What is the Airport Security Market Size?

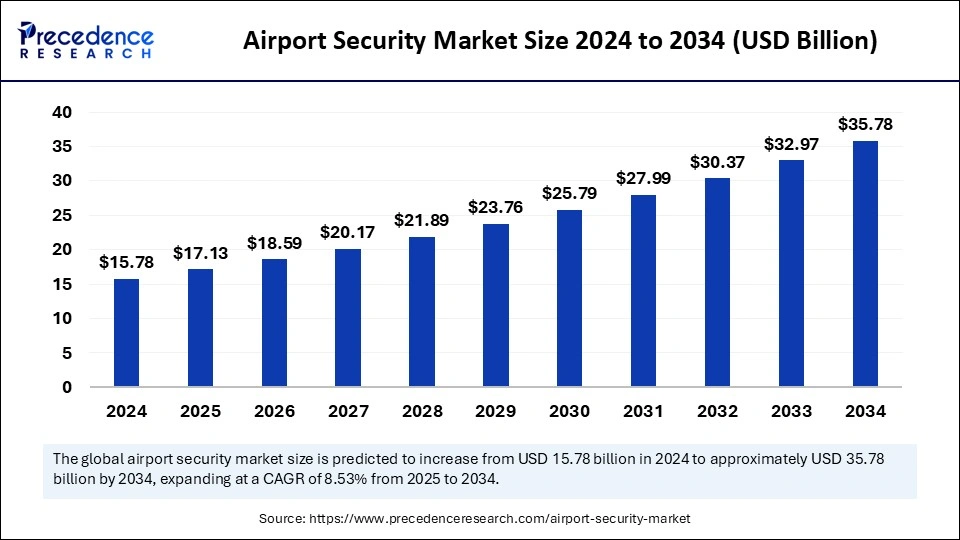

The global airport security market size is calculated at USD 17.13 billion in 2025 and is predicted to increase from USD 18.59 billion in 2026 to approximately USD 38.45 billion by 2035, expanding at a CAGR of 8.42% from 2026 to 2035.The market is gaining traction because it protects passengers, the airport, and the country from dangerous circumstances.

Airport Security Market Key Takeaways

- In terms of revenue, the airport security market is valued at $17.13 billion in 2025.

- It is projected to reach $38.45 billion by 2035.

- The airport security market is expected to grow at a CAGR of 8.53% from 2026 to 2035.

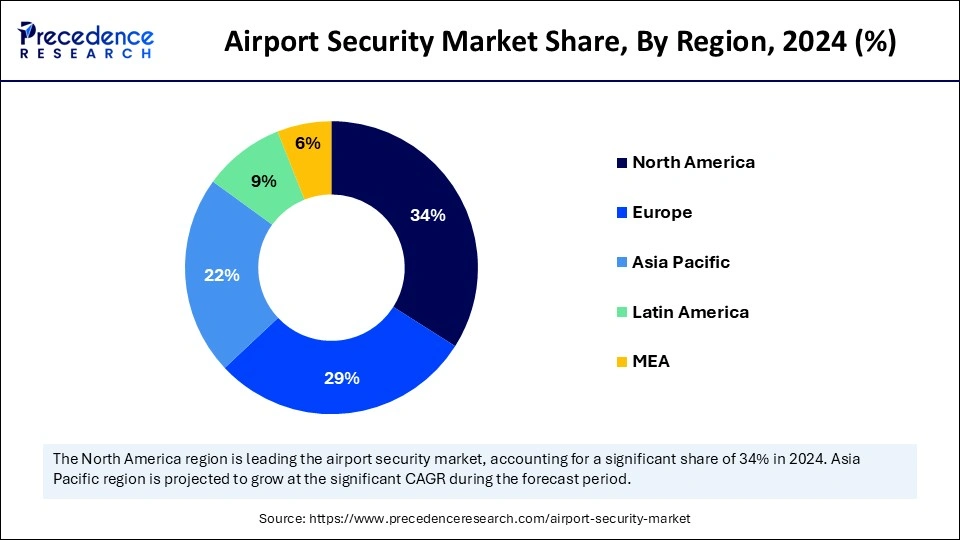

- North America dominated the global market with the largest market share of 34% in 2025.

- Asia Pacific is observed to witness the fastest CAGR during the forecast period.

- By location, the terminal segment contributed the highest market share of 64% in 2025.

- By location, the airside segment is expected to grow at a significant CAGR during the forecast period.

- By technology, the cyber security segment captured the biggest market share in 2025.

- By technology, the perimeter security segment is expected to show the fastest growth during the forecast period.

What is Airport Security?

Airport security is an act that provides defense against potential threats such as terrorism, allowing safe air travel. There are various reasons why airport security is essential. It protects the airport and country from any invasion of terrorists, and it reassures the traveling of the general public that they are safe and protected. The airport security market incorporates technological equipment, qualified personnel, and protocols implemented at airport facilities.

The Transportation Security Administration (TSA) at the airports as screeners checks the passengers and personal items carried along for any dangerous items such as chemicals, weapons, and liquids that are not allowed. The passenger has to go through X-ray machines and metal detectors to scan their full body and explosive detection devices.

Why is AI an Integral Part of Airport Security?

The integration of artificial intelligence has the potential to analyze security footage and identify suspicious behavior. In recent years, AI has significantly enhanced threat detection by analyzing passenger data, X-ray images, and video footage in real-time. In the airport security market, AI algorithms have the capability to monitor the entire airport area through multiple cameras 24/7. This includes identifying and tracking suspicious objects or actions. AI-powered solutions are proven to bring numerous benefits to the airport, from site aviation to security, by leveraging AI technology to optimize safety and improve operational efficiency.

- In February 2025, Frankfurt Airport introduced AI-powered security scanners, which were approved by the German Federal Police. The use of Rohde & Schwarz QPS Walk2000system at Terminal 1 has successfully phased the test phase.

Airport Security Growth Factors

- Modern surveillance technologies for airport security facilities are used to create a camera equipped with integrated analytic capabilities. At present, surveillance solutions are paired with a robust open-platform video management system (VMS) to ensure more efficient and effective detection.

- The initial security check is the pre-board screening, which eliminates the majority of the potential threats. Airports have commenced the use of new passenger screening technologies in response to increased fear about explosives and non-metallic weaponry.

- To prevent airports from cybercrime, cyberattacks can corrupt the technology, including the information stored online, including aircraft booking systems, airline reservations, financial transactions, and passenger identity information, which all require a high level of security. Blockchain technology creates a secure and difficult to hack, manipulate, or decipher.

- Integrated biometric identification technology, such as face recognition and fingerprint scanning at the airport, improves the efficiency of passenger check-in and security screening. Moreover, these advanced technologies offer quick and secure verification, leading to reduced waiting time.

Market key trends

The airport security market is undergoing significant transformation, powered by the rising need for advanced surveillance and safety systems in the face of increasing air traffic, geopolitical tensions, and global threats. A major trend shaping the sector is the integration of AI-driven surveillance technologies such as facial recognition, biometric authentication, and automated threat detection. These systems are not only improving real-time security but also enhancing passenger processing efficiency.

Additionally, the shift towards non-intrusive screening methods like millimetre-wave scanners and full-body imaging systems is reducing traveller discomfort while maintaining rigorous safety standards. Another growing trend is the adoption of cloud-based security infrastructure, allowing real-time data sharing between airport terminals and central command units, improving responsiveness to potential threats. The move toward contactless identity verification and smart access control, particularly after the pandemic, has also redefined operational protocols in airports globally.

Airport Security Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to the growing emphasis of the aviation sector to enhance airport security, coupled with the rapid adoption of AI-based security solutions by modern airports.

Numerous market players are actively entering this market, drawn by partnerships, R&D, and joint ventures. Several airport security brands, such as Rapiscan Systems, L3Harris Technologies, Vision-Box, and others, have started investing rapidly in developing advanced security solutions for airports.

Various startup brands are engaged in developing advanced airport security solutions in different parts of the world. The prominent startup companies dealing in airport security solutions consist of Scylla, Quadridox, D-Fence, and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 38.45 Billion |

| Market Size in 2025 | USD 17.13 Billion |

| Market Size in 2026 | USD 18.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.42% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Location, Technology, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Heavy passenger traffic

The airport has a constant flow of passengers, which requires personnel security to screen everyone passing through quickly and efficiently. The airport security market services facilitate screening for dangerous items such as weapons, chemicals, and liquids that are prohibited on board and prevent crimes by deterring potential threats, including theft and terrorism. Passenger safety at the airport is crucial as it acts as the first line of defense, ensuring the well-being of passengers by identifying and mitigating potential risks.

- According to the Aviation Ministry data, it is estimated that around 20 crore people will travel by flight in 2024. There are over 2.9 million passengers daily boarding 45,000 flights in the United States.

Restraint

Strict guidelines

The aviation industry has several stringent guidelines and quality standards to follow, which, in some cases, might hinder the implementation and operation of airport security. A technical glitch faced by aircraft and air traffic management systems might lead to disruption to passengers and impact the brand name. Supply chain risk is a bigger challenge for baggage and transportation misplacement or unclaimed baggage is possible, which may trigger panic or a potential terrorist threat.

Opportunity

Advanced Technologies

The airport security market is expected to witness the incorporation of novel technologies. According to the Airport Council Internation (ACI), total airport operating costs are related to security, with a large percentage of airport staff working on security-related activities. Implementation of technologies offers a reduction in personnel costs and more time to verify the risk of each passenger.

Airport security is becoming more advanced, including technologies such as biometric systems, CT walkways, suspect detection systems, Advanced imaging technology, off-airport handling, artificial intelligence, and many more. Incorporation of this advanced technology will allow a free-flowing security checkpoint; passengers will not need to remove their laptops, liquids, belts, and shoes, and there will be standard pre-qualified security and walk-through security tunnels.

Segment Insights

Location Insights

The terminal segment led the airport security market with the largest share in 2025. The airport security at the terminal is dominating due to the high volume of passengers that need screening of them and their belongings to check for the presence of any potential threat. This approach allows for critical responsibility to maintain safety on aircraft, making the environment focus on efficiency and thoroughness.

The airside segment is expected to grow at a significant rate during the forecast period. Airport security at the airport is in demand due to the high traffic operation and high-risk environment, where there are high chances of the occurrence of potential threats to aircraft and passengers. There is strict adherence to safety protocols that need to be followed.

Technology Insights

Thecyber security segment dominated the global airport security market in 2025. The dominance of this segment is due to the protection of critical systems and data from threats offered by cybersecurity in airports. As digitalization is becoming more popular with the passing days, it is crucial to have a robust cybersecurity measure that can handle sensitive passenger information, flight data, and operation systems, making cyberattacks its prime target. Plenty of airports are investing in breakthrough cybersecurity solutions to prevent possible breaches, which include firewalls, intrusion detection systems, encryption technology, and employee training programs.

- In January 2025, SITA, an air transport technology firm, partnered with Palo Alto, a cybersecurity company, to enhance security for critical airport applications. This collaboration is integrated with the AI cybersecurity platform.

The perimeter security segment is expected to show the fastest growth during the forecast period. The growth of this segment is experienced due to the rising demand for deterrence, detection, assessment, and action. Every airport needs physical and technological measures implemented around the airport boundaries to prevent unauthorized access or intrusion. Professional perimeter security includes surveillance cameras, intrusion detection, regular patrol, robust barriers, and the maintenance of operational safety.

- In February 2025, the Jaipur International Airport is in the process of implementing new security measures with the installation of view cutters and Perimeter Intrusion Detection systems (PIDS). This aims to prevent security breaches along the 15 km surrounding the airport.

Regional Insights

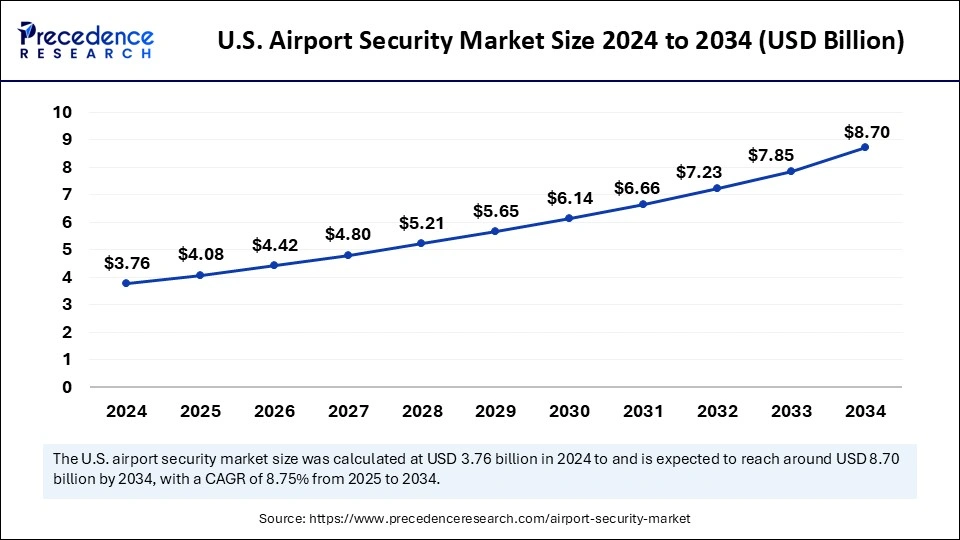

The U.S. airport security market size is exhibited at USD 4.08 billion in 2025 and is projected to be worth around USD 9.40 billion by 2035, growing at a CAGR of 8.70% from 2026 to 2035.

North America dominated the airport security market with the largest share in 2025. The dominance of the airport security market in North America is primarily observed due to the high volume of passengers traveling. American Airlines and American Eagles hub with Dallas/ Fort Internation Airport has the largest number of flyers in the world. It is estimated that more than 200 million passengers fly from America annually.

There is a heightened awareness of potential terrorist threats followed by the event of 9/11. America has a constant rate of low risk, credited to trained pilots and trained air traffic controllers, offering a safe transportation system. Agencies similar to the Transportation Security Administration (TSA) have implemented strict guidelines for airport security.

North America continues to lead the global airport security market, with the United States and Canada at the forefront due to their robust air travel infrastructure, strong governmental support, and advanced R&D capabilities. The U.S. has made consistent investments in aviation security posts, with federal bodies such as the Transportation Security Administration (TSA) and the Department of Homeland Security (DHS) actively funding next-generation screening technologies and cybersecurity protocols.

Canada, on the other hand, has focused heavily on integrated airport screening systems and passenger biometrics, aligning with international safety mandates. These governments have prioritized airport modernization programs, ensuring deployment of smart surveillance cameras, perimeter intrusion detection, and advanced baggage screening devices. Furthermore, frequent public-private collaborations and defense contracts in North America have boosted innovation and scalability within the market.

Europe held a significant share of the industry. The rise in the number of international airports in several nations, including Germany, France, the UK, Italy, and some others, has driven the market expansion. Additionally, partnerships among airport authorities and market players for deploying advanced solutions in modern airports are expected to propel the growth of the airport security market in this region.

What are the Advancements in the Airport Security Market in Europe?

Germany Airport Security Market Trends: The rising integration of advanced technologies helps to enhance the efficiency and accuracy of security systems. Moreover, the implementation of stringent regulations to prevent the occurrence of security breaches and the increasing number of individuals preferring air travel are some of the factors propelling the growth of the market.

Asia Pacific is observed to witness the fastest rate of growth in the airport security market during the forecast period. The expansion of this region is due to a rapid increase in air travel, particularly in countries such as China and India. Asia Pacific has a growing concern about terrorists and smuggling, where the airport follows strict regulations and implementation of advanced security technologies to manage large passenger volumes and evolving threats at the airport. The Southeast Asia nations are developing new airports and upgrading the existing facilities to accommodate the rising number of passengers.

Asia-Pacific is rapidly becoming the fastest-growing market for airport security solutions, driven by a surge in air traffic, rapid airport expansions, and increasing awareness around threat prevention. Countries such as India, China, Singapore, and South Korea are leading the charge by investing in new airport terminals and upgrading existing facilities. These nations are implementing smart security lanes, biometric boarding gates, and AI-based surveillance to meet both domestic and international aviation standards.

A key growth factor in this region is the emphasis on safety amidst expanding aviation hubs India and China, for instance, are among the top countries globally in terms of passenger volume and new airport development. Moreover, rising geopolitical risks and cross-border tensions have prompted governments to prioritise homeland and aviation security.

The Middle East and Africa held a notable share of the market. The increasing emphasis of the defense sector for deploying advanced screening solutions in military airports in several nations, including the UAE, Saudi Arabia, South Africa, and some others, has boosted the market expansion. Additionally, the presence of numerous aerospace startups, coupled with rapid investment for developing the airport infrastructure, is expected to drive the growth of the airport security market in this region.

How is the Airport Security Market Growing in the Middle East and Africa?

Saudi Arabia Airport Security Market Trends: The Saudi Arabian country has stringent government regulations on security, which are helping in driving up the demand for advanced airport security solutions. We can see that several companies in the region are actively investing in developing new airport infrastructure, driving market demand.

Latin America held a considerable share of the industry. The growing adoption of AI-enabled metal detectors in airports across numerous countries, such as Brazil, Peru, Argentina, and some others, has boosted the market growth. Also, rapid investment by the government for developing the airport infrastructure is expected to boost the growth of the airport security market in this region.

What are the Key Trends in the Airport Security Market in Latin America?

Brazil Airport Security Market Trends: The country's growth is due to the rapid expansion of the aviation sector, which has experienced a substantial increase in domestic and international air travel. The Brazilian government is also seen prioritizing airport security, implementing strict regulations and standards in order to enhance airport safety.

Airport Security Market Companies

G4S is a global integrated security company. This company specializes in security services and solutions, including security guarding, cash management, and security systems, operating in about 90 countries.

Securitas AB is a global safety and security solutions company headquartered in Stockholm, Sweden, that provides services like on-site and mobile guarding, technology-based security solutions, monitoring, and consulting. This company serves a diverse range of clients across many industries through a decentralized, local structure that combines global reach with a local presence.

Allied Universal is a global security and staffing company formed in 2016 by the merger of AlliedBarton and Universal Services of America. It is the world's largest provider of private security guards and offers a range of services, including security personnel, technology integration, and janitorial and staffing services.

ICTS Europe is a global security company that provides comprehensive security solutions and technology for the aviation, maritime, rail, and corporate sectors. It offers a wide range of services, including airport and airline security, X-ray screening, passenger flow facilitation, and automated passenger processing systems.

Smiths Detection is a global leader in threat detection and security screening technology, providing solutions for explosives, weapons, contraband, and chemical threats. The company serves various sectors like aviation, ports & borders, urban security, and defense with its equipment and services, including X-ray scanners, chemical detectors, and screening systems.

Honeywell International is a multinational technology and manufacturing conglomerate headquartered in Charlotte, North Carolina, that provides products and solutions for aerospace, building automation, and industrial automation, as well as energy and sustainability solutions. The company’s extensive product line includes aircraft engines and avionics, control systems for buildings and industrial processes, safety and security equipment, and materials for various industries.

Leidos is an American science, engineering, and technology company headquartered in Reston, Virginia, that provides solutions in national security and health to government and commercial clients worldwide. This company was founded in 1969 and operates through several segments, such as defense solutions, civil, and health.

Provides integrated terminal safety systems, including intelligent video surveillance, public address, and fire detection.

OSI Systems: Offers high-speed baggage screening through its specialized subsidiaries, focusing on Computed Tomography (CT) and automated checkpoint technology.

Specializes in high-resolution explosive detection for checked bags and biometric identity solutions for passenger boarding.

Focuses on the digital side of security, providing air traffic management, secure communications, and ground surveillance networks.

Delivers biometric "seamless travel" platforms that automate passenger identity verification at every airport touchpoint.

Manufactures a wide range of X-ray imaging and trace detection systems for screening people, carry-on items, and air cargo.

Other Major Key Players

- Bosch

- OSI Systems

- Safran Morpho

- L3Harris Technologies

- Vision-Box

- Rapiscan Systems

Recent Developments

- In October 2025, Kyndryl launched an AI-based solution. This AI-enabled solution is designed for enhancing security in the aviation sector.

(Source: kyndryl.com) - In September 2025, Agilent Technologies Inc. launched Insight Series Alarm Resolution Systems. This system is designed for improving safety and security in modern airports.

(Source: businesswire.com) - In February 2025, PANDRONE launched an autonomous drone. This drone is developed for enhancing security and safety in airports.

(Source:unmannedairspace.info) - In February 2025, Southampton Airport enhances CX with a new phase of next-generation security screening. A part of AGS Airports has entered a new phase in its multi-million-pound project, featuring a Next Generation Security Checkpoint (NGSC) scanner at the airport security process.

- In December 2024, CISF-Central Industrial Security Force is taking over the security at Vijayawada International Airport. This action includes 400 police personnel from the Special Protection Force (SPF), armed Reserve, OCTOPUS, and Civil police to monitor security.

Segments Covered in the Report

By Location

- Landside

- Airside

- Terminal side

By Technology

- Access Control

- Cyber Security

- Perimeter Security

- Screening

- Surveillance

- Others

By Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting