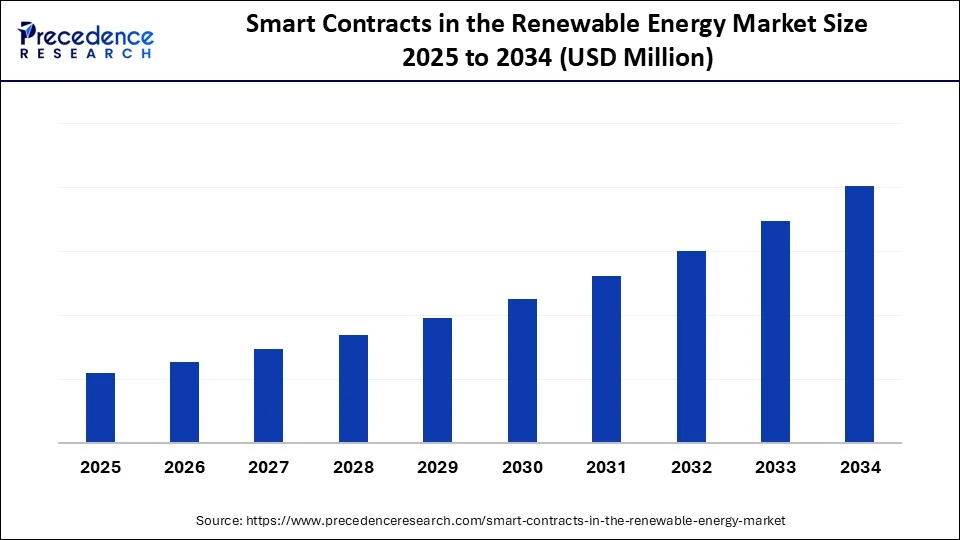

Smart Contracts in the Renewable Energy Market Size and Forecast 2025 to 2034

The global smart contracts in the renewable energy market allow seamless automation of clean energy exchanges with minimal human intervention. Increasing shift towards clean energy production, growing trend of blockchain technology for transparency in major sectors, are driving reasons for the market.

Smart Contracts in the Renewable Energy MarketKey Takeaways

- North America dominated the smart contracts in renewable energy market share in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By application, the energy trading/peer-to-peer trading segment held the largest market share of 30% in 2024.

- By application, the renewable attribute tracking and tokenization (REC/GO tokenization) segment is expected to grow at the fastest CAGR during the foreseeable period.

- By technology, the public/permissioned blockchain platforms segment held the largest market share in 2024.

- By stakeholder/end user, the utilities and grid operators segment led market share in 2024.

- By stakeholder/end user, the commercial and industrial (C&I) consumers segment is expected to witness the fastest CAGR during the foreseeable period.

- By deployment model, the permissioned/consortium deployments segment held the biggest market share in 2024.

- By deployment model, the public/permissionless segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-use case/service model, the software platforms segment captured the highest market share in 2024.

- By end use case/ service model, the middleware/oracles and metering integration segment is expected to witness the fastest CAGR during the foreseeable period.

How is AI Transforming the Smart Contracts in the Renewable Energy Market?

The convergence of ‘Artificial Intelligence' and smart contracts in renewable energy is a completely revolutionary idea that is paving the way to operate in the global market for tech giants that are willing to invest in such a technology to excel in business. AI-powered smart contracts can seamlessly automate the peer-to-peer process for energy trading that helps continuous transactions between consumers who generate energy and the grid. This encompasses tasks like matching buyers' and sellers' expectations and verifying if energy is available, and then performing transactions using smart meter data by initiating automatic payment and settlements by analysing predefined rules.

AI-based smart contracts can potentially reduce transaction costs by eliminating the need for a middle person due to automation, which further enhances efficiency and streamlines energy management operations, enabling consumers to leverage maximum benefits. In addition to this, AI algorithms can detect potential cyberattacks by analysing irregular patterns in real-time data and find system vulnerabilities to fix them. This offers enhanced security to use blockchain's distributed ledger technology with more transparency.

Market Overview

Smart contracts in renewable energy market are self-executing digital agreements (code) running on distributed ledgers that automatically enforce, verify, and record energy-related transactions without intermediaries. In renewable energy, they enable automated peer-to-peer (P2P) energy trading, automated billing and settlement, renewable-attribute (REC/GO) tracking and tokenization, automated demand-response and flexibility markets, EV charging coordination, payments, and microgrid orchestration. Benefits include faster settlement, lower transaction costs, greater transparency and provenance for renewable attributes, and new business models (tokenized asset finance, community energy DAOs).

What are the Key Trends in the Smart Contracts in Renewable Energy Market?

- Automated peer-to-peer energy trading: A significant trend responsible for the expansion of smart contracts in renewable energy market is automation in peer-to-peer energy trading, which offers direct energy trading between businesses and individuals interested in investing in it. Businesses with renewable energy sources, such as solar panels, offer highly cost-effective energy networks. Smart contracts further automate the response to fluctuations in energy demand, changes in energy consumption during peak hours that are not recorded to use any energy, and optimize grid stability based on this data.

- Decentralized identity for transparency:Smart contracts offer private and secure energy transactions without reliance on centralized authority by leveraging decentralized identity and zero-knowledge proofs to achieve it seamlessly. Also, decentralized autonomous organizations that are operated by smart contracts will further empower local communities to participate in the decision-making process related to the energy market and infrastructure.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology/Platform, Stakeholder/End-User, Deployment Model, Application, Use Case/Service Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Transparency with decentralization

A major driving factor for the adoption of the smart contracts in renewable energy market includes their transparency due to blockchain technology and the decentralization process, which makes transactional data immutable and tamperproof. Smart contracts further help to adopt peer-to-peer energy trading, which reduces the need for intermediaries between prosumers-like people using solar panels who produce energy, and other consumers. This approach makes it highly cost-effective and provides trustworthy contracts among people with the same intent, even having lesser investments. Smart contracts further enable local energy grids to optimize energy distribution and ensure fair pricing without overestimating and violation charges, facilitating energy freedom and resilience.

Restraint

security concerns with scalability

Despite having major benefits, the market's growth may be hindered due to various reasons like scalability issues, security concerns, regulatory hurdles, along complex implementation. Public blockchain networks are highly prone to facing scalability issues when used by a large number of people at once, which is essential for part of energy trading. Also, keeping track of the evolving regulatory landscape about blockchain and its application is quite a complex process for professionals, and even common people looking to invest in energy trading, which might affect the market's expansion.

Opportunity

Renewable energy certificates with carbon credits

Smart contracts are helpful to automate complex processes like issuance, transfer, and expiration of renewable energy certificates to enhance transparency and efficiency, with cost reduction in administrative work. This step prevents double-counting and possibilities of fraud, further increasing the credibility of renewable energy certificates. Smart contracts can enhance carbon trading by verifying and tracking real-time carbon offsets. It promotes responsible and eco-friendly practices, aligning with the goal of carbon emission reduction, creating lucrative opportunities for the growth of the smart contracts in renewable energy market.

Application Insights

Why is energy trading/peer-to-peer trading applicable highly in the smart contracts in renewable energy market?

The energy trading/peer-to-peer trading segment held the largest market share of nearly 30% in 2024. The segment's growth is related to its ability to proceed with automated transactions with minimize costs while enhancing security and transparency due to a decentralized approach. This can be performed by using predefined conditions and eliminating the need for manual interaction. Peer-to-peer trading streamlines the energy exchange between buyers and sellers, speeds up transactions, and enhances the working efficiency of energy trading platforms.

The renewable attribute tracking and tokenization (REC/GO tokenization) segment is expected to witness the fastest CAGR during the foreseeable period. Tokenization provides partly ownership of renewable energy assets, which is beneficial for small investors to participate without hurdles. These tokens can be traded on the secondary market, increasing liquidity to offer faster access to funds assigned for project developers, along with investors.

Technology Insights

How do public/permissioned blockchain platforms drive the smart contracts in renewable energy market?

The public/permissioned blockchain platforms segment held the largest market share in 2024. The technology enhances transparency and security for energy trading and management with the help of a decentralized platform. It offers transparent and immutable energy transaction records, which offer all parties the same data and its access, creating high transparency in the process. Blockchain has a cryptographic security feature, making it hard to alter or tamper with records about transactions without the need for manual intervention.

Stakeholder/end user Insights

Why do utilities and grid operators dominate the smart contracts in renewable energy market?

The utilities and grid operators segment held the largest market share in 2024. The utilities and grid operators majorly used smart contracts in renewable energy to effortlessly manage the complexities regarding the integration of variable renewable energy sources, such as solar and wind sources, into established power grids. These smart contracts help automate, streamline various processes such as grid balancing, energy trading, and real-time data exchange, along with enhanced efficiency and reliability, leading to better grid stability and seamless functioning.

The commercial and industrial (C&I) consumers segment is expected to witness the fastest CAGR during the foreseeable period. The segment is expanding due to a couple of factors, like high energy demand at on-site generation, specifically in factories, industries, and large institutes, along with growing focus on sustainability. Moreover, ongoing advancement in smart grid technology and blockchain has made smart contracts highly secure and practical to utilize, contributing segment's growth further.

Deployment model insights

Why is the permissioned/consortium deployment model used most often in the smart contracts in renewable energy market?

The permissioned/consortium deployments segment held the largest market share in 2024. These deployment models are favoured due to their ability to provide a balance between privacy and transparency as compared to the public deployment model. Permissioned deployment model provides a middle path with controlled access and data visibility for a specific group of people/participants, which makes it an ideal methodology to manage complex energy transactions and grid operations as well.

The public/permissionless segment is expected to witness the fastest CAGR during the foreseeable period. Smart contracts in a public/permissionless environment offer distributed energy resources to consumers. It includes solar panels to directly trade excess energy directly with each other. This process bypasses conventional mediators like utility companies and leads to lower energy costs. By minimizing the need for mediators, blockchain-based P2P energy trading can prominently reduce overall transaction costs, making it highly affordable for everyone, even with small investments.

End-use case/service model Insights

Why do software platforms dominate the smart contracts in renewable energy market?

The software platforms segment held the largest market share in 2024. Software platforms offer seamless transactions, increased security, while promoting decentralization. Platforms based on technologies like Ethereum, R3 Corda provide features such as secure data storage, process automation, and compatibility to support peer-to-peer energy trading crucial factor to integrate renewable energy sources into the grid. These platforms support transactions with high security due to their features like immutability and decentralized approach, fuelling the segment's growth.

The middleware/oracles and metering integration segment is expected to witness the fastest CAGR during the foreseeable period. Oracle works as an intermediary to securely fetch data from outside the blockchain, such as smart meters, and transfer it to the smart contract. It fills the gap between real-world data about energy and the blockchain-based smart contracts to securely manage energy transactions.

Regional Insights

North America

Why does North America dominate the smart contracts in renewable energy market?

North America held the largest market share in 2024. The dominance of North America is due to early adoption of newer technologies and their real-world applications, such as blockchain technology. U.S., in particular, was the frontier of blockchain technology and leading across the globe due to its robust culture of technological innovation, risk-taking nature for research, along with substantial investment in clean energy generation systems with cutting-edge technologies. Major players like IBM, AWS, and Oracle are further working to develop smart contract solutions for different energy applications.

Moreover, supportive government policies along with significant investment in the renewable sector are needed to minimize their carbon footprints. This is achievable by the adoption of blockchain-based solutions to track and trade renewable energy credits with data about carbon emissions. Many leading tech firms like LO3 Energy and Power Ledger have adopted and are practising innovative P2P energy trading models, showcasing the potential of blockchain further.

Asia Pacific

What are the factors influencing the growth of Asia Pacific smart contracts in the renewable energy market?

Asia Pacific is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The Asia Pacific region is witnessing rapid economic growth with an increasing population rate that requires high energy consumption, creating a need for efficient and sustainable energy solutions without harming the environment. Several countries in the region are actively taking part in promoting renewable energy sources, which is backed by government policies, feed-in-tariffs, along renewable portfolio standards. Such policies are creating a favourable environment to adopt smart contracts, specifically in sectors where streamlining renewable energy projects is crucial for their management.

In addition to this, renewable energy technologies like solar and wind power are becoming more cost-friendly due to their innumerable benefits and competitive nature with conventional energy sources like fossil fuels. This cost reduction is making them economically affordable to invest in several energy generation projects, fuelling the market's growth in the region.

Value Chain Analysis

- Power Generation

Smart contracts can automate power purchase agreements and their execution without human intervention and initiate payments, which is highly beneficial for renewable sources like wind and solar power generation.

Key players- Power Ledger, Sonnen Community, LO3 Energy, and WePower.

- Distribution Network Management

Smart contracts offer automation in smart grids by helping in acknowledging demand response, energy flow management, and creating a balance between supply and demand from distributed renewable resources. This approach effectively improves energy usage and reduces strain on infrastructure.

Key players- Siemens, Itron, IBM, GE Vernova, and ABB

- Energy Storage Systems

Smart contracts can offer streamlined energy trading to maximize efficiency, financial returns, with grid stability by managing the charging and discharging cycle of energy storage systems.

Key players- Samsung SDI, Exide Industries, L&T, Amara Raja Group, and Tata Power Solar Systems.

Smart Contracts in the Renewable Energy Market Companies

- Power Ledger

- Energy Web Foundation (EWF)

- LO3 Energy/TransActive Grid

- Electron

- Siemens

- IBM

- Accenture

- WePower

- Grid Singularity

- Power Ledger and partners

- Kaluza (AGL)

- Octopus Energy/Kraken

- UrbanChain

- SunContract

- Electron

- Grid+

- WeaveGrid

- TransActive/ConsenSys-backed pilots

- Local/Regional Pilots and DSOs

Recent Developments

- In August 2025, RICH miner applies new energy and smart contracts to drive XRP cloud mining that will offer XRP profit maximization. The RICH Miner cloud mining platform utilizes 100% renewable energy, including wind and solar power, reducing the environmental impact of energy-intensive mining. (Source: https://coincentral.com)

- In August 2025, Servo Tech achieves 7.3 MW on-grid solar Rooftop order by the North Western Railway Jaipur division, which will be a significant move for the clean energy transition of India. The project carries a total value of Rs 28.84 crore and marks yet another milestone in Servotech's journey of driving India's clean energy transition. (Source: https://www.psuconnect.in)

Segments Covered in the Report

By Application

- Energy Trading/Peer-to-Peer (P2P) Trading

- Renewable Attribute Tracking and Tokenization (REC/GO tokenization)

- Automated Billing and Settlement (meter-to-cash automation)

- Demand-Response and Flexibility Markets

- EV Charging/Smart Charging Coordination

- Microgrids and Community Energy Settlement

- Asset Tokenization and Crowdfunded Project Finance

By Technology/Platform

- Public/Permissioned Blockchain Platforms (e.g., Energy Web, Hyperledger Fabric, Ethereum-based solutions).

- Off-chain settlement + on-chain smart contracts

- Tokenization/Stablecoin payment rails

- Interoperability layers and oracles

By Stakeholder/End-User

- Utilities and Grid Operators — large adopters for settlement, flexible resources, and market orchestration.

- Commercial and Industrial (C&I) consumers, households, and community energy groups (P2P participants)

- Project developers and financiers (tokenization)

- EV charging operators and fleet managers

By Deployment Model

- Permissioned/Consortium Deployments

- Public/Permissionless Deployments

- Hybrid (on-chain settlement + private data layers)

By Use Case/Service Model

- Software platforms (SaaS) for marketplace orchestration

- Managed services/system integrators

- Middleware/Oracles and metering integration

- Tokenization and asset issuance platforms

By Region

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting