What is the Aluminium Cans Market Size?

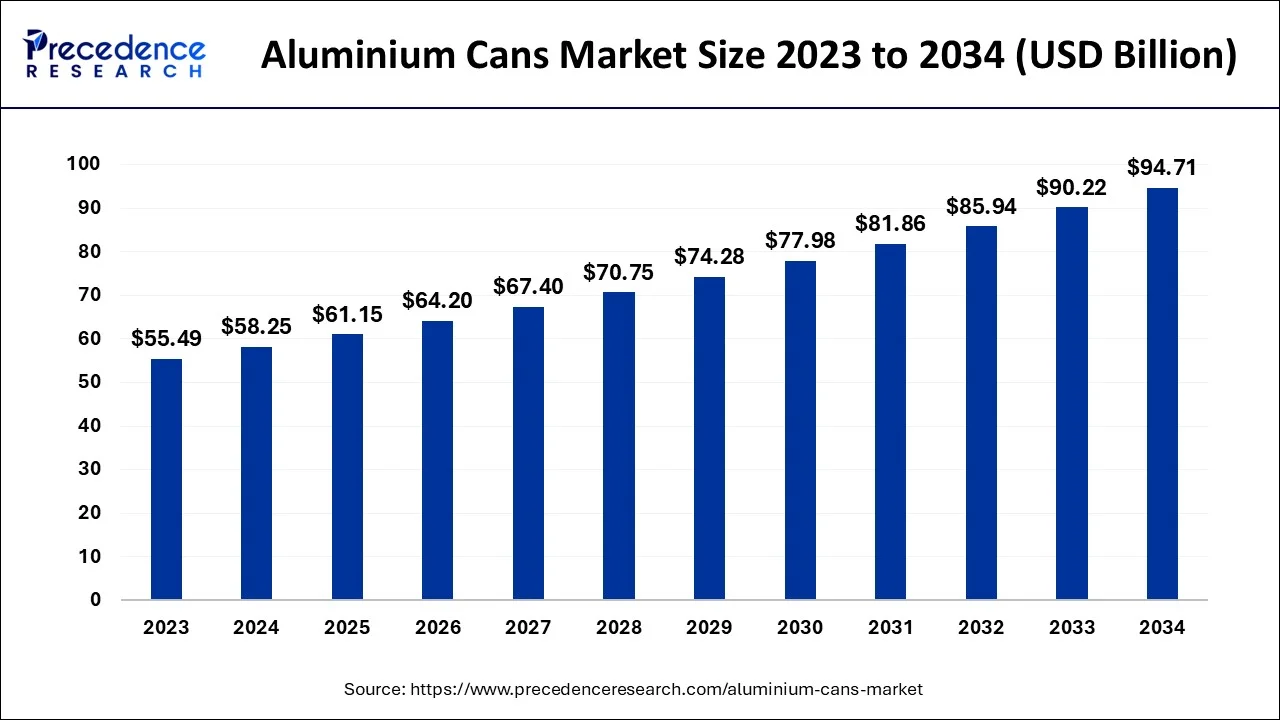

The global aluminium cans market size is valued at USD 61.15 billion in 2025 and is predicted to increase from USD 64.20 billion in 2026 to approximately USD 99.20 billion by 2035, expanding at a CAGR of 4.50% from 2026 to 2035.

Aluminium Cans Market Key Takeaways

- Japan accounted for 23% of the market share in 2025.

- In Europe, the U.K. held 19% of revenue share in 2025.

- Germany has contributed 22% of sales in the Europe aluminum cans market in 2025.

- In 2024, the U.S. held 88% of aluminum cans market share in North America.

AI in the Market

Here, we list the artificial intelligence applications applied to aluminum pollution. It gives complete justification and explication of these uses. For example, some AI uses are for predictive maintenance to ensure less downtime, for controlling handling and assembly, and for defect detection while in the fabrication process; hence, bigger things go into the world. The aluminium and tin can industry, with the aid of AI, can come up with new alloy compositions for lighter and stronger cans. AI helps with forecasting, logistics, and supplier assessment in supply chains. Further, it can undertake energy measurement, emission reduction, and recycling activities through accurate sorting and life cycle analysis. These integrations respond to demand for cost-effective aluminum packaging systems that are sustainable and of high quality for the consumer and the law.

What are the Aluminium Cans?

Aluminium cans are also known as the tin cans. The increased consumption of different types of beverages is expected to be one of the major reasons that will help in the growth of the market during the forecast period. Aluminium cans are offered in different types of capacities and due to which the market is expected to grow well in the coming years.

Aluminium cans are also used for the packaging of food and it is expected to gain more popularity in the coming years. Through the introduction of the aluminium cans that are BPA free which happens to be a packaging that is chemical free the demand for these aluminium cans is expected to grow in the coming years and provide major opportunities for the growth of the market during the forecast period. The demand for different types of canned foods is expected to grow especially in the developed nations across the world due to the introduction of the chemical free option.

- In June 2024, Sonoco Products Company acquired Eviosys, a European leader in metal packaging, for $3.9 billion. This acquisition strengthens Sonoco's position as the global leader in metal food can and aerosol packaging. Eviosys, with 44 facilities across 17 countries, is expected to generate $2.5 billion in revenue in 2024. Sonoco anticipates $100 million in synergies and is committed to advancing sustainable metal packaging through its new Technical & Engineering Center in Ohio.

Aluminium Cans Market Growth Factors

- Rising demand for convenient, lightweight, and sustainable packaging has increased aluminum can adoption in industries.

- Recycling benefits, such as allowing unlimited reusability without loss of quality, make cans a preferred environmentally friendly alternative.

- With increased corrosion resistance properties and durability, the position of the aluminum market in the packaging industry gets further strengthened.

- Increasing demand is a result of an increase in beverage consumption and the diversification into functional and premium drinks.

- Sustainability policies by the government and green packaging preferences by consumers retain growth in the long term.

In the recent years in most of the developing as well as the developed regions the demand for convenient and sustainable packaging for different types of beverages has increased. In order to have packaging solutions that are convenient the demand for aluminium cans has increased. Due to the sustainability policies adopted by various nations across the world the demand for metal packaging has increased and it will continue to grow in the coming years. Recycling of metals is extremely easy and it is environment friendly. These materials can be recycled many times and the recycling process does not hamper the quality of the product and this is expected to be a major factor that will be instrumental in the growth of the market in the coming years. Compared to all other packaging options the demand for aluminium cans is expected to grow as it happens to be an economic option for the packaging of different types of products used in personal care and for different types of foods as well as beverages. Aluminium cans are used on a large scale in the food and beverages industry and it will continue to dominate the market as compared to any other metal packaging available in the market as they are extremely cost effective. Most of the aluminium hence used widely in the food and packaging industry contains about 70% of the recycled form which is the highest as compared to any other type of containers.

- In the coming years there shall be an increased demand for the aluminium cans as they are cost effective and also, they do not harm the environment.

- The sales of the aluminium cans are expected to increase in the coming years as they are strong

- Aluminium cans offer high resistance to corrosion and also, they are light in weight due to which the demand for them is expected to grow in the coming years.

- Aluminium cans act as the best barriers that prevent the interaction of moisture, light as well as air. Ease of handling is another feature that will help in the growth of the market during the forecast period.

Market Outlook

- Industry Growth Overview: The aluminium cans industry is showing stable growth that is largely fuelled by the convenience factor and the lightweight packaging, and the environmental consumer trend.

- Sustainability Trends: The recycling trend is also rather high, which supports the circular economy, but also couples with a decrease in energy consumption during the production process.

- Global Expansion: The globalization, the change of lifestyles, and the variety of products offered make aluminium cans an increasingly used product all over the world.

- Major Investors: Among the key investors are Ball Corporation, Crown Holdings, Ardagh Group, CAN-PACK, Novelis, and Toyo Seikan Group.

- Startup Ecosystem: The low-carbon processes, sustainable materials, and climate technology solutions are the most important spheres of innovation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 58.25 Billion |

| Market Size in 2026 | USD 61.15 Billion |

| Market Size by 2035 | USD 94.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.98% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Capacity, End User and region |

MarketDynamics

Drivers

- The growth of the beverages industry- During the forecast period a higher growth of the beverages industry is estimated. when it comes to the countries like China, India and Brazil the demand for the beverages is expected to grow. The increased use of aluminium cans in the beverages sector is expected to provide maximum opportunities for the growth of the market in the coming years and it will help in generating a large amount of revenue for the market players.

- Increased preference for cans- Large number of cans used in the packaging of chilled beverages are aluminium cans. Consumers across the globe prefer these types of cans as compared to the plastic bottles. The use of aluminium cans is expected to grow as the consumers find this option more refreshing.

- Convenient for travelers- The demand for aluminium cans is expected to grow across most of the nations as it helps in meeting the demand of the changing lifestyle of the consumers. The availability of various sizes will be a boon for the beverages industry. Hectic lifestyles and busy schedules are some of the reasons why the convenience associated with the aluminium cans will provide opportunity for the growth of the market.

Market Challenges

- Availability of other alternatives- In the food and beverages packaging industry apart from the use of aluminium cans there has been an increase in the usage of paper, plastic as well as glass. In most of the end user industries the other alternatives that are lower in both will be preferred by the manufacturers.

- Fluctuating prices of the raw materials- The pricing of the product depends upon the manufacturing of the product and the changes in the cost of the raw material will change the price of the product which will hamper the growth of the market in the coming years. As the consumer seek cheaper options as compared to the expensive one's manufacturers are constantly engaged on making use of cost-effective products in order to reduce the price of the final product.

Market Opportunities

- Environmental concerns- Increase in the concerns associated with the pollution caused by plastic will lead to an increased use of metals for packaging. As aluminium cans can be easily recycled the demand for aluminium cans is expected to grow in the coming years.

- Growing demand for lightweight and durable options- There shall be an increased demand for the aluminium cans in the coming years as they are lightweight and durable as compared to the steel or the tin cans. They are highly resistant to corrosion and they do not rupture even in high pressure due to carbon dioxide. aluminium cans act as a barrier for various contaminants from the environment.

- Usage in different types of end user industry- Apart from the usage of aluminium cans in the beverages industry, which shall be an increased use of this packaging option in the cosmetics industry, paints industry, aerosol products, food and pharmaceuticals. As the demand for the processed foods and packaged foods has increased across most of the developed nations as well as the developing nations of the world which is mainly due to the changes in the lifestyle, the market is expected to grow in the coming years. There shall be a great demand for different types of processed and packaged foods in the North American region especially for the United States.

- Usage in food packaging- Aluminium cans are used on a large scale in the food packaging industry as it helps in improving the shelf life and the safety of various food products. As the demand for fast food has increased in the recent years there shall be an increased use of aluminium cans in the packaging industry.

Type Insights

Standard cans dominate markets industrially because of their compatibility with filling lines worldwide and because of cost-effectiveness and logistics. Their use among mainstream drinks makes it the most trusted packaging, with widespread consumer knowledge backing this market dominance.

Being premium and lifestyle-type beverages, sleek cans have been growing fast. The tall body gives it shelf appeal and the ability to stand apart, which has made it popular for health and ready-to-drink categories.

End-User Insights

In stark competition, the beverage segment preferred aluminum cans as packaging for carbonated drinks, energy products, and alcoholic beverages. Their lightweight feature, recyclability, and excellent barrier properties put them well to sustain this leadership.

Being very corrosion and formulation resistant, the fast growth of the aerosol application is supported. The rapid growth of personal care, household, and food products is behind this trend.

Structure Insights

Two-piece cans dominate due to manufacturing efficiencies, lightweighting potential, and lowered scrap rates. Streamlined production and durability have made them a preferred choice for bulk packaging.

Extruded-draw-redraw is the fastest-growing format, giving shape to cans used for aerosols, wine, and premium personal care. This variety allows brands to differentiate and yet retain durability.

Product Insights

On the basis of the product, the 2-piece Segment is expected to dominate the market with a 53% revenue share in 2024. This segment is expected to grow well in the coming years as this type of packaging is used in many different industries. These cans are extremely convenient to use and provide easy opening. They are light in weight due to which they are used in the beverages industry.

The demand for packaged food and beverages that are convenient to carry around has created more demand for aluminium cans of this type in the recent years and it will continue to grow in the coming years.

End User Insights

On the basis of the end user, the beverages segment is expected to have the largest market share in the coming years period this segment has dominated the market in the past with the higher share in terms of revenue. Increased use of aluminium cans in different types of beverages will provide opportunities for the growth of the market. The use of the aluminium cans is also expected to grow in the food industry. Aluminium cans help in improving the shelf life of the products and it also acts as the best barrier for all the contaminants. All of these factors will drive the market growth in the coming years.

- In February 2025, Canpack Group commenced the construction of its third beverage can manufacturing plant in India, located in Uttar Pradesh. This greenfield project, with an estimated investment of $150 million, is part of the state's IMLC initiative under the AGREES project. The new facility aims to meet the growing demand for aluminum beverage cans in India

Capacity Insights

On the basis of capacity, the 201-450ml segment is expected to have the largest market share in the coming years period it is expected to grow with the highest compound annual growth rate which is expected to be 4.1% in the coming years. This is the most affordable option in the market do to which the segment is expected to grow. About 35% of the total of the aluminium cans used in the market out of the capacity 201-450ml. The 1000 ml capacity segment is also expected to grow well in the coming years due to its increased use in the food industry.

The mid-size cans dominate, balancing refreshment volume, convenience for the consumers, and artwork visibility. Their widespread acceptance among many beverage categories maintains them as the core of any market.The small cans are the fastest-growing segment. It is propelled by portion control trends and premium positioning. These are attractive to health-conscious consumers and are suited to multipacks, thus facilitating their adoption.

Regional Insights

U.S. Aluminium Cans Market Size and Growth 2026 to 2035

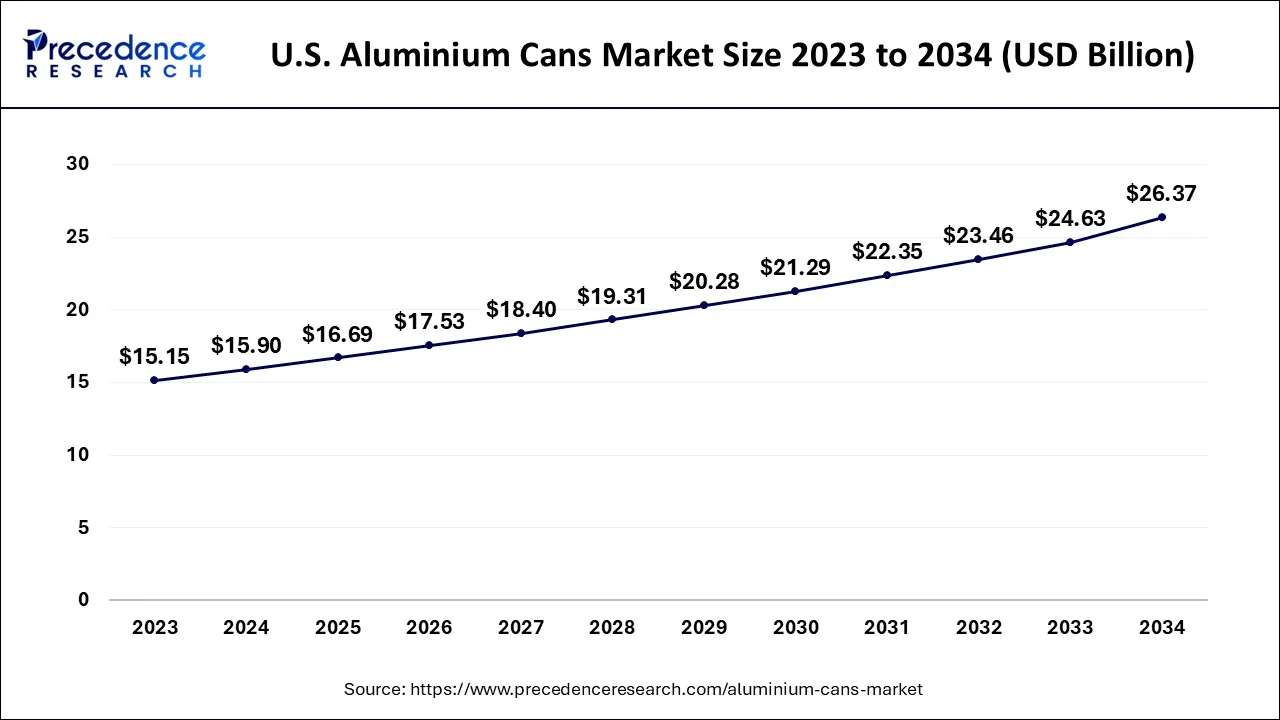

The U.S. aluminium cans market size was evaluated at USD 16.69 billion in 2025 and is predicted to be worth around USD 27.73 billion by 2035, rising at a CAGR of 4.72% from 2026 to 2035.

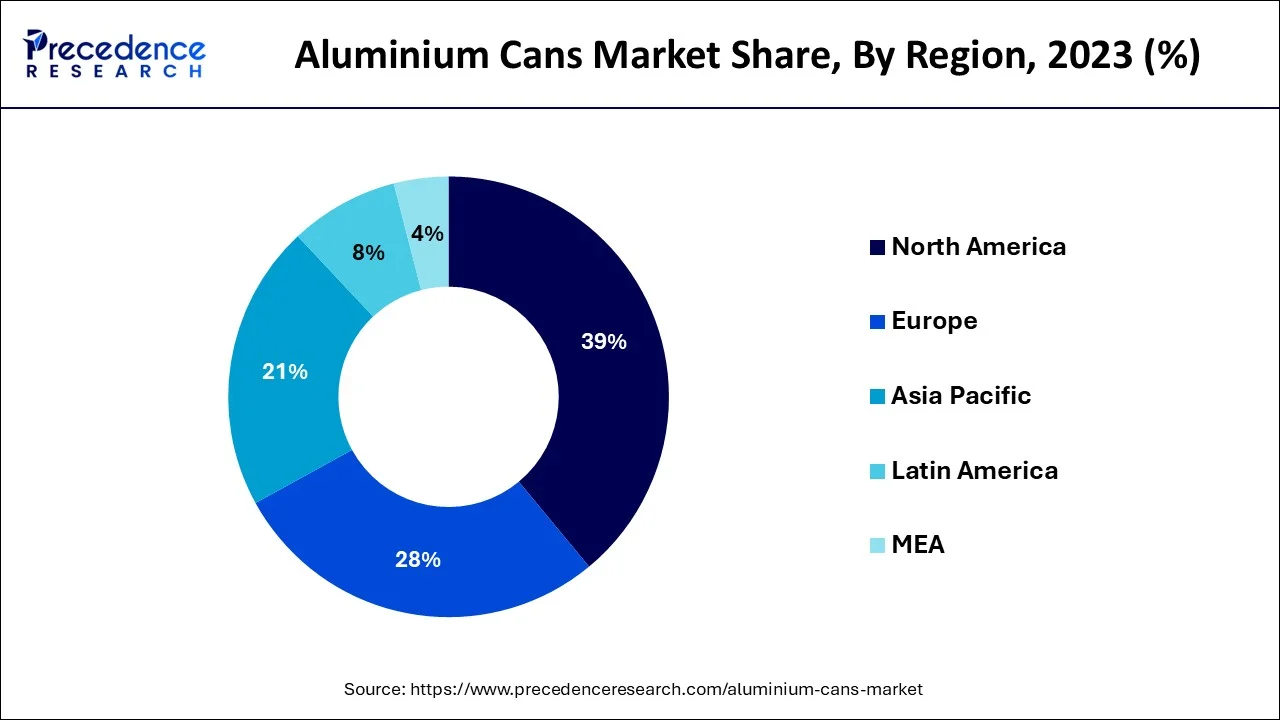

On the basis of geography, North American region accounted 39% market share in 2025. As the demand for processed and packaged foods in this nation has increased the demand for aluminium cans is also expected to grow. The sales of the aluminium cans are also expected to grow in the European region especially in Germany due to its increased use of aluminium cans in the food and beverages industry as well as the chemical industries.

Chemical industry in Germany is growing at a great pace and they shall provide maximum opportunities for the growth of the market in the coming years. Apart from Germany United Kingdom is also expected to have a good amount of market share in the coming years. The demand for canned food has increased in the recent years which has generated a good amount of revenue, and the increase in the consumption of canned food will lead to an increased consumption of aluminium cans. The beverages industry also makes use of aluminium cans in its packaging which will help in the growth of the market in the coming years. Countries like Japan are constantly focusing on recycling the products used in packaging due to which the plastic and glass packaging options will not be used on a large scale in the food and beverages industry.

North America's Leadership Anchored in Recycling and Domestic Manufacturing

North America remains a leader in the aluminium cans market, supported by a formidable recycling and recovery system; in the U.S., more than 75% of all aluminum produced at any time in the U.S. remains available. However, the move toward 2025 policy developments, such as tariffs on imported aluminum cans as well as beer, has disrupted supply chains. Coca-Cola, among others, cautioned about tariffs causing companies to pivot back to plastic packaging, jeopardizing sustainability initiatives.

Asia Pacific Region's Fastest Growth Driven by Sustainability Mandates and Innovation

Asia Pacific has the fastest growth trajectory regarding the adoption of aluminium cans, propelled by urbanization, lifestyle changes, and government sustainability mandates. In 2024, India adopted a requirement for recycled content in metal packaging, while China continues to tighten regulations to limit plastics. Local manufacturers are investing in new technology to produce lightweight and energy-efficient cans. This trend coincides with a growing demand for environmentally conscious packaging of ready-to-drink beverages, thereby establishing the Asia Pacific as an area of growth and innovation in sustainable metal packaging.

U.S. Aluminium Cans Market Trends:

In the U.S., the beverages sector has the largest share of the consumption, with soft drinks, energy drinks, and beer being the main contributors. The U.S. regulations banning single-use plastics have been a boon for the aluminum industry. The recycling practice, combined with the sustainability awareness that the public has, is the main reason why cans are so popular in the food and beverage sectors.

India Aluminium Cans Market Trends:

India is a quickly growing market that is backed by improved manufacturing capacity and health consciousness among consumers. The demand for portable, eco-friendly packaging is growing in the beverage sector. The investments in local production are gradually creating strong supply chains and are also making it easier for the different consumer-oriented industries to switch to aluminum cans.

What Are the Driving Factors of The Aluminium Cans Market in Europe?

Europe is witnessing gradual and slow growth in the markets influenced by the circular economy regulations. Recycling expectations are high in the region, and they dictate the types of packaging that will be used. Smallest standard cans in premium and colorful custom-made formats are the packaging choices that the brands are making. They want to be in the right spot where compliance, convenience, and consumers' choices of beverages equally exist.

Germany Aluminium Cans Market Trends:

Germany is still a key player in the market due to its excellent recycling facilities, which are up to date with what is happening in the industry. The food, beverage, and chemical sectors are the ones that make the strongest demand for the products. The country has a very high sustainability awareness level, and the material circularity aspect is also focused on, so the use of aluminum cans in both industrial and consumer packaging applications is widespread throughout the country.

Aluminium Cans Market-Value Chain Analysis

- Raw Material Sourcing: Getting bauxite and materials used in the aluminum production process, as well as the transport of incoming materials.

Key players: Alcoa, Rio Tinto, BHP - Materials processing and conversion: Changing raw aluminum into can bodies and components that are ready to be used.

Key Players: Novelis, Ball Corporation, Crown Holdings - Logistics and Distribution: The entire process of keeping finished aluminum cans in the right place, moving them, and finally giving them to the clients.

Key Players: DHL, FedEx, XPO Logistics - Recycling and Waste Management of Aluminum Cans: It is the activity of collecting, processing, and reusing aluminum cans after consumption.

Key players: Novelis, Waste Management, Republic Services

Top Companies in the Aluminium Cans Market & Their Offerings:

- Crown Holdings Inc.: Crown Holdings has a design and production of aluminum beverage, food, and aerosol cans of varying sizes and decorative services, besides international supply services.

- CCL Industries Inc.: CCL Industries is a producer of impact extruded aluminum bottles that are shaped, decorated, and specialty packaging with a high level of expertise.

- CPMC Holdings Inc.: CPMC Holdings also manufactures aluminum packaging besides the tinplate and plastic products, hence aiding in the diversification of the packaging requirements of various industries.

Aluminium Cans Market Companies

- Crown Holdings Inc.

- CCL Industries Inc.

- CPMC Holdings Inc.

- Ball Corporation

- Ardagh Group S.A.

- Silgan Containers LLC

- Toyo Seikan Co., Ltd.

- Nampak Ltd.

Recent Developments

-

On 15 January 2025, the Government of India released updated packaging norms urging FMCG and beverage companies to adopt recyclable packaging materials, especially aluminum cans. These regulations are part of the Ministry of Environment's extended producer responsibility (EPR) strategy. The initiative promotes aluminum's infinite recyclability and low carbon footprint. It also aligns with India's roadmap toward achieving a circular economy in packaging by 2030.

-

On 15 January 2025, Ball Corporation, in partnership with Dabur, launched Réal Bites fruit juices in sleek, single-serve aluminum cans. These new cans not only offer extended shelf-life and portability but also appeal to eco-conscious urban youth. The launch supports Dabur's pledge to use 100% recyclable packaging by 2026 and marks Ball's aggressive entry into India's non-carbonated beverage segment.

- On 28 October 2025, Bira91 unveiled its popular craft beer in slim aluminum cans aimed at metro markets and festivals. The company stated that cans reduce transportation weight by 30%, saving fuel and costs. This launch is part of Bira's broader sustainability strategy to become carbon-neutral by 2026, while improving convenience for consumers.

- In August 2024, AkzoNobel unveiled Accelshield™ 300, the next-generation internal coating technology for aluminium cans. It is entirely free of bisphenols, styrene, PFAS, and formaldehyde and surpasses existing industry technologies by offering enhanced corrosion protection, flexibility, and superior sensory performance.

- In December 2024, Dabur partnered with Ball Corporation for recyclable aluminum cans in the Indian market, offering a sustainable and innovative way to enjoy juices. Packaged in 185ml aluminum cans, they cater to on-the-go consumers, offering convenience and a longer shelf life of up to one year, significantly exceeding the typical four to nine months of other packaging formats.

- In May 2024, Estathé, an iconic Italian tea leaf beverage produced by Ferrero Group, partnered with Crown to launch a summer promotion in a 330ml “Sleek” format aluminum can. The partnership between Crown and Ferrero also leverages a sustainable container that supports the circular economy, thanks to aluminum's ability to be recycled endlessly.

- A large number of cans used in the packaging of chilled beverages are aluminum cans. Consumers across the globe prefer these types of cans as compared to plastic bottles. The use of aluminum cans is expected to grow as consumers find this option more refreshing. The demand for aluminum cans is expected to grow across most nations as it helps in meeting the demand of the changing lifestyles of consumers. The availability of various sizes will be a boon for the beverage industry. Hectic lifestyle and busy schedules are some of the reasons why the convenience associated with aluminum cans will provide an opportunity for the growth of the market.The pricing of the product depends on the manufacturing of the product, and the changes in the cost of the raw material will change the price of the product, which will hamper the growth of the market in the coming years. As the consumers are constantly engaged in making use of cost-effective products to reduce the price of the final products

- In the year 2019, for the United States PepsiCo announced replacing the plastic bottles with a better alternative of aluminium cans for Aquafina.

Segments covered in the report

By Product

- 1 Piece cans

- 2 Piece cans

- 3 Piece cans

By Type

- Slim

- Sleek

- Standard

By Capacity

- Up to 200 ml

- 201 to 450 ml

- 451 to 700 ml

- 701 to 1000 ml

- more than 1000 ml

By End User

- Food

- Fruits & Vegetables

- Ready-to-eat

- Meat, Poultry, & Seafood

- Pet Food

- Bakery & Confectionery

- Others

- Beverages

- Alcoholic

- Non-alcoholic

- Pharmaceutical

- Personal Care and Cosmetics

- Paints and Lubricants

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content