What is the U.S. Smart Healthcare Market Size?

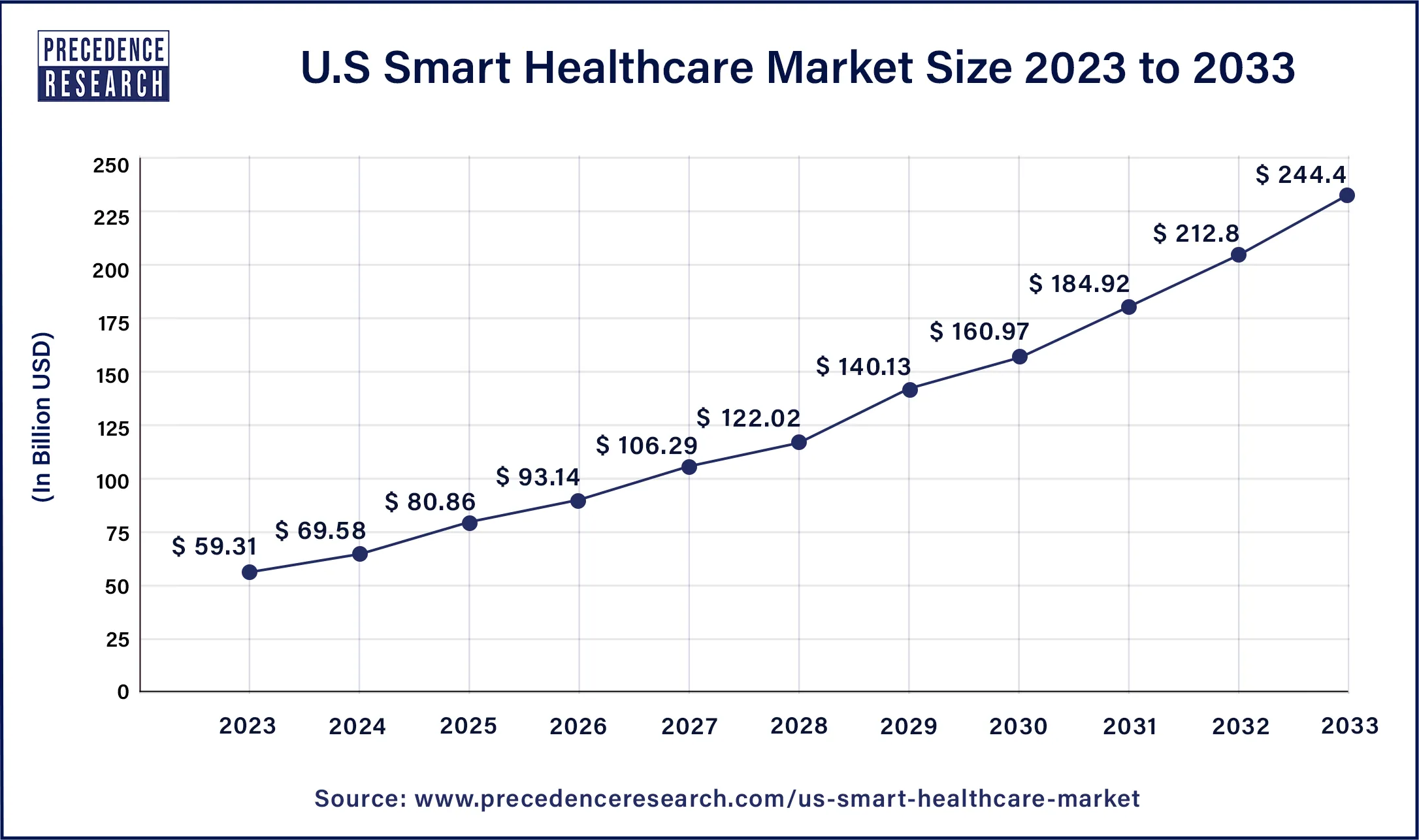

The USsmart healthcare market size surpassed USD 80.86 billion in 2025 and is projected to reach USD 276.00 billion by 2034, representing a CAGR of 14.98% from 2024 to 2033. The US smart healthcare market is driven by the growing need for RPM, or remote patient monitoring.

Market Highlights

- By product type, the telemedicine segment dominated the market in 2024.

- By product type, the mHealth segment is growing at a faster rate during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 80.86 Billion

- Market Size in 2026: USD 93.14 Billion

- Forecasted Market Size by 2034: USD 276.00 Billion

- CAGR (2025-2034): 14.98%

Market Overview

The U.S. smart healthcare market offers devices and solutions to manage chronic diseases, wearable technology and sensors gather real-time health data (heart rate, blood pressure, etc.), enabling earlier intervention and better results. Chatbots and technology-based treatment platforms provide accessible and reasonably priced mental health services. Healthcare systems are being worked on to become more interoperable so that providers may more readily share patient data.

Robotic, less intrusive operations are becoming more popular because they improve patient outcomes and hasten recovery. Technologies are being employed to promote disease prevention and early diagnosis. The proliferation of venture capital investment in smart healthcare fuels new product development and innovation.

- In October 2023, MedAID, a virtual assistant powered by AI for medical websites, was introduced by Anzolo Medical. MedAID offers website users round-the-clock assistance by responding to inquiries, dispensing information, and setting up appointments.

U.S. Smart Healthcare Market Data and Statistics

- In November 2023, Hyro and Artera collaborated to introduce an AI-powered virtual assistant. In as little as 48 hours, a healthcare provider can implement Artera Care Assist, a virtual web assistant on their website, to respond to frequently asked patient inquiries around the clock. The virtual assistant may respond to patient questions immediately using data on the provider's website, including office hours, parking locations, and other topics.

- In September 2023, Amazon revealed that it would be investing in generative AI and its application to the medical field. Healthcare is impacted by Amazon's $4 billion investment in the AI startup Anthropic.

- In January 2023, Varian has been granted an investigational device exemption for the RADIATE-VT cardiac radio ablation clinical trial. In PALO ALTO, California, the trial offers a chance to assess a non-invasive treatment option for individuals with high-risk refractory ventricular tachycardia.

Growth Factors

- The increasing number of people who have diabetes, heart disease, and cancer drives up demand for preventative treatment and remote monitoring.

- Real-time monitoring, early disease identification, and customized interventions are made possible by advancements in data processing, wearable technology, and linked devices, promoting the growth of the U.S. smart healthcare market.

- The use of cost-effective options like preventative care and remote monitoring is encouraged by rising healthcare expenses.

- Concerns are addressed, and developments in data security and privacy laws increase confidence in intelligent healthcare solutions.

- Healthcare data fuel market expansion to get insights into illness trends, treatment efficacy, and resource allocation.

- Growing emphasis on individualized treatment planning opens new possibilities for tailored medicines and AI-powered diagnostics.

- Market growth is driven by supportive policies such as funding for telehealth development and digital health infrastructure.

- The growing use of digital treatments, remote monitoring apps, and virtual consultations enhances accessibility and convenience.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 80.86 Billion |

| Market Size in 2026 | USD 93.14 Billion |

| Market Size by 2034 | USD 276.00 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.98% |

| Base Year | 2025 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type |

Market Dynamics

Drivers

Rapid innovation in AI, IoT, and wearables

AI algorithms can analyze massive quantities of patient data to enable early disease identification and individualized treatment regimens. Real-time surveillance and intervention are made possible by IoT devices and wearables, which continuously monitor health indicators and vital signs. The spread of user-friendly IoT wearables and gadgets motivates people to manage their health actively, encouraging wellness practices and preventive care, while promoting the growth of the U.S. smart healthcare market. AI-driven automation frees healthcare workers to concentrate more on patient care by streamlining administrative duties like booking appointments and maintaining medical records.

Consumer preference for convenience and accessibility

The desire for healthcare services that are always open to the public and unrestricted by traditional appointment scheduling is growing. With telemedicine and online monitoring tools provided by smart healthcare technologies, patients can receive medical care from the comfort of their homes. It can facilitate underprivileged people's access to healthcare services, such as those living in remote areas and those with restricted mobility. All patients can receive high-quality care because of telemedicine, mobile medical clinics, and remote diagnostic techniques that eliminate geographic barriers.

Restraints

Lack of interoperability

Often, healthcare data is kept in separate systems that are unable to communicate with one another efficiently. Because of this fragmentation, it is difficult for healthcare professionals to obtain complete patient data, resulting in inefficiencies and service gaps.

The seamless flow of information between various healthcare organizations, including hospitals, clinics, and labs, must be improved by incompatible data formats and standards. This affects patient outcomes and satisfaction by impeding provider collaboration and care coordination. Thereby, the lack of interoperability causes a major restraint for the US smart healthcare market.

Healthcare equity and access gaps

Only some have access to the high-speed internet or smartphones essential for smart healthcare solutions, particularly in remote or underprivileged locations. Access disparities are made worse by differences in digital and health literacy. Some populations might not be able to fully utilize or abuse smart healthcare devices because they lack the necessary knowledge or abilities. Disparities in the quality of care might result from healthcare providers' deliberate or unconscious bias or discrimination. Given that the acceptability of smart healthcare solutions depends on public confidence in the healthcare system, this may impact their uptake and efficacy.

Opportunities

Personalized public health interventions

Healthcare professionals can adjust their tactics to each patient's unique needs by considering genetic predispositions, lifestyle decisions, and environmental factors using personalized interventions. This focused approach may result in better patient satisfaction and more successful outcomes. Enabling people to participate actively in their health care promotes higher patient engagement. By receiving tailored advice and comments, patients are more likely to follow their treatment regimens and make better decisions.

Wearable technology and data analytics can be used to tailor therapies to emphasize preventive rather than reactive healthcare. Through the early detection and treatment of health disorders, before they worsen, this move can help save healthcare expenses.

Growing focus on mental health

The need for mental health services and solutions is rising as people become more aware of how crucial mental health is to overall well-being. Adopting smart healthcare solutions in this area is made more accessible by legislative initiatives to increase access to and affordability of mental health services and insurance coverage expansions for such services. Thereby, the rising emphasis on mental wellness is observed to create potential opportunities for the U.S. smart healthcare market.

Stress, anxiety, sadness, and other mental health issues are becoming more common, primarily because of cultural shifts, financial strains, and international emergencies like the COVID-19 pandemic. The increased prevalence of mental health issues increases the need for creative remedies.

Segments Insights

Product Type Insights

The telemedicine segment dominated the U.S. smart healthcare market in 2025. Patients can obtain medical services remotely using telemedicine, eliminating the requirement for in-person consultations. Its popularity has been greatly influenced by its convenience, particularly in rural areas with limited access to healthcare institutions. Telemedicine has expanded due to the widespread use of cell phones, high-speed internet, and advanced communication technology. Remote healthcare delivery has become smoother with the availability of video calls, chat platforms, and smartphone apps allowing patients to consult with healthcare providers.

- As reported in a study published in Communications Medicine, in March 2023, 29% of all mental health care appointments and 21% of substance use disorder treatments were conducted through telemedicine. Payment parity requirements correlate with a 2.5 percentage point rise in telemedicine usage in the first quarter of 2023 when compared to states lacking these mandates.

- Mobile health technology, or mHealth, is a rapidly expanding element in modern healthcare that aims to elevate and enhance health services. A recent poll revealed that 83 percent of doctors in the U.S. are currently utilizing mobile health technology or mHealth for caring for patients. In 2024, 43 percent of the U.S. population was utilizing health apps.

The mHealth segment is the fastest growing in the US smart healthcare market during the forecast period. With mobile health technologies, people may easily access healthcare services, keep an eye on their health, get advice, and access medical records from anywhere. Because mHealth solutions eliminate the need for costly medical procedures, hospital stays, and in-person consultations, they present affordable alternatives to traditional healthcare services.

Creating creative mHealth solutions for various healthcare requirements, including remote patient monitoring, telemedicine, and medication adherence, has been made possible by advancements in mobile technology, such as smartphones, wearables, and the Internet of Things devices.

US Smart Healthcare Market Companies

- Allscripts

- Cerner Corporation

- Cisco Systems

- GENERAL ELECTRIC COMPANY

- IBM Corporation

- BD

- AirStrip

- eClinicalWorksResideo Technologies, Inc.

Recent Developments

- In May 2025, on Children's Mental Health Awareness Day, Interactive Health Technologies, LLC (IHT), a leader in the industry based in Austin, Texas, and the producer of the only heart rate monitor system designed to assess the physical and emotional well-being of K-12 students, today unveils its latest device: the Spirit Heart Rate Monitor.

- In June 2024, BD, a prominent global medical technology firm, and Edwards Lifesciences, revealed a definitive agreement where BD will take over Edwards' Critical Care product group ("Critical Care"), a worldwide leader in advanced monitoring solutions, for $4.2 billion in cash, opening new avenues for value creation and strengthening BD's portfolio of smart connected care solutions. Critical Care is a rapidly expanding, pioneering leader in sophisticated patient monitoring, utilizing advanced AI algorithms to assist millions of patients worldwide.

- In September 2024, Oracle revealed a new replenishment solution within Oracle Fusion Cloud Supply Chain & Manufacturing designed to assist healthcare clients in enhancing inventory management. The updated RFID for Replenishment solution in Oracle Fusion Cloud Inventory Management, which is included in Oracle Cloud SCM, employs RFID technologies from Avery Dennison, Terso Solutions, and Zebra Technologies to automatically record usage, refresh stock balances, monitor location, and initiate replenishment of supplies and materials.

- In August 2023, Philadelphia's Jefferson Health and Nashville's Vanderbilt University Medical Center introduced virtual nursing programs to enhance treatment delivery and lessen administrative workloads.

- In April 2023, Bosch BASF Smart Farming and AGCO Corporation have announced today that they will work together to create new features and incorporate Smart Spraying technology into Fendt Rogator sprayers for commercialization.

- In March 2023, Eli Lilly & Company said that the prices of its most prescribed insulins would be reduced by 70% and that the Insulin Value Program, which sets patient out-of-pocket expenses at $35 or less per month, would be expanded. Lilly is taking these steps to help Americans who might struggle to navigate a complicated healthcare system that might prevent them from accessing inexpensive insulin and to make Lilly insulin more accessible.

Segments Covered in the Report

By Product Type

- RFID Kanban Systems

- RFID Smart Cabinets

- Electronic Health Records (EHR)

- Telemedicine

- mHealth

- Smart Pills

- Smart Syringes

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting