What is the Mammography Systems Market Size?

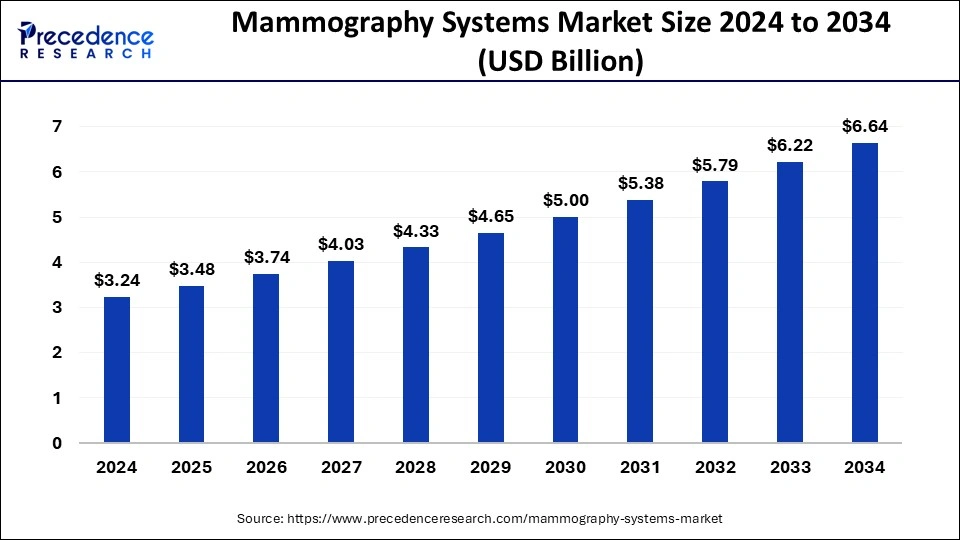

The global mammography systems market size accounted at USD 3.48 billion in 2025 and is predicted to increase from USD 3.74 billion in 2026 to approximately USD 7.07 billion by 2035, expanding at a CAGR of 7.35% from 2026 to 2035. Due to the growing incidence of breast diseases such as cancer in women, there is a significant concern for detecting those diseases in their early stages and curing them with proper treatment. Mammography systems have significantly helped medical agencies to minimize the burden of breast cancer across the world.

Mammography Systems MarketKey Takeaways

- The global mammography systems market was valued at USD 3.24 billion in 2025.

- It is projected to reach USD 6.64 billion by 2035.

- The mammography systems market is expected to grow at a CAGR of 7.44% from 2026 to 2035.

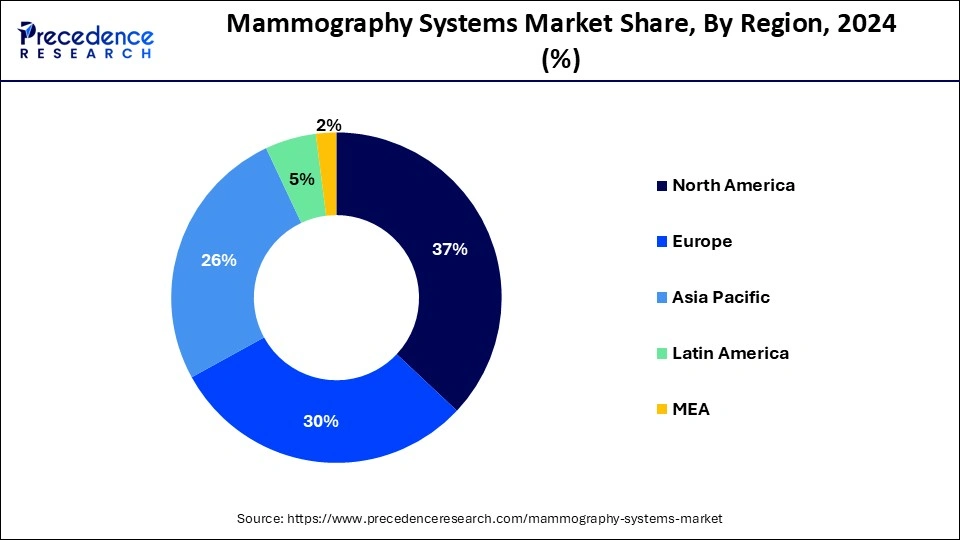

- North America dominated the global mammography systems market share of 37% in 2025.

- Asia Pacific is expected to experience the fastest growth over the forecast period.

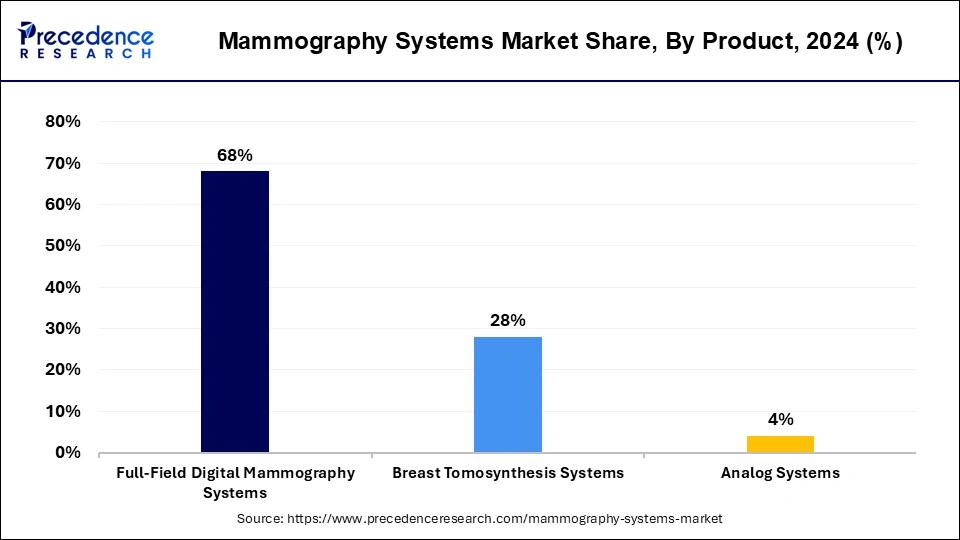

- Based on the product, the full-field digital mammography systems segment held the largest share of the market.

- Based on the product, the breast tomosynthesis systems segment is expected to show the fastest growth in the market.

- Based on technology, the 3D mammography systems segment is projected to witness the fastest growth in the forecasted period.

- Based on end-users, the ambulatory surgical centers segment is projected to uplift the market in the upcoming years.

Strategic Overview of the Global Mammography Systems Industry

Breast cancer has become a global cause of concern because of the increase in cases worldwide. It is one of the most prevalent cancers affecting both men and women, but mainly dominates women.Digital mammography, or X-ray imaging of the breast, is the most common method to screen for breast cancer. The mammography systems market provides specialized medical imaging that employs a low-radiation X-ray to observe the internal structure of the breasts and check abnormalities without any symptoms, which helps physicians analyze and treat medical conditions. Digital mammography is used in a wide variety of settings, including hospitals, specialist clinics, and diagnostic and ambulatory surgery centers.

Breast cancer screening systems are becoming more widespread, and the government is taking steps to support clinical interpretation. These are key factors expected to drive the growth of the market. There are various mammography solutions available, including breast tomosynthesis, film screen systems, and X-rays for the detection of breast cancer. However, 3D mammography has become the gold standard for detecting breast cancer due to advancements in technology. The growth in the mammography systems market is propelled by all these factors and advanced technologies because of the high demand in the market.

Artificial Intelligence: The Next Growth Catalyst in Mammography Systems

AI is significantly impacting the mammography systems industry by enhancing diagnostic accuracy and workflow efficiency, positioning it as a key driver of market growth. The technology, particularly deep learning, helps detect subtle cancer patterns that human radiologists might miss, leading to higher cancer detection rates and fewer false positives and negatives. This improved performance reduces radiologists' workloads, mitigates burnout, and enables faster patient results, thereby streamlining the entire screening process.

Market trends

- Growing prevalence of breast cancers: According to the World Health Organization, globally, 2.3 million women were diagnosed with breast cancer in 2022, and around 670000 deaths. The growing prevalence of breast cancer in women increases demand for mammography systems for diagnosis and detection. The system provides early detection of breast cancer and effective screening.

- Technological advancements: The growing technological advancements in mammography systems help in the market growth. Advancements like digital breast tomosynthesis, digital mammography, and computer-aided detection enhance breast cancer detection rates, image quality, and diagnostic accuracy. The growing demand for high diagnostic accuracy and improved image quality helps in market growth.

Mammography Systems Market Growth Factors

- The growing awareness about the importance of breast cancer screening and early diagnosis, along with the increasing prevalence of breast cancer worldwide, is driving the growth of the mammography systems market.

- Rapid global healthcare development is responsible for expanding the market growth and is predicted to uplift the market very soon.

- Age is also a significant factor for breast cancer in women. Hence, Women over 40 years of age are more prone to this. The mammography systems market provides solutions for early detection, which is the only way to improve the spread of this disease.

- Mammography machines are the most essential tool for detection. Increase in cases of breast cancer worldwide, boosting the growth of the mammography systems market.

Market Outlook

- Market Growth Overview: The mammography systems market is expected to grow significantly between 2025 and 2034, driven by the rising breast cancer cases, the enhancement of artificial intelligence in image analysis, the improvement of accuracy and efficiency, and the dominance of digital systems and 3D tomosynthesis.

- Sustainability Trends: Sustainability trends involve reduced energy footprints, eco-friendly materials, recyclability, and sustainable manufacturing.

- Major Investors: Major investors in the market include Hologic, GE Healthcare, Siemens Healthineers, Fujifilm, Philips, Canon Medical, and Planmed.

- Startup Economy: The startup economy is focused on improved accessibility and workflow, integration of AI, and strategic partnerships.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.59% |

| Market Size in 2025 | USD 3.48 Billion |

| Market Size in 2026 | USD 3.74 Billion |

| Market Size by 2035 | USD 7.07 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, and End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in cases of breast cancer worldwide

Breast cancer stands as the second most common cancer globally, with around 2.3 million new cases, accounting for approximately 11% of total new cancer cases. This makes early detection crucial for effective treatment and higher chances of survival. Women's growing awareness about breast cancer, its diagnosis, and treatment is likely to boost sales in the mammography systems market.

- According to the World Health Organization (WHO), there were approximately 20 million new cancer cases and 9.7 million deaths worldwide in 2022. In the same year, 670,000 related deaths were reported, constituting 6.9% of total cancer deaths.

Advanced screening tools

Advanced screen tools for breast cancer are crucial in detecting the disease in the early stage and can be treated. Regular mammograms are one of the most effective screening tools for detecting breast cancer. Also, full-field digital mammograms and 3D mammography have significantly improved breast cancer detection techniques with fewer false positive results. It also provides more detailed images of breast tissue and helps to detect smaller breast cancers. Adopting these technologies meets the growing demand for breast cancer detection and uplifts the mammography systems market.

Restraint

Lack of knowledge and awareness regarding mammography systems

The absence of knowledge about mammography frameworks persists regardless of the developing prominence of mammography for the identification of breast cancer disease; different difficulties are generally limiting business developments in the mammography systems market. These variables include exposure to radiation, high capital venture, and lack of awareness about mammography systems across a few developing and underdeveloped regions worldwide.

Opportunity

Initiatives and investments by the government and private organizations for breast cancer

Breast cancer is the primary or second leading cause of cancer deaths in women in 95% of countries. However, survival rates for breast cancer vary greatly both between and within countries. Lower and middle-income people in countries account for almost 80% of breast and cervical cancer deaths. Weaker health system regions are least able to cope with the increasing burden of breast cancer. To this end, there are various organizations involved and putting their efforts into diagnosing and treating breast cancer. Therefore, mammography technology is highly adopted in healthcare services.

- WHO is supporting more than 70 countries by detecting early breast cancer, diagnosing it faster, and treating it better, particularly in low- and middle-income countries, in the hope of a bright and cancer-free future.

Segment Insights

Product Insights

The full-field digital mammography systems segment held the largest market share of 68% in 2024. It is considered the most prominent way of detecting cancer at an early stage and provides better image resolution than other systems. The results obtained can ensure more accurate detection of breast cancer.

The breast tomosynthesis systems segment is the fastest-growing and is expected to uplift the growth of the mammography systems market in the forecasted period. This growth is primarily attributed to the accuracy of diagnosis associated with the breast tomosynthesis systems. Radiologists often employ this cutting-edge technique in cases involving dense body tissue. Its efficiency in diagnostic, as well as screening procedures, has attracted the interest of several market players, opening opportunities for collaborations and other ventures.

Technology Insights

The 3D mammography systems segment is projected to be the fastest growing and is expected to increase CAGR in the forecasted period. A 3D mammogram is an imaging test that creates a three-dimensional breast image. It is used to look for breast cancer in people with the absence of any signs or symptoms. Also, it can help to investigate the cause of different breast problems, for example, breast mass, pain, and discharge from the nipples. 2D mammography systems are not successful in identifying every indication of cancer, so further advancements are needed for the identification of the disease.

End-user Insights

The hospitals segment led the mammography systems market in 2024. Hospitals typically handle a large volume of patients, including those seeking preventive screenings, diagnostic tests, and treatment for various medical conditions. Mammography, as a crucial tool for breast cancer detection and screening, is frequently performed in hospital settings due to their capacity to accommodate a high number of patients efficiently. Hospitals often invest in state-of-the-art medical equipment and imaging technology to provide accurate and reliable diagnostic services. Mammography systems installed in hospitals are typically equipped with advanced features such as digital imaging, 3D mammography (tomosynthesis), and computer-aided detection (CAD), enhancing the accuracy and efficiency of breast cancer detection.

The ambulatory surgical centers segment is projected to uplift the market in the upcoming years. These centers consist of advanced cancer detection devices, further improving the diagnosis procedures. Safe, effective, and less time-consuming procedures are also expected to uplift mammography systems in such centers for detecting cancer. Ambulatory surgical centers offer convenient and accessible healthcare services, including mammography screenings, to patients in a community-based setting. Patients can undergo mammograms at ASCs without the need for hospital admission, reducing wait times and offering greater flexibility in scheduling appointments. This convenience encourages more individuals to undergo regular mammography screenings, leading to higher demand for mammography systems in ASCs.

Regional Insights

What is the U.S. Mammography Systems Market Size?

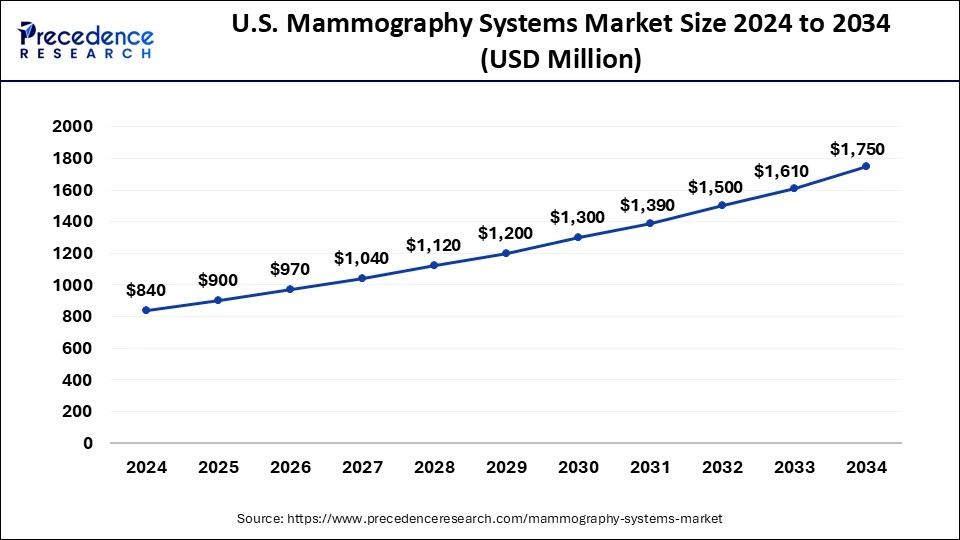

The U.S. mammography systems market size was exhibited at USD 900 million in 2025 and is projected to be worth around USD 1,970 million by 2035, growing at a CAGR of 7.59%.

North America held the largest market share of 37% in 2024, and globally, owing to the growing prevalence of breast cancer, with a significant market share in the forecasted period. The reason behind the growth in the region is the presence of major key players in the market and the concerned population for early detection and diagnosis of the disease to limit the mortality rate. Also, various favorable initiatives by various organizations uplift the market growth of the market.

United States mammography systems market trends

The growing number of breast cancer cases yearly increases demand for mammography systems for diagnosis & screening. According to the American Cancer Society, about 316950 new cases of invasive breast cancer are detected in the United States. The presence of advanced healthcare infrastructure and a number of imaging centers helps in the market growth. The public health campaigns and various government initiatives for breast cancer detection increase demand for mammography. The growing technological advancements in medical technology and the growing development of mammography systems drive market growth. Additionally, the presence of major players and favorable reimbursement policies supports the overall growth of the market.

Asia Pacific, the mammography systems market is expected to experience the fastest growth, with a significant CAGR over the forecast period. This is mainly due to the development of countries such as China, India, and Japan. The increased prevalence of breast cancer, high investments in research and development for breast cancer therapies, and advancements in breast imaging modalities are the primary drivers that are propelling the market growth in Asia-Pacific.

China Mammography Systems Market Trends

China's swift adoption of 3D digital breast tomosynthesis (DBT) is due to its superior cancer detection capabilities in dense breast tissue. This technology is becoming the gold standard, superseding traditional digital systems, which are now integrating advanced AI software to further enhance sensitivity and reduce false positives.

The European mammography market is driven by factors like the presence of highly established key players with highly established healthcare infrastructure, and a growing geriatric population that is prone to fatal diseases like cancers. According to the data published by the European Union population more than 448.8 million people of the total European population are aged more than 65 years.

On a country level, the UK mammography market is anticipated to grow significantly during the foreseeable period, owing to the country's increasing healthcare expenditure. France mammography market is expected to showcase a notable growth rate due to increasing incidences of breast cancer. On the other hand, the market in Germany is expanding due to many local enterprises forming collaborations and partnerships to launch innovative diagnostic products.

Value Chain Analysis of Mammography Systems Market

- Research & Development (R&D) and Technology Development: This initial stage involves innovating and developing new technologies, such as digital breast tomosynthesis (3D mammography), AI-powered detection software, and features to enhance patient comfort.

Key Players: Hologic Inc., GE Healthcare, Siemens Healthineers, and Koninklijke Philips N.V. - Inbound Logistics/Raw Material Sourcing: This involves procuring high-quality components and raw materials necessary for the sophisticated equipment.

Key Players: Hologic, Siemens, and GE - Operations/Manufacturing: In this stage, the components are assembled into the final mammography systems.

Key Players: Hologic Inc., GE Healthcare, Siemens Healthineers, Fujifilm Holdings Corporation, and Canon Medical Systems Corporation.

Mammography Systems Market Companies

- Siemens Healthineer develops advanced mammography systems that contribute to the market through innovative technologies like their 3D Mammography (Digital Breast Tomosynthesis) and AI-powered workflow solutions, aiming to improve early detection and diagnostic accuracy.

- Planmed Oy contributes to the mammography market by specializing in ergonomic and patient-friendly digital mammography and breast tomosynthesis units, focusing on comfort and image clarity to enhance the screening experience.

- NP JSC Amico contributes to the market as a manufacturer of medical equipment, including mammography systems designed to be cost-effective and accessible, serving specific regional markets with reliable diagnostic tools.

- Koninklijke Philips (Philips Healthcare) impacts the market with comprehensive breast care solutions, integrating mammography systems with advanced image processing and connectivity features to support confident diagnosis and efficient clinical workflows.

- Konica Minolta contributes to the mammography market primarily through its digital radiography and computed radiography systems, providing flexible and high-quality imaging solutions for breast screening and diagnostics.

Other Major Key Players

- Hologic

- Fujifilm Holdings Corporation

- Delphinus Medical Technologies

- Carestream Health, Inc.

- Canon Medical Systems Corporation (Toshiba Medical Systems Corp.)

- Analogic Corporation

- GE Healthcare

- Allengers Medical Systems Limited

- BET Medical

Recent Developments

- In May 2025, Sir HN Reliance Foundation Hospital launched the Genius AI 3D mammography system. The system focuses on transforming breast cancer detection, and scans are complete in just 3.7 seconds. The system enhances the comfort of patients and provides accuracy in the detection of breast cancer. The system offers faster diagnoses and uses advanced artificial intelligence. It enables timely treatment and improves the overall comfort of the screening experience. (Source: https://indiamedtoday.com)

- In May 2025, Siemens Healthineers launched a revolutionary mammography system, MAMMOMAT B brilliant, in Indonesia. The system is developed to support healthcare providers with efficient diagnostic processes, enhanced precision, and streamlined workflows. It sets a new standard in image quality for Full-field Digital Mammography and Digital Breast Tomosynthesis. It consists of patient-centric, intelligent, and efficient designs. (Source: https://www.biospectrumasia.com)

- On 26th November 2024, GE Healthcare launched a mammography system name Pristina Via, designed for the enhancement of the screening experience for patients and medical professionals. The system is designed to offer mammography technologies with various sophisticated tools to meet the increasing demands of diagnostic precision, with fast-paced workflows to provide patient-centric breast care. (Source: https://www.itnonline.com)

- On 1st December 2024, Hologic launched two new technologies to help demonstrate a reimagining of breast health. The envision mammography platform provides a 3D mammography with high-speed and precision that delivers the sharpest images with high resolution. Another is the next-gen Genius AI detection PRO solution is also made available for use. It is a highly advanced cancer screening technology that offers even greater precision and efficiency to mitigate false positive rates.(Source : https://appliedradiology.com)

- On 3rd June 2024, FUJIFIL India and NM Medical collaboratively introduced their first Fujifilm skill lab for full-field digital mammography. It includes interactive sessions on mammography, interpretation of protocols, and a hands-on workshop with live demo sessions. (Source: https://www.fujifilm.com)

- In February 2023, the introduction of a new Global project on Breast Cancer with the objective of reducing mortality rates and improving treatment was announced by the World Health Organization (WHO). It targets to save millions of breast cancer cases by the year 2040. The newly launched project emphasizes three critical steps for health: early detection, timely diagnosis, and comprehensive management of breast cancer.

- In October 2023, Siemens Healthineers presented a novel mammography framework called Mammomat B. Brilliant with wide-angle tomosynthesis. This system utilizes Flying focal spot technology innovation for the first time in mammography. It was the first gadget from Siemens Healthineers that consolidated wide-angle tomosynthesis, the new detector, the newly evolved Flying Focus Spot tube, and the Premia computer-based intelligence recreation to upgrade image quality.

- In November 2022, Google Health announced a partnership with iCAD, a medical technology company, to incorporate its AI technology into breast imaging solutions. This was the first commercialization agreement for Google Health's mammography AI models and allowed the technology to be used in real-life clinical settings.

Segments Covered in the Report

By Product

- Analog Systems

- Full-Field Digital Mammography Systems

- Breast Tomosynthesis Systems

By Technology

- Screen Film

- 2D Mammography

- 3D Mammography

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting