What is the Ethyl Acetate Market Size?

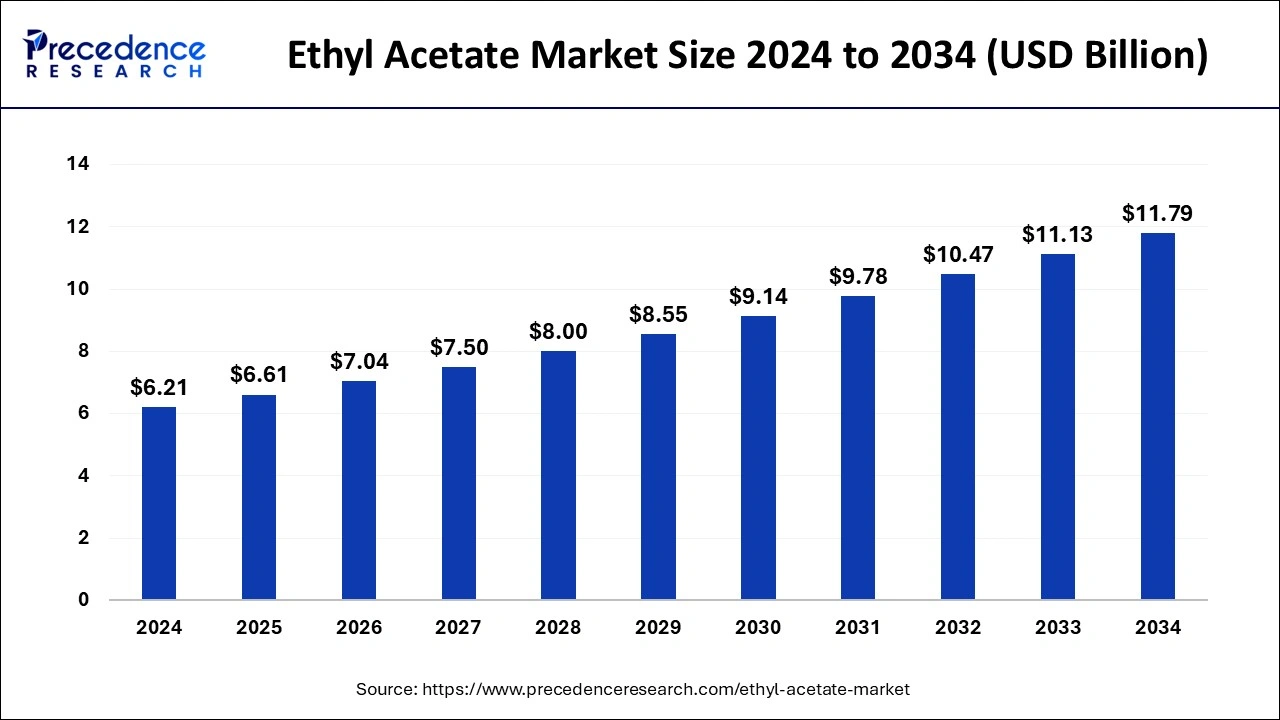

The global ethyl acetate market size is calculated at USD 6.61 billion in 2025 and is predicted to increase from USD 7.04 billion in 2026 to approximately USD 12.45 billion by 2035, expanding at a CAGR of 6.54% from 2026 to 2035. The global ethyl acetate market growth is attributed to the growing automotive and food and beverage industry, along with the increasing shift towards flexible packaging solutions across the world.

Ethyl Acetate Market Key Takeaways

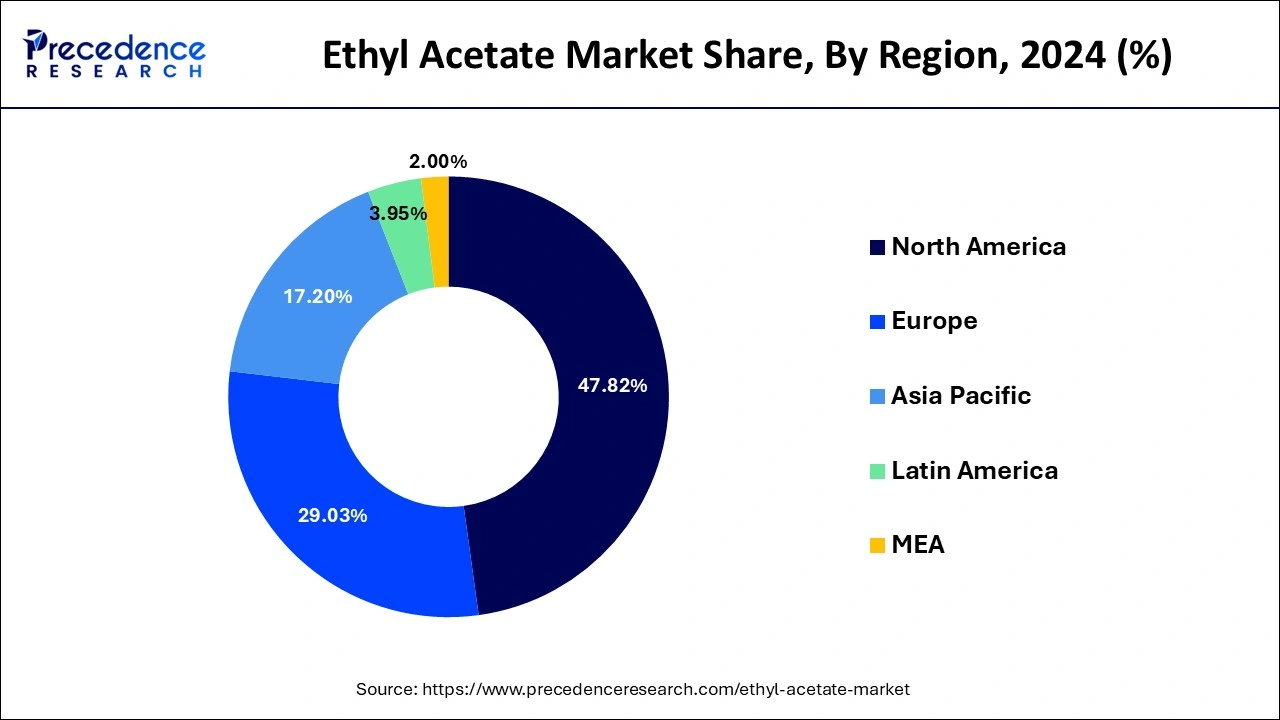

- Asia Pacific dominated the global ethyl acetate market with the largest market share of 47.82% in 2025.

- North America is projected to expand at the notable CAGR during the forecast period.

- By application, the paints and coatings segment contributed the highest market share in 2025

- By application, the process solvents segments is estimated to be the fastest-growing segment during the forecast period.

- By end-user, the automotive segment has held the largest market share in 2025.

- By end-user, the pharmaceutical segments is predicted to be the fastest-growing segment during the forecast period.

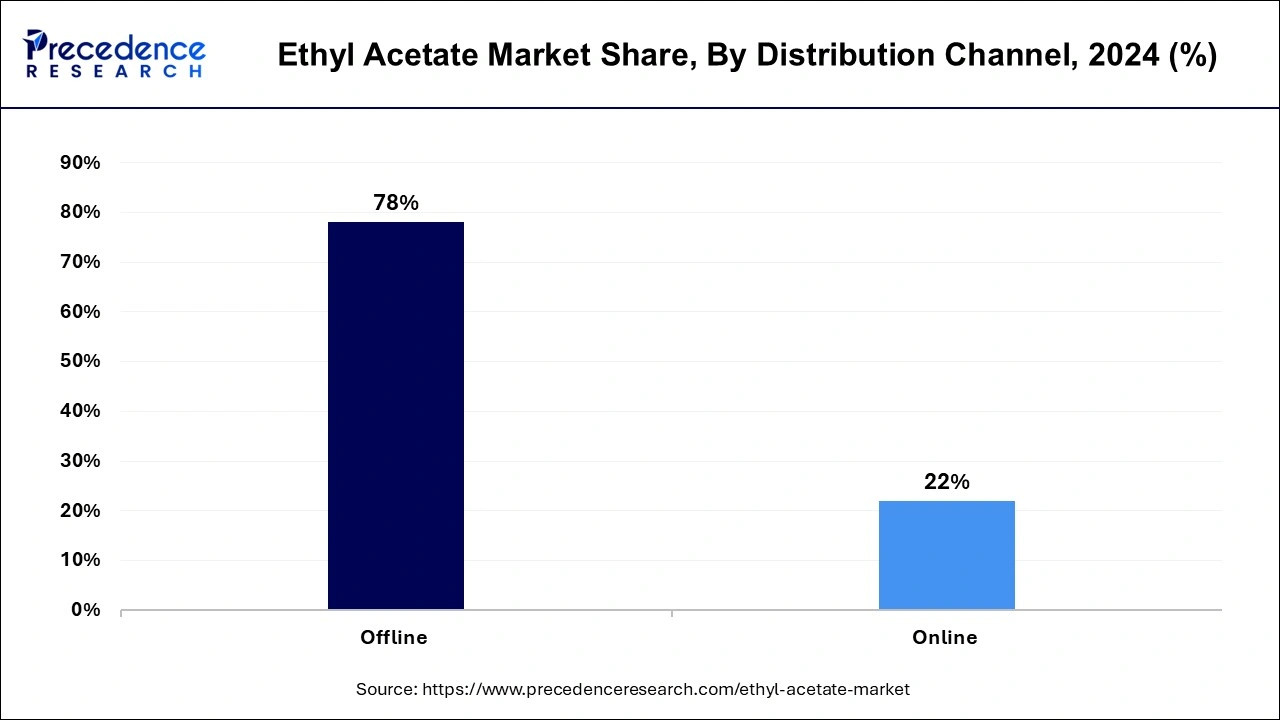

- By distribution channel, the offline segment captured the biggest market share in 2025.

- By distribution channel, the online clinics segment is expected to grow at a significant CAGR from 2026 to 2035.

Market Overview

Ethyl acetate, known chemically as CH3COOCH2CH3, is a versatile chemical compound appreciated for its distinctive fruity fragrance, reminiscent of pears and bananas. This colorless, volatile liquid is widely employed across diverse industries, primarily as a solvent due to its exceptional dissolving capabilities.

In the pharmaceutical, food, and cosmetics industries, ethyl acetate serves as a preferred solvent, frequently integrated into the development of varnishes, paints, and nail polish removers. Furthermore, it assumes a critical role in the synthesis of flavors and fragrances, enhancing their captivating aromas. Beyond that, it is instrumental in extracting essential oils from plant materials and serves as a flavor enhancer in the culinary field. While deemed safe for consumption in small quantities, ethyl acetate's significance reaches well beyond its delightful aroma, as it plays a vital role in countless chemical processes and industrial applications, thanks to its remarkable properties as an efficient solvent and versatile organic compound.

How AI is Revolutionizing the Ethyl Acetate Market?

Artificial intelligence is revolutionizing various industries, and the chemical industry is no exception. The ethyl acetate industry is transforming rapidly with the integration of artificial intelligence. AI can improve production stages in the chemical industry, such as safety monitoring, failure prevention or prediction, process improvement, and quality control. Advanced AI technologies can control the variables of complicated reactions, enhancing safety, maximizing yield, and ensuring consistent quality by anticipating complex conditions. AI technologies streamline the drug development procedure, minimizing the trial- and error aspect significantly. By design, while meeting consumers' needs and safety concerns, materials developed through AI are more durable and sustainable. AI in the chemical industry points to a future where innovation, efficiency, and precision are at the forefront and further expected to revolutionize the growth of the ethyl acetate market.

Ethyl Acetate Market Growth Factors

- Significant demand in the food and beverage industry: The rising demand in the food and beverage industries where it is used as a flavoring formulation is driven by consumers from emerging economies in the Asia Pacific, as well as the advent of convenience stores and an increase in the consumption of processed foods.

- Automotive sector expansion: Ethyl Acetate is a prominent component of the automotive paints industry. The rise in the global automotive industry and the growing popularity of electric vehicles are also driving demand in the market.

- Investment in the Pharmaceutical industry: A global push for investment in the pharmaceutical industry, driven by big pharma companies in the United States is also expected to contribute to the demand for ethyl acetate, where it is used for extractions and in some formulations.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 6.62% |

| Market Size in 2025 | USD 6.61 Billion |

| Market Size in 2026 | USD 7.04 Billion |

| Market Size by 2035 | USD 12.45 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Application, By End-Use, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Industrial applications and essential oils extraction

Industrial usage and essential oils extraction play a pivotal role in boosting market demand within the ethyl acetate industry. Ethyl acetate, prized for its versatility, serves as a go-to solvent in a wide spectrum of sectors. Its application in pharmaceuticals, cosmetics, paints, and adhesives is indispensable, given its remarkable solvency and rapid evaporation characteristics, rendering it the preferred choice for a variety of industrial processes.

As these sectors expand, the need for ethyl acetate escalates, as it assumes a fundamental role in the development of a diverse range of products, thus propelling market expansion. Essential oils extraction is another key contributor to the market's surge in demand. As the consumer trend towards natural and herbal products gains momentum, the need for ethyl acetate in extracting essential oils from plant materials has increased. Ethyl acetate is favored for its ability to extract these oils efficiently while preserving their aromatic properties. The growing preference for natural and organic products in various industries further amplifies the demand for ethyl acetate, making it an essential component of the essential oils extraction process and a significant driver of market growth.

Restraint

Price volatility

Price volatility in the ethyl acetate market represents a significant restraint on its growth. This volatility primarily stems from the fluctuating costs of its raw materials, namely ethanol and acetic acid. When the prices of these feedstock experience sudden spikes or drops due to factors such as changes in supply, demand, or geopolitical events, it directly impacts the production cost of ethyl acetate. The price uncertainty in raw materials makes it challenging for ethyl acetate manufacturers to maintain stable pricing for their products.

This, in turn, can make ethyl acetate less attractive to consumers and industries seeking predictability in their procurement costs. Price fluctuations can also disrupt the profit margins of manufacturers, potentially reducing their capacity for research and development or capital investment in expanding production facilities. Additionally, price instability can encourage industries to explore alternative solvents or chemical options, further limiting the market's growth potential. Therefore, managing and mitigating price volatility in raw materials is crucial for sustaining the ethyl acetate market's growth and competitiveness.

Opportunity

Cosmetic product trends and green solvent demand

Cosmetic product trends and the increasing demand for green solvents are creating substantial opportunities within the ethyl acetate market. In the realm of cosmetics, the constant introduction of new beauty and personal care products, including nail polish removers and perfumes, underscores the importance of ethyl acetate as a key ingredient. This positions ethyl acetate to align seamlessly with the dynamic and ever-evolving cosmetic industry. The compound's characteristics, such as its ability to dissolve various substances while providing a pleasant fragrance, make it an attractive choice for formulators looking to meet consumer preferences for both efficacy and sustainability.

Furthermore, the rising demand for eco-friendly and sustainable solutions has spurred the green solvent movement. Ethyl acetate's reputation for having a minimal environmental footprint in comparison to alternative solvents positions it exceptionally well within the growing trend towards eco-friendly choices.

As industries place an increasing emphasis on adopting environmentally responsible options, ethyl acetate emerges as a leading solvent in numerous applications, combining excellent performance with its eco-friendly characteristics. This dual advantage makes ethyl acetate a prominent choice for those seeking to balance efficiency and sustainability in their processes. These combined trends in cosmetics and sustainability position ethyl acetate for substantial market growth, as it satisfies the dual demands of product innovation and environmentally conscious production.

Segment Insights

Application Insights

The paints and coatings segment contributed the highest market share in 2024. Within the ethyl acetate market, the application segment refers to the use of ethyl acetate as a crucial ingredient in formulating various paint and coating products. Ethyl acetate's role in this segment revolves around its function as a solvent, aiding in the even distribution of pigments and resins, which, in turn, contributes to achieving the desired texture and finish in paints and coatings.

Noteworthy trends in this segment include a transition towards low-VOC (volatile organic compound) formulations to comply with environmental regulations, as well as advancements in high-performance coatings that necessitate specialized solvents like ethyl acetate. These trends underscore ethyl acetate's adaptability to evolving industry requirements while upholding a commitment to environmental sustainability.

The process solvents segments is estimated to be the fastest-growing segment during the forecast period. Within the ethyl acetate market, the category pertains to the use of ethyl acetate as a vital component in industrial procedures. This encompasses its role as a solvent in the manufacturing of pharmaceuticals, chemicals, and diverse formulations.

A noticeable trend in the process solvents sector of the ethyl acetate market is the escalating demand for environmentally responsible and sustainable solvents. Given the increasing emphasis on ecological considerations, industries are actively exploring eco-friendly options, with ethyl acetate emerging as an appealing choice due to its comparatively modest environmental impact. Furthermore, its adaptability and efficacy as a solvent continue to propel its adoption across various industrial applications.

End-use Insights

The automotive segment has held the largest market share in 2024.The automotive segment commands a significant share in the ethyl acetate market due to its versatile applications within the industry. Ethyl acetate serves as a crucial solvent in automotive paint formulation, adhesive production, and coatings, meeting the stringent performance requirements of this sector. Additionally, the increasing emphasis on sustainable and eco-friendly practices in the automotive industry aligns well with ethyl acetate's environmentally responsible characteristics. Its ability to balance performance with reduced environmental impact makes it an attractive choice, leading to a substantial presence in the automotive segment of the ethyl acetate market.

The pharmaceutical segments is predicted to be the fastest-growing segment during the forecast period.The pharmaceutical segment commands a significant growth in the ethyl acetate market due to the compound's indispensable role as a solvent. Ethyl acetate's excellent solvency properties, along with its ability to rapidly evaporate, make it a preferred choice for drug formulation and production. In the pharmaceutical industry, precise solvents are vital for ensuring the effective mixing of active pharmaceutical ingredients. Ethyl acetate's performance, safety, and reliability in this regard have solidified its dominant position, driving its substantial market growth and continued demand within the pharmaceutical sector.

Distribution Channel Insights

The offline segment captured the biggest market share of 78% in 2024.The offline distribution channel commands a significant share of the ethyl acetate market due to the nature of the chemical industry. Ethyl acetate is primarily a bulk commodity chemical used in various industrial processes, making it a staple for manufacturers and processors who require substantial quantities. Offline channels provide direct and established relationships with manufacturers, facilitating the reliable and consistent supply of ethyl acetate. Additionally, stringent quality control, technical support, and tailored solutions offered through offline distributors contribute to their dominance in the market, as they cater to the specific needs and requirements of industrial clients in a dependable and personalized manner.

The online segment is anticipated to expand fastest over the projected period.In the ethyl acetate market, the online distribution segment refers to the method of selling and purchasing ethyl acetate products through e-commerce platforms. This distribution channel has witnessed notable trends in recent years, with the industry increasingly embracing online sales channels.

The trend is driven by the convenience of online procurement, access to a broader range of suppliers and products, and the ability to compare prices and specifications easily. As digital platforms continue to evolve, the online segment in the ethyl acetate market is expected to further expand, offering customers a seamless and efficient purchasing experience.

Regional Insights

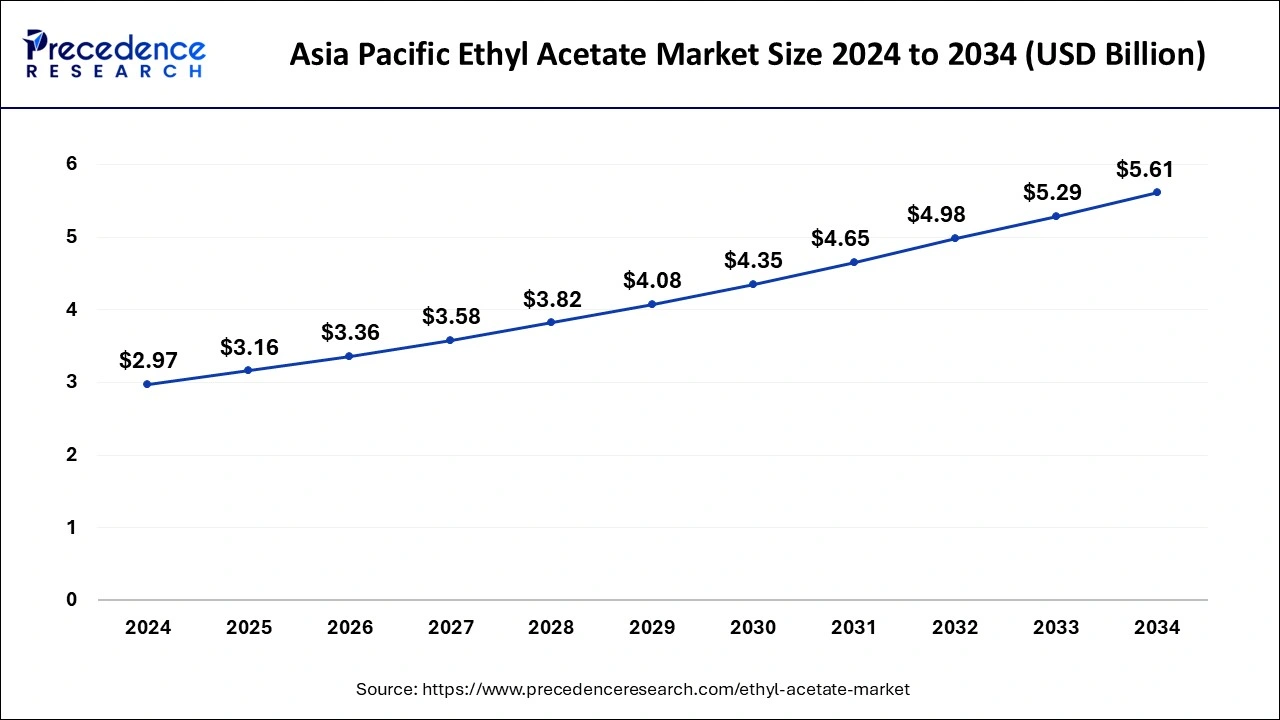

What is the Asia Pacific Ethyl Acetate Market Size?

The Asia Pacific ethyl acetate market size is exhibited at USD 3.16 billion in 2025 and is projected to be worth around USD 5.92 billion by 2035, growing at a CAGR of 6.48% from 2026 to 2035.

Asia Pacific has held the largest revenue share of 47.82% in 2024. The region within the ethyl acetate market encompasses East Asia, Southeast Asia, South Asia, and Pacific Island nations. It commands a leading position in industry, primarily propelled by its strong industrialization and economic expansion. Current trends indicate a growing emphasis on sustainability and eco-friendly practices, fostering the adoption of green solvents such as ethyl acetate. Moreover, the flourishing pharmaceutical, cosmetic, and manufacturing sectors in the region are driving a surge in ethyl acetate demand, solidifying its pivotal role in the global market.

North America is estimated to observe the fastest expansion. North America commands a significant portion of the ethyl acetate market due to several key factors. Notably, the region's well-established pharmaceutical and cosmetics industries drive substantial demand for ethyl acetate, while the thriving automotive sector bolsters its use in coatings and adhesives. North America's commitment to sustainability and eco-friendly solutions aligns well with ethyl acetate's characteristics. Additionally, the presence of advanced manufacturing processes and major industry players reinforces North America's prominent share in the global ethyl acetate market.

Ethyl Acetate Market Companies

- Celanese Corporation

- INEOS Group Holdings S.A.

- Eastman Chemical Company

- Sasol Limited

- Jubilant Life Sciences Ltd.

- Dairen Chemical Corporation

- Chang Chun Petrochemical Co., Ltd.

- Solvay S.A.

- LCY Chemical Corp.

- Daicel Corporation

- Sekab Biofuels & Chemicals

- Jiangsu SOPO Corporation

- Nippon Nyukazai Co., Ltd.

- Ruijia Chemical Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

Recent Developments

- In August 2024, to embrace sustainable innovation. BASF launched bio-based Ethyl Acrylate. This shift enables customers globally to reduce their environmental impact and supports BASF's sustainability goals. The aim behind this launch was to strengthen the company's leadership in promoting eco-friendly solutions.

Segments Covered in the Report

By Application

- Paint & Coatings

- Inks

- Process Solvents

- Pigments

- Other Applications

By End-Use

- Artificial Leather

- Automotive

- Food & Beverage

- Packaging

- Pharmaceutical

- Other End-uses

By Distribution Channel

- Offline

- Online

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting