What is the Smart Water Metering Market Size?

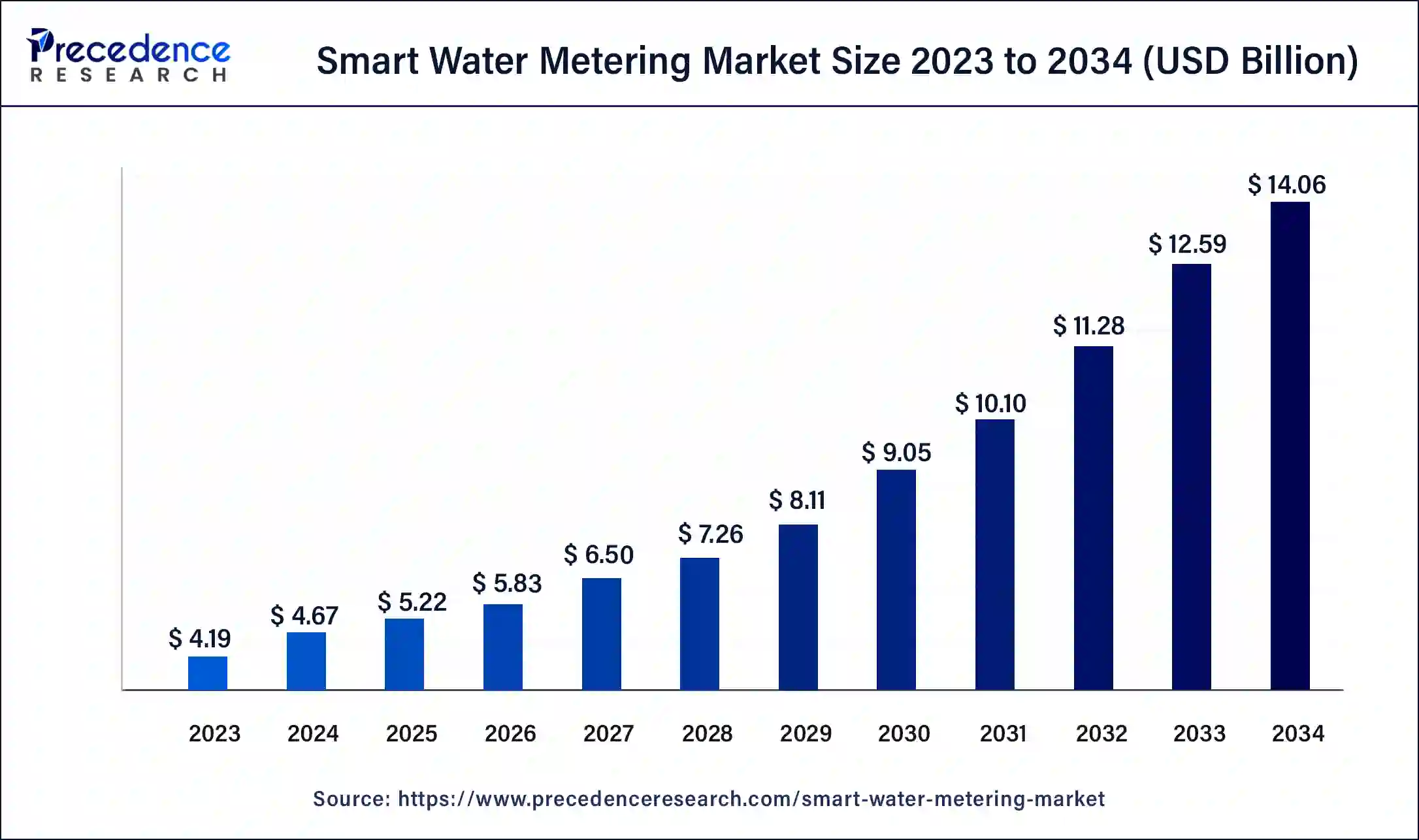

The global smart water metering market size is calculated at USD 5.22 billion in 2025 and is predicted to increase from USD 5.83 billion in 2026 to approximately USD 15.42 billion by 2035, expanding at a CAGR of 11.65% from 2026 to 2035. The smart water metering market growth is attributed to the growing demand for advanced and modern water metering technology.

Smart Water Metering Market Key Takeaways

- Asia Pacific dominated the smart water metering market in 2025.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

- By meter type, the smart mechanical meter dominated the market in 2025.

- By meter type, the ultrasonic meters segment is projected to expand rapidly in the market in the future years.

- By technology, the AMR segment held the largest market in 2025.

- By technology, the AMI is expected to grow rapidly in the market over the forecast period.

- By component, the meter & accessories segment dominated the market in 2025.

- By component, the IT solution segment is projected to grow rapidly in the market in the coming years.

- By application, the water utilities segment held the largest share of the market in 2025.

- By application, the industries segment is projected to expand significantly in the market during the forecasting period.

Market Overview

Smart water meters are gadgets that quantify water consumption and convey information through the utilization of one or more techniques for remote data transmission, such as cellular, RF, or PLC. The meters also help utility companies to regulate and control the usage of water efficiently and effectively. The escalating need for reliable water billing systems has thereby enhanced the expansion of the smart water meter market.

The increasing awareness of focused aims such as the reduction of non-revenue water and the optimization of water distribution fuels the market growth due to the need for utilities to improve their water management. The capabilities of smart meters to offer accurate and timely information and consequent outputs are expected to drive new applications in the smart water metering market.

Impact of Artificial Intelligence on the Smart Water Metering Market

AI advances the water supply as resources are efficiently and effectively supplied with little or no wastage. The smart water metering market with artificial intelligence helps discern leaks, presage demand, and regulate water usage in real-time spheres. Such advancements allow utilities to realize substantial savings and are important for the sustainable use of water. Moreover, the growing degree of urbanization and the need for clean water are expected to boost the utilization of AI technology and improve water distribution performance and dependability.

Smart Water Metering Market Growth Factors

- Supportive governmental policies and regulations aimed at energy efficiency, conversation, and modernizing infrastructure drive the adoption of the smart water metering market.

- Growing awareness and emphasis on reducing energy consumption and optimizing resource use lead to higher demand for the smart water metering market.

- The need to replace outdated infrastructure and improve grid reliability spurs investment in the smart water metering market.

- Rising consumer demand for real-time data and control over energy consumption encourages the adoption of smart meters.

- Rapid urban growth requires efficient management of utilities, which smart metering solutions support through better data collection and analysis.

Smart Water Metering Market Outlook

- Industry Growth Overview: The smart water metering market is expected to grow at a significant rate from 2025 to 2034 due to the increasing adoption of automated, data-driven water management systems. Rising concerns over water scarcity, aging infrastructure, and high levels of non-revenue water (NRW) are prompting utilities to implement ultrasonic and electromagnetic smart meters for continuous monitoring.

- Sustainability Trends:Sustainability is a major factor influencing the market by driving utilities to adopt solutions that reduce water leakage, enhance operational efficiency, and lower carbon footprints. It also encourages the development of environmentally friendly technologies, such as ultra-low-power electronics, long-life batteries, and recyclable materials in advanced metering systems.

- Global Expansion:The market is expanding worldwide, as utilities invest in large-scale digital infrastructure to optimize water supply management and ensure efficient service delivery. In the Middle East, countries like Saudi Arabia and the UAE are replacing traditional meters with AMI-enabled systems as part of national water digitization initiatives. Asia Pacific is also witnessing rapid adoption, driven by government-led smart city projects, urbanization, and infrastructure modernization. Moreover, government regulations on water-loss control are accelerating the deployment of smart metering technologies through municipal networks.

- Major Investors:Major investors in the market include infrastructure funds and private equity firms such as Macquarie, KKR, and Brookfield, which provide capital to accelerate the development and deployment of advanced metering technologies. Their investments enable vendors to expand capabilities, form strategic partnerships, and integrate IoT connectivity, cloud platforms, and cyber-secure solutions into their portfolios.

- Startup Ecosystem and Technological Innovation:The market's startup ecosystem is rapidly expanding, with emerging companies increasingly focused on developing IoT-enabled meters, real-time leak-detection systems, and advanced analytics platforms. These startups accelerate technology adoption, enhance data-driven water management, and provide scalable, cost-efficient solutions that complement the offerings of established utilities and vendors.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 15.42 Billion |

| Market Size in 2026 | USD 5.83 Billion |

| Market Size in 2025 | USD 5.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.65% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Meter Type, Technology, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing focus on water conservation

Governments and utilities worldwide are anticipated to drive the smart water metering market in the coming years, and growing investment in water conservation is anticipated to drive the market. Global water scarcity has become a pressing issue. These meters offer a precise and real-time method for monitoring and controlling water usage. They provide detailed consumption data and enable households, businesses, and municipalities to identify inefficiencies and implement targeted conservation strategies. This increasing focus on sustainability is expected to drive demand for smart water metering systems to efficiently manage water resources.

The smart water metering market products facilitate proactive maintenance by alerting users to leaks and abnormal usage patterns, thereby preventing water loss before it escalates. The integration of these meters into existing water management frameworks also supports compliance with stringent environmental regulations aimed at preserving natural resources. Moreover, technological advancements in smart meters to reduce water consumption in households are expected to expand their adoption, making them a cornerstone of future water conservation efforts.

- According to the report published in April 2024, there are around 82 gallons of water per day in American households.

Rising investments in smart city initiatives

A global push towards smart city development is anticipated to foster the growth of the smart water metering market. These measures are directed at applying high technologies in the urban setting to improve the standard of living and encourage sustainable activity. Smart water meters are used for efficient water management and support other applications of the smart grid. Growing interest in smart city projects in Asia Pacific and Europe is likely to drive near-essential systems like smart water metering technologies.

Other than precision water metering, these meters play another role in making smart cities achieve the aim of making decisions based on the data collected and resource management. They also support decreasing the operational expenses of utilities by handling the billing activities and the need for interventions. Furthermore, smart metering innovations are promoted through partnerships between governments, technology suppliers, and utilities, which contributes to boosting the smart water metering market.

- In August 2022, the Ministry of Science & Technology, Union Minister Dr. Jitendra Singh, announced financial support of Rs 3.29 crores to M/s Kritsnam Technologies, a start-up company incubated at IIT Kanpur. An MoU was signed between the Technology Development Board (TDB) under DST and M/s Kritsnam Technologies for the production and commercialization of the Dhaara Smart Flow Meter, aimed at developing smart water management technologies.

Restraint

Restrain limited interoperability

Lack of standardization and interoperability among different smart water metering systems is expected to impede the smart water metering market. Different manufacturing companies that produce these systems employ unique technologies that are incompatible with the others, which is a problem for the utilities that want to install them in their systems. This is not only a problem that is difficult to solve during implementation but also leads to higher total costs in system maintenance and further updates. Additionally, the absence of strategy and guidelines to support these smart meters further hinders the market in the coming years.

Opportunity

High demand for water efficiency solutions

The rising need for water efficiency solutions is anticipated to create immense opportunities for the players competing in the smart water metering market. The issue of water scarcity is rising as a major concern in most parts of the world, and utilities and governments are turning their attention to developing technologies that could augment water conservation. Smart water systems help monitor water usage, hence helping utility firms notice some of the losses. Manufacturing is developing and adopting new advanced metering solutions to help sustain water usage in regions that are experiencing water shortages. Furthermore, various smart water meters are expected to be integrated with other smart grid technology platforms' energy management systems, enhancing its value proposition and leading to higher adoption rates.

Segmental Insights

Meter Type Insights

The smart mechanical meter dominated the smart water metering market in 2024 due to the high usage of smart mechanical water meters in residential and commercial sectors. Due to their reliability, relatively low cost, and compatibility with existing infrastructure, such meters are expected to have already attracted considerable interest. The mechanical durability and sophistication of remote monitoring and real-time data transmission have made these meters popular among consumers. Furthermore, the lack of an external power supply, with their resilience in adverse conditions, further boosts their demand.

The ultrasonic meters segment is projected to expand rapidly in the smart water metering market in the future years owing to their contactless means of measuring water flow by use of sound waves. Ultrasonic meters do not have mechanical components, which makes them extremely durable and less costly to maintain. Its capability to give highly accurate flow measurement even at low flow rates is expected by utilities interested in improving the measurement of water and control of NRW loss. Moreover, the need for real-time analysis of data increases, along with the usage of IoT in water management systems is likely to propel the demand for ultrasonic meters.

Technology Insights

The AMR segment held the largest of the smart water metering market in 2024 due to their potential to capture meter readings from a distance without physically reading the meters. This technology offers utilities accurate and timely information on consumption to aid in billing, besides cutting other expenses involved in hands-on data gathering. Organizations have embraced AMR technology as it does not require the massive overhaul of infrastructure required and is easily implemented with little investment. Moreover, implementing AMR systems offers less labor cost and enhanced data reliability, boosting segment growth.

The AMI is expected to grow rapidly in the smart water metering market over the forecast period, owing to the escalating need for efficient water management technologies. AMI synchronizes communication networks with smart meters, tracks water utilization increases, and identifies leakages. Moreover, AMI offerings to handle dynamic pricing models and real-time alerts further fuel their demand.

Component Insights

The meter & accessories segment dominated the smart water metering market in 2024, as it offers basic hardware components of smart water metering systems. Such components are crucial for utilities with plans to update their systems and increase the level of precise water usage reporting. Moreover, the hardware upgrade is a relatively simpler solution than various IT systems or communication, and it has become a preferred option for instant changes in water management efficiency. All these factors will further fuel the market in the coming years.

The IT solution segment is projected to grow rapidly in the smart water metering market in the coming years owing to the rising requirements for enhanced data management, analytics, and integration solutions. Advanced IT solutions, such as DMP, software applications, and analytical tools, are used by utilities and municipalities in meters to enhance them. These solutions provide complex features, including monitoring, prediction, and reporting, which are essential for effective water management and organizational performance. Furthermore, the increased use of smart water meters and the focus on data-driven decision-making and connection with overarching utility management systems are expected to boost the segment.

Application Insights

The water utilities segment held the largest share of the smart water metering market in 2024 due to the facility's importance in the administration of public water supply networks and assets. Smart meters offer water utilities proper meter reading ways, cost reductions, enhanced legitimate uses, and lower non-revenue water through constant monitoring and leakage detection. Additionally, the focus on enhancing service quality and meeting various regulatory standards is expected to propel the demand for smart metering solutions.

The industries segment is projected to expand significantly in the smart water metering market during the forecasting period owing to the growing use of smart water metering to reduce wastage. The necessity to save resources and to meet the continually changing requirements of the legislation facilitates the utilization of smart meters. The implementation of an efficient metering system that provides comprehensive readings and analyses and low-level indication of the failures and problems with the industrial processes. Smart meters assist industries in gauging water use and detecting areas that have the potential for wastage to enable them to enforce conservation procedures. Furthermore, industries are extremely focused on incorporating smart technologies for their water management, which further fuels the market.

Regional Insights

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific dominated the smart water metering market in 2024 owing to the heightened rate of urbanization and the regional emphasis on smart infrastructure investments. The increasing rate of urbanization in China and India creates demand for smart water meters and other sophisticated water management technologies. Furthermore, the increased focus on smart city projects and government support towards technology infrastructure further fuels the market in this region.

China Smart Water Metering Market Trends

China is a major contributor to the Asia Pacific smart water metering market. The market in China is fueled by high rates of urbanization, government-led smart city projects, and growing concerns about water scarcity. The market is also driven by large-scale modernization of municipal water networks and the widespread deployment of AMI-enabled meters. High non-revenue water (NRW) levels and outdated infrastructure are also creating strong demand for advanced monitoring and management solutions.

Why is North America Considered the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest CAGR in the smart water metering market during the forecast period due to its advanced infrastructure and strong regulations. North America has invested in the modernization of water management systems. The efforts to rationalize operational costs, reduce NRW, and address mandatory regulatory requirements create demand for smart water metering in this region. Furthermore, the presence of the biggest water conservation technology solutions providers in this region will further boost the market in the coming years.

U.S. Smart Water Metering Market Trends

In the U.S., the market is expanding as utilities install ultrasonic and electromagnetic smart meters to reduce non-revenue water (NRW) and improve billing efficiency. The adoption of smart water meters is expected to increase in the U.S., driven by federal and state programs encouraging conservation, particularly in areas prone to drought, such as California and Arizona.

How is the Opportunistic Rise of Europe in the Smart Water Metering Market?

Europe is experiencing an opportunistic rise in the market, driven by strict regulations on consumption accuracy, data protection, and water efficiency across EU member states. Utilities are deploying ultrasonic and electromagnetic smart meters to manage aging infrastructure and meet leakage-reduction targets set by the EU Water Framework Directive. Countries such as Germany, Denmark, and the UK are expected to see faster adoption through large-scale AMI and district metering programs.

Germany Smart Water Metering Market Trends

The market in Germany is growing due to the country's focus on modernizing aging water infrastructure and improving water efficiency. Strict regulations on consumption accuracy and leakage reduction are driving utilities to adopt ultrasonic and electromagnetic smart meters. Additionally, large-scale AMI deployments and district metering programs are accelerating the adoption of advanced water metering technologies nationwide.

What are the Advancements for Smart Water Metering in Latin America?

Latin America is set to witness substantial growth throughout the forecast period. This growth is driven by the increasing need for efficient water resource management, accurate billing, and improved operational efficiency in utility networks. Other factors, like increasing digitalization, coupled with water conservation policies, further help in encouraging large-scale deployment of smart meters.

Smart water metering adoption in the region is expected to accelerate even more as infrastructure modernization programs expand and smart city projects incorporate advanced water management solutions. Moreover, advanced communication technologies such as AMI and IoT are gaining traction, fueling market growth even more.

Brazil Smart Water Metering Market Trends

The country is expanding rapidly as utilities continue to modernize infrastructure to improve water efficiency and revenue management. Other factors, like rising urbanization and growing concerns about water scarcity, are driving the adoption of smart meters in Brazil.

Middle East and Africa Smart Water Metering Market Analysis

The Middle East and Africa are witnessing steady growth in the market. This growth is driven by an increasing need for sustainable resource management due to escalating urbanization and climate change. The region is building its strategic prominence as governments and utilities continue to prioritize digital infrastructure to enhance water efficiency, reduce losses, and comply with evolving regulatory frameworks.

Other growth factors include rapid urban expansion, increasing investments in smart city initiatives, and a growing emphasis on data-driven decision-making for resource conservation.

Saudi Arabia Smart Water Metering Market Trends

Leading players in the country are set on expanding strategic partnerships, optimizing distribution networks, and investing in talent development in order to drive growth and development. Companies are also seen prioritizing data-driven insights, sustainability initiatives, and robust compliance frameworks.

Smart Water Metering Market – Value Chain Analysis

- Raw Material Sourcing: Smart water meters require a variety of materials, including metals (brass, copper, stainless steel), polymers (engineering plastics for casings), semiconductors, sensors, communication modules, and battery components. These materials form the physical and electronic base of the meter body, measuring chamber, and IoT communication hardware.

Key Players: Texas Instruments (semiconductors), Infineon Technologies (microcontrollers), TE Connectivity (sensing components), 3M (industrial materials) - Component Fabrication:Raw materials are processed into critical meter components, including ultrasonic sensors, mechanical measuring units, communication chips (RF, NB-IoT, LoRaWAN), AMR/AMI modules, displays, and long-life lithium batteries. These fabricated components determine accuracy, durability, communication range, and power efficiency.

Key Players: STMicroelectronics (sensor modules), Murata Manufacturing (communication units), Holley Technology (meter parts), Tadiran Batteries (lithium batteries) - Smart Meter Manufacturing:Manufacturers assemble electronic/mechanical parts into complete smart meters (ultrasonic, electromagnetic, or mechanical with digital encoders). Production includes calibration, sealing, software loading, and system-level testing to ensure compliance with metrology standards (OIML, ISO, MID).

Key Players: Kamstrup, Itron, Badger Meter, Diehl Metering, Sensus, BMETERS, Apator - Communication & System Integration:Smart water meters are integrated into AMI (Advanced Metering Infrastructure) or AMR (Automated Meter Reading) platforms. This stage involves connecting meters with data concentrators, gateways, cloud platforms, and utility SCADA systems to enable remote monitoring, leak detection, and analytics.

Key Players: Honeywell, Schneider Electric, Siemens, Landis+Gyr, Aclara Technologies, Arad Group - Deployment & Installation Services:Utilities deploy smart water meters across residential, commercial, and industrial networks. Installation includes meter replacement, network configuration, communication validation, and cybersecurity setup. Service providers also manage network optimization and calibration over time.

Key Players: Utility Service Contractors, Local Water Utilities, Sensus Services, Itron Deployment Services - Distribution to Utilities & End Users: Finished smart meters and network solutions are distributed to municipal water utilities, private water operators, residential developers, and industrial facilities. Large-scale rollouts rely on procurement contracts and long-term maintenance service agreements.

Key Players: Global Distributors, Water Utilities (e.g., Thames Water, American Water, Veolia), OEM distribution partners - Data Analytics, Software & After-Sales Services:Once deployed, ongoing data management, cloud analytics, cybersecurity monitoring, firmware updates, and maintenance services are essential. These solutions optimize leak detection, demand forecasting, billing accuracy, and overall water-network efficiency.

Key Players: Itron Analytics, Sensus FlexNet, Schneider EcoStruxure, Siemens Water Platforms, Kamstrup READy Suite

Top Companies in the Smart Water Metering Market & Their Offerings

- Apator S.A.: A leading European provider of smart water metering systems offering advanced electronic meters and automated data-collection technologies.

- Aclara Technologies LLC (U.S.): Delivers intelligent water metering solutions powered by robust AMI/AMR platforms for accurate, real-time consumption monitoring.

- Arad Group (Israel): Known globally for its ultrasonic and mechanical smart water meters designed for high precision and long-term network performance.

- BMETERS Srl (Italy):Manufactures compact ultrasonic and electronic smart water meters tailored for residential and commercial metering needs.

- Badger Meter, Inc. (U.S.): Offers innovative smart water metering systems integrated with analytics software for improved utility efficiency and leak detection.

- Diehl Stiftung & Co. KG (Germany):Provides advanced metering infrastructure and IoT-enabled water meters with strong data security and system interoperability.

- Honeywell International Inc. (U.S.):Supplies smart metering technologies featuring automated monitoring, predictive analytics, and seamless connectivity.

- Itron Inc. (US):A global leader delivering end-to-end smart water metering solutions, including AMI networks, IoT sensors, and advanced analytics.

- Kamstrup (Denmark): Specializes in ultrasonic smart water meters known for high accuracy, long battery life, and efficient smart-grid integration.

- Landis+Gyr (Switzerland):Provides scalable smart water metering platforms built on AMI technology to enhance utility visibility and operational control.

- Ningbo Water Meter Co., Ltd. (China): Produces cost-effective smart water meters with wireless communication and robust metering accuracy.

- Neptune Technology Group Inc. (U.S.): Offers advanced AMI-based smart water meters focused on improving distribution efficiency and reducing non-revenue water.

- Schneider Electric (France):Integrates smart water metering into its digital utility management ecosystem for real-time monitoring and optimized water networks.

- Sensus (U.S.):A Xylem brand delivering smart water meters and FlexNet communication systems for large-scale, high-reliability utility deployments.

- Sontex SA (Switzerland): Provides ultrasonic smart meters and IoT-enabled data management solutions for precise consumption measurement.

- Siemens (Germany):Offers smart metering and digital water-management technologies integrated with automation, analytics, and IoT platforms.

- ZENNER International GmbH & Co. KG (Germany):Delivers a broad portfolio of ultrasonic and IoT-ready smart water meters with strong AMI/AMR compatibility.

Recent Developments

- In February 2025, LAISON launched a pilot project in Indonesia to upgrade existing mechanical water meters with its innovative Meter Interface Unit (MIU). LAISON Meter Interface Unit (MIU) is an innovative solution designed to retrofit traditional mechanical water meters with pulse outputs into a smart meter.

- In March 2025, Netmore Group, a leading global operator of IoT networks, announced the availability of Metering-as-a-Service (MaaS) for water and gas utilities. Offering an option for utilities to redirect their focus from meter-related concerns to critical sustainability and efficiency issues, Netmore's Metering-as-a-Service delivers a hassle-free, fully managed, turnkey AMI solution.

- In September 2024, Metron, the global leader in cellular-based smart metering and water intelligence, launched two exciting new products: WaterScope™ Utility, an advanced analytics app streamlining frontline operations across complex municipal water systems; and the Metron Spectrum Wave, an advanced ultrasonic smart meter combining versatility and resilience with best-in-class data capture.

- In April 2024, SUEZ and Vodafone partnered for the remote reading of new-generation smart water meters. It cuts the volume of water consumed by up to 15% by detecting leaks and monitoring use. Patricia Villoslada, SVP SUEZ Digital Solutions, stated, “The global partnership that we are launching today with Vodafone improves the service we offer, allowing us to provide all our customers worldwide.”

- In March 2024, the Kerala Water Authority (KWA) introduced prepaid water meters, starting with major users. The project will be rolled out following a thorough assessment of the meter functionality at various centres on an experimental basis.

- In April 2024, Suez SA, a water and waste management solutions manufacturer, announced that SUEZ and Vodafone are partnering to speed up the global implementation of remote water meter-reading through Narrowband IoT (NB-IoT) communication networks. Their goal is to deploy over 2 million NB-IoT meters by 2030.

- In February 2024, Diehl Stiftung & Co. KG, a leading manufacturer and supplier of smart metering solutions, introduced the ALTAIR V5 MANIFOLD, the latest generation of volumetric water meters designed for installation on a coaxial base in a manifold.

- In November 2022, Landis+Gyr, a leading provider of integrated energy management solutions, announced the launch of ultrasonic smart water meters, W270 and W370, based on IoT technologies. The new portfolio follows the Landis+Gyr Green Design principles and is fully recyclable after over 15 years of use.

- In March 2023, Avnet, Inc., a distributor of electronic components, announced its agreement with Huizhong to distribute smart water meters. The renewed agreement appointed Avnet as the sole distributor of smart water meters in Australia, New Zealand, and Singapore for another two years, with potential expansion to other global markets.

Segments Covered in the Report

By Meter Type

- Ultrasonic Meters

- Smart Mechanical Meters

- Electromagnetic Meters

By Technology

- AMR

- AMI

By Component

- IT Solution

- Meter & Accessories

- Communications

By Application

- Industries

- Water Utilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting