What is the Water Storage Systems Market Size?

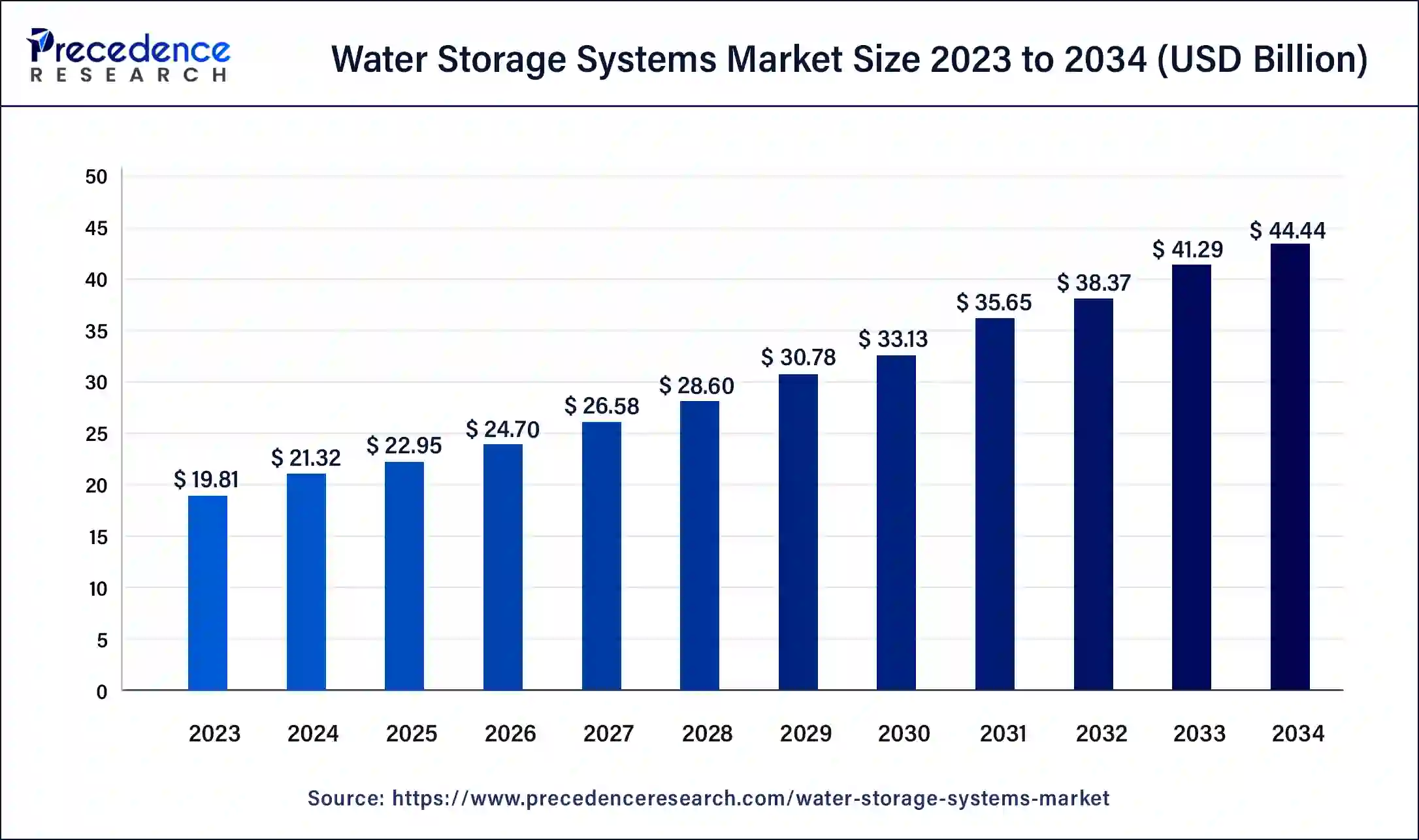

The global water storage systems market size is valued at USD 22.95 billion in 2025 and is predicted to increase from USD 24.70 billion in 2026 to approximately USD 44.44 billion by 2034, growing at a CAGR of 7.62% over the forecast period 2025 to 2034. The increasingly growing concerns regarding water shortages are the key factor driving the growth of the water storage systems market.

Water Storage Systems Market Key Takeaways

- The global water storage systems market was valued at USD 21.32 billion in 2024.

- It is projected to reach USD 19.81 billion by 2034.

- The water storage systems market is expected to grow at a CAGR of 7.62% from 2025 to 2034.

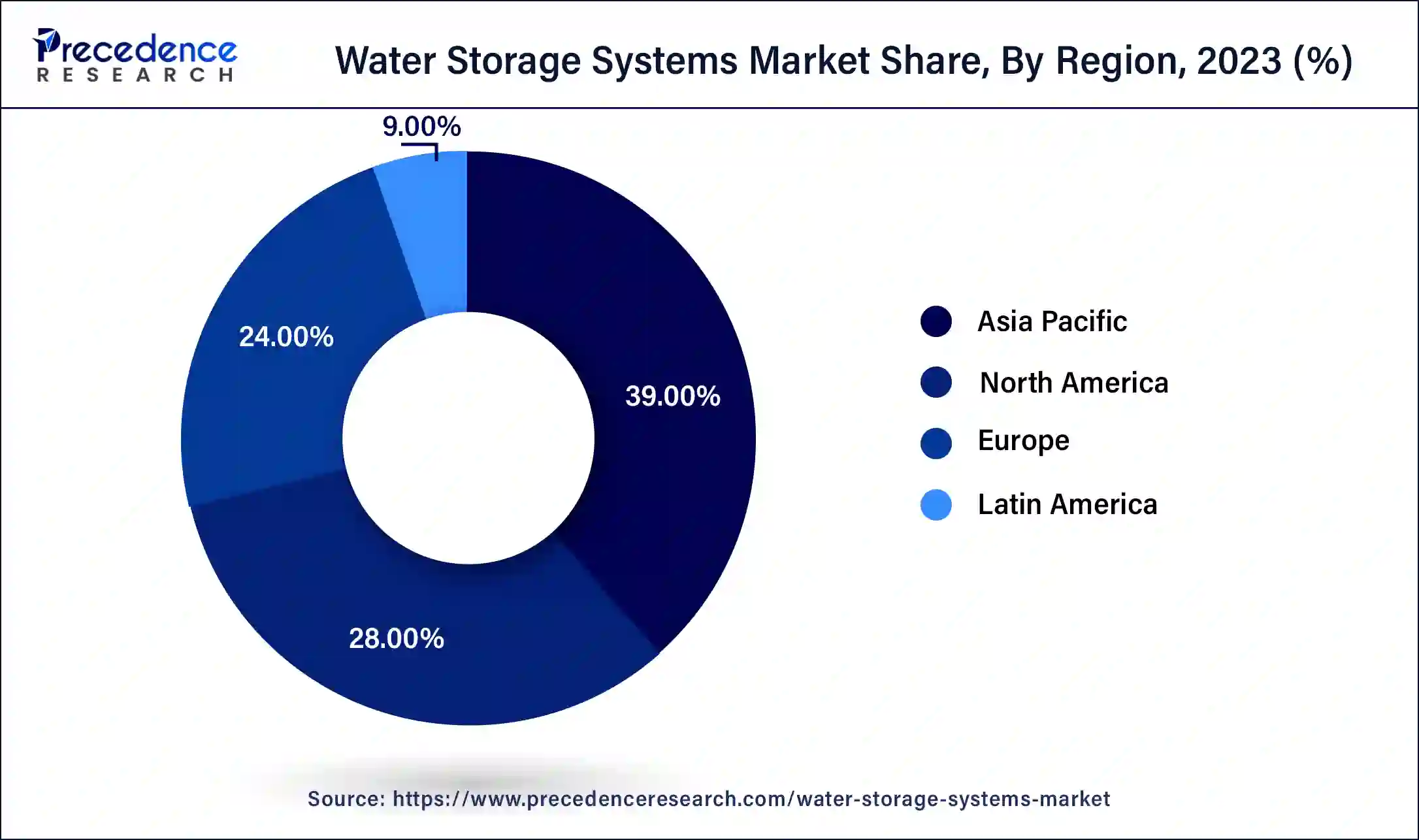

- Asia Pacific dominated the water storage systems market with the highest market share of 39% in 2024.

- North America is expected to witness significant growth in the market over the forecast period.

- By material, the concrete segment dominated the market in 2024.

- By material, the fiberglass segment is expected to witness the fastest growth in the market over the forecast period.

- By application, the hydraulic fracture storage & collection segment led the global market in 2024.

- By application, the onsite water & wastewater collection segment is expected to grow at a significant rate in the market during the projected period.

- By end-use, in 2024, the municipal segment accounted for the largest share of the market.

- By end-use, the residential segment will show remarkable growth in the market over the projected period.

What is the Impact of AI on the Water Storage Systems Market?

In the water storage systems market, AI can help detect and prevent leaks in water distribution systems by processing data from meters and sensors. AI algorithms can detect hurdles in water pressure and flow by indicating possible leaks. This approach can save a substantial amount of water and reduce the expenses associated with repairing leaks. Furthermore, AI algorithms can offer key insights on when and what amount of water should be used for irrigation, cutting water waste, and stimulating sustainable agriculture practices.

- In August 2024, Veolia will take artificial intelligence deployment to the next level to drive sustainable water management. Veolia launches an innovative digital solution based on AI, Hubgrade Water Footprint, to help customers achieve water neutrality goals by effectively monitoring and managing water consumption in real-time.

What are Water Storage Systems?

Water storage systems are a key element of water management infrastructure that stores. Maintains and distributes water for various applications, including industrial, agricultural, home, and environmental needs. These systems include an extensive range of buildings and technology created to fulfill needs geographic locations, and environmental conditions. The water storage systems market plays a crucial role in regulating a vast range of water management issues, such as conservation, distribution, and access to clean water. Urban clusters and megacities need large-scale reservoir facilities to maintain a constant water supply in the face of climatic change.

Water consumption by country 2020

| Country | Total water withdraw (m3 per capita) 2020 |

| Turkmenistan | 4351.49 |

| Guyana | 1836.75 |

| Uzbekistan | 1759.83 |

| Chile | 1693.33 |

| Iraq | 1407.67 |

| United States | 1342.26 |

| Kazakhstan | 1308.22 |

What are the Growth Factors in the Water Storage Systems Market?

- An increase in the global population rate is also expected to drive the water storage systems market growth further.

- Rising urbanization, along with the implementation of stringent regulations, can fuel market growth shortly.

- An increase in innovations in rehabilitation and construction-related activities of water storage systems is expected to boost market growth soon.

- The rising adoption of plastic and reused and recycled plastic storage tanks in many households can propel market growth in the near future.

- Growing water use in the industrial and commercial sectors will likely contribute to the water storage systems market expansion further.

Water Storage Systems Market Outlook

- Industry Growth Overview: From 2025 to 2030, the market was expected to undergo significant growth, owing mainly to demand for secure water storage across residential, industrial, and agricultural markets. Growth was significantly driven by climate stressors, urbanization, and the need to replace aging infrastructure, particularly across Asia-Pacific and North America.

- Sustainability Trends: Eco-friendly storage solutions changed the industry, as usage of recycled plastics, corrosion-resistant materials, and rainwater harvest systems continued to increase. With regulations tightening in Europe and major cities across the world, companies expanded investments in green storage tank manufacturing.

- Global Expansion: Leading companies expanded into Southeast Asia, Africa, and the LATAM regions to not only address the increasing need for available water, but also increase profit margins with cheaper manufacturing costs. Companies also increased the capacity of decentralized storage solutions using water tanks to address the needs of remote communities and areas prone to drought.

- Major Investors: The allure of stable demand, long-term asset lives, and compatibility with climate-resiliency goals has enabled private equity and infrastructure funds to increase their investments. These investors targeted firms that are focused on large-volume tanks, smart monitoring technologies, and modular installations.

- Startup Ecosystem: The growth of smart water storage, leak detection technologies, and tank solutions using sustainable and composite materials progressed quickly. Firms engaged in building IoT-connected tanks and advanced composite systems attracted significant VC interest based on the potential for efficiency and long-term water security.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 44.44 Billion |

| Market Size in 2025 | USD 22.95 Billion |

| Market Size in 2026 | USD 24.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.62% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising concerns over climate change and water scarcity

Climate change causes droughts, unpredictable rainfall patterns, and extreme weather events. Promoting global water scarcity concerns. As climatic unpredictability rises, regions related to dependable water sources face uncertainty, exacerbating stakeholders' need to invest in new adaptation measures of the water storage systems market. Additionally, Water storage can play the role of buffer against climate-created changes in water supply, enabling water to be captured, stored, and distributed during the period of abundance for later use.

- In December 2023, Thailand tried nature-based water management to adapt to climate change. With an economy largely underpinned by irrigated crops like rice, water is a crucial resource in Thailand.

Restraint

Infrastructure aging and deterioration

Many storage facilities, such as tanks, reservoirs, and pipelines, were constructed years ago and are now nearing the end of their operational life. This aging infrastructure is at risk of developing leaks, cracks, and structural failures, which could lead to water contamination, loss, and service disruptions. Furthermore, the water storage systems market infrastructure is aging and diverse, which may result in long-term damage.

Opportunity

The emergence of smart cities and green buildings

Governments of various nations have implemented diverse initiatives to develop smart cities. ‘Green building' refers to activities primarily focused on reducing environmental impact through efficient design, construction, and maintenance. These innovations aim to minimize waste and environmental degradation. An excellent example of this is the rainwater harvesting systems market. Both private and public organizations endorse the concept of green building.

- In February 2024, Saudi Arabia launches a rainwater harvesting project to rehabilitate 620,000 hectares of land. The project will use rainwater harvesting techniques to improve vegetation cover in nine regions across the Kingdom. It will involve studying the feasibility of implementing rehabilitation projects in three main climatic regions: continental, coastal, and mountainous.

Material Insight

The concrete segment dominated the water storage systems market in 2024. The dominance of the segment can be attributed to the cost-effectiveness of material-based water tanks coupled with lower maintenance costs. Additionally, concrete-based water storage systems are more durable, easily available in developed and developing countries, and have easy-to-maintain hygiene, which can fuel their adoption across the globe shortly.

The fiberglass segment is expected to witness the fastest growth in the water storage systems market over the forecast period. The growth of the segment can be credited to the superior qualities of fiberglass-based structures over other materials, including extra mechanical strength and resistance to degradation, which is propelling its usage in a variety of storage systems and water tanks. Moreover, rising awareness regarding the food-grade coating makes fiberglass highly preferable for a longer duration of time.

- In July 2022, Boka Marine joined the American Recreational Products portfolio and launched a fiberglass boat line. The National Composites recreational watercraft line features battery—or solar-powered technologies, a fiberglass frame, and room to hold four people.

Application Insight

The hydraulic fracture storage & collection segment led the global water storage systems market in 2024. This is due to increasing usage of treated and fresh water in the gas& oil refineries and rising concerns related to water conservation because of water scarcity in numerous regions, which are among the key concerns boosting the segment growth. Also, the demand for water storage systems is get impacted by the extent of hydraulic fracturing, regulatory oversight, and water resource accessibility.

- In May 2022, SPM Oil & Gas, an upstream provider of pressure pumping and pressure control equipment and services, announced an innovation to enhance the hydraulic fracturing process: the new, more streamlined SPM Simplified Frac Iron System.

The onsite water & wastewater collection segment is expected to grow at a significant rate in the water storage systems market during the projected period. The growth of the segment is driven by a rapid increase in the incidence of a variety of water-borne diseases and raised regulations on the safe and appropriate use of onsite water treatment systems globally. Furthermore, the upsurge in clean water supply in developing nations across the globe has added to the demand for advanced water storage systems.

End-use Insight

The municipal segment accounted for the largest share of the water storage systems market. The key factor that lets the municipal segment dominate the market is the global water crisis. However, the segment's growth is anticipated to be promoted by growing urbanization and an increased population over the studied period. Moreover, municipal organizations utilize water storage systems to provide a consistent water supply for their municipalities and towns. These systems also help to store and regulate water for a variety of goals like firefighting, irrigation, and other municipal needs.

The residential segment will show remarkable growth in the water storage systems market over the projected period. The growth of the segment can be linked to the growing awareness about the depletion of groundwater levels with the extensively rising g scarcity of freshwater resources in the entire world, which has led to the increased adoption of smooth water-saving techniques in various households.

Regional Insights

Asia Pacific Water Storage Systems Market Size and Growth 2025 to 2034

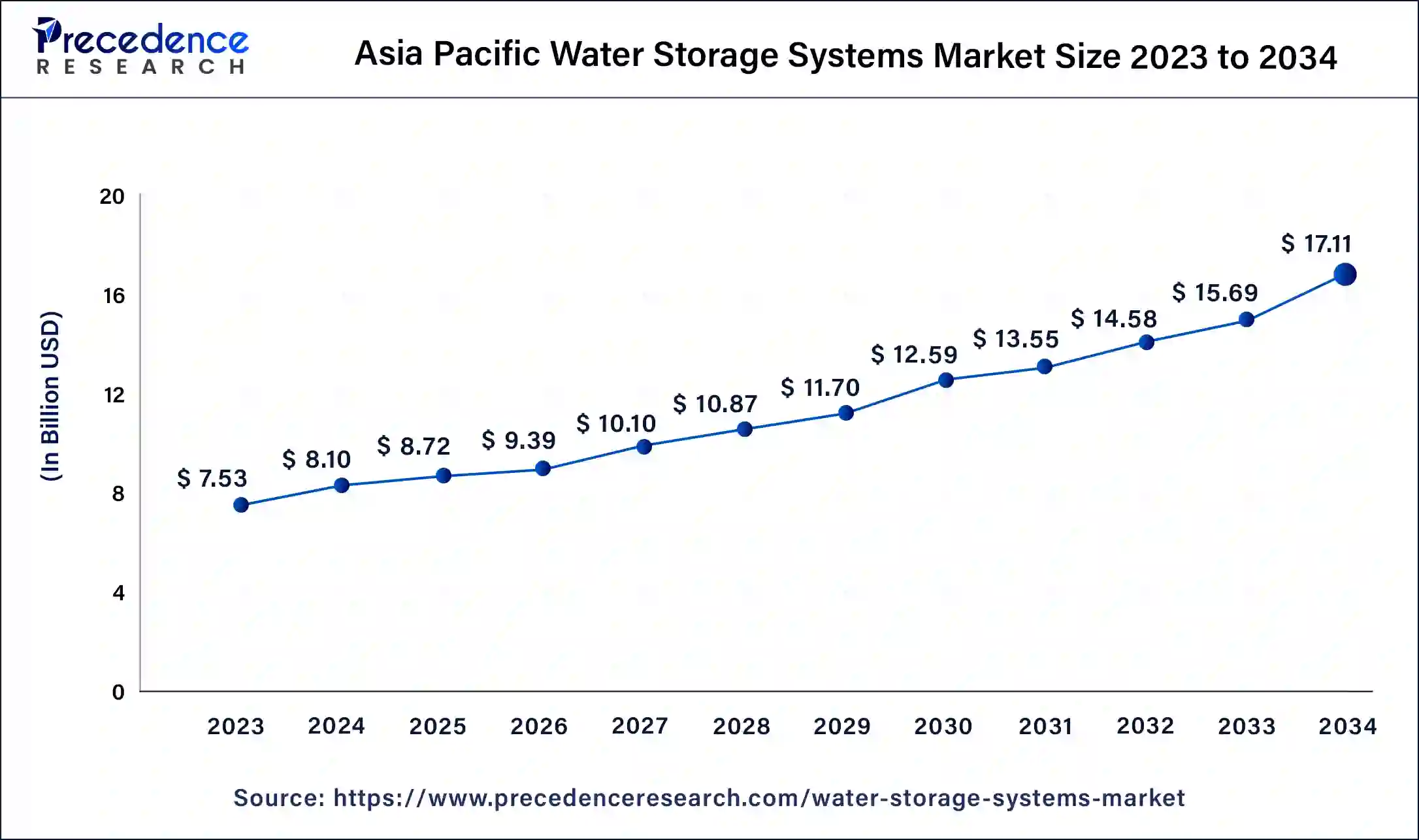

The Asia Pacific water storage systems market size is exhibited at USD 8.72 billion in 2025 and is projected to cross around USD 17.11 billion by 2034, poised to grow at a CAGR of 7.76% from 2025 to 2034.

Asia Pacific dominated the water storage systems market in 2024. This is because the region has witnessed tremendous economic growth, good water management, and rapid social development. Moreover, the region faces growing needs for sophisticated water management and the cultivation of human capital. As urbanization increases with the rising population, the pressure on existing water resources increases, necessitating advanced solutions for water storage and distribution.

Asia Pacific: China Water Storage Systems Market Trends

China's market is being driven by rapid urbanization and industrialization, which increases the need for reliable water management and storage infrastructure. The government's aggressive investment in large scale reservoir projects and pumped-storage hydropower facilities is strengthening long-term water and energy resilience. There's a rising adoption of advanced storage technologies, including smart tanks integrated with real-time monitoring, to improve efficiency and reduce water loss.

North America is expected to witness significant growth in the water storage systems market over the forecast period. The region's growth can be attributed to the increasing utilization of water in nations like the U.S. and Canada for industrial, commercial, and residential applications. Coupled with the presence of major gas reserves in the U.S. Furthermore, the increasing oil and gas activities and surge in the thermoelectric power generation field utilize water on a larger scale.

- In May 2024, the Department of the Interior announced a USD 242 million investment as part of President Biden's Investing in America agenda that will bring clean, reliable drinking water to communities across the West through five water storage and conveyance projects.

Why did Europe experience stable growth in the water storage systems market?

Europe experienced stable growth due to strict environmental regulations, urgency from climate change, and growing usage of advanced water systems. Many countries experienced droughts and heat waves, which led to elevated anticipation for advanced localized storage options. The area supported green infrastructure, reused stormwater, and bio-based materials. Residential and industrial property owners sought high-quality tanks for water security and storage.

With some countries driven towards sustainability and reusing technology and having investigated the efficiency of modernizing older water networks in urban and rural areas, new opportunities arose for water tank utilization.

Germany Water Storage Systems Market Trends

Germany led the European region in the water storage systems market by significantly influencing rainwater harvesting, green building, and energy-efficient storage systems. Germany proactively used luxury alternative materials and utilized smart monitoring technology. Climate Change made water management a more important agenda, which contributed to higher utilization of residential and industrial tanks.

Germany itself heavily invests in sustainable urban planning and stormwater management. Germany successfully leveraged strong engineering capacity and public awareness to stay ahead of the curve concerning innovative and improved water storage systems.

Why did Latin America show significant growth in the water storage systems market?

Latin America exhibited significant growth given the rising urbanization, water scarcity, and rising demand for safe household storage solutions. Many areas experienced an inconsistent supply, and storage tanks were an important solution. Governments invested in rural water access and rainwater harvesting projects. Within households and for agricultural and industrial users, there was also an uptake in larger storage solutions. As the construction sector in the region expanded and climate risk increased, the opportunity for storing water in a cost-effective and permanent way became even more important.

Brazil Water Storage Systems Market Trends

Brazil was the strongest growth driver in the region, as many urban cities have irregular water supply, thus producing a large demand for household storage tanks. The country invested in rural water storage solutions and large-scale agricultural water storage. The increased risk of drought due to climate change has increased dependence on storage solutions in the northeastern states of Brazil, where precipitation is limited. Brazil expanded its construction sector, and this promoted more community tank installations.

Why did the Middle East & Africa experience stable growth in the water storage systems market?

The Middle East & Africa experienced stable growth due to extreme water scarcity, increased temperatures, and rising population demands. Many markets had large-capacity tanks along with desalination and storage tanks. Additionally, governments implemented many programs that ensure longer-term water security, along with smart monitoring. Rural areas saw many affordable plastic tanks, while city areas increasingly used these tanks and less expensive advanced storage solutions.

The region had strong opportunities for expansion of construction, climate resilience plans, and increased demand for reliable storage in a drought-prone environment.

Saudi Arabia Water Storage Systems Market Trends

Saudi Arabia served as a leading contributor to regional water scarcity levels and a significant investment in storage infrastructure. Saudi Arabia employed very large tank installations throughout cities, farms, and industrial applications. Programs put in place by the government around long-term water security supported the market. The operation of desalination plants also increased the demand for high-volume storage installations.

Water Storage Systems Market Companies

- CST Industries, Inc.

- ZCL Composites, Inc.

- Synalloy Corporation

- AG Growth International Inc.

- Grupo Rotoplas S.A.B. De C.V.

- Mcdermott International, Inc.

- BH Tank

- Fiber Technology Corporation

- Caldwell Tanks

- Containment Solutions Inc.

- Maguire Iron Inc.

- Snyder Industries

- Crom Corporation

- Tank Connection

- Contain Enviro Services Ltd.

- HMT LLC

- DN Tanks

- Hendic Bv

- Sintex Plastics

Recent Developments

- In November 2023, McDermott International Inc. received a “limited notice to proceed” from Shell Trinidad and Tobago Limited for an engineering, procurement, construction, and installation (EPCI) contract for the Manatee gas field development project located off Trinidad and Tobago's east coast.

- In November 2023, CST Industries Inc. and Amoy Diagnostics Co., Ltd. announced an expansion of their current relationship in China to develop companion diagnostics.

- In January 2022, Prayag announced the launch of its new extra strong and durable water tanks that combine technology and innovations, have been tested for durability, and are virtually unbreakable. These tanks are developed with the latest Rotomoulding technology and have strong corners, and ribs have also been provided for additional strength.

- In March 2022, TRUFLO announced the start of its new water storage tanks from the Telangana plant to fulfill the demand from the southern market. Initially, the water storage solutions will be produced at a capacity of 45 lakh liters per month and will expand further as demand increases.

Segments Covered in the Report

By Material

- Steel

- Fiberglass

- Concrete

- Plastic

- Others

By Application

- Hydraulic Fracture Storage & Collection

- Onsite Water & Wastewater Collection

- Portable Water Storage Systems

- Rainwater Harvesting & Collection

By End-Use

- Residential

- Commercial

- Industrial

- Municipal

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting