What is the 3D Printing Plastics Market Size?

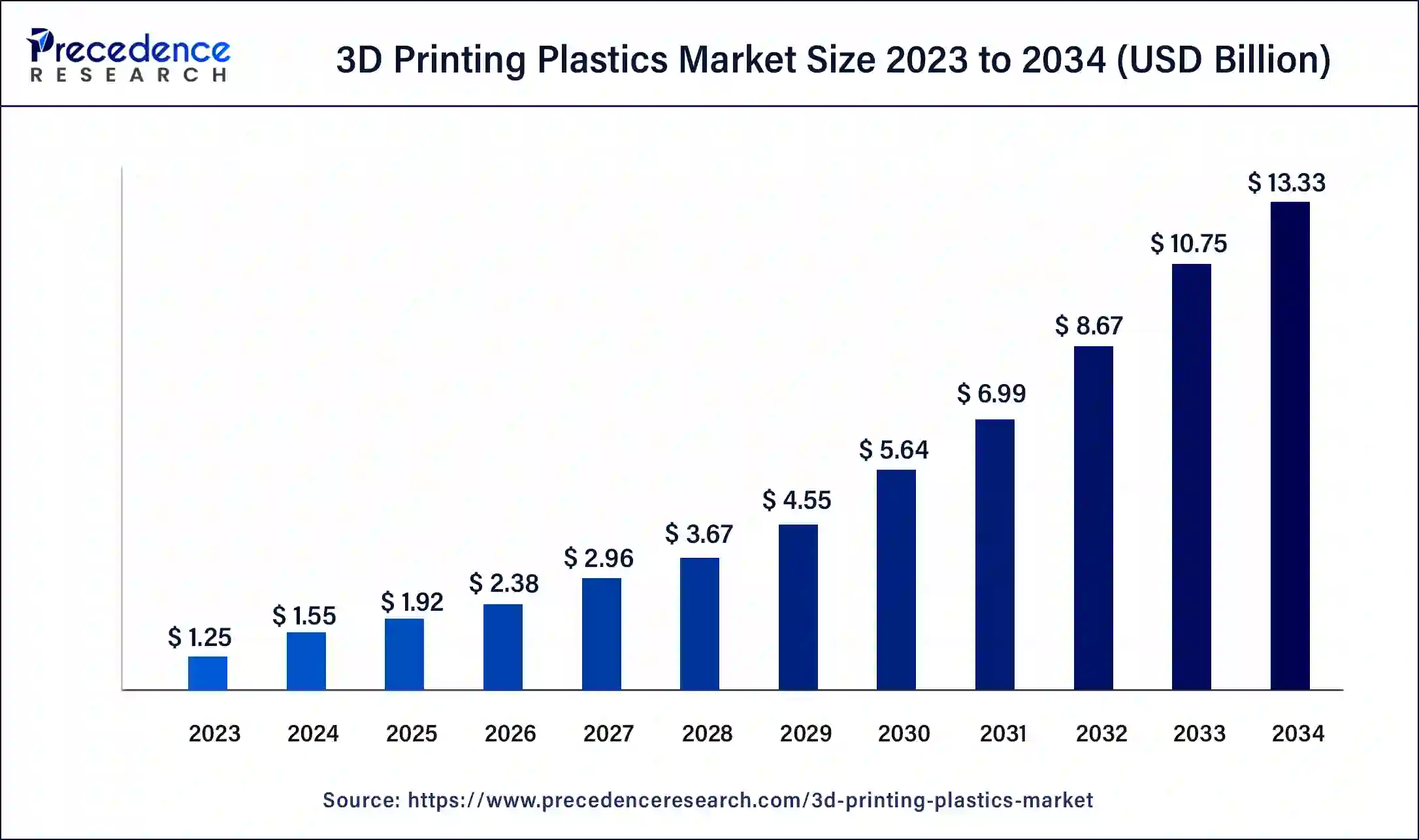

The global 3D printing plastics market size is accounted at USD 1.69 billion in 2025 and predicted to increase from USD 2.10 billion in 2026 to approximately USD 11.98 billion by 2034, growing at a CAGR of 24.01% over the forecast period 2025 to 2034. Several factors, such as technology improvement, cost reduction, rapid prototyping, design flexibility, and sustainable development in various sectors, fuel the growth of the 3D printing plastics market.

3D Printing Plastics Market Key Takeaways

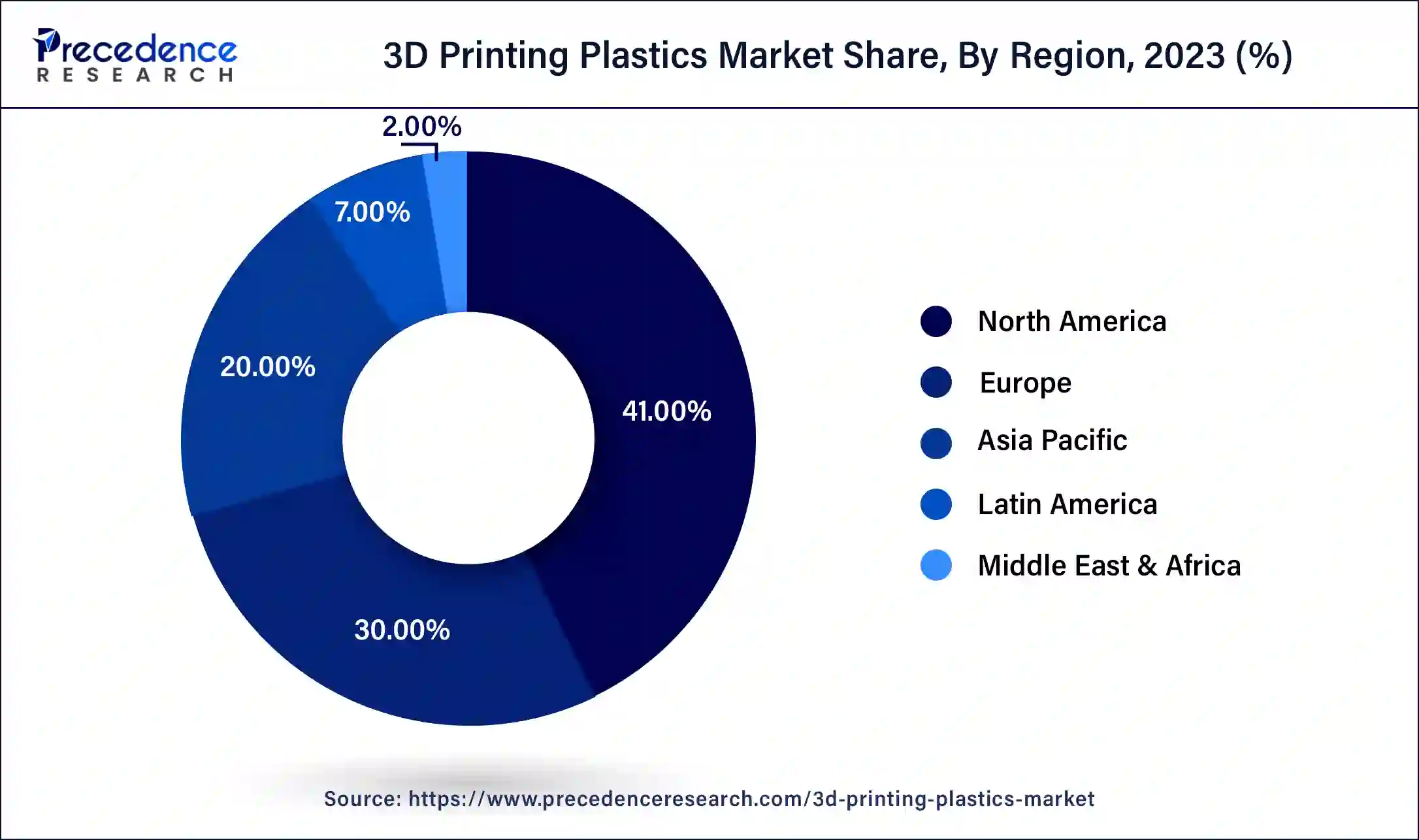

- North America led the global 3D printing plastics market with the biggest market share of 41% in 2024.

- Asia Pacific is anticipated to grow notably in the market during the forecast period.

- By type, the photopolymers segment accounted for the largest market share of 60% in 2024.

- By type, the polyamide/nylon segment is expected to witness significant growth in the market during the forecast period.

- By form, the filament segment contributed more than 72% of the market share in 2024.

- By form, the ink segment is expected to grow at the fastest rate in the market over the forecast period.

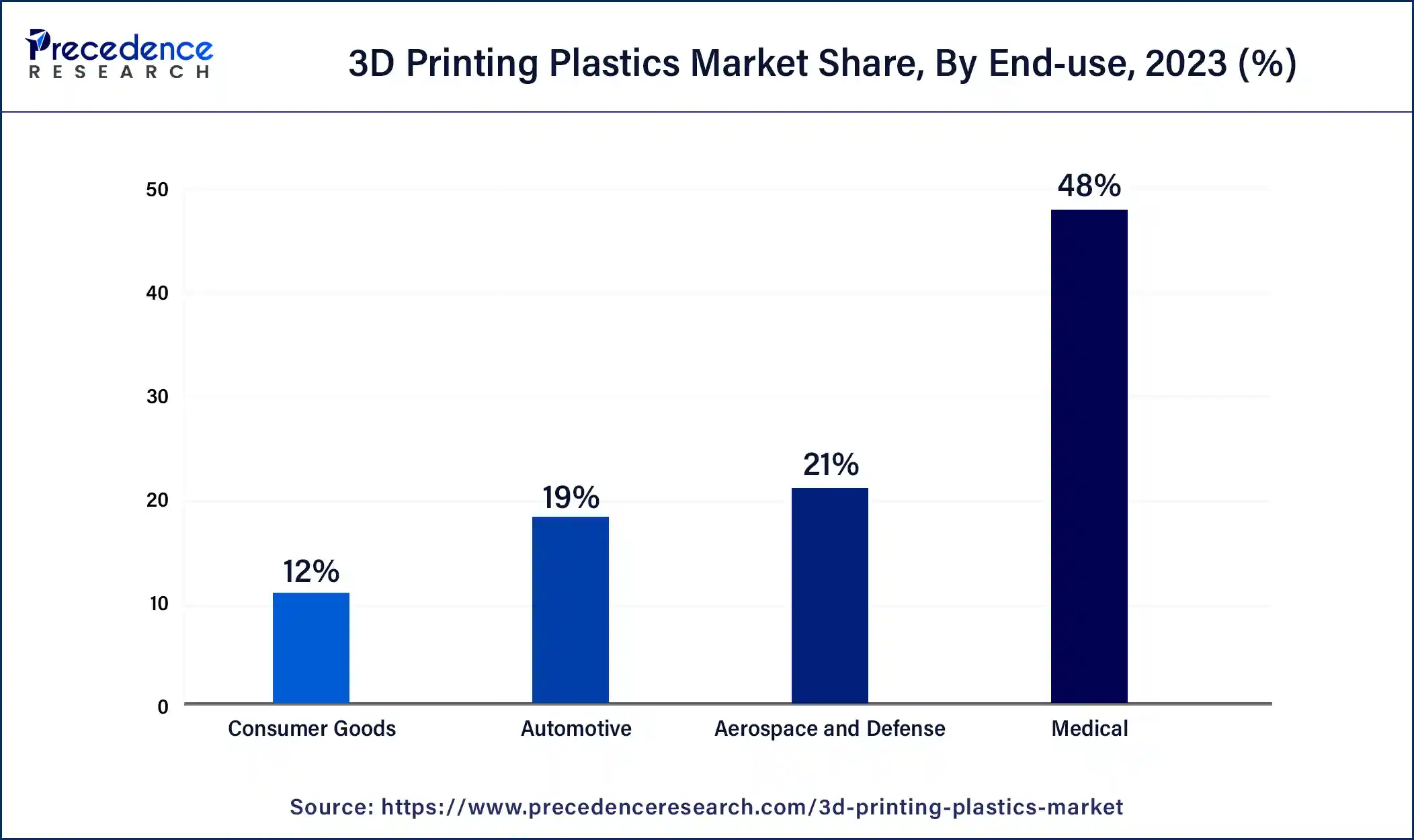

- By end-use, the medical segment generated the highest market share of 48% in 2024.

- By end-use, the aerospace & defense segment is anticipated to grow significantly in the market during the forecast period.

How is AI Changing the 3D Printing Plastics Market?

The AI-enhanced 3D printing plastics market is expected to expand at a strong pace due to its ability to integrate with artificial intelligence, which offers 3D printers greater control and accuracy. AI is transforming 3D printing by automating design processes and optimizing manufacturing operations. This includes utilizing AI to immediately generate proposals for certain designs in CAD software application sets, enhancing the speed and reducing the need for extensive engineering experience. Sophisticated AI is now built into many 3D printers to detect and respond to errors that occur in the printing process.

What are the Extensive Benefits of the 3D Printing Plastics?

3D printing or additive manufacturing is a process of making three-dimensional objects from a digital file. Plastic is the most common raw material for 3D printing. The benefit of using plastic is that it is a highly diverse material for 3D-printed products like toys, household fixtures, desk utensils, and vases. The properties of plastic, such as strength, smoothness, and flexibility, have also played a critical role in increasing the applications of plastic in 3D printing. It also makes the material a relatively cheaper raw material to be used for 3D printing for both businesses and customers.

Types of 3D printing technology

| Ink-jet Printing | It uses inkjet technology to selectively deposit liquid photopolymer materials layer-by-layer, which are cured with UV light. |

| Fused Deposition Modelling (FDM) | A plastic filament or metal wire is unwound from a coil and supplies material to an extrusion nozzle, which can turn on and off. |

| Stereolithography (SLA) | A laser is used to selectively cure a tank of liquid photopolymer resin layer by layer. |

| Selective Laser Sintering (SLS) | A high-power laser is used to fuse small particles of plastic, metal, ceramic, or glass powders into a mass representing the desired 3D shape. |

| Electronic Beam Melting (EBM) | Uses an electron beam in a vacuum environment to melt and fuse metallic powder particles layer by layer. |

| Laminated Object Manufacturing (LOM) | Layers of adhesive-coated paper, plastic, or metal laminates are successively glued together and cut to shape with a knife or laser cutter. |

| Digital Light Processing (DLP) | Similar to stereolithography but with a digital light processing chip controlling the light source, enabling faster build times. |

3D Printing Plastics Market Growth Factors

- Cost efficiency: Due to the ability of the technology to reduce material wastage, avoid longer production cycles avoid indulging in unnecessary spending.

- Prototyping and rapid production: The use of 3D printing in product development and manufacturing of complex spare parts for automobiles, aerospace, and healthcare sectors.

- Innovation and design flexibility: The flexibility situates it as a tool that allows designers to work with numerous designs in a short time and make changes as they test various materials, hence increasing the demand for 3D printing plastics.

- Industrial Adoption: The automotive, aerospace, and healthcare industries are increasingly likely to use 3D printing materials such as plastics for prototyping and custom parts (plausibly saving costs and producing efficiencies).

- Sustainability Initiatives increased demand for biodegradable and recycled plastics as well as eco-friendly solutions provides a natural fit for the 3D printing scope and sustainability initiatives.

- Digital manufacturing integration: The integration of 3D printing technology with IoT (Internet of Things) and AI (Artificial Intelligence) provides real-time data gathering and monitoring, creating faster prototypes and working in an efficient manner on demand, leading to better flexibility and reduced overhead.

- Cost and time reduction: Aided by slim tooling and lead times, 3D printing provides a cost-efficient solution for low-volume production of complex parts (effective regardless of size), with accelerated product development cycles.

3D Printing Plastics Market Outlook:

- Global Expansion: An accelerating need for lightweight, durable, and personalized parts, and advancements in material science are propelling the overall transformations.

- Major Investor- In October 2025, LuxCreo received a planned investment from Angelalign Technology for the co-development of next-generation 3D printing materials for clear aligners.

- Startup Ecosystem: Alpha Powders, a startup assisting in converting waste polymers into high-quality powder feedstock for powder bed fusion (PBF) using a proprietary, solvent-free technology.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.98 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Size in 2026 | USD 2.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.01% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing usage in automotive industries

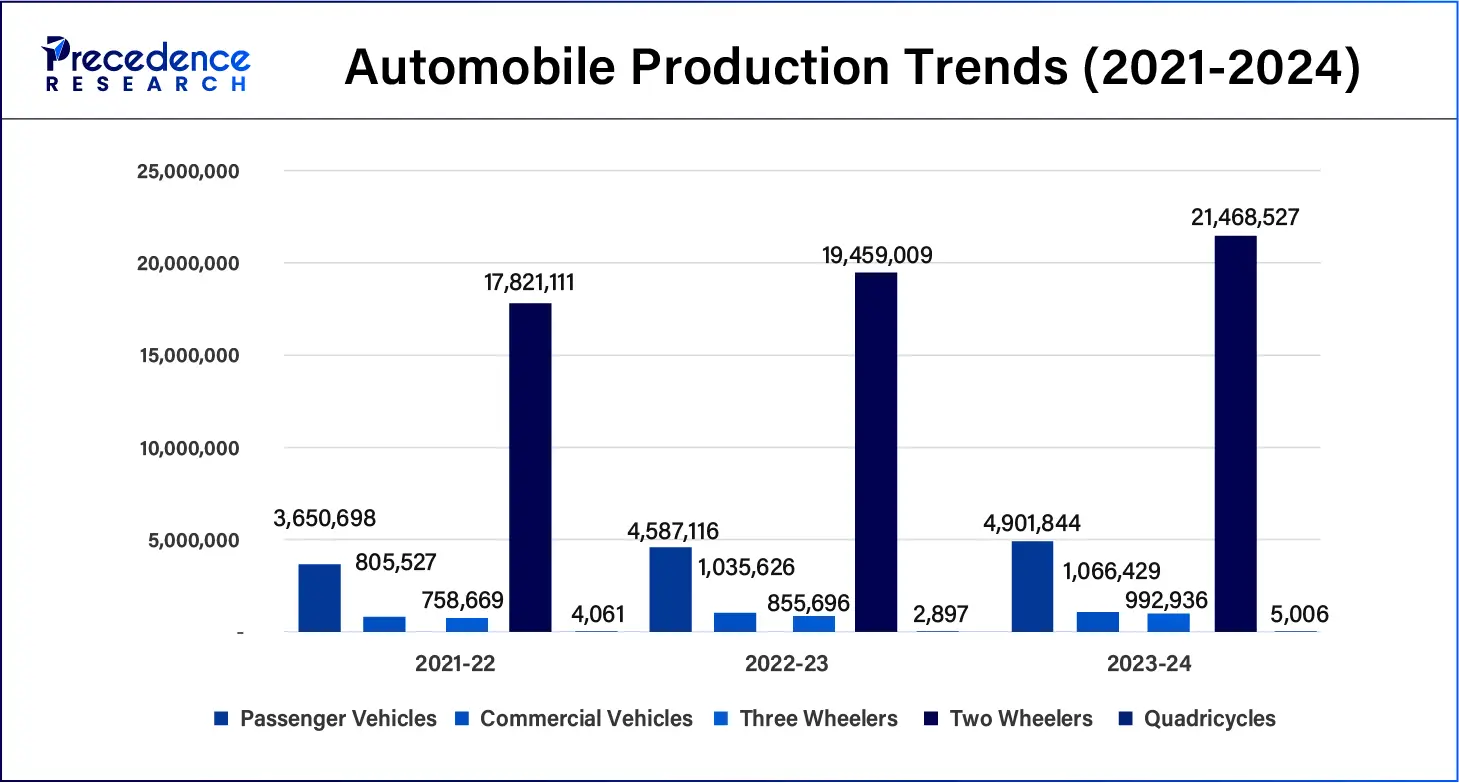

The 3D printing plastics market has led to significant advancements in the automotive industry. This includes fast prototyping, widespread production of final car parts, and even the possibility of 3D manufacturing the entire car. The ability to create physical models of parts designed in a very short time has made 3D printing indispensable in the automotive industry. The automotive industry has been a leader in exploring the use of 3D printing technology in manufacturing.

- In July 2023, Peugeot automotive manufacturing company included 3D fashion technology by Stratasys in the interior of its new Inception concept car.

- According to the Society of Indian Automobile Manufacturers (SIAM), in 2023, the total production volume of vehicles in India was approximately 25.93 million units.

Rising adoption in various sectors

The trends that have been encouraging the growth of the 3D printing plastics market, especially in different industries, including within the consumer goods value chain, 3D printing presents a great opportunity for the invention of speedy and individualized goods and models, thus improving design freedom and quick market entrance. The medical devices industry has benefited from the use of technology in the production of patient-specific implants and prosthetic and surgical tools that enhance the quality of life of patients, as well as offering unique medical solutions. 3D printing is useful in the industrial sector since it is capable of creating specific tools and parts that will cut inventory in addition to closing the production time gap. All these sectors appreciate 3D printing for its efficiency, cost-saving, and innovation.

Restraints

Non-standardized practices in 3D printing

The lack of elaborate laws regulating the use of the 3D printing plastics market products opens up a sort of ambiguity and challenges as to whether uniformity and safety measures can be achieved in the process. These challenges include the qualification of new materials and processes, which continues to be a major challenge. It is also important to note that the standardization and the ability to produce similar results across a range of applications are often unpredictable, which hampers wider acceptance of 3D printing technologies.

Opportunity

Increasing demand for bio-based grades of material

Biodegradable thermoplastics are plastic products that are based on renewable resources. Biomass used for developing bioplastics is currently derived from starch constituents or cellulose. Bio-derived bioplastics, on the other hand, allow for a significant reduction in carbon footprint at the resource extraction stage. Such natural sources include starch, chitin, protein, and cellulose. PLA is cheaper and less expensive; obtaining high-quality prints with PLA material is also possible. This is typical in most extrusion-based 3D printers because it is possible to print at a lower temperature without the use of a heated bed. Biodegradable bioplastics offer disposal channels that decrease the volume of plastic waste that is disposed of in the environment.

- In October 2023, Evonik introduced the world's first PA12 powder for 3D printing based on bio-circular raw material.

Type Insights

The photopolymers segment accounted for the biggest share of the 3D printing plastics market in 2024. Photopolymers are materials that can be processed in 3D printing and can be used to create objects that possess improved characteristics. There are many areas of use for photopolymers as well as for 3D printing technologies. These polymers have been used in different printing methods ranging from ink-jet to relatively new jetted 3D printing. It is in demand in the printing business as it provides better results.

- In March 2022, Evonik and Asiga, an Australian 3D printer manufacturer, collaborated in photopolymer-based 3D printing. The company's objective is to raise the competence of the photocuring technologies to enhance the industrial manufacturing of 3D printing at larger scales among the companies.

The polyamide/nylon segment is expected to witness significant growth in the 3D printing plastics market during the forecast period. The polyamide is used in 3D printing in different types of forms. Polyamide has to be applied in powder form and is used in SLS (Selective Laser Sintering). Nylon is a very useful and versatile material. Its flexibility and strength make it ideal for automotive applications, such as the manufacture of friction and deformation-resistant parts. This material produces durable and flexible plastic parts. Nylon has a range of usages, from prosthetics to cases and enclosures.

Form Insights

The filament segment held the largest share of the 3D printing plastics market in 2024. The filament-based 3D printing material has several advantages, such as being easy to use and cost-effective. However, the filament is extruded from the nozzle, which shapes it into a filament.

- In March 2022, Evonik revealed VESTAKEEP iC4800 3DF, which is an osteoconductive PEEK filament that enhances the bonding between bone and implant. With this new filament, the company will increase its line of 3D printable biomaterials for the medical technology industry.

- In June of 2024, Nexa3D, a company specializing in ultra-fast 3D printing solutions, revealed its latest product called Xyon, which is the carbon-fiber-filled plastic 3D printing filament that is expected to revolutionize the market.

The ink segment is expected to grow at the fastest rate in the 3D printing plastics market over the forecast period. Materials serve as the ‘ink' in this paradigm of 3D printing ink solution formula and procedure through which these three-dimensional physical structures are constructed in layers. Possibilities for using 3D print materials are countless, and the technology has found its use in aerospace, automotive, medical, fashion, construction, and consumer sectors. The applications of 3D printing materials are vast and diverse, spanning across industries such as aerospace, automotive, healthcare, fashion, construction, and consumer goods.

End-use Insights

The medical segment dominated the 3D printing plastics market in 2024. 3D Printing creates high-speed and low-cost prototypes of medical devices. This technology can enable a perfect replica of a specific geometry/ feature of a particular patient's body. They are implant, instrumentation, and external prostheses devices used for dental implant procedures. In addition to prototyping, 3D printing for medical applications involves application in the manufacture of parts and casings for end-use medical products. Other 3D-printed products that have been produced in the medical field include inhalers, injectors, needle holders, surgical tool trays, splints, and testing equipment. The technology also advanced conventional manufacturing by manufacturing accurate models, patterns, cast, and dies for use in different molding and casting machinery for mass production.

- In October 2023, 3D Systems Corp, an American-based additive manufacturing company, launched a cranial implant developed using point-of-care technology. This technology is unique in the field by allowing for the production of personal geometric patterns as a result of the nanoscale fabrication for a specific patient.

- In January 2023, RMS Company, a United States-based medical device manufacturer, incorporated the DMP Flex 350 Dual into its production process. This new addition belongs to 3D Systems' Direct Metal Printing (DMP) portfolio.

The aerospace & defense segment is anticipated to grow significantly in the 3D printing plastics market during the forecast period. 3D printing is suitable for prototyping and use in the aerospace and aviation industries. The aerospace industry was one of the first industries to embrace 3D printing and is still a major contributor to the technology's evolution. It was also relevant to acknowledge that the use of 3D printing technology for aerospace and defense sectors is revolutionary. The advantages include increased design opportunities, reduction of weight, increased efficiency, and savings in terms of financial resources.

- In February 2022, 3D Systems announced to sign an agreement to acquire Titan Additive LLC (Titan Robotics). By this acquisition, 3D systems will be in a position to expand and complement the polymer AM solution to cover new fields such as consumer goods, aerospace, defense, and automobile industries.

Regional Insights

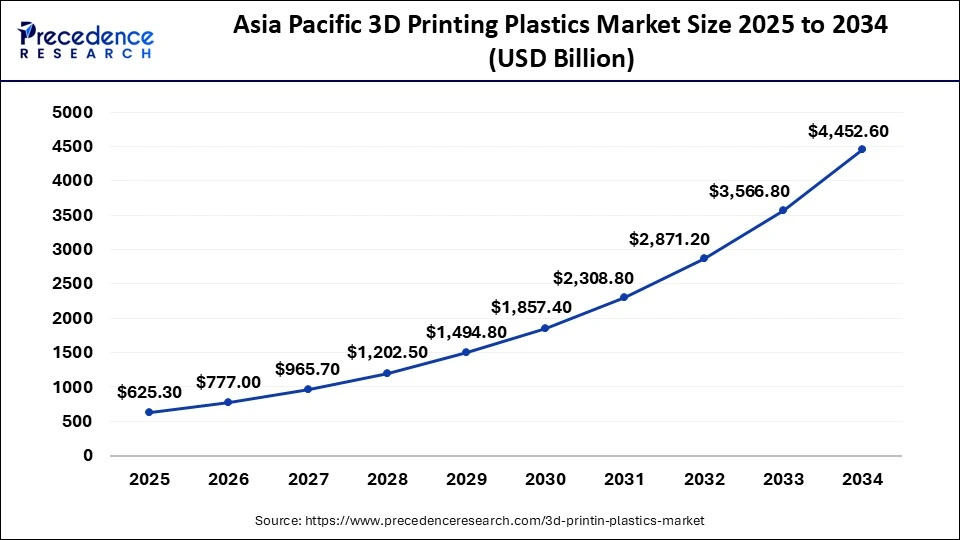

Asia Pacific 3D Printing Plastics Market Size and Forecast 2025 to 2034

The global Asia Pacific 3D printing plastics market size is calculated at USD 625.30 million in 2025 and is anticipated to reach around USD 4,452.60 million by 2034, growing at a CAGR of 24.35% over the forecast period 2025 to 2034.

Rapid Adoption by Key Players: North America's 3D Printing Industry to Boom

North America is expected to grow at the fastest rate during through the forecast period. 3D printing technology is experiencing wide adoption in the manufacturing industry, especially within the automotive, aerospace, healthcare, and defense industries. An increase in governmental initiatives in the United States towards the expansion of 3D printing and funding of research and development acts as the driver of this technology in North America. Furthermore, there is a sequence of new product developments in North America that are aimed at harnessing the opportunities available through 3D printing and also performing mergers and acquisitions.

- In March 2023, General Electric declared its investment of over USD 450 million in the current manufacturing sites of the United States to purchase cutting-edge equipment and make improvements to position the company and its U.S. workforce for the future. The company is on the way to transforming itself into two new powerful companies in the fields of energy and aerospace.

Composition of Specialized Materials: U.S. Market Trends

The U.S. market has been expanding due to the rising emphasis on the revolution of certified biocompatible materials, like particular resins employed for dental applications. Alongside, U.S. researchers are continuing with the materials incorporation of carbon fiber, graphene, and other nanoparticles to escalate the strength, conductivity, and thermal stability of 3D-printed parts.

How did Asia Pacific Capture the Largest Share of the Market in 2024?

Asia Pacific dominated the 3d printing plastics market in 2024. The dominance is due to increasing manufacturing sectors in the region and technological improvements. The prominent leaders in adopting 3D printing are China, India, and Japan. Decreased material costs, increased efficiency in the manufacturing process, and flexibility in terms of innovation are some of the drivers that 3D printing plastics are good for the automotive, aerospace, and healthcare industries.

- According to data published by the China Association of Automobile Manufacturers in 2023, China car production exceeded 30.16 million units, up 11.6% year-on-year, and total car sales during the year hit more than 30.09 million units, up 12% year-on-year.

Strengthening Medical-Grade Plastics: Chinese Market Trends:

A prominent catalyst involved in the expansion of the Chinese market is the accelerating application of medical-grade plastics, specifically PEEK and PMMA, for surgical guides and prosthetics. Additionally, they are promoting engineering plastics, such as nylon and polycarbonate, for automotive and aerospace parts, and the integration of plastic composites for boosted capability.

Composition of Specialized Materials: U.S. Market Trends

The U.S. market has been expanding due to the rising emphasis on the revolution of certified biocompatible materials, like particular resins employed for dental applications. Alongside, U.S. researchers are continuing with the materials incorporation of carbon fiber, graphene, and other nanoparticles to escalate the strength, conductivity, and thermal stability of 3D-printed parts.

Developing High-Performance Polymers is Impacting Europe:

Day by day, the European companies are taking their major step in the development and use of high-performance plastics, such as Evonik created VESTAKEEP iC4800 3DF, a new osteoconductive PEEK filament to enhance the fusion between bone and implants in medical applications. As well as Victrex plc partnered with aerospace OEMs to explore the utilization of PAEK-based filaments for flight-critical components.

Raised Emphasis on Automotive: German Market Trend

Particular efforts in the automotive sector of the German market contributed to the substantial experiments, such as the BMW employed 3D printing for creating tailored spike plates for bobsled shoes, optimizing acceleration and power transmission for athletes. Along with this, other firms are fostering the processes for the manufacturing of high-performance metal and plastic components for the automotive sector.

3D Printing Plastics Market: Value Chain Analysis

- Feedstock Procurement

They mainly procure virgin material (filaments, pellets, or powder) from manufacturers or through recycled plastic sources.

Key Players: Arkema S.A., BASF SE, Sabic, Etc. - Quality Testing and Certification

This includes prominent mechanical tests like tensile strength, chemical analysis, and evaluating material properties, such as density and stability.

Key Players: UL Solution, TÜV Rheinland, CRP Technology, etc. - Regulatory Compliance and Safety Monitoring

The market emphasises the prevention of health risks from emissions (Volatile Organic Compounds and nanoparticles), and ensures product safety.

Key Players: US FDA, ECHA, OSHA, etc.

Key Players Offerings:

- 3D Systems Corporation- They usually offer diverse engineering-grade materials, biocompatible options for medical and dental use.

- Arkema Inc.- A leading company that leverages liquid resins for UV curing, thermoplastic powders for powder bed fusion, and filament materials.

- Envisiontec Inc.- It provides tough, ABS-like materials, high-resolution resins, and biocompatible resins for medical applications.

- Stratasys Ltd.- It explored durable FDM thermoplastics (like Nylon 12CF, ULTEM, and ABS), versatile PolyJet photopolymers for flexible and transparent parts, and high-performance P3 DLP resins.

- SABIC- A vital player offers high-performance filaments and compounds based on materials like ULTEM (PEI), LEXAN (PC), CYCOLAC (ABS), and EXTEM (TPI).

3D Printing Plastics Market Companies

- 3D Systems Corporation

- Arkema Inc.

- Envisiontec Inc.

- Stratasys Ltd.

- SABIC

- Materialise NV

- HP INC.

- Eos GmbH Electro Optical Systems

- PolyOne Corporation

- Royal DSM N.V.

Recent Developments

- In March 2025, Stratasys announced the launch of AIS™ Antero 800NA and AIS™ Antero 840CN03 as validated materials for the Stratasys F900, marking a new milestone in qualified additive manufacturing for aerospace, defense, and other highly regulated industries. Stratasys is leading the global shift to additive manufacturing with innovative 3D printing solutions for industries such as aerospace, automotive, consumer products, and healthcare. (Source: https://www.businesswire.com)

- In May 2025, Siraya Tech released three new flexible 3D printing materials: two filaments, one resin, a foam TPU Air, AMS-compatible TPU 64D, and "highly flexible and elastic resin" Rebound 55A. The weight and softness of foaming filament TPU Air can be controlled by adjusting the print temperature, offering the possibility of creating prints with a Shore hardness ranging from 63A to 85A. (Source: https://all3dp.com)

- In February 2025, NatureWorks, a global leader in sustainable biopolymer innovation, announced the launch of Ingeo 3D300, the company's newest specially engineered 3D printing grade. Designed for faster printing without compromising quality, Ingeo 3D300 sets a new benchmark in additive manufacturing by offering enhanced efficiency and exceptional performance. (Source: https://www.businesswire.com)

- In April 2024, Filamentive launched free polylactic acid (PLA) 3D printing waste recycling.

- In July 2023, 3D Systems, Inc. introduced high-performance materials Accura AMX Tough FR V0 Black, Figure 4 Tough FR V0 Black, and Figure 4 JCAST-GRN 20 to enhance its stereolithography (SLA). These materials enable efficient production for automotive, semiconductor, aerospace, and consumer goods.

- In June 2023, Arkema declared a partnership with Raplas, a leading 3D printer manufacturer, to develop high-performance N3xt Dimension custom formulations for use in stereolithography (SLA) 3D printers. The partnership will bring Arkema's material expertise for new market trends and application-specific needs.

- In May 2023, Formlabs announced a strategic partnership with Hawk Ridge Systems to expand access to digital fabrication tools across North America. The full Formlabs ecosystem of materials, 3D printers, and solutions is available to Hawk Ridge Systems customers.

Segments Covered in the Report

By Type

- Photopolymers

- ABS and ASA

- Polyamide/nylon

- Polylactic Acid

- Others

By Form

- Filament

- Ink

- Powder

By End-use

- Automotive

- Medical

- Prosthetics & Implants

- Surgical Instruments

- Others

- Aerospace & Defense

- Consumer Goods

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting