What is the Factoring Services Market Size?

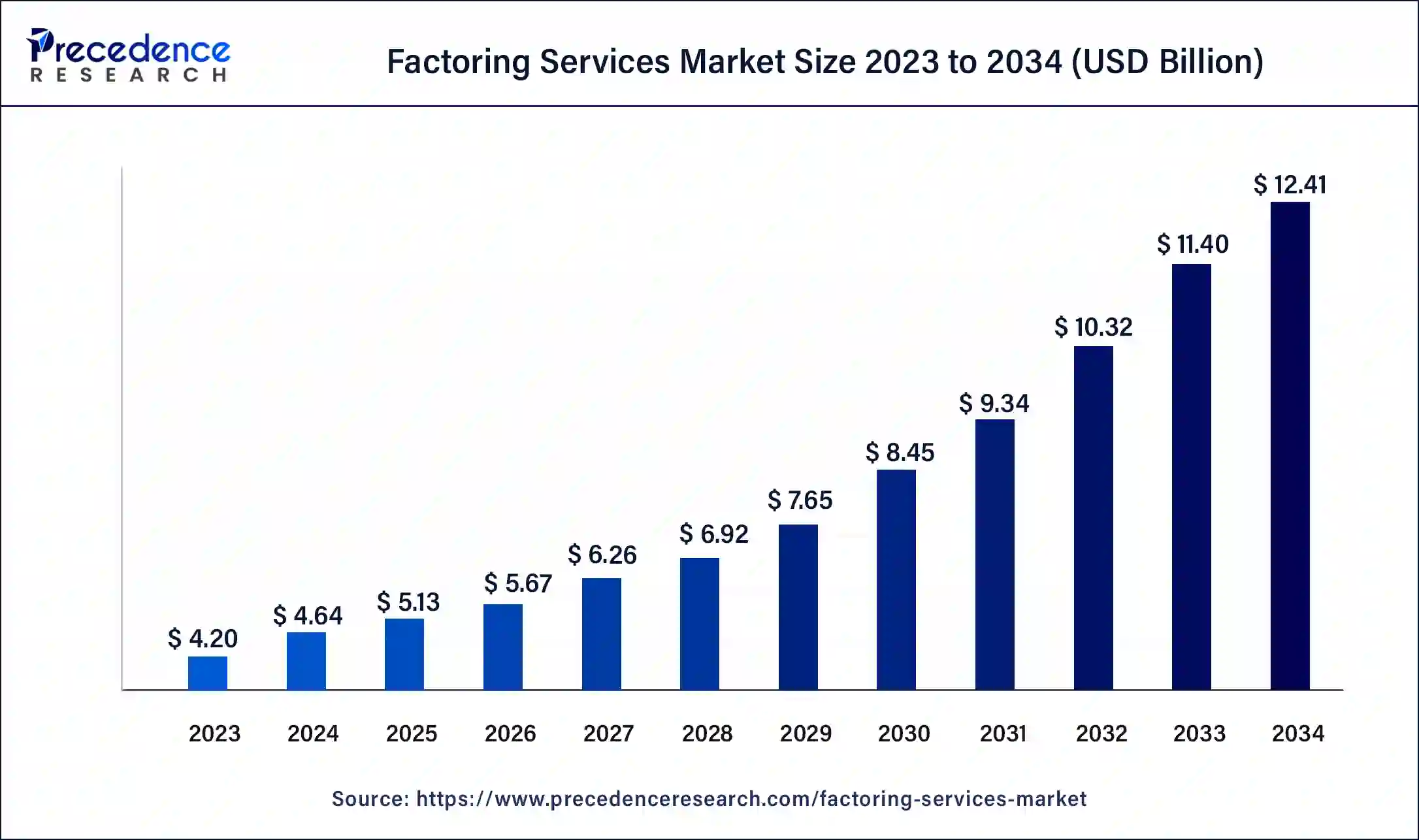

The global factoring services market size is accounted at USD 5.13 billion in 2025 and predicted to increase from USD 5.67 billion in 2026 to approximately USD 12.41 billion by 2034, expanding at a CAGR of 10.34% from 2025 to 2034.

Factoring Services MarketKey Takeaways

- In terms of revenue, the market is valued at $5.13 billion in 2025.

- It is projected to reach $12.41 billion by 2034.

- The market is expected to grow at a CAGR of 10.34% from 2025 to 2034.

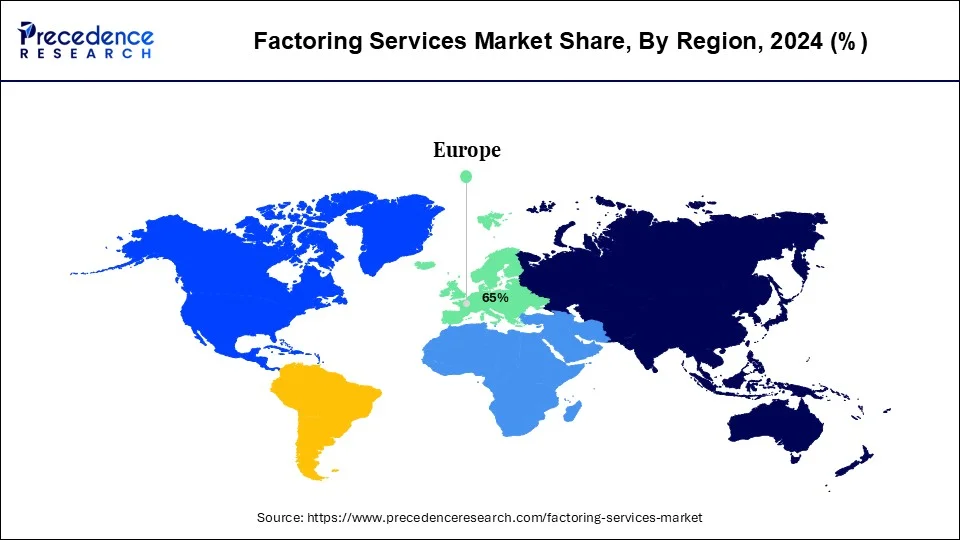

- Europe led the global market with the highest market share of 60% in 2024.

- Asia-Pacific is predicted to expand at the fastest CAGR during the forecast period.

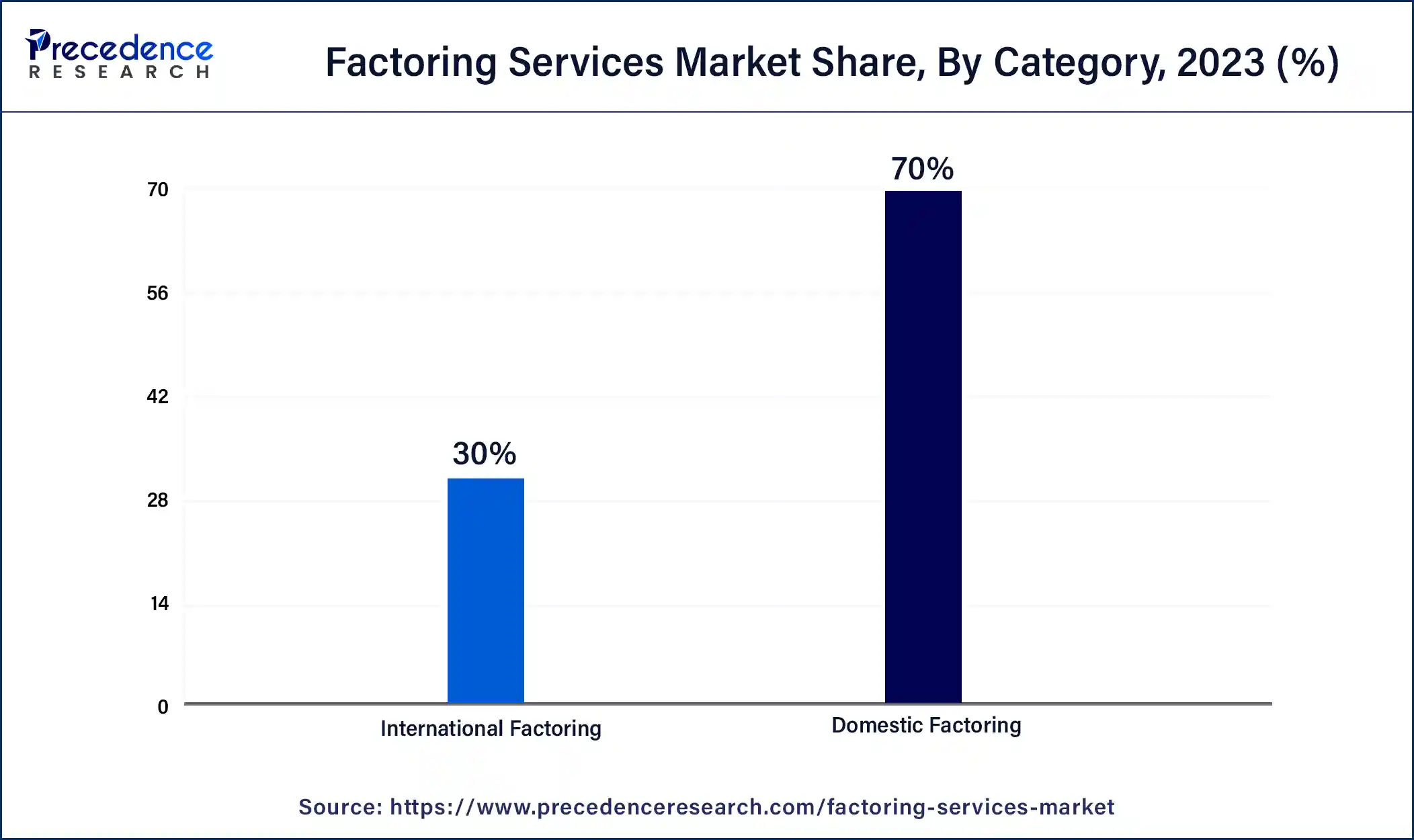

- By category, the domestic factoring segment held the largest market share of 70% in 2024.

- By category, the international factoring segment is anticipated to grow at a remarkable CAGR during the projected period.

- By type, the recourse factoring segment held the largest share of the market in 2024.

- By type, the non-recourse factoring segment is expected to grow with the highest CAGR during the forecast period.

- By application, the small and medium enterprises segment held a significant share of the market in 2024.

- By vertical, the large enterprises segment dominated the market in 2024.

Factoring Services Market Growth Factors

The factoring is a financial service in which a company sells its bill receivables at a discount rate to a third party in order to raise funds. It's not the same as invoice discounting. The invoice discounting is the process of having an invoice discounted at a given rate in order to obtain funds, although factoring is a larger notion. Factoring is the process of selling all account receivables to a third party.

Factoring guarantees a predictable cash flow pattern. The credit department is virtually eliminated with continuous factoring. Because of the distinct advantage of flexibility that factoring provides to the borrowing firm, receivable financing is gaining popularity as a beneficial form of financing short-term finance requirements of business organizations. The seller's bills receivables may continue to be funded in a semi-automated manner. If the company's revenues grow or shrink, the financing can be adjusted accordingly.

The increase in open account trade and the quick expansion of businesses in Asia, led by China, the increase in cross-border factoring, and the rapid growth and development of factoring services in the developing regions are some of the factors contributing to the growth of the factoring services market during the forecast period.

The growth of the factoring services market can be attributed to rising public knowledge of financial technology advancements, such as government and factoring organization advocacy and initiatives, cryptocurrency, increased use of digital platforms, and an increase in cross-border transactions.

Furthermore, the use of crypto-solutions has increased the accuracy of transactions and secured both parties' important and confidential information preventing financial fraud. However, the factoring services market growth is being hampered by an increase in data breaches and data privacy violations. In addition, the increased implementation of machine learning, natural language processing (NLP), and artificial intelligence (AI) is expected to generate profitable growth prospects for the factoring services market in the near future.

Factoring Services Market Outlook

- Industry Growth Overview:

It is projected that the global factoring services market continue to grow in the coming years. More businesses are learning to use receivables financing as a living and working capital management method due to the tightening credit conditions. Market development is especially gaining momentum in Europe, Asia-Pacific and North America, where cross-border trade and cross-border supply chain financing activities. They are on the increase, as a result of the emergence of digital factoring platforms and embedded finance ecosystems. - Trends of Digital Transformation:

Factoring is being redefined by technology-based innovation. The combination of AI, blockchain, and cloud-based solutions is enhancing the transparency, the speed of transactions, and the evaluation of credit risks. In the same vein, banks such as HSBC, Deutsche Bank, and BNP Paribas are making significant investments in the digital trade finance infrastructure to enable real-time receivables monitoring and automatic risk scoring. This is an indication of a transition towards completely digitised and data-driven factoring ecosystems. - Global Expansion:

The major participants in the factoring industry are diversifying their territorial presence to capture the emerging markets that have a high concentration of SME and increasing volumes of trade. The Asia-Pacific and Latin America have risen and become areas of strategic investment. Due to the efforts of the governments to increase access of MSMEs to finance. Standard Chartered and ICICI Bank, which have developed digital factoring offerings in Southeast Asia and India, which building cross-border offers on Latin American and European routes to attract trade-related factoring business. - Major Investors:

The factoring industry is attracting more attention from both private equity and institutional investors. As a result of the solid cash-flow model, scalable digital infrastructure, and compatibility with the financial inclusion trends. This capital infusion likely further consolidate and spurs technological change, and encourages new collaborations between the current banks and nimble fintech startups. - Fintech Ecosystem:

The fintech industry of the world that provides factoring services is currently developing quickly. New companies are working on artificial intelligence to evaluate credit, on blockchains to provide trade financing, and on automated invoice factoring. PrimeRevenue, Demica, FundThrough, and MarketFinance are some of the emerging companies that are disrupting the funding process in SMEs by providing quicker, more open, and accessible funding options. Additionally, the Finastra trade finance offerings are opening new opportunities for embedded factoring and digital supply chain finance globally.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.41 Billion |

| Market Size in 2025 | USD 5.13 Billion |

| Market Size in 2026 | USD 5.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.34% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Category, Type, Component, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Category Insights

The domestic factoring segment accounted highest share of 70% in 2024. The domestic factoring is carried out within a country. Domestic factoring refers to the acquisition, funding, management, and collection of short-term accounts receivable deriving from the supply goods and services to domestic customers. The goods are distributed on a 180-day open account credit basis.

The international factoring is the fastest growing segment during the forecast period. For businesses involved in the import and export of goods and services, international factoring is a must-have service. Importers frequently demand account trade and longer payment terms from companies engaged in international trade, regardless of their size or industry. This entails receiving money several weeks after the invoice date.

Type Insights

Recourse factoring led the market with highest share in 2024. Recourse factoringis agreement between a customer and a factor in which the client agrees to buy back the factor's unpaid accounts receivable. As a result, in the event of non-payment by the debtor, the credit risk remains with the client.

On the other hand, non-recourse factoring is expected to grow at a faster rate during the forecast period. The customer and the factor enter into a non-recourse factoring agreement in which the factor assumes responsibility for absorbing any unpaid bills receivables. As a result, the unpaid invoices have no impact on the firm.

Application Insights

Based on the application, the small and medium enterprises (SMEs) is likely to dominate the factoring services market in 2024. As small and medium enterprises (SMEs) are the primary adopters of this financing facility, and the interest rates for both recourse and non-recourse factoring are almost same around the world, the global factoring services is anticipated to be dominated by small and medium enterprises (SMEs).

On the other hand, the large enterprises segment is expected to grow at a fast rate during the forecast period. The large enterprises' increased need for non-recourse borrowing is likely to promote short-term financing in emerging nations, ensuring debt security, employment, and growth possibilities.

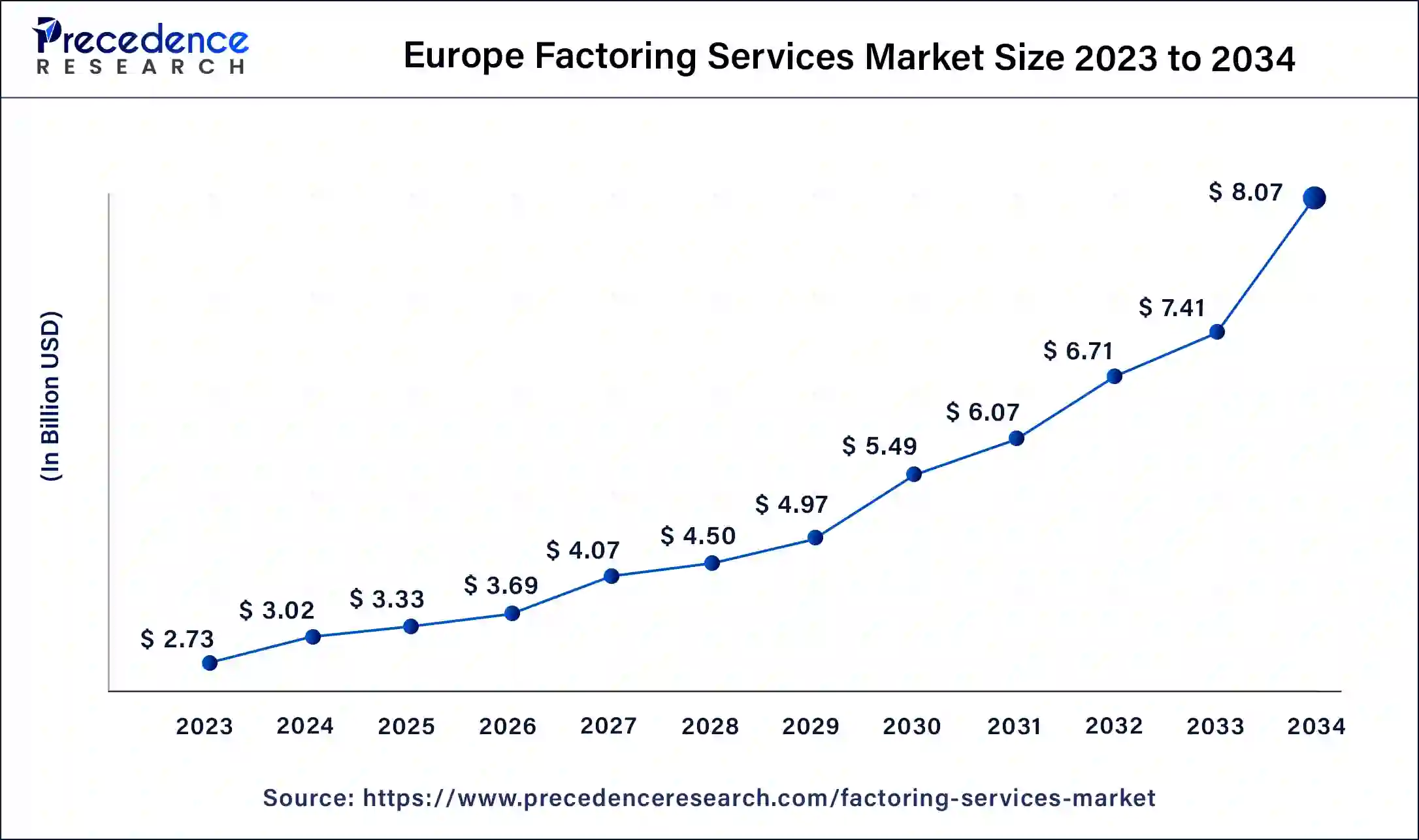

Europe Factoring Services Market Size and Growth 2025 To 2034

The Europe factoring services market was valued at USD 3.33 billion in 2025 and is expected to be worth around USD 8.13 billion by 2034, at a CAGR of 10.41% from 2025 to 2034.

The Europe segment dominated the global factoring services market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. More than two-thirds of the regional market is accounted by the UK, Italy, Germany, Spain, and France. The strategic relevance of receivables funded by commercial banking might be ascribed by the growth. The factoring services are high in demand in the Europe region due to current trade policies inside the European Economic Zone and the rising trade with fast-growing markets in Eastern Bloc nations.

The Asia-Pacificis estimated to be the most opportunistic segment during the forecast period. Due to rapid rise of economies in the Asia-Pacific region, as well as infrastructural and industrial growth, the region is expected to emerge as the fastest-growing regional market. China and India are the two populous countries of Asia-Pacific region, that have a larger need for factoring services among small and medium enterprises (SMEs) in the region.

The India factoring services market is experiencing expansion due to an increase in open account trading prospects within the country. Furthermore, the demand for cash flow management and the requirement for alternative financing options for SMEs in India drive the expansion of the market. Additionally, the adoption and evolution of blockchain technology is anticipated to create profitable opportunities for the market to experience growth in the coming years.

- IFFSPL is among the seven NBFC-Factors registered with the Reserve Bank of India and functions as a Category III Authorized Dealer, focusing on receivable financing and factoring. In the past five years, IFFSPL has positioned itself as the leader in Indian export factoring, capturing approximately 54% market share in export factoring conducted via FCI in CY 2023.

The growth of the factoring services market in United States is due to the increasing demand for alternative funding options for Micro, Small & Medium Enterprises. Multiple finance firms are offering adaptable factoring solutions to freelancers and small to medium-sized enterprises to help alleviate financial strain from late payments. Additionally, the adoption of cloud-based and AI-driven models in factoring services is increasing to enhance service efficiency. Banks in the area are becoming more customer-friendly by offering accessible websites where clients can view their account balances, submit loan applications, and manage invoices. These advancements are anticipated to propel market expansion throughout the projected timeframe.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting different marketing strategies, such as new product launch, investments, partnerships, and mergers & acquisitions. The companies are also spending on the development of improved products. Moreover, they are also focusing on competitive pricing.

- In December 2019, the China Construction Bank (CCB) launched the platform for factoring services and trading.

The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships,joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Factoring Services Market – Value Chain Analysis

- Client Acquisition & Credit Assessment

The value chain begins with identifying and onboarding clientstypically small and medium-sized enterprises (SMEs), exporters, and supplierswho seek liquidity through the sale of accounts receivable. This stage involves due diligence, creditworthiness evaluation, and KYC/AML verification.

Key Players: HSBC Holdings plc, BNP Paribas, Standard Chartered Bank, Citigroup Inc., Deutsche Bank AG - Invoice Submission & Verification

Once clients are onboarded, invoices and trade documents are submitted to the factoring company for validation. The process includes verifying buyer authenticity, invoice legitimacy, and transaction compliance through automated document management and risk analytics platforms.

Key Players: UniCredit S.p.A., Crédit Agricole Group, Santander Bank, Wells Fargo & Company, China Construction Bank Corporation - Financing & Fund Disbursement

After verification, a pre-agreed percentage of the invoice value (typically 70–90%) is advanced to the seller, providing immediate liquidity. This phase is driven by financial structuring, risk pricing, and dynamic funding systems integrated with digital banking platforms.

Key Players: Barclays plc, ING Group, ICICI Bank Limited, Absa Bank Limited, Mitsubishi UFJ Financial Group, Inc. - Receivables Management & Collection

Factoring firms assume responsibility for managing the debtor ledger, monitoring payment cycles, and collecting outstanding dues from buyers. Modern platforms employ predictive analytics, digital reminders, and automated reconciliation tools to enhance efficiency.

Key Players: Taulia Inc., PrimeRevenue Inc., Demica Ltd., TradeIX (Marco Polo Network), Finastra - Risk Management & Credit Insurance

This stage focuses on mitigating default risks through credit insurance, reserve funds, and integration with global credit bureaus. Factoring companies also partner with insurers and regulatory bodies to ensure compliance and safeguard against cross-border payment risks.

Key Players: Euler Hermes (Allianz Trade), Coface, Atradius, FCI (Factors Chain International), Aon plc - Settlement & Client Reporting

Upon buyer payment, the remaining invoice amount (minus service fees) is transferred to the client. Transparent reporting, performance analytics, and ERP integration ensure clients have real-time visibility into receivables, financing costs, and payment histories.

Key Players: SAP, Oracle Financial Services, FIS, Fiserv, Intuit, Sage Group - Technology Integration & Platform Innovation

The final stage of the value chain revolves around digital transformation automation, blockchain, and AI-powered factoring platforms that streamline onboarding, risk scoring, and transaction processing to enable scalable and transparent financing ecosystems.

Key Players: TradeIX, Taulia, PrimeRevenue, Finastra, Marco Polo Network, TietoEVRY

Top Vendors in the Factoring Services Market & Their Offerings

- Mitsubishi UFJ Financial Group, Inc. (Japan): MUFG offers factoring and trade finance services through its global network, supporting exporters and manufacturers with liquidity solutions, credit protection, and efficient receivables management.

- China Construction Bank Corporation (China): As one of the largest state-owned commercial banks, CCB provides domestic and international factoring services that support China's exporters, manufacturers, and supply chain enterprises.

- Wells Fargo & Company (USA): Wells Fargo's factoring services focus on accounts receivable management, invoice financing, and credit protection for manufacturers, wholesalers, and service providers across North America.

- Barclays plc (UK): Barclays provides innovative factoring and invoice discounting solutions that enable businesses to unlock working capital and manage cash flow efficiently, particularly within the UK and European SME sectors.

- ING Group (Netherlands): ING Commercial Finance offers international factoring and receivables management services through its digital trade platforms, enabling companies to optimize liquidity and reduce credit exposure.

- Taulia Inc. (USA): A global fintech leader in supply chain finance, Taulia offers digital factoring and dynamic discounting solutions powered by AI and automation, helping enterprises accelerate payments and strengthen supplier relationships.

- PrimeRevenue Inc. (USA): Specializing in working capital optimisation, PrimeRevenue delivers cloud-based factoring and supply chain finance platforms that help large corporations improve liquidity and strengthen global supplier networks.

- Demica Ltd. (UK): A prominent fintech company focused on trade finance digitization, Demica offers receivables financing, factoring, and securitization technology for banks and large corporates worldwide.

- TradeIX (Ireland): Through its Marco Polo Network, TradeIX enables blockchain-based factoring and supply chain finance solutions, offering transparent, secure, and efficient trade finance infrastructure.

- Ameri Express Company (USA): Amex offers business financing and B2B payment solutions, including factoring-like cash flow management tools for SMEs seeking faster invoice settlement and improved working capital efficiency.

- ICICI Bank Limited (India): ICICI Bank provides factoring and bill discounting services to exporters and domestic businesses, facilitating seamless cash flow and credit protection through its trade finance solutions.

- Absa Bank Limited (South Africa): Absa's factoring and invoice discounting services support African enterprises by enhancing liquidity and providing flexible working capital solutions tailored to regional market dynamics.

Segments Covered in the Report

By Category

- Domestic Factoring

- International Factoring

By Type

- Recourse Factoring

- Non-recourse Factoring

By Application

- Small and Medium Enterprise (SMEs)

- Large Enterprise

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting