in 2025.

Market Overview

A pressurized water reactor (PWR) is a kind of light-water nuclear reactor that constitute the majority of nuclear power plants across the world. The pressurized water reactor is used for generating electricity and propelling nuclear submarines as well as naval vessels. The pressurized water reactor involves light water (ordinary water) as a coolant along with a neutron moderator.

The growth rate in the pressurized water reactors market is attributable to factors such as increasing demand for nuclear power, modernization of existing infrastructure, and advancements in technology. The rising count of nuclear power plants at the global level is fueling the requirement for pressurized water reactors.

Out of 24 pressurized water reactor nuclear power plants in Japan, the first few power plants were designed, developed, and constructed by MITSUBISHI HEAVY INDUSTRIES, LTD. as the main contractor. Nuclear power plants in the U.S. involve either a pressurized-water reactor or a boiling-water reactor. As of 1st of July 2022, 61 out of 92 nuclear power reactors operating in the United States are pressurized-water reactors.

Once completed, this Changjiang ACP100 reactor will be able to produce 1 billion kilowatt-hours of electricity per year. As per China National Nuclear Corporation (CNNC), 1 billion kilowatt-hours of electricity per year is sufficient to meet the requirements of around 526,000 households.

Pressurized Water Reactors Market Outlook

- Market Growth Overview: The pressurized water reactors market is growing due to rising global energy demand, the need for low-carbon power generation, and government support for nuclear energy projects. Technological advancements, long operational lifespans, and high safety standards are further driving market expansion.

- Global Expansion: The market is growing worldwide as countries seek reliable, low-emission energy solutions to meet increasing electricity demand. Emerging regions, particularly in Asia-Pacific and the Middle East, offer opportunities through new nuclear plant constructions and government initiatives supporting clean energy adoption.

- Major Investors: Key investors include nuclear energy corporations, government bodies, and international financial institutions that fund reactor development, research, and infrastructure projects. They contribute by financing new PWR projects, supporting technological innovation, and enabling large-scale deployment of nuclear power plants.

- Sustainability Trend: The shift toward sustainability is reshaping the market by emphasizing low-carbon, clean energy solutions and reducing reliance on fossil fuels. This trend drives the adoption of advanced reactor designs, efficient fuel cycles, and enhanced safety and waste management practices.

Market Scope

| Report Coverage | Details |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Growing investment in the power sector, rising demand for electricity, and increasing population are some of the significant factors driving the growth of the pressurized water reactor market all over the world.

Growing support from the Defense Ministry of various nations is enhancing the scope for the pressurized water reactor market to a great extent. In 2016, the Indian Defense Ministry approved the Indian Navy's plan to purchase nuclear submarines. In March 2023, it was reported that the Indian Navy is expected to receive approval for purchasing 3 nuclear submarines during the initial stage.

In order to enhance the development of pressurized water reactors, respective companies can consider acquisition, merger, partnership, joint ventures, and collaborations. Furthermore, evolving pressurized water reactors technology can make the existing pressurized water reactors technology obsolete very soon. This is expected to intensify the competition among the significant market players.

Since the count of pressurized water reactors providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is higher as compared to the bargaining power of buyers. Owing to high profitability, the threat of new entrants in the pressurized water reactors market is found to be moderate as of now.

Our pressurized water reactors market report includes an in-depth analysis of the recent market scenario. The report mentions relevant key factors such as the competitive landscape (CL), key market players, relevant latest trends, and regional analysis. The analytical research on the impact of the pandemic of COVID-19 is helpful in knowing the effects on the supply as well demand side. The segmental analysis of the pressurized water reactors market offers a distinct overview of particular applications of pressurized water reactors.

Application Insights

Based on applications, the global pressurized water reactors market is segmented into submarines, power plants, and others. The power plants segment held the largest market share in 2023. The power plants segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the study period till 2034.

South Korea is one of the prominent countries with respect to nuclear energy and exports its technology across the world. South Korea is involved in the construction of the United Arab Emirates' (UAE's) 1st nuclear power plant, under a contract of $20 billion. The increasing count of nuclear power plants is expected to support the power plants segment growth respectively.

Regional Insights

The pressurized water reactors market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America (NA) held a high share of the global Pressurized Water Reactors Market in 2022. In 2022, the United States held the highest share in the North American region. Considering the presence of countries with a high gross domestic product, lucrative economic policies, and early adoption of the latest power technologies, the North American pressurized water reactors market is expected to grow noticeably.

The European pressurized water reactors market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is predicted to hold the highest share of the European pressurized water reactors market during the forecast period.

The pressurized water reactors market in the Asia Pacific (APAC) region is segmented into China, Japan, India, South Korea, and the rest of the Asia Pacific (APAC) region. In 2023, China dominated the Asia Pacific (APAC) Pressurized Water Reactors Market followed by Japan and India.

As per United Nations, about 68% of the world population is estimated to live in urban areas by 2050. The majority of the shift from rural to urban population is anticipated to take place in the Asia Pacific region. Thus, growing urbanization enhances the count of homes in cities and consequently increases the demand for electricity. Hence, the growing requirement for electricity is estimated to boost the demand for pressurized water reactors accordingly.

Latin America, Middle East, and African (LAMEA) pressurized water reactors market is segmented into South Africa, North Africa, Saudi Arabia, Argentina, Brazil, and the Rest of LAMEA. The Latin America region is predicted to witness considerable growth in the pressurized water reactors market during the forecast period. In 2022, Brazil held the largest market share in the LAMEA pressurized water reactors market region. Owing to inadequate education, lack of effective economic policies, and political instability in some African countries, the pressurized water reactors market in the African region is expected to grow at a slower rate.

What Made North America the Dominant Region in the Market?

North America dominated the pressurized water reactors market with the largest share in 2024. This is mainly due to its early adoption of nuclear technology and strong government support for civilian nuclear programs. The region benefits from a well-established nuclear infrastructure, including advanced research facilities and skilled engineering expertise. Strict regulatory frameworks and consistent investments in safety and efficiency have also boosted public and investor confidence in nuclear energy. Additionally, the growing demand for clean and reliable energy sources has reinforced North America's leadership in PWR deployment and innovation.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate over the forecast period due to rapid industrialization and rising energy demand in countries like China and India. Strong government initiatives and investments in nuclear energy as part of clean energy strategies are accelerating new reactor construction. The region also benefits from technological collaborations and the adoption of advanced reactor designs, improving efficiency and safety. Additionally, increasing electricity consumption and the need to reduce carbon emissions are driving the rapid expansion of nuclear power in the region.

What Makes Europe a Notably Growing Region in the Pressurized Water Reactors Market?

Europe is expected to grow at a notable rate in the upcoming period due to its focus on modernizing aging nuclear infrastructure and extending the lifespan of existing reactors. Strong regulatory support for safe and efficient nuclear energy, coupled with government incentives, encourages new reactor projects and upgrades. The region's commitment to reducing carbon emissions and achieving climate goals is driving investments in nuclear power as a stable, low-carbon energy source. Additionally, technological advancements in reactor design and fuel efficiency contribute to Europe's steady growth in the PWR market.

Top Companies in the Pressurized Water Reactors Market

- Westinghouse: Offers advanced PWR designs and fuel technology, along with comprehensive engineering, maintenance, and nuclear services.

- Siemens AG: Provides reactor automation, control systems, and safety solutions for PWR plants to enhance efficiency and reliability.

- Mitsubishi Electric Corporation: Supplies instrumentation, control systems, and electrical equipment tailored for PWR operations and monitoring.

- Kraftwerk Union (AREVA): Develops PWR reactors, nuclear fuel, and turnkey solutions, focusing on high safety standards and performance optimization.

Pressurized Water Reactors Market Companies

- Westinghouse

- Siemens AG

- Mitsubishi Electric Corporation

- Kraftwerk Union (AREVA)

- GE Hitachi Nuclear Energy

- Framatome

- Combustion Engineering (CE)

- Brown Boveri (BBR)

- Babcock and Wilcox (B&W)

- Atommash

Recent Developments

- Kakrapar Atomic Power Plant, Unit-3 (KAPP-3), India's 1st 700 MWe Pressurized Heavy Water Reactor (PHWR) with innovative features achieved criticality at about 09:36 Hrs on 22nd of July 2020. Atomic Energy Regulatory Board (AERB) conducted an exhaustive check of respective safety aspects for ensuring satisfactory compliance with regulatory requirements. On 17th of July 2020, Atomic Energy Regulatory Board gave permission for 1st Approach to Criticality of KAPP-3. Such enthusiastic support from respective atomic power plants is expected to support the pressurized water reactors market growth drastically.

- In April 2022,the Government of China approved the construction of 6 reactors in order to decrease carbon dioxide emissions by doubling nuclear power capacity till 2030. As per Chinese media reports, construction costs for all 6 reactors combined are estimated to be around ¥120 billion ($18.7 billion). Lufeng, which is run by China General Nuclear Power Group will get a pair of 3rd generation Hualong One pressurized water reactors. Sanmen Nuclear Power Station and Haiyang Nuclear Power Plant, which are operated by CNNC and State Power Investment Corp. respectively, would receive CAP1000 pressurized water reactors. The technology of CAP1000 pressurized water reactors is based on the AP1000 reactor that is developed by Westinghouse.

- In January 2025, GE Hitachi Nuclear Energy (GEH) awarded BWX Technologies the contract to manufacture the reactor pressure vessel for the first BWRX-300 small modular reactor at Ontario Power Generation's Darlington New Nuclear Project.

Segments Covered in the Report

By Type

- Western Pressurized Water Reactor PWR

- Soviet Pressurized Water Reactor VVER

By Application

- Submarines

- Power Plants

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting