Acute Repetitive Seizures Market Size and Forecast 2025 to 2034

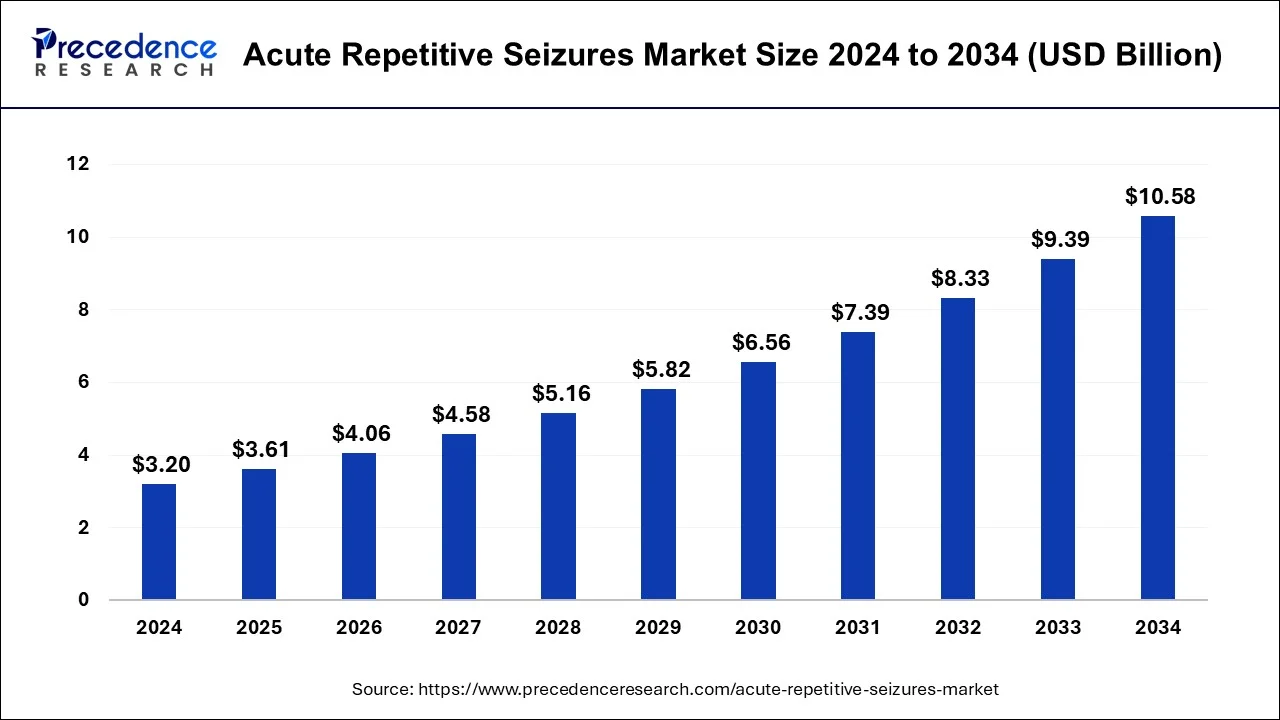

The global acute repetitive seizures market size was estimated at USD 3.20 billion in 2024 and is predicted to increase from USD 3.61 billion in 2025 to approximately USD 10.58 billion by 2034, expanding at a CAGR of 12.70% from 2025 to 2034.

Acute Repetitive Seizures Market Key Takeaways

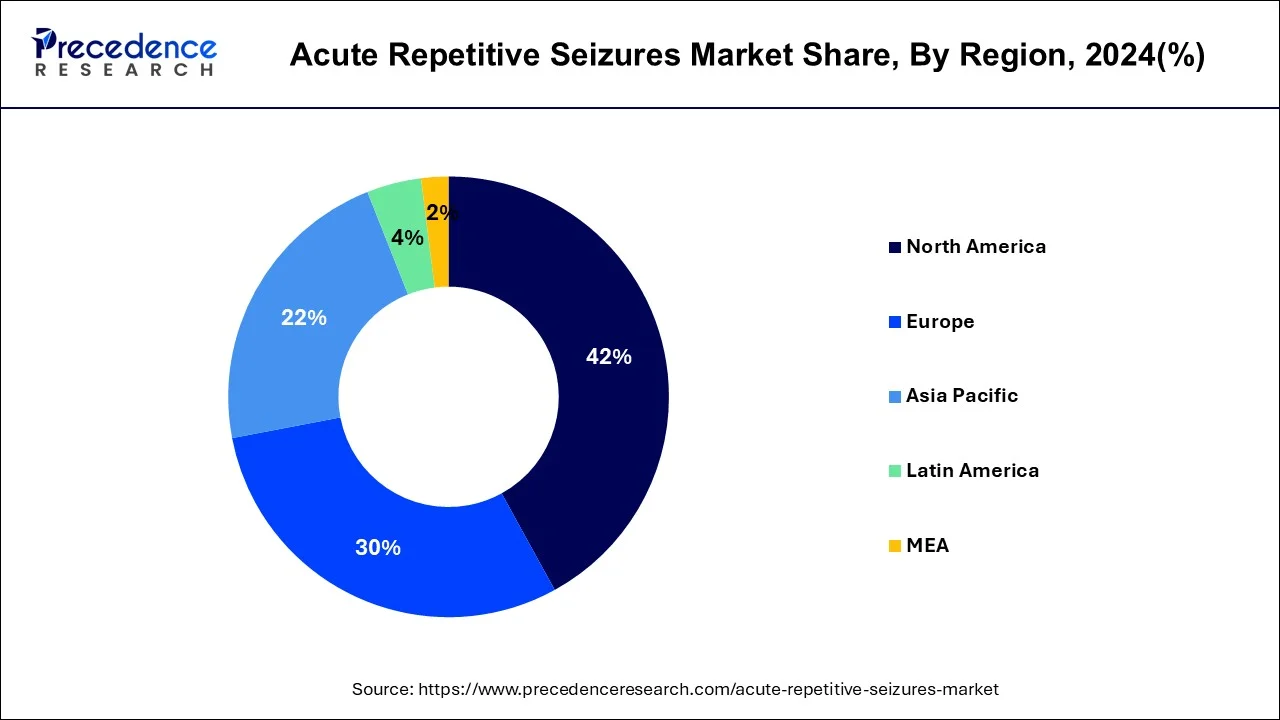

- North America led the global market with the highest market share of 42% in 2024.

- Asia Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By product, the diastat rectal gel segment has held the largest market share in 2024.

U.S. Acute Repetitive Seizures Market Size and Growth 2025 to 2034

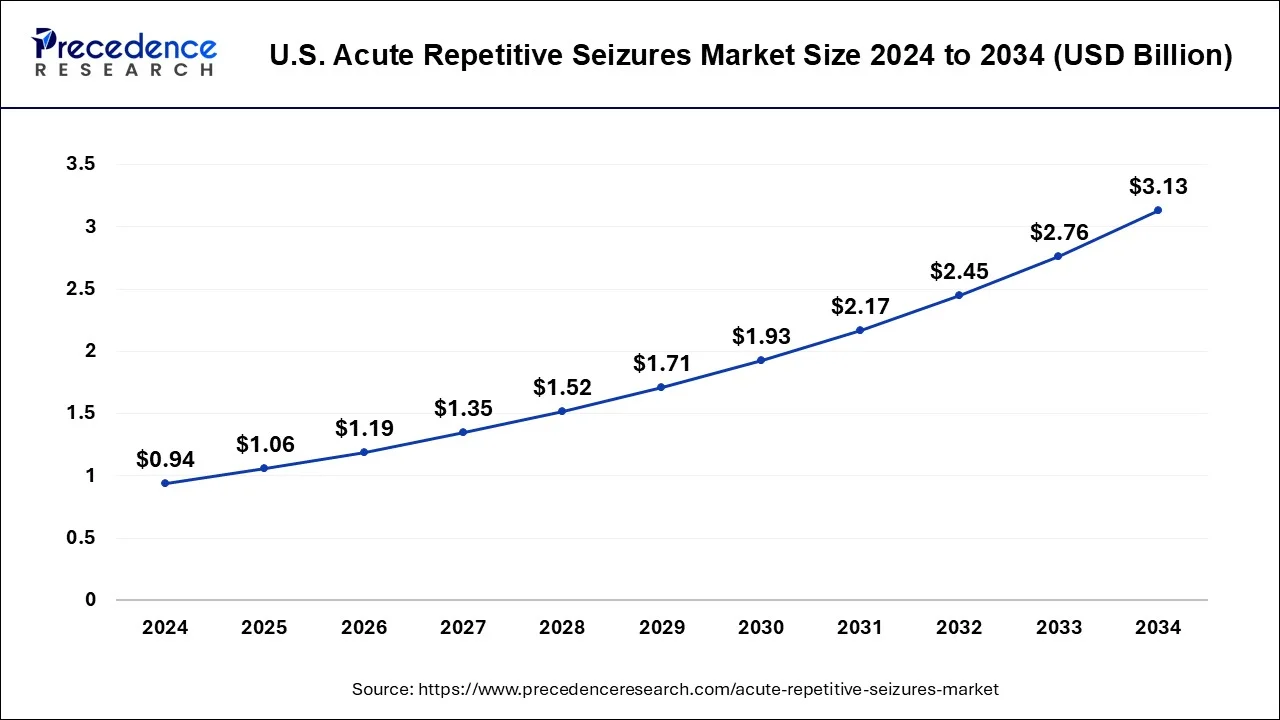

The U.S. acute repetitive seizures market size was valued at USD 0.94 billion in 2024 and is predicted to be worth around USD 3.13 billion by 2034, at a CAGR of 12.78% from 2025 to 2034.

North America garnered foremost share of the global acute repetitive seizures and epileptic seizures treatment market in 2024. This growth is credible to escalation in occurrence of neurological disorders, current drug approvals, surge in brain injuries, and deep-rooted healthcare structure. North America is likely to continue this trend during the estimate period. Further, acute repetitive seizures market in Europe is expected to advance at a rapid pace from owing to upsurge in investment R&D in the area of neurology, upsurge in funds presented by the government, and escalation in requirement for medications for epilepsy.

As per data released by National Center for Biotechnology Information, in February 2016, U.S. Library of Medicine specified that each year 50,000 to 150,000 individuals in the U.S. affected with status epilepticus, with mortality projected at less than 3% in kids, nonetheless around 30% in adults. Asia Pacific is expected to develop at a higher growth rate within the estimate period, due to greater epilepsy patient population, intensification in alertness about epileptic seizures, upsurge in emphasis on refining healthcare infrastructure, upsurge in elderly population, and increasing number of market participants reinforcing their footmark in the region.

Furthermore,growing in consciousness about the treatment of neurological disorders and upsurge in requirement for novel drug formulations for treating critical situations in neurology are further boosting the market growth in this region.

Acute Repetitive Seizures Market Growth Factors

Emergence routes of administration for epileptic seizures, novel drug treatments and genetic factors related with brain malformations & epileptic seizures are few of the major influences stimulating the growth of epileptic seizures treatment market across the globe. Furthermore, upsurge in occurrence of head injuries, cardiovascular diseases, brain cancer, substance abuse and infections accelerate the demand for epileptic seizures treatment worldwide.

Upsurge in patient populace with status epilepticus and acute repetitive seizures are the main reason bolstering the development of the epileptic seizures treatment market. High unmet clinical requirements for patients along with caregivers, and obtainability of cutting-edge product pipeline are certain foremost influences predicted to push market growth. Drug therapy is operative for most of the patients undergoing from cluster seizures. Yet, there are a substantial amount of treatment issues and unmet medical requirements such as adversative reactions, drug-induced seizures, and deficiency of antiepileptogenic agents that can avert the growth of seizures and its comorbidities. Ratio of acute treatment successes and route of administration are crucial drivers of physicians' recommending decisions and/or are the emphasis of drug development for novel ARS therapies.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 3.20 Billion |

| Market Size in 2025 | USD 3.61 Billion |

| Market Size by 2034 | USD 10.58 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Region Type |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Product Insights

On the basis of product, the acute repetitive seizures market is classified into Diastat Rectal Gel, NRL-1, USL-261, AZ-002, and others. Among all, diastat rectal gel controlled majority of the revenue stake in 2023 due to its competence and absence of FDA-approved drugs in the marketplace. It is the solitary FDA-approved drug and the generic forms of it were announced in 2010. Amongst the numerous routes of medicine administration, patients favor the intra-nasal route over other kinds including rectal, buccal, and intramuscular route. Parenteral medications have confirmed to be the optimum choice for outpatient treatment. Yet, in few nations like the Netherlands, caregivers are not competent for managing parenteral medications.

Acute Repetitive Seizures Market Companies

- Neurelis, Inc.

- UCB S.A.

- Valeant Pharmaceuticals North America LLC

- Alexza Pharmaceuticals

- Others

Recent Developments

New-fangled product advancement with novel route of administration, acquisitions, mergers and tactical associations, distribution tie-ups, and augmented research & development spending are the key approaches implemented by top players in the global acute repetitive seizures treatment market.The acute repetitive seizures market is motivated by an intensification in the number of pharmaceutical players involved in new-fangled drug development and upsurge in pervasiveness of epileptic seizures.

- In September 2018, Neurelis, Inc., a pharmaceutical company submitted a New Drug NDA to the FDA for a treatment for epilepsy patients with acute repetitive seizures named VALTOCO.

- In January 2020, Neurelis, stated that the U.S. FDA has legalized diazepam nasal spray named VALTOCO as an acute treatment of intermittent, stereotypic episodes of recurrent seizure movement that are dissimilar from a patient's general seizure pattern in persons with epilepsy 6 years of age and older. The exclusive formulation of VALTOCO includesIntravail for reliable and consistent absorption.

- In May 2019, UCB declared that the U.S. FDA has permitted a New Drug Application for the company's latest anti-epileptic drug (AED) NAYZILAM nasal spray CIV. It is a benzodiazepine designated for the stereotypic incidents of recurrent seizure activity and acute treatment of intermittent that are different from a patient's normal seizure form in person with epilepsy 12 years and older1. NAYZILAM delivers caregivers and patients with the foremost and only FDA-approved nasal selection for treating seizure clusters.

Segments Covered in the Report

ProductOutlook

- NRL-1

- Diastat Rectal Gel

- USL-261

- AZ-002

- Others

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- South Africa

- North Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting