What is the U.S. Post-Acute Care (PAC) Market Size?

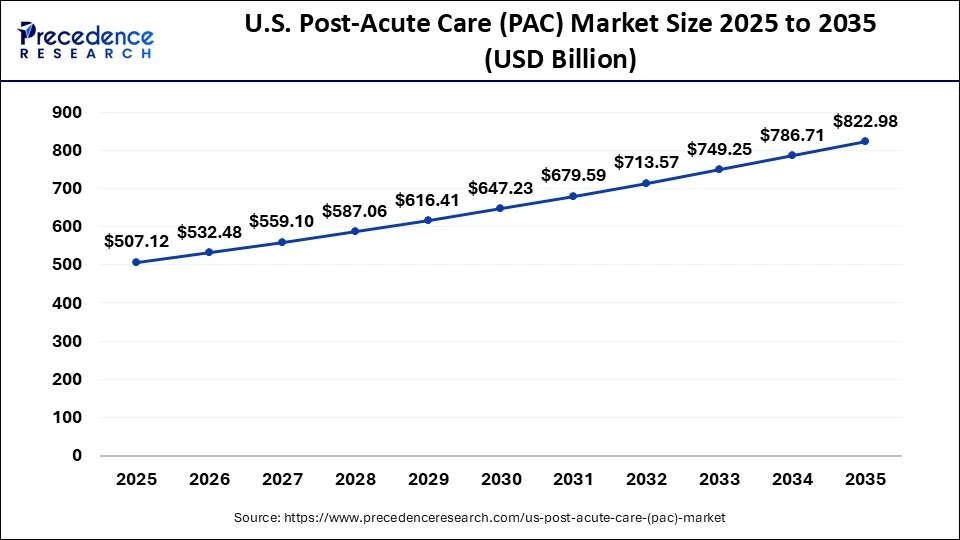

The U.S. post-acute care (PAC) market size is accounted at USD 507.12 billion in 2025 and predicted to increase from USD 532.48 billion in 2026 to approximately USD 822.98 billion by 2035, representing a CAGR of 4.96% from 2026 to 2035.The growing patient burden on hospitals in the U.S. boosts the demand for post-acute care.

U.S. Post-Acute Care (PAC) Market Key Takeaways

- By conditions, the amputations segment is the fastest-growing segment in the market.

- By application, the elderly segment dominates the market.

- By spending, the inpatient rehabilitation segment shows remarkable growth in the market.

What is Post-Acute Care (PAC) in the U.S.?

Post-acute care (PAC) is a healthcare service provided to patients after hospital discharge. The post-acute care services in the U.S. have been effective for both patients and the healthcare system in the country, as it provides quality healthcare support for acute to chronic illness by reducing the burden from hospital administration and medical expenditures for patients.

Not all patients are prepared for a home stay after a surgery/operation or prolonged illness. In such cases, hospital administration or doctors may suggest post-acute care to patients to manage their health. Post-acute care includes skilled services that offer healing/recovery, therapies, rehabilitation and management of medicines. Post-acute care centers provide skilled professionals such as certified nurses, therapists, dietary teams, case managers, assistance teams and clinical teams. Moreover, the doctors are connected with the clinical team of post-acute care centers for patients' health updates.

Under the observation of skilled professionals in post-acute care centers, patients are less likely to be re-admitted or suffer from severe health deterioration. Post-acute care provides medical attention and health monitoring to patients. Post-acute care services offer multiple advantages such as a comfortable environment for recovery, professional medical monitoring 24x7, wound care management, pain management, daily assistance such as dressing and bathing, self-care training and nutrition services for better clinical recovery of a patient.

Post-acute care services in the U.S. have elevated the overall healthcare management service for the population. In recent years, many hospitals in the U.S. have entered the field of post-acute care services by opening post-acute care centers and skilled nursing facility residences for their patients to ease the process of recovery. This has helped hospitals in the country stay in touch with their patients by offering them additional care after a prolonged hospitalization.

For instance, NYC Health + Hospitals in New York, United States, has five (5) advanced and unique post-acute care centers across New York City, including skilled nursing facilities and rehabilitation centers.

How is AI contributing to the U.S. Post-Acute Care (PAC) Industry?

AI makes a significant difference in post-acute care by enabling the implementation of proactive monitoring, predictive risk identification, automated documentation, and seamless care coordination. It offers support for personalized treatment plans, facilitates staff utilization and resource allocation, improves communication among different care locations, reduces some administrative burden, and ultimately leads to better patient outcomes, fewer preventable complications, and stronger value-based care delivery across skilled nursing, rehabilitation, and home health environments.

Market Outlook

- Industry Growth Overview:

The rise of the market is hastened by elderly people and the larger number of chronic cases, which require long care periods. - Sustainability Trends:

The trends during this time are in support of home care, telehealth integration, value-based models, and analytics-powered quality improvement initiatives. - Global Expansion:

Demand for organized post-acute care services grows with the increasing number of elderly worldwide, thus the market is expanding outside North America. - Major Investors:

Sector expansion got support from the participation of investors like Kindred Healthcare, Amedisys, Brookdale Senior Living, and Genesis Healthcare. - Startup Ecosystem:

The digital, AI, and virtual post-acute care tools are among the areas where start-ups are creating new business models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 507.12 Billion |

| Market Size in 2026 | USD 532.48 Billion |

| Market Size by 2035 | USD 822.98 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.96% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Conditions, By Application, and By Spending |

Market Dynamics

Many hospitals in the U.S. have begun to enter into a strategic partnership with post-acute care centers to manage patients post-discharge from hospitals for recovery. The increasing geriatric population in the country has boosted the demand for effective post-acute care management. Increasing demand for quality care and speedy recovery by the population are significant driving factors for the market's growth.

The overall development of the healthcare sector in the U.S. and the rapid adoption of skilled nursing facilities have fueled the growth of the post-acute care market in the country. Growing demand for home-based services post-hospitalization is seen as another factor driving the development of the market. Rising healthcare expenditures and increased cases of chronic diseases such as cancer, diabetes and cardiac disease have propelled the growth of the U.S. post-acute care market.

Moreover, the growing focus on improving patient outcomes by hospitals in the country has boosted the demand for post-acute care services to manage patients. The growth of the U.S. post-acute care market is driven by the involvement of social workers in the services that volunteer at the centers to provide additional support to the overall administration. Furthermore, the modernization of post-acute care centers in upcoming years is considered to boost the post-acute care market growth in the U.S.

However, the higher cost involved in service centers is likely to hinder the growth of the U.S. post-acute care market. The need for more skilled professionals in the centers is another restraining factor in developing the U.S. post-acute care market. Furthermore, changes in reimbursement policies by centers in the U.S. hamper the growth of the market. Along with this, the lack of awareness for advanced post-acute care services in countryside areas of the U.S. is a restraining factor for the growth of the U.S. post-acute care market.

Condition Insights

Based on the condition, the U.S. post-acute care market is segmented into neurological disorders, amputation, wound management, brain injury, spinal cord injury, and others. The increasing prevalence of cancer in the U.S. is boosting the growth of the amputation segment. The segment is the fastest-growing segment in the U.S. post-acute care market. Amputation is performed to remove a part of the body to stop cancer growth into the major blood vessels and nerves.

The amputation segment is expected to dominate the market during the forecast period. Post-acute care offers additional support and therapy for cancer patients post-amputation as they are disabled for a short time.

Furthermore, the neurological disorder segment is anticipated to show significant growth during the forecast period. Increasing cases of depression, brain stroke, multiple sclerosis, and other neurological diseases are prone to boost the development of the neurological disorder segment in the upcoming years. Post-acute care post-discharge from hospitals provides rehabilitation for such patients. Over one-of third patients with brain stroke conditions are moved to post-acute care facilities for rehabilitation in the U.S.

Application Insights

Based on application, the U.S. post-acute care market is segmented into elderly, adult, and child. The elderly segment dominates the market for post-acute care in the U.S. Population above 65 age group is considered to be in the elderly group. People at this age are at high risk of adverse health consequences and thus require ongoing healthcare support. The geriatric population with disabilities, complex health issues, or post-surgery demands seamless healthcare delivery. Post-acute care offers home as well as institutional care for older people.

Also, post-acute care reduces unnecessary hospital readmissions or pre-admissions for elderly people and promotes functional recovery. Factors such as the increasing geriatric population in the country, demand for cost-effective post-hospitalization services, and growing cases of chronic diseases that require continuous observation are prone to boost the growth of the elderly segment in the U.S. post-acute care market.

The rate of adults getting into post-acute care centers is comparatively lower than the elderly population. Furthermore, children with trauma and long-term illness will likely get into post-acute care services for recovery. The pediatric population of the country with special healthcare needs and medical complexities are likely to boost the growth of the child segment in the U.S. post-acute care market.

Spending Insights

Based on spending, the U.S. post-acute care market is segmented into skilled nursing facilities, home care, long-term acute care, and inpatient rehabilitation. The inpatient rehabilitation segment shows significant growth in the U.S. post-acute care market. Increased spending on rehabilitation facilities post-hospitalization for neurological and cardiac disorders is fueling the growth of inpatient rehabilitation in the U.S. market.

Rehabilitation is a therapy offered to patients to boost their strength and coordination. Increasing cases of chronic diseases that require continuous observation have grown in the skilled nursing facilities segment in recent years. The segment is expected to witness significant growth during 2024-2034. The skilled nursing facility is a licensed healthcare residence that offers full-time service to patients with the presence of registered nurses and other professional staff.

Skilled nursing facilities are designed to provide ongoing healthcare services for any health condition. The geriatric population is more likely to opt for skilled nursing facilities.

The prevalence of Covid-19 has boosted the demand for home care settings. The home care segment in the post-acute care market offers healthcare services such as bathing, dressing, medication and monitoring in the comfort of the home. However, the chances of readmission in hospitals for patients in home care settings are likely to hinder the growth of the home care segment in the U.S. post-acute care market.

Furthermore, patients with severe health conditions requiring extended treatment post-discharge for a minimum of 20 to 30 days are provided long-term acute care. The long-term acute care units in the post-acute care centers have specialized medical staff to manage patients quite differently than others at post-acute care centers.

U.S. Post-Acute Care (PAC) Market-Value Chain Analysis

- R&D: A systematic investigation and innovation to discover new drug candidates and refine the current ones as a support for the growth of the pipeline.

Key Players: Pfizer Inc., Johnson & Johnson, and Merck - Clinical Trials and Regulatory Approvals: Testing the drug for safety and efficacy in a rigorous manner and then submitting it to the authorities for approval to sell the drug in the market.

Key Players: IQVIA, Parexel, and ICON plc - Formulation and Final Dosage Preparation: Manufacturing phase wherein active and inactive ingredients are combined to yield stable, usable, and ready-to-use patient dosage forms.

Key players: Pfizer, Novartis - Packaging and Serialization: Finishing dosage forms with serial numbers that not only guarantee product integrity and patient safety but also prove compliance with regulations.

Key Players: Tracelink, Optel Group, and Antares Vision Group - Distribution to Hospitals, Pharmacies of the US Post-Acute Care (PAC) Market: A logistic network that not only delivers the finished products through distributors to the healthcare facilities serving post-acute care providers but also does so securely.

Key Players: McKesson Corporation, Cardinal Health

Top Companies in the U.S. Post-Acute Care (PAC) Market & Their Offerings:

- Brookdale Senior Living: Provides comprehensive services for the elderly, ranging from independent living and assisted living to memory care, continuing care communities, and home health support.

- Athena Health Care Systems: Offers nursing, rehab, long-term hospitals, and hospice care, all to a different degree, through which patients of all ages can receive post-acute care after discharge.

- Genesis Healthcare: Nationally, integrated post-acute services include skilled nursing, short-stay rehabilitation, long-term care, and contract rehabilitation programs.

US Post-Acute Care (PAC) Market Companies

- Brookdale Senior Living

- Athena Health Care Systems

- Genesis Healthcare

- The Ensign Group Inc

- LHS Group

Recent Developments

- In December 2025, a next-generation solution developed specifically for post-acute and long-term care environments, Assure Titanium Blood Glucose Monitoring System (BGMS), was launched by ARKRAY, a leader in clinical diagnostics and diabetes care solutions. Now available in the U.S., Titanium BGMS is created to help skilled nursing facilities, endocrinology clinics, and other post-acute providers advance their diabetes management protocols with confidence. (https://www.morningstar.com)

Segments Covered in the Report

By Conditions

- Neurological Disorder

- Amputations

- Wound Management

- Brain Injury

- Spinal Cord Injury

- Others

By Application

- Elderly

- Adult

- Child

By Spending

- Skilled Nursing Facilities

- Home Care

- Long-Term Acute Care

- Inpatient Rehabilitation

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting