What is the Digital Mammography Market Size?

The global digital mammography market size is accounted at USD 3.01 billion in 2025 and predicted to increase from USD 3.33 billion in 2026 to approximately USD 8.07 billion by 2035, representing a CAGR of 8.55% from 2026 to 2035. The market is driven by the increasing prevalence of breast cancer worldwide.

Digital Mammography Market Key Takeaways

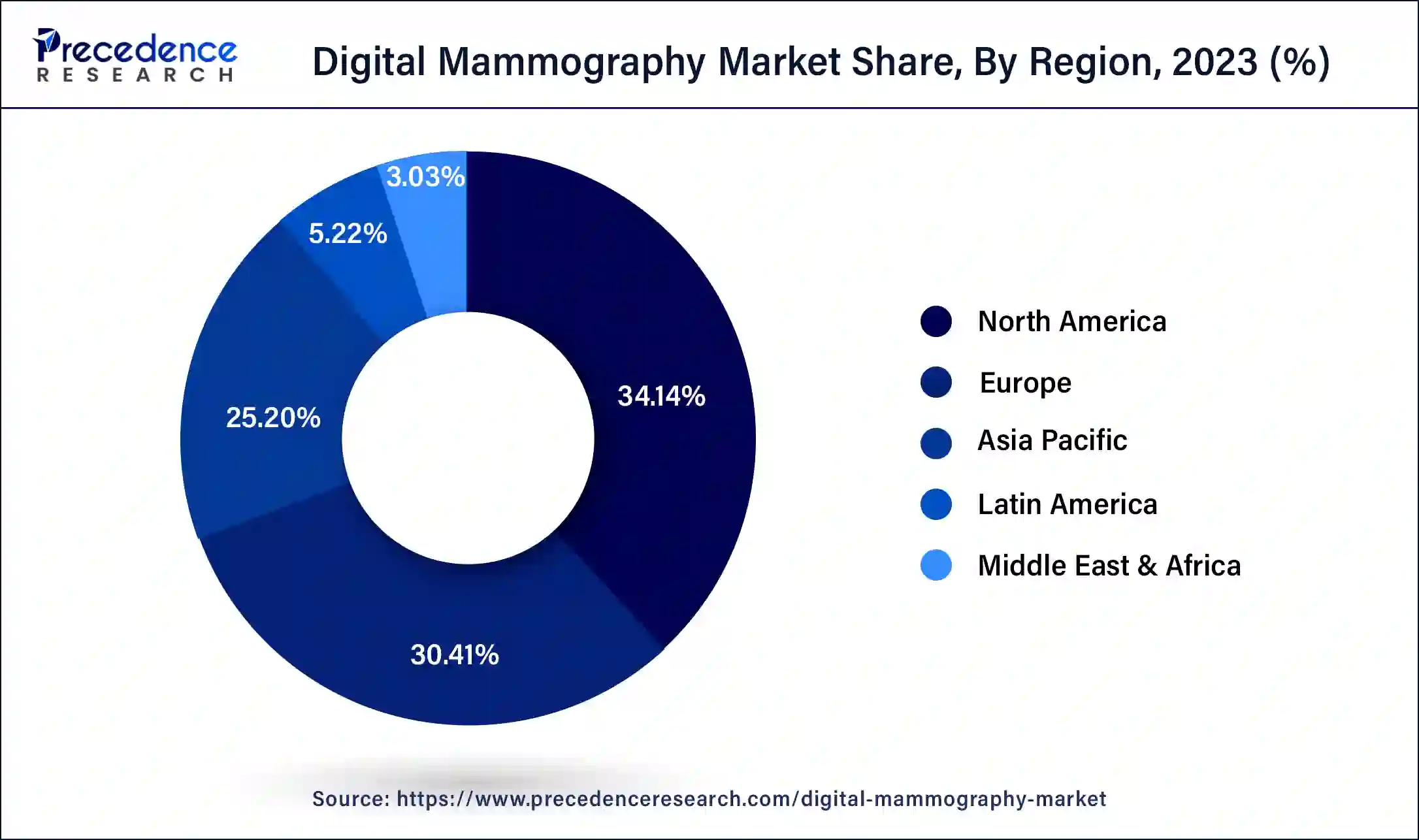

- North America region generated more than 36.14% of revenue share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 12% from 2026 to 2035.

- By product, the 2D full-field digital mammography tomosynthesis segment registered more than 61% of revenue share in 2025.

- By end-use, the hospital segment contributed the largest share of 46% in 2025.

Market Overview

The digital mammography market refers to the market for mammography systems that use digital technology to capture and produce mammogram images. Mammography is a medical imaging technique specifically designed for breast examination and is primarily used for the early detection and diagnosis of breast cancer.

Digital mammography systems have replaced traditional film-based mammography due to their numerous advantages. Digital technology allows for the immediate acquisition, display, and storage of high-quality digital images, offering improved image resolution and manipulation capabilities. Digital mammography also enables the use of computer-aided detection (CAD) systems, which assist radiologists in the detection of abnormalities and potential signs of breast cancer.

How is AI Impacting the Digital Mammography Market?

AI is significantly transforming the digital mammography market by enhancing diagnostic accuracy, efficiency, and clinical outcomes. Advanced AI algorithms can detect subtle patterns and abnormalities that may be overlooked by the human eye, enabling earlier cancer detection and improved sensitivity. Studies indicate that AI-assisted mammography readings now achieve higher accuracy than human interpretation alone, helping reduce false positives and false negatives. Additionally, AI improves image quality and optimizes imaging protocols, which can lower radiation exposure while maintaining diagnostic performance, making mammography safer and more effective for patients.

Digital Mammography Market Growth Factors

The increasing prevalence of breast cancer is the key factor that will boost the market's growth during the forecast period. Additionally, the incidence of breast cancer among elderly women is driving the market expansion. Relative survival from breast cancer decreases among elderly women. Thus, the growing geriatric population is expected to drive the market growth during the forecast period. In addition, several extensive studies have shown that combined 2D/3D systems of mammography are superior to 2D mammography alone in diagnosing breast cancer. Growing awareness of the use of these systems and high detection rates are critical drivers for the segment.

Market Outlook

- Market Growth Overview: The digital mammography market is expected to grow at a significant rate from 2025 to 2034, driven by growing breast cancer cases and an aging population. Technological advancements, such as AI and 3D mammography (tomosynthesis), are improving image accuracy, contributing to market growth.

- Global Expansion: Worldwide growth is driven by expanding screening programs, improved healthcare infrastructure, and supportive government initiatives for women's health. Emerging regions such as Asia-Pacific, Latin America, and the Middle East offer strong opportunities due to increasing healthcare investments, growing awareness, and rising adoption of cost-effective digital imaging solutions.

- Major Investors: Major investors include global medical imaging companies such as GE HealthCare, Siemens Healthineers, Hologic, Philips, and Fujifilm, which invest heavily in R&D and product innovation. Their contributions focus on advancing imaging technology, expanding global distribution networks, and integrating AI-driven solutions to improve diagnostic outcomes and market penetration.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.01 Billion |

| Market Size in 2026 | USD 3.33 Billion |

| Market Size by 2035 | USD 8.07 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.6% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Time-Efficient Process offered by the technological advancements in digital mammography units

Digital mammography offers quick and accurate diagnostic results, that are available in less than a few hours. The time-efficient process offered by digital mammography units promotes their application in the healthcare sector. Healthcare providers are focusing on the installation of technologically advanced mammography devices. Technologically advanced mammography units are capable of offering customized outcomes while focusing on specific areas of breasts. Such advanced units can also decrease or increase the contrast to distinguish healthy breast tissues. All these elements act as a driver for the market's growth while increasing the adoption of digital mammography units.

Restraint

Limited access and awareness and high cost

In some regions, particularly low-income areas or rural communities, access to digital mammography services may be limited. Lack of awareness about the importance of regular mammograms and limited infrastructure can hinder the adoption of digital mammography in these areas. Digital mammography systems tend to be more expensive compared to traditional film-based systems, which can pose a financial challenge for healthcare facilities, especially in developing countries with limited resources. The initial investment cost, along with the costs of maintenance, upgrades, and training, can be significant.

Opportunity

Adoption of portable/mobile digital mammography devices

According to the Centers for Disease Control and Prevention, mobile mammography services are one of the most powerful tools to serve medically underserved communities. Mobile or portable mammography units aim to offer rapid detection of disease by reducing the patients' visit to the hospital or diagnostic centers. Additionally, the restrictions during the Covid-19 period boosted the demand for portable and mobile healthcare services.

The adoption of portable digital mammography devices brings innovation to the industry. It allows remote and mobile monitoring. It will be able to offer services in underdeveloped areas. Also, it will promote early detection of breast cancer. Rising demand for early and rapid diagnosis will supplement portable mammography devices that offer digital images.

Product Insights

The 2D full-field digital mammography tomosynthesis segment is leading in the market with more than half the market share and is expected to grow significantly during the forecast period. In a 2D mammogram, two X-ray images are taken, one from above and one from the side. The requirement for accurate and rapid diagnostic reports along with the rapid adoption of 2D mammography devices promotes the growth of the segment.

The 3D full-field digital mammography tomosynthesis segment is expected to register the fastest growth during the forecast period. In 3D tomosynthesis, more photos are taken, resulting in images of thin sections of the breast. This implies that pictures of the opposite side of the breast are not obscured by breast tissue from the other side. 3D tomosynthesis has been shown to reduce false positives and reduce recall for further imaging. With the technological advancements and rapid adoption of advanced diagnostic mammography services, the 3d full-field digital mammography tomosynthesis segment will continue to grow.

End-use Insights:

The hospital segment contributed the largest share in 2025, the segment is expected to sustain its dominance during the forecast period owing to the presence of advanced facilities offered by hospitals for breast cancer detection. Multiple government hospitals offer cost-effective diagnostic services along with healthcare policies for cancer treatments. This factor promotes the adoption of digital mammography devices in hospitals. Hospitals often carry a significant patient population. Additionally, the presence of experienced and skilled healthcare providers supports the growth of the segment. In addition, public and private investments in the health sector are expected to accelerate the segment's growth.

The diagnostic center's segment is expected to witness the fastest growth during the forecast period. The availability of digital and 3D mammography, whole breast ultrasound, and noise magnetic resonance imaging (MRI) for risk screening, diagnosis, and treatment planning has increased the diagnosis and detection accuracy at such diagnostic stores, which is projected to support the growth of this segment shortly. The development is driven by the increased availability of comprehensive breast imaging services at cost-effective prices, the use of advanced imaging techniques, and the availability of competent and experienced professionals.

Regional Insights

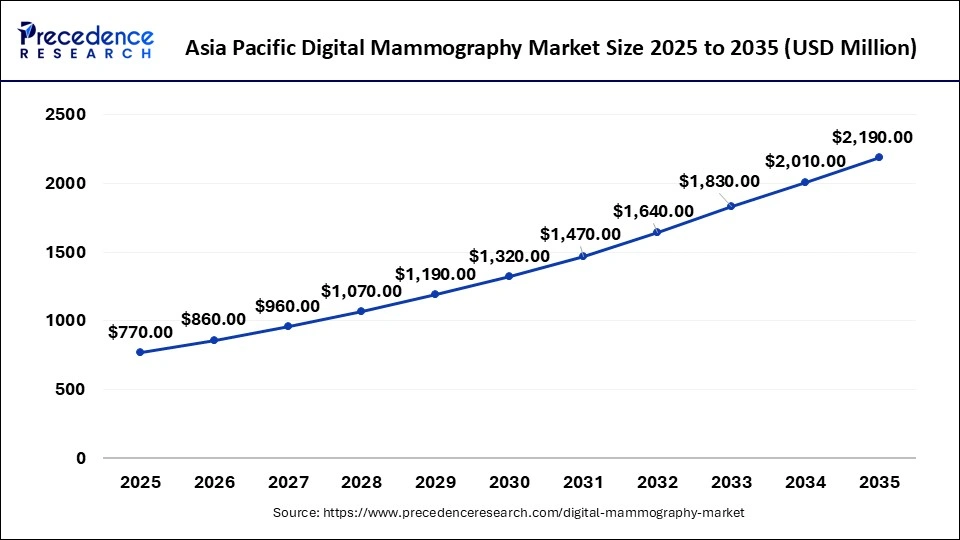

Asia Pacific Digital Mammography Market Size and Growth 2026 to 2035

The Asia Pacific digital mammography market size is estimated at USD 770 million in 2025 and is predicted to be worth around USD 2,190 million by 2035, at a CAGR of 11.02% from 2026 to 2035.

North America dominated the global digital mammography market in 2025. The region is expected to sustain its dominance during the forecast period. The increasing reimbursement from countries and progressive healthcare institutions will further fuel the growth of the digital mammography market in the region during the forecast period.

U.S. Market Trends

The U.S. is a major contributor to the North American digital mammography market. This is mainly due to the high prevalence of breast cancer, widespread adoption of routine screening programs, and strong recommendations from healthcare authorities for early detection. Additionally, rapid integration of advanced technologies such as 3D mammography and AI-assisted imaging, supported by favorable reimbursement policies and well-established healthcare infrastructure, is accelerating market expansion in the country.

The government's support and funding for improving the healthcare infrastructure play a crucial role in the growth of the market. North America carries a forefront healthcare infrastructure, and the continuous and rapid adoption of advanced diagnostic technologies promotes the development of the digital mammography market in the region. Along with this, the Covid-19 pandemic has boosted the deployment of home care settings, which subsequently supports the adoption of portable and digitally advanced mammography devices.

The increasing prevalence of breast cancer in the region, especially in younger women, supplements the growth of the digital mammography market in North America. According to the Cancer Net, in 2023, approximately 2,97,790 women with invasive breast cancer will be diagnosed in the United States (estimated). This element excites the demand for advanced diagnostic methods in the nation while fueling the market's growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

The Asia-Pacific digital mammography market is expected to grow significantly due to increasing health awareness. Moreover, the increasing incidence of breast cancer will further fuel the growth of the digital mammography market in the region in the coming years. The rising demand for early detection of breast cancer in the region, with the increasing number of breast cancer patients, promotes the growth of the market in the Asia Pacific. In India, breast cancer is becoming the most prevalent type of cancer. Almost 50% of breast cancers in India are diagnosed at stage 3 and stage 4; this fact increases the requirement for more advanced and rapid diagnostic techniques for the country.

As the number of radiology centers increases in the region, along with the rising emphasis on the improvement of the healthcare infrastructure, will propel the growth of the digital mammography market during the forecast period.

China Market Trends

The digital mammography market in China is driven by rising breast cancer incidence, increasing awareness of early screening, and rapid expansion of healthcare infrastructure. Government-led healthcare reforms, growing adoption of advanced imaging technologies, and rising investments in diagnostic equipment across urban and tier-2 cities are further accelerating market growth.

What Makes Europe a Significant Region in the Market?

Europe is a significant region in the digital mammography market due to well-established healthcare infrastructure, widespread breast cancer screening programs, and strong regulatory support for early detection initiatives. Additionally, high adoption of advanced technologies like 3D mammography and AI-assisted imaging, along with increasing healthcare spending and awareness campaigns, drive consistent market growth across key countries such as Germany, the UK, and France.

Top Companies in the Digital Mammography Market & Their Offerings

- PLANMED OY: It provides advanced digital mammography systems, which include Digital Breast Tomosynthesis (DBT), such as the Planmed Clarity 3D and standard digital mammography with improved patient comfort, low-dose options, and ergonomic features, plus stereotactic biopsy systems, all programmed for early breast cancer detection and easy usability.

- Fujifilm Corporation: Fujifilm Corporation provides a comprehensive suite of products for the digital mammography market, advanced image processing technologies, centered on Full Field Digital Mammography (FFDM) systems, and supporting software solutions.

Digital Mammography MarketCompanies

- Hologic Inc.

- Koninklijke Philips NV

- GE Healthcare

- Siemens Healthcare GmBH

- PLANMED OY

- Fujifilm Corporation

- Toshiba Medical Systems

- Metaltronica S.p.A

Recent Developments

- In October 2022,The America College of Radiology announced that it has entered into a strategic collaboration with the Breast Cancer Research Foundation in order to intrlduce contrast-enhanced mammography imaging screening trial (CMIST). The trial study aims to examine the outcomes of mammography with contrast detection in females with breast cancer. The trial will conduct the study to understand the benefits of contrast-enhanced mammography (CEM).

- In November 20222,the Radiological Society of North America (RSNA) announced the launch of the screening mammographic breast cancer detection artificial intelligence challenge. The challenge is developed to assess the ability of competitors to develop AI. The penetration of AI will be used to detect breast cancer during the mammography screening. According to the RSNA, the challenge is a segment of a larger research project that deals with the AI tools in clinical settings.

- In June 2023,UNC Health Pardee announced the release of a program with mobile mammography ‘Mammo on the Go'. The mobile mammography unit offers state-of-the-art early detection services along with 3D digital mammography. The service is open in Buncombe, Polk and Transylvania counties. The mobile mammography service by UNC Health service is offered with a bus which is occupied with trained staff and board-certified radiologists.

- In January 2025, Siemens Healthineers declared the first U.S. installation of its Mammomat B.brilliant mammography system. This system incorporates advanced 3D image acquisition and even reconstruction technology, along with features for full-field digital mammography, titanium contrast-improved imaging, and breast biopsy.

Segment Covered in the Report

By product

- 3D Full Field Digital Mammography Tomosynthesis

- 2D Full Field Digital Mammography Tomosynthesis

By End-use

- Diagnostic Centers

- Hospitals

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content