What is the Subcutaneous Immunoglobulin Market Size?

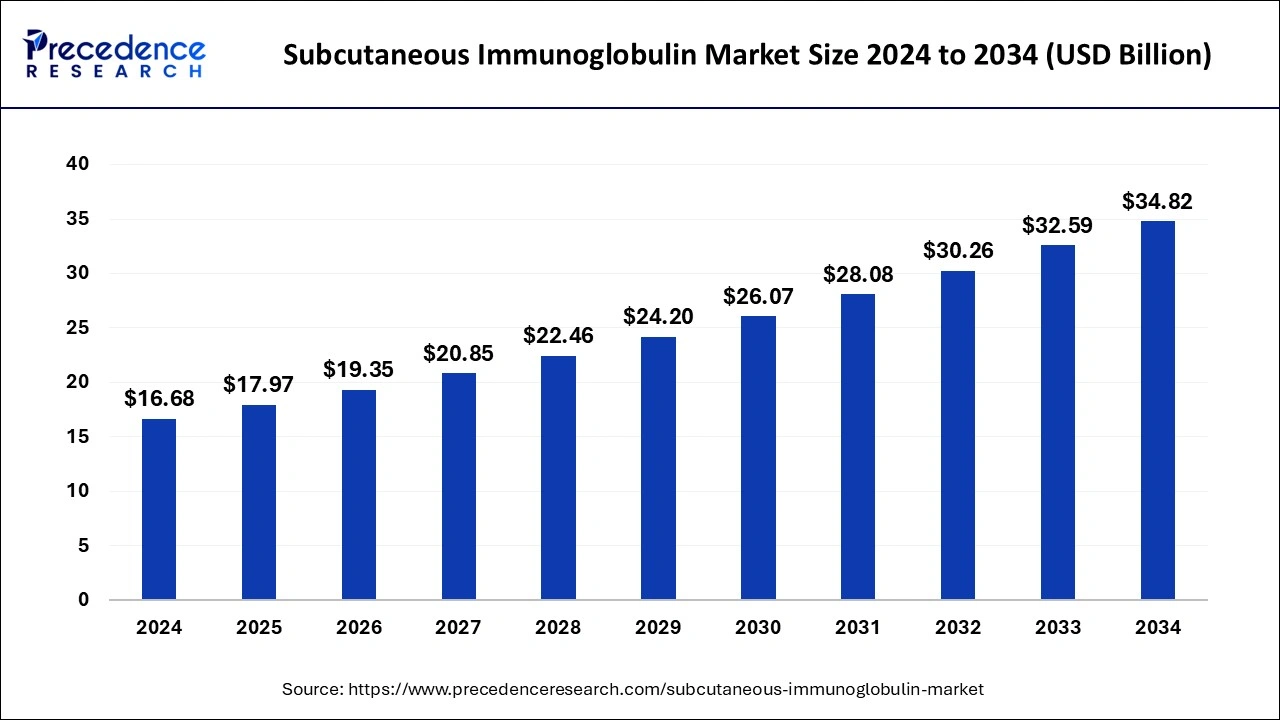

The global subcutaneous immunoglobulin market size was estimated at USD 17.97 billion in 2025 and is predicted to increase from USD 19.35 billion in 2026 to approximately USD 37.12 billion by 2035, expanding at a CAGR of 7.52% from 2026 to 2035.

Subcutaneous Immunoglobulin MarketKey Takeaways

- In terms of revenue, the global subcutaneous immunoglobulin market was valued at USD 17.97billion in 2025.

- It is projected to reach USD 37.12billion by 2035.

- The market is expected to grow at a CAGR of 7.52% from 2026 to 2035.

- North America dominated the market with the largest share in 2025.

- Asia Pacific is observed to grow at the fastest CAGR during the forecast period.

- By product type, the IgG segment held the largest share of the market in 2025.

- By application, the primary immunodeficiency segment dominated the market in 2025. The segment is observed to sustain the position during the forecast period.

- By end-use, the hospital segment dominated the market in 2025.

What is the Subcutaneous Immunoglobulin?

The global subcutaneous immunoglobulin market offers a method of administering immunoglobulin (Ig) therapy by injecting immunoglobulin beneath the skin (subcutaneously). Immunoglobulins are proteins that play a crucial role in the immune system, helping to fight off infections and providing immunity. SCIg therapy is often used in the treatment of certain immunodeficiency disorders, where the body's immune system is unable to produce enough antibodies to effectively combat infections.

By delivering immunoglobulins subcutaneously, the therapy helps supplement the deficient antibodies, boosting the individual's immune response. Compared to intravenous immunoglobulin (IVIg) administration, which involves injecting immunoglobulins directly into a vein, SCIg allows for a slower and more sustained absorption of the immunoglobulins into the bloodstream.

This method is often preferred by patients because it can be administered at home, reducing the need for frequent hospital visits. The choice between subcutaneous and intravenous administration depends on various factors, including the patient's condition, preferences, and the specific requirements of the immunoglobulin therapy.

How is AI contributing to the Subcutaneous Immunoglobulin Industry?

AI promotes SCIG therapy by providing individual dosing models and adherence rates. Algorithms study the pharmacokinetics, predict the response to treatment, and optimize the ways of administration. Linked devices monitor infusion, treat side effects, enhance patient trust, simplify supply planning, and enhance clinical research in rare immunological diseases.

Subcutaneous Immunoglobulin MarketGrowth Factors

- There is a general trend in healthcare towards more patient-centric and home-based treatments. The shift from intravenous immunoglobulin (IVIg) to SCIg can be driven by the desire to offer patients a more convenient and comfortable treatment option, while promoting the growth of the subcutaneous immunoglobulin market.

- Ongoing advancements in infusion pump technology and the development of more user-friendly devices for administering SCIg can drive market growth. Improved devices may enhance patient experience and ease of use.

- SCIg is commonly used in the treatment of primary immunodeficiency disorders (PIDD), where the immune system is compromised. As the awareness and diagnosis of immunodeficiency disorders increase, the demand for SCIg may also rise. Thus, this is expected to drive the subcutaneous immunoglobulin market during the forecast period.

Market Outlook

- Industry Growth Overview: High-concentration formulations and the adoption of home-based therapy keep increasing the demand for SCIG around the world.

- Sustainability Trends: Manufacturers maximize the yield of plasma, fractionation capability, and reliability of supply, and minimize its impact on the environment.

- Major Investors: BioTest AG, Baxter International Inc., ADMA Biologics, CSL Behring, Takeda Pharmaceutical Company Limited, Grifols S.A., in addition to Kedrion Biopharma.

Subcutaneous Immunoglobulin Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.52% |

| Market Size in 2025 | USD 17.97 Billion |

| Market Size by 2035 | USD 37.12Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

An increase in immune-related diseases

As immunodeficiency conditions become more prevalent, the subcutaneous immunoglobulin market is growing. The need is being driven by conditions like primary and secondary immunodeficiency diseases. Because patients with compromised immune systems require effective subcutaneous immunoglobulin inoculations for immune system augmentation, the subcutaneous immunoglobulin market is growing. Due to its simplicity as compared to traditional intravenous methods, the market is expanding. As awareness of immune-deficiency diseases and improved diagnostics increase, the market will likely see a rise in demand for affordable and effective immunoglobulin treatments.

Advantages of administration

Ongoing research and development efforts have led to the development of advanced SCIG formulations with improved stability, bioavailability, and pharmacokinetic profiles. Newer SCIG products offer longer dosing intervals, reduced infusion volumes, and enhanced tolerability, which contribute to improved patient compliance and treatment outcomes. SCIG offers several advantages over intravenous immunoglobulin (IVIG) therapy, including convenience, flexibility, and reduced healthcare resource utilization. Patients can self-administer SCIG at home, eliminating the need for frequent hospital visits and intravenous infusions, which enhances patient convenience and quality of life.

Restraint

High cost and limited awareness

The cost of SCIg therapy, including the immunoglobulin product itself and associated administration supplies, can be a significant factor limiting its widespread adoption. Affordability and reimbursement policies may impact patient access to SCIg treatment. Moreover, a lack of awareness among healthcare providers and patients about the benefits of SCIg therapy compared to other forms of immunoglobulin administration, such as intravenous immunoglobulin (IVIg), could be a constraint.

Opportunity

Technological advancements

Significant subcutaneous immunoglobulin market expansion is being driven by technological advancements. Drug delivery innovations, such as the use of autoinjectors and vaccination devices, improve behavior and increase patient comfort and compliance. Production processes yield incredibly complex and sophisticated formulas, optimizing the results of therapy. Advancements in diagnosis and observation methods permit personalized treatment regimens and simultaneous tracking of immunoglobulin levels. The subcutaneous immunoglobulin market is changing as a result of the evolving technical landscape, which promises improved patient outcomes, availability, and productivity in the treatment of immunodeficiency diseases.

Segment Insights

Product Type Insights

The IgG segment held the largest share of the subcutaneous immunoglobulin market in 2025. IgG is a type of immunoglobulin, specifically one of the four subclasses of antibodies found in the blood. Immunoglobulin therapy involves the administration of immunoglobulin products, which can include IgG, to individuals with primary immunodeficiency disorders or certain autoimmune conditions. The increasing product launches are expected to propel the segment expansion.

- For instance, In January 2022, Argenx SE announced that the Ministry of Health, Labour and Welfare (MHLW) in Japan has approved VYVGART. For the treatment of individuals with generalized myasthenia gravis (gMG), intravenous infusion of VYVGART is recommended. Besides, the IgM segment is expected to grow at the fastest rate over the forecast period.

IgM is one of the five major classes of immunoglobulins, or antibodies, found in the blood. Immunoglobulin therapy typically involves the replacement or supplementation of immunoglobulins, including IgM, for individuals with primary immunodeficiency disorders or certain autoimmune conditions. Immunodeficiency disorders can result in a lack of one or more immunoglobulin classes, including IgM. Replacement therapy aims to provide the deficient antibodies, and the composition of immunoglobulin products may include IgM. Thereby, driving the segment expansion.

Application Insights

The primary immunodeficiency segment dominated the subcutaneous immunoglobulin market. Immunoglobulin surface is used subcutaneously as a patient's primary immunodeficiency treatment, transforming healing gait. The need for subcutaneous immunoglobulin is increasing because of the approval of home spun management, which gives patients self-managing options, reduces reliance on hospital visits, and promotes dependability. Its adaptable treatment plan with customized dosage regimens accommodates various lifestyle choices.

Immunoglobulin administered subcutaneously ensures a constant supply of immunoglobulins, maintaining stable antibody levels and protecting against contaminations. It increases patient satisfaction with the least amount of overall consequences, offering a recommended and feasible solution. Thus, this is expected to drive the global subcutaneous immunoglobulin market growth.

End-use Insights

The hospital segment held the largest share of the subcutaneous immunoglobin market. The segment is observed to sustain the growth during the forecast period. While subcutaneous immunoglobulin therapy is often associated with home-based treatment due to its convenience and self-administration potential, hospitals also play a role in the administration of SCIg. Some patients may receive their SCIg therapy within a hospital setting, particularly if they require medical supervision or if they are newly diagnosed and need initial training.

Hospitals admit patients for immunoglobulin therapy, including SCIg, for various reasons. This could include patients with primary immunodeficiency disorders or other conditions where immunoglobulin replacement is indicated. In such cases, hospitals provide the infrastructure and expertise to administer the therapy.

The homecare segment is expected to grow at the highest CAGR during the forecast period. One of the primary drivers for the growth of the homecare segment in the market is the convenience it offers to patients. Home-based administration allows individuals to self-administer their SCIg therapy, reducing the need for frequent hospital or clinic visits. Additionally, the development of user-friendly and portable infusion devices has facilitated the shift toward home-based SCIg administration. Advances in technology have made it easier for patients to self-administer their treatments. Thereby, driving the segment expansion.

Regional Insights

North America, in 2025, held the largest share of the subcutaneous immunoglobulin market because of advances in technology that have improved productivity in prescription and delivery processes while raising awareness among patients and healthcare donors, boosting the market. Growing healthcare spending is correlated with the recognition of its clinical utility and the approval of the government to expand treatment alternatives. Patient-centered care promotes the ease of SCIG, which promotes wider adoption. The aggressive topography consists of stimulating inventions from both surfacing and entrenched actors. Collaboration drives the gathering of facts, insurance coverage influences strategy, and the COVID-19 effect emphasizes the sector's viability by highlighting its critical role in immune-related scenarios.

U.S. Subcutaneous Immunoglobulin Market Trends

The U.S. is the pioneer of innovations with home infusion preference and the strength of reimbursements. Convenience and compliance are enhanced with the help of SCIG. The increased concentration preparations increase secondary immunodeficiency application, decrease hospital dependence, and enhance outpatient administration of immunotherapy.

Besides, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. Increasing awareness among healthcare professionals and patients about the benefits of SCIg therapy has contributed to its adoption. Education programs and awareness campaigns have played a role in informing the medical community and the public. Moreover, government initiatives and policies supporting the treatment of immunodeficiency disorders may impact the availability and affordability of SCIg in the region. These policies can include reimbursement mechanisms and incentives. Thus, this is expected to drive the subcutaneous immunoglobulin industry in the region.

Japan Subcutaneous Immunoglobulin Market Trends

Japan registers a fast rate of adoption by high-end delivery devices and regulatory licensing. Self-care is supported by the aging population and plasma localization programs. This augments the demand of long term outpatient immunoglobulin therapy by increasing the SCIG uptake in chronic neurological disorders.

What Are the Driving Factors of The Subcutaneous Immunoglobulin Market in Europe?

Europe is expected to grow at a remarkable rate during the forecast period. Europe is a highly growing region with the help of patient-centric regulations that promote home-based therapy. Supply is enhanced by investments in plasma collection and fractionation. Adoption is pioneered by Germany, France, and Spain via organised reimbursement systems and long-term immunodeficiency management programs.

Germany Subcutaneous Immunoglobulin Market Trends

Germany is expected to witness steady adoption due to well-organized patient training programs. Subcutaneous therapy is better than intravenous therapy in regard to quality of life. Germany is the best SCIG market in Europe with strong infrastructure, high diagnosis rates, and favorable reimbursement.

Value Chain Analysis of the Subcutaneous Immunoglobulin Market

- R&D: High-concentration immunoglobulin preparations and delivery systems to facilitate safe home-based self-administration.

Key Players: Takeda, CSL Behring, Grifols, Octapharma, Biotest, ADMA Biologics - Clinical Trials and Regulatory Approvals: Trials in human beings to establish the safety and efficacy and pass the strict regulatory examination procedures.

Key Players: Takeda, CSL Behring, Grifols, Octapharma, ADMA Biologics - Formulation and Final Preparation of dosage: Preparation of plasma antibodies with stabilizers to make strong liquid preparations to use as injections.

Key players: CSL Behring (Hizentra), Takeda (HYQVIA), Grifols (Xembify) - Packaging and Serialization: Digital identifiers with vial filling, which can be tracked as well as counterfeited.

Key players: Gerresheimer, CSL Behring, Takeda - Distribution to Hospitals and Pharmacies: Looking after the cold chain logistics that maintain the biological integrity of transportation and storage.

Key players: CSL Behring, Takeda, Grifols, Octapharma, Kedrion, ADMA Biologics

Subcutaneous Immunoglobulin Market Companies

- Pfizer Inc.: Indications Cutaquig is provided as an intravenous immunoglobulin. Cutaquig is indicated for the treatment of primary humoral immunodeficiency in both adults and children.

- Johnson & Johnson: Via Omrix, manufactures plasma-derived immunoglobulins to facilitate more extensive immunotherapy and biosurgical side effects.

- Baxter International Inc.: Further research led to the development of HyQvia that allowed SCIG with an extended interval of administration owing to the use of hyaluronidase-enhanced absorption.

Other Major Key Players

- Takeda Pharmaceutical Company Limited

- Grifols SA

- CSL Behring

- Kedrion S.p.A

- Biotest AG

- ADMA Biologics, Inc.

- Octapharma AG

- Shanghai RAAS Blood Products Co. Ltd.

Recent Developments

- In November 2025, Merus N.V. and Halozyme Therapeutics, Inc. announced a global non-exclusive collaboration. Merus licensed Halozyme's ENHANZE drug delivery technology to develop and commercialize subcutaneous administration of petosemtamab, a bispecific antibody targeting EGFR and LGR5.(Source: https://ir.merus.nl )

- In February 2025, CSL Behring K.K. received approval from Japan's MHLW for ANDEMBRY (garadacimab) Subcutaneous Injection 200mg Pens, aimed at preventing acute hereditary angioedema (HAE) attacks. This marks the first pre-filled pen for monthly subcutaneous use for HAE prophylaxis, following similar approvals in Australia, the UK, and the EU. (Source: https://www.prnewswire.com )

- In September 2023,Takeda revealed that CUVITRUTM [Immune Globulin Subcutaneous (Human), 20% Solution] can now be used in patients with agammaglobulinemia or hypogammaglobulinemia1, conditions marked by extremely low or absent antibody levels and a higher risk of serious recurrent infection brought on by either primary (PID) or secondary (SID) immunodeficiency2. With this permission, patients in Japan will get subcutaneous immunoglobulin (SCIG) treatment for the first time.

- In November 2023, Chugai Pharmaceutical Co., Ltd. declared the launch of Phesgo combination for Subcutaneous Injection MA, IN [generic name: genetically recombinant pertuzumab, trastuzumab, and vorhyaluronidase alfa] (henceforth, Phesgo), an anti-HER2 humanized monoclonal antibody and antineoplastic agent for the treatment of “HER2-positive breast cancer” and “Advanced or recurrent HER2-positive colorectal cancer that has progressed after cancer chemotherapy and is not amenable to curative resection.” On September 25, 2023, Phesgo was authorized by the Ministry of Health, Labour and Welfare (MHLW) and was included in the current national health insurance (NHI) reimbursement price list.

- In April 2023, leading biotechnology company CSL Behring announced that a 50mL/10g prefilled syringe for Hizentra (Immune Globulin Subcutaneous [Human] 20% Liquid) has been authorized by the FDA in the United States. To fulfil the specific needs of individuals with Primary Immunodeficiency (PI) or Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), CSL Behring now provides a full variety of prefilled syringe sizes. The first and only immune globulin (Ig) that comes in an easy-to-use, prefilled syringe that is ready to use is called Hizentra.

Segments Covered in the Report

By Product Type

- IgA

- IgG

- IgM

By Application

- Primary Immunodeficiency Disease

- Secondary Immunodeficiency Disease

By End-use

- Clinics

- Homecare

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting