What is the Ammonium Acetate Market Size?

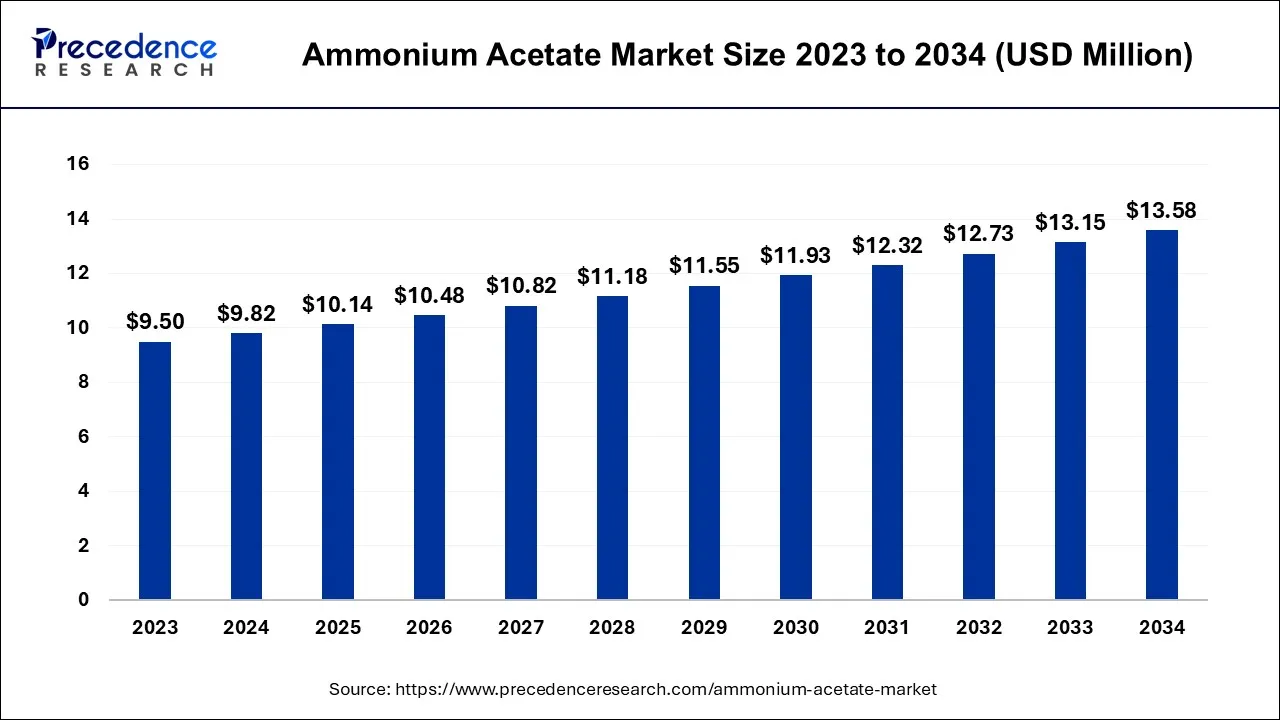

The global ammonium acetate market size is accounted at USD 10.14 billion in 2025 and predicted to increase from USD 10.48 billion in 2026 to approximately USD 13.58 billion by 2034, expanding at a CAGR of 3.3% over the forecast period from 2025 to 2034.

Ammonium Acetate Market Key Takeaways

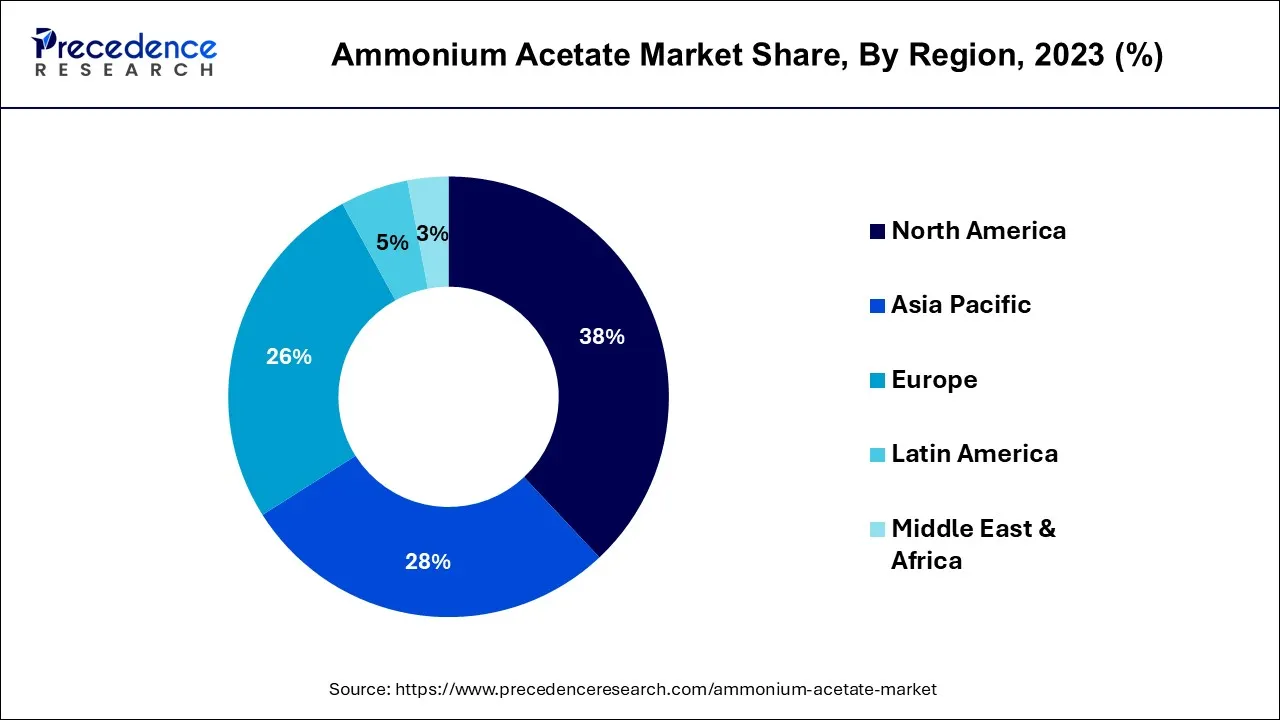

- By region, North America contributed more than 38% of revenue share in the ammonium acetate market in 2024. On the other hand, the Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Grade, the medical grade segment has held the largest market share of 36% in 2023. Meanwhile, the food grade segment is anticipated to grow at a remarkable CAGR of 3.5% between 2025 and 2034.

- By Application, the fertilizers segment generated over 25% of revenue share in 2024. On the other hand, the other segment is expected to expand at the fastest CAGR over the projected period.

- By Sales Channel, the medical & pharmaceutical segment had the largest market share of 32% in 2034. Meanwhile, the other segment is expected to expand at the fastest CAGR over the projected period.

Ammonium Acetate Market Overview: The Market Snapshot

The ammonium acetate market is a chemical industry segment involving the production, sale, and utilization of ammonium acetate, a white crystalline salt with diverse applications. It serves as a source of acetate ions and is used in laboratory settings, agriculture as a nitrogen source, and in chemical processes like dyeing and electroplating. The market's dynamics are influenced by factors like demand in research and industrial applications, agricultural practices, and the overall chemical industry trends. Prices and availability fluctuate based on supply and demand, with manufacturers, distributors, and end-users driving the market's growth and stability.

Ammonium Acetate Market Growth Factors

- Ammonium acetate, a pivotal player in the realm of mass spectrometry and analytical chemistry, is increasingly sought after as the scientific community intensifies research and development efforts in the pharmaceutical, biotechnological, and environmental domains. This escalating quest propels the market to new heights.

- The chemical sphere revels in ammonium acetate's multifaceted contributions, be it in the vivid dyeing of textiles or the meticulous world of electroplating. An upsurge in these industries, driven by technological innovations and consumer demand, is a linchpin for the ammonium acetate market's expansion.

- The market benefits from a heightened consciousness about eco-friendliness and sustainability, with ammonium acetate being favored for certain applications due to its diminished ecological footprint. This environmentally conscious shift augments the market's upward trajectory.

- Ammonium acetate's global footprint is expanding, with emerging nations expressing greater interest in its myriad applications. This geographical diversification begets fresh possibilities and a broader clientele, fostering market growth.

- Ingenious pricing strategies and inventive product formulations, such as the advent of granulated ammonium acetate, empower manufacturers to cater to diverse industries and applications, heightening competitiveness and stoking market growth.

- Ammonium acetate dovetails into the principles of green chemistry, an ethos that advocates environmentally responsible and sustainable chemicals. This alignment beckons industries committed to eco-sensitive practices, serving as a robust impetus for market growth.

Ammonium Acetate Market Outlook: The Emerging Opportunities

- Industry Growth Overview: The growing demand for ammonium acetate across pharmaceutical, agriculture, and food processing is contributing to the industrial growth of the market.

- Major Investors: Large institutional asset management firms and private equity firms are the major investors in the market.

- Startup Ecosystem: The development of green sustainable production methods and discovering new applications is the focus of the startup ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.14 Million |

| Market Size by 2034 | USD 13.58 Million |

| Market Size in 2026 | USD 10.48 Million |

| Growth Rate from 2024 to 2034 | CAGR of 3.3% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Grade, By Application, and By Sales Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Scientific research and analytical applications

Scientific exploration and analytical applications function as the preeminent ignition for the surge in the ammonium acetate market, an escalation intrinsically linked to its inescapable role in amplifying and progressing the techniques that underlie a myriad of scientific fields. In the intricate realm of mass spectrometry and analytical chemistry, ammonium acetate occupies a pivotal niche, orchestrating the preparation and ionization of samples, thus facilitating the precise scrutiny of intricate molecular structures. Its seamless alignment with liquid chromatography-mass spectrometry (LC-MS) methodologies remains a distinctive hallmark, enabling the meticulous quantification of a wide spectrum of compounds, including pharmaceuticals, biomolecules, and environmental contaminants.

The insatiable pursuit of scientific ingenuity and the ever-expanding yearning for impeccable research results drive an unwavering demand for ammonium acetate. As researchers persistently push the frontiers of knowledge in sectors such as pharmaceuticals, biotechnology, and environmental sciences, the ammonium acetate market not only thrives but transgresses the confines of scientific inquiry, ushering in unprecedented applications and spreading its influence across an array of research domains.

Restraint

Environmental concerns

Environmental concerns are emerging as a significant restraint on the growth of the ammonium acetate market. While ammonium acetate is considered relatively eco-friendly in specific applications, it may not align with increasingly stringent environmental regulations and sustainability objectives in various regions. One primary concern is its potential contribution to soil and water contamination when used in agriculture. The runoff of excess ammonium acetate can result in increased nitrogen levels in water bodies, causing ecological imbalances and posing risks to aquatic ecosystems.

Additionally, the disposal of ammonium acetate and its byproducts requires careful consideration to prevent harm to the environment. Handling and storage procedures must comply with safety and environmental regulations, increasing operational costs for manufacturers.

Furthermore, the carbon footprint associated with ammonium acetate production can be a concern, especially if manufacturing processes rely on energy-intensive methods. As environmental regulations continue to evolve and become more stringent, the ammonium acetate market may face obstacles in ensuring compliance and maintaining environmentally responsible practices, potentially limiting its market access and growth opportunities.

Opportunity

Biotechnology and pharmaceuticals

Biotechnology and pharmaceuticals are catalysts for the growth of the ammonium acetate market, providing lucrative opportunities. The pivotal role of ammonium acetate in mass spectrometry and analytical chemistry is paramount for drug discovery, analytical research, and pharmaceutical development. It serves as an essential reagent in sample preparation, facilitating the accurate analysis of complex biomolecules and pharmaceutical compounds.

As these industries continue to expand and innovate, the demand for high-purity ammonium acetate remains robust. The development of cutting-edge drugs and biotechnological advancements relies on precise and reliable analytical methods, where ammonium acetate plays a crucial part. Opportunities arise from the continuous quest for innovative pharmaceuticals, the need for efficient quality control, and the drive for accurate biomarker identification. This demand encourages market growth and creates avenues for ammonium acetate manufacturers to supply high-quality reagents, supporting the ever-evolving biotechnology and pharmaceutical sectors.

Grade Insights

According to the grade, the medical grade segment has held a 36% revenue share in 2024. The medical grade segment holds a significant share in the ammonium acetate market due to its critical role in pharmaceutical and medical research. Ammonium acetate's high purity and consistency are vital in analytical chemistry, particularly in mass spectrometry, making it indispensable for drug development and biomarker analysis.

The global focus on healthcare and the increased demand for pharmaceuticals, especially during the COVID-19 pandemic, have amplified the need for reliable and high-quality reagents. As a result, the medical grade segment has become a major driver of the ammonium acetate market, meeting the stringent requirements of the pharmaceutical and healthcare sectors.

The food grade segment is anticipated to expand at a significant CAGR of 3.5% during the projected period. The preeminence of the food-grade segment within the ammonium acetate market can be attributed to its pivotal position in a myriad of food and beverage applications. As a verified, safe, and compliant food additive, it enjoys a distinct advantage. This grade of ammonium acetate has secured regulatory approvals for its deployment in the realm of food processing, rendering it a preferred choice.

Its primary function involves acting as an acidity regulator and pH modulator, significantly enhancing the preservation and sensory characteristics of food products. Furthermore, its environmentally friendly and non-toxic attributes seamlessly resonate with the surging consumer demand for sustainable and secure food ingredients, further solidifying its dominance in this specific market domain.

Application Insights

Based on the application, the fertilizers generator segment is anticipated to hold the largest market share of 25% in2024. The prominence of the fertilizers segment in the ammonium acetate market is attributed to the indispensable role ammonium acetate plays in revolutionizing modern agricultural practices. It serves as a pivotal nitrogen source in fertilizers, fostering not only enhanced crop yields but also the adoption of sustainable and eco-conscious agricultural methods.

In an era of global population expansion and heightened demands for food security, ammonium acetate's reputation for environmental friendliness aligns harmoniously with the imperative for sustainable farming. Thus, it stands as a substantial force in the fertilizer industry, and its eco-friendly attributes substantiate its significant share within the ammonium acetate market.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The other segment holds significant growth in the ammonium acetate market due to the compound's versatility. This catch-all category encompasses a wide range of applications beyond the more defined sectors, including niche uses in research, chemical processes, and specialized industries. Ammonium acetate's flexibility and compatibility with various processes make it a valuable component in applications not covered by more specific segments, allowing it to cater to diverse and evolving market demands. This adaptability and broad utility in addressing unique needs contribute to the segment's substantial growth in the ammonium acetate market.

Sales Channel Insights

In2024, the medical & pharmaceutical segment had the highest market share of 32% on the basis of the end-use industry. The dominance of the medical and pharmaceutical segment in the ammonium acetate market can be attributed to its indispensable contribution to drug development and analytical chemistry. Ammonium acetate plays a pivotal role in enabling the precise analysis of intricate biomolecules through mass spectrometry and analytical research in the pharmaceutical sector. Given the ongoing evolution and breakthroughs within the pharmaceutical and biotechnology industries, ammonium acetate's high-purity variant remains in unwavering demand.

Its reputation for delivering reliable and precise results in analytical methods underscores its irreplaceable significance in pharmaceutical research, quality control, and biomarker identification, thereby solidifying its prominent standing within this specific end-use sector.

The other segment is anticipated to expand at the fastest rate over the projected period. The others segment holds a substantial share in the ammonium acetate market due to the compound's versatility and wide range of applications that do not fit neatly into specific industry categories. Ammonium acetate finds use in various niche sectors, including food and beverage, construction, and cosmetics, where it serves unique purposes such as pH regulation, chemical processing, and as a buffering agent. This adaptability across diverse industries contributes to the "others" segment's significant market share, demonstrating ammonium acetate's ability to cater to a broad spectrum of specialized needs beyond the primary end-use categories.

Regional Insights

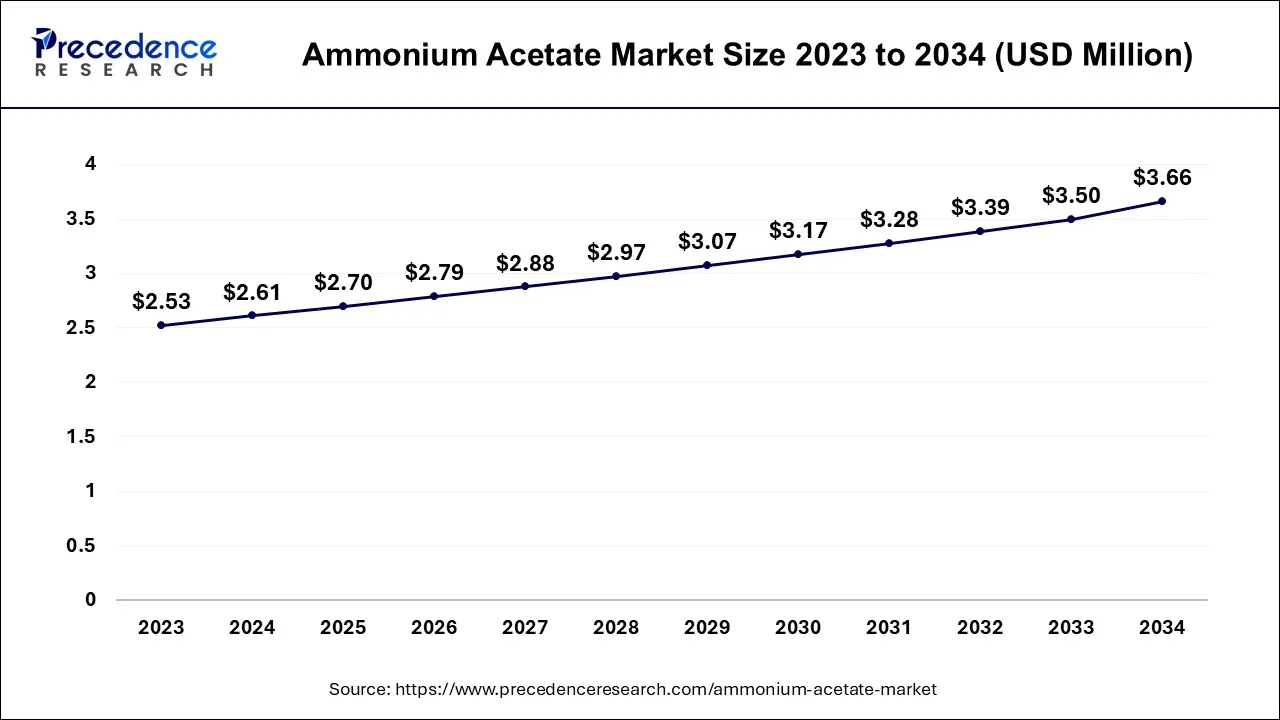

U.S. Ammonium Acetate Market Size and Growth 2025 to 2034

The U.S. ammonium acetate market size is accounted for USD 2.70 million in 2025 and is projected to be worth around USD 3.66 million by 2034, poised to grow at a CAGR of 3.44% from 2025 to 2034.

Well-Developed Industries Boost North America

North America has held the largest revenue share 38% in 2024. North America's dominance in the ammonium acetate market can be attributed to several distinctive factors. The region boasts a well-entrenched pharmaceutical and biotechnology sector that heavily relies on ammonium acetate for precision-driven analytical chemistry and cutting-edge research. The region's uncompromising commitment to stringent environmental regulations and its inclination toward environmentally sustainable chemical solutions, like ammonium acetate, further solidify its foothold.

Moreover, the thriving agricultural industry in North America propels the demand for ammonium acetate-based fertilizers. The region's economic prowess, unwavering dedication to research and development endeavors, and a prevailing emphasis on sustainability collectively underpin North America's preeminent position in the ammonium acetate market.

Asia Pacific Driven by Robust Agricultural Sector

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific's growth in the ammonium acetate market is primarily due to its robust agricultural sector and burgeoning industrial activities. The region's extensive agricultural practices rely on ammonium acetate-based fertilizers, driving consistent demand. Moreover, Asia-Pacific's rapidly expanding pharmaceutical and chemical industries employ ammonium acetate extensively in research and production, further boosting consumption.

The region's cost-effective manufacturing capabilities, coupled with its growing population and urbanization, make it a key market for ammonium acetate. Additionally, the presence of several ammonium acetate manufacturers in the region strengthens its market share, as it cater to both domestic and international markets, consolidating its leadership position.

Advanced Industries Propel U.S.

The presence of advanced industries is increasing the demand for ammonium acetate for R&D purposes. They are also being used in institutions for experimental activities, where the industries are offering high-quality chemicals. Advanced technologies are also accelerating their production and maintaining their quality.

Expanding Industries Fuel India

The expanding industries in India are increasing the demand for ammonium acetate. They are being used in the development of drug products and food additives. Moreover, their affordable production is increasing their exports, leading to new trade agreements.

Robust Chemical Manufacturing Hubs Shape Europe

Europe is expected to grow significantly in the ammonium acetate market during the forecast period, due to robust chemical manufacturing hubs. This increased the production of specialty-grade and high-purity ammonium acetate for laboratory and analytical purposes. They were also used by the pharma and biotech companies, which comply with stringent regulations, promoting the market growth.

Increasing R&D Activities Facilitates the UK

The growing R&D activities in the pharmaceutical and biotechnology industries are increasing the demand for ammonium acetate in the UK. Additionally, they are also being used in the development of safe food additives, which in turn is driving their production rates. Companies are also focusing on discovering new applications.

Value Chain Analysis

- Feedstock Procurement

The feedstock procurement of ammonium acetate involves the procurement of high-purity acetic acid and ammonia sourced from major chemical suppliers.

Key players: Eastman Chemical Company, Ava Chemicals. - Quality Testing and Certification

Adherence to the purity standard is required in the quality testing and certification of ammonium acetate.

Key players: SGS, Intertek. - Regulatory Compliance and Safety Monitoring

Adherence to the regulatory guidelines to ensure safe handling, disposal, and storage of the ammonium acetate is involved in its regulatory compliance and safety monitoring.

Key players: Sigma-Aldrich, Vinipul Chemicals.

The Ammonium Acetate Market Titans: Key Players' Offering

- Eastman Chemical Company: The company provides raw material, which is acetic acid.

- Niacet Corporation: The company provides sodium and calcium salts of acetic and propionic acids.

- Thermo Fisher Scientific: The company provided ammonium acetate for laboratory and analytical use.

- Merck KGaA: Different grades of ammonium acetate are provided for laboratory purposes by the company.

- Yafeng Chemical: The company provides raw materials for ammonium acetate.

Ammonium Acetate Market Companies

- Eastman Chemical Company

- Niacet Corporation

- Allan Chemical Corporation

- Thermo Fisher Scientific

- Merck KGaA

- Wuxi Yangshan Biochemical Co., Ltd.

- Yafeng Chemical

- Nantong Zhongwang Chemical Co., Ltd.

- CHUTIAN FINE CHEMICAL

- Victor Chemical

- Shandong Minji Chemical Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Tengzhou Tenglong Chemical Co., Ltd.

- Shanxi Hanzhong Dongsheng Tangshen Chemical Co., Ltd.

- Shandong Jiurui New Energy Science and Technology Co., Ltd.

Recent Developments

- In 2022,Victor Chemical's acquisition of Aceto Corporation's ammonium acetate division solidified its position as a leading North American ammonium acetate producer. This strategic move bolstered its standing within the industry and its influence in the North American market.

Segments Covered in the Report

By Grade

- Industrial Grade

- Agricultural Grade

- Medical Grade

- Food Grade

By Application

- Drugs

- Fertilizers

- Pesticides

- Cleaning Products

- Food Additive

- Latex

- Foam Rubber

- Shampoos

- Others

By Sales Channel

- Food & Beverages (Bakery, Dairy, Meat and Others)

- Medical & Pharmaceutical (Patent Drug, Chemical Medication and Others)

- Cosmetics & Personal Care (Hair Care, Skin Care, Body Care and Others)

- Agriculture

- Chemical

- Textile

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting