What is the Homeland Security and Emergency Management Market Size?

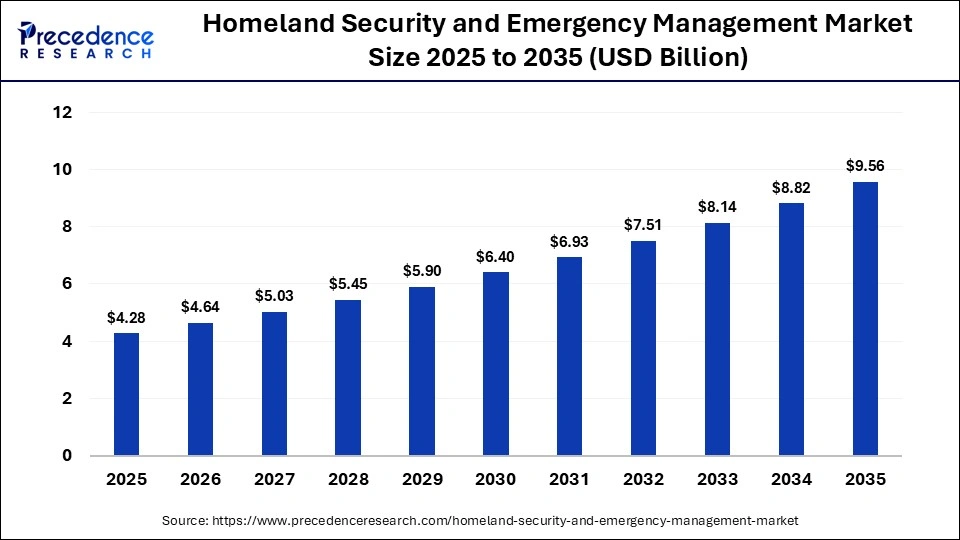

The global homeland security and emergency management market size was calculated at USD 4.28 billion in 2025 and is predicted to increase from USD 4.64 billion in 2026 to approximately USD 9.56 billion by 2035, expanding at a CAGR of 8.37% from 2026 to 2035. The homeland security & emergency management market is boosted by the rising cases of terror attacks in the border areas, along with the rapid deployment of advanced weapon detection systems in the aviation sector. Moreover, the growing investment by the governments of several countries for strengthening the defense sector, as well as technological advancements in the maritime industry.

Market Highlights

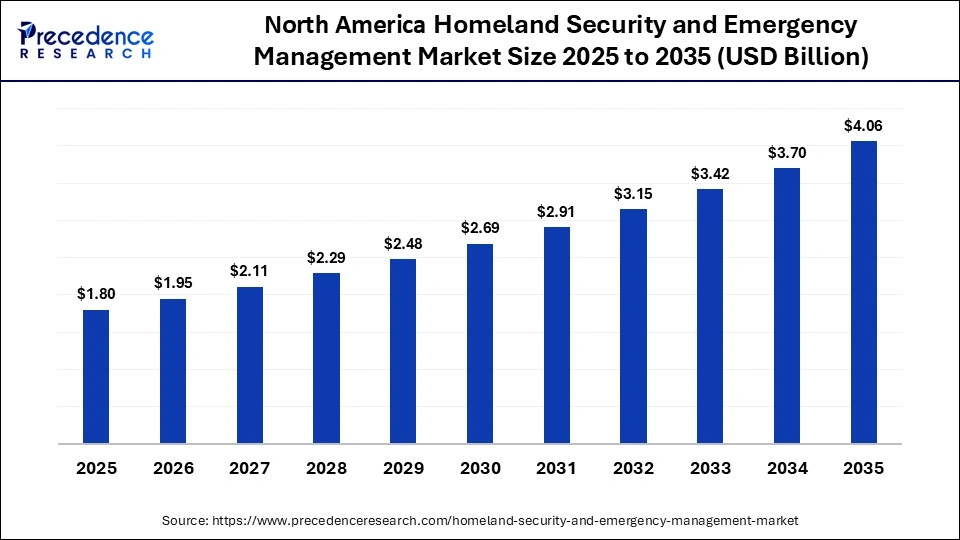

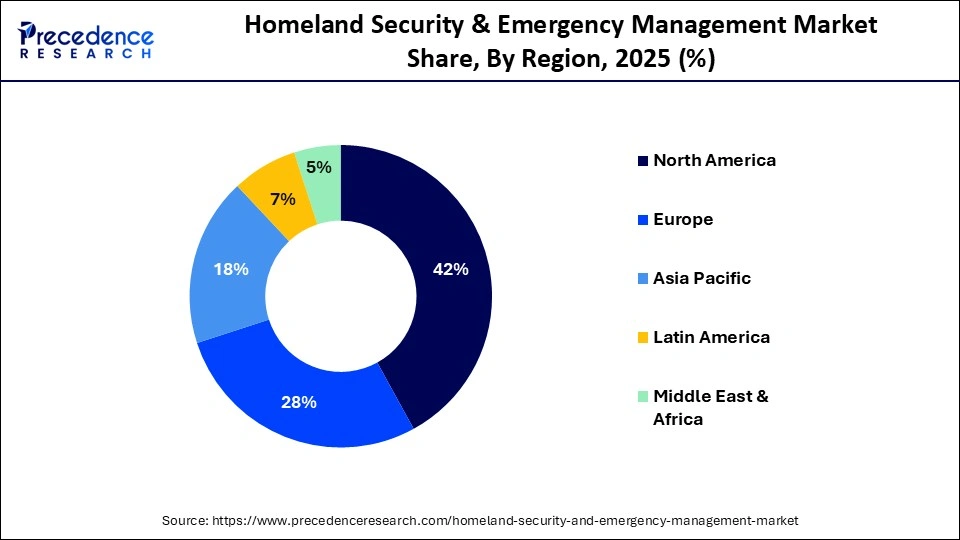

- North America dominated the homeland security and emergency management market, holding a share of 42% in 2025.

- Asia Pacific is expected to expand with the highest CAGR of 9% between 2026 and 2035.

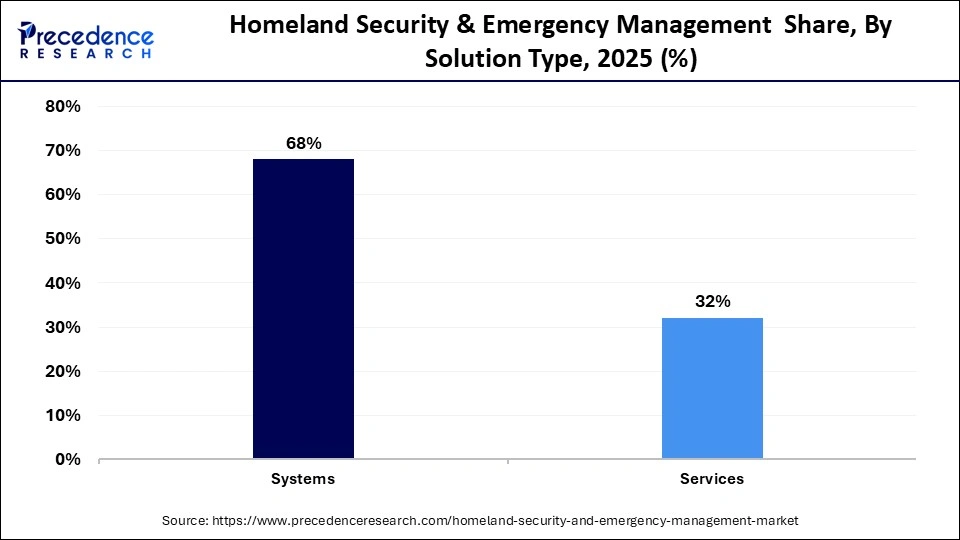

- By solution type, the systems segment held the largest market share, accounting for 68% in 2025.

- By solution type, the services segment is growing at a strong CAGR of 8.5% between 2026 and 2035.

- By component, the cybersecurity & risk management segment dominated the market with a share of 21% in 2025.

- By component, the border & aviation/maritime security segment is expected to rise with a considerable CAGR from 2026 to 2035.

- By system/technology, the detection & surveillance systems segment held the largest share of 30% of the market in 2025.

- By system/technology, the communication systems segment is poised to grow at a significant CAGR between 2026 and 2035.

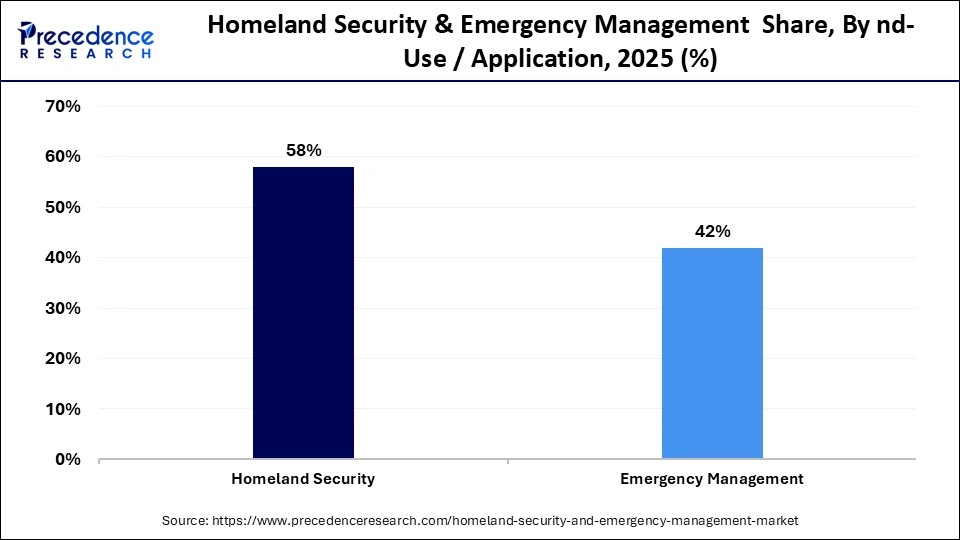

- By end-use/application, the homeland security segment held the largest share of 58% in the industry.

- By end-use/application, the emergency management segment is expected to grow with the highest CAGR of 8.3% between 2026 and 2035.

What is the Landscape of the Homeland Security and Emergency Management Market?

The homeland security and emergency management market is an integral branch of the defense and military sector. This industry specializes in the distribution of security systems and emergency management solutions worldwide. There are several types of solutions provided by this sector, comprising surveillance solutions, command solutions, monitoring solutions, and others.

These solutions are operated using various technologies, including detection & surveillance systems, communication systems, access control systems, rescue and recovery systems, simulation systems, and others. The end-users of these solutions comprise homeland security and emergency management. This market is expected to rise significantly with the growth of the drone industry across the globe.

What is the Role of AI in the Homeland Security and Emergency Management Market?

The technological advancements in the artificial intelligence industry have reshaped the landscape of the defense sector. AI has been widely adopted by the defense organizations for enhancing security in border areas. Also, the integration of AI in the intelligence and surveillance system improves threat detection capabilities and enhances behavioral analysis, automated monitoring, and face recognition. Moreover, AI solutions are deployed by emergency management service providers to enhance disaster prediction, data analysis, and infrastructure resilience. Thus, AI has played a vital role in shaping the homeland security & emergency management market positively.

- In September 2025, Ask Sage launched Ask Sage Edge. Ask Sage Edge is an AI-enabled solution designed to transform military operations across the globe.

Homeland Security & Emergency Management Market Trends

- Rising Defense Expenditure: The governments of several nations, such as the U.S., Russia, Germany, China, and India, are increasing their defense budget to enhance border security. According to the USA.SPENDING.Gov, the government of the U.S. invested around US$2.21 trillion in 2025 for strengthening the defense sector in this nation.

- Business Expansions: Several market players are engaged in expanding their business globally by constructing new production facilities in different regions. For instance, in July 2025, Stark inaugurated a drone manufacturing plant in the U.K. region. This new production facility was opened to produce a wide range of drones to enhance defense capabilities.

- Partnerships: Various defence companies are partnering with software developers for deploying advanced security solutions in border areas to enhance safety. For instance, in June 2025, MITRE partnered with Gambit. Through this partnership, these companies will deploy autonomous ground and aerial vehicles for enhancing homeland security and national defense.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.28Billion |

| Market Size in 2026 | USD 4.64 Billion |

| Market Size by 2035 | USD 9.56Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution Type, Component, System/Technology, End-Use/Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Solution Type Insights

Why Did the Systems Segment Dominate the Homeland Security & Emergency Management Market?

The systems segment dominated the homeland security & emergency management market with a share of 68% in 2025. The growing adoption of AI-based surveillance systems by the defence organizations for enhancing border security has boosted the market expansion. Additionally, the rapid investment by the market players for developing a wide range of object detection systems and safety monitoring systems is expected to drive the growth of the homeland security & emergency management market.

The services segment is expected to rise at a remarkable CAGR of 8.5% between 2026 and 2035. The growing emphasis of surveillance solution providers on delivering training services to professionals has boosted the market growth. Additionally, the surging demand for advanced monitoring services from the homeland security sector is expected to propel the growth of the homeland security & emergency management market.

System/Technology Insights

What Made the Detection & Surveillance Systems Segment Lead the Homeland Security & Emergency Management Market?

The detection & surveillance systems segment leads the homeland security & emergency management market with a share of 30% of the market in 2025. The growing demand for AI-based surveillance systems from the defense organizations to enhance maritime security in disputed areas has driven the market expansion. Also, the rapid deployment of weapon detection systems by the aviation authorities is expected to boost the growth of the homeland security & emergency management market.

The communication systems segment is expected to rise at a significant CAGR between 2026 and 2035. The rising adoption of blockchain-based communication solutions by the border security forces to enhance their contact capabilities with headquarters has boosted the industrial expansion. Also, partnerships among defense companies and software developers to develop advanced communication systems for the defense sector are expected to drive the growth of the homeland security & emergency management market.

Component Insights

Why Did the Cybersecurity & Risk Management Segment Hold the Largest Share of the Homeland Security & Emergency Management Market?

The cybersecurity & risk management segment held the largest share of 21% in the homeland security & emergency management market in 2025. The increasing cases of hacking activities in the defence sector has increased the demand for advanced cybersecurity solutions, thereby driving the market expansion. Additionally, the integration of AI in risk management systems is expected to foster the growth of the homeland security & emergency management market.

The border & aviation/maritime security segment is expected to grow with a considerable CAGR during the forecast period. The growing investment by the governments of several countries in enhancing border security has boosted the market expansion. Additionally, the deployment of C2 solutions for improving maritime security is expected to accelerate the growth of the homeland security & emergency management market.

End-Use/Application Insights

What Made the Homeland Security Segment Lead the Homeland Security & Emergency Management Market?

The homeland security segment leads the homeland security & emergency management market with a share of 58% in 2025. The growing focus of governments across several countries on protecting their countries against terrorist activities, natural disasters, and other hazards has boosted the market expansion. Additionally, the rapid investment by the defense organizations to deploy high-quality surveillance systems for enhancing homeland security is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among defense companies and governments for developing advanced security solutions to improve homeland security are expected to accelerate the growth of the homeland security & emergency management industry.

The emergency management segment is expected to rise with the highest CAGR of 8.3% between 2026 and 2035. The increasing adoption of facial recognition cameras and thermal imaging solutions by rescue organizations for countering emergencies has boosted the market growth. Also, the surging investment by the governments of several countries for strengthening the disaster management sector is positively contributing to the industry. Moreover, the rapid deployment of advanced communication systems for predicting future risks and deploying personnel in disturbed areas is expected to propel the growth of the homeland security & emergency management market.

Regional Insights

How Big is the North America Homeland Security & Emergency Management Market Size?

The North America homeland security & emergency management market size is estimated at USD 1.80 billion in 2025 and is projected to reach approximately USD 4.06 billion by 2035, with a 8.47% CAGR from 2026 to 2035.

Why Did North America Dominate the Homeland Security & Emergency Management Market in 2025?

North America dominated the homeland security & emergency management market with a share of 42% in 2025. The surging deployment of advanced command and control systems by the defense organizations to enhance border security has boosted the market expansion. Additionally, the rapid investment by the governments of several nations, including the U.S., Canada, and Mexico, in strengthening maritime security is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players, such as Lockheed Martin Corporation, Northrop Grumman Corporation, Honeywell International Inc., and General Dynamics Corporation, is expected to propel the growth of the homeland security & emergency management market in this region.

- In January 2026, Northrop Grumman launched an Intercontinental Ballistic Missile (ICBM) target vehicle. This target vehicle is designed to simulate advanced threats reaching the U.S. region.

What is the Size of the U.S. Homeland Security & Emergency Management Market?

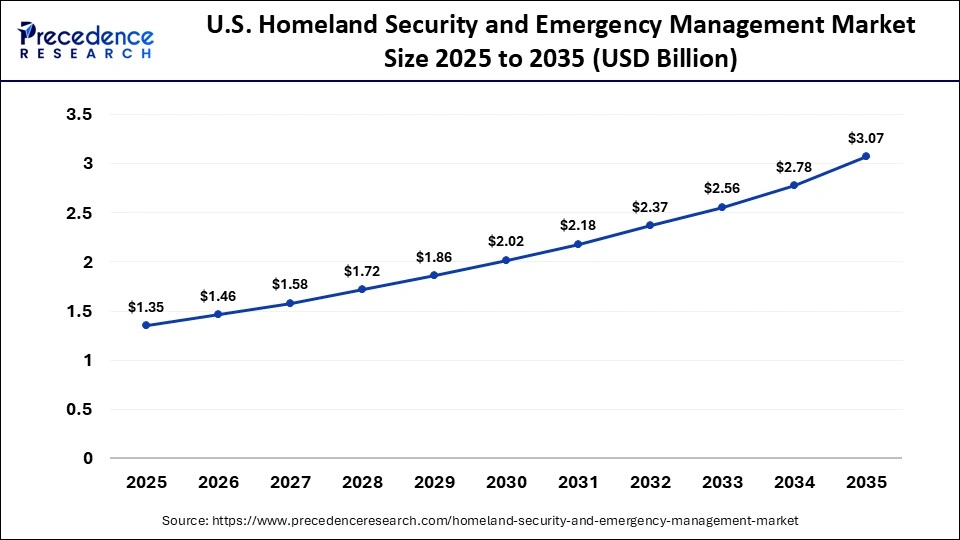

The U.S. homeland security & emergency management market size is calculated at USD 1.35 billion in 2025 and is expected to reach nearly USD 3.07 billion in 2035, accelerating at a strong CAGR of 8.56% between 2026 and 2035.

U.S. Homeland Security & Emergency Management Market Analysis

The geopolitical issues of the U.S. with numerous countries, including Russia, Colombia, Venezuela, Brazil, China, and Mexico, have increased the demand for superior border security solutions, thereby driving the market expansion. Additionally, the rapid investment by the defense companies in opening new production centers is playing a vital role in shaping the industrial landscape. Rising federal spending on surveillance systems, emergency response technologies, and critical infrastructure protection is strengthening procurement across homeland security agencies. In parallel, increasing adoption of data analytics, AI-enabled monitoring, and integrated command-and-control platforms is improving threat detection and emergency preparedness capabilities across the U.S.

Why Is the Asia Pacific Growing With the Highest CAGR in the Homeland Security & Emergency Management Market?

Asia Pacific is expected to grow with the highest CAGR of 9% during the forecast period. The growing demand for advanced detection and surveillance systems from the defense organizations in several countries, such as China, India, Japan, and South Korea, has boosted the market expansion. Also, numerous government initiatives aimed at strengthening border security, coupled with the increasing sales of access control systems, are positively contributing to the industry. Moreover, the presence of several defense solution manufacturers, including Hanwha, Hindustan Aeronautics Ltd (HAL), LIG Nex1, and Aviation Industry Corporation of China (AVIC) is expected to accelerate the growth of the homeland security & emergency management market in this region.

- In September 2025, Hanwha launched a next-generation QVGA AI thermal surveillance camera. This camera is equipped with numerous advanced features, such as AI object detection, advanced thermal imaging, and long-range monitoring.

China Homeland Security & Emergency Management Market Trends

The growing focus of the Chinese government on deploying advanced security solutions in the border areas to provide additional security has boosted the market expansion. Additionally, the increase in the number of defense startups, along with the rapid adoption of firefighting services by the disaster management organizations, is positively contributing to the industry.

Who are the Major Players in the Global Homeland Security & Emergency Management Market?

The major players in the homeland security & emergency management market include Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, BAE Systems plc, General Dynamics Corporation, Thales Group, Leidos Holdings, Inc., Boeing Company, SAIC (Science Applications International), Honeywell International Inc., L3Harris Technologies, Inc., Cubic Corporation, Elbit Systems Ltd., Motorola Solutions, Inc., IBM Corporation.

Recent Developments

- In January 2026, KeepZone AI launched an AI-driven homeland security solution. This security solution aims to develop an integrated system for border protection, infrastructure security, and public safety.(Source: https://www.quiverquant.com)

- In January 2026, Satcom Global launched Aura Citadel. Aura Citadel is an IT management and security solution designed to enhance security in the maritime sector.(Source: https://www.marinelink.com)

- In November 2025, Omnisys launched the battle resource optimization C-UAS system. The battle resource optimization C-UAS system is designed for safeguarding airports against drone attacks.(Source: https://www.suasnews.com)

Segments Covered in the Report

By Solution Type

- Systems

- Services

By Component

- Cybersecurity & Risk Management

- Critical Infrastructure Protection

- Border & Aviation/Maritime Security

- Search & Rescue, Firefighting, EMS Services

- Others

By System/Technology

- Detection & Surveillance Systems

- Communication Systems

- Command & Control Systems

- Access Control Systems

- Rescue & Recovery Systems

- Others

By End-Use/Application

- Homeland Security

- Emergency Management

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting