What is the Drug Discovery Market Size?

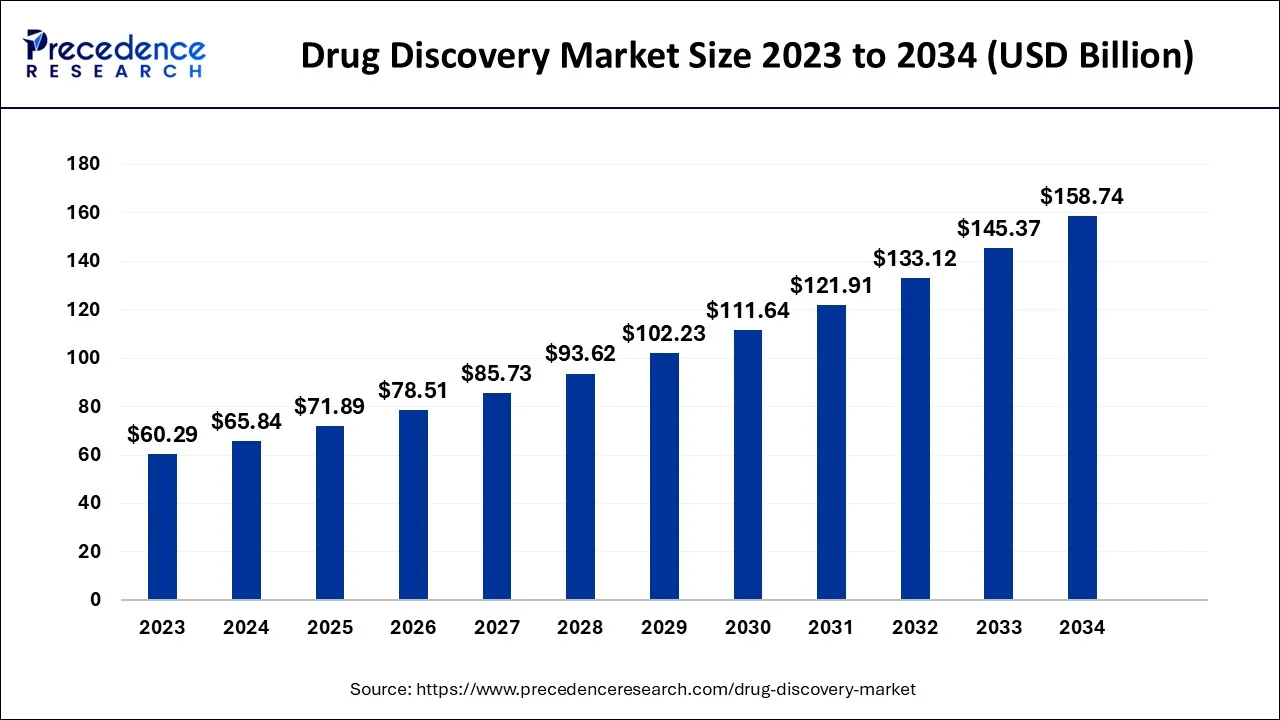

The global drug discovery market size is valued at USD 71.89 billion in 2025 and is predicted to increase from USD 78.51 billion in 2026 to approximately USD 158.74 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034.

Drug Discovery Market Key Takeaways

- North America dominated the commercial boiler market in 2024.

- By drug type, the small molecule segment dominated the market in 2024.

- By end user, the pharmaceutical companies segment led the market in 2024.

AI Foreshowing a new wave in Drug Discovery

Artificial intelligence is quickly changing drug discovery with platforms now predicting molecular behaviour, clinical outcomes, and target interactions much earlier in the development pipeline than ever before. This momentum picked up even more steam in 2025 as companies developed multimodal models combining structural biology, physics-based simulation, and generative design.

- In Novembe, 2025, Iambic raised $100 million to further develop its AI-first discovery engine, having last week announced the release of Enchant v2 and promising anti-tumour data from its lead candidate. (Source: bioxconomy.com)

- Insilico Medicine secured major funding in 2025 to enhance its generative AI programmes. Experts within the industry agree that AI is increasingly shortening experimental cycles and improving success rates with candidates being pursued by global R&D teams.

Drug Discovery Market Growth Factors

The global drug discovery market is significantly driven by the rising prevalence of various chronic diseases, rising healthcare expenditure, and patent expiration of certain popular drugs across the globe. The global population is facing a growing burden of various diseases such as cardiovascular diseases, diabetes, cancer, respiratory diseases, and neurological disorders, which is significantly fueling the demand for new and innovative drugs. The exponentially growing pharmaceutical industry owing to the rapid growth of biopharmaceuticals is expected to drive the drug discovery market in the forthcoming years. The biopharmaceutical industry is growing at a rapid pace owing to the rising investments by the government and corporate for the development of new medicines to treat chronic diseases. Moreover, the favorable government regulations coupled with the active role of the authorities such as FDA and EMA is fueling the market growth.

The changing lifestyle, shifting consumption pattern, unhealthy food habits, rising pollution levels, and physical inactivity is resulting in the growing burden of various diseases like cancer, diabetes, and cardiovascular diseases. According to the International Agency for Research on Cancer, around 19.3 million new cancer cases and around 10 million cancer deaths were reported in 2020. As per the International Diabetes Federation, around 783 million people across the globe are estimated to live with diabetes by 2045. Further, over 1.2 million children and teenagers are suffering from type 1 diabetes. According to the World Health Organization, the cardiovascular diseases results in almost 18 million deaths each year and it is the leading cause of death across the globe. Thus, the demand for the innovative drugs that can cure chronic diseases is high among the global population, which in turn fuels the growth of the drug discovery market. The rising investments by the pharmaceutical companies in the research & development of various new drugs and clinical trials research is expected to propel the growth of the global drug discovery market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 71.89 Billion |

| Market Size in 2026 | USD 78.51 Billion |

| Market Size by 2034 | USD 158.74 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.20% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type,End User,Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segmental Insights

Drug Type Insights

The small molecule segment dominated the market in 2024. This is attributable to the increased demand for the small molecule drugs among the population. The small molecule drugs can easily affect the cells and can treat the diseases owing to its small molecules and weight. Therefore, the increased awareness regarding the effectiveness of the small molecule drugs has resulted in the increased investments of the manufacturers to develop small molecule drugs.

The large molecule or the biologics is estimated to be the fastest-growing segment during the forecast period. The rising adoption of the new manufacturing technologies is fueling the production of the biologics. Further, the rising awareness among the population regarding the effective treatment abilities of the biologics coupled with rising healthcare expenditure is boosting the growth of the large molecule segment.

End User Insights

The pharmaceutical companies segment dominated the global drug discovery market in 2024. This is because of the rising investments by the top pharmaceutical and biotechnology companies in the development of new drugs. The rising prevalence of chronic diseases and growing geriatric population is creating a huge demand for the various innovative drugs. The increased demand for the drugs across the globe has fueled the drug discovery market. Moreover, the rapid growth of the biopharmaceutical industry has significantly contributed towards the market growth.

On the other hand, the CROs segment is estimated to be the most opportunistic segment during the forecast period. The rising penetration of the several small and medium size CROs across the globe owing to the rising demand for the CRO services among the pharmaceutical companies is exponentially boosting the growth of the drug discovery market. Research is the most common activity in the drug discovery process and the small and the medium pharmaceutical companies with low financial capabilities generally tends to acquire the CRO services, which in turn fuels the growth of this segment.

Regional Insights

North America dominated the global drug discovery market in 2024. The nation like US leads the globe in terms of spending on research and development. Moreover, US holds the patents of the majority of the new drugs that have been produced recently. Furthermore, the increased demand for the advanced and innovative drugs owing to the increased prevalence of chronic diseases has fueled the growth of the drug discovery market in North America. Around half of the US population is suffering from either one or more chronic diseases. This has resulted in a high healthcare expenditure in the country. Moreover, the rising awareness regarding the biologics in the region is further fueling the market growth. Furthermore, the surging demand for the generic drugs, immunotherapy drugs, and biosimilars is expected to significantly impact the growth of the drug discovery market in North America.

Asia Pacific is estimated to be the most opportunistic market in the forthcoming years. This can be attributed to the presence of numerous CROs in the region. Moreover, the countries like South Korea, India, and China are investing heavily in the growth of the pharmaceutical industry, which is fueling the demand for the biopharmaceutical products. Further, the rising geriatric population across the region is expected to increase the demand for the drugs in the upcoming future, as the geriatric people are more susceptible to the chronic diseases. According to the United Nations, 80% of the global geriatric population will be living in the low and middle income countries by 2050. Hence, the region is expected to witness a surge in the drug discovery market growth in the upcoming future.

How Is the Europe Region Supporting Drug Discovery?

There is steady growth in drug discovery in Europe as a result of strong biomedical research activities, additional partnerships in drug discovery engagements between pharmaceutical companies and academic institutes, and increasing investments in advanced platforms such as AI-based screening and precision medicine. Countries such as Germany, the U.K., and France are advancing innovation through regulatory pathways and building clinical trial ecosystems. The focus for the region remains on areas such as research into diseases that have a limited commercial impact, biosimilars, and personalized therapeutics, which together comprehensively develop a greater footprint for the region as a growing center for modern drug discovery approaches.

Germany

Germany remains an important part of the European drug discovery landscape, involving a significant pharmaceutical manufacturing base, world-class research institutions, and established biotech clusters. The German drug discovery community is focused on precision medicine, innovative assays, and chemical synthesis methods. Germany continues to foster federal R&D funding initiatives and partnerships across universities, startups, and pharma companies to fuel drug discovery, renewal of novel biological targets, and preclinical applications.

Why Is the Middle East and Africa Region Emerging in Drug Discovery?

The Middle East & Africa region is emerging slowly due to faster healthcare modernization including biopharma development and government-led initiatives to help modernize R&D capabilities. Gulf states have been investing in genomic studies, local manufacturing, and early phase biotech companies, while many African countries have been developing research labs and clinical trial networks. International partnerships, digital health adoption, and growing interest in infectious and chronic disease research are beginning to make MEA participants more viable in the global drug discovery ecosystem.

United Arab Emirates (UAE)

In drug discovery, the UAE is emerging by developing biomedical research hubs and digital labs and establishing AI-enabled drug technology modeling platforms. Government initiatives are inviting global biotech collaborations and inspiring local innovation. The UAE is focused on developing capacity in translational research, enabling therapeutic exploration, and establishing itself as a regional hub for advanced pharmaceutical research.

Country Analysis

United States

The United States continues to lead in global drug discovery due to the presence of strong biotech clusters, ample R&D funding, and a regulatory environment that encourages innovation. In particular, the ascent of new frontiers such as AI-based screening technologies, genomics, and biologics development is strengthening the drug discovery pipeline. The collaboration of pharma companies with academic institutes and technology companies continues to hasten the kiln from target identification to candidate optimization.

China

China is rapidly emerging as a destination for drug discovery, supported by increased government funding, a growing biotech startup community, and increasing acceptance of AI-based and high-throughput screening approaches to drug discovery. Local companies are developing expertise in both small-molecule and biologics research. Partnerships with multinational pharma companies, coupled with advances in research facilities is leading to faster innovation cycles and including early-stage drug development in China.

Drug Discovery Market Companies

- Pfizer Inc.

- GlaxoSmithKline PLC

- Merck & Co. Inc.

- Agilent Technologies Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Abbott Laboratories Inc.

- AstraZeneca PLC

- Shimadzu Corp

Key Developments

- In November 2025, Merck KGaA announced a partnership with Valo Health to leverage its AI-driven drug discovery platform in a deal potentially worth over US$3 billion, targeting therapeutics for Parkinson's disease and related disorders.

(Source: tradingview.com) - In November 2025, the Alzheimer's Drug Discovery Foundation (ADDF) launched its “Milestones in Motion” campaign and kicked off the fifth season of its Palm Beach symposium series to boost funding and innovation in Alzheimer's research.

(Source: prnewswire.com) - In October 2025, Eli Lilly and Nvidia unveiled a collaboration to build a supercomputer powered by over 1,000 Nvidia GPUs to accelerate AI-driven drug discovery through Lilly's TuneLab platform.

(Source: thepharmaletter.com)

Segments Covered in the Report

By Drug Type

- Small Molecule

- Large Molecule

By End User

- Pharmaceutical Companies

- CROs

- Others

By Technology

- High Throughput Screening

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- Other Technologies

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting