Spectrometry Market Size and Forecast 2025 to 2034

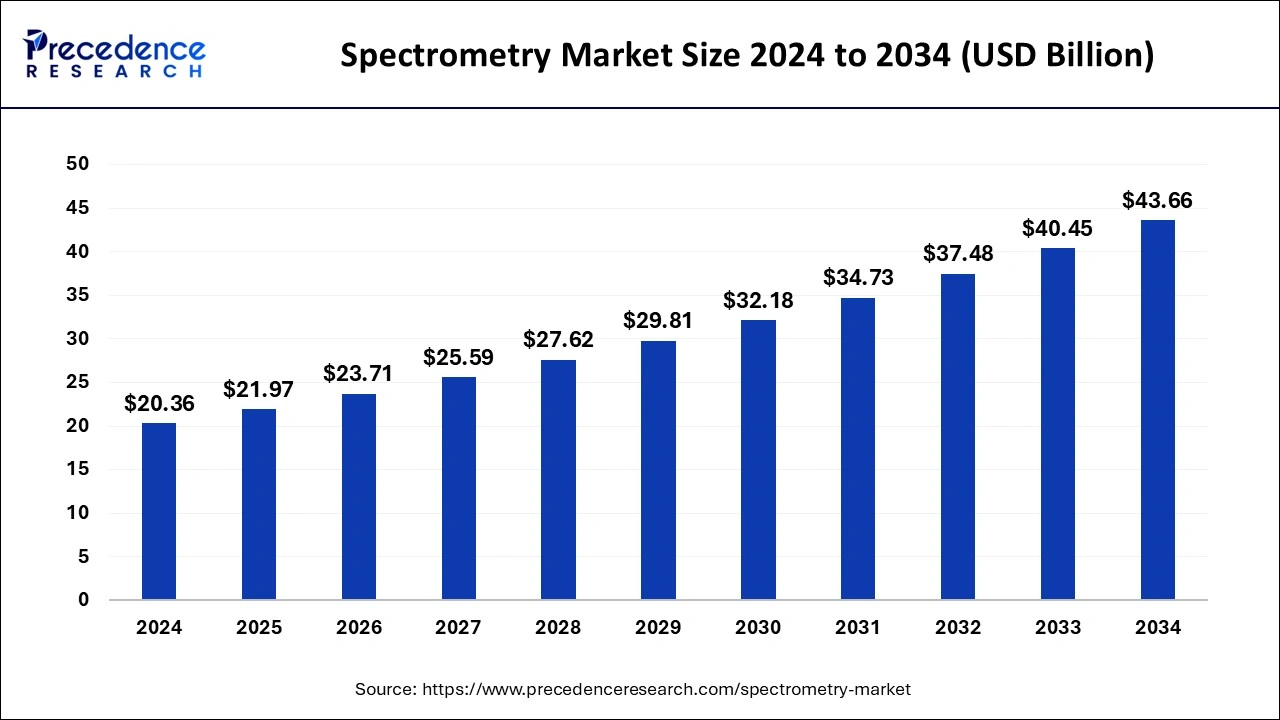

The global spectrometry market size is estiamted at USD 20.36 billion in 2024 and is anticipated to reach around USD 43.66 billion by 2034, expanding at a CAGR of 7.93% between 2025 and 2034. The growing adoption of spectrometry instruments in drug discovery and development drives the growth of the market. Additionally, the increasing demand from the food & beverages industry for quality control of products and detection of contaminations.

Spectrometry Market Key Takeaways

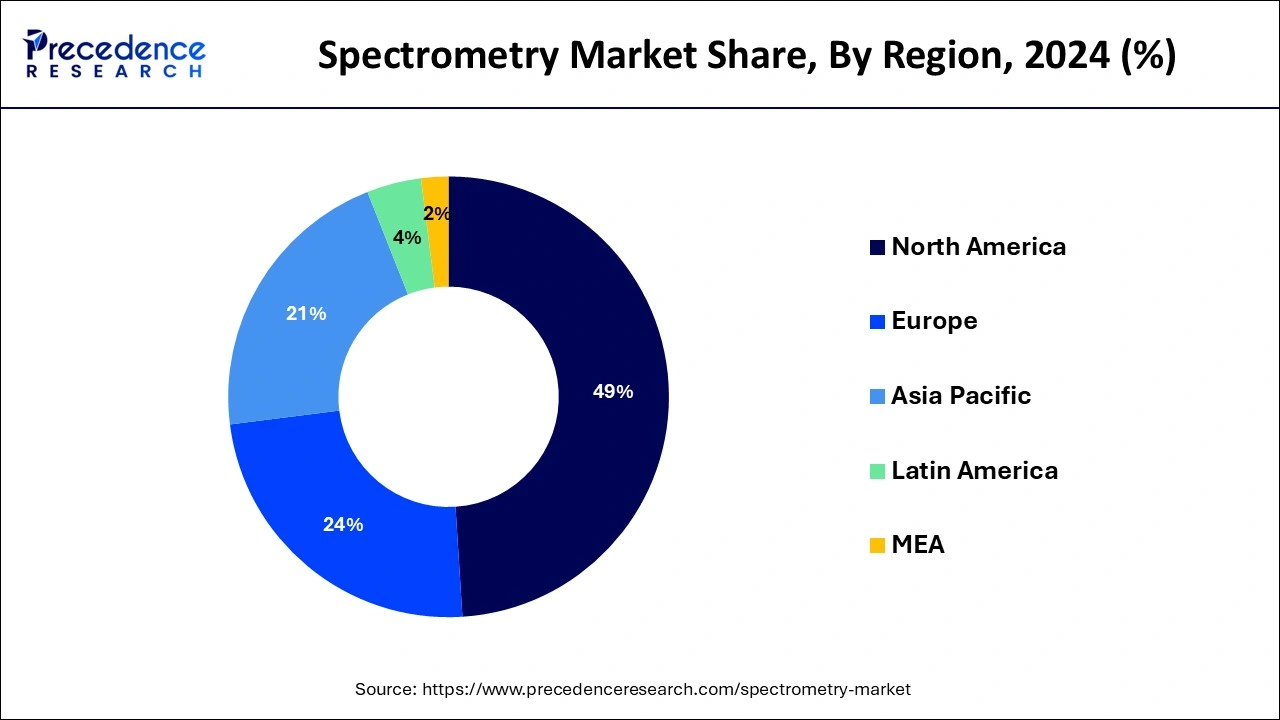

- North America generated more than 49% of revenue share in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By type, the molecular spectrometry segment led the market in 2024.

- By type, the mass spectrometry segment is expected to grow at a rapid pace in the coming years.

- By product, the instrument segment held the largest share of the market in 2024.

- By product, the consumables segment is anticipated to expand at the fastest rate during the projection period.

- By application, the pharmaceutical analysis segment dominated the market in 2024.

- By application, the metabolomics segment is projected to grow rapidly in the near future.

- By end-user, the government & academic institutions segment held the largest market share in 2024.

- By end-user, the pharmaceutical & biotechnology companies segment is anticipated to grow at the highest CAGR during the forecast period.

Impact of AI on the Spectrometry Market

AI has a positive impact on the market. Integrating AI algorithms in spectrometry instruments enables combining mass spectrometry data with other omics technologies, like transcriptomics, metabolomics, and genomics, for the creation of single multi-omics data. This further helps detect protein expression associated with metabolite levels and gene expression changes. AI helps to improve the accuracy of the data analysis process to identify irregularities in spectral data continuously. Several industries like pharmaceuticals and biotechnology are prioritizing AI integration in spectrometry technologies for more accurate results and insights. For instance, integrating AI with surface-enhanced Raman spectroscopy (SERS), a sensitive and specific method for detecting low-concentration substances, advances various fields such as biomedicine, environmental protection, and food safety.

- In June 2024, Agilent Technologies Inc. launched two new products, the 7010D Triple Quadrupole GC/MS System and the ExD Cell for use on the 6545XT AdvanceBio LC/Q-TOF system at the 72nd ASMS Conference on Mass Spectrometry and Allied Topics. The Agilent 7010D Triple Quadrupole GC/MS System targets the food and environmental field and offers precision and sensitivity in gas chromatography-mass spectrometry. On the other hand, the Agilent ExD Cell for use with the 6545XT AdvanceBio LC/Q-TOF system is utilized in the biopharma industry and life science research. These two instruments are integrated with artificial intelligence capabilities.

U.S. Spectrometry Market Size and Growth 2025 to 2034

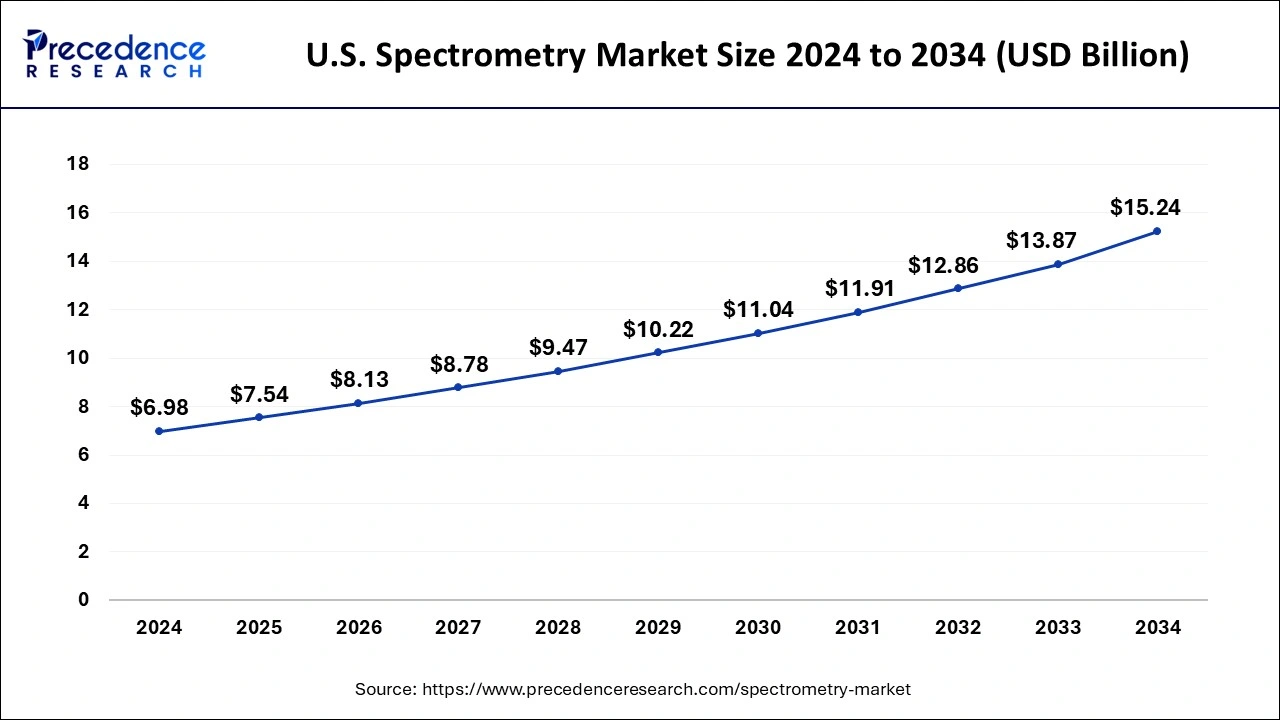

The U.S. spectrometry market size accounted for USD 6.98 billion in 2024 and is predicted to be worth around USD 15.24 billion by 2034, growing at a CAGR of 8.12% between 2025 and 2034.

North America held the largest share of the spectrometry market in 2024. This is mainly due to the availability of advanced spectroscopic products and techniques, favorable government funding for research studies, and sophisticated healthcare infrastructure. Increased awareness about food safety, wide adoption of mass spectrometer instruments in the life sciences, metabolomics, forensics, and petroleum sector, and increasing investments by pharmaceutical players in R&D activities also bolstered the market's growth in the region. The presence of key market players in the region, such as Danaher Corporation, PerkinElmer, Inc., Agilent Technologies, Bruker Corporation, Waters Corporation, and Thermo Fisher Scientific, Inc., is another factor propelled the regional market growth.

Asia Pacific is expected to witness the fastest growth during the forecast period. This is mainly due to the increasing use of spectroscopy, particularly in the areas of food testing, agriculture, pharmaceutical, and environmental testing. Moreover, the rising adoption of mass spectrometry across various industries, increasing government funding for several research programs, increasing investments in R&D by pharmaceutical & biotechnology companies, and growing concerns over food safety contribute to regional market growth.

Market Overview

Spectrometry deals with the measurement of a specific spectrum. Spectrometry is a popularly known measurement method for the interaction between matter and light. The spectrometry market encompasses various types of spectrometers, including mass spectrometers, atomic absorption spectrometers, nuclear magnetic resonance spectrometers, infrared spectrometers, UV-visible spectrometers, and Raman spectrometers, among others. These instruments find applications in diverse industries such as pharmaceuticals, biotechnology, environmental monitoring, food and beverage, oil and gas, and academic research.

Spectrometry Market Growth Factors

- Government Initiatives: Due to the rise in pollution, governments worldwide are taking several initiatives to monitor pollution and environmental testing, which is projected to spur the demand for mass spectrometry.

- Market Competition: Prominent market players are constantly working to advance their existing products and launch innovative mass spectrometers to fulfil the varying demands of end-use industries.

- Technological Advancements: Advanced technologies like tandem mass spectrometry and high-resolution mass spectrometry are gaining immense popularity in the pharmaceutical and biotechnology industries for protein identification, small molecule analysis, and discovery of biomarkers.

- Increased Usage in the Food and Environmental Sectors: Growing concerns about food and environmental safety are major factors boosting the demand for spectrometry devices in the food and environmental sectors. The food sector uses spectrometry instruments to test and control food quality. Similarly, the environmental sector uses spectrometry technologies to monitor air and water quality and contamination risks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.97 Billion |

| Market Size by 2034 | USD 43.66 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.93% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Product, By Application, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rapid growth of the pharmaceutical and biotechnological industries

The exponential growth of the pharmaceutical and biotechnological industries is anticipated to drive the growth of the market. Mass spectrometry is an analytical tool with multiple applications in the pharmaceutical and biotechnological industry. The rising investments in areas such as biopharmaceuticals and customized medicine are expected to fuel research in the pharmaceutical and biotechnology industries. Starting from the initial stages of drug discovery to late-stage development and clinical trials, mass spectrometry plays a crucial role and is essential to pharmaceutical & biotechnological companies.

The increasing demand for new and advanced instruments from the pharmaceutical and biotechnological industries is projected to spur the demand for mass spectrometry. The use of mass spectrometry in proteomics, metabolomics, genomics, and personalized therapies is driving the growth of the spectrometry market. In pharmaceutical and biotechnological companies, some important uses of spectrometry include drug testing, protein testing, raw materials testing, drug discovery, quality assurance of products, and quality control of products. Mass Spectrometry is widely used in research & development activities in pharmaceutical and biotechnological industries owing to its potential to rapidly and accurately quantify and identify molecules.

Restraint

High cost of the instruments

The high cost associated with the spectrometry instruments is projected to limit the adoption of spectrometry. The cost of spectrometry can be too expensive for use in diagnostic clinics and laboratories due to advancements in technology. Technological advancement has increased the cost, which also resulted in the slow adoption of spectrometry instruments in emerging economies. In addition, the high maintenance cost of these devices is likely to limit the expansion of the global spectrometry market during the forecast period.

Opportunity

Increasing use of mass spectrometry in various applications

The rising use of mass spectrometry in various applications such as proteomics, metabolomics, environmental analysis, pharmaceutical analysis, forensic analysis, and others is expected to offer significant opportunities for market expansion during the forecast period. Clinical applications of mass spectrometry include clinical tests, clinical drug development, drug therapy monitoring, disease screening, phase 0 studies, analysis of peptides used for diagnostic testing, and identify infectious agents for specific therapies. The rapid expansion of nano and micro spectrometers is likely to positively influence market growth.

Type Insights

The molecular spectrometry segment led the spectrometry market with the largest share in 2024. This is mainly due to the increased adoption of molecular spectrometry in the pharmaceutical, biotechnology, and forensic science sectors because of its ability to provide detailed molecular information and detect specific molecules. Molecular spectrometry, like visible and ultraviolet spectroscopy, infrared spectroscopy, and nuclear magnetic resonance (NMR) spectroscopy, is majorly applied in pharmaceuticals, biotechnology, food safety, and environmental monitoring. Moreover, increased adoption in the food industry to detect contaminants and adulterants bolstered the segment.

The mass spectrometry segment is expected to grow at a rapid pace in the coming years. Mass spectrometry is widely used for various applications across several industries. Some specific applications of mass spectrometry include food contamination detection, drug testing and discovery, isotope ratio determination, pesticide residue analysis, protein identification, and carbon dating. It is also used in clinical labs to examine small sample volumes across various healthcare applications, from toxicology to customized medicine. The increasing focus on developing precision medicines further fuels segmental growth.

Application Insights

The pharmaceutical analysis segment dominated the market by holding the largest share in 2024. Pharmaceutical analysis includes a set of processes used for identifying, purifying, and quantifying a substance, as well as determining the structure of a compound or isolating components of a mixture. Clinical mass spectrometry is widely used to diagnose metabolism deficiencies and to examine whether enzymes or biomarkers are present and for toxicology testing. The applications of mass spectrometry in pharmaceutical analysis include drug discovery, preclinical development, metabolite screening and distribution, absorption, metabolism, and elimination (ADME) studies.

The metabolomics segment is projected to grow rapidly in the near future. This is primarily due to its increasing usage in disease diagnosis and biomarker discovery. Mass spectrometry-based metabolomics approaches can detect and quantify many metabolite features simultaneously. The increasing focus on personalized medicines and the need for solutions to understand disease mechanisms further contribute to segmental expansion.

Product Insights

The instrument segment accounted for the largest share of the spectrometry market in 2024. This is mainly due to its increased usage in the pharmaceutical and food industries. Spectrometry instruments provide accurate and reliable results, making them suitable for drug and food testing. Stringent regulations regarding drug and food safety further fueled segmental growth. Moreover, increased usage in environmental testing positively boosted the segment.

The consumables segment is anticipated to expand at the fastest rate during the projection period. The increasing demand for high-quality consumables, such as reagents and sample preparation materials, is a major factor boosting the segment's growth. In addition, the rising development of innovative consumables that can enhance instrument performance by reducing analysis time contributes to segmental expansion.

End-User Insights

The government & academic institutions segment dominated the spectrometry market with the largest share in 2024. Government and academic institutions extensively use spectrometry techniques and associated products in their various research studies, contributing to segmental growth. On the other hand, the pharmaceutical & biotechnology companies segment is expected to expand at the highest CAGR during the forecast period owing to the rising investments by pharmaceutical and biotechnology companies in R&D of novel drugs. Mass spectrometry products are crucial in drug development to ensure safety.

Spectrometry MarketCompanies

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- JEOL Ltd.

- FLIR Systems, Inc.

- Endress+Hauser Group

- MKS Instruments, Inc.

- Danaher Corporation

- LECO Corporation

- Kore Technology Ltd.

- AB Sciex, Inc.

- Analytik Jena AG

- Advion

- MassTech

Recent Developments

- In June 2022, Waters Corporation introduced high-resolution Mass Spectrometry products and software to speed up the drug development process. This new launch includes the new Xevo G3 quadrupole time-of-flight (QTof) mass spectrometer, New CONFIRM Sequence app on the waters_connect software platform, Coupling UPLC to Waters MRT SELECT SERIES Research Mass Spectrometer with Electrospray ionization source for Fast Molecular Characterization.

- In June 2022, Bruker Corporation announced the launch of XFlash 7 detector series for its X-ray spectrometer system, QUANTAXTM energy dispersive system. The spectrometer system allows the chemical analysis of material samples with high speed and sensitivity. The XFlash 7 will be used in academic and industrial research which is expected to offer improved analytical performance in a cost-effective way.

- In March 2022,Thermo Fisher Scientific acquired Max Analytical Technologies. The Max Analytical Technologies has created a Fourier-transform infrared spectroscopy-baesd solutions for source testing, ambient air monitoring and process monitoring. Such systems have a wide role in industrial process monitoring, environmental health and safety applications and semiconductor manufacturing.

- In June 2024,Thermo Fisher Scientific, Inc. introduced Thermo Scientific Stellar mass spectrometer (MS), a new solution that combines fast throughput and high sensitivity, further allowing researchers to advance their translational omics research and make more efficient discoveries.

- In October 2024, Waters Corporation introduced a comprehensive set of sample preparation enzymes, reagents, and waters connect software that simplify sequence and modification confirmation of large molecule RNA therapeutics using liquid chromatography-mass spectrometry (LC-MS) analysis.

Segments Covered in the Report

By Type

- Mass Spectrometry

- Molecular Spectrometry

- Atomic Spectrometry

By Product

- Consumables

- Instrument

- Services

By Application

- Pharmaceutical Analysis

- Forensic Analysis

- Proteomics

- Metabolomics

- Others

By End-user

- Government & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content