What is the 3D Printing Materials Market Size?

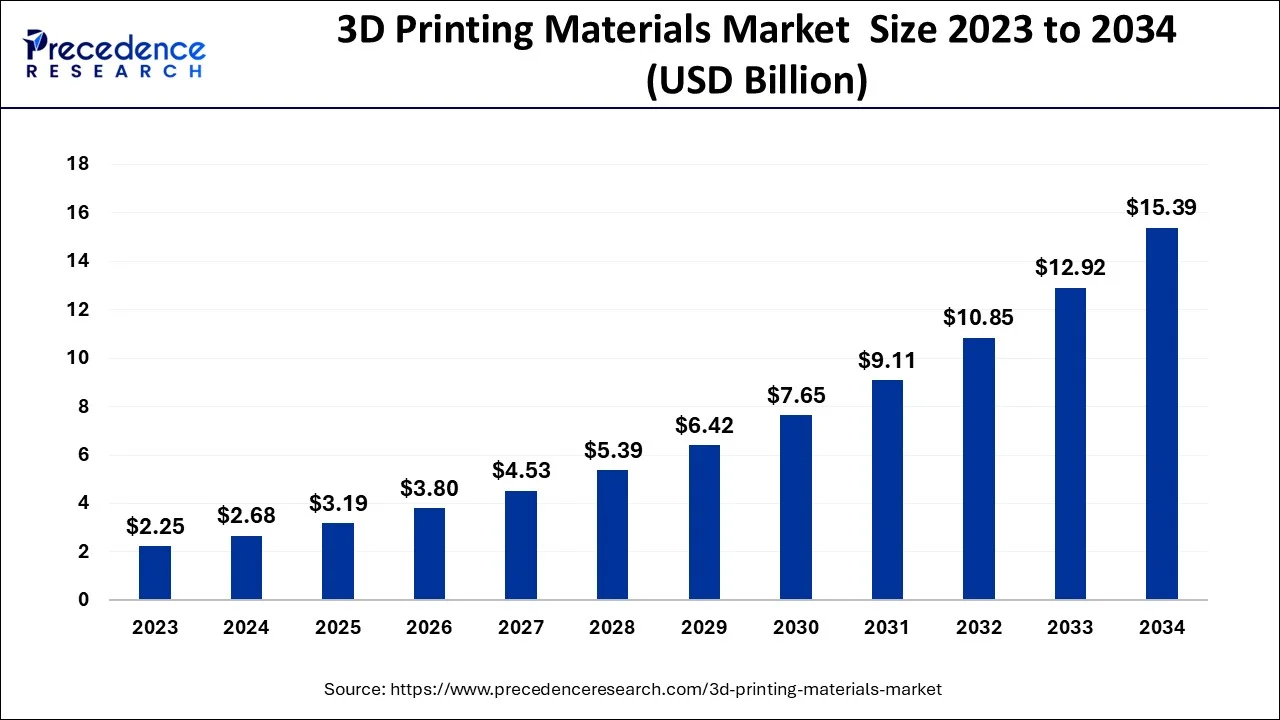

The global 3D printing materials market size is calculated at USD 3.19 billion in 2025 and is predicted to increase from USD 3.80 billion in 2026 to approximately USD 17.59 billion by 2035, expanding at a CAGR of 18.36% from 2026 to 2035.

3D Printing Materials Market Key Takeaways

- In terms of revenue, the 3D printing materials market is valued at $3.19 billion in 2025.

- It is projected to reach $17.59 billion by 2035.

- The market is expected to grow at a CAGR of 18.36% from 2026 to 2035.

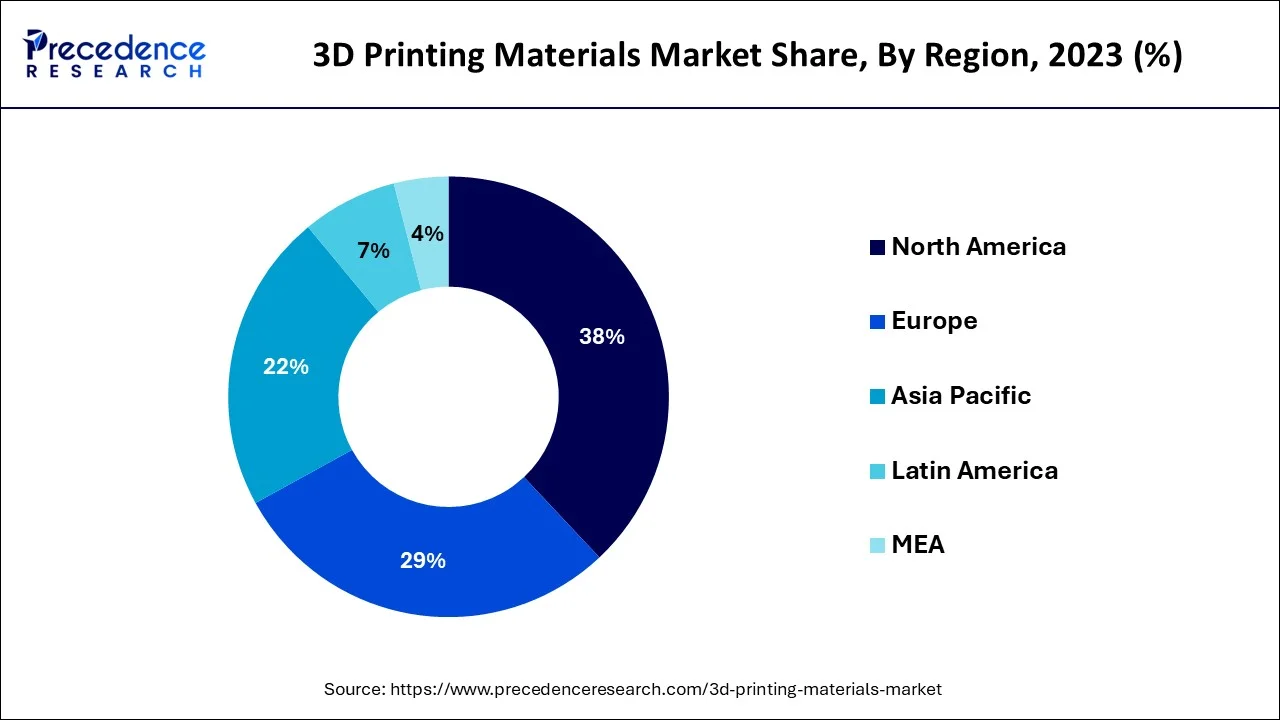

- North America dominated the global market with the largest market share of 38% in 2025.

- By type, the polymers segment accounted for 54% of revenue share in 2025.

- By application, the aerospace and defense segment held the highest revenue share of over 28% in 2025.

Market Overview

The digital file that specifies the intended object's configuration and the materials to be utilized serves as a link between the finished thing and the 3D printers. The materials utilized in 3D printing, also known as 3D printing materials, are thoroughly examined in this research. These materials are utilized in three different forms, including powder, filament, and liquid, with the latter being used extensively.

The market for 3D printing materials is also being described in terms of current trends and possible future expansion. Among the materials now employed in 3D printing include polymers (plastics), metals, and ceramics. The most widely utilized printing materials among them are polymers, which are anticipated to continue dominating material demand over the projection period. This is due to the numerous industrial and consumer goods uses for plastics in the market for 3D printing materials. Personal protective equipment (PPE), isolation wards, and medical equipment are just a few of the requirements for which on-demand solutions may be developed using 3D printing.

Due to the COVID-19 outbreak's effects on the supply chain, there was a scarcity of PPE, which exposed front-line healthcare workers to risk and put a strain on the world's healthcare system. Therefore, growing demand for 3D printing materials & tools to fabricate various items, particularly for medical uses, has been beneficial for market expansion during the pandemic.

How Is Artificial Intelligence Impacting 3D Printing Materials?

Artificial Intelligence (AI) is helping to reshape 3D printing through prediction and optimization of material properties, and improving the accuracy of the design. AI can use machine learning algorithms to analyze data from multiple elements while 3D printing to evaluate potential performance – helping to reduce wasted materials and improve mechanical performance. AI would also enable researchers to begin using new composite materials that offer improved strength, flexibility or thermal resistance through predictive modeling that allows narrow error margins effectively at real time during the printing process.

This union of decision making through advanced software like AI and 3D printing can enhance the rate of innovation in various advanced industries including aerospace and biomedical. As data indicates, there was a decrease of 25% in defect rates when AI optimized material gathering and designed accuracy was reported, meaning AI technology may help broaden innovation pathways. It is likely AI application for materials use will continue to rise as this technology matures, helping to develop more intelligent, sustainable, and customized 3D printing applications.

3D Printing Materials Market Growth Factors

Numerous industrial processes, notably in the manufacturing industry, have been changed by 3D printing or additive manufacturing. The technology is fostering innovation and the creation of breakthrough technologies thanks to its unmatched capacity to increase speed-to-market, save costs, and tailor unique parts. The market for 3D printing materials & equipment is anticipated to increase over the projected period because to the rising range of applications for 3D printing across several sectors.

By depositing molten material selectively layer by layer in a predetermined pattern, fused deposition modeling (FDM), also known as fused filament fabrication (FFF), builds components. It makes use of polymers that are available in the form of thermoplastic polymers. FDM would increase product acceptance since it is affordable, portable, less complicated, has an ergonomic and compact design, and works with a variety of materials.

Market Outlook

- Industry Growth Overview: The 3D printing materials market is poised for rapid growth from 2025 to 2034. This is mainly due to the increasing adoption in aerospace, medical devices, defense, and industrial sensing sectors. Advancements in additive manufacturing technologies, demand for low-volume, high-value customized parts, and the integration of printed electronics with conventional microelectronics also support market expansion.

- Major Investors: Major investors in the market include venture capital firms, private equity funds, and large industrial conglomerates, providing funding for innovation, technology development, and market expansion. Their investments support the development of advanced materials, next-generation printing equipment, and integration solutions, enabling broader adoption across aerospace, medical, defense, and industrial sectors.

- Sustainability Trend: The sustainability trend is driving the market toward eco-friendly and recyclable materials, reducing waste and energy consumption in additive manufacturing processes. Additionally, companies are adopting sustainable production practices and bio-based polymers, promoting circular economy models and enhancing the environmental profile of printed components.

- Global Expansion: The market is expanding globally because more industries like aerospace, automotive, and healthcare are adopting additive manufacturing to produce complex, lightweight, and customized parts that improve efficiency and reduce waste, boosting demand for a wider range of specialized polymers, metals, and resins. Additionally, ongoing material innovations and the shift toward localized, on‑demand production are driving broader use of these materials across applications, further fueling market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 17.59 Billion |

| Market Size in 2025 | USD 3.19 Billion |

| Market Size in 2026 | USD 3.80 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 18.36% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Foam, Type, Application, End User and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Market Drivers

- Growing Adoption of 3D Printing Technology: In the near future, the growing transition from traditional printing to 3D printing technology will support the market's robust expansion. Reduced waste, more complicated designs, cost efficiency, and improved design modification are just a few benefits of 3D printing. Additionally, producers from a variety of industries have been drawn in by the growing knowledge of the 3D printing technology's undeniable advantages. The technique is being used in the food, footwear, music, jewelry, and medical industries to create new items more cheaply. This will increase the market share for 3D printing materials in the upcoming years. In addition, the market will expand quickly throughout the projection period due to the increasing use of 3D printed components in military, automotive, and aerospace applications. However, the manufacturing practicality and low cost of 3D printing allow designers to produce complicated pieces. For instance, titanium parts used in the aerospace sector are frequently produced using 3D printing because of its excellent mechanical qualities and high degree of dimensional precision.

- Positive outlook of electronics sector - The development of consumer goods and electronics can benefit greatly from 3D printing. It is changing how electronics are developed through prototyping. One of its key benefits is that it allows businesses to internally prototype electrical devices and PCBs, which reduces the requirement for external PCB fabrication services. The design flexibility in the electronics industry is increased by the usage of 3D printers and materials. With the use of 3D materials and tools, a number of consumer items are being produced, including eyeglasses, a carbon fiber bike, mascara brushes, helmet liners, insoles, and eyewear. The ability to make any desired product form is made possible by the manufacturers' high flexibility and improved CAD design tools. For prototype, 3D printers provide advantages in terms of materials and process.

Market Challenges

- High Cost: The 3D printing industry's expansion may be hampered by the high costs involved with the technology. The equipment needed for 3D printing has a significant initial investment cost. These machines are inappropriate for small batch manufacturing runs since they use 50 to 100 times more energy than injection molding when melting plastic with lasers or heat. In comparison to conventional production, the materials utilized in the automobile industrial grade 3D printers are highly expensive. Additionally, because 3D printers require specialized components and equipment as well as high voltage power sources, they are challenging to use and control.

Market Opportunities

Positive outlook of automotive production

- The market for 3D printing materials and equipment will develop in the future due to the optimistic prognosis for the automobile industry. Prototypes and finished components are produced using a variety of durable methods, including fused filament fabrication (FFF). In the automobile business, 3D printed scale models with a high level of detail, accuracy, and smoothness are frequently used to present ideas and designs for new cars.

- Rapid prototyping in the pre-manufacturing stage is made possible by the 3D printing materials and machinery. The materials are widely employed in the prototype of automotive and aerospace components. The technique has the benefit of lower costs and production viability while being extremely successful in producing complicated pieces.

Growing Demand for 3D Printing Materials in Healthcare

- The fastest-growing sector of the market for 3D printing materials in terms of volume is the healthcare sector. Medical items made using 3D printing include surgical instruments, prosthetics and implants, and tissue engineering tools. Additionally, 3D printing materials are useful in the medical sectors of orthopedics, dentistry, craniomaxillofacial, and other. Making goods that match the anatomy of the patient through additive manufacturing is really beneficial.

- Healthcare is one of the sectors with the most potential for additive manufacturing, and the COVID-19 pandemic scenario is no exception. Manufacturers are producing face shields, N95 masks, and other safety equipment to aid physicians, healthcare workers, and individuals in fending off the new coronavirus. Stratasys Inc., 3D Systems Corporation, a few start-up companies, and others are among the top producers. The US government spent 36.0 percent more on healthcare in 2020 than it did in 2019, the Center for Medical Care and Medical Services reports. These government programs are expected to raise the need for 3D printing supplies in the healthcare industry.

Segment Insights

Technology Insights

The EBM sector is anticipated to develop at the greatest CAGR over the projected period based on technology. The cost-effective manufacturing of metal components for high-end prototyping and small series productions, the quick adoption of technology to produce lightweight components, and the production of 3D printed turbine blades for jet engines are primarily responsible for the segment's explosive growth. The market for 3D printing materials is anticipated to be dominated by the fused deposition modeling (FDM) segment in 2023.

Foam Insights

The filaments sector is anticipated to experience the greatest CAGR throughout the projection period based on form. The usage of filaments in the production of props, jigs & fixtures, toys, assembly components, and educational models, together with their unique features and high melting temperatures, are primarily responsible for this market segment's rapid growth. The market for 3D printing materials is anticipated to be dominated by the powders segment in 2023.

Type Insights

Over the forecasted period, the category for ceramics and composites is expected to see the highest CAGR in terms of value growth. The ability of materials to be shaped into specific shapes utilizing traditional methods like as injection molding, die pressing, tape casting, and gel casting has spurred the expansion of the ceramics & composites industry.

Injection molding, tape casting, die pressing, and gel casting are some of these technologies. In 2023, the polymers industry is expected to rule the market for 3D printing materials.

End User Insights

In terms of volume, the market for 3D printing materials is being dominated by the healthcare sector. Through the use of 3D printing technology, a number of medical items are produced, including surgical instruments, prostheses and implants, and tissue engineering devices. Additionally, 3D printing materials are very beneficial for various medical applications, including orthopedic, dental, and craniomaxillofacial ones. Using additive manufacturing, it is possible to make medical equipment that are tailored to the anatomy of the patient. One of the most potential industries for additive manufacturing is healthcare, and the COVID-19 pandemic situation reflects this. Face shields, N95 masks, and other tools are being produced by businesses to help physicians, healthcare workers, and patients combat the new coronavirus. Face masks are being produced by well-known companies including Stratasys Inc., 3D Systems Corporation, and other startups.

Regional Insights

U.S. 3D Printing Materials Market Size and Growth 2026 to 2035

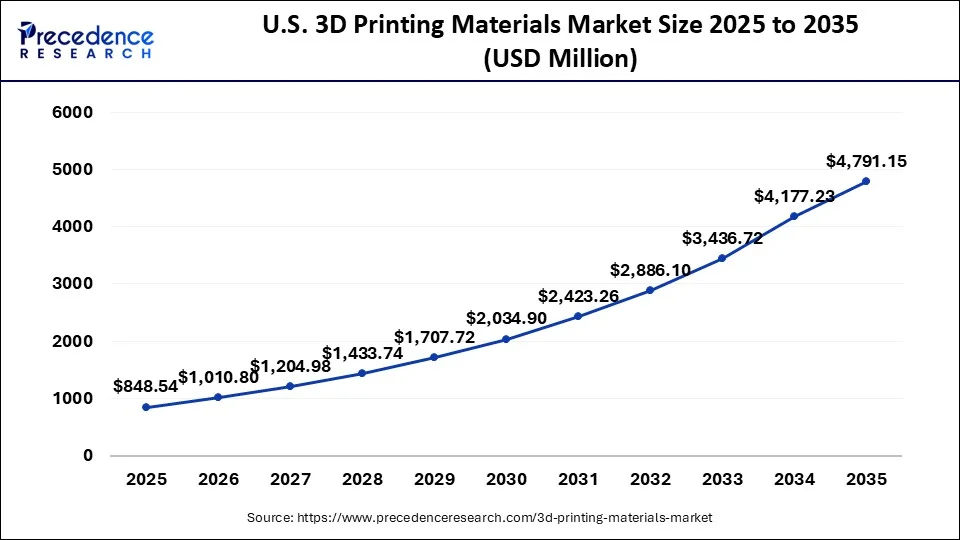

The U.S. 3D printing materials market 5ize was evaluated at USD 848.54 million in 2025 and is predicted to be worth around USD 4791.14 million by 2035, rising at a CAGR of 18.90% from 2026 to 2035.

By 2034, the market for 3D printing materials in North America would produce more than USD 1.4 billion. The market expansion in North America will be driven by favorable trends related to the medical and aerospace industries. There will be potential for growth as a result of the adoption of 3D printing across a variety of sectors and the expanded selection of materials. The American government's initiatives for the advancement of 3D printing, together with funding for research and development, will accelerate its uptake and increase the demand for 3D printing supplies and machinery in the area.

What Makes Asia Pacific the Fastest-Growing Region in the 3D Printing Materials Market?

Asia Pacific is the fastest-growing region in the market due to rapid industrialization and strong adoption of advanced manufacturing technologies in countries like China, Japan, and South Korea. The region's expanding automotive, aerospace, and healthcare sectors are increasingly adopting 3D printing for prototyping and production, driving demand for a range of materials, including metals and polymers. Government initiatives and investments to promote innovation and digital manufacturing further accelerate market growth. Additionally, the availability of cost-effective labor and manufacturing infrastructure supports large-scale production, making the region highly attractive for the adoption of 3D printing materials.

Why is Europe Considered a Notably Growing Area in the 3D Printing Materials Market?

Europe is expected to grow at a notable rate in the market because it has advanced manufacturing clusters and focuses on high-value, specialized applications like aerospace components and medical implants. The region's push for industrial digitization and product customization aligns well with additive manufacturing, while strong collaboration between design houses, material scientists, and SMEs enables smooth transitions from prototypes to production. Additionally, strict regulations and quality standards drive suppliers to ensure reliability and testing, building end-user trust and encouraging adoption of carefully validated, application-specific 3D printing solutions.

Germany is the leader, with a focus on precision manufacturing, industrial automation, and a robust supplier network that enables the development of equipment and materials for printed electronics. The Netherlands and Scandinavia are leaders in research on printed sensors, wearable interfaces, and the integration of electronics into the textile industry. Strong research and development ecosystems, along with collaboration between universities, research institutes, and manufacturing SMEs, accelerate material innovation. Additionally, strict quality standards and a reputation for precision engineering encourage adoption of reliable, high-performance 3D printing materials.

What Potentiates the Market in the Middle East & Africa?

The 3D printing materials market in the Middle East & Africa is driven by investments in smart infrastructure, energy monitoring, and localized manufacturing for remote or harsh environments. Reliance on technology transfer and partnerships with established international players helps the region build initial capabilities and expertise. Over time, the growth of local R&D hubs and targeted public funding is expected to accelerate adoption and strengthen regional manufacturing capabilities.

Gulf states like the UAE and Saudi Arabia are focusing on pilot projects in smart infrastructure and advanced manufacturing zones to test printed electronics for sensors and environmental monitoring. South Africa leads regional activity with strong university research and industrial collaborations, enabling testing of ruggedized printed devices for mining and energy applications, while other African countries prioritize low-cost, durable sensors for agriculture and supply-chain monitoring. Cross-border partnerships help bridge capability gaps by providing additional testbeds and expertise, laying the foundation for broader regional adoption in the future.

Why the 3D Printing Materials Market in Latin America is Growing?

The 3D printing materials market in Latin America is growing due to increasing adoption of additive manufacturing in industries like automotive, aerospace, and healthcare for prototyping and low-volume production. Investments in industrial digitization and the expansion of local manufacturing capabilities are driving demand for advanced polymers, metals, and composites. Additionally, collaborations with international technology providers and rising interest in research and development support innovation and material adoption across the region.

Brazil leads the market due to its strong network of research centers, industrial design studios, and pilot manufacturing initiatives that test and develop printed electronics for agriculture and healthcare. Increasing adoption of additive manufacturing in industries for prototyping, small-batch production, and customized solutions is driving demand for advanced polymers, metals, and composites. Additionally, government support, innovation-focused collaborations, and a skilled workforce help accelerate material development and regional market expansion.

3D Printing Materials Market Scope

- 3D Systems Corporation (US),

- Stratasys, Ltd. (US),

- Materialise NV (Belgium),

- Arkema SA (France),

- Evonik Industries AG (Germany),

- General Electric (US),

- The ExOne Company (US),

- Hoganas AB (Sweden)

- Royal DSM N.V. (Netherlands)

Recent Developments

- In May 2025, Vision Miner has announced continued profitability and the full-market release of its 22 IDEX industrial high-temperature 3D printer. Priced at USD 14,900, the 22 IDEX is designed for high-temperature polymer printing applications, including materials like PEEK, ULTEM, and carbon-fiber composites

(Source:engineering.com) - In May 2025, France-based 3D printing service Sculpteo has ramped up its material portfolio in recent months, first by launching a food-grade SLS material, PA12 Blue, and now by introducing a new polyamide material for HP's Multi Jet Fusion platform. The new material, PA12 S, is suitable for industrial applications and imparts a distinctly smooth quality to printed parts.

(Source: voxelmatters.com) - In May 2025, Polymaker launches two high-performance PLA filaments for extrusion 3D printing technologies. The HT-PLA material is capable of withstanding temperatures exceeding 130°C directly off the print bed, while HT-PLA-GF carries much the same capability with enhanced structural performance. (

Source: tctmagazine.com)

Segments covered in the report

By Technology

- Fused Deposition Modeling (FDM)

- Selective Laser Sintering (SLS)

- Stereolithography (SLA)

- Direct Metal Laser Sintering (DMLS)

- PolyJet

- Multi Jet Fusion

- Digital Light Processing (DLP)

- Binder Jetting

- Electron-beam Melting (EBM)

- Other Technologies

By Foam

- Powder

- Filament

- Liquid

By Type

- Polymers

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Photopolymers

- Nylon

- Others

- METALs

- Steel

- Titanium

- Aluminium

- Others

- Ceramic

- Silica Sand

- Glass

- Gypsum

- Others

- Others

- Laywood

- Paper

- Others

By Application

- Prototyping

- Manufacturing

- R&D

By End User

- Automotive

- Aerospace & defense

- Healthcare

- Consumer Goods

- Construction

- Others (Electronics, Education, Food, etc.)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content