What is the 3D Printing Photopolymers Market Size?

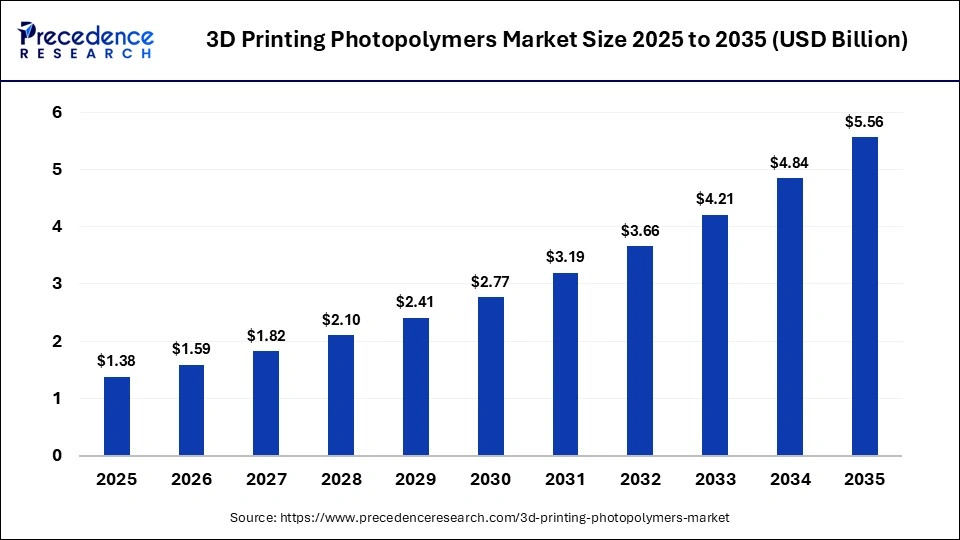

The global 3D printing photopolymers market size was calculated at USD 1.38 billion in 2025 and is predicted to increase from USD 1.59 billion in 2026 to approximately USD 5.56 billion by 2035, expanding at a CAGR of 14.96% from 2026 to 2035. The 3D printing photopolymers market is driven by growing adoption of additive manufacturing for rapid prototyping, customized production, and high-precision industrial and healthcare components.

Market Highlights

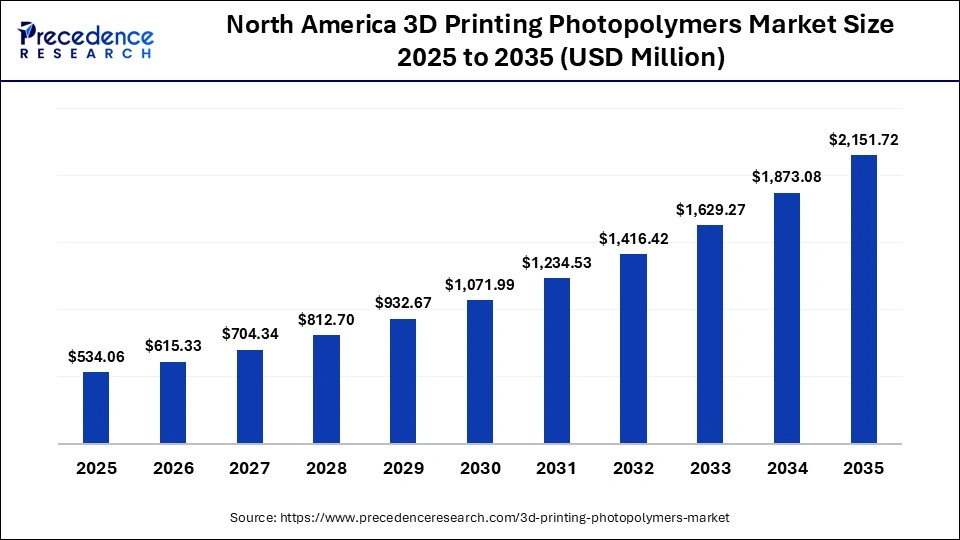

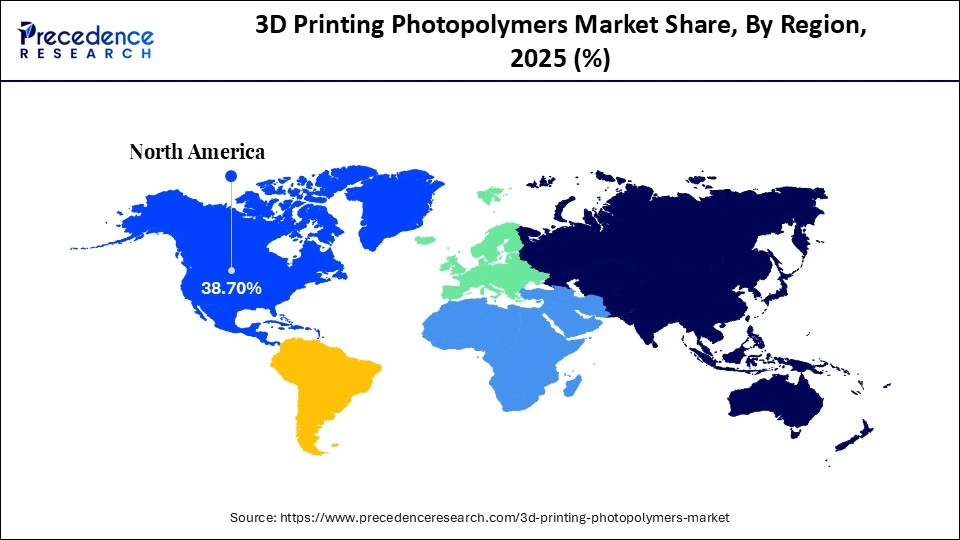

- North America dominated the market, holding the largest market share of 38.7% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 15.5% in the 3D printing photopolymers market between 2026 and 2035.

- By material/resin type, the standard photopolymers segment held the largest market share, accounting for 44.1% in 2025.

- By material/resin type, the biocompatible/medical-grade resins segment is expected to grow at a remarkable CAGR of 13.7% between 2026 and 2035.

- By technology, the stereolithography segment held the largest market share of 54.5% in 2025.

- By technology, the polyjet/multi-jet printing segment is expected to grow at a remarkable CAGR of 13.8% between 2026 and 2035.

- By application, the prototyping & concept models segment held the largest share of 46.2% in the 3D printing photopolymers market during 2025.

- By application, the dental & medical devices segment is expected to grow at a remarkable CAGR of 14.0% between 2026 and 2035.

- By end-user industry, the healthcare & dental segment held the largest share of 47.5% in the market during 2025.

- By end-user industry, the automotive industry is set to grow at a remarkable share of 14.2% CAGR between 2026 and 2035.

Redefining Relief & Diagnosis: How Innovation Is Transforming the 3D Printing Photopolymers Market

The 3D printing photopolymers market is oriented on the high-precision light-curable resin systems that were intended to be applied in the precision production in the areas of stereolithography, digital light processing, and PolyJet technologies. The materials enable very smooth surfaces, geometries with complexity, and tailored mechanical action and must be essential in manufacturing in the medical care, automotive, aerospace, electronics, and consumer products industries. The photopolymers are currently being developed in functional form and not merely for prototyping, which is helping in the development of dental aligners, dental models, micro-components, and lightweight structural components.

The growth in the end-use market, which is stipulated by the growing popularity of 3D printing, the growing demand for patient-specific and customized medical solutions, and the continuous development of resin chemistry aimed at enhancing its durability, heat resistance, and biocompatibility, is the driver of the market growth. Additional growth in the market is supported by the booming dental and biomedical printing and increased investment in industrial prototyping and micro-manufacturing. The regulatory and environmental objectives are also befitting the use of smart materials, hybrid resin, and recyclable formulations, which confirms the acceptance of the commercial aspect.

Key AI Integration in the 3D Printing Photopolymers Market

The adoption of AI in the market is accelerating the rate of innovation in the creation of materials, production efficiency, and quality assurance. AI-based process management systems can change exposure time, depth of layers, and support structures during printing to increase accuracy, minimize defects, and improve surface finishing. Monitoring with computer vision will allow automatic inspection of defects and in-process quality checks, and predictive algorithms of maintenance will monitor the performance of printers and the state of resin and decay of UV-lamps to avoid downtime. AI is also used in mass customization processes, especially in dental and medical applications and consumer applications, to automate preparation, printing, scheduling, and planning material utilization.

Beyond process control, AI is increasingly applied to photopolymer formulation by analyzing material behavior under different curing and stress conditions to accelerate resin development cycles. Machine learning models help predict mechanical strength, biocompatibility, and durability outcomes before physical testing, reducing development costs and time. AI-driven demand forecasting and production planning are also improving inventory management for photopolymer resins, supporting more responsive and scalable manufacturing workflows.

3D Printing Photopolymers Market Outlook

- Industry Growth Overview: The expansion is encouraged by further investment in additive manufacturing processes and the emergence of customized and lightweight part production, as well as enhanced integration of digital production technologies. The ever-increasing print rate, resolution, and material durability are increasing the pace of switching to scalable, production-grade 3D printing solutions.

- Global Expansion: The market is growing at a global level with high adoption in North America and Europe, and Asia-Pacific is the rapidly growing center due to the drive of modernization of the manufacturing industry and the government-sponsored programs. The spread of technologies and diversification of their usage is becoming a fast process due to cross-border cooperation of material developers, OEMs, and research institutions.

- Major Investors: The major companies that are involved in the key corporation investments are 3D Systems, Stratasys, BASF Forward AM, Evonik, and Henkel Loctite, which are investing in the development of advanced resin chemistry and special application material R&D. Increased venture and strategic investments are in bio-resin, industrial-grade photopolymers, and green formulations for high-value manufacturing.

- Startup Ecosystem: The new resin technology, the high-speed printing technology, and the special-purpose materials are being developed by the innovators in the startup ecosystem that includes Formlabs, Carbon, Photocentric, and Nexa3D. Other niche products that emerging startups are exploring include dental aligner resins, micro-manufacturing materials, and environmentally friendly photopolymers to respond to unmet industrial requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.38 Billion |

| Market Size in 2026 | USD 1.59 Billion |

| Market Size by 2035 | USD 5.56 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.96% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material/Resin Type, Technology, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material/Resin Type Insights

Why Did the Standard Photopolymers Segment Hold a 44.1% Share in 2025?

In 2025, the standard photopolymers segment was leading the market in the 3D printing photopolymers with a market share of 44.1% of the market due to the fact that the photopolymers are the most popular and economical to use in prototyping, conceptual modeling, and low-stress functional parts. The widespread support of their prices provided to the users of any printer brand, as well as the wide range of material options, including rigid and transparent resins, as well as colored ones, further boost the uptake by small- and mid-scale users. Low levels of brittleness, improved dimensional stability, and continued advancements in formulation, including improved dimensional stability, have enhanced reliability and productivity, which are conducive to high-volume iterative printing procedures.

The biocompatible/medical-grade resins segment occupied 13.7% in 2025 and was the most dynamic of the categories since the application in the dental, orthopedic, and custom-made healthcare products was rapidly rising. These are special photopolymers that enable the production of patient-specific surgical guides, dental aligners, crowns, anatomical models, and the components of medical apparatuses that meet the standards of safety and sterility and also regulatory standards. The chemistry of resins has been improved to possess more preferable properties, such as cytocompatibility, wear resistance, moisture tolerance, and stability in sterilization, allowing it to be used more clinically. The increased focus on precision medicine and customizable forms of treatment also gained traction on the market, as medical-grade photopolymers allow the production of devices with a high level of precision and overall custom-fit usage options.

Technology Insights

Why Did the Stereolithography Segment Hold a 54.5% Share in 2025?

The stereolithography segment is at 54.5% in 2025 due to SLA being the most proven and most commonly used technology to print high precision levels of photopolymer components with a high level of surface quality and dimensional accuracy. The SLA systems are also able to handle a wide range of resin materials, such as standard resin, engineering-grade resin, and biocompatible resin, which increases the level of industry diversification. An ongoing series of enhancements in the resin chemistry, build speed, and print reliability has reinforced production capacity and maintained the low operating costs of small labs and industrial users. Also, robust usage in dental clinics, service bureaus, and design studios, coupled with an already established ecosystem of materials and printers, served to keep SLA on top.

The polyjet/multi-jet printing segment has a market share of 13.8% in 2025 because of its special ability to print parts of multi-material and multi-color in one build and is, therefore, of high value in advanced prototyping, medical modeling, and design validation. The technology allows the production of prototypes with very realistic finishes as well as transparency levels and combinations of rubber-like or rigid materials, which is hard to achieve with other printing technologies. It has become widely used in the health care field as well as in automotive design studios and consumer product development settings that require the visual precision and tactile realism to test and make decisions. Continuing innovations of elastomeric and engineering-grade PolyJet resins and higher productivity of printers and resolution further helped it to gain acceptance.

Application Insights

Why Did Prototyping & Concept Models Lead the 3D printing photopolymers market in 2025?

The prototyping and concept models segment also leads the market in 3D printing photopolymers with a 46.2% market share in 2025, since photopolymers are best suited for creating detailed visual and functional prototypes. They are better at testing designs, help engineers better communicate with the market, and reduce time-to-market because of their smoothness, ability to test in fine resolution, and ability to simulate complex geometries. Automotive, electronics, consumer goods, and industrial manufacturing are the industries that are very dependent on prototypes that are done using photopolymers to test their ergonomics, fit, or aesthetic value before proceeding to the mass production stage. The low cost and availability of SLA and DLP printers have further enhanced prototype-based applications among emerging businesses, research and development, and service providers.

The dental and medical devices segment, with a market share of 14.0%, will grow significantly due to the further digitalization of dentistry, the individual approach, and the individualization of medical production. Dental aligners, crowns, braces, surgical guidelines, anatomy models, splints, and prosthetic components can be manufactured precisely using photopolymer materials to help in clinical accuracy and speed of clinical practice. The prospect of application is even being widened by further advances in the medical-grade resin chemistry, such as improved mechanical strength, wear resistance, and biosafety. With the growing need to customize products and services, to conduct less invasive business, and to exploit digital and patient-care opportunities.

End-User Industry Insights

Why did the Healthcare & Dental Segment lead the 3D printing photopolymers market in 2025?

The healthcare & dental segment dominated the 3D printing photopolymers market by 47.5% in 2025 due to the fact that printing based on photopolymers has become part and parcel of clinical modeling, dental restoration processes, and customized treatment plans. The increased use of digital dentistry, the expansion of orthodontic and implantology operations, and the transition towards customized medical solutions were also the major factors that increased the pace at which material is required. The use of biocompatible and Class-certified photopolymers has facilitated safe clinical usage, and it has intensified the further infiltration into the hospital laboratory and dental manufacturing ecosystem. Furthermore, accelerated turnaround, minimized material wastage, and economical production of small quantities enhanced an inclination in favor of photopolymer printing, as opposed to the traditional fabrication techniques.

The automotive segment is projected to grow at a significant CAGR over the forecast period, holding a 14.2% share. Car manufacturers and mobility technology companies are progressively relying on SLA and DLP printing as a means to speed up the product design process. Super-resolution photopolymers give a chance to simulate the aesthetics, fit, and assembly performance of the final products more precisely, help to make engineering decisions faster, and cut down development costs. The adoption is further supported by the necessity to redesign components in a short period, use thermal-resistant materials, and create compact structural prototypes as the electric vehicle platforms increase. As digital engineering and additive-based production processes continue to be invested in, the automotive sector.

Region Insights

How Big is the North America 3D Printing Photopolymers Market Size?

The North America 3D printing photopolymers market size is estimated at USD 534.06 million in 2025 and is projected to reach approximately USD 2,151.72 million by 2035, with a 14.95% CAGR from 2026 to 2035.

Why did North America lead the Global 3D Printing Photopolymers Market in 2025?

In 2025, North America was the largest market with a 38.7% share of the 3D printing photopolymers market due to the fact that the region has the most developed additive manufacturing environment based on the high level of R&D investment, technology adoption, and high level of industrial penetration. Precision photopolymer materials are actively used in the United States in dental, aerospace, medical devices, and prototyping, where they are popular in making functional models, anatomical guides, and customized parts. The high demand for tailored healthcare-related solutions, quick development cycles of products, and on-demand production make the consumer.

Strong collaboration between material suppliers, printer manufacturers, and end-use industries is accelerating qualification of advanced photopolymer formulations. Academic research centers and industrial labs are supporting rapid prototyping and pilot-scale production using next-generation resins. Widespread adoption of digital manufacturing workflows is also enabling faster design iteration and reduced time-to-market. These factors collectively reinforce North America's leadership in photopolymer-based additive manufacturing.

What is the Size of the U.S. 3D Printing Photopolymers Market?

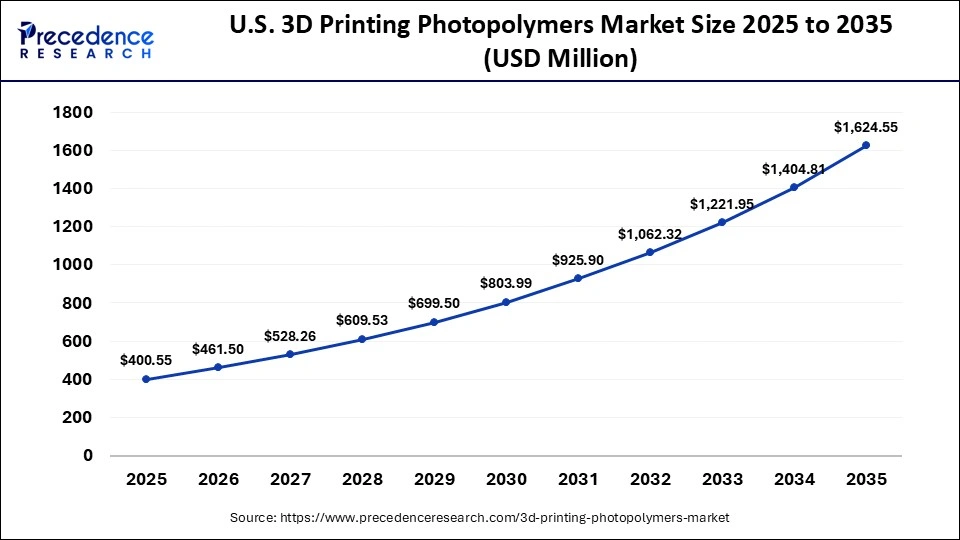

The U.S. 3D printing photopolymers market size is calculated at USD 400.55 million in 2025 and is expected to reach nearly USD 1,624.55 million in 2035, accelerating at a strong CAGR of 15.03% between 2026 and 2035.

U.S 3D Printing Photopolymers Market Analysis

The U.S. has a high concentration of industrial users, dental laboratories, service bureaus, and med-tech fabricators that will require highly precise photopolymer printing, which explains the domination of the North American market in 3D printing photopolymers. Digital dentistry, orthopedic modeling, aerospace prototyping, electronics micro-components, and automotive design validation are the areas of adoption that are prevalent. The ever-growing improvements in resin performance, like increased toughness, heat resistance, and biocompatibility, have seen applications of resin go beyond prototyping to functional and near-end-use applications. The availability of major technology players and substantial IP assets, as well as immense investment in automation and AI-driven printing processes, makes the U.S. the main driver of growth in the regional market.

Why is Asia Pacific undergoing the Fastest Growth in the 3D Printing Photopolymers Market?

The Asia Pacific region is experiencing the most rapid growth in the world 3D printing photopolymers market, which has a 15.5% market share, due to the growing manufacturing capacities, favorable government policies, and growing use of digital production technologies. China, Japan, South Korea, and India are actively investing in industrial automation, electronic manufacturing, dental care-based infrastructure, and production of medical devices, which all use photopolymer-based 3D printing for precision parts and prototyping. Demand is also increasing with the rapid urbanization and the development of small manufacturing firms and service bureaus. Also, the growth of educational and research centers on additive manufacturing is enhancing the capacity for innovation.

Rising adoption of localized production models is encouraging the use of photopolymer printing for short-run and customized components. Government-supported innovation hubs and industrial parks are accelerating technology diffusion among small and mid-sized manufacturers. These dynamics are strengthening the region's role as a high-growth center for photopolymer-based additive manufacturing.

China 3D Printing Photopolymers Market Trends

The Chinese 3D printing photopolymers market is growing at a high rate because of the intensive government-sponsored industrial digitalization initiatives, the booming dental and healthcare production, and the escalating use of 3D printing in consumer electronics and automotive design. Local producers are increasing the production of affordable SLA and DLP printers, with competitive resin technology that facilitates prototyping, tooling, and production of parts in small quantities. Photopolymers are even more heavily used due to the emergence of contract manufacturing, service bureaus, and on-demand production hubs. The increasing focus on the localized supply chains, innovation clusters, and material certification systems remains increasing to enhance the role of China as one of the key consumers and producers in the global photopolymers arena.

Why is the European 3D Printing Photopolymers Market Experiencing Notable Growth?

The European market of photopolymers in 3D printing is recording substantial growth due to great uptake in the sphere of healthcare, dental laboratories, the production of medical devices, and high-precision engineering sectors. Regulatory compliance, material safety, and quality certification have been the focus in the region, and this has promoted the production and application of improved biocompatible and engineered photopolymers in clinical and industrial applications. Innovation in resin chemistry and new structural components in lightweight and high-resolution printing are being supported by leading research institutes and industrial technology programs in Germany, the United Kingdom, France, and Italy. With European industries becoming more and more involved in additive manufacturing as a part of small-scale production and precision tooling processes, photopolymer usage is steadily growing.

In addition, strong emphasis on sustainability and material traceability is shaping the development of low-toxicity and recyclable photopolymer formulations. Collaboration between universities, dental labs, and industrial manufacturers is accelerating clinical validation and material standardization. Public funding programs supporting Industry 4.0 adoption are expanding access to advanced photopolymer printing systems. Together, these factors are reinforcing consistent growth in photopolymer consumption across European manufacturing and healthcare ecosystems.

UK 3D Printing Photopolymers Market Trends

The UK 3D printing photopolymers market is stable, as the use of dental technology, medical modeling, aerospace prototyping, and precision engineering applications has been growing significantly. Dental laboratories and clinics are quickly going computerized, with a great need for biocompatible photopolymer materials employed in aligners, crowns, surgical guides, and diagnostic models. The developed ecosystem of R&D within the UK, facilitated through universities, innovation centers, and industrial research programs, has remained useful in developing specialized engineering and high-resolution photopolymers. The increased investment in healthcare innovation, sustainability, and production-grade uses of photopolymers also amplifies the popularity of the UK as a major European player in the market growth.

Why Is the MEA 3D Printing Photopolymers Market Gaining Momentum?

There is an upsurge in the Middle East and Africa market whereby greater investments in healthcare infrastructures, modernization of the dental services, and diversification of the industrial manufacturing are taking place. Prototypes in architecture, dental restorations, medical modeling, and customization components are some of the parts of additive manufacturing that are gaining popularity in the United Arab Emirates, Saudi Arabia, and South Africa. The government has developed innovations and technology hubs that are encouraging the country to use digital technologies in production (SLA and DLP printing sets) in production. With increased awareness, training capacity, and material accessibility in the region, MEA is moving from an early adopter to an organized, application-based expansion into photopolymer-based 3D printing.

In addition, rising investment in vocational training and additive manufacturing certification programs is improving workforce readiness across the region. Local service bureaus are expanding their photopolymer material portfolios to support dental, healthcare, and industrial prototyping needs. Increased participation of international equipment suppliers is also improving access to advanced printers and certified resins. These developments are supporting a more structured and scalable adoption of photopolymer-based additive manufacturing in MEA.

Why Is the Latin American 3D Printing Photopolymers Market Emerging Rapidly?

The Latin American 3D printing photopolymers market is increasing by leaps and bounds due to increased adoption in dental laboratories, orthodontics, education, consumer product prototyping, and small-scale industries. There is an increase in investment in digital dentistry and medical modeling, including in Brazil, Mexico, Chile, and Colombia, which implies that biocompatible photopolymers used in aligners, surgical guides, anatomical models, and prosthetic parts are in demand. With the local industries adopting fast product development and customized manufacturing processes, the usage of photopolymers is increasing. Continuous training programs, innovative centers, and step-by-step modernization of regulations also maintain the upslope course of the market, which makes Latin America a new high-potential growth region.

Growing penetration of affordable desktop SLA and DLP systems is lowering entry barriers for clinics, universities, and small manufacturers. Partnerships between dental service providers and local printing service bureaus are improving turnaround times and material utilization. Gradual alignment with international material safety and medical device standards is also strengthening confidence in clinical and industrial photopolymer applications.

Who are the Major Players in the Global 3D Printing Photopolymers Market?

The major players in the 3D printing photopolymers market include 3D Systems Corporation, Stratasys Ltd., Henkel AG & Co. KGaA, Formlabs Inc., BASF SE, Carbon, Inc., Materialise NV, Photocentric Ltd., Bomar, Polysciences Inc., Inoes, Rohm GmbH, SOLTECH Ltd., Mohini Organics Pvt. Ltd., and Fushun Donglian Anxin Chemical Co., Ltd.

Recent Developments

- In November 2025, Nexa3D also stated that it partnered with BASF to launch three additional photopolymer materials in its NXE 400 stereolithography 3D printing platform. The materials are meant to assist users in creating housings, enclosures, packaging products, and footwear components that possess improved performance, strength, and functional traits.(Source: https://www.tctmagazine.com)

- In June 2024, UnionTech created a very strong impression at the Rapid+TCT 2024 in Los Angeles by presenting its most recent 3D printing technologies and complete additive manufacturing systems. The company presented developments that strive towards the enhancement of industrial-scale productivity, the versatility of materials, and application-oriented 3D printing adoption in various industries.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Material/Resin Type

- Standard Photopolymers

- Flexible Photopolymers

- High-Temperature Photopolymers

- Biocompatible/Medical-Grade Resins

- Casting Photopolymers

By Technology

- Stereolithography (SLA)

- Digital Light Processing (DLP)

- PolyJet/Multi-Jet

By Application

- Prototyping & Concept Models

- End-Use Parts & Functional Components

- Dental & Medical Devices

- Jewelry & Art

By End-User Industry

- Healthcare & Dental

- Automotive

- Aerospace & Defense

- Consumer Electronics & Goods

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting