Aerosol Cans Market Size and Forecast 2025 to 2034

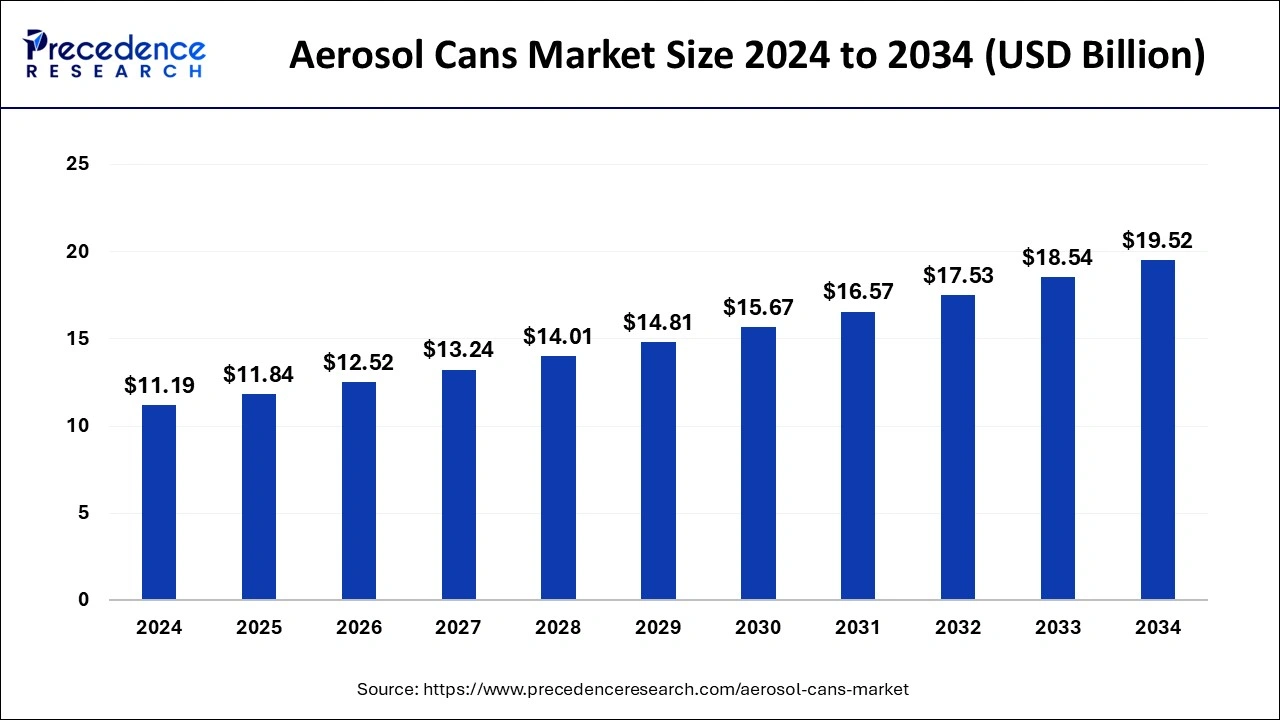

The global aerosol cans market size was estimated at USD 11.19 billion in 2024 and is predicted to increase from USD 11.84 billion in 2025 to approximately USD 19.52 billion by 2034, expanding at a CAGR of 5.72% from 2025 to 2034. The rise in consumers' preference for styling and personal care products with appealing packaging options, such as sprays, dry shampoos, and showers, is expected to spur the sales of aerosol cans in the coming years.

Aerosol Cans Market Key Takeaways

- The global aerosol cans market was valued at USD 11.19 billion in 2024.

- It is projected to reach USD 19.52 billion by 2034.

- The aerosol cans market is expected to grow at a CAGR of 5.72% from 2025 to 2034.

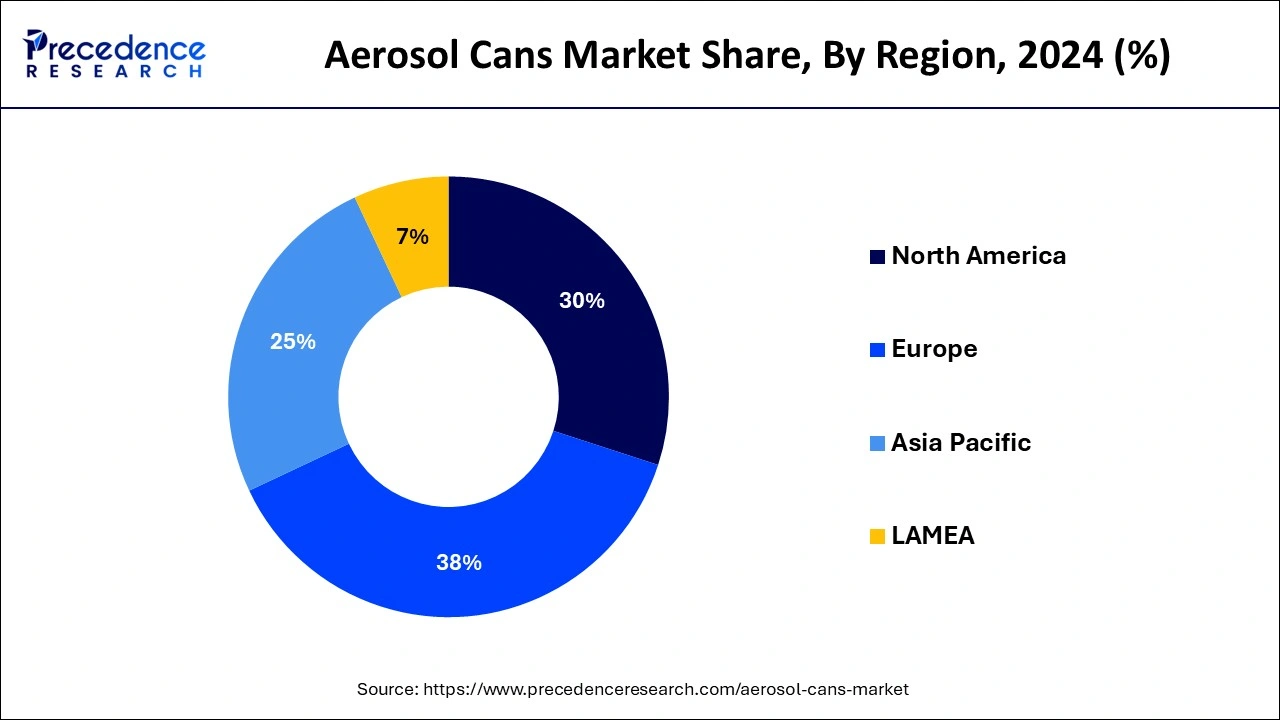

- Europe led the market with the largest market share of 38% in 2024.

- By material, the aluminum segment dominated the aerosol cans market in 2024. and is also expected to sustain its dominance throughout the forecast period.

- By material, the plastic segment is significantly growing over the projected period.

- By product, in 2024, the necked-in segment dominated the market.

- By product, the straight-wall segment is the fastest growing during the forecast period.

- By application, the personal care segment has held the biggest market share of 53% in 2024.

- By application, the homecare segment is observed to grow at the fastest rate during the forecast period.

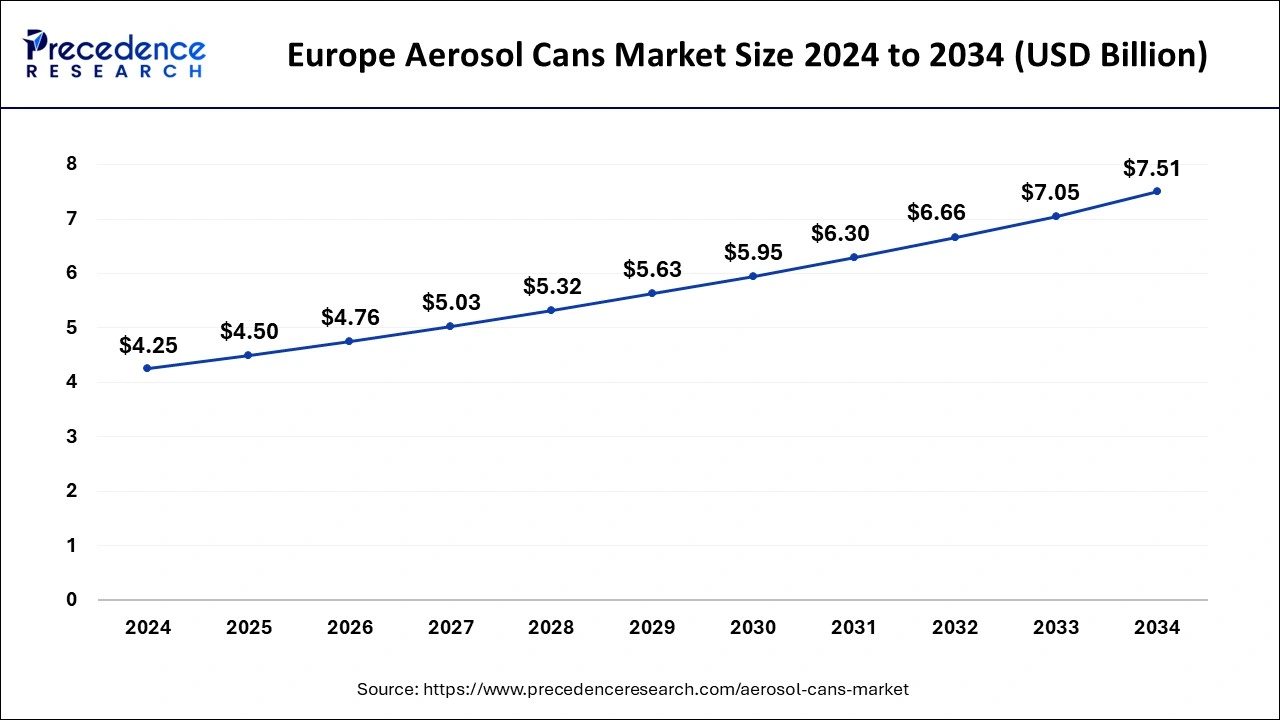

EuropeAerosol Cans Market Size and Growth 2025 to 2034

The Europe aerosol cans market size was estimated at USD 4.25 billion in 2024 and is predicted to hit around USD 7.51 billion by 2034, at a CAGR of 5.86% from 2025 to 2034.

Europe dominated the aerosol cans market in 2024. Europe benefits from a well-established and diverse consumer market that includes personal care, household products, and industrial sectors. The region's leadership in aerosol packaging is driven by stringent environmental regulations and a strong focus on sustainability. Key countries like Germany, France, and the United Kingdom play significant roles in fostering innovation and sustainability efforts within the aerosol packaging industry. European consumers appreciate the convenience and precision offered by aerosol packaging while prompting manufacturers to invest in eco-friendly materials and propellants to address environmental concerns by delivering user-friendly packaging solutions across various industries.

- In September 2023, Beiersdorf a German personal care company reduced the carbon footprint of deodorant aerosol cans by 58% by using recycled aluminum and a lighter design, Beiersdorf was able to reduce the CO2 emissions of the deodorant aerosol cans it produces in Leipzig, Germany.

North America is the second-largest marketplace for aerosol cans. In North America, a diverse consumer base values convenience and practicality in their everyday routines. Aerosol can meet this demand by offering convenient and portable packaging solutions for a wide range of products, including personal care items, household cleaners, and automotive products. The United States plays a significant role in boosting market growth, with a robust presence of manufacturers and consumers across various sectors such as personal care, healthcare, household goods, and automotive products.

Asia Pacific is the fastest-growing region during the projected period. The region is experiencing a surge in demand for personal care, household care, and automotive products, which drives the growth in the aerosol cans market. Countries like China and India are at the forefront of this trend, benefiting from their flourishing economies and increasing disposable incomes. China stands out as the world's largest consumer of personal care products, driving substantial growth in the aerosol cans sector. Similarly, India's expanding automotive sector and growing emphasis on personal grooming are contributing to the rising demand for aerosol cans in the region.

Market Overview

An aerosol can is a container that holds liquid or fine particles, usually under pressure. When you press the valve, it releases a spray or mist. These cans are used for products like deodorant, paint, hairspray, and household cleaners. They're made from recyclable materials, so people can easily recycle them. This aligns with the growing focus on eco-friendly packaging. The global trend toward environmentally friendly packaging is making the market for metal aerosol packaging more competitive. Moreover, suppliers and brands are working to create packaging that's both environmentally responsible and eye-catching on store shelves. There's also a rising demand for aerosol cans because of the high number of people, especially older individuals, with respiratory issues like asthma.

Aerosol Cans Market Growth Factors

- A growing trend among the young and aged population for the use of beauty products like fragrances, haircare, etc. are driving the growth of the aerosol cans market.

- High incidence of asthma and respiratory diseases among the aging population is stirring the demand for aerosol cans.

- The rising demand for eco-friendly packaging materials can further boost market growth.

- The launch of aluminum aerosol cans is expected to fuel the global need for aerosol cans shortly.

- Technological advancements in low-VOC propellants can drive the growth of the aerosol cans market in upcoming years.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.72% |

| Market Size in 2025 | USD 11.84 Billion |

| Market Size by 2034 | USD 19.52 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Product Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Sustainability initiatives can drive market growth

The cans industry is playing a vital role in supporting sustainability efforts across businesses. Manufacturers are actively engaging in sustainability initiatives to meet consumer demands and regulatory standards. These cans are made from lightweight and durable materials, which are highly recyclable, thus can reduce environmental impact and waste in landfills. Some companies are even exploring innovative options like using bio-based propellants sourced from renewable resources, offering a greener alternative to traditional ones. These initiatives not only lower the carbon footprint of cans but also demonstrate the industry's commitment to environmental conservation on a broader scale.

- In June 2023, APS unveiled twistMist, a twist-activated, propellant-free, reusable aerosol technology. TwistMist is a continuous dispensing technology that eliminates the need for pressurized tinplate, aluminum, or plastic cans and allows brands to switch to recyclable plastics (HDPE, PET), metal, or glass bottles.

Restraint

Strict regulations on hazardous waste disposal

Strict regulations on hazardous waste disposal, especially regarding volatile organic compounds (VOCs) found in traditional propellants, are driving the demand for eco-friendly alternatives in aerosol cans. Concerns about air pollution and health risks are prompting consumers and manufacturers to shift towards recyclable materials like aluminum or steel, which can impact the industry's growth. Additionally, lack of awareness about the convenience of aerosol cans for on-the-go use and concerns about misuse or accidents are also affecting consumer perception and market growth.

Opportunity

Growing demand from the cosmetics and personal care industries

Customers appreciate the convenience and precision of aerosol cans, which are widely used for packaging various cosmetic products such as body sprays, deodorants, and hairsprays. The compact and user-friendly design makes them popular for travel purposes. Cosmetic manufacturers often utilize aerosol packaging for innovative product formulations like foams and mousses, meeting evolving consumer preferences.

Furthermore, aerosol cans offer excellent branding opportunities due to their customizable appearance and labeling options, by enhancing product visibility and sales. With their airtight and sealed packaging, aerosol cans help extend the shelf life of cosmetics by protecting them from external impurities and ensuring product effectiveness and purity.

- In September 2023, Aptar Beauty launched a range of overlap-free aerosol actuators. The new range of aerosol actuators has been designed to eliminate the need for an overlap. The innovation was made possible thanks to intuitive locking and unlocking technology, dubbed twist-to-lock.

Material Insight

The aluminum segment dominated the aerosol cans market in 2024and is also expected to sustain its dominance throughout the forecast period. Aluminum aerosol cans have become widely favored across industries for their outstanding qualities. Their lightweight nature, corrosion resistance, and superior barrier properties make them ideal for preserving the integrity and prolonging the shelf life of various products. As a result, aluminum cans are the preferred packaging option for personal care items, household goods, and food products. In the global aerosol cans market, the aluminum segment dominates in terms of market size, holding a significant share of the global market.

- In June 2022, Ball Corp. launched a low-carbon footprint aluminum aerosol can. The sustainable aluminum aerosol can is made with up to 50% recycled content and will be available to customers around the world.

The plastic segment is observed to grow significantly over the projected period. Plastic cans serve as a specialized segment in the market, catering to products like insect repellents, air fresheners, or specialty coatings. Their lightweight and durable nature akes them a preferred choice for certain applications, because of the added safety benefits due to their shatterproof properties. The selection of plastic cans is usually dictated by the product's unique requirements and consumer preferences for packaging that is both lightweight and recyclable.

Product Insights

The necked-in segment dominated the aerosol cans market in 2024. Necked-in cans feature a slender neck design at the top, rendering them suitable for a wide array of products such as personal care items, household cleaners, and industrial aerosols. Their construction enables precise dispensing of contents, minimizing wastage and providing controlled application. Manufacturers frequently opt for necked-in cans when their products necessitate accurate dosage, highlighting the segment's appeal due to its adaptability and extensive use across various industries.

The straight-wall segment is observed to be the fastest growing during the forecast period. The advantage of straight wall cans over domed or waisted cans of similar size lies in their ability to accommodate a larger filling volume. This feature is particularly beneficial for products intended for extended use or larger quantities. the straight wall design enhances the user experience by providing a comfortable grip while using the can, by improving usability.

Application Insights

The personal care segment dominated the aerosol cans market in 2024. The personal care sector holds a prominent position in the aerosol packaging market, primarily due to the rising demand for aerosol packaging across cosmetics, skincare, and hair care industries. As consumers increasingly prioritize personal grooming and beauty routines, they favor packaging solutions that offer convenience and efficiency. Aerosol cans excel in providing precise and controlled dispensing, ensuring user-friendly application and prolonged product freshness, thus making them highly favored for a diverse array of personal care items. This segment is expected to experience significant growth shortly, driven by various factors.

- In April 2022, Sidel launched Pressure SAFE, a PET aerosol container suitable for home and personal care products, which is approved for recycling in traditional PET streams and reportedly offers a lower carbon footprint than aluminum alternatives.

The homecare segment is observed to grow at the fastest rate in the aerosol cans market during the forecast period. Aerosol cans are widely utilized for household products, including air fresheners, furniture polish, cleaning solutions, insect repellents, and oven cleaners. These cans are preferred for household use because they are convenient and enable even and efficient distribution of these products.

Aerosol Cans Market Companies

- Aero-pack Industries Inc.

- Ardagh Group S.A.

- Arminak & Associates, Inc.

- Alcon Public Company Limited

- Ball Corporation

- Bharat Containers

- CCL Containers

- Colep

- Crown Holdings Inc.

- DS Containers Inc.

- Exal Corporation

- Jamestrong Packaging

- Nampak Ltd.

- Spray Products

- WestRock group

Recent Developments

- A joint venture agreement was signed in October 2023 between Colep and the Envases Group to build an aerosol packaging plant in Mexico. Based on a 50/50 stake, the transaction will entail an initial investment of about $30 million spread over two years.

- Ball Corporation introduced a new aluminum can with a low carbon footprint in June 2022. The new cans include low-carbon aluminum that was smelted with the use of renewable energy sources, like hydroelectric power, and up to 50% recycled material. The new Ball can maintains all of its strength and structure while being 30% lighter than a typical aluminum can.

- Loryma introduced Lory Starch Opal, a spray-on adhesive for seeds and other culinary seasonings that are used for decoration, in October 2022. Pregelatinized wheat starch is used to make the spray, which emphasizes solubility to make application easier.

Segments Covered in the Report

By Material

- Aluminum

- Steel

- Plastic

- Other

By Product Type

- Straight Wall

- Necked In

- Shaped

By Application

- Personal Care

- Home Care

- Industrial

- Pharmaceutical

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content