Anti-D Immunoglobulin Market Size and Forecast 2025 to 2034

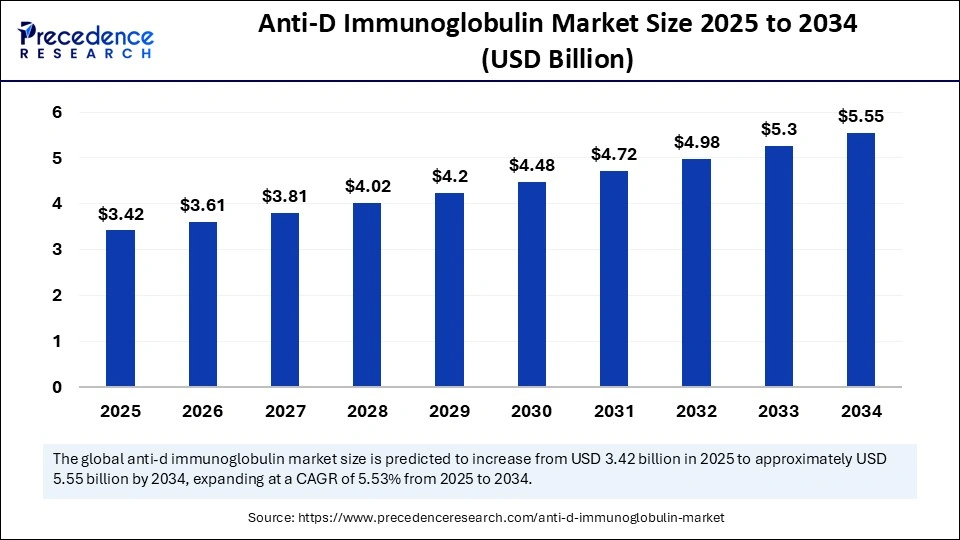

The global anti-D immunoglobulin market size accounted for USD 3.24 billion in 2024 and is predicted to increase from USD 3.42 billion in 2025 to approximately USD 5.55 billion by 2034, expanding at a CAGR of 5.53% from 2025 to 2034. The market is growing rapidly due to rising awareness of Rh incompatibility, government-supported immunization programs, and increasing demand for prophylactic treatment for hemolytic disease of the newborn.

Anti-D Immunoglobulin MarketKey Takeaways

- In terms of revenue, the anti-D immunoglobulin market is valued at $3.42billion in 2025.

- It is projected to reach $5.55 billion by 2034.

- The market is expected to grow at a CAGR of 5.53% from 2025 to 2034.

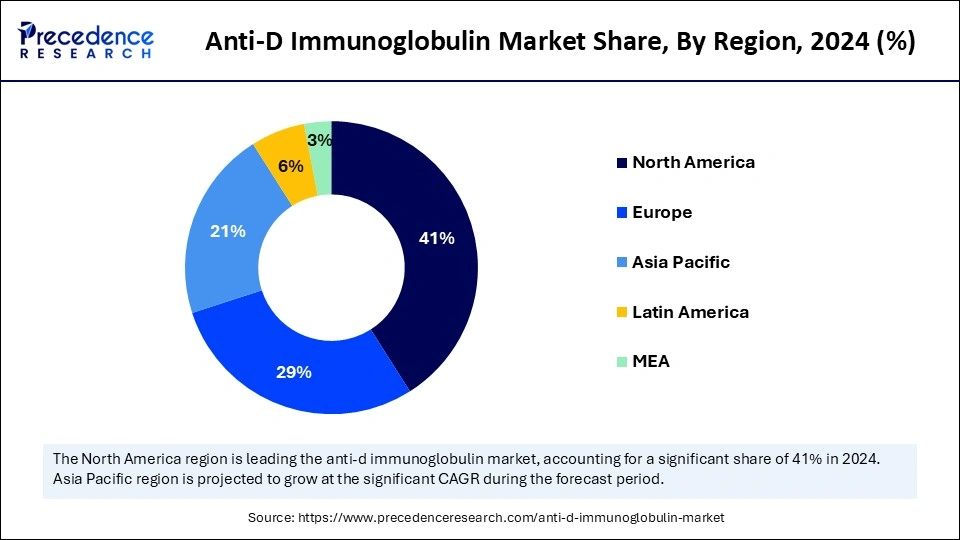

- North America led the anti-D immunoglobulin market with the highest share of 41% in 2024.

- Asia Pacific is expected to expand a the fastest CAGR between 2025 and 2034.

- By product type, the intravenous anti-D immunoglobulin segment held the biggest market share in 2024.

- By product type, the intramuscular anti-D immunoglobulin segment is expected to grow at a significant CAGR between 2025 and 2034.

- By application, the Rh immunoprophylaxis during pregnancy segment captured the major market share in 2024.

- By application, the hemolytic disease of the newborn (HDN) segment is expected to expand at the highest CAGR over the projected period.

- By rout of administration, the intravenous administration segment held the largest market share in 2024.

- By rout of administration, the parenteral administration segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By dosage form, the liquid formulation segment led the market in 2024.

- By end-user, the hospitals segment captured the biggest market share in 2024.

- By end-user, the blood banks segment is expected to expand at the fastest CAGR over the forecast period.

How is Artificial Intelligence Impacting the Anti-D Immunoglobulin Market?

Artificial intelligence is rapidly transforming the market for anti-D immunoglobulin by better enabling early diagnosis and risk assessment of Rh incompatibility during pregnancy. AI-based tools are capable of leveraging patient data to identify Rh-negative mothers and anticipate their chance of developing Rh sensitization (due to exposure from an Rh-positive pregnancy) to administer anti-D immunoglobulin in a timely manner. Moreover, AI accelerates the discovery and development of new anti-D immunoglobulin drugs by identifying potential drug candidates.

Furthermore, AI will eliminate medical record “silo” effects by automating analyses and document-based reviews and will assist clinicians in making informed data-based medical decisions. Pharmaceutical companies are using AI to accelerate research, improve processes, enhance production, and ensure compliance with regulatory bodies. As AI continues to merge into systematizing prenatal care, it will also continue to address the complications imposed by Rh incompatibility and generally assist with maternal and neonatal health.

U.S. Anti-D Immunoglobulin Market Size and Growth 2025 to 2034

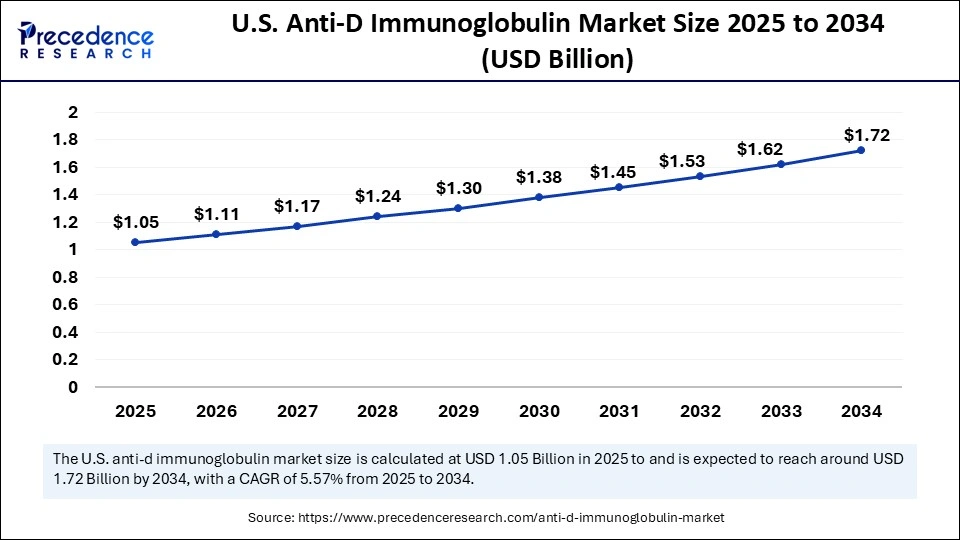

The U.S. anti-D immunoglobulin market size was exhibited at USD 1.00 billion in 2024 and is projected to be worth around USD 1.72 billion by 2034, growing at a CAGR of 5.57% from 2025 to 2034.

What Made North America the Global Leader in the Anti-D Immunoglobulin Market?

North America dominated the market by holding the largest share in 2024. This is mainly due to the increased birth rates in the region, leading to a large population of pregnant women who may require anti-D immunoglobulin. The robust health system, high awareness of Rh incompatibility, and government endorsement of immunization policies further contribute to the region's dominance. North America has early screening guidelines and timely Rh immunoprophylaxis for pregnancy, which aim to reduce the prevalence of hemolytic disease of newborn (HDN).

The U.S. is a major player in the market within North America. High prenatal care standards and developed networks of public and private providers that offer advanced blood products consistently support market expansion. The U.S. FDA brought attention to maternal health programs in the U.S. by stating that maternal Rh screening should routinely open up as a target where it is relevant and appropriate. This highlighted the need for anti-D immunoglobulin. Additionally, increasing collaboration between pharmaceutical companies and research institutions is positively impacting product development and innovation practices.

What Factors Support the Growth of the Anti-D Immunoglobulin Market Within Asia Pacific?

The anti-D immunoglobulin market in Asia Pacific is expected to grow at the fastest rate in the coming years. This is mainly due to high birth rates and increasing prevalence of Rh-negative mothers. The rising awareness of Rh incompatibility and enhanced maternal healthcare systems contribute to high demand for anti-D immunoglobulin. Countries such as India, China, and the Philippines are constantly improving their screening programs for Rh into public health policies because they believe that it has the potential to reduce preventable neonatal complications.

Notably, India is emerging as a major player due to its growing pharmaceutical sector and rising investment in maternal health infrastructure. In 2025, the Ministry of Health in India launched campaigns aimed at reducing HDN-related neonatal mortality rates. In addition, the Indian government is investing heavily in advancing healthcare infrastructure to improve access to affordable healthcare.

Market Overview

The anti-D immunoglobulin market deals with the manufacturing and distribution of Rho(D) immune globulin, a blood product used to protect Rh-negative individuals from becoming immunized against Rh-positive blood. Its primary use is in the treatment of Rh-negative pregnant women in the events of childbirth, miscarriage, and invasive prenatal procedures to decrease the incidence of hemolytic disease in the newborn. The growth of the market is driven by multiple factors, including greater awareness of maternal-fetal health, rising numbers of pregnancies globally, and improved diagnostic capabilities that result in increased treatments of eligible Rh-negative individuals.

In addition, government efforts aimed at mitigating complications to neonates, increasing standardization of prenatal care and management plans,biopharmaceutical innovations, and collaborative efforts with positive outcomes from manufacturers and vendors to improve availability and product reliability contribute to market growth. Both intramuscular and intravenous formulations are prevalent in the marketplace, comprising hospitals, clinics, and specialty pharmacies as points of access.

Anti-D Immunoglobulin MarketGrowth Factors

- Increased Global Birth Rate: Higher birth rates, particularly in developing countries, increase the demand for prenatal care solutions, such as Anti-D immunoglobulin, to reduce human harm related to Rh incompatibility.

- Increasing Awareness of Hemolytic Disease: Increased education to healthcare providers and expectant mothers regarding hemolytic disease of the newborn has encouraged providers to routinely provide Anti-D immunoglobulin as prophylaxis.

- Government Initiatives for Prenatal Health Care: National health initiatives and policies surrounding maternal and neonatal health foster access and funding in public health care systems for essential treatments like Anti-D immunoglobulin.

- Improved Diagnostic Screening: Advancements in screening technologies for Rh typing and prenatal screening produce more timely diagnoses regarding at-risk pregnancies, thereby increasing appropriate, timely use of Anti-D immunoglobulin.

- Expanding Healthcare Infrastructure: Growing hospitals, clinics, and maternity care facilities, particularly in developing economies, enhance access to Anti-D immunoglobulin products and infrastructure to administer the product.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.55 Billion |

| Market Size in 2025 | USD 3.42 Billion |

| Market Size in 2024 | USD 3.24 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application,Route of Administration, End-User, Dosage Form, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Supply Shortages

Supply shortages of anti-D immunoglobulin significantly drive the growth of the market. Shortages create a sense of urgency, encouraging pharmaceutical companies to boost production. Shortages also highlight the critical need for the product. In 2024, the U.S. Food and Drug Administration (FDA) notified healthcare facilities of a shortage of Rho(D) immune globulin and that the reason cited was strong demand and decreased supply. As a result, manufacturers, such as Kedrion Biopharma, placed their anti-D products (Rho(D) immune globulin) under allocation.

(Source: https://www.aabb.org)

As the shortage grew, clinical organizations began fetal Rh(D) genotyping through non-invasive cell-free DNA testing to determine whether anti-D use was indicated. The process would help to conserve the limited supplies and avoid unnecessary use of anti-D; however, this also highlighted the critical role anti-D immunoglobulin plays in maternal care. The current clinical situation has induced market pressure that is prompting governments and healthcare providers to be involved in procurement. Concurrently, manufacturers are investing in enhanced production scale-ups to stabilize their supply chain, which is boosting market growth.

Restraint

Complicated Manufacturing Processes and Expensive Costs Impede Global Access

The complicated and expensive manufacturing of anti-D immunoglobulin is likely to restrain the growth of the market. Anti-D is produced out of human plasma. Multiple purification sequences are needed to separate the required antibodies to produce anti-D and also guarantee virus and product contamination safety. This standard requires lots of capacity and is supremely costly, with limited capacities in many geographies to manufacture anti-D. In addition, depending on a human donor pool affects market growth. The limited availability of Rh-negative blood donors can restrict the supply of anti-D immunoglobulin. These obstacles lead to high dose costs and can be cumbersome to healthcare systems, particularly in developing countries. Moreover, the high cost of anti-D immunoglobulin limits its accessibility and availability in some regions.

Opportunity

Recombinant Innovations & Intelligent Targeting via Fetal Genotyping

The future key opportunity in the anti-D immunoglobulin market lies in recombinant technology and personalized diagnostics. Historically, anti-D products are derived from human plasma. Recent advances in science have allowed the development of recombinant anti-D immunoglobulin from cell-based systems. Bharat Serums & Vaccines in India has an advanced recombinant anti-D product, Trinbelimab, which is now in a clinical program in over 20,000 Rh-negative pregnant women. Lab-made antibodies can provide more consistent quality, less reliance on donors, and scale-up supply.

At the same time the use of non-invasive fetal RhD genotyping using cell-free fetal DNA (cffDNA) is letting clinicians know whether the fetus is Rh-positive or negative. In a recent study from the U.S., the targeted use of anti-D found that dependent on the fetal genotype lowered unnecessary prophylactic doses by over 20%. The intersection of biotechnology and precision can now offer more effective, tailored, and cost-effective opportunities for maternal-fetal care and an exciting market opportunity.

Product Type Insights

Which Product Type Segment Dominate the Market in 2024?

The intravenous anti-D immunoglobulin segment dominated the anti-D immunoglobulin market with the largest share in 2024. This is mainly due to its widespread acceptance as it absorbs easily and acts quickly. It is typically administered in a hospital setting for managing acute cases of Rh incompatibility and immune thrombocytopenia. It is ideal when precise and controlled dosing is necessary, particularly in high-risk cases and during labor and delivery. It is effective; it has a documented formulation and clinical management strategies have been well established, which support its predominance in developed and developing healthcare systems.

The intramuscular anti-D immunoglobulin segment is expected to grow at a significant CAGR during the forecast period due to its ease of use and low cost. This medication is commonly used for prenatal prophylaxis, and even with fatigue surrounding the 28-week injection. With no or fewer side effects, intramuscular anti-D immunoglobulin is a good fit for community health programs. Importantly, as awareness grows and global initiatives rise to prevent Rh sensitization in pregnant women, especially in remote and underserved areas, the demand for intramuscular injections rises.

Application Insights

Why did the Rh Immunoprophylaxis during Pregnancy Segment Dominate the Market in 2024?

The Rh immunoprophylaxis during pregnancy segment dominated the anti-D immunoglobulin market as this is a standardized process during antenatal care. Anti-D immunoglobulin is administered to all Rh-negative women to prevent maternal sensitization to Rh-positive blood and complications in future pregnancies. Included in prenatal care guidelines around the world, it is now common practice to ensure that anti-D immunoglobulin is available in hospitals and maternity clinics. Hospitals in developed and developing countries are routinely ordering anti-D immunoglobulin for each antenatal intervention, supporting segmental growth.

The hemolytic disease of the newborn (HDN) segment is expected to expand at the highest CAGR over the projected period. Hemolytic disease of the newborn (HDN) is the most rapidly growing application as neonatal care has started to be treated as a priority worldwide. Screening programs have improved, and the diagnosis and treatment of HDN due to Rh incompatibility are now commonplace. Many countries are starting and/or expanding maternal and child health initiatives, leading to rising demand for anti-D immunoglobulin for the management of HDN, especially in countries with high Rh-negative prevalence rates.

Dosage Form Insights

What Made Liquid Formulation the Dominant Segment in the Anti-D Immunoglobulin Market?

The liquid formulation segment dominated the market with the largest share in 2024. This is mainly due to its established clinical use, ease of administration, and minimal preparation time. Healthcare professionals prefer liquid forms when administering intravenous immunoglobulin (IVIG) to patients because of the reduced risk of dosing errors. The liquid formulation is particularly useful in emergencies, such as Rh incompatibility situations, which can arise during pregnancy when rapid administration is critical. This segment is benefitting from relatively high availability and stable supply chains.

The ready-to-use formulation segment is expected to grow rapidly over the projected period due to its convenience and reduced need for onsite preparation. Ready-to-use formulations greatly reduce the need for preparation time, making them well-suited for outpatient and emergency treatment environments. The demand for ready-to-use anti-D immunoglobulin is increasing as healthcare facilities are increasingly moving toward efficient, standardized treatment protocols.

End-user Insights

How Does the Hospitals Segment Dominate the Market?

The hospitals segment dominated the anti-D immunoglobulin market with a major share in 2024 due to their major role in the administration of anti-D immunoglobulin during labor emergencies and labor interventions, Rh screening procedures, and provision of immunization care. Hospitals are the main sites for births, blood transfusions, and immunological care and are the major end-users of anti-D products. They have the capacity to support IV and parenteral administration, making anti-D immunoglobulin mandated.

The blood banks segment is expected to expand at the fastest rate over the forecast period due to their contribution to the storage and distribution of anti-D immunoglobulin. With growing attention on donor-recipient compatibility and the prevention of alloimmunization, blood banks are becoming key suppliers of prophylactic doses of anti-D. The expansion of public and private blood storage facilities in developing markets is resulting in the fast growth of this segment.

Route of Administration Insights

What Made Intravenous Administration the Dominant Segment?

The intravenous administration segment dominated the anti-D immunoglobulin market in 2024. This is mainly due to the high preference for intravenous administration for its rapid onset of action and targeted delivery. Giving a precise dose in a rapid method is important, especially in cases such as acute ITP or severe cases of Rh sensitization. Hospitals appreciate and use IV administration due to its biocompatibility. It can achieve a controllable immune response rapidly. The IV route has been used on a large scale in tertiary care and obstetric centers where there is often little or no time for delay.

The parenteral administration segment is anticipated to grow at a remarkable CAGR in the coming years. This is mainly due to their quicker absorption, resulting in a quick effect in a variety of indications. Healthcare providers appreciate that parenteral options give greater service flexibility, which improves treatment outcomes. The increase in parenteral options contributes to the growth of the segment.

Recent Development

- In August 2024, The UK & Ireland Blood Transfusion Network (UKIBTN) introduced a new patient leaflet on anti-D immunoglobulin use during pregnancy to support better awareness, informed decision-making, and consistent guidance across maternity services.

(Source: https://hospital.blood.co.uk)

Anti-D Immunoglobulin Market Companies

- Octapharma

- Kedrion Biopharma

- Grifols

- Saol Therapeutics

- Bayer

- Bio Products Laboratory

- Others

Segments Covered in the Report

By Product Type

- Intramuscular Anti-D Immunoglobulin

- Intravenous Anti-D Immunoglobulin

By Application

- Hemolytic Disease of the Newborn (HDN)

- Rh Immunoprophylaxis during Pregnancy

- Management of Thrombocytopenic Patients

By Route of Administration

- Parenteral Administration

- Intravenous Administration

- Subcutaneous Administration

By End-User

- Hospitals

- Clinics

- Blood Banks

- Research Laboratories

By Dosage Form

- Liquid Formulation

- Lyophilized Powder Formulation

- Ready-to-Use Formulation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content