What is the Aircraft Leasing Market Size?

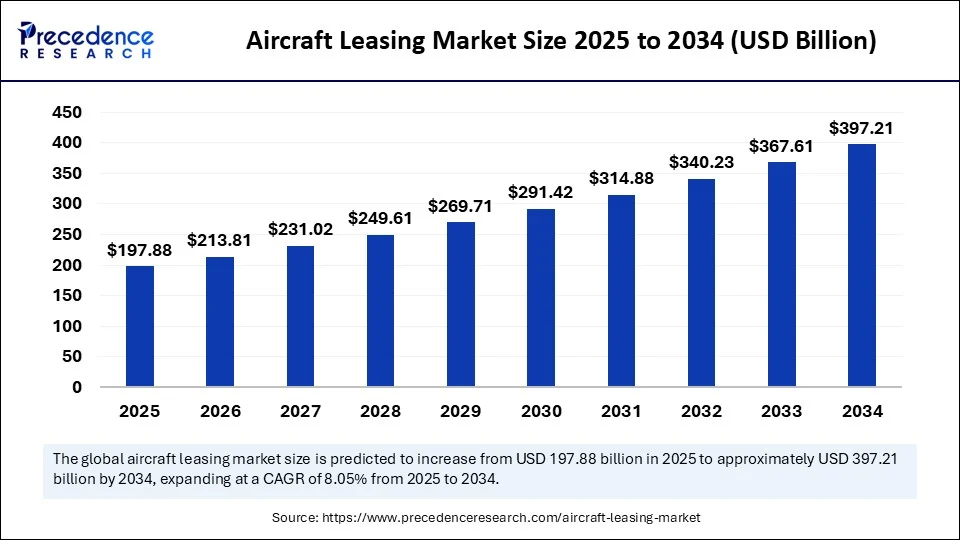

The global aircraft leasing market size accounted for USD 197.88 billion in 2025 and is predicted to increase from USD 213.81 billion in 2026 to approximately USD 425.33 billion by 2035, expanding at a CAGR of 7.95% from 2026 to 2035. The market growth is attributed to increasing demand for fleet flexibility, reduced capital expenditure by airlines, and rising preference for asset-light business models.

Aircraft Leasing Market Key Takeaways

- In terms of revenue, the global aircraft leasing market was valued at USD 197.88 billion in 2025.

- It is projected to reach USD 425.33 billion by 2035.

- The market is expected to grow at a CAGR of 7.95% from 2026 to 2035.

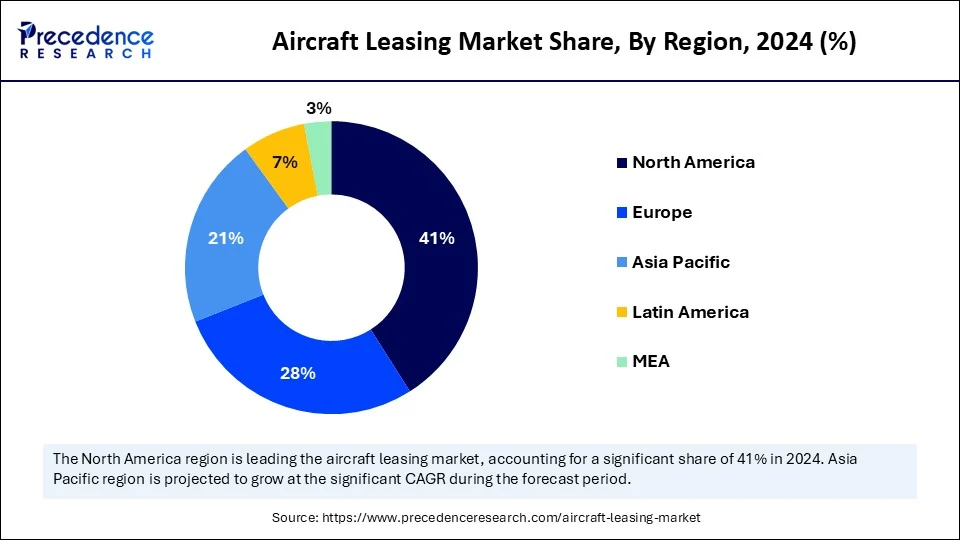

- North America dominated the aircraft leasing market with the largest share of 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By lease type, the dry lease segment held the major market share in 2025.

- By lease type, the wet lease segment is projected to grow at a significant CAGR between 2026 and 2035.

- By aircraft type, the narrow-body segment contributed the biggest market share in 2025.

- By aircraft type, the wide-body segment is expected to grow at a significant CAGR between 2026 and 2035.

- By lease term, the long-term leases segment led the market in 2025.

- By lease term, the short-term leases segment is expected to grow at the highest CAGR over the projected period.

- By lessee type, the commercial airlines segment captured the biggest market share in 2025.

- By lessee type, the cargo operators segment is expected to grow at the fastest CAGR from 2026 to 2035.

Market Overview

The high demand, driven by the need to increase fleet size at a low cost and with flexibility in operations, has seen the aircraft leasing industry grow exponentially. Airlines in various parts of the world are finding ways to modernize their fleets at a low cost. Aircraft leasing occurs when airlines take aircraft on a lease basis rather than purchasing them directly through a leasing company. This model comprises dry leases (aircraft alone) and wet leases (aircraft, operation, maintenance, and insurance) to enable operators to match their fleet operations to their short- and long-term business needs among lessors offering narrow- and wide-body aircraft, as lessees increased their demands, particularly for the Airbus A320neo and Boeing 787. Furthermore, the need to accommodate short-term demand, rising cargo operations, and the adoption of short-term leasing by regional airlines have also been touted as drivers of further market growth.

Impact of Artificial Intelligence on the Aircraft Leasing Market

Top leasing companies utilize AI-powered tools to analyze aircraft performance statistics, optimize lease structures, and predict market demand with the greatest accuracy. The companies use machine learning algorithms to estimate residual value rather than relying on traditional financial modeling and minimizing risk in assets. Artificial intelligence (AI) also enhances portfolio management through real-time operational measures, such as tracking flight hours and fuel consumption. Moreover, it can assist in predictive maintenance planning by identifying wear patterns of certain components, reducing unscheduled downtime, and enhancing aircraft availability.

Aircraft Leasing Market Growth Factors

- Rising Demand for Fleet Modernization: Airlines are replacing aging aircraft to meet emission targets and improve fuel efficiency, driving demand for leased next-generation jets.

- Growing Adoption of ACMI Lease Models: Airlines are increasingly utilizing wet lease (ACMI) solutions to manage seasonal surges and temporary route expansions, fueling short-term leasing activity.

- Boosting Demand from Startup Carriers: The emergence of new low-cost and regional airlines, particularly in emerging markets, is driving aircraft leasing as a scalable entry strategy.

- Driving Fleet Expansion in Cargo Aviation: The accelerated growth of e-commerce logistics and air freight is driving leasing interest among dedicated cargo operators.

- Expanding Use of Sale-and-Leaseback Agreements: Airlines are leveraging sale-and-leaseback deals to unlock capital, boosting liquidity and operational flexibility.

Market Outlook

- Industry Growth Overview: The airline leasing industry is on an upward trajectory as airlines emphasize maintaining an asset-light balance sheet, modernizing fleets, and having the ability to manage capacity flexibly. On a global level, the accumulation of pressures associated with rising maintenance costs, considerations related to residual value, and changing financing structures are all impacting long-term lease structures.

- Sustainability Trends: Fleet renewal based on sustainability is affecting lease negotiations as airlines are choosing to use fuel-efficient narrowbody models. Additionally, lessors are embedding carbon reporting standards and green financing designs into their portfolios due to the global decarbonization initiatives.

- Global Expansion: The number of global leasing transactions is increasing due to a broader range of funding sources that include the capital markets, insurance-linked securities, and Islamic finance structures. Emerging aviation hubs are providing secondary market opportunities for mid-life aircraft that need to be served by regional and lower-cost carriers.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 425.33 Billion |

| Market Size in 2025 | USD 197.88 Billion |

| Market Size in 2026 | USD 213.81 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Lease Type, Aircraft Type, Lease Term, Lessee Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Soaring Air Travel in Emerging Markets Reshaping the Aircraft Leasing Landscape?

Increasing air travel demand across emerging economies is expected to drive greater dependence on leased aircraft and market growth. The growing demand for air travel further encourages airlines to use leased aircraft in an attempt to increase their fleet size without making significant capital investments. The growth in middle-income levels, urban development, and tourism in regions such as the Asia-Pacific, the Middle East, and Africa has facilitated rapid growth in passenger numbers.

The International Air Transport Association (IATA) stated that in 2024, international air traffic reached 99.1% of 2019 levels worldwide. Regions dominated by the Asia-Pacific region recorded the largest gains, with a 92.6% increase in international demand over 2023.

Airlines also want to be able to react rapidly to the dynamic route demand by leasing rather than the long manufacturing lead time involved with a direct purchase. The trend has prompted leasing companies to increase their regional coverage and flexibility of leasing arrangements to suit rapidly growing carriers. AerCap said it expects to witness a sharp increase in lease placements in India and Southeast Asia next year, as aircraft operators show great interest in newer-generation aircraft without being tied to a heavy upfront ownership position. Furthermore, other indications of extensive growth potential in lease-dependent aviation markets were record numbers of air operators, which are fuelling the market.(Source: https://www.iata.org)

Complex Regulatory Environments Across Regions

Varying aviation regulations and lease registration requirements across jurisdictions are expected to hamper the growth of the aircraft leasing market. The presence of inconsistent taxation laws and airworthiness standards means that lessors must incorporate complex transactions and delay the execution of leases. The efficiency of processes under the Cape Town Convention in certain countries limits the recovery of assets in the situation of defaults. Additionally, these regulatory challenges impose administrative costs that adversely impact leasing efficiency and deter fast market entry of foreign lessors.

Opportunity

Why Are Airlines Shifting to Asset-Light Models to Navigate the Aircraft Leasing Market?

Growing preference for asset-light business models among airlines is anticipated to create immense opportunities market. The popularization of asset-light business models by airlines means that the use of leasing instead of outright ownership is likely to speed up. Operators are also more willing to have financial flexibility by lowering their capital-intensive investments, particularly in dynamic fuel prices and shifting regulatory environments. Leasing allows them to change the composition of their fleets more quickly. They enhance the performance of their balance sheets and shift dedicated resources to their operations and customer service. In March 2024, Avolon said a higher percentage of its new signings involved airlines shifting towards an asset-light model due to interest rate pressures. Furthermore, the airlines in volatile fuel price regimes relied increasingly on flexible fleet options as a safety net for operating margins.

(Source: https://assets.kpmg.com)

Segment Insights

Lease Type Insights

Why Did the Dry Lease Segment Dominate the Market in 2025?

The dry lease segment dominated the aircraft leasing market with the largest share in 2025 due to its ability to provide cost-effective fleet integration without requiring other operational necessities by the carrier. In this lease type, airlines only rent the aircraft, without crew, maintenance, or insurance. They maintain complete control over flight operations, and the associated costs are fully managed by them. This structure is especially appealing to operators with existing infrastructure and licensing, enabling long-term route planning and efficient capacity utilization.

In 2024, major leasing companies like AerCap, BOC Aviation, and SMBC Aviation Capital expanded their dry lease offerings, responding to growing demands from Asian and European carriers. In its Q4 2025 operational update, BOC Aviation noted that over eighty percent of its new orders were for dry leasing provisions, particularly in India and Southeast Asia. Furthermore, the dry lease model offered a beneficial opportunity for airlines in regions focused on cost-efficiency and asset-light strategies.

The wet lease segment is expected to grow at the fastest CAGR in the coming years, driven by the rising demand for short-term capacity services, especially during peak travel periods and market disruptions. In this arrangement, lessors provide not only the aircraft but also the crew, maintenance, and insurance (ACMI). This model is attractive to startups, charter operators, and new airlines, particularly those entering new markets and lacking crew certification or maintenance facilities.

Seasonal route accuracy, tourism fluctuations, and geopolitical instabilities are likely to increase demand for flexible leasing. In 2025, Airbus and ATR saw increased demand for turboprop airplanes in regional service within the African and Southeast Asian markets under ACMI leasing agreements. Furthermore, the growing need for operational flexibility supports the utilization of wet lease operators to serve this rapidly developing sector.

(Source: https://www.atr-aircraft.com)

Aircraft Type Insights

What Made Narrow-Body the Dominant Segment in the Market in 2025?

The narrow-body segment dominated the aircraft leasing market while holding the largest revenue share in 2025, as short- to medium-haul routes gained popularity and single-aisle operations proved cost-effective. The Airbus A320neo and Boeing 737 MAX, narrow-body aircraft, were favored by airlines in Asia-Pacific, Europe, and North America. These aircraft aimed to improve fuel efficiency, reduce operational costs, and support sustainability goals. Lessors such as AerCap, BOC Aviation, and Avolon expanded their narrow-body aircraft portfolios to meet the strong demand from regional airlines. IATA reported that in 2024, passenger levels in domestic travel recovered first, reinforcing the role of narrow-body aircraft with high flight frequencies. Additionally, these aircraft offered quick turnaround times and efficient seat utilization, further driving their demand in the aviation industry for domestic flights.

(Source: https://www.iata.org)

The wide-body segment is expected to grow at the fastest CAGR in the coming years due to the increasing demand for long-haul international travel and substantial cargo storage capacity. Airlines are expected to continue leasing wide-body aircraft to support their long-range, high-capacity operations, including models like the Boeing 787 Dreamliner, Airbus A350, and A330neo. Furthermore, modern wide-body aircraft with reduced emissions and improved fuel efficiency are meeting market demands and driving segment growth.

Lease Type Insights

How Does the Long-Term Leases Segment Dominate the Market in 2025?

The long-term leases segment dominated the aircraft leasing market in 2025 due to the extensive use by full-service and low-cost airlines, offering stable fleet planning and long-term capacity control. These contracts, typically spanning six to twelve years, enabled airlines to maximize aircraft utilization and manage costs effectively over time. Leasing companies like AerCap, CDB Aviation, and Jackson Square Aviation engaged in numerous long-term lease transactions during 2024. Furthermore, long-term leasing continues to provide the financial predictability and fleet stability that airlines require for network adjustments, making it a compelling option in the market.

(Source: https://www.iata.org)

The short-term segment is expected to grow at the fastest rate in the coming years due to the increasing demand for operational flexibility, particularly as market conditions and route seasonality evolve. These leases, typically spanning one to three years, appeal to airlines needing to adjust fleet capacity in response to demand spikes, special events, and network disruptions. Moreover, short-term leasing is anticipated to gain popularity among smaller regional airlines, charter companies, and new airline start-ups seeking rapid expansion.

Lessee Type Insights

Why Did the Commercial Airlines Segment Dominate the Market in 2025?

The commercial airlines (full-service & LCCs) segment held the largest revenue share in the aircraft leasing market in 2025. Commercial airline companies are increasingly utilizing full-service carriers and low-cost carriers (LCCs) as a global trend, driven by the need for cost-efficient fleet expansion. These operators prioritize leased planes to manage operational scalability without the costs of ownership. Major leasing companies like AerCap, SMBC Aviation Capital, and Avolon made agreements in 2025 with LCCs such as IndiGo, Ryanair, and Lion Air, facilitating route expansion and aircraft upgrades. The International Air Transport Association (IATA) reported a 10.4% increase in Revenue Passenger Kilometers (RPKs) worldwide in 2025 compared to 2023, indicating traffic growth. The ability to access new-generation aircraft without upfront investment is a key driver of segment leadership.

(Source: https://www.iata.org)

The cargo operators segment is expected to grow at the fastest rate in the coming years due to the rising e-commerce and cross-border trade, alongside supply chain realignments. High freight demand is expected along major logistics corridors globally. Cargo carriers are anticipated to increase their use of leased freighters to boost capacity without the financial burden of ownership. Additionally, limited freighter production slots continue to drive leasing among express logistics businesses and all-cargo airlines, further fueling the segmental growth.

Regional Insights

What is the U.S. Aircraft Leasing Market Size?

The U.S. aircraft leasing market size was exhibited at USD 56.79 billion in 2025 and is projected to be worth around USD 125.01 billion by 2035, growing at a CAGR of 8.21% from 2026 to 2035.

What Made North America the Dominant Region in the Aircraft Leasing Market?

North America led the aircraft leasing market, capturing the largest revenue share in 2025. This is mainly due to its robust commercial aviation ecosystem, mature leasing infrastructure, and increasing fleet renewal projects among major airlines. Companies like Delta Air Lines, American Airlines, and United Airlines focused on modernizing their fleets by leasing fuel-efficient narrow-body aircraft, including the Boeing 737 MAX and Airbus A321neo. The Federal Aviation Administration (FAA) highlighted that a significant percentage of new U.S. carrier aircraft acquired in 2024 were through leases to maintain fleet flexibility.

Leasing companies such as Air Lease Corporation, Jackson Square Aviation, and Aircastle expanded their North American portfolios, with strong lease renewals in the regional market. According to the IAIA, the domestic scheduled passenger airline industry's increased capacity resulted in quicker short-term leasing to address sudden peak demands. Moreover, U.S. Securities and Exchange Commission (SEC) filings indicated a rise in sale-and-leaseback transactions by airlines, aimed at boosting liquidity without affecting operational capacity.

(Source: https://www.iata.org)

Asia Pacific is expected to grow at the fastest rate during the forecast period, driven by significant airline expansion, high passenger traffic, and the increasing adoption of leased fleets in emerging markets. The leasing of narrow-body aircraft was a significant aspect of carrier structures in India, China, Indonesia, and Vietnam, supporting the growth of local and inter-regional travel. The International Air Transport Association (IATA) predicted that Asia Pacific would contribute the highest percentage of global air traffic in 2024, exceeding pre-pandemic domestic travel in key markets. Low-cost airlines are increasingly favoring asset-light business models.

(Source: https://www.laranews.net)

Major lessors like BOC Aviation, CDB Aviation, and SMBC Aviation Capital focused on expanding their portfolios with Asia-based lessees. Airbus noted that India was the second-largest market for new aircraft deliveries in 2025, with a high proportion of these aircraft being accessed through operating leases. Furthermore, regulatory support from governments, including tax breaks and streamlined registration processes, has boosted the market in this region.

(Source: https://www.airbus.com)

Europe: Structured Financing and Leadership in Secondary Markets

European aviation is a worldwide banking centre for aircraft leasing by providing a favourable legal system, tax-efficient borrowing arrangements, and access to a large amount of capital. The operating lease market is mainly based in Dublin, but securitisation and structured debt financing for aviation assets in mainland Europe are strengthening. Europe is also currently experiencing a very active second-hand market for mid-aged aircraft.

Ireland has the advantage of having a supportive regulatory environment and a fully developed aviation services sector. The leasing infrastructure in Ireland supports cross-border transactions and the continued growth of structured aviation finance.

Latin America: Fleet Renewal Fuels Demand for Leasing

The aircraft leasing market in Latin America is affected by the restructuring cycles of airlines, fluctuations in currencies, and the demand for upgrading narrow-body fleets. Also, leasing represents access to the operational flexibility of the aircraft without the ownership risks associated with changes in passenger yield and uncertainty about the state of the economy.

Regional carriers in Latin America are generally entering into short- to medium-term leases, rather than full-ownership of the aircraft, to help mitigate ownership risk.

Brazil has the largest market for aircraft leasing in Latin America due to the continued expansion of domestic airline networks and the continued modernisation of airline fleets. The improvements in traffic recovery and growth of leasing can continue to strengthen Brazil's position in the aircraft leasing market.

MEA Expansion Hub of Large-Body Lease Market

The MEA Region has a strong demand for both very large-body & passive body long-haul aircraft leases. Regional carriers with strong hub operations have significantly increased the need for leased aircraft for route diversification, decreased risk by sharing large numbers of aircraft with other airlines to expand their fleets, and increased the overall demand for aircraft.

The UAE has some of the best infrastructures in the world when it comes to the aviation industry and a high volume of global transit traffic. Therefore, continued developments of airlines throughout the UAE are largely based on sizable operating lease agreements with many of their customers.

Aircraft Leasing Market Companies

- AerCap (GECAS)

- Air Lease Corporation

- Avolon

- BBAM

- BOC Aviation

- Boeing Capital Corporation

- DAE Capital

- ICBC Leasing

- Nordic Aviation Capital

- SMBC Aviation Capita

Recent Developments

- In June 2025, AIP Capital partnered with Monroe Capital to acquire an aircraft leasing portfolio valued up to US$1 billion. The portfolio focuses on mid-life commercial aircraft on long-term leases with global airlines. Monroe will supply the capital, while AIP will serve as asset service and manage airline relationships. To initiate the venture, Monroe secured a US$500 million warehouse facility from Deutsche Bank and Fifth Third Bank.

(Source: https://avitrader.com) - In May 2024, Hanwha has launched Hanwha Aviation, an engine leasing platform with a global strategy across Singapore, Ireland, and the U.S.The platform targets new-generation engine assets, backed by Hanwha's expertise in manufacturing and MRO services.

It aims to deliver flexible, innovative leasing solutions for both aircraft and engines worldwide

(Source: https://www.hanwha.com) - In May 2025, BeauTech Power Systems has acquired four Embraer E175 aircraft under lease with LOT Polish Airlines. The purchase represents its first deal with Altavair and reinforces BeauTech's E-Jet portfolio. This move highlights the firm's focus on mid-life, income-generating aircraft assets. The deal strengthens BeauTech's position in the global engine and aircraft leasing market.

(Source: https://beautech.aero)

Latest Announcement by Industry Leader

- In June 2025, Volato Group, Inc., a technology-focused private aviation company, introduced a new aircraft leasing initiative aimed at placing high-demand jets with third-party operators. This strategy is designed to create a recurring, asset-light revenue model by leveraging Volato's transaction expertise and expanding its ecosystem of aviation partners and software users. The announcement comes just ahead of the company's scheduled participation in the Jefferies Virtual Business Aviation Summit on June 5, 2025, where Co-Founder and CEO Matt Liotta will provide further insight into the leasing strategy and broader platform evolution. “We're not just leasing aircraft - we're building an infrastructure layer for the industry,” said Liotta. “By connecting supply, demand, and technology more intelligently, we're unlocking value that traditional models leave on the table.” The new model seeks to capitalize on the projected 11% growth in business aircraft aviation demand in 2025, as operators and travelers increasingly shift toward more agile, technology-integrated solutions. Volato's approach reflects a growing trend across the sector, prioritizing flexibility, efficiency, and platform-based innovation.

(Source: https://www.eplaneai.com)

Segments covered in the Report

By Lease Type

- Dry Lease

- Wet Lease

By Aircraft Type

- Narrow-body

- Wide-body

- Freighters

By Lease Term

- Long-term Leases

- Short-term Leases

- Medium

By Lessee Type

- Commercial Airlines (Full-Service & LCCs)

- Cargo Operators

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting