List of Contents

What is the Supply Chain Analytics Market Size?

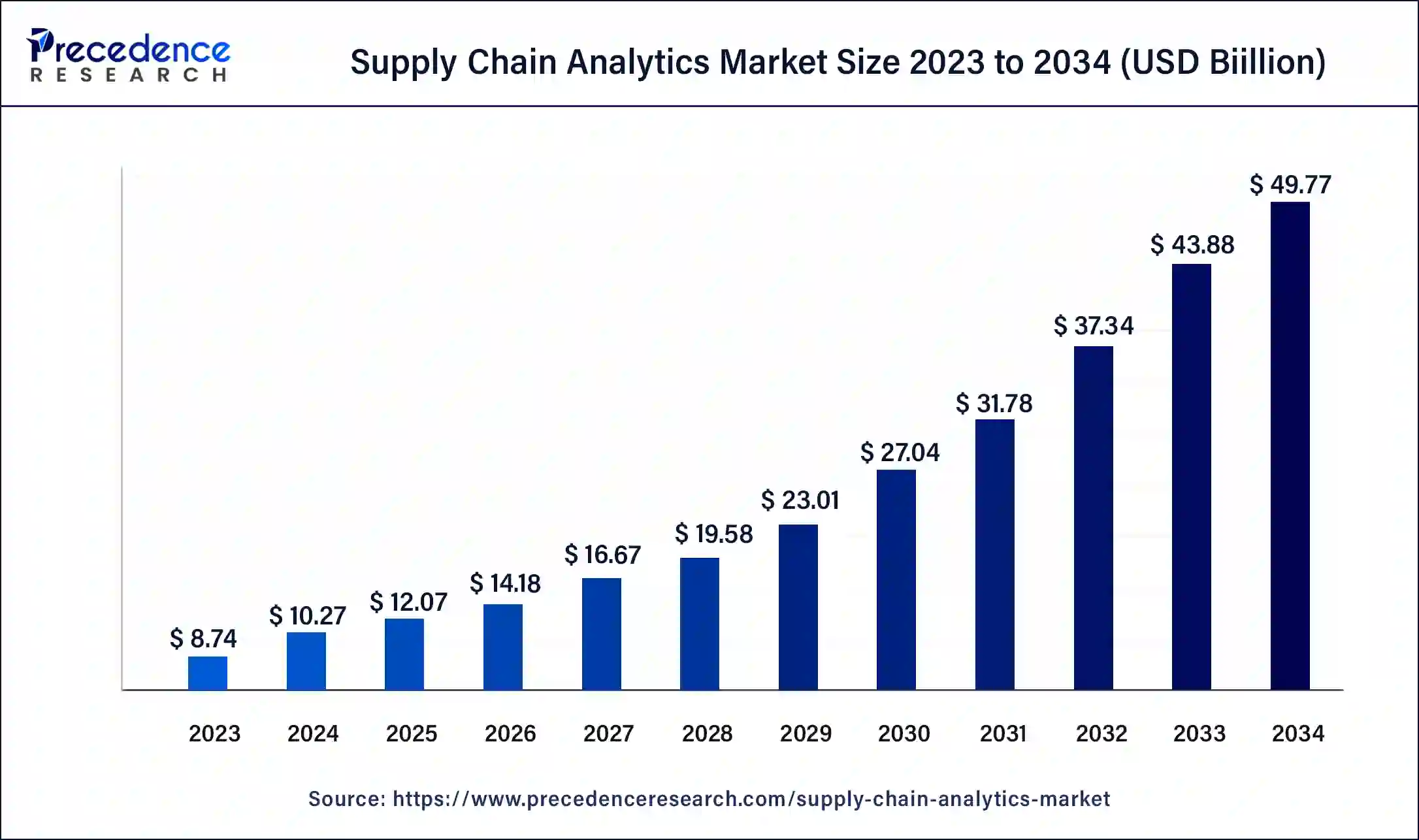

The global supply chain analytics market size is accounted at USD 12.07 billion in 2025 and is predicted to increase from USD 14.18 billion in 2026 to approximately USD 49.77 billion by 2034 with soild a CAGR of 17.51% from 2024 to 2034.

Supply Chain Analytics Market Key Takeaways

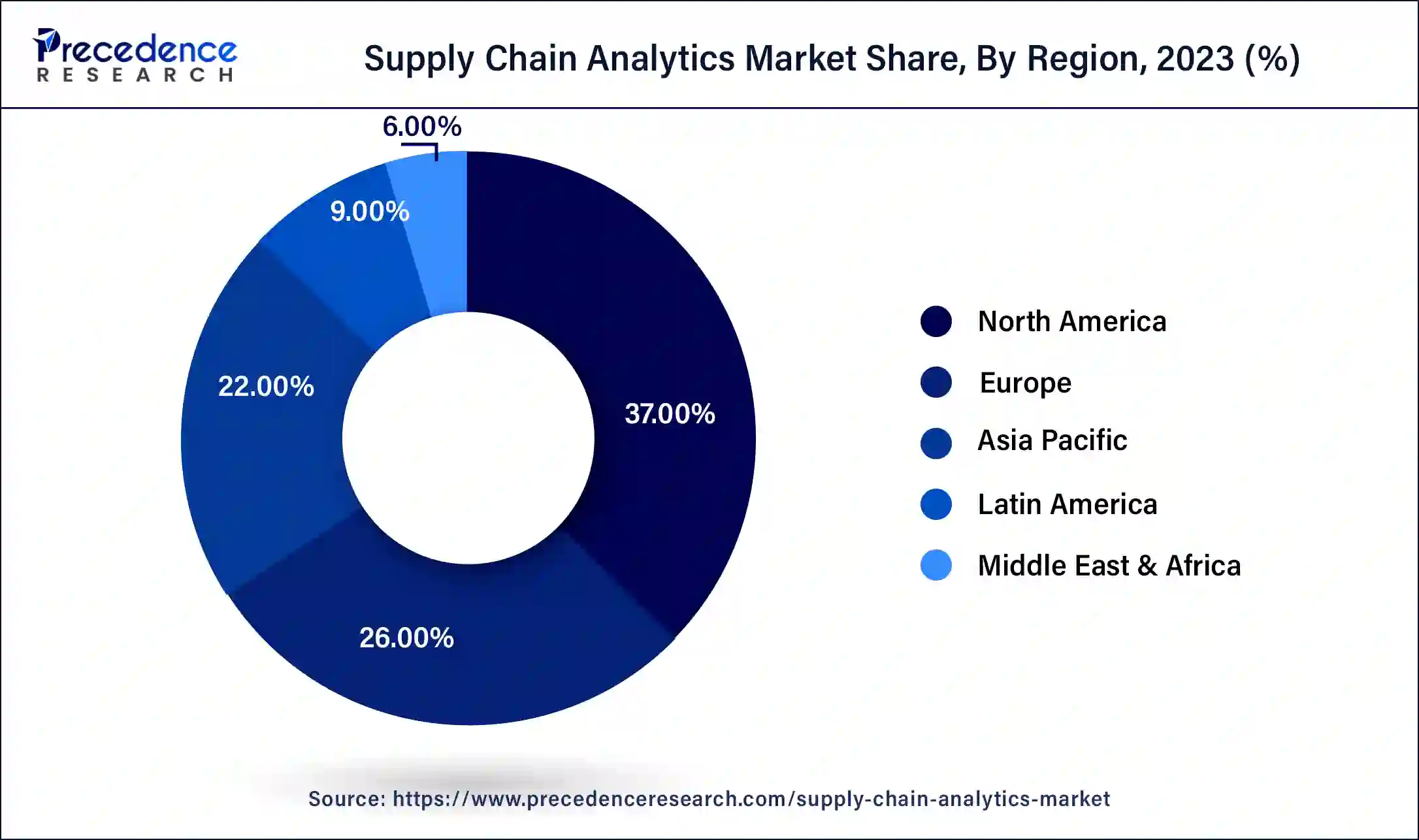

- North America has generated more than 37% of revenue share in 2024.

- Asia Pacific region is expected to expand at the fastest CAGR between 2025 and 2034.

- By Solution, the sales and operations segments held the largest market share of over 26% in 2024.

- By Service, the professional segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By Deployment, the cloud segment is predicted to grow the greatest CAGR from 2025 to 2034.

- By Enterprise Size, the large-scale enterprise segment is predicted to dominate the global market between 2025 and 2034.

- By End-use, the manufacturing segment held the maximum revenue share in 2024.

Market Overview

The global supply chain is useful for the maintenance and development of the future economy, it is useful for the day-to-day basic necessities like food and fuel to luxurious goods, supply chain analytics used data analytics to enhance and support the supply chain management. Due to the large and complex organizational type supply chain maintains the big data of information to understand the requirement understanding trends and efficiencies and insightful development.

It can be helpful in the maintenance, operations, and optimization of the supply chain. The growth of the e-commerce industries will help to drive the supply chain market and due to the higher demand and inventory, the supply chain analytics market will grow significantly.

Supply Chain Analytics Market Outlook

- Industry Growth Overview: Between 2024 and 2034, the supply chain analytics market is projected to grow robustly, driven by rising enterprise demand for data-driven decision-making, real-time visibility across multimodal networks, and cost and inventory optimization. The expanding manufacturing sector, logistics modernization, and the rapid rise of e-commerce are encouraging a shift from reactive supply chain management to proactive, network-wide analytics, reshaping the competitive and investment landscape.

- Technology and Innovation Trends:Analytics in the supply chain domain is undergoing a transformation, with organizations moving beyond descriptive dashboards toward predictive and prescriptive models. Artificial Intelligence (AI), machine learning (ML), and large language model (LLM) tools now enable anomaly detection, multi-tier risk modeling, and scenario simulation across complex global networks. Additionally, cloud deployment, edge data capture through IoT sensors, and hybrid data architectures are lowering barriers to entry, allowing SMEs to access advanced analytics previously available only to large enterprises.

- Global Expansion:Supply-chain analytics vendors and service providers are expanding geographically to align with regional regulations and leverage local digital infrastructure. Rising manufacturing capacity and enhanced digital networks are driving demand for analytics solutions, prompting vendors to establish regional hubs or form strategic partnerships. Modernization of outdated logistics networks presents a key opportunity in Latin America, Eastern Europe, and Africa, where analytics can deliver significant cost reductions and improved supply chain visibility.

- Major Investors:Investors, including private equity, venture capital, and strategic technology funds, are increasingly entering the supply-chain analytics space due to its high growth potential, strong technical barriers, and recurring subscription revenue models. Niche analytics startups, focusing on visibility platforms, predictive demand modules, and multi-tier risk forecasting, are securing significant funding, signaling the maturation of the ecosystem. The recurring-revenue nature of cloud-based analytics and service-oriented deployment further attracts investors by offering higher lifetime value and predictable returns.

- Startup Ecosystem:The supply-chain analytics startup ecosystem is rapidly maturing, particularly in AI-driven demand forecasting, supply-chain visibility, supplier risk scoring, and real-time optimization. Cloud-native analytics platforms and applications are attracting numerous venture-backed companies, designed for agile deployment across manufacturing, retail, consumer goods, and logistics sectors. Furthermore, low barriers to entry and a high-value proposition, coupled with growing market demand, are fostering a highly innovative environment.

Supply Chain Analytics Market Growth

The supply chain analytics used for businesses can effectively be planning the research and development, manufacturing, sourcing, and supply chain for the product and demand in the market. Supply chain analytics is used for the range of data provided by the supply chain. The supply chain is used for the business to analyze its operation, sourcing, manufacturing, waste minimization, forecasting, and data synthesis. Medium and large-scale companies will be the highest end-user of the supply chain analytics market due to their large-scale operations and to effectively compete with the market player in the forecast period.

Supply chain analytics enhance the operations and decision-making capacity of the enterprise by giving them a high-quality data picture by use of supply chain analytics. Supply chain analytics increase the demand in several manufacturing industries to increase productivity and give real-time data across the value chain or the changes made in any production process and changes in real-time data in any region.

Additionally, the rise in the demand of the consumer for better delivery of the product and in-time delivery will result in the growth in demand of the supply chain analytics market. Implementing supply chain analytics in the organization will provide highly efficient productivity, improve quality, and profitability increase in the market growth by analyzing the insights of the market so the manufacturer can take the data-driven decision to improve the profitability of the organization.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 17.09% |

| Market Size in 2025 | USD 12.07 Billion |

| Market Size in 2026 | USD 14.18 Billion |

| Market Size by 2034 | USD 49.77 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Solution, Service, Deployment, Enterprise Size, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rapidly growing adoption in manufacturing industries

The supply chain analytics market can be driven by the high adoption of the service in various manufacturing industries and organizations for better decision-making processes. Supply chain analytics provide better and more efficient supply chain management by delivering the real-time data of the organization according to the current requirement of the consumers from the organization. It reduced the manufacturing cost of the product and reduced the time of production. As supply chain analytics deals with the planning of product material, sourcing, production, and distribution hence it is useful for planning these factors and increasing the profitability of the manufacturer.

In the field of supply chain analytics, supply chain analysts aforementioned the manufacturer's historical sale of that specific product and predict when the demand for the product will increase or decrease that is called demand forecasting, due to the demand forecasting process the manufacturer is known as the future events and analyze the market growth. All these factors would drive the higher demand for the supply chain analytics market in the organization.

Restraints

Uncertainty in data and future prediction

While there are many benefits to supply chain analytics like it collects data forecasting for the profitability of the business, giving solutions to the supply chain management, etc. but there are some limitations in supply chain analytics though the data is streamlined according to the analytics sometimes it is hard to humans to understand it. Another problem with supply chain analytics is that the organization can not only rely on the data collected by the supply chain analytics for-profit and decision-making process, but sometimes data is of low quality and hamper the decision-making and growth of the organization.

Opportunities

The deployment of artificial intelligence in supply chain analytics

Artificial Intelligence is getting abundant popularity over the years. In modern supply chain analytics, AI is one of the prominent factors for better service and increasing the profitability of the organization. The AI supply chain analytics works with a smart machine that can solve the task of problem-solving in several departments of the organization. Smart industry manufacturing is fully automated and works by the IIOT (Industrial Internet of Things) can operate the overall supply chain without and manual operating system. AI which is used by the organization will be more efficient in machine-made data flowing out of IoT devices. It has better connectivity for the effective decision-making process.

Segment Insights

Solutions Insights

Sales and Operations segments held the largest market share in 2024. The growth of the sales and operation segment is attributed to the increase in the utilization of resources and cost consideration by multiple industries. Sales and operation process works effectively when the small number of outcomes are combined with the method of solving the issues such as process roles, operational issues, and roles and responsibilities.

The logistics analytics segment will increase significantly in the supply chain analytics market during the forecast period. Logistics analytics solution works with the transportation network for the predicted market demand of the service or product.

The planning and procurement segment is expected to rise in the anticipated timeframe. The increase in the planning and procurement segment is attributed to supply chain planning includes future data forecasting for the cost, production, and manufacturing for better logistics operations.

Service Insights

The professional service-type segment is expected to increase in the supply chain analytics market in the forecast period. The professional service works with the prevention of data loss or data theft, professional service ensures the new technology is compatible with the previous services in the department for effective workflow.

The support and maintenance segment is expected to register significant growth in the anticipated period. Support and maintenance ensure the smooth and effective flow of the supply chain analytics in the organization. It understands the technicalities of software and maintenance of the analytics during the breakdown. It is one of the most important factors for the supply chain analytics market.

Deployment Insights

The cloud segment is expected to show the fastest growth during the forecast period. The technological adoption in the organization and the large-scale adoption of IoT devices in the organization will lead the OEM consumers, depending on the cloud-based platform. Cloud-based platforms increase production and manufacturing customization over large and medium-scale organizations.

Enterprise Insights

The Large-Scale enterprise segment will dominate the supply chain market in the forecast period. The rising need for automation and monitoring of resources and enhancing the decision-making process, especially in large-scale enterprises, will drive the large-scale enterprise segment over the anticipated time period.

The small and medium-scale enterprises segment will likely show a significant increase during the predicted period. The deployment of information technology (IT) in supply chain management for small and medium-scale enterprises will fuel the segment's growth in the upcoming period.

End-User Insights

The manufacturing segment held the largest share of the market in 2024; the demand for supply chain analytics in manufacturing units for data management is fueling the segment's growth. Manufacturing units require supply chain analytics for real-time data management and to improve performance for timely production and distribution. The rising focus on smart supply chains from manufacturing companies is expected to boost the segment's growth during the forecast period.

The retail and consumer goods segment is expected to witness promising growth during the forecast period. The rapidly growing e-commerce sector is expected to grow the demand for supply chain analytics in the retail industry. E-commerce and retail businesses require supply chain analytics to get visibility across production, warehousing, and distribution networks. Furthermore, the rising focus on enhanced customer relationships and scaling omnichannel practices in retail and consumer goods industries will fuel the demand for supply chain analytics by propelling the segment's growth.

Regional Insights

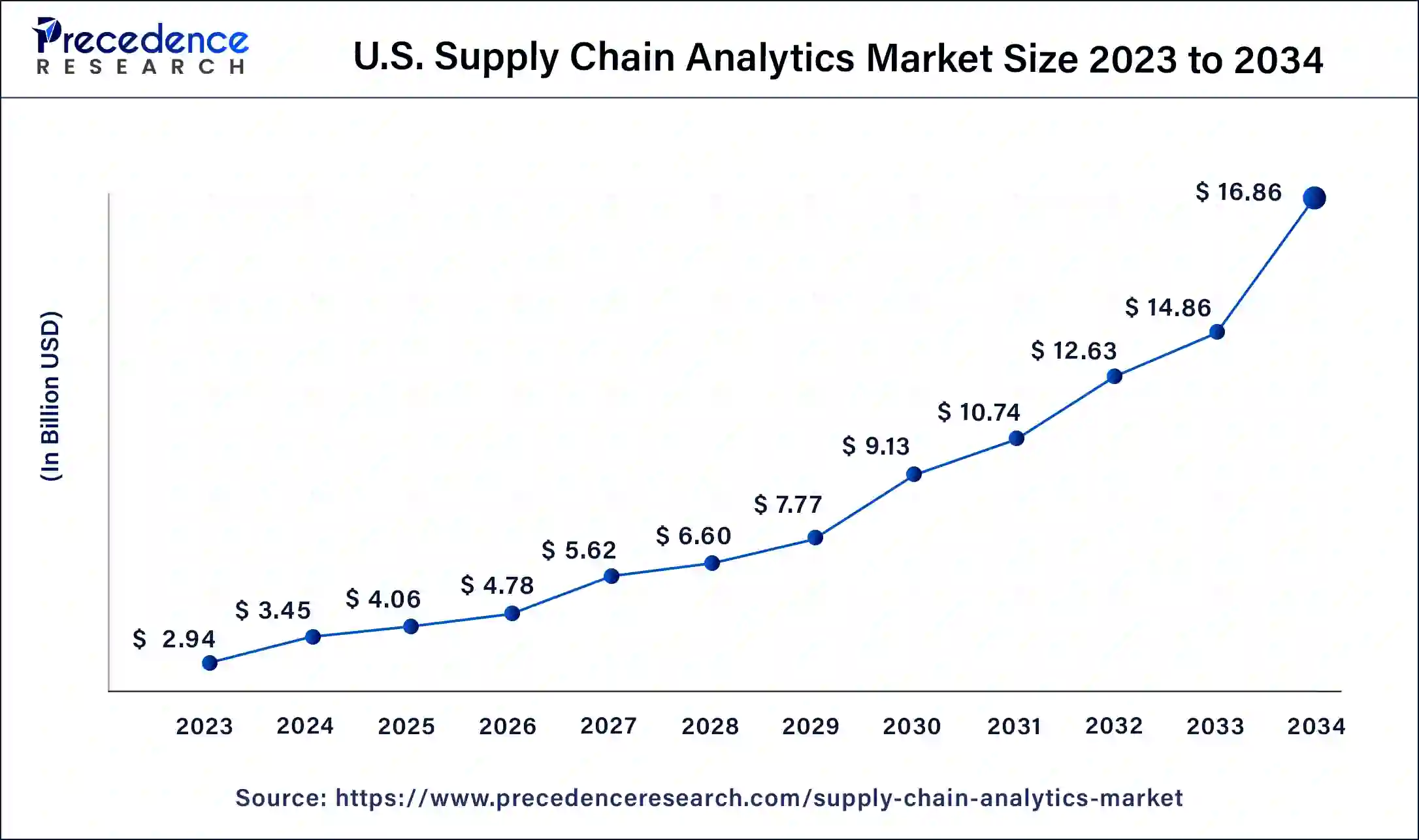

U.S. Supply Chain Analytics Market Size and Growth 2025 to 2034

The U.S. supply chain analytics market size is valued at USD 4.06 billion in 2025 and is expected to be worth around USD 16.86 billion by 2034 at a remarkable CAGR of 17.19% from 2025 to 2034.

North America held the largest share of the supply chain analytics market in 2024; the region is expected to sustain its dominance during the forecast period. The rising utilization of supply chain-related services for profitability and improvement purposes is observed as a significant factor in supporting the market's development throughout the predicted timeframe. Infrastructural development, rapid adoption of advanced services, and the presence of major key players in the region are a few other factors to fuel the market's growth in the upcoming period.

Moreover, the rising demand for real-time insights and inventory from multiple organizations is propelling the market's growth. In addition, the increasing investments in start-ups that require data analytics services with minimal IT investments will supplement the market's growth in the region. The market's growth is driven by the penetration of data analytics services in the retail sector of North America.

U.S. Supply Chain Analytics Market Analysis

The U.S. is likely to lead North America's market because of the widespread use of advanced analytics in manufacturing, retail, and logistics sectors. Large enterprises are expected to invest heavily in predictive and prescriptive analytics to optimize inventory and strengthen supply chain resilience. The markets are expected to grow due to increasing complexity in global trade and the rising demand for real-time supply-chain visibility.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is observed as the fastest-growing region for the supply chain analytics market.The rise in the use of supply chain management services for business purposes, along with improvisation in the industrial infrastructure, is considered a driving factor for the market's growth in the region. Technological advancement and increased expenditure on small and medium-scale organizations in this region will drive the development of the supply chain analytics market in the Asia Pacific. Countries including China, India, and Japan are considered to be the most significant contributors to the market's growth in the region.

With the rising industrialization, multiple businesses in the region are focusing on the improvement of the supply chain network between suppliers, companies, and end-users. Additionally, the booming e-commerce industry in the region is another factor boosting the growth of the market during the forecast period.

China Supply Chain Analytics Market Analysis

China is a major contributor to the market in Asia Pacific due to rapid industrialization, expanding e-commerce, and large-scale logistics networks. Enterprises in China are increasingly implementing analytics solutions to optimize inventory, forecast demand, and achieve real-time supply chain visibility. Government efforts supporting intelligent production, digitalization, and industrial robots are also likely to accelerate market growth.

What Makes Europe a Significantly Growing Area in the Market?

During the forecast period, Europe is expected to grow at a significant rate. The market growth in Europe is attributed to the rising technological innovations, increase in the demand for supply chain management, and expansion of end-users such as growing e-commerce businesses. Moreover, Europe's well-established and advanced healthcare sector shows an enormous demand for supply chain analytics and data management services to offer and manage electronic health records. This factor fuels the market's growth in the region.

Germany Supply Chain Analytics Market Analysis

Germany leads the European supply chain analytics market due to its strong manufacturing sector and focus on Industry 4.0 adoption. German companies are implementing analytics solutions for predictive maintenance, production optimization, and supply chain efficiency. The rise in sustainability demands, emission restrictions, and the increasing popularity of the circular economy are likely to encourage firms to use analytics for traceability and compliance. Trade within the EU is expected to require real-time monitoring and risk management.

What Potentiates the Growth of the Supply Chain Analytics Market in Latin America?

Latin America is projected to see moderate growth in the near future as companies modernize outdated supply chains and adopt digital solutions to improve efficiency. Retail and manufacturing firms in Brazil, Mexico, and Argentina are investing in analytics tools to streamline their operations. Brazil is expected to lead Latin America's supply chain analytics market as companies modernize operations and adopt digital solutions to enhance efficiency. The adoption of predictive analytics helps businesses tackle logistics costs, trade-route complexities, and inventory challenges, supported by government initiatives in industry digitalization and infrastructure modernization.

How is the Opportunistic Rise of the Middle East and Africa in the Market?

The Middle East and Africa offer significant opportunities in the supply chain analytics market, driven by economic diversification, modernization of logistics hubs, and efforts to boost industrial productivity. Key markets like the UAE, Saudi Arabia, and South Africa are investing in analytics solutions to improve real-time monitoring, operational efficiency, and supply chain resilience, with e-commerce expansion further speeding up adoption.

UAE Supply Chain Analytics Market Analysis

The UAE is expected to lead the Middle East and Africa market because of its role as a regional logistics hub and its emphasis on economic diversification. It is likely that businesses adopt analytics solutions for real-time monitoring, improving operational efficiency, and strengthening supply-chain resilience. The rapid growth of e-commerce and industrial diversification programs are expected to drive demand and boost market expansion.

Supply Chain Analytics Market – Value Chain Analysis

Data Sourcing & Integration

The foundation of supply chain analytics lies in collecting, integrating, and cleansing data from multiple sources such as ERP systems, IoT devices, logistics networks, and supplier databases.

- Key Players: IBM, Genpact, Capgemini, Maersk, Kinaxis

Data Processing & Storage

Collected data is processed, normalized, and stored in cloud or on-premises data warehouses and data lakes to enable advanced analytics and reporting.

- Key Players: Birst, Inc., IBM, Capgemini, Manhattan Associates

Analytics & Modeling

Advanced analytics techniques, including AI, machine learning, predictive modeling, and optimization algorithms, are applied to extract insights, forecast demand, and optimize inventory and logistics.

- Key Players: Aera Technology, Kinaxis, JDA Software (Blue Yonder), IBM

Decision Support & Visualization

Insights are delivered through dashboards, reports, and real-time monitoring tools to support decision-making, scenario planning, and risk management across the supply chain.

- Key Players: Aera Technology, Birst, Inc., Manhattan Associates, Genpact

Implementation & Continuous Optimization

Recommendations from analytics are implemented across procurement, manufacturing, distribution, and logistics operations, followed by continuous monitoring and fine-tuning to improve efficiency, reduce costs, and enhance resilience.

- Key Players: Capgemini, IBM, Maersk, Lockheed Martin

Supply Chain Analytics MarketCompanies

- Aera Technology (U.S.): Provides AI-powered supply chain decision-making platforms that enable real-time insights and predictive analytics for enterprise operations.

- Birst, Inc. (U.S.):Offers cloud-based analytics solutions that integrate business intelligence and networked analytics for end-to-end supply chain visibility.

- Capgemini SA (France):Delivers consulting and technology services with advanced supply chain analytics solutions, leveraging AI and process optimization for global clients.

- Genpact Limited:Provides data-driven supply chain transformation services, including predictive analytics and process automation for operational efficiency.

- International Business Machines Corporation (IBM):Offers enterprise-grade supply chain analytics platforms combining AI, IoT, and blockchain for predictive insights and resilience.

- JDA Software Group, Inc. (now Blue Yonder): Specializes in supply chain planning and analytics solutions, enabling demand forecasting, inventory optimization, and fulfillment planning.

- Kinaxis (Canada): Delivers cloud-based supply chain management and analytics solutions with rapid scenario modeling and real-time planning capabilities.

- Lockheed Martin Corporation (U.S.):Provides advanced logistics and supply chain analytics solutions for aerospace, defense, and complex global operations.

- Maersk Group (Denmark): Integrates digital supply chain analytics into its shipping and logistics operations to enhance visibility, predictive insights, and operational efficiency.

- Manhattan Associates, Inc. (U.S.): Offers supply chain software solutions, including warehouse, transportation, and omnichannel analytics for optimized inventory and logistics management.

Recent Developments

- In May 2023, At Gartner Supply Chain Symposium 2023, Everstream Analytics, the company working in global supply chain insights and risk insights announced the launch of Everstream Connect. The new platform works with the end-to-end supply chain risk management platform and connects to deliver intelligent mapping and visibility into logistics network flow.

- In April 2023, the company named Project 44 works in the field of supply chain visibility platforms announced the launch of GPT, a brand new AI technology for the company that put the power of generative AI into the hands of the industry.

- In April 2023, National Institute of Industrial Engineering (NITIE) announced its collaboration with TimePRO to launch its post-graduation executive program in digital supply chain management. It will help the professional to build a digitally enabled supply chain network.

- In May 2023, powered by eBPF Technology, Aqua Security, the pioneer in cloud-native security announced pipeline integrity scanning and preventing software supply chain attacks and assuring CI/CD pipeline integrity.

Segments Covered in the Report

By Solution

- Logistics Analytics

- Manufacturing Analytics

- Planning & Procurement

- Sales & Operations Analytics

- Visualization & Reporting

By Service

- Professional

- Support & Maintenance

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprise

- Small & Medium Enterprises

By End-use

- Retail & Consumer Goods

- Healthcare

- Manufacturing

- Transportation

- Aerospace & Defense

- High Technology Products

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client