AI Trading Platform Market Size and Forecast 2025 to 2034

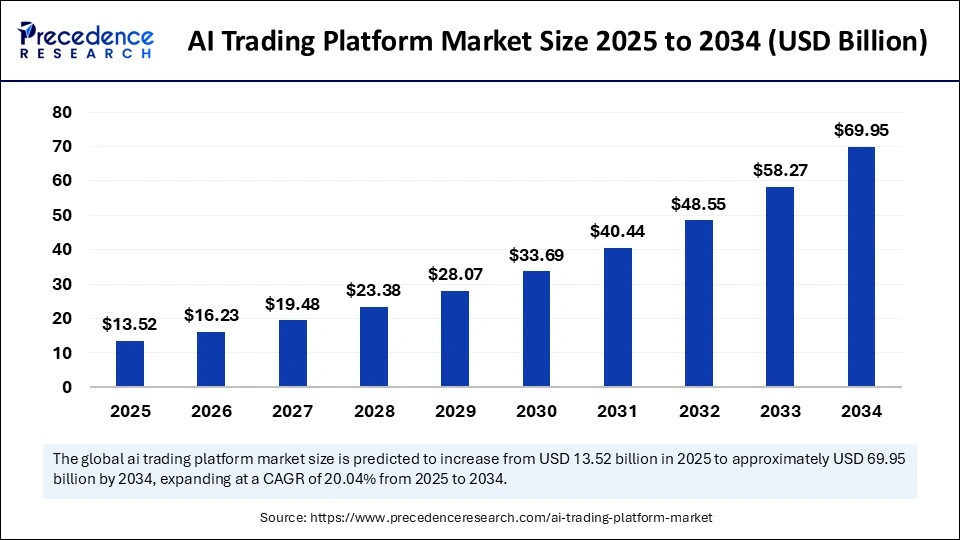

The global AI trading platform market size accounted for USD 11.26 billion in 2024 and is expected to increase from USD 13.52 billion by 2025 to approximately USD 69.95 billion by 2034, expanding at a CAGR of 20.04% from 2025 to 2034. The market is witnessing significant growth due to the increasing demand for algorithmic trading solutions and need for real-time data analytics to analyze large volumes of financial data, identify trading patterns and generate actionable insights.

AI Trading Platform Market Key Takeaways

- In terms of revenue, the AI trading platform market is valued at 13.52 billion in 2025.

- It is projected to reach 69.95 billion by 2034.

- The market is expected to grow at a CAGR of 20.04% from 2025 to 2034.

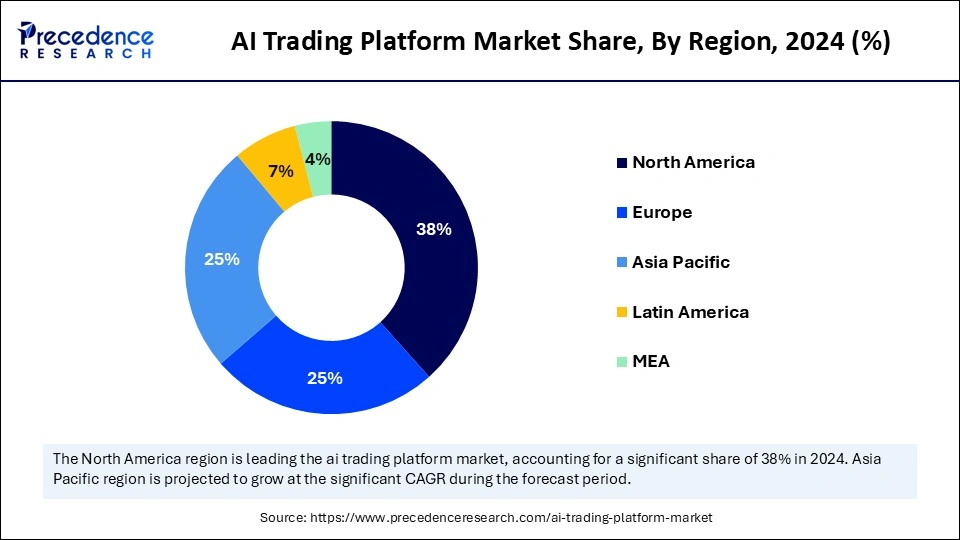

- North America dominated the global market with the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By application, the algorithmic trading segment held the largest market share of 39% in 2024.

- By application, the risk management segment is expected to grow at the fastest CAGR during the forecast period.

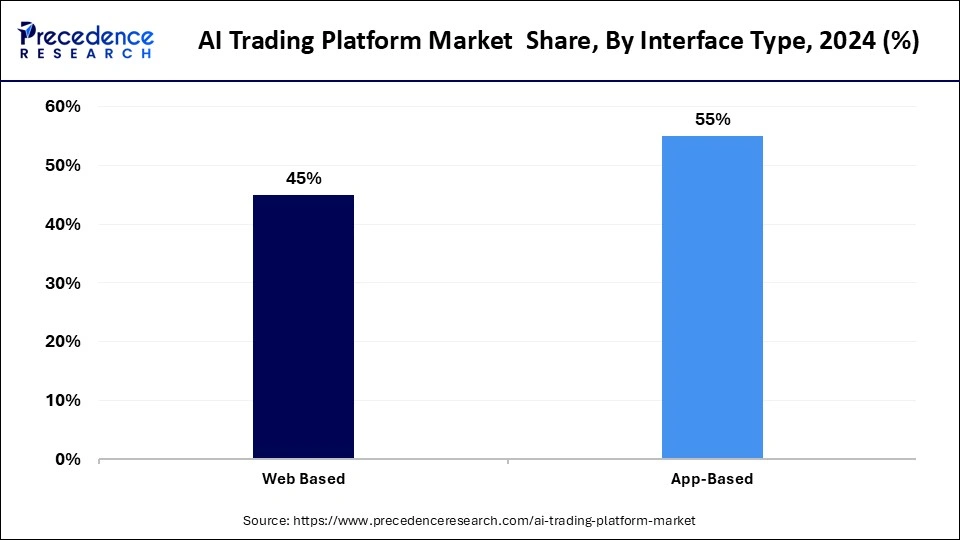

- By interface type, the app-based segment captured the biggest market share of 55% in 2024.

- By interface type, the web-based segment is expected to grow at a significant CAGR in the upcoming years.

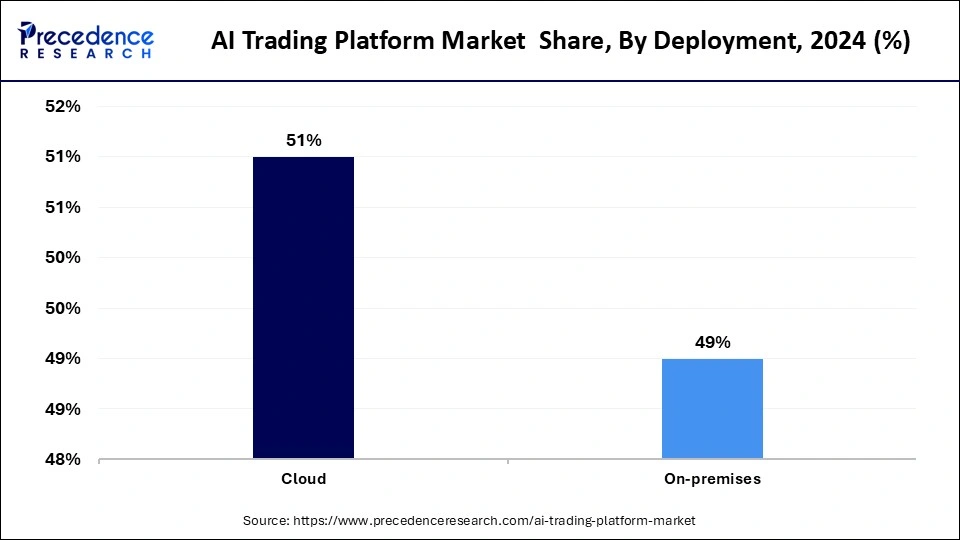

- By deployment, the cloud segment contributed the largest market share of 51% in 2024.

- By deployment, the on-premise segment is projected to expand at a rapid pace in the coming years.

- By end use, the institutional investors segment generated the major market share in 2024.

- By end use, the retail investors segment is expected to expand at the fastest CAGR during the projection period.

How AI Aids in the Management of Trading Strategies?

Artificial Intelligence is transforming trading strategies by making trade execution faster, more accurate, and adapting to market conditions. It can analyze vast datasets, detect patterns, and manage strategies in real-time by improving decision-making while minimizing manual effort. Traders now rely on AI for stock trading to optimize risk management and gain a competitive advantage.

U.S. AI Trading Platform Market Size and Growth 2025 to 2034

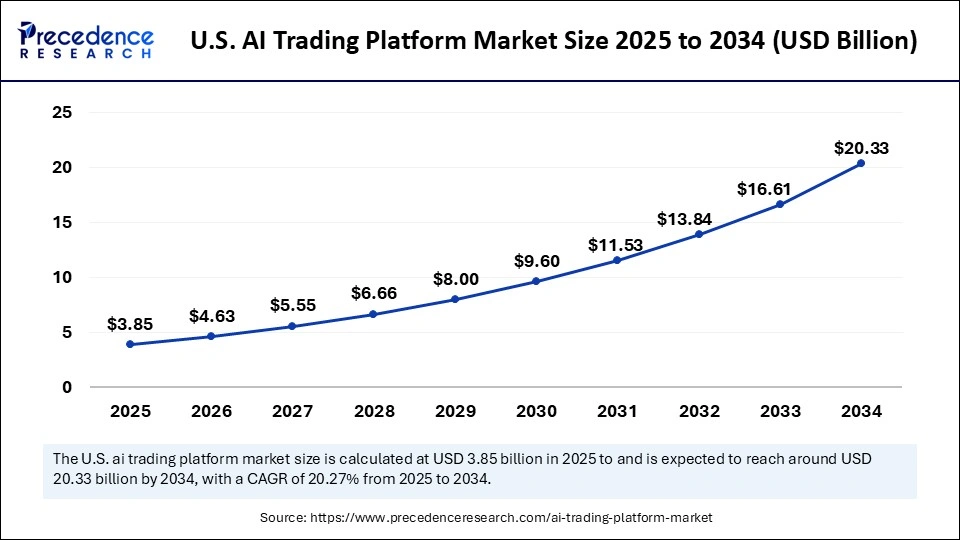

The U.S. AI trading platform market size was exhibited at USD 3.21 billion in 2024 and is projected to be worth around USD 20.33 billion by 2034, growing at a CAGR of 20.27% from 2025 to 2034.

What Made North America the Dominant Region in the AI Trading Platform Market?

North America dominated the market with the largest share in 2024. This is mainly due to its strong financial ecosystem and advanced technology infrastructure, including high-speed internet and cloud computing, which are essential for AI-powered trading platforms. The region is an early adopter of AI and fintech innovations. North America has been at the forefront of adopting AI and fintech innovations as well as it is home to various prominent financial institutions and technology providers such as SAS Institute, Oracle, and JP Morgan Chase, which are actively developing and deploying AI-powered trading platforms. The U.S. leads in private AI investment and has a robust venture capital ecosystem, fostering the growth of AI-powered trading platforms.

The U.S. AI Trading Platform Market

The U.S. held the maximum share of the North American AI trading platform market in 2024 due to its well-established financial ecosystem with major stock exchanges, high liquidity, and advanced trading facilities. Other factors, such as robust financial infrastructure, a strong technological base, substantial investment in fintech, and a large pool of talent in AI and finance, further support market growth. This dominance is propelled by leading financial institutions, technology companies, and a well-established regulatory framework that supports the development and use of AI in the financial industry by establishing fair and transparent trading practices.

What are the Key Trends in the AI Trading Platform Market Within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to strong economic growth, leading to increased investment and trading activity coupled with expanding capital markets and rising fintech adoption. Government support for digital initiatives and a large, growing population of retail investors contribute to this growth by fostering a vibrant AI ecosystem. Advancements in technology, especially in AI and related fields, are also driving this expansion.

China AI Trading Platform Market Trends

China is leading the market in Asia Pacific because it has a vast user base, which generates massive amounts of real-time data, driving AI model development and training. Its strong government-led digitalization strategies and investments in AI infrastructure also drive adoption. Chinese retail investors are increasingly using AI tools, such as DeepSeek, to improve their trading strategies.

India: A Key Force in the AI Trading Platform Market

India plays an important role in the market because it is a leading destination for AI readiness, with government-led strategies supporting funding and programs. India has a large and growing population of retail investors, providing a significant market for AI trading platforms. Furthermore, India offers the second largest digital data generation, coupled with a growing economy, making it an ideal testing ground for AI-driven innovations embracing the financial sector.

What Opportunities Exist in the European AI Trading Platform Market?

Europe is considered to be a significantly growing area. European financial institutions are investing heavily in AI to enhance trading efficiency, compliance, and risk management. A strong financial ecosystem and the adoption of advanced technologies support regional market growth. Moreover, rising government initiatives to promote digital transformation in the financial sector open up avenues for AI trading platforms.

Market Overview

The AI trading platform market is distinguished by a dynamic landscape driven by advancements in artificial intelligence and machine learning technologies. AI trading platforms integrate AI capabilities into algorithmic trading systems. AI trading bots possess the ability to crunch a vast amount of technical and fundamental market data in real-time pertaining to a wide variety of financial markets such as stocks, commodities, bonds, indices, forex, and crypto. These platforms can perform a wide range of activities, such as risk assessment, historic price and volume analysis, signal creation, strategy testing, entry and exit suggestions, and trade execution. These platforms not only enable trading bots to identify and analyze but also to draw inferences from data patterns, allowing them to adapt to shifting market conditions and respond to trading opportunities without explicit programmed instructions.

AI Trading Platform Market Growth Factors

- Increasing Demand for Algorithmic Trading Solutions: As the financial industry becomes increasingly complex, institutions are increasingly seeking solutions to enhance their trading strategies. AI-powered trading platforms streamline operations, improving efficiency and accuracy in trade execution.

- Rising Demand for Real-Time Data Processing: The financial industry demands instant decision making. AI platforms excel in processing vast amounts of data in real-time, offering traders actionable insights.

- Customization and Accessibility: Platforms offer customizable solutions to cater to diverse trading strategies and are increasingly accessible to retail investors, equalizing advanced trading tools.

- Regulatory Support and Technological Innovation: Supportive regulations in financial hubs are fostering innovation and the adoption of AI technologies in trading.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 69.95 Billion |

| Market Size in 2025 | USD 13.52 Billion |

| Market Size in 2024 | USD 11.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Interface Type, Deployment, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Need for Accuracy and Efficiency in Trading Decisions

There is a heightened need for high speed, accuracy, and efficiency in trading decisions, which acts as a primary driver of the AI trading platform market. AI trading platforms analyze vast amounts of data and execute trades faster than humans. They also analyze market trends more effectively, leading to better trading outcomes and increased operational efficiency. The widespread adoption of AI and ML in the financial industry and the rising demand for algorithmic trading further support market growth.

- In December 2023, CFI launched an AI Trading Assistant to enhance online trading for new users, followed by Capitalise AI, which offers traders to automate strategies without needing advanced development skills.

Restraint

Lack of High-Quality and Domain-Specific Data for Training and Deploying AI Models

A primary restraint in the AI trading platform market is the lack of high-quality, domain-specific data for training and deploying AI models. AI can identify patterns and predict market movements with enhanced accuracy than human traders to reduce risks and improve trading outcomes. This makes AI trading platforms vulnerable to cyber threats. The lack of security protocols makes it challenging to share or use data for training AI models without risking breaches or violating privacy laws.

Opportunity

Rising Demand for Personalized and Automated Trading Strategies

The main future opportunity in the AI trading platform market is the rising demand for personalized and automated trading strategies, leading to increased efficiency and potentially higher returns for investors. Technological innovations open up new growth avenues. Advancements in AI technologies enable the development of complex and effective trading platforms. The future could see the integration of AI with quantum computing, further improving the speed and accuracy of AI algorithms in trading.

Application Insights

How Algorithmic Trading Segment Dominated the AI Trading Platform Market in 2024?

The algorithmic trading segment dominated the market with the largest revenue share in 2024. This is mainly due to its ability to enhance speed, accuracy, and risk management in trading. There is a heightened adoption of AI and machine learning by institutional investors and trading firms. This enables financial institutions and individual traders to execute trades with enhanced efficiency and precision, minimizing manual errors and improving decision-making.

The risk management segment is expected to grow at the fastest rate during the forecast period. Manual risk management processes are prone to errors and cannot keep up with the speed of modern markets. However, AI trading platforms identify and predict risks, allowing traders to take proactive measures to mitigate potential losses. AI insights help traders make more accurate and real-time portfolio monitoring predictions about market movements and adjust their strategies accordingly by providing better risk management solutions, faster reaction times and more informed decision-making, leading to more resilient and compliant trading environments.

Interface Insights

What Made App-Based the Dominant Segment in 2024?

The app-based segment dominated the AI trading platform market in 2024. This is mainly due to the increased use of app-based platforms, which provide convenient access to trading tools, real-time analytics, and automated investment features, regardless of location. App-based platforms often feature intuitive interfaces, making them accessible to both novice and experienced by encouraging wider market participation, particularly among retail investors. These platforms enable real-time market analysis and personalized insights, improving decision-making.

The web-based segment is expected to grow at a significant CAGR in the upcoming years due to its accessibility, scalability, and user-friendly features. Web-based platforms provide seamless integration with various data sources, such as real-time market data, financial databases, social media feeds, and advanced tools, without the demand for dedicated software installations. Web-based platforms typically have minimal development and maintenance costs compared to traditional desktop applications, resulting in more affordable solutions for both providers and users.

Deployment Insights

Why Did the Cloud Segment Dominate the AI Trading Platform Market in 2024?

The cloud segment dominated the market with a major revenue share in 2024. Cloud-based platforms can easily scale up according to trading volumes and workloads. These platforms require lower operational costs compared to maintaining on-premises infrastructure, providing necessary resources for processing large volumes of real-time data. Cloud-based platforms are widely preferred for their enhanced security measures, which can be more robust than those of individual institutions. They also facilitate the rapid deployment of AI models and algorithms, allowing traders to rapidly implement new strategies and adapt to market changes.

The on-premise segment is projected to expand at a rapid pace in the coming years. Financial institutions are increasingly prioritizing on-premise solutions for their enhanced data security, compliance, and latency control. This allows for customization and a personalized approach to meeting specific regulatory and operational demands to maintain control over sensitive data. Since on-premises platforms host in organization's existing infrastructure, they enable organizations to control their data, reducing cyber threats.

End Use Insights

What Factors Contributed to Institutional Investors Segment Dominance in 2024?

The institutional investors segment dominated the AI trading platform market with the largest share in 2024. This is mainly due to their significant trading volumes, resources, and the need to gain an edge in highly competitive markets. Institutional investors, like closed-end funds and asset managers, handle substantial trading volumes and have the financial resources to invest in and deploy AI-driven trading strategies. These platforms automate trading processes, minimizing operational costs and freeing up human resources for strategic decision-making.

The retail investors segment is expected to expand at the fastest rate during the projection period due to factors like increased accessibility of AI-powered tools, user-friendly interfaces, and the democratizing effect of these technologies. AI platforms offer automated investment tools and educational resources, making it easier for individuals with limited experience to participate in the market by appealing to a wider audience.

AI Trading Platform Market Companies

- Kavout

- Numerai, Inc.

- Algotraders

- Tickeron Inc.

- MetaQuotes Ltd

- SAS Institute

- Oracle

- JP Morgan Chase

- Trade Ideas LLC

- Alpaca Securities LLC

- Wealthfront Corporation

- TradingView, Inc.

- ProRealTime SAS

Recent Developments

- In April 2025, Hantec Trader unveiled InsightPro, a next-generation AI-powered trading intelligence tool developed in collaboration with Acuity Trading. Designed to empower traders with deeper insight and faster decision-making. InsightPro delivers real-time signals, sentiment-driven analytics and comprehensive market data.

- In April 2025, Trendy Traders introduced Quanttrix.io, an innovative algo trading software in India. It is designed to simplify trading for retail investors. With advanced features powered by artificial intelligence and automation, Quanttrix.io forms trading accessible and efficient for beginners and experienced traders.

- In February 2025, WiseBit, a global trading platform, introduced incorporation of AI tools to enhance trading experience. These AI-driven features are designed to support traders with data-driven insights and assist in navigating dynamic financial markets.

- In January 2025, AMG Financial EU announced the launch of its state-of-the-art AI-powered trading platform. This advanced technology is designed to provide German investors with advanced tools, personalized solutions and unprecedented market insights, setting a new standard for financial growth and security.

- In January 2025, Ovoro launched ai-powered crypto trading platform to make buying and selling cryptocurrency easy and safe with just one click, aims to make cryptocurrency investing more accessible, attractive and less risky. Ovoro is a registered Virtual Asset Service Provider (VASP) operating under the supervision of the Finnish Financial Supervisory Authority (FIN-FSA).

- In July 2023, MachineTrader launched a beta version of its software which allows traders to automate their investment strategies without the need to write code or hire programmers to build a custom trading platform. It provides users to develop flow-based processes using visual development interface, enhanced with Open AI, allowing users to develop complex programs without writing code.

Segments Covered in the Report

By Application

- Algorithmic Trading

- Robo-Advisory Services

- Market Forecasting

- Risk Management

- Others

By Interface Type

- Web Based

- App-Based

By Deployment

- Cloud

- On-premises

By End Use

- Retail Investors

- Institutional Investors

- Hedge Funds

- Brokerage Firms

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting