What is the Biologics Market Size?

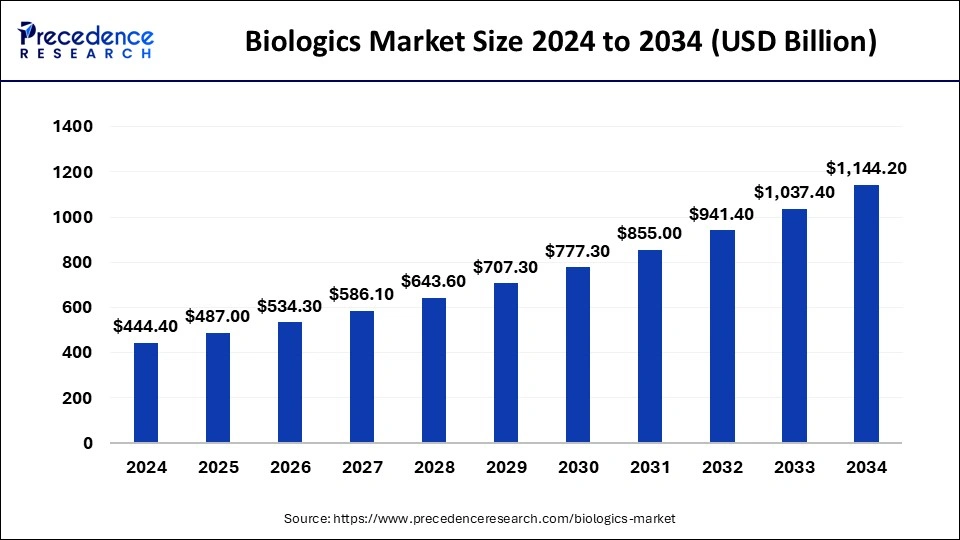

The global biologics market was calculated at USD 487 billion in 2025 and is predicted to increase from USD 534.30 billion in 2026 to approximately USD 1243.80 billion by 2035, expanding at a CAGR of 9.83% from 2026 to 2035.

Biologics MarketKey Takeaways

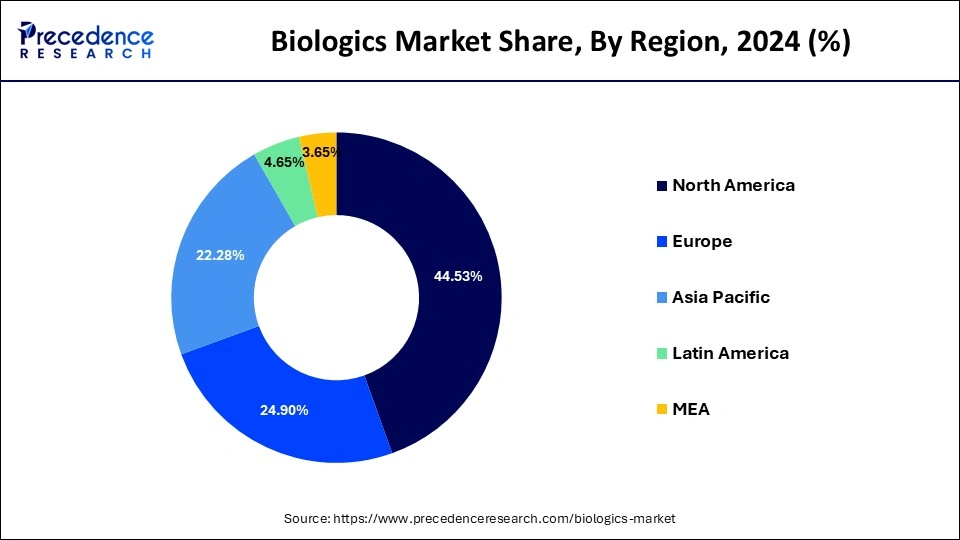

- North America contributed more than 44.53% in 2025.

- Asia Pacific region is projected to expand at the CAGR of 11.05% during the forecast period.

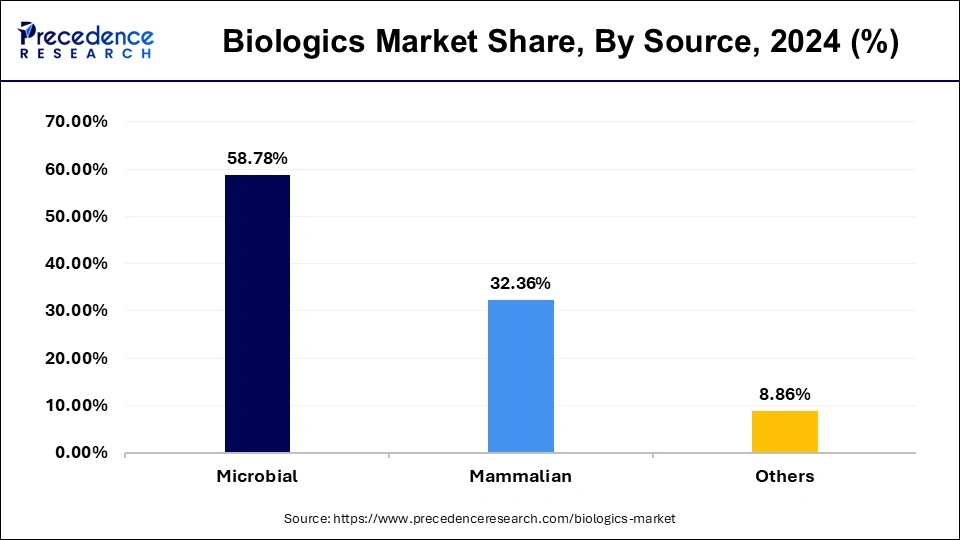

- By source, the microbial segment dominated the market with a share of 58.78% in 2025.

- By manufacturing, the in-house segment dominated the market with 83.96% share in 2025.

- By product, the monoclonal antibodies segment accounted for a share of 56.48% in 2025.

Biologics Market Growth Factors

Biologic is a substance made from live creatures or containing living organism components. Biologic medications are a general class of biotechnology derived pharmaceuticals originating from humans, microorganisms, and animals. Proteins that influence the activity of other proteins and cellular processes, genes that control the creation of critical proteins, modified human hormones, and cells that create substances that suppress or activate immune system components may all be found in biologic products. As biologic medications alter the way natural biologic intracellular and cellular processes work, they are sometimes referred to as biologic response modifiers.

The rise in the frequency and diagnosis of chronic diseases has demanded the availability of sophisticated diagnostics and treatment medications, which has fueled the worldwide biologics market. Biologics are drugs that have been genetically modified to target a particular portion of the immune system that causes inflammation. With the emergence of coronavirus diseases, governments in various countries are also taking steps to boost the healthcare industry and secure the supply of biologics. In addition, researchers and scientists are studying species and expression systems in order to improve the productivity of biological products. In addition, a number of pharmaceutical companies are conducting research and development to increase the efficacy of oral medications for arthritis.

Due to the fall in small molecule medication research and development productivity, biologics are expected to grow dramatically in the future years. The pharmaceutical companies are working on a variety of biologic medications in order to maintain their market dominance. When oral medications for Crohn's diseases and rheumatoid arthritis improve in effectiveness, more moderate patients are predicted to move to branded and new therapies. In addition, new compounds offer therapeutic options for patients who have previously failed to respond to conventional treatments, and they frequently display higher protection and efficacy.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 487 Billion |

| Market Size in 2026 | USD 534.30 Billion |

| Market Size by 2035 | USD 1243.80 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.83% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Product, Indication, Manufacturing, Distribution Channel, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

As processing capacity improves, biopharmaceutical production capacity is likely to rise. Another example of these innovations in the employment of single use technologies is the production and manufacturing of biopharmaceuticals. Furthermore, biologists are working on developing more efficient creatures and speech processes. The development of cell lines and reagents that improve the efficacy of biological products is predicted to drive revenue growth.

The prevalence of prevalent chronic disorders as well as some countries' comprehensive healthcare finance plans are expected to play a key role in the growth of the global biologics market. Over the projection period, improvements in the healthcare organizations together with reforms in numerous nations are projected to reflect well for the biologics market. In addition, developments in the anti-inflammatory biologics industry are expected to grow during the forecast period.

The adoption of novel biological procedures by pharmaceutical corporate giants in order to speed up their manufacturing processes is expected to result in a wide range of drug versions. The biologics industry is predicted to grow in demand due to technological advancements and less health risks.

Manufacturing is one of the most essential steps in the biologics production process, accounting for a significant portion of the worldwide biologics industry. As it represents the sector's outsourcing and in-house operations, the mode of production is an important element to investigate. Rather than acquiring or outsourcing services, businesses choose to create their own. As a result, the percentage of biologics produced in-house has increased. Businesses are putting money into their own bioprocessing equipment.

Market Dynamics

Drivers

Development of drugs for arthritis

The medical industry has a significant emphasis on the development of novel drugs and treatments. Drugs for treating rheumatic arthritis has gained a major attention in the industry, as arthritis has become one of the rapidly spreading chronic condition. According to an estimation, by 2040, 78.4 million adults will have doctor-diagnosed arthritis.

While conventional drugs such as painkillers and DMARDs are widely prescribed to control arthritis pain, they have not shown adequate results for the same. This factor brings a demand for efficient medicine for arthritis. Biologics are derived from living organisms and target specific components of the immune system that are involved in inflammatory processes. As biologics have started gaining acceptance among healthcare professionals, there has been an increase in their adoption for arthritis treatment. Moreover, the ongoing commitment towards the development of arthritis treatment promotes the growth of the market by acting as a driving factor.

Rising research and development activities

Research and development activities in the pharmaceutical and biotechnology industries lead to the discovery and development of new and innovative range of therapeutic options for numerous medical conditions that contain a wide range of biologics. Biologics can be designed to target specific molecular pathways and receptors, making them more precise and personalized in their therapeutic approach.

Additionally, research and development activities are being done for developing biosimilars, that are similar to the approved biologics drugs. Multiple research laboratories demand biologics for the comparison purpose during the development of biosimilars. All these elements associated with research and development activities act as a driver for the growth of the biologics market.

Restraints

Integration of biosimilars in the industry

Biosimilars are highly approved materials that are similar to biologics. Biosimilars are typically introduced at lower prices as compared to biologics, the rapidly expiring patents of biologics open a wide set of opportunities for biosimilars. The integration of biosimilars in the industry can lead to a reduction in the market share for biologics. The reduced profit margins for biologics are observed to shift the focus towards biosimilars. This element acts as a major restraint for the market.

High development cost

Biologic developers or manufacturers face challenges due to the high capital investment required for the development of biologics, the development of biologics is a lengthy and time-consuming process. It can take years from the initial investment to the market approval. This extended timeline increases the overall costs as it requires continuous clinical trials, research-based activities and manufacturing practices. This factor can limit manufacturers from entering into the business which hampers the growth of the market. Thereby, considered a restraint for the market.

Opportunity

Rising demand for personalized medicine

Personalized medicine often depends on the targeted therapies, such therapies are designed to address specific molecular targets in the human body. Personalized medicine also relies heavily on the identification of biomarkers. Biologics play a major role in the development of diagnostic tools such as biomarkers. This can help in diagnosing diseases. With personalized medicine, there is an increasing demand for customized treatments to meet specific needs of an individual. Biologics can be modified and engineered to fit these requirements which leads to more effective and patient-centric treatment options. Thus, the demand for personalized medicine is observed to create opportunities for the market.

Market Challenge

Regulatory hurdles

The biologics market is expanding, many players are investing in research and development on an international level. Whereas the lack of harmonization among regulatory agencies from different countries may create a challenge for the growth of the market. Moreover, certain uncertainties in the regulatory framework pose a challenge for the market. As biologics continue to advance, regulatory agencies may face uncertainty in defining appropriate regulatory pathways. All these factors including scientific and technological challenges hamper the growth of the market by limiting the entry of manufacturers as well as researchers.

Segment Insights

Source Insights

In 2025, the microbial segment dominated the biologics market. Due to the vast number of pharmaceuticals produced by these products, microbial expression systems had the highest revenue generation. E. coli and yeast are commonly included in microbial expression systems.

The mammalian segment is predicted to develop at the quickest rate in the future years. Platelet derived growth factor, recombinant insulin, and recombinant interferon is some of the products that have been generated using these expression systems.

Biologics Market Revenue, By Source, 2022-2024 (USD Billion)

| Source | 2022 | 2023 | 2024 |

| Microbial | 221.10 | 239.40 | 261.20 |

| Mammalian | 119.30 | 130.50 | 143.80 |

| Others | 33.80 | 36.30 | 39.40 |

Product Insights

In 2025, the monoclonal antibodies (MABs) segment dominated the biologics market. Due to the increased use of this class of pharmaceuticals in several therapeutic areas, monoclonal antibodies dominated the market with the biggest revenue share. Monoclonal antibodies allow sick cells to be targeted without hurting good cells.

Thevaccines segment, on the other hand, is predicted to develop at the quickest rate in the future years. Due to its use as a prophylactic measure in infectious disorders, vaccines are expected to expand at the fastest rate in the next years.

Biologics Market Revenue, By Product, 2022-2024 (USD Billion)

| Product | 2022 | 2023 | 2024 |

| Monoclonal Antibody | 211.1 | 229.4 | 251.2 |

| Immune Checkpoint Inhibitors | 116.5 | 126.5 | 138.4 |

| Biosimilar | 71.9 | 78.7 | 86.8 |

| Antibody-Drug Conjugates (ADC) | 22.6 | 24.2 | 26.1 |

| Recombinant Insulin | 41.4 | 44.9 | 49.0 |

| Vaccine | 76.0 | 81.3 | 87.6 |

| Human Growth Hormone | 6.4 | 7.0 | 7.7 |

| Cell & Gene Therapy | 23.0 | 26.0 | 29.5 |

| Recombinant Enzyme | 3.6 | 4.0 | 4.4 |

| Interferon | 9.3 | 10.0 | 10.9 |

| Others | 3.5 | 3.7 | 4.0 |

Disease Insights

In 2025, the oncology segment dominated the biologics market. This is attributed to the increased incidence of cancer combined with the presence of many research and development programs.

The cardiovascular diseases segment, on the other hand, is predicted to develop at the quickest rate in the future years. This is attributed to the rising prevalence of heart and blood vessel diseases.

Biologics Market Revenue, By Disease, 2022-2024 (USD Billion)

| Disease | 2022 | 2023 | 2024 |

| Oncology | 111.2 | 122.0 | 134.9 |

| Infectious Diseases | 63.1 | 68.3 | 74.5 |

| Immunological Disorders | 49.0 | 52.8 | 57.4 |

| Cardiovascular Disorders | 88.8 | 96.7 | 106.1 |

| Hematological Disorders | 35.3 | 37.9 | 41.0 |

| Others | 26.8 | 28.5 | 30.4 |

Regional Insights

What is the U.S. Biologics Market Size?

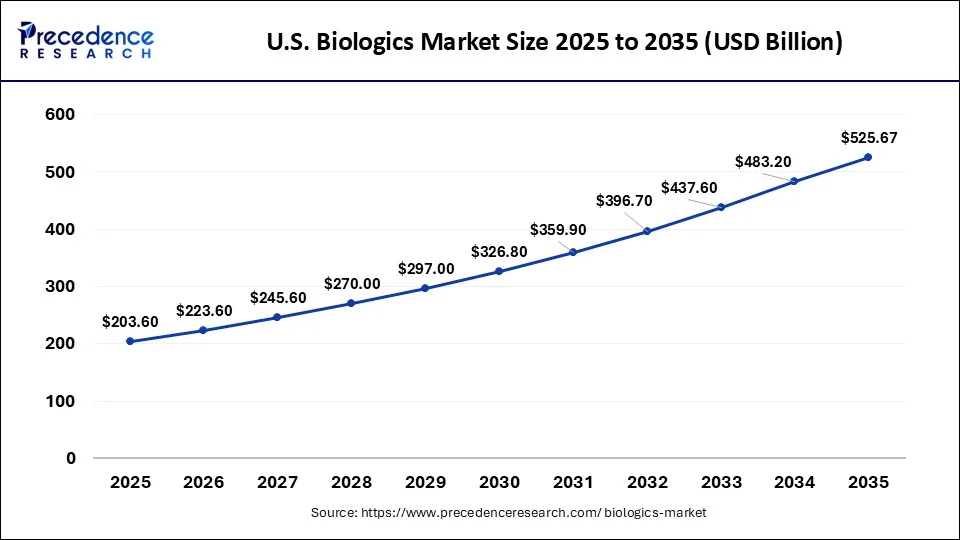

The U.S. biologics market size was exhibited at USD 203.60 billion in 2025 and is projected to be worth around USD 525.67 billion by 2035, growing at a CAGR of 9.95% from 2026 to 2035.

What Made North America the Dominant Region in the Biologics Market?

North America dominated the biologics market with the largest share in 2025 due to its well-established pharmaceutical and biotechnology infrastructure, supported by advanced research facilities and leading global biotech companies. Strong government funding, favorable regulatory frameworks, and high healthcare expenditure facilitate rapid biologics development and commercialization. Additionally, growing demand for personalized medicine, biologic therapies, and innovative treatments drives adoption, reinforcing the region's market leadership.

U.S. Market Analysis

The biologics market in the U.S. is growing due to the rising prevalence of chronic and complex diseases, such as cancer, autoimmune disorders, and rare genetic conditions, which increase demand for advanced therapies. Strong research and development capabilities, supportive regulatory frameworks, and high healthcare spending enable rapid development and commercialization of biologic drugs.

What Makes Asia Pacific the Fastest-Growing Region in the Biologics Market?

Asia Pacific is expected to grow at the fastest rate in the upcoming period due to rapidly expanding healthcare infrastructure, increasing investments in biotech research, and rising demand for advanced therapies in countries like China and India. The region also benefits from a large patient population, growing prevalence of chronic and lifestyle diseases, and supportive government initiatives promoting biologics development and local manufacturing. Additionally, cost advantages and collaborations between global and regional biotech firms are accelerating adoption and market growth.

China Market Trends

China is a major contributor to the Asia Pacific biologics market due to its rapidly expanding biotech and pharmaceutical industry, large patient population, and strong government support for biologics development and innovation. Significant investments in research infrastructure, clinical trials, and local manufacturing capabilities are accelerating the production and adoption of biologic therapies.

How is the Opportunistic Rise of Europe in the Biologics Market?

Europe's opportunistic rise in the biologics market is driven by strong pharmaceutical and biotech ecosystems, extensive R&D capabilities, and supportive regulatory frameworks that facilitate biologics development and approval. The region benefits from government incentives, public–private partnerships, and growing adoption of advanced therapies, including monoclonal antibodies, vaccines, and cell & gene therapies. Additionally, increasing healthcare expenditure, aging populations, and rising demand for personalized medicine are creating significant opportunities for market expansion across Europe.

Germany Market Trends

Germany's biologics market is driven by the growing prevalence of chronic disorders, strong R&D capabilities, and increasing demand for personalized medicine. Key trends include innovations in targeted therapies, a focus on efficient cold-chain logistics, and the strategic role of contract development and manufacturing organizations (CDMOs) in scaling biologics production.

What Potentiates the Market in Latin America?

The biologics market in Latin America is being propelled by rising prevalence of chronic and lifestyle-related diseases, increasing healthcare access, and growing adoption of advanced therapies. Supportive government initiatives, expanding biotechnology infrastructure, and collaborations between global and regional companies further accelerate biologics development, manufacturing, and market penetration in the region. Brazil is leading the biologics market in Latin America, driven by the rising prevalence of chronic conditions, which fuels demand for advanced biologic therapies.

What Opportunities Exist in the MEA for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the biologics market due to growing healthcare infrastructure, increasing government investment in biotechnology, and rising demand for advanced therapies to address chronic and infectious diseases. Expanding public-private partnerships, adoption of innovative biologics, and capacity-building initiatives in countries like Saudi Arabia, the UAE, and South Africa further support market growth and regional expansion. The UAE leads the market within the region, driven by the growing demand for biosimilars, strong government support, and strategic investments in biomanufacturing.

Value Chain Analysis of the Biologics Market

- R&D: It includes discovering, testing, developing, manufacturing, and monitoring highly complex drugs derived from living organisms.

Key Players: Johnson & Johnson, Roche, Pfizer, Novartis, and Amgen - Clinical Trials and Regulatory Approvals: It includes a rigorous, multi-stage process overseen by agencies such as the FDA and EMA to ensure safety, purity, and even potency before they can be marketed.

Key Players: Pfizer Inc., Amgen Inc., Sandoz Group AG - Formulation and Final Dosage Preparation: It includes careful selection of ingredients, specific processing steps, as well as stringent quality control to guarantee product integrity and patient safety.

Key Players: Becton, Dickinson and Company, West Pharmaceutical Services, Gerresheimer AG

Biologics Market Companies

- Eli Lilly & Company

- Samsung Biologics

- F Hoffman La Roche

- Celltrion Addgene

- Amgen

- Abbvie Inc.

- Sanofi

- Pfizer Inc.

- Merck & Co. Inc

- Novo Nordisk A/S

Recent Developments

- Moderna Inc., announced in August 2021 that it had completed the rolling submission process for its Biologics License Application to the FDA for full licensure of the Moderna COVID-19 vaccine for active immunization to prevent COVID-19 in people aged 18 and up.

- Pfizer Inc. and BioNTech SE declared in August 2021 that they had started a supplemental Biologics License Application with the FDA for the approval of a booster dose of COMIRNATY to prevent COVID-19 in people aged 16 and up.

- As India's biggest biosimilar maker increases its production to generate value to stakeholders ahead of an anticipated initial pubic offering, Biocon Biologics is in talks with ADQ, the Abu Dhabi government's wealth fund, to advance capital.

- A South Korean business, Samsung Biologics has committed to work with Eli Lilly & Company on the development of a virus neutralizing antibody for the COVID-19 virus.

- In 2020, WuXi Biologics completed purchase of Bayer's drug product manufacturing facility in Germany. WuXi Biologics' first medication production facility in Europe was expected to increase the company's commercial manufacturing capabilities.

- In October 2020, Cadila Pharmaceuticals released two similar biologics known as NuPTH and Cadalimab in the Indian market to increase its geographical reach.

Segments Covered in the Report

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- Human mABs

- Humanized mABs

- Chimeric mABs

- Murine mABs

- Vaccines

- RecombinantProteins

- Antisense, RNAi & molecular therapy

- Cell Based Therapies

- Stem Cell Therapy

- CAR-T Cell Therapy

- Tissue Engineering

- Others

By Indication

- Oncology

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

By Manufacturing

- Outsourced

- In-house

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content