What is the Broadband Services Market Size?

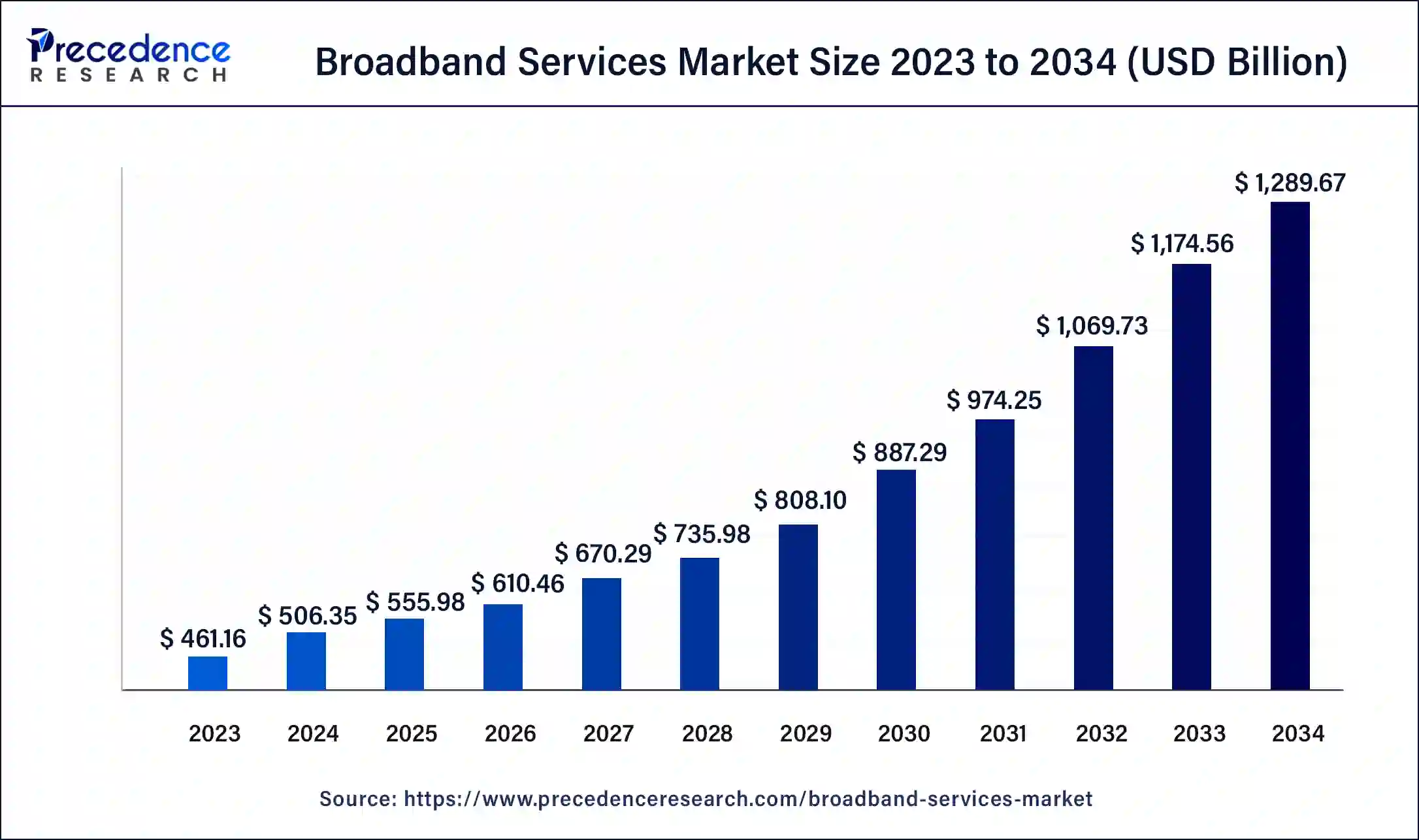

The global broadband services market size is anticipated at USD 555.98 billion in 2025 and is expected to be worth around USD 1,397.93 billion by 2035, at a CAGR of 9.66% from 2026 to 2035.

Broadband Services Market Key Takeaways

- In terms of revenue, the broadband services market is valued at $555.98 billion in 2025.

- It is projected to reach $1,397.93 billion by 2035.

- The broadband services market is expected to grow at a CAGR of 9.66% from 2026 to 2035.

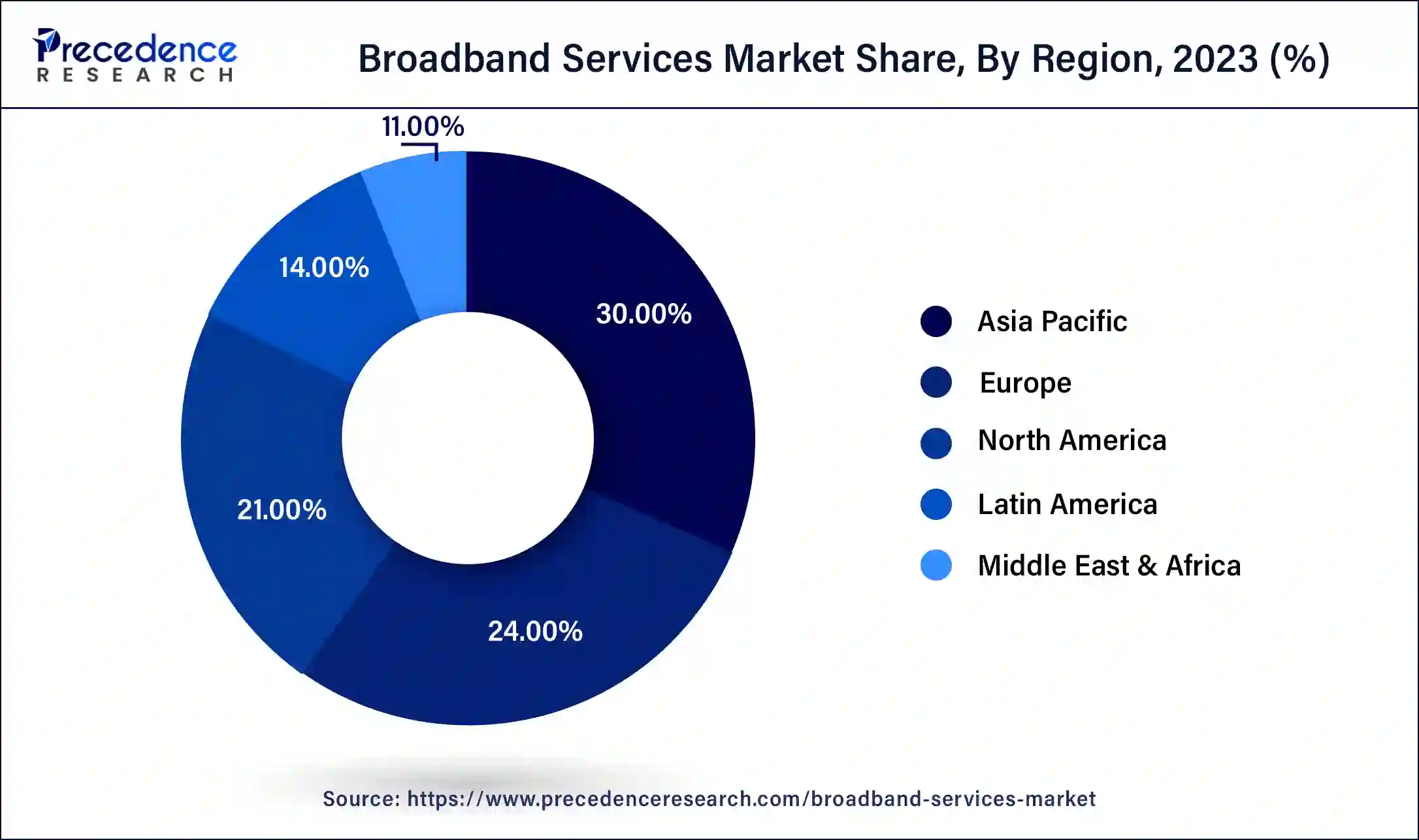

- Asia Pacific dominated the global broadband services market with a 30% revenue share in 2025.

- By end user, the business segment garnered a market share of around 45% in 2025.

- By connection, the fiber optic segment accounted for over 36% of the market share in 2025.

Broadband Services Market Growth Factors

The broadband services market is witnessing a significant growth due to the digital transformations of businesses in almost all the industries across the globe. The rapid growth of the e-commerce industry, digitization of the healthcare units, increased consumption of online entertainment, and e-governance initiatives by the government are some of the prominent factors that drives the growth of the global broadband services market. The growing popularity of the wireless technologies is transforming the digital revolution and it has potential to increase cost-effectiveness and enhance productivity. As per the data published by the Organization for Economic Co-operation and Development, the increasing number of the wireless subscribers is driving the growth of the broadband services market. The growing need for the uninterrupted internet connectivity across the commercial and the household sector is compelling the service providers to invest in the enhancement of their technology and services to provide seamless services to the customers.

The increasing penetration of the online learning platforms, rising trend of work from home, and increasing adoption of the eHealth platforms among the consumers have significantly driven the demand for the broadband services in the last couple of years. Moreover, the increasing adoption of the broadband services in the communication field has driven the market growth. The increasing adoption of the digital technologies such as artificial intelligence AI, internet of things IoT,cloud computing, data analytics, and social media across various industry verticals such as pharmaceutical, healthcare, education, automotive, and BFSI has significantly contributed towards the growth of the global broadband services market. The outbreak of the COVID-19 pandemic resulted in a significant spike in the demand for the broadband services owing to the increased demand for the digital platforms for various uses such as e-commerce for shopping, social media, online entertainment, and online education. Most of the businesses were shifting towards the digital platforms for continuing their business operations. The increasing investments by the major players in the development of the 5G technologies is expected to have a huge and positive effect on the global broadband services market in the upcoming future. All these factors are expected to drive the growth of the broadband services market in the forthcoming years.

Major trends in the Broadband Service Market:

- The trend of service providers bundling broadband with OTT platforms and services to reduce churn & increase ARPU has been strengthened by the need to do so in competitive urban areas.

- Additionally, the increasing importance of using AI and machine learning for network optimization has resulted in companies implementing these technologies into their networks to predict network congestion, automate fault detection, and provide more efficient/fast bandwidth allocation on a real-time basis without the need for additional infrastructure spend.

- The demand for equal upload/download speeds has also been increasing due to remote work, increased cloud collaboration, and creating content, so the demand for equal upload/download speeds is now being accounted for in many products offered by companies as opposed to just being offered for consumer use cases.

Market Outlook

- Industry Growth Overview: The market is experiencing a gradual upward trend as a result of greater use of the internet, the growth of digital offices, the increased usage of cloud solutions, and greater access to fiber optic and wireless broadband technology throughout the world.

- Sustainability Trends: To decrease their environmental footprint and meet the demand for higher-bandwidth broadband, telecommunications providers are investing in the use of energy-efficient network equipment, constructing green data centers, and leveraging virtualization technologies to support their networks.

- Global Expansion: Investors in telecommunications are increasingly investing in the rural sections of developing economies, as these areas represent large growth opportunities for telecommunications investments to facilitate cross-border digital trade and smart city development through improved broadband accessibility.

- Startup Ecosystem: Start-up companies are playing a role in advancing satellite broadband, providing network analytics and cybersecurity solutions, and providing last-mile delivery solutions for large telecommunications operators by offering nimble, technology-based solutions cooperatively.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 1,397.93 Billion |

| Market Size in 2025 | USD 555.98 Billion |

| Market Size in 2026 | USD 610.46 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.66% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Connection, End User, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Connection Insights

The fiber optic segment dominated the global broadband services market in 2025. The fiber optics can carry superior quality signals directly from the operators to the users. The continuous improvements in the technology and customization of the bandwidth as per the requirements of the user is a major factor that boosts the demand for the fiber optics among the users. The fiber optic has gained rapid traction among the consumers in the recent years owing to the high speed and affordable prices.

The wireless is estimated to be the most opportunistic segment during the forecast period. This is attributable to the higher conveniences and increased efficiency of the wireless broadband services. Moreover, it does not involves the deployment of wires that involves costs for the companies. The wireless broadband services uses radio waves in place of cables and the rapid shift from 3G to 4G and from 4G to 5G is expected to drive the growth of this segment in the forthcoming years. The wireless segment is expected to surpass the fiber optic segment in terms of revenue during the forecast period.

End User Insights

Business segment dominated the global broadband services market in 2025. The increased demand for the fast and consistent internet connectivity among the various business organizations has fueled the demand for the broadband services. Almost all formats of businesses includes marketing, sales, client meetings, and customer service solutions that requires 24/7 internet connectivity. This has favored the growth of this segment in the past few decades. Moreover, with the growing adoption of the latest technologies like AI and IoT, the demand for the broadband services across the businesses is expected to grow significantly during the forecast period.

The household is estimated to be the fastest-growing segment during the forecast period. This is primarily attributed to the increasing adoption of various home improvement and smart devices at home like smart TVs. Moreover, the increasing demand for the online education and rising adoption of work from home has driven the growth of this segment. Furthermore, the increased number of subscriber of various OTT platforms and similar entertainment services is expected to drive the growth of this segment.

Regional Insights

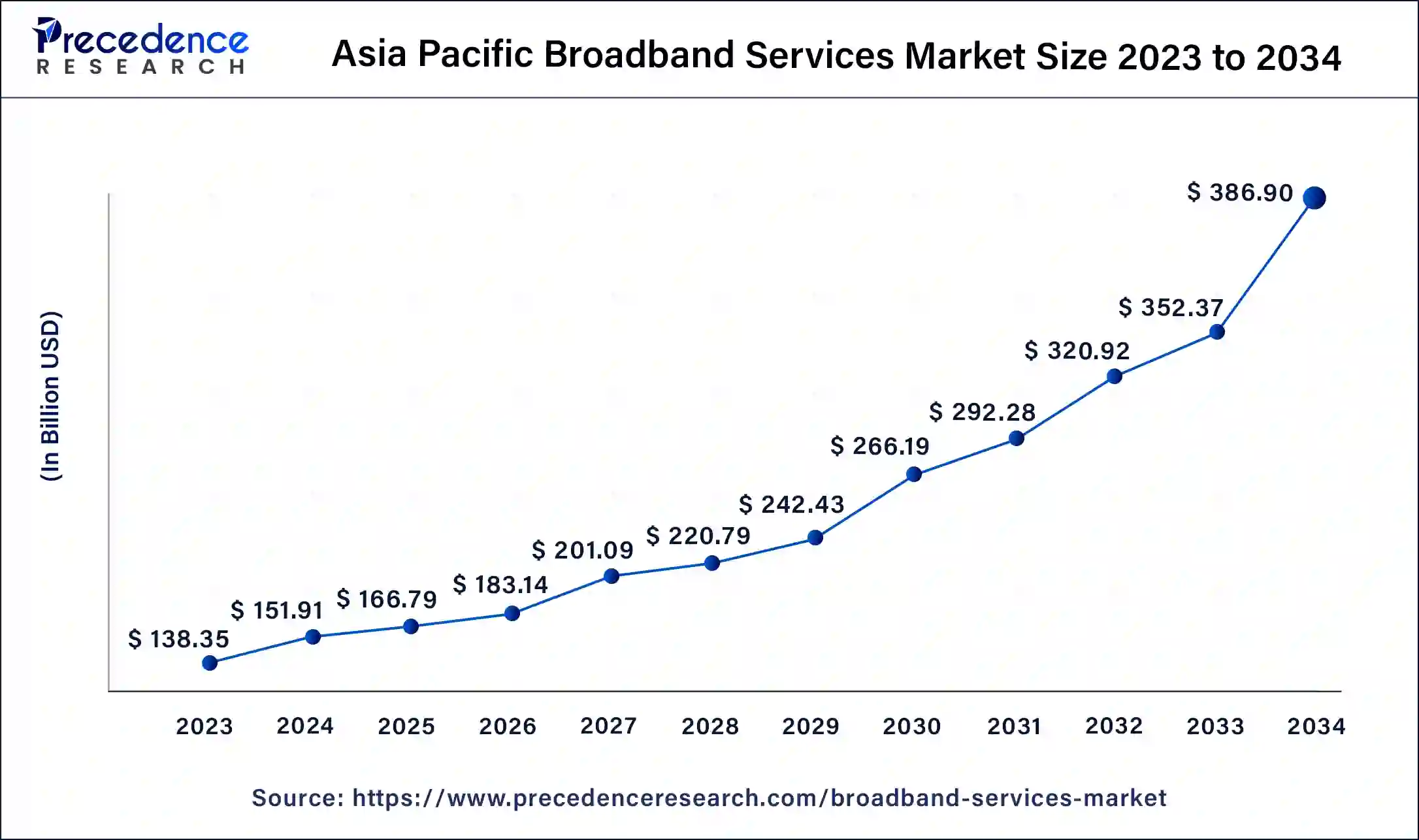

Asia Pacific Broadband Services Market Size and Growth 2026 to 2035

The Asia Pacific broadband services market size is exhibited at USD 166.79 billion in 2025 and is predicted to be worth around USD 434.33 billion by 2035, at a CAGR of 10.04% from 2026 to 2035.

Asia Pacific held the largest market share in 2025. This can be attributed to the presence of huge number of households and the SMEs. Furthermore, the rapidly growing number of internet users in the region along with the increasing penetration of the online education and online entertainment has fueled the market growth. Moreover, the availability of cheap data in an emerging market like India is significantly boosting the demand for the broadband services across the nation. Moreover, the rising disposable income, rise of middle class, and rising standards of living are the major factors that drives the demand for the broadband services in the region. Furthermore the presence of several gianttelecommunication companies in the region along with the rising investments in the development of IT and telecommunications infrastructure is further expected to drive the growth of the Asia Pacific broadband services market. Asia Pacific is also estimated to be the most opportunistic segment owing to the increasing consumer base and increasing penetration of various digital businesses.

- In February 2025, Union Minister Nirmala Sitharaman stated that the central government would provide broadband connectivity to every government-operated secondary school and primary healthcare centre in rural regions via the BharatNet initiative.

Europe was the second leading broadband services market in 2025 and garnered a 24% revenue share. The increased presence of SMEs and higher adoption rate of the digital technologies across the households and businesses has led to the growth of the market. The increasing popularity of the 5G technologies coupled with the presence of developed telecommunications and IT infrastructure is expected to retain its position throughout the forecast period.

Europe: Building on Solid Foundations to Quickly Deploy Fiber and Ensure Digital Inclusion

Europe is at the forefront of broadband development as a result of effective regulations, extensive deployment of fiber-to-home (FTTH) networks, and governmental efforts to make high-speed internet access available throughout rural areas. The combination of these elements enables businesses throughout Europe to pursue digital transformation and provide smart infrastructure to their customers.

North America is witnessing swift expansion in the broadband services sector, fueled by rising demand for high-speed internet and considerable investments in network infrastructure. As reported by the Federal Communications Commission, broadband subscriptions in the U.S. grew by 6.2% in 2023, totaling 500 million connections. This expansion is driven by the growth of fiber-optic networks and 5G technology. In February 2024, Comcast Corporation revealed the introduction of its 10 Gbps symmetrical internet service in 20 major U.S. cities, showcasing the industry's drive for ultra-fast broadband speeds.

Latin America: Connecting the Untouched

Latin America's growing demand for broadband was driven by a boom in mobile broadband services, affordable monthly fees for home internet access, and private companies investing significantly in urban and suburban networks.

Middle East and Africa: Rapidly Expanding Digital Opportunities

The Middle East and Africa (MEA) market has significant growth potential. Smart city initiatives and government-led digital programs are creating new opportunities to utilise existing telecommunication networks, and as more people in rural areas find it more convenient to use wireless broadband services than fixed-line services, MEA will continue to grow.

Value Chain Analysis of the Broadband Service Market:

- Developing Network Infrastructure: This is the development of the fibre optic network, providing the backhaul for 5G deployments and developing infrastructure to enable satellite connectivity. Because it is capital-intensive, this area of capital investment represents the largest investment with respect to scalability and reduction of latency in providing bandwidth to meet future demand.

Major players: Huawei, Nokia, and Ericsson. - Service Provisioning and Network Management: This is the administration and management of the distribution of bandwidth, customer service, billing, and security of a network for service providers. Automation and software-defined networking are critical elements in optimising costs while providing a better quality of service.

Major players: AT&T, Vodafone Group, and Comcast. - Value Added Services and Customer Interface: This includes all aspects of customer service, bundled digital services, enterprise solutions, and content partnerships. Differentiation is delivered through personalised customer service and service reliability.

Major players: Verizon, BT Group, and Deutsche Telekom.

Broadband Services Market Companies

- Comcast

- AT&T Intellectual Property

- Verizon Communications, Inc.

- Cox Communications, Inc.

- Charter Communications, Inc.

- Time Warner Cable, Inc.

- Rogers Communications, Inc.

- Qwest Communications International, Inc.

- Cablevision Systems Corp.

Recent Developments

- In March 2025, Jio Platforms Limited revealed a strategic alliance with SpaceX, a development that will launch Starlink broadband services in India. The subsidiary of Reliance Industries states it would utilize the constellation of low-Earth orbit satellites owned by Elon Musk's company to offer high-speed broadband services to its customers, including those in the most isolated and rural regions of the country. Starlink gear will be offered for sale in Reliance Jio outlets, including installation and activation customer service.

- In April 2025, China rolled out its inaugural 10G broadband network in Sunan County, Hebei Province, representing a notable milestone in internet infrastructure development. The introduction is a joint effort by Huawei and China Unicom, aiming to provide download speeds reaching 9,834 Mbps, upload speeds of 1,008 Mbps, and latency as low as 3 milliseconds.

- In April 2025, Amazon commenced the rollout of its ambitious $10 billion Project Kuiper, introducing its initial group of 27 satellites designed to offer worldwide broadband access, particularly to isolated and rural regions. This launch signifies the start of Amazon's competition with SpaceX's Starlink, which currently operates more than 8,000 satellites in orbit and serves millions of users globally.

- In May 2020, NBCUniversal and Sky introduced an offering that allows the consumers to buy Sky's international news using the NBCUniversal'sOne platform.

The broadband services market is moderately fragmented with the presence of several local companies. These market players are competing to strengthen their market position by adopting strategies, such as partnerships, acquisitions, new product launches, and collaborations. Companies are also spending on the development of enhanced and efficient products. Moreover, they are also focusing on maintaining competitive pricing.

Segments Covered in the Report

By Connection

- Fiber Optic

- Cable

- Satellite

- Wireless

- Digital Subscriber Line

By End User

- Business

- Household

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting