What is the 7T Magnetic Resonance Imaging Systems Market Size?

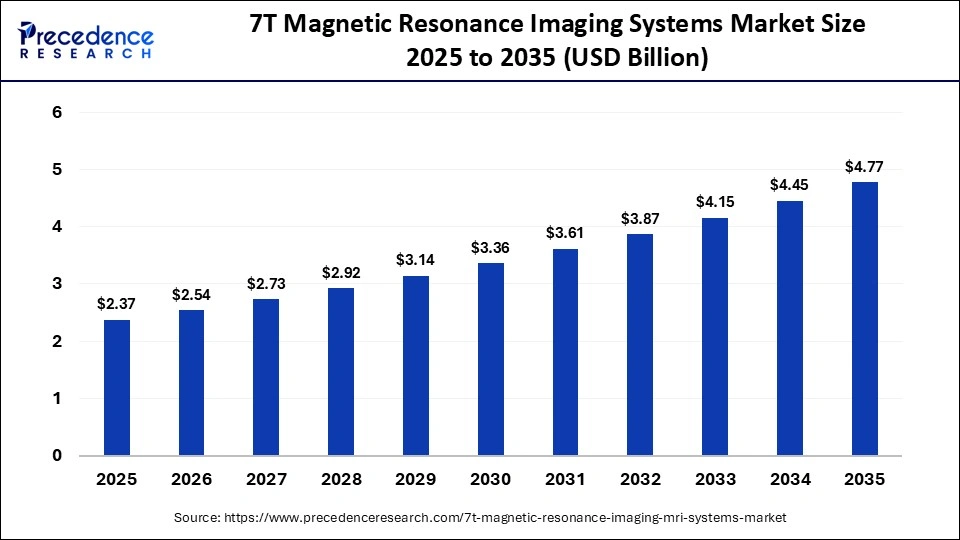

The global 7T magnetic resonance imaging systems market size accounted for USD 2.37 billion in 2025 and is predicted to increase from USD 2.54 billion in 2026 to approximately USD 4.77 billion by 2035, expanding at a CAGR of 7.25% from 2026 to 2035. The 7T magnetic resonance imaging systems market is expanding steadily worldwide, driven by advanced imaging adoption, broader clinical and research applications, and rising diagnostic demand.

Market Highlights

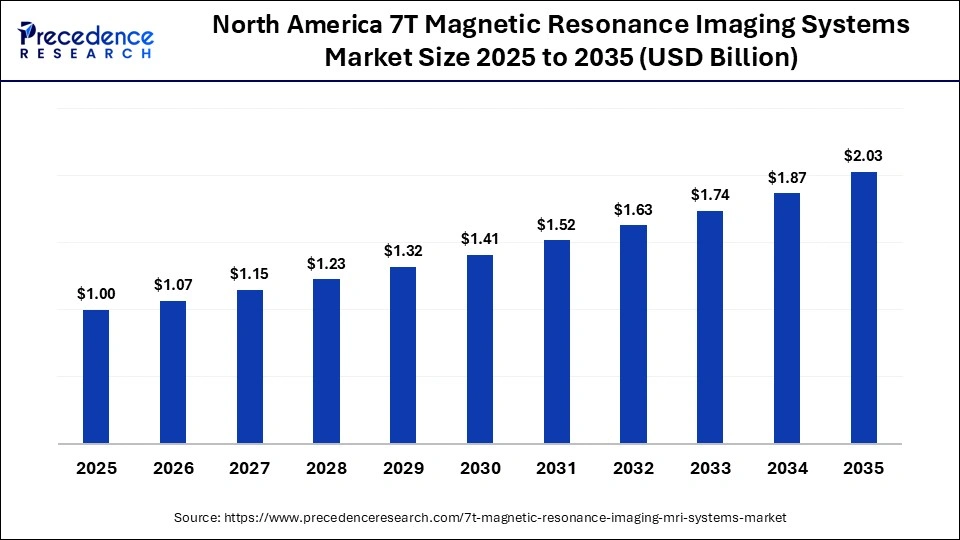

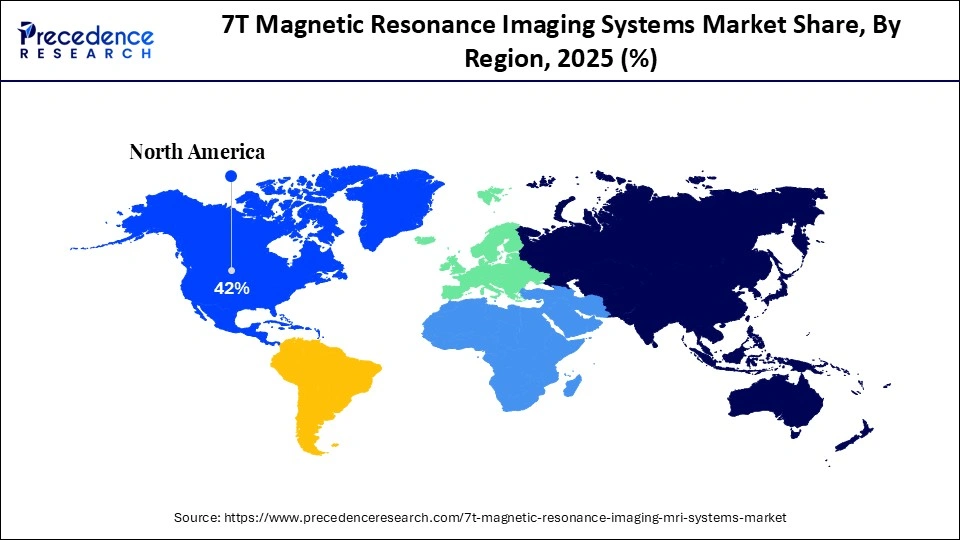

- North America led the global market by holding more than 42% of market share in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR of 8.43% between 2026 and 2035.

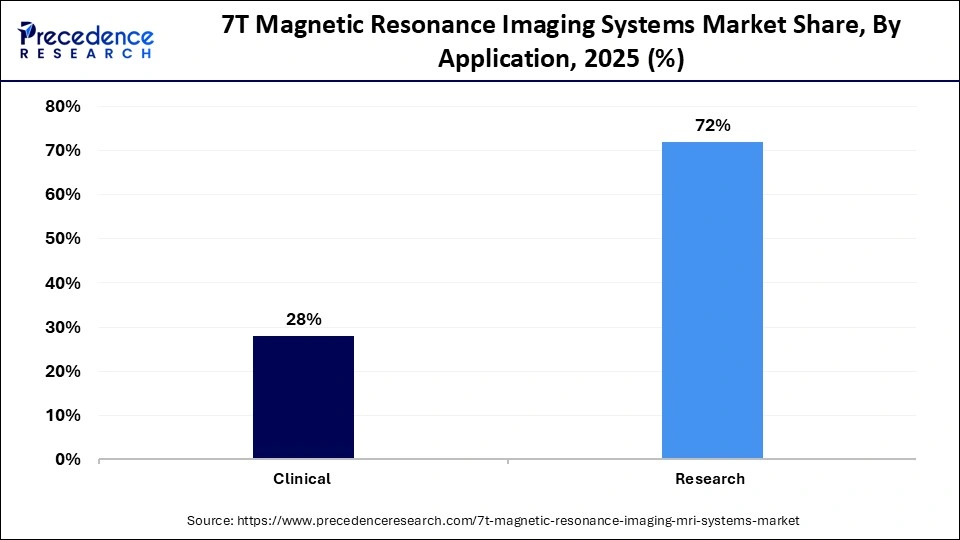

- By application, the research segment captured the highest market share of 72% in 2025.

- By application, the clinical segment is poised to grow at a solid CAGR of 7.72% from 2026 to 2035.

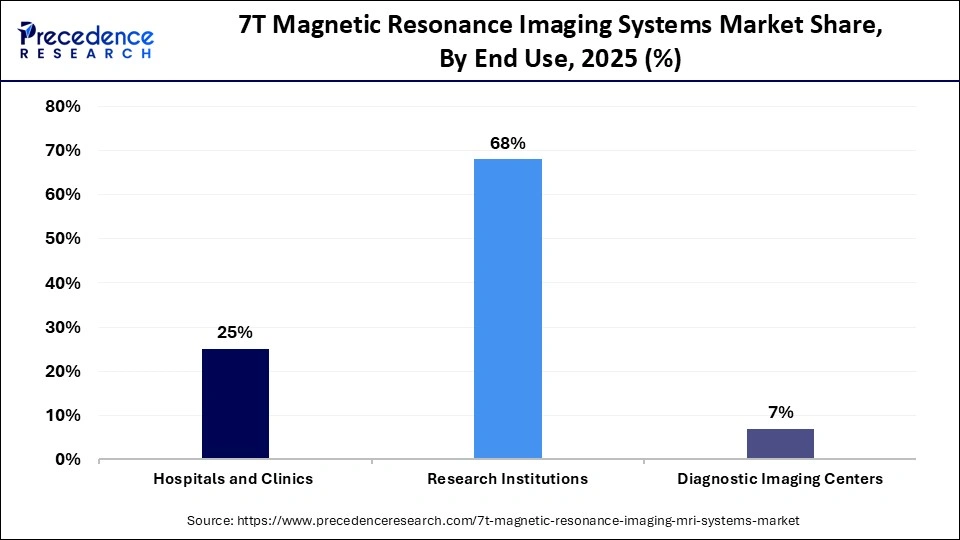

- By end use, the research institutions segment held the major market share of 68% in 2025.

- By end use, the hospital and clinics segment is growing at a notable CAGR berween 2026 and 2035.

What Is Driving The Growth In The 7T MRI Systems Market?

The Global market for 7T Magnetic Resonance Imaging systems is targeted towards Ultra High Field MRI scanners that operate at 7T, allowing ultra-high detail of both the anatomy and function of the body. The primary use of these systems is for neurological, musculoskeletal, and research advances.

The demand for more accurate brain imaging has led to increased neuroscience research. increased academic hospital usage, and the development of new research infrastructures in a growing number of countries. Continued industrial development of MRI technology through advancements in both gradient coil and RF systems and the introduction of Artificial Intelligence (AI) for image reconstruction has increased safety, improved clarity of images, and increased efficiency in scanning. In addition, the approval of regulatory authorities for the use of 7T MRI systems to treat patients allows 7T MRI systems to enter clinical practice, as compared to earlier practices of being used strictly as a research tool. Despite the momentum towards increased utilization of 7T MRI systems, there are still prohibiting issues such as high installation costs, complex infrastructure needs, and a lack of qualified and trained personnel to operate them. The overall growth of the market is being driven by innovation in diagnostics and the growth of translational research.

AI Is A Game-Changer for 7T MRI(s) in Diagnostic Accuracy & Efficiency

The advent of artificial intelligence (AI) is not only transforming the Magnetic Resonance Imaging (MRI) market but specifically the Ultra High-field MR imaging systems (≥7T). Through implementing state-of-the-art algorithms that reconstruct MRIs, AI can provide patients with faster images, improve the quality of those images by allowing clinicians to visualize detail that would be difficult to see otherwise, and accelerate the amount of time it takes to obtain data and the amount of data collected. All of these factors improve clinical confidence when dealing with complex neurological and musculoskeletal conditions.

Recent industry advancements, such as the introduction by Philips (New Showroom/RSNA2025) of an entire suite of AI-enabled solutions for cardiac MRI that allow quicker acquisition of images, increase overall access, and ultimately improve the clinical accuracy of cardiac MRI through automated workflows and smarter Acceleration Tools is a clear example of how intelligent software is facilitating the rapid evolution of High-field MRI towards making healthcare more accessible and providing higher-quality services to patients.

7T Magnetic Resonance Imaging Systems Market Outlook

- Market Overview: 7T MRI systems are classified as ultra-high field imaging technology (greater than 3T) and are primarily used in high-level research and selective clinical applications. These systems offer substantially higher signal-to-noise ratios and greater anatomical details than standard MRI systems.

Regulatory/Clinical Acceptance: The regulatory clearances for clinical usage of 7T MRI are leading hospitals to use 7T MRI for both neurology and musculoskeletal imaging. Amongst the facilities supporting the adoption of 7T MRI are academic institutions with government backing, as well as National Research Institutes. - Technological Advances: 7T MRI systems are continually improving with advancements in gradient systems, RF coils, and improvements in AI-assisted reconstruction. The result is lower scan times and fewer artifacts in clinical and translational research applications, leading to increased confidence that 7T MRI can be utilized more routinely.

- Infrastructure and Public Sector Funding: Government funds are currently available to support installation of 7T MRI systems at publicly funded universities and teaching hospitals where neurosciences, brain mapping, and precision medicine are areas of importance.

- Increasing Focus on Neurological Diseases: The growing prevalence of neurological diseases such as epilepsy, Alzheimer's, and multiple sclerosis is increasing interest and demand for ultra-high-resolution imaging using 7T MRI systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.37 Billion |

| Market Size in 2026 | USD 2.54 Billion |

| Market Size by 2035 | USD 4.77 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Application Insights

Why Is Research Leading the Application Segment in the 7T Magnetic Resonance Imaging Systems Market?

Research is anticipated to account for the largest share of the market in 2025, due to the high level of demand for neuroscience, brain mapping, and advanced musculoskeletal studies. 7T MRI systems are widely used by academic labs and government research institutions due to their ultra-high spatial resolution, allowing for greater detail in visualizing brain microstructures. Sustaining the continued growth of this segment of the market are strong research grants, collaborative projects with MRI manufacturers, and the growing interest in neuroscience and cognitive disorder research.

The clinical application segment will expand at the fastest rate from 2025 to 2035, as regulatory approvals are being incrementally granted and as clinical evidence increases. The increasing use of 7t MRI systems for complex neurological diseases, epilepsy, and brain tumor characterization is creating the fastest growth potential for the segment. Clinical 7t MRI systems are being used by facilities to increase their diagnostic confidence, while recruiting for and establishing standardized protocols for clinical trials is removing the historical barriers to the adoption of 7t MRI systems.

End User Insights

What Makes Research Institutes the Leading Users of 7T MRI Systems?

The dominance of research institutes within this field can be attributed to their entry into ultra-high-field magnetic resonance imaging (MRI) technology prior to 2025. Research institutions focus primarily on applying advanced imaging techniques, developing new methods for imaging using these technologies, and studying the brain using functional MRI, all of which necessitate outstanding levels of signal-to-noise in order to produce high-quality images. A critical mass of expert researchers, access to significant public funding, and numerous collaborations with equipment manufacturers will continue to ensure that research institutes remain the primary user base for 7T MRI.

Hospitals and clinics are anticipated to experience the fastest growth in the period between 2026 and 2035, as 7T MRI systems continue to migrate from the research environment into the clinical arena. As physicians become increasingly familiar with 7T MRI technology, reimbursement conversations improve, and demand for precision diagnosis continues to rise, hospitals are anticipated to invest in 7T MRI systems for increased capabilities related to advanced neurological diagnostics, thereby providing hospitals with an opportunity to create competitive advantages. Advancements in technology will also create opportunities for hospitals to make sure their patients are safe during diagnostic procedures by ensuring a higher degree of compatibility between the different components of these advanced MRI systems and improving patient workflow solutions accordingly.

Regional Insights

How Big is the North America 7T Magnetic Resonance Imaging Systems Market Size?

The North America 7T magnetic resonance imaging systems market size is estimated at USD 1.00 billion in 2025 and is projected to reach approximately USD 2.03 billion by 2035, with a 7.34% CAGR from 2026 to 2035.

Why Is North America the Top Region for 7T Magnetic Resonance Imaging Systems Market?

North America led the 7T magnetic resonance imaging systems market in 2025, driven by extensive clinical research activity, strong hospital and university infrastructure, and early adoption of ultra-high-field imaging technologies. The region benefits from a dense network of academic medical centers and specialized diagnostic imaging facilities focused on neurological and musculoskeletal applications, where 7T MRI provides superior spatial resolution and tissue contrast. Continued investment in healthcare technology, along with innovation-friendly regulatory pathways supported by agencies such as the U.S. Food and Drug Administration, has enabled controlled clinical deployment and validation of 7T MRI systems, reinforcing North America's leadership position.

Close partnerships between research hospitals, universities, and imaging device manufacturers are strengthening the clinical and scientific ecosystem around 7T MRI. These collaborations support the development of standardized imaging protocols, safety frameworks, and peer-reviewed clinical evidence, particularly in neuroscience, neurodegenerative disease research, and advanced brain mapping. Such cooperative efforts are expanding clinical confidence, broadening application scope, and accelerating translational use of 7T MRI beyond research environments into specialized clinical workflows.

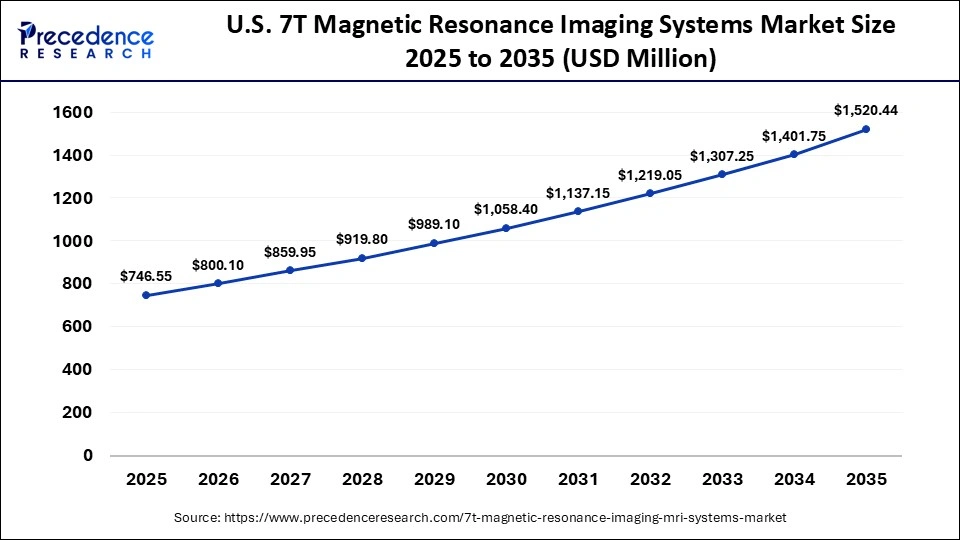

What is the Size of the U.S. 7T Magnetic Resonance Imaging Systems Market?

The U.S. 7T magnetic resonance imaging systems market size is calculated at USD 746.55 million in 2025 and is expected to reach nearly USD 1,520.44 million in 2035, accelerating at a strong CAGR of 7.37% between 2026 and 2035.

U.S. 7T Magnetic Resonance Imaging Systems Market Trends

The U.S. is the leader in North America in having implemented 7T systems across numerous medical institutions and research hospitals. The array of ongoing clinical trial studies, along with the establishment of a reimbursement methodology for high-functioning imaging technologies, has allowed for the rapid growth of the market in the U.S. The collaboration between manufacturers and research hospitals has provided the foundation for this continued growth.

Why Is Asia Pacific Experiencing the Fastest Growth in the 7T Magnetic Resonance Imaging Systems Market?

Asia Pacific is estimated to expand at the fastest CAGR in the market between 2026 and 203, as Rapid growth in the Asia-Pacific region through 7T MRI deployment will continue into the near term, with many factors driving this growth, including increasing health care needs, including a growing number of neurology and oncology patients, as well as increased investments for advanced medical imaging research. The region's major population centers have begun to upgrade major tertiary hospitals with new, advanced imaging systems.

Urbanization, the growing public awareness regarding the importance of detecting disease at an early stage, and government initiatives aimed at promoting the development of high-end medical technologies within their regions are contributing to the momentum of these new technologies. Strategic partnerships between private healthcare providers and local government healthcare programs are essential to expanding the application of ultra-high-field MRI technologies across the Asia-Pacific region and solidifying this region's ability to lead as one of the fastest-growing international markets.

China 7T Magnetic Resonance Imaging Systems Market Trends

China is the leading nation using these technologies, with a significant amount of investment in high-field MRI systems combined with an emphasis on neuroscience research. As more high-end medical centers establish 7T MRI systems as part of the development of advanced clinical programs, there are increasing numbers of medical professionals in China with the ability to apply advanced imaging systems to their clinical practice. Additionally, China's current commitment to upgrading its healthcare systems and increasing access and availability of higher-quality imaging will allow for a large percentage of the market to have access to these high-end systems.

How Europe is Entering a New Era of 7T Magnetic Resonance Imaging Systems?

Europe will be one of the major areas growing 7T MRI systems, driven by the large number of clinical research institutes and translational medicine that have a long-standing tradition. The development of 7T MRI systems in this region has been aided by the formation of a substantial number of clinical/university hospital networks, neuroscience research institutes, and governmental and not-for-profit research organizations that continue to use ultra-high-field MRI in brain mapping, studying neurodegenerative diseases, and undertaking advanced imaging of musculoskeletal conditions.

In addition, established training and education programs for radiologists and physicists and increased collaboration in cross-border research will develop operational maturity of these systems and sustain their future use.

Germany 7T Magnetic Resonance Imaging Systems Market Trends

Germany is leading the way because it has some of the strongest academic hospitals, very well-established imaging research infrastructures, and the highest percentage of clinical validation of emerging technology compared to all other countries. Investment in both the neurosciences and collaborative research efforts will enhance continued adoption and widespread application of 7T MRI in high-resolution diagnostic and research settings.

The Middle East & Africa Region Accelerating the Use Of 7T Magnetic Resonance Imaging Systems in the Market?

The Middle East and Africa are emerging markets for 7T MRI systems due to the relatively selective nature of their adoption of new diagnostic technologies. The majority of the opportunity in the Middle East lies with the government-led development of tertiary healthcare systems to create specialized hospitals for the complex treatment of neurological and oncology patients.

Other initiatives include national healthcare transformation programs that are working together to improve Precision Medicine, promote early disease detection, and create new opportunities for research-based therapies. While there is limited adoption of these systems on the African continent, it is developing gradually through partnerships with international hospital groups, targeted investment in flagship hospitals, and a growing emphasis on research and training.

Saudi Arabia 7T Magnetic Resonance Imaging Systems Market Trends

Saudi Arabia is emerging as the leading market for 7T MRI systems in the Middle East and Africa, supported by large-scale healthcare modernization programs and the development of advanced medical cities. National investments in tertiary care hospitals, academic medical centers, and research-focused healthcare infrastructure are creating the conditions required for ultra-high-field imaging deployment. These initiatives prioritize advanced diagnostics, precision medicine, and research-grade imaging capabilities, positioning select institutions to adopt 7T MRI systems for specialized clinical and translational research use.

The integration of 7T MRI systems into select research hospitals in Saudi Arabia is strengthening capabilities in neuroscience research, advanced brain mapping, and the diagnosis of complex neurological conditions. Ultra-high-field imaging is enabling improved visualization of microstructural changes, functional connectivity, and disease biomarkers that are difficult to detect with lower-field systems. This deployment is supporting clinician-researchers in managing complex patient cases while advancing local research output, reinforcing Saudi Arabia's role as the regional reference point for next-generation MRI adoption.

Who are the major players in the global 7T Magnetic Resonance Imaging Systems Market?

The major players in the 7T magnetic resonance imaging systems market include Bruker, GE HealthCare, Siemens Healthineers, and Koninklijke Philips N.V.

Recent Developments

- In October 2025, Toronto's academic health research partners opened a new 7-Tesla MRI facility at Sunnybrook Health Sciences Centre, enhancing ultra-high-resolution clinical research imaging and collaboration across multiple institutions.(Source: https://www.canhealth.com)

- In September 2025, Lilavati Hospital & Research Centre in Mumbai launched the OMEGA 3T MRI system with an ultra-wide bore and AI-enhanced imaging, improving diagnostic speed, comfort, and precision for diverse patient groups.(Source: https://www.healthcareradius.in)

Segments Covered in the Report

By Application

- Clinical

- Research

By End Use

- Hospitals and Clinics

- Research Institutions

- Diagnostic Imaging Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting