What is the AI in Medical Imaging Market Size?

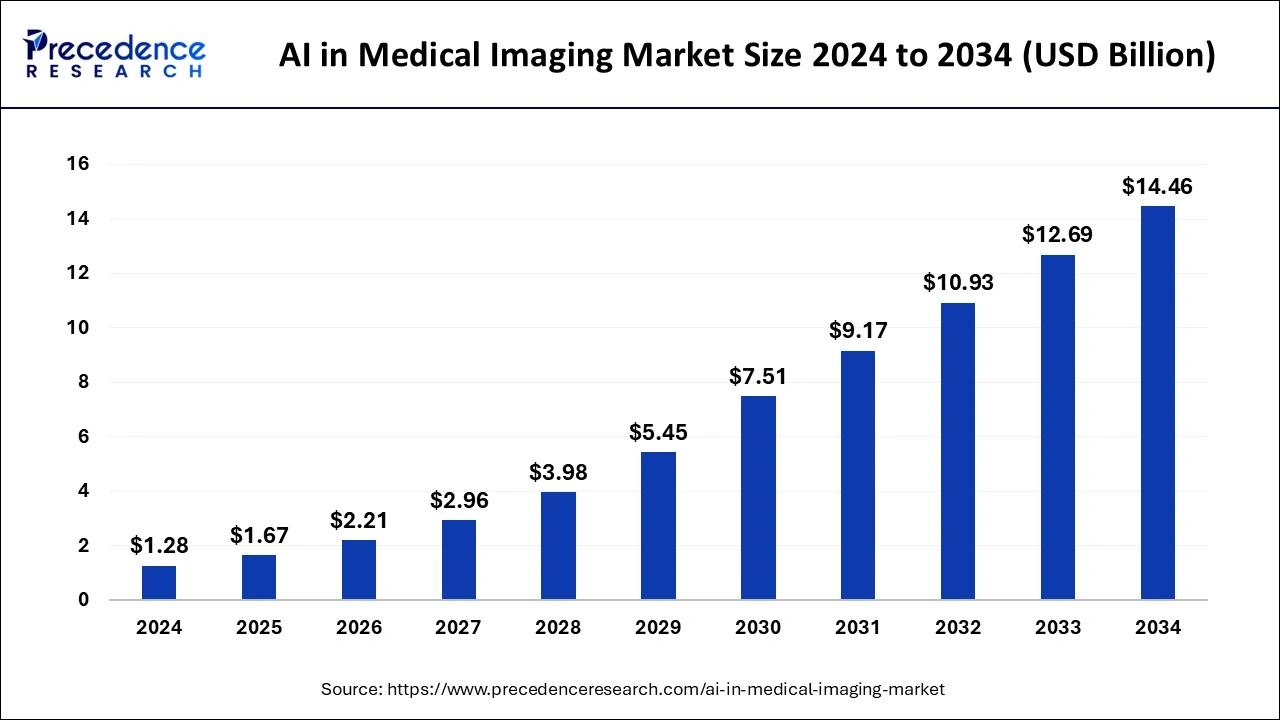

The global AI in medical imaging market size is valued at USD 2.01 trillion in 2025 and is predicted to increase from USD 2.57 trillion in 2026 to approximately USD 22.97 trillion by 2035, expanding at a CAGR of 27.57% from 2026 to 2035.

Market Highlights

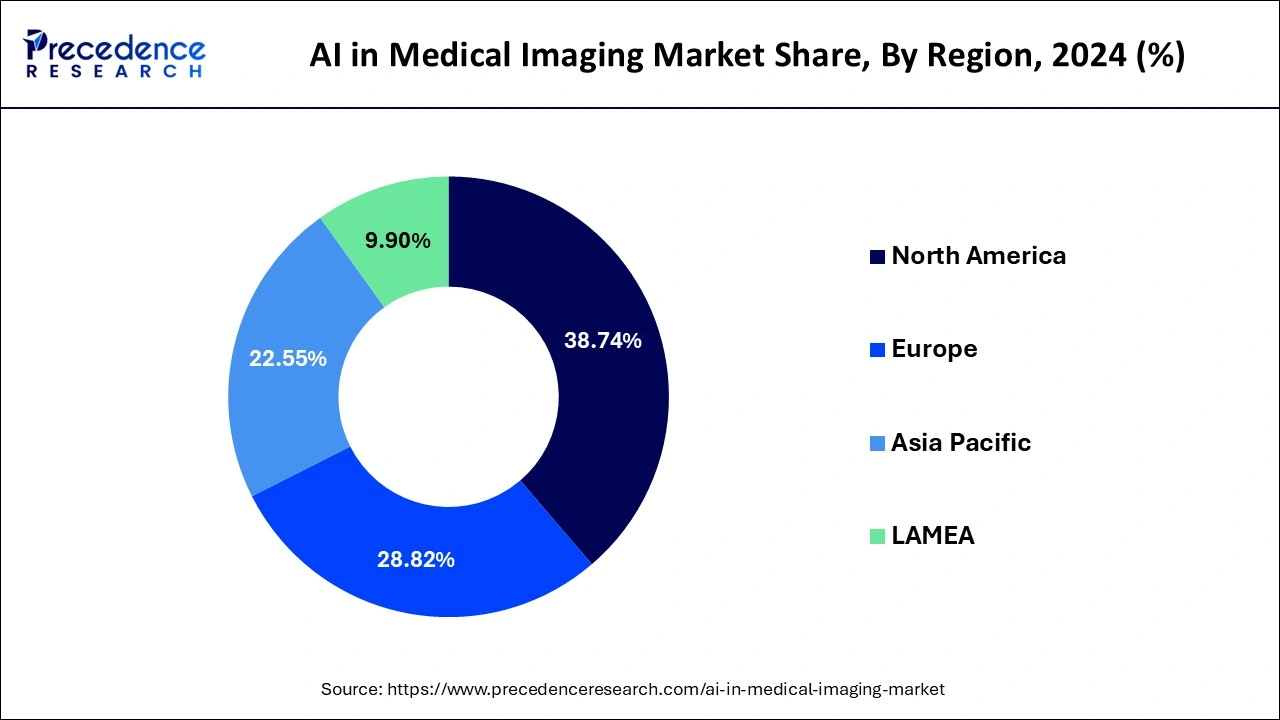

- North America accounted for the largest market share of 45% in 2025.

- Asia Pacific is poised to grow at the fastest CAGR of 30.80% between 2026 and 2035.

- By clinical area, the lung/pulmonary segment contributed to the largest market share of 22% in 2025..

- By clinical area, the oncology segment is growing at a notable CAGR of 30.20% between 2026 and 2035.

- By technology type, the deep learning segment accounted for the highest market share of 48% in 2025.

- By technology type, the explainable AI segment is poised to grow at a notable CAGR of 30% between 2026 and 2035.

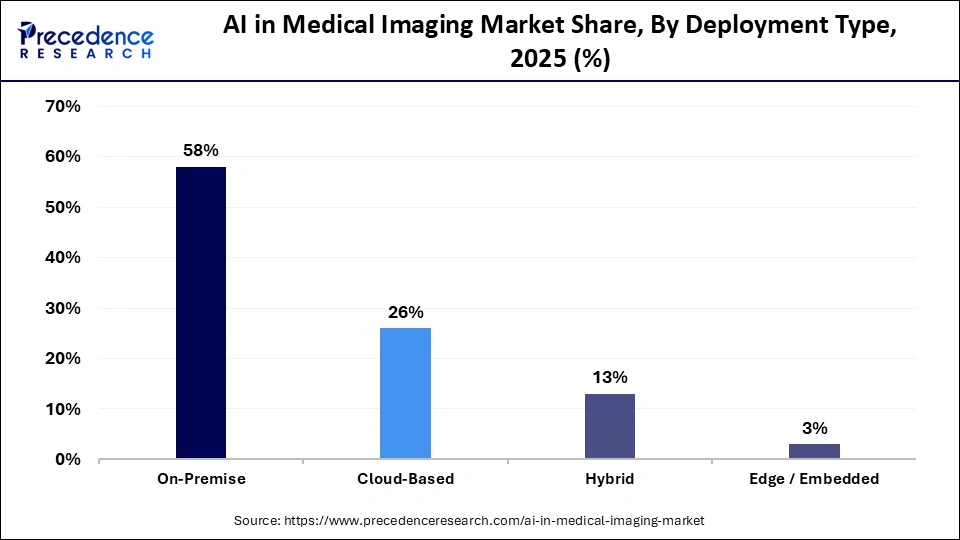

- By deployment mode, the on-premise segment dominated the market with the largest share of 58% in 2025.

- By deployment mode, the edge/embedded segment is expanding at a healthy CAGR of 30.80% between 2026 and 2035.

- By deployment mode, the cloud-based segment is observed to grow at a notable rate during the forecast period.

- By imaging modality, the CT segment led the market share of 37% in 2025.

- By imaging modality, the MRI segment is expected to grow at a 30% CAGR from 2026 to 2035.

- By functionality, the image analysis segment dominated the market with the largest share of 51% in 2025.

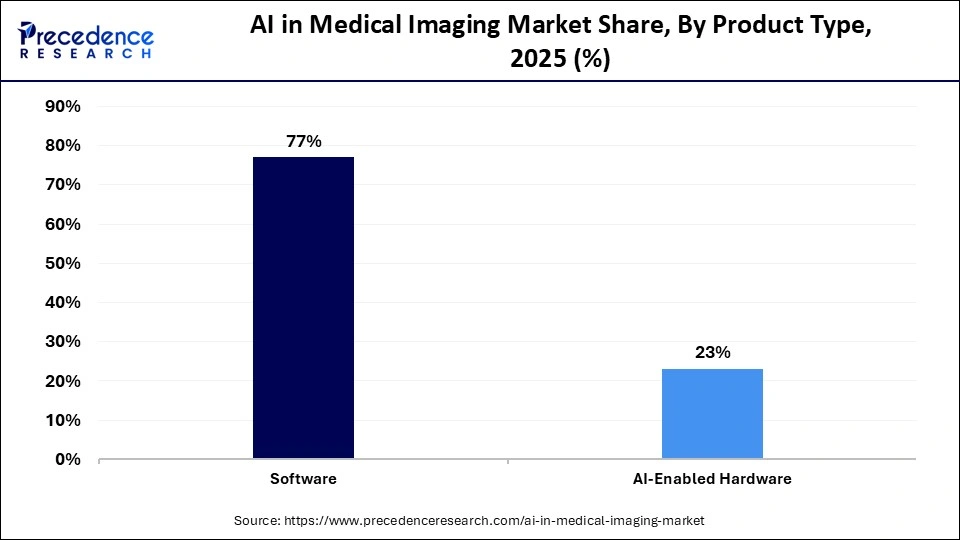

- By product type, the software segment led the market with the highest share of 77% in 2025.

- By product type, the AI-enabled hardware segment is seen to grow notably.

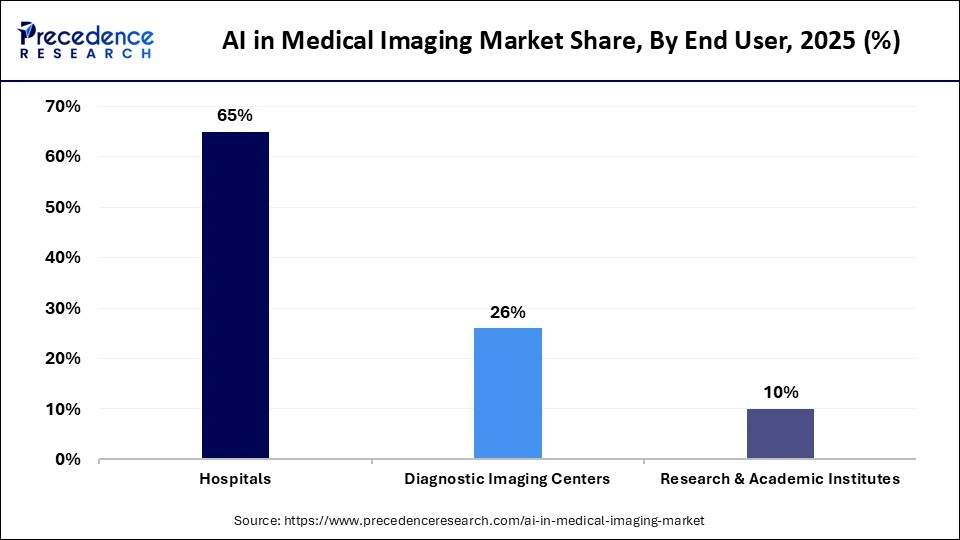

- By end user, the hospitals segment led the market with the largest share of 65% in 2025.

- By end user, the diagnostic imaging centers segment is expected to expand at the fastest CAGR of 28.90% during the foreseeable period.

AI in Medical Imaging Market Growth Factors

One of the most promising areas of health and medical innovation is the use of artificial intelligence (AI) in medical imaging. Medical imaging uses AI in a variety of ways, including image capture, processing for assisted reporting, planning for follow-up visits, data storage, data mining, and more. AI has demonstrated impressive sensitivity and precision in the categorization of imaging abnormalities in recent years, and it guarantees to enhance tissue-based detection and characterization. A branch of artificial intelligence called machine learning (ML) uses computational models and algorithms that mimic the structure of the brain's organic neural networks. Layers of linked nodes make up the architecture of neural networks. Each network node weights and summarizes the input data before sending them to the activation function.

The diagnostic process was changed by the use of AI in healthcare and medical imaging, which stimulated the growth of the market for AI in medical imaging on a global scale. Medical practitioners are assisted by artificial intelligence in the execution of the picture acquisition process and in the analysis of these pictures for the diagnosis and personalized care of each patient. AI has been utilized by researchers to objectively evaluate radiographic properties and automatically identify difficult patterns in imaging data. In radiation oncology, Artificial Intelligence has been used to enhance many distinctive image modalities which are used at various stages of the therapy. One of the most well-liked study subjects in medical imaging nowadays is radiation omics, which involves the high-throughput extraction of a significant number of picture attributes from radiation images.

Additionally, AI plays a crucial role in the analysis of a large volume of medical photos, which reveals illness signs that are otherwise missed. As a result, it is anticipated that the market for AI in medical imaging will expand during the next years. Scientists have significantly advanced the effort to combat COVID-19; new study discoveries, such as analytical reports as well as publications from both university and corporate researchers, are emerging every day. A growing number of researchers are turning to artificial intelligence (AI) to detect and forecast diseases in the context of medical imaging studies. AI-based image analysis algorithms offer more accurate, effective, quick, stable, and reproducible illness information than conventional image processing techniques. The basis of AI-based COVID-19 diagnosis processes is therefore image analysis, image segmentation of infected lung regions, and analytics for clinical evaluation. During the anticipated timeframe, these AI-based methods have shown great commercialization potential for AI in the medical imaging sector.

- Artificial intelligence is making its way into many everyday applications, from voice recognition and driver assistance systems in automobiles to intelligent chatbots at help desks. When artificial intelligence is used to correctly identify photos, amazing results are obtained.

- Medical imaging plays a big role in healthcare and offers precise illness diagnosis and management. Technology and digital data have revolutionized the photographic industry. As a result, during the past several years, the adoption of AI-based solutions in the healthcare industry has expanded.

- The market for AI in medical imaging is supported by the use of AI in imaging analysis to increase accuracy, speed up interpretation, and decrease repetition for radiologists.

- Growth in the usage of AI technologies for medical purposes has resulted from increased knowledge of the advantages given by AI technologies and their numerous applications in the healthcare sector, helping the market for AI in medical imaging.

- A number of hospitals and healthcare organizations have embraced artificial intelligence as a more appealing option for therapeutic applications. Leading businesses are making significant investments in AI technology solutions for medical imaging. Researchers and businesses are working together to develop efficient AI-based systems.

- Developed nations have been investing in cutting-edge, cost-effective healthcare systems for their citizens as a result of population issues, which has fueled the market for AI in medical imaging. Such tactics encourage market participants to make investments in the healthcare industry and provide cutting-edge solutions to clients, increasing their position in AI in the medical imaging market.

Latest Trends of AI in Medical Imaging Market

- Focus on Early Disease Detection: The healthcare industry worldwide has established a significant focus on early disease detection due to the increased prevalence of chronic and rare diseases. The rising incidence of diseases like neurological disorders, cancer, and cardiovascular diseases is fueling the need for cutting-edge technologies like AI in medical imaging devices to detect the disease at the initial stage.

- Increased Prevalence of Complex Disease: The prevalence of complex diseases like stroke and cancer has increased globally, driving a spectacular need for efficient and enhanced patient outcomes. The rising shortages of radiologists are shifting the healthcare sector toward AI-driven medical imaging.

- Rapid Adoption of AI-enabled Medical Imaging Systems: The Healthcare industry is prioritizing the adoption of AI-based medical systems, including medical imaging systems, to improve diagnostic accuracy and overall patient outcomes.

- Emerging Integration with Multi-Modal Imaging: The ongoing shift toward integration of multi-modal imaging technologies, including CT, MRI, PET, and EHRs for improved diagnostics and personalized medicines and treatments, is solidifying AI's position in the medical imaging devices and systems.

- Implementation of Edge AI:Edge AI is becoming an essential part of daily healthcare services. Professionals are prioritizing Edge AI implementation in imaging devices, which can facilitate real-time analysis. Reducing latency and increasing the use of medical imaging in remote and resource-limited healthcare settings are enabling the acceptance of Edge AI in medical imaging systems and services.

- Supportive Regulations:The Government is implementing several support regulations to enter AI in the healthcare sector through various initiatives and funding, enabling healthcare digitalization and boosting focus toward AI in medical imaging.

- For instance, between 2022 and 2025, the number of FDA-approved AI and ML devices has been doubled, which indicates the increased adoption and regulatory support. RapidAI, an AI-driven medical imaging analysis and coordination leader, has achieved FDA clearance for its Rapid Aortic product in December 2025.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.01 Trillion |

| Market Size in 2026 | USD 2.57 Trillion |

| Market Size by 2035 | USD 22.97 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 27.57% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Clinical Area, Technology Type, Deployment Type, Imaging Modality, Functionality, Product Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

AI-based diagnostic imaging improves care models in the healthcare sector

- The introduction of cutting-edge AI tools and technology is expected to play a significant role in the near-term transformation of the radiology and healthcare sectors. The present market for AI in medical imaging is predicted to offer a wide range of opportunities for businesses with more use of AI in the medical sector, notably in radiology.

- Expanding the gap between the increasing number of radiologists available and the number of scans that can interpret data is a significant element that will probably accelerate the adoption of AI in medical imaging.

- Due to the increased workload and pressure to expedite the process of data interpretation, mistakes significantly increased. This in turn is opening up opportunities for market presence expansion for players in the AI-enabled diagnostic imaging market.

Key Market Challenges

Medical professionals' reluctance to utilize AI-based technology

- Healthcare professionals may now help patients through cutting-edge treatment modalities thanks to the extensive rise of digital health. With the use of AI technology, doctors can better diagnose and treat patients. However, it has been noted that doctors are reluctant to adopt new technology. For instance, doctors mistakenly believe that AI would eventually supplant them in the medical field. As per doctors' and radiologists' beliefs, technology cannot entirely rule out the existence of a doctor because abilities like empathy and persuasion are considered to be human traits. A further worry is that patients may turn away from critical in-person treatments due to their excessive propensity for these technologies, which might strain long-term doctor-patient relationships. Many medical practitioners are skeptical about the accuracy with which AI can diagnose patient diseases. It is difficult to persuade providers that AI-based solutions are affordable, secure, and effective solutions that provide doctors with convenience and better patient care. Healthcare providers are, however, more open to the potential advantages of AI-based solutions and the variety of fields they may be used in. Therefore, it's possible that in the years to come, physicians and radiologists may be increasingly receptive to AI-based technology in healthcare.

Key Market Opportunities

Emerging economies display significant potential

- Developing nations are concentrating on pooling their investments in AI, which will enable businesses to use AI with medical imaging to increase their revenue share. For instance, China wants to lead the world in artificial intelligence by 2030. The strategy calls for significant government financing and investments to accelerate the use of AI technologies in businesses. Additionally, it is projected that companies in the market for AI in medical imaging would benefit from the growing patient populations in nations like India, China, and Brazil. By 2031, the market for artificial intelligence in medical imaging is anticipated to be worth US$20 billion, growing at a CAGR of 36%.

Segmental Insights

Clinical Area Insights

The lung/pulmonary segment dominated the AI in medical imaging market share of 22% in 2025 due to the high volume of chest imaging procedures worldwide. Increasing prevalence of respiratory disorders such as pneumonia, COPD, and tuberculosis significantly drove demand for AI-assisted diagnostics. Within this segment, non-cancer lung diseases accounted for the largest share as AI tools improved early detection and clinical decision-making. Widespread use of chest X-rays and computed tomography (CT) scans further supported the dominance of this clinical area.

AI in Medical Imaging Market Revenue (USD Billion), By Clinical Area, 2023-2025

| Clinical Area | 2023 | 2024 | 2025 |

| Lung / Pulmonology | 267.64 | 341.59 | 438.03 |

| Brain / Neurology | 241.42 | 306.61 | 391.24 |

| Heart / Cardiology | 166.44 | 212.49 | 272.57 |

| Oncology (Other than Lung, Brain, Heart) | 149.36 | 192.5 | 249.23 |

| Musculoskeletal | 115.79 | 148.24 | 190.66 |

| Gastroenterology / Hepatology | 91.57 | 116.27 | 148.32 |

| Ophthalmology | 75.81 | 96.46 | 123.32 |

| Other Specialties (Obstetrics/Gynecology, Urology, Dermatology) | 131.97 | 161.88 | 199.25 |

The oncology segment is projected to grow at the fastest rate during the forecast period. Rising global cancer incidence and the need for early, accurate diagnosis are key growth drivers. AI-based imaging solutions are increasingly used for tumor detection, segmentation, and treatment monitoring. Continuous advancements in precision medicine and personalized oncology care are further accelerating adoption.

Technology Type Insights

Under the deep learning category, convolutional neural networks (CNNs) dominated the market share 48% in 2025. CNNs are highly effective in image recognition, classification, and segmentation tasks used in medical imaging. Their proven accuracy and reliability have driven widespread adoption across multiple imaging modalities. As a result, CNNs remain the foundational technology for most AI imaging applications.

AI in Medical Imaging Market Revenue (USD Billion), By Technology Type, 2023-2025

| Technology Type | 2023 | 2024 | 2025 |

| Machine Learning (ML) | 205.3 | 257.01 | 323.18 |

| Deep Learning (DL) | 593.24 | 757.03 | 970.58 |

| Natural Language Processing (NLP) | 84.5 | 106.42 | 134.64 |

| Hybrid / Multimodal AI | 136.75 | 172.21 | 217.87 |

| Explainable AI (XAI) | 220.21 | 283.38 | 366.33 |

The explainable AI segment is expected to grow at the fastest rate over the forecast period. Growing demand for transparency and interpretability in clinical decision-making is driving adoption. Explainable AI helps clinicians understand how AI models reach conclusions, increasing trust and usability. Regulatory focus on accountable and ethical AI further supports this segment's rapid growth.

Deployment Mode Insights

The on-premise deployment segment dominated the market share by 58% in 2025 due to strong data security and compliance requirements. Hospitals prefer on-site systems to maintain control over sensitive patient data. On-premise solutions also allow easier integration with existing hospital IT infrastructure. These factors collectively contributed to their leading market share.

The edge/embedded deployment segment is projected to grow at the fastest rate during the forecast period. Demand for real-time image processing and low-latency diagnostics is accelerating adoption. Edge-based AI enables faster decision-making directly at imaging devices. This is particularly valuable in emergency and critical care settings.

Imaging Modality Insights

The CT segment led the AI in medical imaging market share of 37% in 2025 due to its widespread clinical use. CT scans are commonly used in lung, oncology, and trauma diagnostics, generating high imaging volumes. AI applications in CT enhance detection accuracy and workflow efficiency. These advantages supported CT's dominant position.

AI in Medical Imaging Market Revenue (USD Billion), By Imaging Modality, 2023-2025

| Imaging Modality | 2023 | 2024 | 2025 |

| X-ray | 251.13 | 318.07 | 404.75 |

| CT | 458.42 | 581.06 | 739.96 |

| MRI | 246.19 | 316.84 | 409.63 |

| Ultrasound | 145.43 | 185.11 | 236.73 |

| PET / SPECT | 56.75 | 72.92 | 94.12 |

| Other Imaging Modalities (Endoscopy, etc.) | 82.07 | 102.05 | 127.41 |

The MRI segment is expected to grow at the fastest rate during the forecast period. Increasing use of MRI in neurology, oncology, and musculoskeletal imaging is driving demand. AI integration improves scan quality, reduces acquisition time, and enhances diagnostic precision. Technological advancements are further boosting adoption of AI-enabled MRI solutions.

Functionality Insights

The image analysis segment dominated the market share of 51% in 2025 due to its central role in AI imaging applications. AI-powered image analysis improves detection, segmentation, and quantification of abnormalities. Healthcare providers increasingly rely on automated analysis to reduce workload and improve accuracy. This made image analysis the most widely adopted functionality.

AI in Medical Imaging Market Revenue (USD Billion), By Functionality, 2023-2025

| Functionality | 2023 | 2024 | 2025 |

| Image Acquisition & Reconstruction | 115.12 | 147.55 | 189.99 |

| Image Enhancement & Processing | 155.19 | 197.5 | 252.55 |

| Image Analysis | 628.39 | 801.5 | 1027.11 |

| Workflow & Reporting | 174.38 | 220.6 | 280.38 |

| Predictive & Prognostic Analytics | 166.92 | 208.88 | 262.57 |

Product Type Insights

The software segment led the market with the highest share of 77% in 2025. Software solutions are easily integrated into existing imaging workflows and systems. They offer scalability, flexibility, and frequent updates without major hardware changes. These benefits have driven strong adoption across healthcare facilities.

The AI-enabled hardware segment is expected to grow notably during the forecast period. Increasing integration of AI processors into imaging devices is driving demand. Hardware-based AI supports faster, real-time image processing. Advances in smart imaging equipment continue to accelerate growth in this segment.

End User Insights

The hospitals segment dominated the AI in medical imaging market share of 65% in 2025 due to high patient volumes and advanced infrastructure. They are early adopters of AI technologies to enhance diagnostic accuracy and operational efficiency. Strong investment capacity supports large-scale AI implementation. This positioned hospitals as the leading end-user segment.

Diagnostic imaging centers are projected to be the fastest-growing end-user segment. Rising demand for outpatient and specialized imaging services is driving growth. These centers adopt AI solutions to improve turnaround times and workflow efficiency. Competitive pressure is further encouraging rapid AI adoption.

Regional Insighst

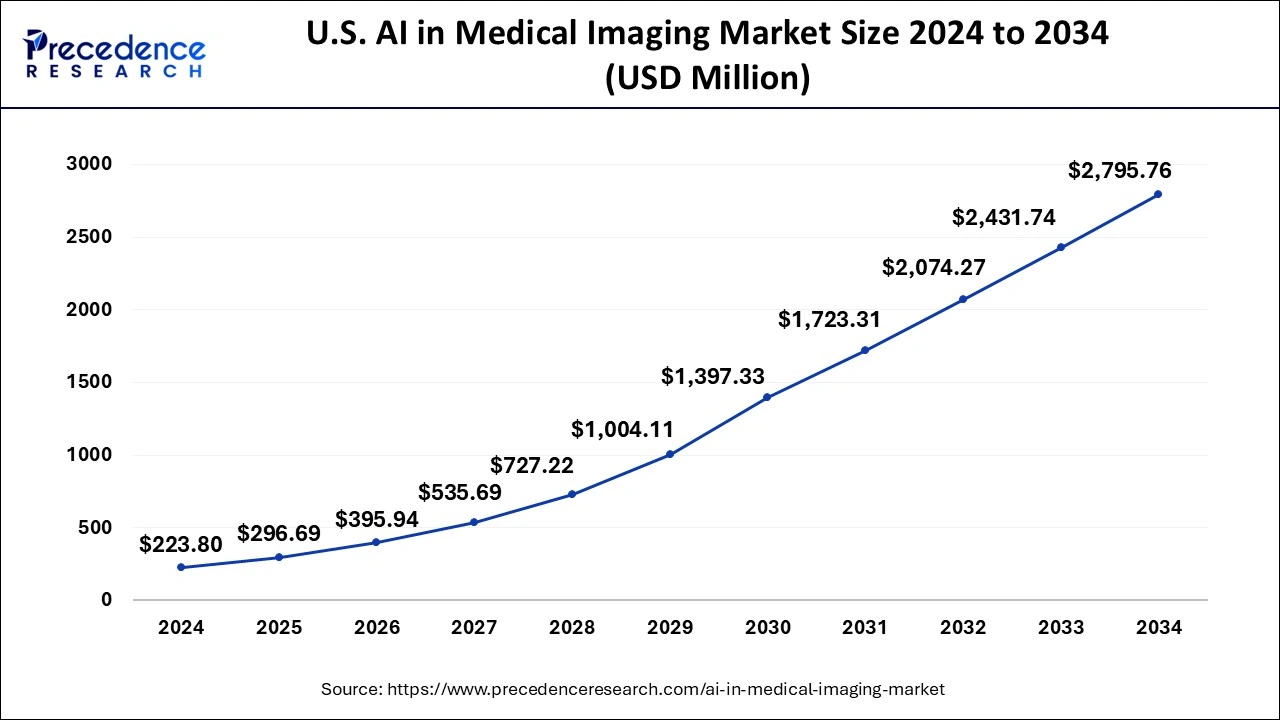

U.S. AI in Medical Imaging Market Size and Growth 2026 to 2035

The U.S. AI in medical imaging market size was valued at USD 716.22 billion in 2025 and is expected to reach USD 7,640.97 billion by 2034, growing at a CAGR of 26.71% from 2026 to 2035.

North America dominated the AI in medical imaging market with the largest share of 45% in 2025. The need for artificial intelligence in medical imaging has also been spurred by the existence of important players and supportive governmental legislation. Moreover, the rising use cases by end users in the market has created potential for the market in North America. On the other hand, the United States and Canada are seen to contribute as the largest shareholders in the market in the upcoming years. Major players that are focused on R&D, innovation and business activities are observed to create sustainable chances for the market's expansion.

Asia Pacific is the fastest growing market for the AI in medical imaging market with a significant CAGR during the forecast period, driven by increasing healthcare needs, technological progress, and supportive government policies. Nations like India, China, and Australia are leading the way, employing AI to improve diagnostic precision and workflow efficiency. In India, a rise in health-tech startups and government-supported digital health initiatives are promoting the adoption of AI in diagnostics. China's implementation of AI technologies such as DeepSeek in major hospitals is revolutionizing clinical decision-making. Australia's use of AI in its public radiology services showcases the region's dedication to utilizing AI for better healthcare results.

India

India is swiftly adopting AI in medical imaging, stimulated by a thriving health-tech landscape and government projects like the Ayushman Bharat Digital Mission. Startups including Qure.ai and Niramai are leading advancements in AI-based diagnostic tools, improving early disease identification. Partnerships between public institutions and private companies are fostering innovation, while the integration of AI within hospitals and diagnostic facilities is enhancing accuracy and accessibility in healthcare throughout the nation.

Europe is observed to grow at a considerable growth rate in the upcoming period, bolstered by strong healthcare systems, regulatory support, and collaborative research efforts. Countries such as Germany, the UK, and Spain are pioneers in the adoption of AI to improve diagnostic methods. Collaborations between healthcare providers and technology firms in Germany are advancing AI uses in radiology. The National Health Service in the UK is implementing AI solutions to boost diagnostic accuracy and efficiency. Investments in AI research facilities in Spain are driving innovation, positioning Europe as a significant player in the global AI medical imaging arena.

Germany

Germany leads the way in integrating AI within medical imaging, focusing on improving diagnostic accuracy and operational efficiency. Partnerships between healthcare organizations and tech companies are propelling the development of AI applications in radiology. The use of AI tools for early detection of diseases and personalized treatment approaches is enhancing patient outcomes. Germany's dedication to innovation and quality healthcare solidifies its position as a frontrunner in the field of AI medical imaging.

South America Expansion AI in Medical Imaging Market Analysis:

South America is emerging as a promising growth region for AI in medical imaging, driven by rising healthcare digitization, increasing prevalence of chronic diseases, and efforts to improve diagnostic accuracy amid shortages of radiologists. Governments and private healthcare providers across the region are investing in advanced imaging infrastructure and AI-enabled solutions to enhance early disease detection, workflow efficiency, and access to quality care.

Partnerships between global AI vendors, local distributors, and healthcare institutions are accelerating technology adoption, while cloud-based deployment models are helping overcome cost and infrastructure constraints. As regulatory frameworks mature and awareness of AI's clinical value increases, South America is expected to witness steady expansion in AI-powered medical imaging applications across radiology, oncology, and cardiology.

Brazil AI in Medical Imaging Market Analysis:

Brazil represents the most dynamic market for AI in medical imaging in South America, supported by its expansive healthcare system, growing private hospital networks, and strong diagnostic imaging demand. The country faces a high burden of non-communicable diseases, driving the need for faster and more accurate imaging-based diagnoses.

Brazilian healthcare providers are increasingly adopting AI tools for image interpretation, workflow optimization, and population-scale screening programs, particularly in radiology and oncology. Supportive digital health initiatives, growing investments in health IT, and collaborations between local startups and international AI companies are further strengthening Brazil's role as a regional hub for AI-driven medical imaging innovation.

Middle East & Africa AI in Medical Imaging Market Analysis:

The Middle East & Africa region is gradually expanding in the AI in medical imaging market, propelled by healthcare modernization initiatives, rising investments in diagnostic infrastructure, and the need to address workforce shortages. In the Middle East, government-led digital health strategies and smart hospital projects are driving early adoption of AI-based imaging solutions, particularly in high-income Gulf countries.

In Africa, while adoption remains at a nascent stage, AI is gaining traction as a tool to improve diagnostic access in underserved areas through scalable and cloud-enabled imaging solutions. Overall, the MEA market is expected to grow steadily as awareness increases, infrastructure improves, and international collaborations expand.

South Africa AI in Medical Imaging Market Analysis:

South Africa stands out as a key market for AI in medical imaging within the MEA region, supported by relatively advanced healthcare infrastructure and a growing private healthcare sector. The country is leveraging AI-driven imaging solutions to address radiologist shortages, improve diagnostic turnaround times, and enhance disease detection for conditions such as tuberculosis, cancer, and cardiovascular disorders.

Increasing adoption by private hospitals, diagnostic centers, and academic institutions, along with pilot projects in public healthcare settings, is driving market growth. As digital health adoption deepens and regulatory clarity improves, South Africa is positioned to become a focal point for AI-powered medical imaging deployment in sub-Saharan Africa.

AI in Medical Imaging Market Companies

- Agfa-Gevaert Group

- Ada Health

- Enlitic Inc

- CELLMATIQ GMBH

- GENERAL ELECTRIC COMPANY

- IBM

- NVIDIA CORPORATION

- MICROSOFT

- KONINKLIJKE PHILIPS N.V.

- SIEMENS

Recent Developments

- In May 2025, The National Health Service of the UK has embraced AI-powered 3D heart scanning technology in 56 hospitals, significantly decreasing the necessity for invasive procedures and yielding considerable cost savings. This effort improves diagnostic accuracy for coronary heart disease and demonstrates effective AI integration in public health services.

- In February 2025, South Australian Medical Imaging has incorporated AI from Annalise.ai across its radiology services, aiding in the interpretation of chest X-rays. This deployment signifies a major step forward in public health, enhancing both diagnostic accuracy and efficiency in medical imaging.

- In March 2025, A multi-center study in India has rolled out an AI system for interpreting chest X-rays, achieving high levels of precision and recall in identifying various pathologies. Implemented in 17 healthcare facilities, this AI model streamlines diagnostic workflows and aims to close gaps in underserved regions.

- The Avicenna. The FDA accepted AI's application for CINA-LVO, CINA-ICH, and neurovascular crises, according to a June 2021 report from the Nuance AI marketplace. This is the largest and first gateway of its sort in the United States, providing a single point of entry to a broad range of AI diagnostic models within the radiology reporting platform.

- In June 2021, VUNO Inc., a South Korean AI business, announced a strategic partnership with Samsung Electronics for the incorporation of the AI-powered mobile digital X-ray system VUNO Med-Chest X-ray within the GM85. This partnership is projected to bring VUNO closer to the expansion of AI applications that are market-ready due to its access to the global market.

Segment Covered in the Report

By Clinical Area

- Lung/Pulmonary

- Lung cancer

- Non-cancer lung diseases

- Brain/Neurology

- Stroke/Haemorrhage

- Dementia & Neurodegenerative Diseases

- Brain Tumors/Lesions

- Heart/Cardiology

- Coronary Artery Diseases

- Heart Failure & Functional Assessment

- Congenital & Structural Heart Diseases

- Oncology

- Musculoskeletal

- Gastroenterology/Hepatology

- Ophthalmology

- Other Specialities (Obstetrics/Gynaecology, Urology, Dermatology)

By Technology Type

- Machine Learning

- Deep Learning

- CNN

- RNN/LSTM

- Transformers/ViTs

- Generative Models (GANs, Diffusers)

- Natural Language Processing (NLP)

- Hybrid/ Multimodal AI

- Explainable AI (XAI)

By Deployment Type

- On-premise

- Cloud-based

- Hybrid

- Edge/Embedded

By Imaging Modality

- X-ray

- CT Scan

- MRI

- Ultrasound

- PET/SPECT

- Other Imaging Modalities

By Functionality

- Image Acquisition & Reconstruction

- Image Enhancement &Processing

- Image Analysis

- Segmentation

- Detection

- Classification

- Quantification

- Workflow & Reporting

- Predictive & Prognostic Analytics

By Product Type

- Software

- AI Analysis Software

- AI Workflow & Reporting Tools

- AI-enabled Hardware

- Imaging Device with Embedded AI (CT, MRI, X-ray, Ultrasound)

- Edge/AI Workstations

- AI Accelerators

By End User

- Hospitals

- Diagnostic Imaging Centers

- Research & Academic Institutes

By Geography

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content