What is the Acute Lymphocytic Leukemia Therapeutics Market Size?

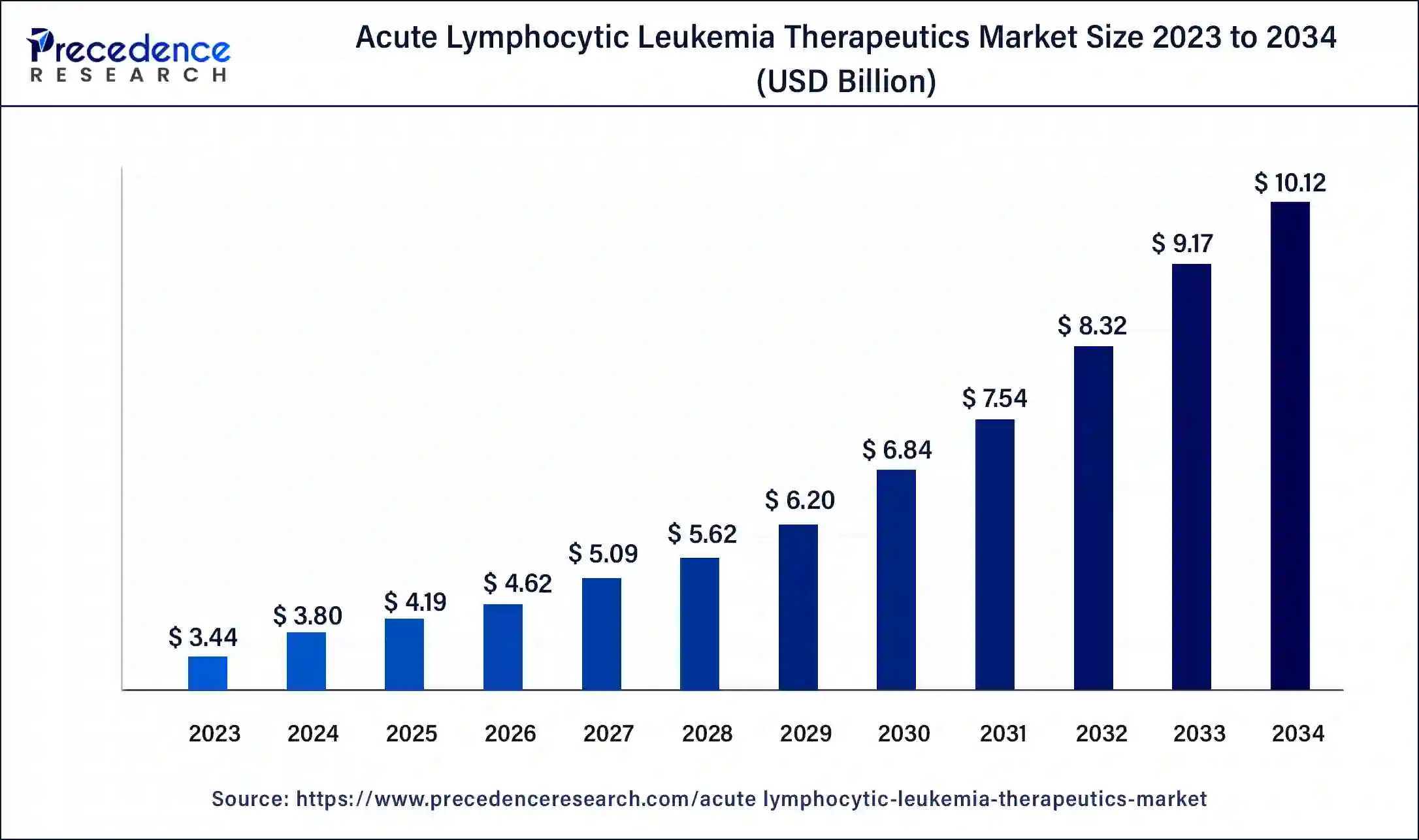

The global acute lymphocytic leukemia therapeutics market size accounted for USD 4.19 billion in 2025 and is expected to be worth around USD 11.00 billion by 2035, at a CAGR of 10.13% from 2026 to 2035.

Acute Lymphocytic Leukemia Therapeutics Market Key Takeaways

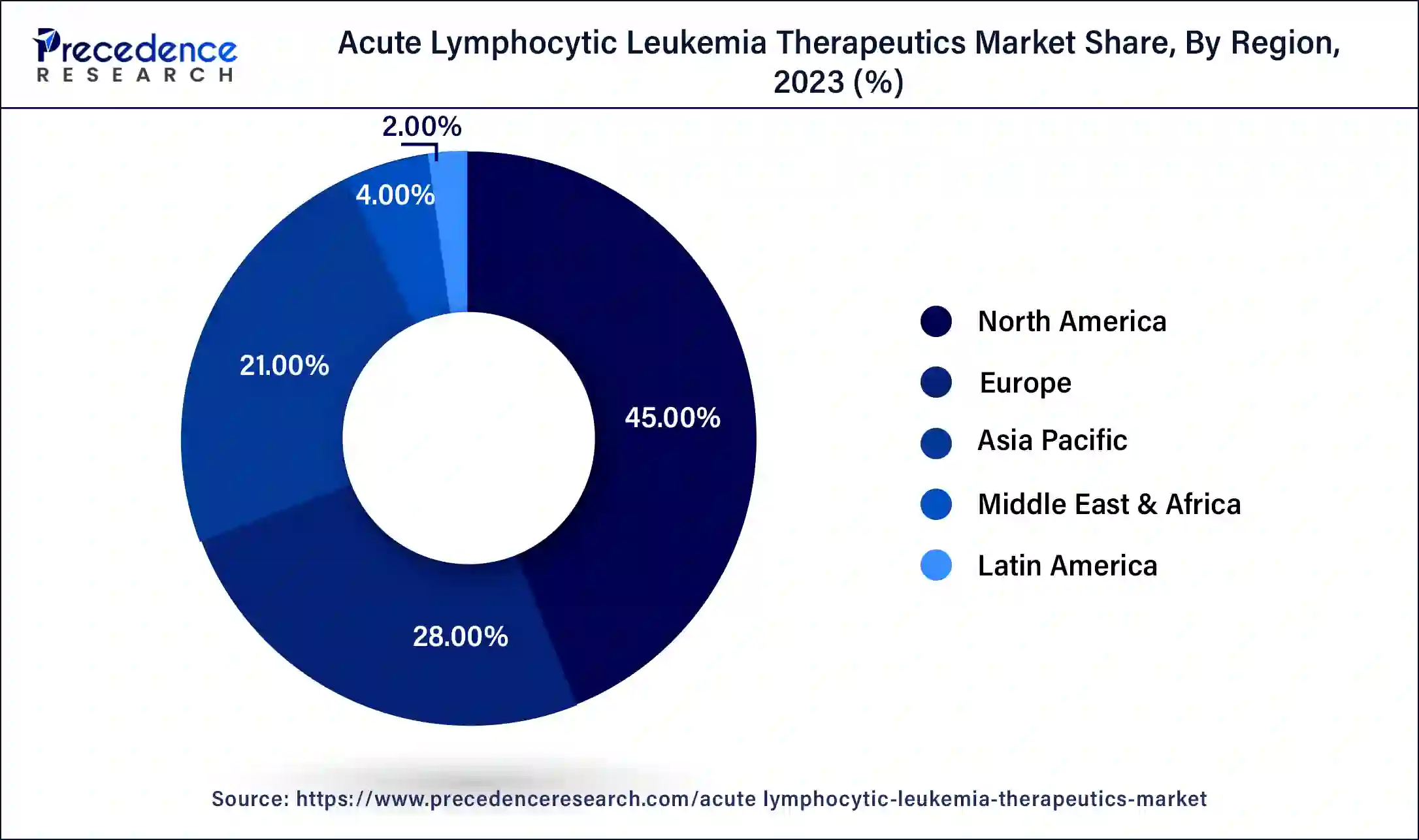

- North America generated for the maximum market share of 45% in 2025.

- By Type, the pediatrics segment captured for the major market share in 2025.

- By Drug, the hyper-CVAD regimen segment contributed to the largest market share in 2025.

- By Cell, the philadelphia chromosome segment captured the highest market share in 2025.

- By Therapy, the chemotherapy segment generated the maximum market share in 2025.

- By Route of Administration, the injectable segment captured for the majority market share in 2025.

- By Distribution Channels, the Hospital segment generated the highest market share in 2025.

Market Overview

Acute lymphocytic leukemia is a type of blood and bone marrow cancer, and bone marrow is the spongy tissue inside bones that produces blood cells. The ongoing clinical trials for acute lymphocytic leukaemia therapeutics, such as consolidation therapy with Blinatumomab to establish survival rates in recently diagnosed adult patients with B-lineage acute lymphoblastic leukaemia in quantifiable residual disease negative remission, which ultimately resulted from the ECOG-ACRIN E1910 Randomized Phase III National Cooperative Clinical Trials Network Trial, are expected to provide ample opportunities in the future.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.19 Billion |

| Market Size in 2026 | USD 4.62 Billion |

| Market Size by 2035 | USD 11.00 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.13% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Drug, By Cell, By Therapy, By Route of Administration, and By Distribution Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rise in incidence of the acute lymphocytic leukemia

The rise in the incidence of acute lymphocytic leukemia is driving the market's growth. According to the American Cancer Society research, acute lymphocytic leukemia in the US for 2023 is about 6,540 new cases, of which 3,660 were male and 2,880 females. The mortality is about 1,390 700 in males and 690 in females. Risks of developing acute lymphocytic leukemia are high in children younger than five.

The danger then reduces slowly until the mid-20s and increases again after age 50. Generally, nearly four of every ten cases of acute lymphocytic leukemia are in adults. ALL is rare cancer that accounts for less than half of all cancers in the United States.

The average human lifetime risk of contracting ALL is approximately one in 1,000. Males are slightly more at risk than females, and Whites are more at risk than African Americans. Most cases are in children, but many of ALL deaths (about four out of five) are in adults. Children outperform adults due to differences in childhood and adult ALL, distinctions in treatment (children's bodies may often withstand aggressive treatment better than adults), or a combination of these factors.

Restraints

High cost of treatment

The high cost of treating acute lymphocytic leukemia obstructs the market.

For instance, the cost of acute lymphocytic leukemia treatment in India

| Treatment | Induction Chemotherapy | Consolidatory Chemotherapy | Maintenance Chemotherapy | Bone Marrow Transplant |

| Cost | 12000 USD | 3500-4000 USD/Month | 3500-4000 USD/month | Autologous transplant: 15,000 USD Allogenic transplant (Full match): 22,000 USD Allogenic transplant (Half match): 40,000 USD |

| Duration | Two weeks | 3-4 months | 18 months to 2 years | 7-10 days |

| Type | Inpatient | Outpatient | Outpatient | Inpatient/Outpatient |

Cost of the all in the US –

Median outpatient costs at 36 months were USD 187,000 for the cohort overall, USD 171,000 for patients aged 1-9 years, USD 221,000 for those aged 10-12 years and USD 274,000 for those age 13 and older. The annual average estimated costs for the initial and treatment stage was estimated to be USD 42,000 and USD 5,000, respectively.

Opportunity

Extensive ongoing clinical trials

The rise in clinical trials for ALL is anticipated to boost the market. For instance, the Safety and Pharmacokinetics of subcutaneous Blinatumomab (SC blinatumomab) for treating adults with relapsed or refractory B Cell Precursor Acute Lymphoblastic Leukemia (R/R-ALL) is going through the clinical phase 1b. Moreover, ongoing clinical phase III, Blinatumomab Alternating with low-intensity Chemotherapy (CT) treatment for Older Adults with newly diagnosed Philadelphia (Ph)- Negative B-Cell Precursor Acute Lymphoblastic Leukemia (BCP-ALL) is well tolerated and efficacious: safety run-in results for the phase 3 randomised controlled golden gate study.

Additionally, Ponatinib and Blinatumomab for patients with newly diagnosed Philadelphia Chromosome-Positive Acute lymphoblastic leukaemia: A Subgroup Analysis from a Phase II study. Thus, all the ongoing clinical trials are estimated to drive the market.

Type Insights

Based on the type, the global ALL therapeutics market is segmented into Pediatrics, Adults. In 2023, the Pediatrics segment accounted for the highest market share. The high prevalence of ALL among the pediatric population is driving the growth of the segment. ALL is the most common malignancy diagnosed in children, representing more than a quarter of all pediatric cancers accounting for about 30 per cent of all pediatric cancer. According to the American Cancer Society, there are about 3,000 ongoing cases of ALL in children and youth up to age 21 each year in the United States. ALL has one of the highest cure rates of all childhood cancer.

Drug Insights

Based on the drug, the global ALL therapeutics market is segmented into Hyper-CVAD Regimen, Linker Regimen, Nucleoside Metabolic Inhibitors, Targeted Drugs & Immunotherapy, CALGB 811 Regimen, and Oncasper. In 2023, the Hyper-CVAD Regimen segment accounted for the highest market share. This is due to the wide range of use in ALL treatments. Hyper-CVAD Regimen is the most used therapy for ALL. Hyper-CVAD includes cyclophosphamide, vincristine sulfate, doxorubicin hydrochloride (Adriamycin), and dexamethasone. It involves the drugs methotrexate and cytarabine. This regimen consists of 8 alternating courses A (cyclophosphamide, vincristine, doxorubicin, dexamethasone) and course B (methotrexate, cytarabine), given every 21 to 28 days.

Cell Insights

Based on Cells, the global ALL therapeutics market is segmented into B-cell ALL, T-Cell ALL, and Philadelphia Chromosome. In 2023, the Philadelphia Chromosome segment accounted for the largest market share. The Philadelphia chromosome is a cytogenetic abnormality that appears as a condensed version of human chromosome 22. Over 90% of chronic myelogenous leukemia (CML) patients and 25% of adult acute lymphocytic leukaemia patients have pH chromosomes. The Philadelphia (Ph) chromosome is divided into two subgroups. People's chances of contracting this disease increase as they age. Tyrosine kinase inhibitors such as dasatinib (Sprycel), imatinib (Glivec), and nilotinib are frequently used to treat ALL (Tasigna). Acute lymphoblastic leukemia is one of the indications for the drug mentioned above. A drug that is used to treat chronic myeloid leukaemia can also be used to treat acute lymphoblastic leukaemia.

Therapy Insights

Based on the Therapy, the global ALL therapeutics market is segmented into Chemotherapy, Targeted Therapy, Radiation Therapy, and Stem Cell Transplantation. In 2025, the chemotherapy segment accounted for the highest market share. This is owing to its potential to eliminate leukaemia cells and inhibit malignant cells from increasing and multiplying, reducing disease progression. All these factors have contributed to increased chemotherapy medication rates over the last two decades. In chemotherapy, single or combined-effect medications (chemotherapy regimen) are used to treat ALL. This therapy employs cytotoxic agents, antimetabolites, alkylating compounds, and other plant derivatives.

Route of Administration Insights

Based on the route of administration, the global ALL therapeutics market is segmented into Oral and Injectable. In 2023, the injectable segment accounted for the highest market share. The segment growth is driven by a significant number of drugs in injectable forms, such as chemotherapy and targeted therapy, which is a highly selected route of administration. Injectable drugs get absorbed intravenously and provide rapid outcomes, raising their preference.

Distribution Channels Insights

The global ALL market is segmented into Hospital Pharmacy, Retail Pharmacy, and Others based on distribution channels. In 2023, the Hospital segment accounted for the largest market share. Hospitals are the primary source of treatment, and patients visit hospitals to diagnose and treat various therapies, which results in the growth of hospital pharmacies.

Regional Insights

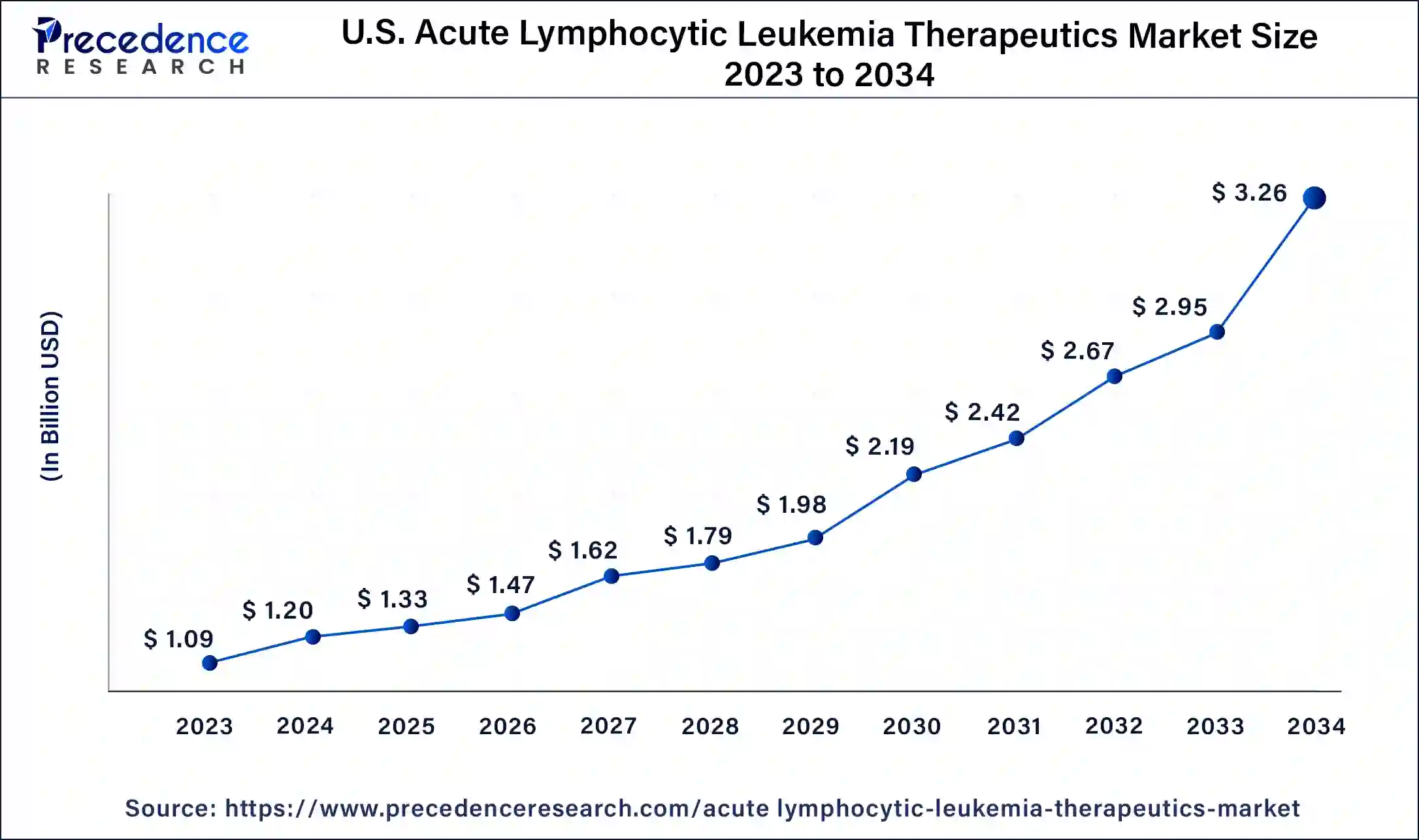

U.S. Acute Lymphocytic Leukemia Therapeutics Market Size and Growth 2026 to 2035

The U.S. acute lymphocytic leukemia therapeutics market size is estimated at USD 1.33 billion in 2025 and is predicted to be worth around USD 3.57 billion by 2035, at a CAGR of 10.38% from 2026 to 2035.

In 2023, North America dominated the market, accounting highest market share. Significant market players in the US and well-recognized healthcare infrastructure and technological advancement are the primary factors contributing to the country's considerable market considerable share.

Additionally, the US is expected to see substantial expansion owing to the drug reaction (inotuzumab ozogamicin) released in August 2021 and robust pipeline drugs such as eryaspase (asparaginase), which is in phase II clinical trials. Furthermore, expanding private healthcare institutions and high spending power in individuals are expected to drive market growth during the forecast period.

The region's market dominance is further supported by NIH funding, Canadian research investments, and expanded trial support. Government agencies in North American countries, such as the U.S. and Canada, promote innovation through policies and targeted funding. Additionally, growing awareness, early diagnosis programs, and high patient access to cutting-edge therapies further strengthen North America's market leadership.

Why is Asia Pacific Considered the Fastest-Growing Region in the Acute Lymphocytic Leukemia Therapeutics Market?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to increasing healthcare investments, rising incidence of leukemia, and expanding access to advanced cancer treatments across countries like China and India. The Asia-Pacific Leukemia Consortium (APLC) is an initiative dedicated to managing specific diseases and improving leukemia treatment in the region. This group aims to tackle the increasing threat of leukemia in this area through its collaborative effort.

India Acute Lymphocytic Leukemia Therapeutics Market Analysis

The market in India is driven by rising leukemia prevalence, increased awareness of early diagnosis, growing adoption of advanced targeted therapies, and supportive government initiatives for cancer treatment. The Ministry of Health and Family Welfare has taken important steps to encourage research, development, and use of CAR-T cell therapy. In April 2025, AbbVie introduced Venetoclax in India for treating Acute Myeloid Leukemia (AML) and Chronic Lymphocytic Leukemia (CLL).

What Makes Europe a Notably Growing Area in the Acute Lymphocytic Leukemia Therapeutics Market?

Europe is a notably growing region in the market due to its well-established healthcare infrastructure, strong research and development in oncology, and widespread access to innovative targeted therapies. In January 2025, the European Commission approved blinatumomab monotherapy for the treatment of acute lymphoblastic leukemia. The European

Union is making efforts to establish a network of cancer centers, supporting the market.

What are the Major Factors Contributing to the Acute Lymphocytic Leukemia Therapeutics Market within Latin America?

The Latin American market is driven by the increasing incidence of leukemia, growing awareness of early diagnosis, and rising adoption of advanced targeted therapies. Governments around the region are launching programs to expand access to advanced treatments for hematologic cancers and acute lymphocytic leukemia. Other related initiatives include domestic cell therapy production and new national cancer frameworks.

What Opportunities Exist in the Middle East & Africa for the Acute Lymphocytic Leukemia Therapeutics Market?

The Middle East & Africa (MEA) offers significant opportunities in the market, driven by government programs and initiatives focused on localizing advanced leukemia treatments. Expanding access to innovative treatments, government initiatives to improve cancer care, and collaborations with global pharmaceutical companies also provide significant growth potential in the region.

Value Chain Analysis

- R&D

This stage focuses on discovering and developing innovative ALL therapies, including targeted drugs, immunotherapies, and gene-based treatments to improve patient outcomes.

Key Players: Amgen Inc., Novartis AG, Pfizer Inc., Bristol Myers Squibb, and Gilead Sciences. - Manufacturing & Production:

Manufacturers produce ALL therapeutics, including oral drugs, injectables, biologics, and CAR-T therapies, ensuring quality, compliance, and scalability for global distribution.

Key Players: Novartis, Pfizer, Bristol-Myers Squibb, F. Hoffmann-La Roche, and Gilead Sciences. - Distribution to Hospitals and Pharmacies

This stage ensures that ALL therapeutics are delivered efficiently to hospitals, oncology centers, and pharmacies, enabling timely patient access to critical treatments.

Key Players: McKesson Corporation, Cencora, Cardinal Health, PHOENIX Group, and Sinopharm Group. - Patient Support and Services

Pharmaceutical companies provide patient education, adherence programs, and clinical support services to optimize therapy outcomes and manage side effects.

Key Players: Amgen Inc., Novartis AG, Pfizer Inc., Bristol Myers Squibb, Gilead Sciences, Roche, and Jazz Pharmaceuticals.

Acute Lymphocytic Leukemia Therapeutics Market Companies

- Amgen, Inc

- Bristol-Myers Squibb Company

- F. Hoffman-La-Roche Ltd

- Pfizer

- Erytech Pharma

- Leadiant Biosciences, Inc

- Takeda Pharmaceuticals, Inc

- Novartis AG

- Sanofi

- Spectrum Pharmaceuticals, Inc

Recent Developments

- In February 2025, Pfizer Inc. announced that the U.S. FDA approved its combination regimen called ADCETRIS for treating relapsed or refractory diffuse large B-cell lymphoma.

Source: https://www.pfizer.com - In October 2024, Novartis announced that its U.S. FDA-approved drug Scemblix provides superior efficacy, safety, and tolerability for newly diagnosed patients with chronic myeloid leukemia.

Source: https://www.novartis.com - In April 2022,Coeptis Therapeutics, Inc, a biopharmaceutical company developing innovative cell therapy platforms for cancer and Bull Horn Holdings Corp. announced that they entered into a definitive merger agreement for a business combination.

- In October 2023, Thermo Fisher Scientific Inc. announced the completion of its acquisition of The Binding Site Group, a global leader in specialty diagnostics. The acquisition will aid in the growth of the specialty diagnostics market.

Segments Covered in the Report

By Type

- Paediatrics

- Adults

By Drug

- Hyper-CVAD Regimen

- Linker Regimen

- Nucleoside Metabolic Inhibitors

- Targeted Drugs & Immunotherapy

- CALGB 811 Regimen

- Oncasper

By Cell

- B-cell ALL

- T-Cell ALL

- Philadelphia Chromosome

By Therapy

- Chemotherapy

- Targeted Therapy

- Radiation Therapy

- Stem Cell Transplantation

By Route of Administration

- Oral

- Injectable

By Distribution Channels

- Hospital Pharmacy

- Retail Pharmacy

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting