Airport Services Market Size and Forecast 2025 to 2034

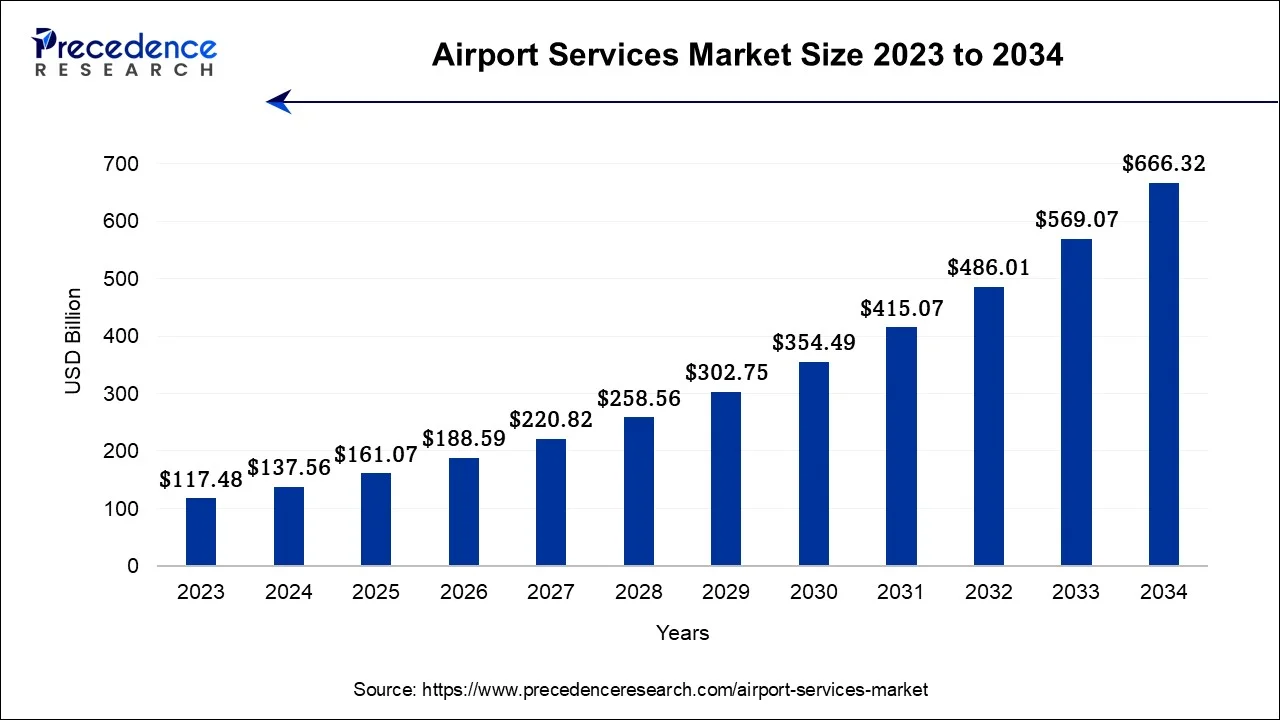

The global airport services market size was estimated USD 137.56 billion in 2024 and is anticipated to reach around USD 666.32 billion by 2034, representing a notworthy CAGR of 17.09% between 2025 and 2034.

Airport Services Market Key Takeaways

- In terms of revenue, the market is valued at $161.07 billion in 2025.

- It is projected to reach $666.32 billion by 2034.

- The market is expected to grow at a CAGR of 17.09% from 2025 to 2034.

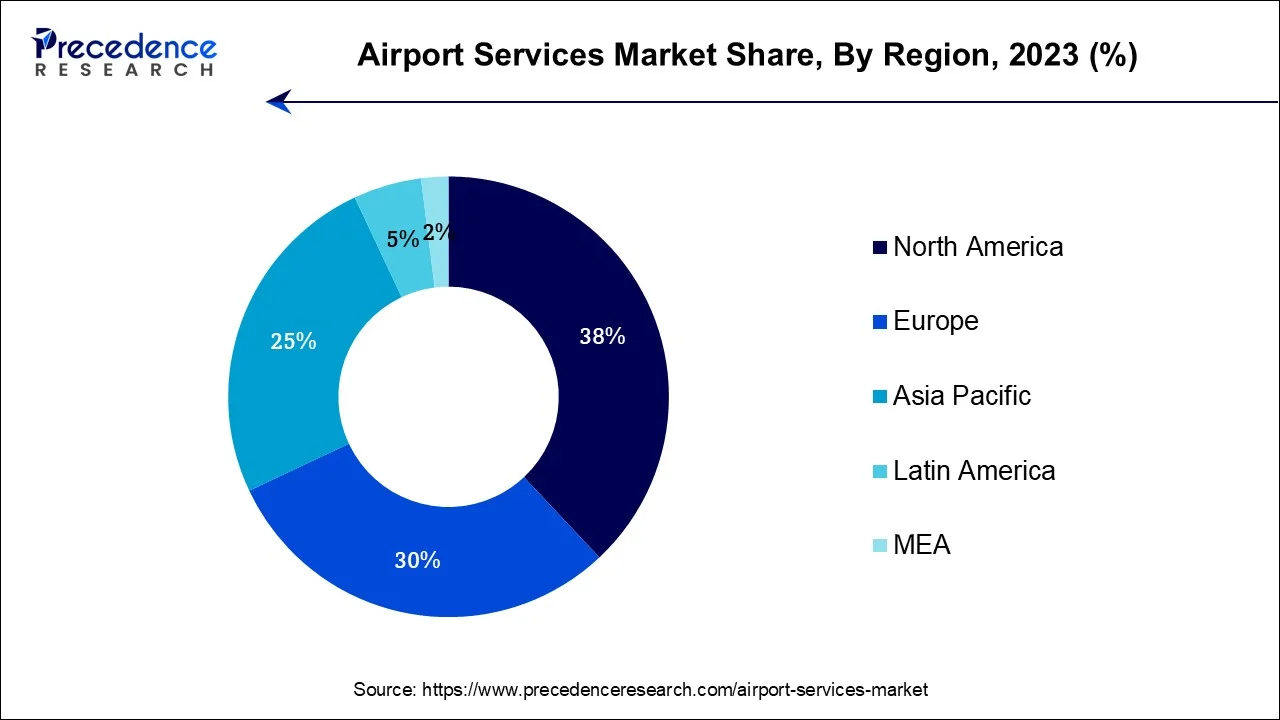

- North America led the global market with the highest market share of 38% in 2024.

- By Airport Type, the domestic airports segment captured the highest revenue share in 2024.

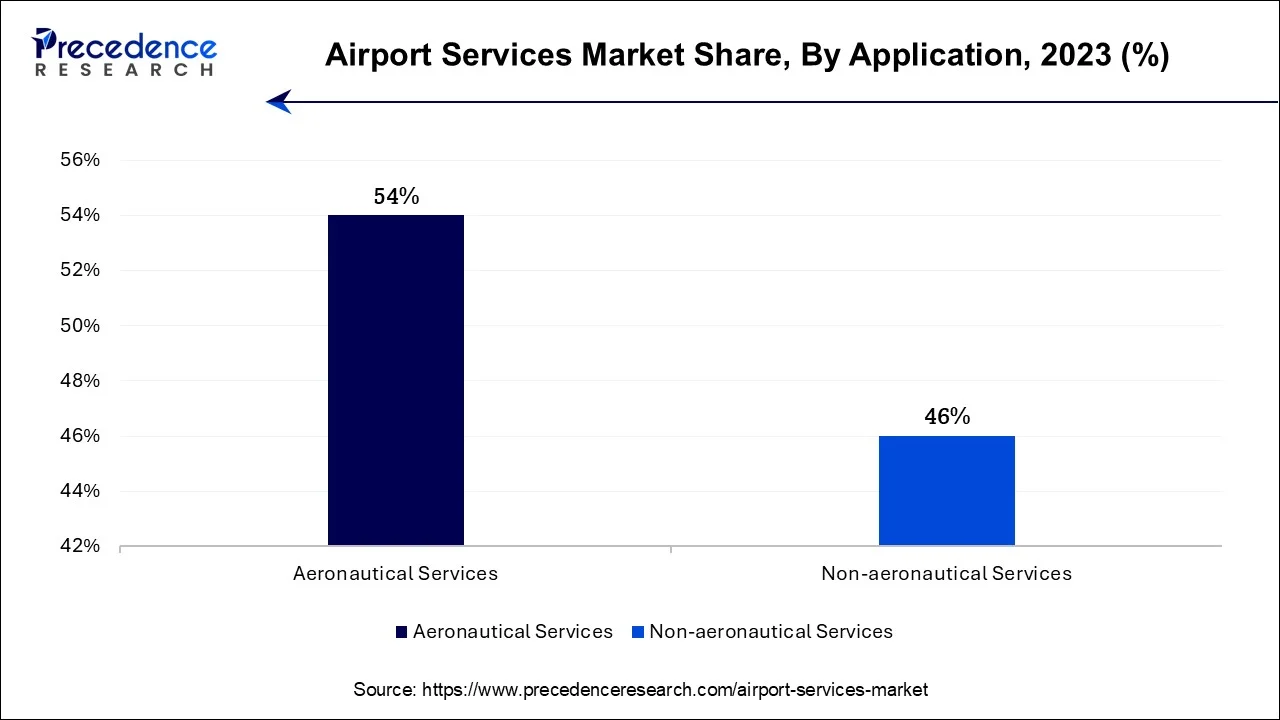

- By Application, the aeronautical services segment accounted more than 54% of revenue share in 2024.

- By Infrastructure Type, the greenfield airports segment had the biggest market share in 2024.

U.S. Airport Services Market Size and Growth 2025 to 2034

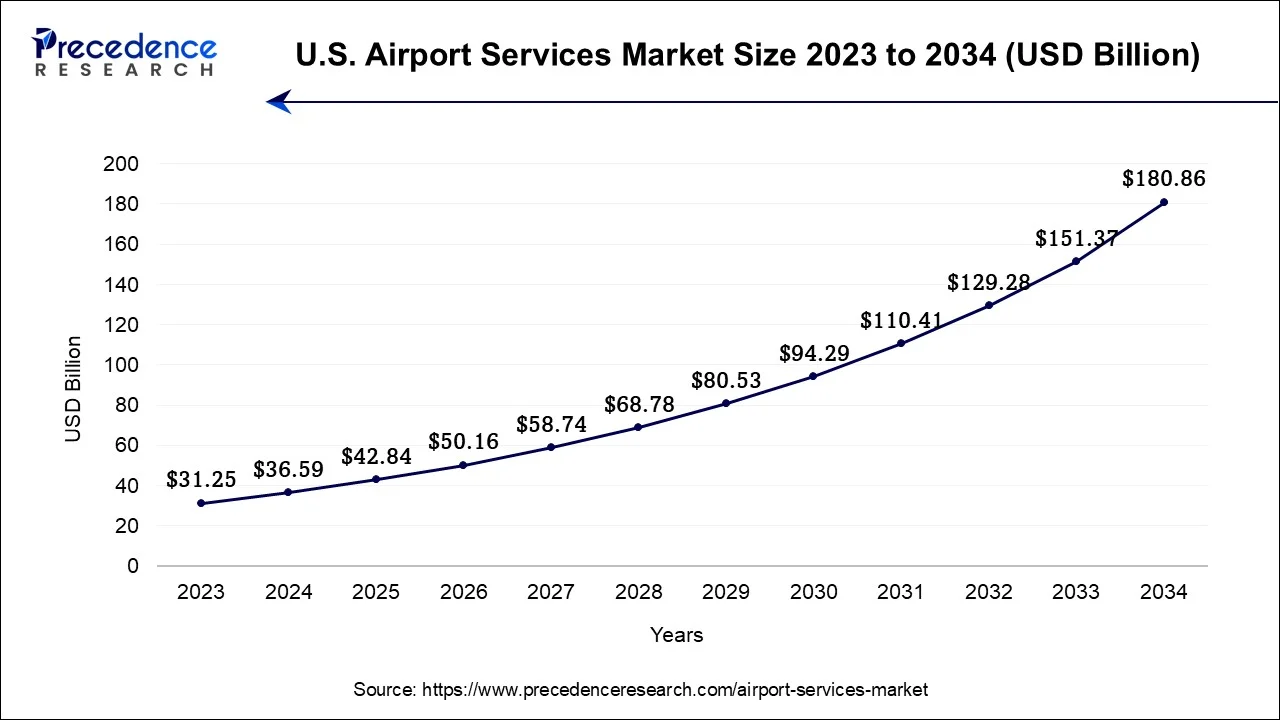

The U.S. airport services market size accounted for USD 36.59 billion in 2024 and is expected to be worth around USD 180.86 billion by 2034, growing at a CAGR of 17.32% between 2025 and 2034.

North America has held largest revenue share in 2024. The region's growth is primarily due to its technological innovation, security emphasis, and commitment to sustainability. Moreover, North America is home to one of the busiest and most prominent airport hubs in the world, including Hartsfield-Jackson Atlanta International Airport, Los Angeles International Airport, John F. Kennedy International Airport and others. These major hubs require considerable services for ground operations, passenger handling, and cargo logistics. As the region's aviation industry continues to evolve, this market remains a critical component in facilitating efficient air travel and supporting economic growth in North America.

Why Is North America at Cruising Altitude in Airport Services?

North America dominates the global airport services market due to its high air traffic volume, advanced infrastructure, and early adoption of airport automation technologies. Major hubs like Atlanta, LAX, and JFK are investing heavily in biometric security, AI-enabled baggage handling, and smart terminal solutions. The region's strong focus on passenger satisfaction, coupled with strategic PPP investments and modernisation projects, keeps it ahead of global peers.

Key Growth Drivers

- Massive domestic air travel demand in the U.S. and Canada

- Government-backed modernisation and expansion projects (e.g., FAA's NextGen initiative)

- Strong ecosystem of tech providers driving digital transformation

Asia-Pacific is estimated to observe the fastest expansion in the airport services market.Asia-Pacific is experiencing substantial growth in air travel demand, driven by various factors such as rising disposable incomes, rapid urbanization, and an increasing middle class. This has helps in increasing passenger traffic at airports across the region. China and India are one of the emerging economies in the region where rapid urbanization and economic development are driving the construction of new airports and expansion of existing ones.

What Makes Asia Pacific the Fastest Ascending Region?

Asia Pacific is the fastest-growing region in the airport services market, led by rising air travel demand, massive airport construction projects, and rapid urbanisation. Countries like China, India, and Southeast Asian nations are building new international airports and expanding existing terminals to support both regional and long-haul traffic. The region is embracing smart infrastructure and integrated transport systems to enhance passenger flow and service innovation.

Key Growth Drivers

- Explosive growth in middle-class air travellers

- Government investment in mega airport infrastructure (e.g., Beijing Daxing, Noida International Airport)

- Rise of budget carriers creating demand for efficient, low-cost airport services

The European airport services market is expected to witness significant growth due to the European airports are at the forefront of adopting advanced technologies, including biometric authentication, automated baggage handling, and smart airport solutions. These technologies enhance passenger experience and operational efficiency. It plays a crucial role in connecting Europe to the global aviation network and supporting economic growth in the region.

The Middle East and Africa are expected to grow significantly in the airport services market during the forecast period. The Middle East and Africa are experiencing an expansion in airport infrastructure, which is increasing the demand for airport services. The growing projects and investments are also driving their demand. Moreover, advanced technologies are being utilized to enhance the security and passenger experiences. Thus, all these developments, along with government support, are promoting the market growth.

Market Overview

The airport services market refers to the broad range of goods and services offered to travelers, airlines, and other stakeholders within and around an airport facility. This market encompasses various services and facilities that contribute to the efficient and comfortable operation of airports and the convenience of passengers. It include services provided directly to airlines, such as ground handling services, aircraft maintenance and repair, catering, and fueling. Ground handling services involve activities like baggage handling, aircraft towing, and passenger boarding. These services are designed to enhance the travel experience for passengers.

Market Trends

Digital Transformation and Automation

The adoption of technologies such as AI, self-service kiosks, biometric check-ins, and digital baggage tracking is transforming the airport experience. These innovations are reducing wait times, enhancing passenger satisfaction, and improving operational efficiency. Airports are increasingly investing in carbon-neutral infrastructure, electric ground support equipment, and renewable energy sources. Green certifications and environmental, social, and governance (ESG) goals are becoming industry standards, especially in Europe and North America. Airports are also evolving into commercial hubs, providing shopping, entertainment, wellness lounges, and co-working spaces. Non-aeronautical revenue is rising due to increased duty-free retail, digital advertising, and premium concierge services. Additionally, governments are encouraging private investment in airport modernization and service expansion, which is driving efficiency and setting global standards for service delivery.

- In July 2025, for the expansion of Malaga-Costa del Sol Airport, along with a goal to enhance its capacity to 36 million passengers annually, a total of €1.5 billion investment was announced by Óscar Puente, the minister for transport and mobility of Spain. Additionally, as the airport handled nearly 25 million passengers in 2024, it was emphasized as a record-breaking year. Moreover, as per the announcement of Puente, this expansion project will be included in the DORA III (Airport Regulation Document), where it will be effective from 2027 to 2031.

- In June 2025, a total of $1 billion was raised for the Mumbai International Airport Ltd (MIAL) financing project by Adani Airports, which is a wholly owned subsidiary of Adani Enterprises Ltd and is the largest private airport operator in the country. As per the company, for refinancing existing debt, a total of $750 million will be issued, as included in the transaction, after the notes maturing in July 2029. An optional $250 million raise is also allowed by the financing structure, making it a total of 41 billion. Thus, the capital expenditure plans to enhance the capacity, development, and modernization of MIAL will be supported by this funding framework by providing greater financial flexibility.

Airport Services Market Growth Factors

- The growth of the market of airport driven by several factors, including the expansion of the aviation industry, changing traveler preferences, technological advancements, regulatory developments, and economic conditions. A surge in the middle class globally, rapid urbanization, and rise in disposable income led to an increasing demand for air travel. Nowadays, more people choose to fly for business and leisure, and airports experience increased passenger traffic, driving the need for additional services and infrastructure.

- Furthermore, airports are continually expanding and modernizing their facilities to accommodate larger aircraft and more passengers. Moreover, the growth of the airline industry directly impacts airport services. Airlines looking to enhance customer experience and improve efficiency rely on airport services like ground handling, maintenance, and passenger services.

- Technological advancements play a crucial role in enhancing airport services. Innovations like self-service kiosks, mobile apps, biometric authentication, and baggage tracking systems improve the efficiency and convenience of airport processes, attracting more passengers. For instance, in August 2023, Virgin Australia launched a luggage tracking system, a digital tool that will allow passengers to find their bags on most journeys within Australia. The technology will be available on 7 out of 10 domestic flights.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 161.07 Billion |

| Market Size in 2024 | USD 137.56 Billion |

| Market Size by 2034 | USD 666.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.09% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 To 2034 |

| Segments Covered | Airport Type, Application, Infrastructure Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in global air travel demand

The expansion of the global middle class, rapid urbanization, and improving economic conditions are fostering an environment where air travel is becoming increasingly accessible and affordable to a broader population. As more people aspire to explore new destinations, pursue business opportunities, or connect with friends and family across borders, airports witness a steady influx of travelers. Furthermore, airports are experiencing higher passenger volumes, necessitating a broader array of services to ensure the efficient handling of these travelers. Check-in counters, baggage handling, security screenings, customs and immigration procedures, and passenger lounges are all pivotal components of the airport experience that must scale up to meet this escalating demand.

Moreover, this demand generates a cascade effect, prompting investments in airport infrastructure expansion and modernization projects. Airports worldwide are compelled to upgrade terminals, runways, taxiways, and parking facilities to accommodate larger aircraft and increased passenger traffic. For instance, in August 2023, HOK collaborated with the Port of Seattle and AECOM, for the modernization of Seattle-Tacoma International (SEA) Airport's S Concourse. The project includes a considerable upgrade to existing structures and building systems, and repurposing space to comply with the latest building codes. Airlines rely heavily on these services to deliver a seamless and comfortable experience to their passengers. Thus, the rising global air travel demand is not merely an indicator of increasing mobility but also a powerful driver for the airport services market.

Restraint

Regulatory compliance

Regulatory compliance serves as a potential restraint on the demand for the airport services market, primarily due to the stringent and ever-evolving nature of aviation regulations. These regulations encompass various facets, including safety, security, environmental standards, and customs procedures. While essential for the safety and security of air travel, they can impose significant challenges and costs on airports and service providers. Compliance with safety regulations is non-negotiable in the aviation industry. Airports must invest in advanced infrastructure, equipment, and personnel training to meet the highest safety standards. This can be financially burdensome and requires constant vigilance and adaptation to remain compliant with evolving safety protocols.

Security regulations are equally demanding, particularly in the current global security climate. Stringent passenger and baggage screening, access control, and surveillance systems are necessary to mitigate security risks. However, these measures can lead to longer passenger wait times and necessitate substantial investments in security infrastructure. Environmental regulations are increasingly influential in shaping the industry. Airports are under pressure to reduce their environmental footprint, requiring investments in energy-efficient technologies, emissions reduction measures, and sustainable practices. While environmentally responsible, these initiatives can impose significant upfront costs. Thus, while necessary for the safety and security of air travel, regulatory compliance can strain airport resources, affect operational efficiency, and potentially increase costs, which may, in turn, restrain the demand for airport services.

Opportunity

Rise in smart airports

Smart airports represent a transformative paradigm shift in the aviation industry and offer significant opportunities for the airport services market. These technologically advanced airports provide digital solutions, automation, and data-driven intelligence to improve operational efficiency, passenger experience, and sustainability. Smart airports use real-time data analytics and Internet of Things sensors to monitor baggage handling, aircraft movements, passenger flow, security and others. The data-driven approach allows airports to streamline processes, reduce bottlenecks, and improve resource allocation, leading to cost savings and enhanced service quality. For instance, in July 2022, Denmark's Copenhagen Airport launched AIRHART, an airport management ecosystem. It is a unique platform and solution that links and combines more than 100 systems using a unified, up-to-the-date platform. AIRHART is developed by smarter airports.

Digital innovations such as biometric identification, mobile apps, and self-service kiosks to offer travelers a seamless and personalized journey. These innovations not only reduce passenger stress but also create opportunities for value-added services like targeted retail promotions and location-based services. Security and safety are paramount in aviation, and smart airports leverage advanced technologies like facial recognition, AI-based threat detection, and automated security checks to enhance security while expediting passenger screening. This combination of improved security and efficiency is attractive to both travelers and airlines. Thus, smart airports are not just a futuristic concept; they represent a tangible opportunity for the Airport Services market.

Airport Type Insights

According to the airport type, the domestic airports has held highest revenue share in 2024. Domestic airports play a vital role in connecting cities, regions, and remote areas within a country. They contribute to improved accessibility and economic development in these areas. Travelers at domestic airports do not need to undergo customs and immigration checks, making the boarding and disembarking processes relatively faster and more straightforward compared to international travel.

The international Airports is anticipated to expand at a significantly CAGR during the projected period because it offer a wide range of services to cater to the needs of travelers crossing international borders. These services include immigration and passport control, customs clearance, currency exchange, visa services, and international lounges. Also, international airports serve as major gateways connecting one country to the rest of the world.

Application Insights

Based on the application, aeronautical services is anticipated to hold the largest market share in 2024. Aeronautical services are services directly related to the operation and safety of aircraft within the airport environment. They are critical for ensuring the smooth flow of air traffic and the safety of passengers and cargo. It also generates revenue for airports through landing fees, aircraft parking charges, and fuel sales.

On the other hand, the non-aeronautical services is projected to grow at the fastest rate over the projected period. Non-aeronautical services encompass a wide range of services and amenities that airports provide to enhance the passenger experience and generate additional revenue. These services are often directed at passengers and visitors within the airport terminal. It plays a crucial role in enhancing the passenger experience and generating revenue to sustain and develop airport facilities.

Infrastructure Type Insights

In 2024, the Greenfield airports had the highest market share on the basis of the infrastructure type. Greenfield airports are entirely new airport developments built from scratch on previously undeveloped land. These airports are typically initiated when there is a need for additional airport capacity in a region or when an entirely new airport is required to serve a specific area.

The Brownfield airport is anticipated to expand at the fastest rate over the projected period. Brownfield airports, on the other hand, are existing airports that undergo significant expansion, renovation, or redevelopment to meet the growing demand for air travel or to modernize infrastructure. Brownfield airports are numerous globally, as many established airports undergo regular upgrades and expansions to keep pace with evolving aviation demands. For instance, London Heathrow Airport and Los Angeles International Airport have undergone extensive brownfield development projects.

Airport Services Market Companies

- Beijing Capital International Airport Co. Ltd. (China)

- Fraport AG Frankfurt Airport Services Worldwide (Germany)

- Air General Inc. (U.S.)

- dnata (UAE)

- Worldwide Flight Services (France)

- S.A.S. Services Group, Inc. (U.S.)

- LHR Airports Limited (U.K.)

- Acciona (Spain)

- Signature Aviation plc (U.K.)

- Tokyo International Air Terminal Corporation (Japan)

- Çelebi Aviation (Turkey)

- Airports de Paris SA (France)

Recent Developments

- On July 2025, Heathrow joined the pioneering BOOST initiative, along with Amsterdam Airport Schiphol, Avinor, Brussels Airport, and Incheon International Airport. BOOST was launched by Future Travel Experience (FTE) in collaboration with the innovation consultancy nlmtd (Unlimited) and emerged from the FTE Baggage Innovation Working Group.

(Source:https://www.futuretravelexperience.com)

- On July 2025, Heathrow Airport joined the BOOST initiative, which also includes Amsterdam Airport Schiphol, Avinor, Brussels Airport, and Incheon International Airport. BOOST was launched by Future Travel Experience (FTE) in collaboration with the innovation consultancy nlmtd and emerged from the FTE Baggage Innovation Working Group.

(Source:https://infra.economictimes.indiatimes.com)

- September 2023:Edmonton International Airport (YEG) signed a memorandum of understanding (MOU) with Edmonton Destination Marketing Hotels Ltd. (EDMH) that. The collaboration will helps in enhancing air service development by increasing seat capacity, attracting new airlines, and introducing fresh routes to Edmonton.

- August 2023:Lucknow's Chaudhary Charan Singh International Airport launched DigiYatra, digital travel initiative to enhance passenger convenience and efficiency. The airport enable travelers to experience hassle-free check-in and boarding processes.

- July 2023:The Delhi International Airport (DIAL) announced that it has selected IDEMIA as the technology partner for DigiYatra. DigiYatra will use IDEMIA's facial recognition technology in Hyderabad, Delhi, and Goa to confirm the identity of domestic flyers.

- June 2023:Chhatrapati Shivaji Maharaj International Airport (CSMIA) launched its valet services at the Multi-Level Car Parking (MLCP). This offers convenience and enhancing passenger satisfaction across the airport.

- December 2022:The Adani Group launched Adani One, digital platform for its airport vertical that will allow users to check flight status, book air tickets, shop for duty-free products, access lounges, get cabs and avail parking facilities.

- December 2022: Aviator Airport Alliance extended its partnership with Turkish Airlines Under the extended partnership, Aviator offers Turkish Airlines with de-icing and ground handling services at Copenhagen Airport.

Segments Covered in the Report

By Airport Type

- International

- Domestic

By Application

- Aeronautical Services

- Aircraft Ground Handling Services

- Aircraft Maintenance Service

- Passenger Service

- Non-Aeronautical Services

- Baggage Handling Services

- Car Rental Service

- Car Parking Service

- Food and Beverage Service

- Retail Service

- Others

By Infrastructure Type

- Greenfield Airport

- Brownfield Airport

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting