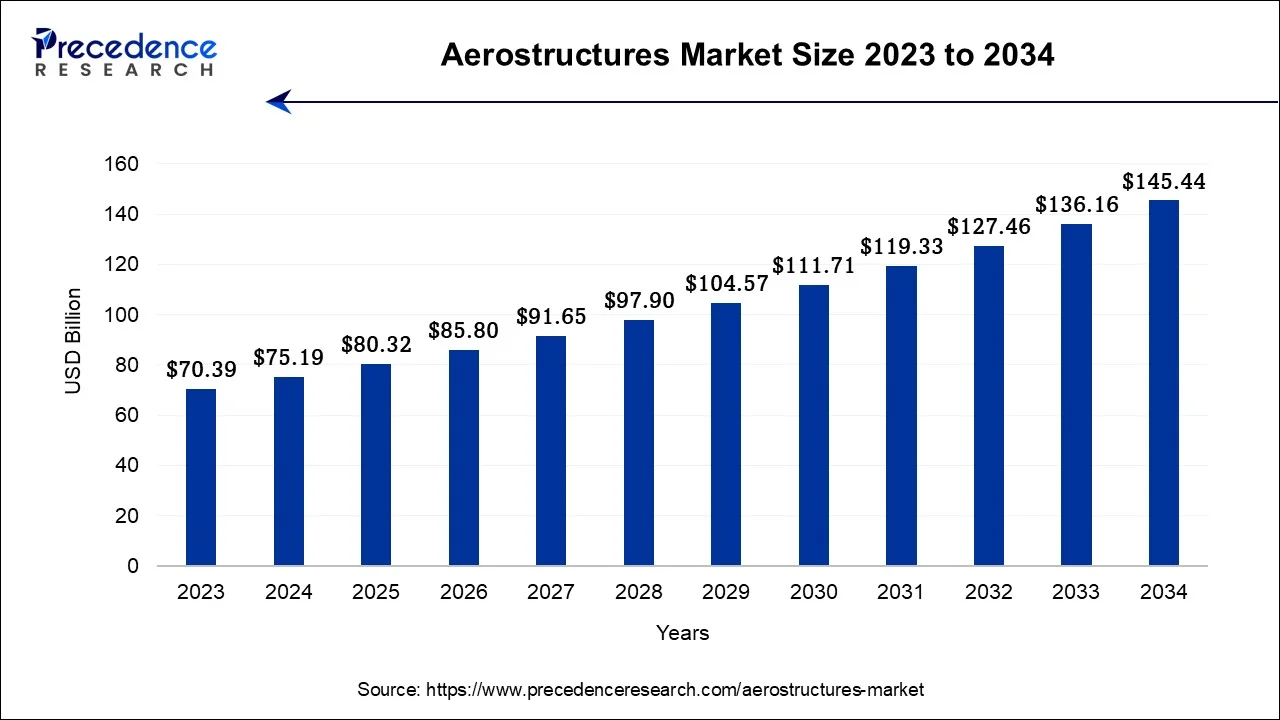

What is the Aerostructures Market Size?

The global aerostructures market size accounted for USD 80.32 billion in 2025 and is predicted to be worth around USD 154.33 billion by 2035, poised to grow at a CAGR of 6.75% between 2026 to 2035.

Aerostructures Market Key Takeaways

- In terms of revenue, the market is valued at $80.32 billion in 2025.

- It is projected to reach $154.33billion by 2035.

- The market is expected to grow at a CAGR of 6.75% from 2026 to 2035.

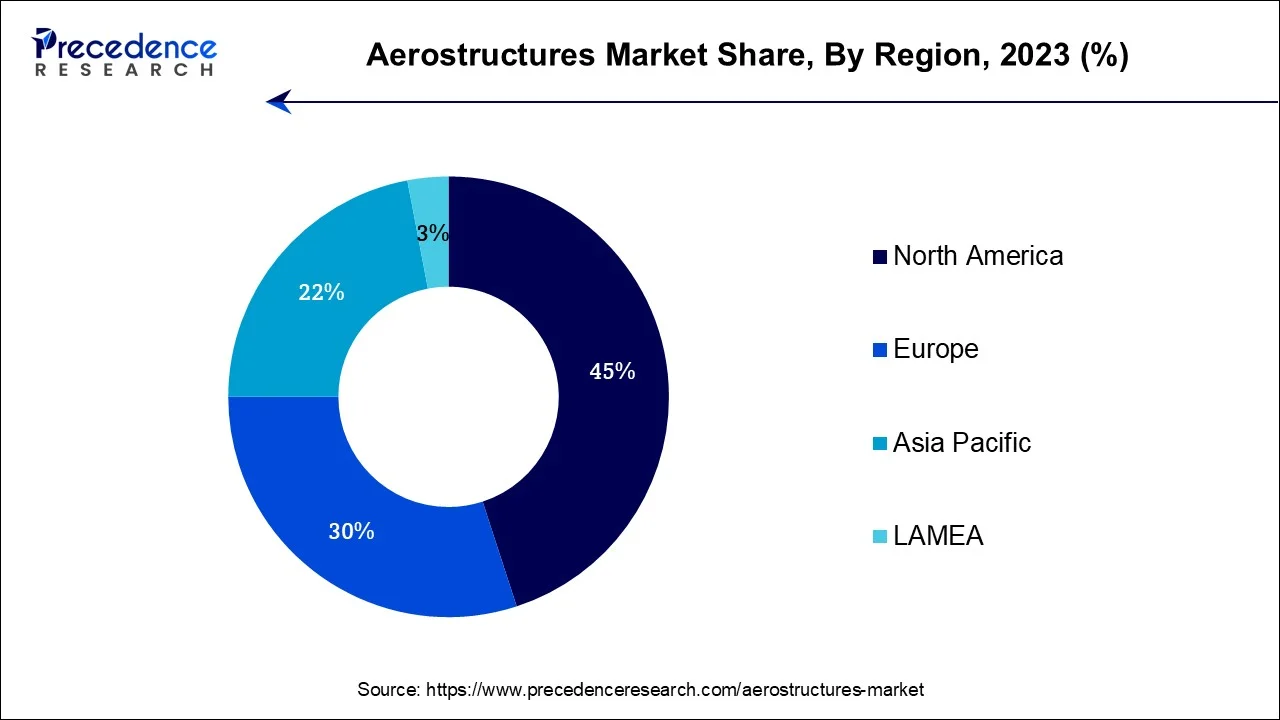

- North America led the global market with the highest revenue share in 2025.

- The Asia-Pacific region is expected to expand at the fastest CAGR from 2026 to 2035.

- By Component, the fuselage segment captured the largest revenue share of around 36% in 2025.

- By Material, the alloys segment registered the largest market share in 2025.

- By Platform, the fixed-wing aircraft segment contributed the largest market share the market in 2025.

- By End-User, the aftermarket segment had the biggest market share in 2025.

Market Overview

- The aerostructures market holds immense importance within the global aerospace industry. It encompasses the design, manufacturing, and assembly of various components that form the structural framework of aircraft and spacecraft. These components include fuselages, wings, tail sections, and other crucial structures ensuring aerodynamic stability and durability to aerospace vehicles.

- The market's significance lies in guaranteeing safety, enhancing performance, and optimizing efficiency in modern aviation and space exploration. This industry involves a complex network comprising manufacturers, suppliers, and service providers varying from prominent aerospace giants to specialized companies exclusively dedicated to producing specific aerostructure components.

- The market's behavior is heavily impacted by factors such as growing air travel demand, the introduction of fresh commercial aircraft projects, and government investments in defense and space exploration. Additionally, environmental worries and stringent regulations have encouraged the need for more eco-friendly aerostructures, thus pushing the incorporation of sustainable materials and technologies.

Aerostructures Market Growth Factors

- Rapid urbanization, increasing disposable income, and rising middle-class population is expected to result in a rise in the number of people travelling through airways which is expected to further propel the aerostructures market. The increasing demand is expected to increase the production rate of airplanes, thereby surging the demand for aerostructures.

- The aerospace sector is currently going through a revolutionary phase. Next-generation aircraft, like the Boeing 777X and the Airbus A350, are leading the way by utilizing advanced materials and innovative designs. These advancements aim to reduce weight and enhance fuel efficiency.

- Due to the necessity of progress, there is an augmenting requirement for corporations that focus on the production of aerostructures which are both lightweight and resilient, as well as aerodynamically proficient.

- In addition to technological advancements, governments worldwide are bolstering their defense budgets and investing in aerospace programs. Their efforts prioritize national security as well as space exploration initiatives. Consequently, this surge in military and space-related projects contributes significantly to the anticipated growth of the aerostructures market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 154.33Billion |

| Market Size in 2025 | USD 80.32 Billion |

| Market Size in 2026 | USD 85.80 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.75% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Components, Platform, Material, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in global air travel demand

The demand for global air travel has been intricately linked to transformative changes in the transportation of people and goods worldwide. Urbanization, growing middleclass populations, and rising disposable incomes have collectively fueled an unprecedented surge in air travel. Today's passengers are in search of efficient, comfortable, and environmentally friendly modes of transportation. As a result, airlines continuously update their fleets with state-of-the-art aircraft that are fuel efficient. This drive towards modernization heavily relies on aerostructures as the foundation for enhancing aircraft design and performance.

In response to the rising demand, aircraft manufacturers are ramping up production and developing new models. This surge in activity creates a significant market for aerostructure manufacturers. Advanced aerostructures are essential components in constructing aircraft that not only prioritize fuel efficiency but also provide improved passenger comfort and safety. These structures play a vital role in optimizing aerodynamics, reducing weight, and enhancing structural integrity all crucial factors for ensuring the economic viability of airlines in an increasingly competitive market.

Moreover, the development of long-range, wide-body planes specifically designed to connect far-flung corners of the world is directly correlated with the rise in global air travel demand. These aircraft heavily rely on groundb¬reaking aerostructures that are capable of enduring the strains posed by extended flights while ensuring optimal fuel efficiency. Airlines are making substantial investments in these cutting-edge aircraft to cater to passengers' desire for uninterrupted, long-distance travel experiences. At the forefront of this engineering marvel, aerostructure manufacturers diligently deliver lightweight yet durable components essential for such remarkable accomplis¬hments.

Restraint

High cost of procuring and maintaining aerostructure components

The aerostructures market is facing a significant hurdle in its growth. This obstacle arises from the substantial costs associated with procuring and maintaining aerostructure components. The aerospace industry's demanding standards for quality and safety necessitate the utili¬zation of advanced materials, cutting-edge manufacturing techniques, and stringent quality control processes. Consequently, these factors contribute to escalated expenses. Moreover, aircraft manufacturers and airlines often bear the brunt of a large initial investment for research and development, material sourcing, and specialized manufacturing facilities. These expenses are passed onto them due to the complex nature of the industry.

Furthermore, the maintenance and repair of aerostructures throughout an aircraft's lifespan incur significant costs due to specialized maintenance demands, highly skilled technicians, expensive equipment, and a comprehensive inventory of spare parts. These costs can be a substantial portion of operational expenses for airlines, making the high cost of aerostructure components a restraining factor for the growth of the aerostructures market.

Opportunity

Growth in usage of UAVs

Unmanned Aerial Vehicles (UAVs) have gained significant popularity in various fields, including surveillance, agriculture, delivery services, infrastructure inspection, and military reconnaissance. With the increasing demand for UAVs, there arises a need for specialized aerostructures that can withstand the unique challenges of unmanned flight. This opens up a niche market for aerostructure manufacturers to develop lightweight, durable components optimized for unmanned platforms. For instance, high-altitude, long-endurance UAVs used in surveillance and communication relay tasks require aerostructures capable of enduring extreme environmental conditions while maintaining stability during extended flights.

The military and defense sector heavily relies on UAVs for reconnaissance and combat missions. In these critical operations, rugged aerostructures play a vital role in ensuring mission success and aircraft safety. As defense budgets increase worldwide, the demand for aerostructure manufacturers to supply components for military UAVs grows significantly.

In the commercial sector, the delivery drone industry is undergoing rapid expansion. Giants like Amazon and UPS are actively exploring drone-powered delivery services. To navigate urban landscapes and transport goods securely, these delivery drones rely on sturdy and efficient aerostructures. Aerostructure manufacturers can seize this emerging market opportunity by supplying the essential components necessary for the growth of drone-based delivery systems.

Segment Insights

Component Insights

According to the component, the fuselage sector has held the major revenue share of around 36% in 2025. The segment of the aerostructures market that deals with the fuselage holds immense significance in the construction of aircraft and spacecraft. Serving as the central body, it encompasses crucial components such as the cockpit, passenger or cargo compartments, and vital systems. The fuselage acts as a structural foundation, providing both aerodynamic shape and integrity to the vehicle. Designing and manufacturing these structures involve intricate processes, which demand unwavering attention to safety measures, weight reduction, and efficient aerodynamics. Companies specializing in fuselage components not only contribute significantly to advancements in the industry but also strive to achieve greater fuel efficiency, reduced environmental impact, and enhanced passenger comfort.

The fuselage segment is continually evolving with the introduction of composite materials, advanced alloys, and cutting-edge manufacturing techniques. These innovations contribute to the development of aircraft and spacecraft that are not only more efficient but also more sustainable. They represent the forefront of modern aviation and space exploration.

Material Insights

The alloy segment is anticipated to hold the largest market share the market in 2025. Alloys play a vital role in constructing aerostructures due to their exceptional properties. These include high strength, durability, corrosion resistance, and the ability to withstand extreme temperatures and pressures experienced during flight. Aerospace engineers and manufacturers utilize specialized alloys, often derived from combinations of metals such asaluminum, titanium, and nickel. They are employed in critical components like wings, fuselages, landing gear, and engine parts.

The alloys segment continually advances with metallurgical progress as experts strive to develop lighter yet heat-resistant and fuel-efficient materials. This pursuit aims to enhance aircraft and spacecraft performance. The aerospace industry increasingly prioritizes weight reduction, improved fuel economy, and safety standards. Within this context, the alloy segment stands at the forefront of innovation. Its role is to ensure that aerospace vehicles meet the rigorous demands of modern aviation and space exploration.

Platform Insights

The fixed-wing aircraft segment is anticipated to hold the largest market share the market in 2025. Fixed-wing aircraft, from commercial airliners to military fighter jets and cargo planes, rely on specialized aerostructures. These aerostructure components, including wings, fuselages, tail sections, and landing gear, undergo meticulous design and manufacturing processes. Their purpose is to withstand the forces and stresses of flight for achieving aerodynamic stability, structural integrity, safety, and performance. Within this segment of aviation innovation thrives as a constant driving force.

The focus lies in the development of lightweight materials, advanced aerodynamic designs, and fuel-efficient technologies. Such advances aim to enhance aircraft performance while prioritizing environmental sustainability. As the demand for air travel continues to rise globally with special significance in emerging markets; fixed-wing aircraft remain an influential stakeholder shaping the future of aviation. This sentence highlights the role of aircraft development in addressing key challenges such as passenger capacity, carbon emissions, and global air transportation demands. The fixed-wing aircraft segment demonstrates the industry's commitment to advancing aviation technology and establishing new bench¬marks for safety, efficiency, and sustainability.

End-User Insights

In 2025, the aftermarket sector had the highest market share on the basis of the end-user. Aftermarket services are crucial for aerostructures. They involve inspecting, repairing, and replacing components that have experienced wear and tear during operational use. This segment encompasses various activities, including routine inspections, structural repairs, corrosion prevention, and the replacement of worn or damaged parts. Meticulous attention to detail is required to ensure that aerostructure components like wings, landing gear, and fuselage sections meet safety standards and performance criteria.

The aftermarket end-use segment serves commercial and military aviation as well as the space industry. It plays a vital role in sustaining the operational fleets of aircraft and spacecraft. Airlines, military forces, and space agencies rely on Maintenance, Repair, and Overhaul (MRO) services. These services help to prolong the lifespan of their assets, optimize operational costs, and ensure mission safety. As the aerospace industry progresses, the aftermarket sector is projected to expand. This growth is driven by older aircraft remaining in service for extended periods and the increasing demand for specialized expertise in aerostructure maintenance and repair. Companies specializing in MRO are presented with lucrative opportunities.

Regional Insights

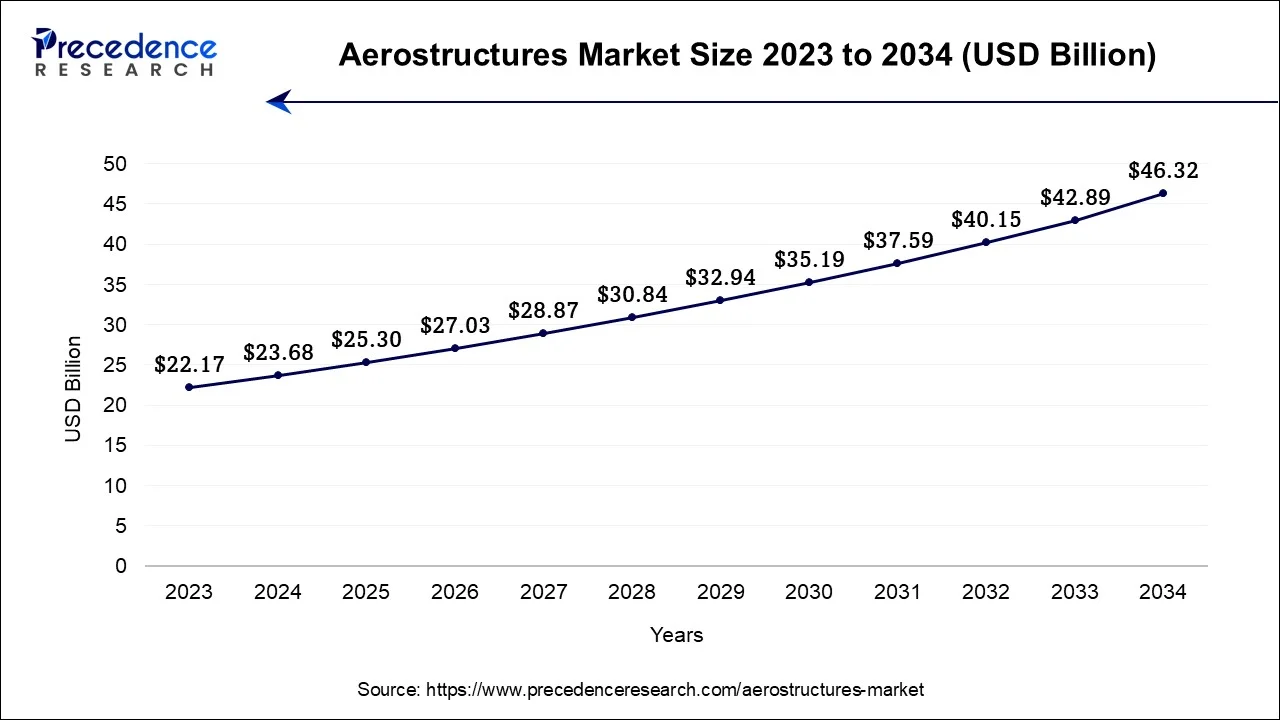

What is the U.S. Aerostructures Market Size?

The U.S. aerostructures market size is estimated at USD 25.30 billion in 2025 and is expected to expand around USD 49.29 billion by 2035, growing at a CAGR of 6.90% from 2026 to 2035.

With companies like Boeing and Lockheed Martin, the U.S. is a heavyweight in the aerostructures sector. In 2025, Boeing completed an agreement to acquire Spirit AeroSystems; this should allow Boeing to cut delays in its manufacturing process, which has been impacted by supply chain disruptions. Defense contractors, such as Karman Holdings, reported record backlogs from increasing investments in tactical missile systems and advanced airframe technologies across its military procurement.

- In January 2024, Arlington Capital in United States announced the launch of Verus Aerospace, a manufacturer of complex aerostructure components for the aerospace, defense and space industries. Verus will emerge as a dynamic player, ready to shape the future of aerostructures with unwavering dedication and expertise.

North America has held largest revenue share in 2025. North America, known for its prominent role in aerospace manufacturing and innovation, holds a key position in shaping the future of aviation and space exploration. Within this region, there is a diverse market that encompasses various companies involved in aerostructure manufacturing and supply, contributing to both commercial and defense aviation sectors. Major players such as Boeing and Airbus have substantial production facilities and operations based in North America, which drive the demand for aerostructure components. In addition to the thriving aerospace industry, North America also hosts renowned organizations like SpaceX and NASA actively engaged in spacecraft development, further fueling the need for specialized aerostructures.

North America's dedication to technological progress and commitment to preserving the environment have spurred remarkable advancements in materials, manufacturing processes, and aircraft design. The aerospace industry within this region stands out as a pioneer in developing incredibly fuel-efficient aircraft and eco-friendly aerostructures.

The Asia-Pacific aerostructures market is rapidly gaining prominence in the global aerospace industry.This growth can be attributed to the region's robust economic progress, surging air travel demand, and its focus on aerospace manufacturing and innovation. As the middle-class population expands and disposable incomes rise, the demand for air travel in Asia-Pacific has skyrocketed, making it one of the fastest-growing aviation markets worldwide. Consequently, there is a substantial need for fuel-efficient aircraft, which has led to an increased demand for aerostructures. Notably, countries like China have made significant investments in aerospace infrastructure by establishing manufacturing facilities and research centers. These efforts have further propelled the aerostructures market in the region. Additionally, Asia-Pacific has also witnessed notable developments with regard to indigenous commercial and military aircraft programs. This advancement has fostered collaboration between international aerospace players while driving up demand for aerostructure components.

China is rapidly maturing its aerospace capabilities with the Comac C919 program that has received over 1,000 orders, mostly from domestic airlines. In 2025, China industrialized to manufacture airframes with large-scale production facilities. The recent lifting of restrictions on Boeing deliveries suggests that Beijing intends to balance China's ambitious innovation pathway with selective globalization and access to aerospace technology.

Europe: Engineering Excellence Creating New Designs

The aerostructures business in Europe has many advantages through strong aerospace R&D, sustainable manufacturing, and joint defense programs. This will help composite materials be used more in production with an increase in digital manufacturing machines and cross-border supply ecosystems, especially for building parts for both military and commercial aircraft.

Germany Aerostructures Market Trends

Germany currently has the fastest growth rate in aerostructures due to increased exports of components used on aircraft and investment in new composite designs for making aircraft lighter. Strategic partnerships between domestic aerospace companies and global players are strengthening Germany's capabilities in design, production, and assembly of aerostructures.

Latin America: A New Manufacturing & MRO Centre

Latin America's aerostructures business continues to develop by taking advantage of inexpensive labor costs and the growing amount of air travel and increased MRO activity of narrow-body aircraft fleets. Adoption of advanced materials, including composites and lightweight alloys, along with automation in manufacturing, is enhancing efficiency and structural performance.

Brazil Aerostructures Market Trends

Brazil currently has the fastest growth rate in the region due to its ability to manufacture aircraft in Brazil and provide continued support for developing the aviation defense program. Government initiatives and partnerships with global aerospace companies are supporting domestic capabilities and skill development in aerostructure design and fabrication.

Middle East & Africa: Strategic Development Of Aviation Infrastructure

The aerostructures business in MEA is impacted by the replacement of ageing fleets and by the purchase of more commercial transport planes, as well as the establishment of aerospace manufacturing parks. Various governments in the region are promoting the local production of parts and the assembly of aircraft as a way to decrease reliance on imported parts.

The UAE Aerostructures Market Trends

The United Arab Emirates has the highest growth rate of the countries in the Middle East region, with numerous aerospace industrial clusters, advanced defense offset contracts, and increased capability to provide aircraft maintenance. Additionally, the adoption of lightweight materials, composite technologies, and automation in manufacturing processes is enhancing the efficiency and performance of aerostructures.

Value Chain Analysis of the Aerostructures market

- Advanced Sourcing of Raw Materials & Composite Innovation: Suppliers are investing in lightweight materials that are projected to be able to withstand repeated stress, ultimately enabling manufacturers to comply with tighter fuel efficiency standards and harsher emissions regulations.

Key Players: Hexcel Corporation, Toray Industries, and Alcoa Corporation. - Precision Manufacturing and Structural Fabrication: This phase centers on the precision manufacturing of fuselage sections, wings, empennage, and nacelles using various techniques: automated fiber placement (AFP), additive manufacturing, and robotic assembly.

Key Players: Spirit AeroSystems, Leonardo S.p.A and Triumph Group. - System Integration / Assembly and Aftermarket Support: Finished aerostructures are assembled with avionics, propulsion interfaces, and landing gear systems, after which they are subjected to extensive testing and certification.

Key Players: Airbus SE, Boeing, and ST Engineering.

Aerostructures Market Companies

- The Boeing Company

- AAR Corp

- Leonardo SpA

- Elbit Systems Ltd.

- Triumph Group Inc.

- Cyient Ltd.

- GKN Aerospace

- Bombardier Inc.

- SAAB AB (Sweden)

- Spirit Aerosystems Inc. (U.S.)

Recent Developments

- In April 2025, vem Partners (“Avem”), a leading private equity firm specializing in lower middle market aerospace and industrial investments, announced the closing of its acquisition of substantially all the assets of Dynamic Aerostructures, Inc. and its affiliates, including Dynamic Aerostructures Intermediate LLC and Forrest Machining LLC.“This acquisition represents a significant opportunity to revitalize a key player in the aerospace supply chain,” said Mike Fourticq for Avem Partners.

- In December 2024, PhysicsX, a London-based startup bringing the power of generative AI to enable breakthrough engineering in advanced industries, launched the first large geometry model (LGM) for aerospace engineering, LGM-Aero, and a publicly accessible reference application, Ai.rplane, to showcase its power in designing aero structures.

- In January 2024, Mahindra Aerostructures Pvt Ltd (MASPL) and Airbus Aerostructures GmbH signed a new contract for the manufacture and delivery of metallic components for all Airbus commercial aircraft models, including the best-selling A320 family. Under the contract, MASPL will supply close to 5000 varieties of metallic components to Airbus in Germany from its manufacturing base in India.

- The Massachusetts Institute of Technology, a highly prestigious institute, has recently revealed an innovative and cost-effective method of reinforcing essential materials being used in energy and aerospace production.

- Leonardo SpA, an aerospace aircraft and components conglomerate based in Italy, has entered into a partnership with Cisco Technology to create collaborative technology projects. Their goal is to create solutions and products that will help facilitate green transition towards a secure transport and logistics system.

- Air-New Zealand has selected Heart Aerospace, which is an electric aircraft developer located in Sweden, for a long-term partnership for their next-generation mission aircraft partnership. This collaboration will aid the airline in replacing their current Q300 domestic fleet.

- Spirit AeroSystems, a U.S.-based global aerostructures provider, recently formed an agreement with Rolls-Royce, a renowned aircraft engine producer. This agreement is meant to construct a slim line next-gen nacelle, specifically for the Peart 10X new engine. The slim nacelle is an ultra-slim, ready-to-assemble product that is intended to enhance lower noise levels and aircraft performance.

Segments Covered in the Report

By Components

- Empennage

- Wings

- Fuselage

- Nacelle & Pylon

- Nose

- Others

By Platform

- Fixed-Wing Aircraft

- Military

- Commercial

- General Aviation Aircraft

- Business Jet

- Rotary-Wing Aircraft

- Military Helicopters

- Commercial Helicopters

- UAVs

By Material

- Composites

- Alloys

- Metals

By End-User

- OEM

- Aftermarket

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting