What is the DNA Diagnostics Market Size?

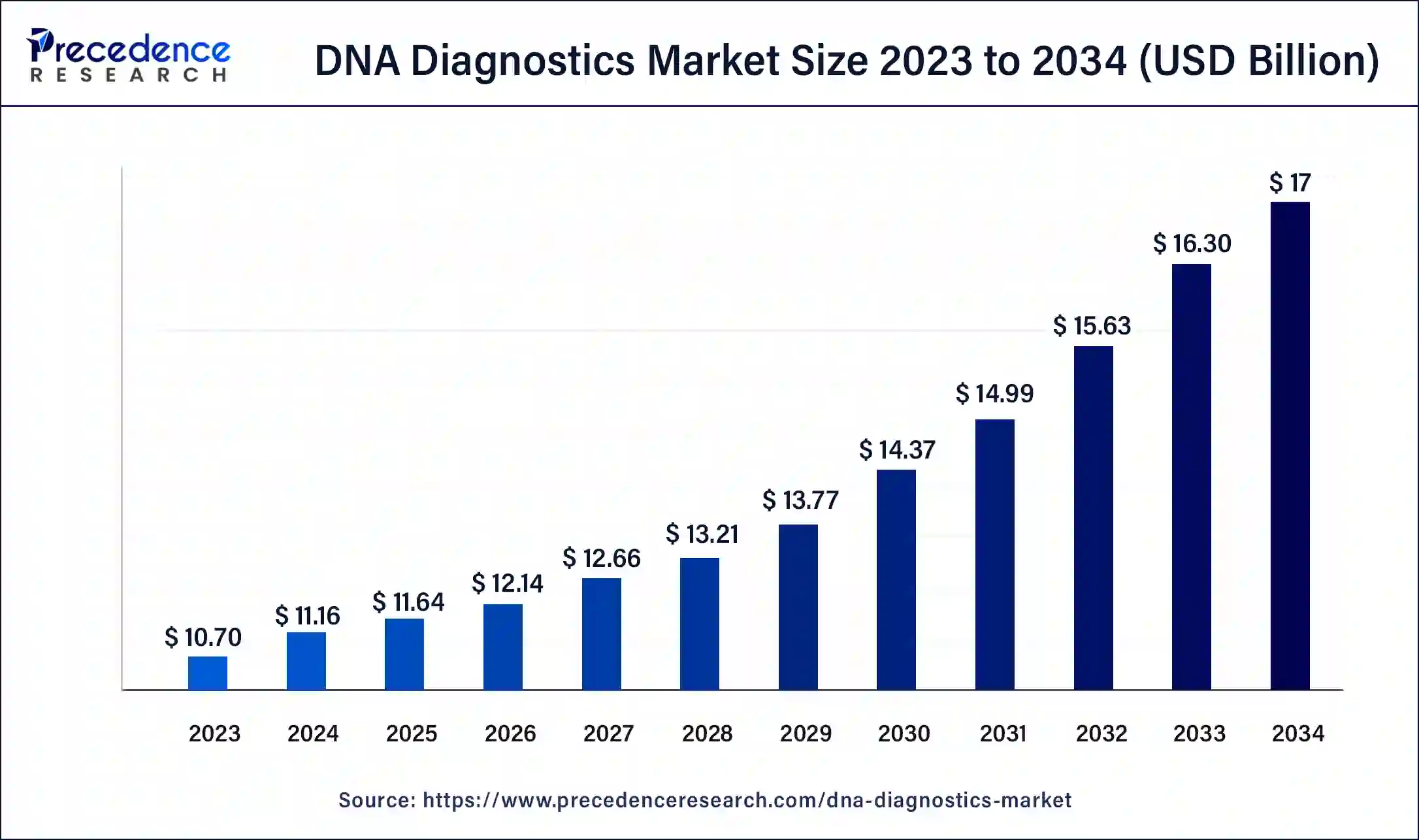

The global DNA diagnostics market size is valued at USD 11.64 billion in 2025 and is predicted to increase from USD 12.14 billion in 2026 to approximately USD 17.78 billion by 2035, expanding at a CAGR of 4.32% from 2026 to 2035. The North America DNA diagnostics market size reached USD 5.01 billion in 2025.

DNA Diagnostics Market Key Takeaways

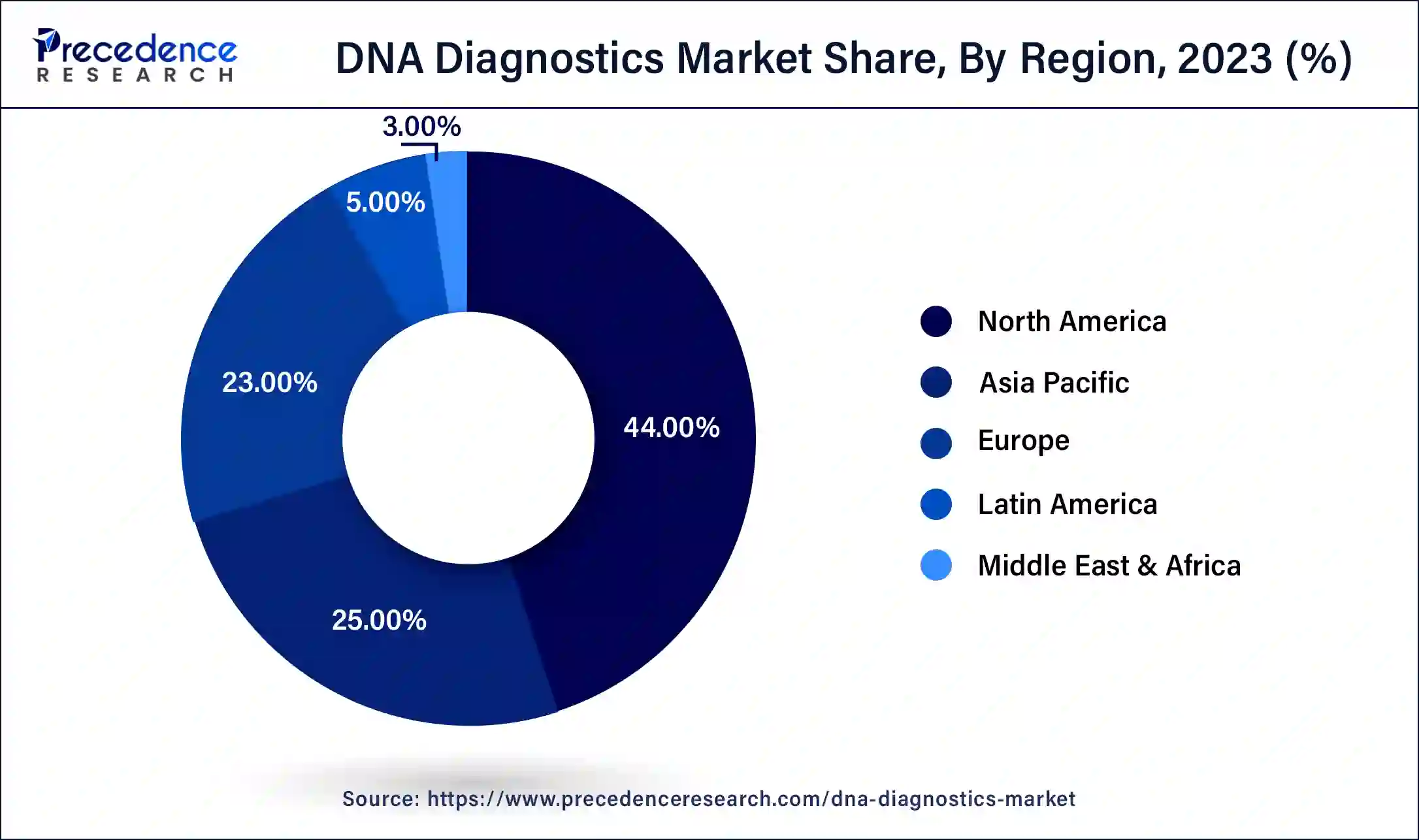

- North America contributed more than 44% of the revenue share in 2025.

- By Technology, the PCR segment has held a revenue share of around 50% in 2025.

- By Product Type, the instruments segment is expected to capture the largest market share over the forecast period.

- By Application, the oncology segment is expected to dominate the market during the forecast period.

- By End-user, the diagnostic center segment is expected to hold the largest market share over the forecast period.

Market Overview

The DNA diagnostics market encompasses a dynamic and rapidly evolving field within the broader realm of molecular diagnostics. It revolves around the analysis and interpretation of an individual's genetic information stored in their DNA (deoxyribonucleic acid). DNA diagnostics have revolutionized various sectors, including healthcare, research, forensics, and personal genomics, by providing insights into genetic traits, disease risks, and ancestry. DNA diagnostics enable the identification of specific genetic variations, mutations, and markers that are associated with various conditions, traits, and diseases. This information is harnessed to make informed decisions about health management, disease prevention, and treatment strategies.

How is AI Influencing the DNA Diagnostics Market?

AI is significantly transforming the DNA diagnostics market by enabling the identification of genetic mutations and subtle data patterns with a level of precision that often surpasses traditional diagnostic methods. This capability is particularly impactful in complex cases, such as rare genetic disorders and various forms of cancer, where conventional analysis is time-consuming and less accurate. By reducing testing times from weeks or days to just hours or minutes, AI facilitates faster clinical decision-making and earlier medical intervention.

DNA Diagnostics Market Growth Factors

Through DNA diagnostics, scientists and medical professionals can uncover specific genetic variations, mutations, and markers that are linked to various medical conditions, inherited disorders, and traits. The rising emphasis on the research and development activities for inherited disorders acts as a major growth factor for the market. By decoding these genetic signatures, individuals can gain insights into their risk factors for certain diseases, better understand their response to medications, and make informed decisions about their health. The market of DNA diagnostics is driven by various factors including growing R&D investments, growing prevalence of cancer, advancements in genomics technologies, rising prevalence of genetic disorders, and many others.

Market Outlook

- Industry Growth Overview: The DNA diagnostics market is expected to grow at a significant rate from 2025 to 2034, driven by rising demand for personalized medicine, growing prevalence of chronic and infectious diseases, advances in sequencing technologies, and increasing healthcare investments.

- Global Expansion: The market is growing worldwide due to rising demand for early disease detection, personalized medicine, and advancements in genomic technologies that enable faster and more accurate testing. Emerging regions present opportunities through expanding healthcare infrastructure, increasing awareness of genetic testing, and a growing prevalence of chronic and hereditary diseases that drive the adoption of DNA-based diagnostics.

- Major Investors: Major investors in the market include leading technology and healthcare corporations such as Roche, Danaher (including Beckman Coulter and Cepheid), Abbott, Thermo Fisher, Illumina, and QIAGEN, as well as private equity and venture capital firms like GHO Capital and NeoTribe Ventures. These investors are driving innovation in areas including sequencing, PCR, and genetic testing platforms.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.64 Billion |

| Market Size in 2026 | USD 12.14 Billion |

| Market Size by 2035 | USD 17.78 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.32% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type, By Technology, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

A growing ageing population and cancer incidence

The growth in the ageing population and cancer incidence is expected to propel the DNA diagnostics market over the forecast period. For instance, according to the Australian Institute of Health and Welfare, the Australian population is ageing, and the likelihood of being diagnosed with cancer rises with age. As more Australians reach old age, the number of cancer cases detected each year rises. Between 2021 and 2031, the Australian population is predicted to grow by 15% and cancer cases (diagnosed) are expected to increase by roughly 22%. DNA diagnostics is observed as a potential method to detect the chances of cancer occurance. As the focus on early detection of cancer rises, the demand for advanced and innovative DNA diagnostics methods grows. Thus, the aforementioned facts are expected to propel the market growth during the projection period.

Restraint

Stringent regulations

Stringent government restrictions are projected to impede the expansion of the global DNA diagnostics industry. The FDA regulates DNA testing in multiple ways, with a critical set of guidelines to be followed. Businesses cannot provide a single product with a label that identifies both approved and forbidden applications, according to the FDA's final recommendation. Such stringent regulatory frameworks and complex guidelines limit developmental activities in the market. thus, the factor is observed to act as a restraint for the market.

Opportunity

Increasing business activities

The increasing business activities among the key market players to broaden their portfolio is expected to offer an attractive opportunity for market growth during the forecast period. For instance, in March 2023, Myriad Genetic, Inc., a pioneer in genetic testing, and Illumina Inc stated that they are intended to increase access to and make HRD testing for oncology more widely available in the US. Illumina TruSight Oncology 500 HRD under a strategic partnership. The enlarged agreement also creates a special companion diagnostic (CDx) alliance for the pharmaceutical sector, enabling further clinical research for gene-based, tailored treatments. Key players in the global DNA diagnostics market are actively participating in multiple business activities, such as collaborations, partnerships and others. This element is expected to offer a significant opportunity for the market.

Segment Insights

Product Type Insights

The instruments segment is expected to capture the largest market share over the forecast period. The DNA diagnostics market relies on a range of sophisticated instruments and technologies to analyze and interpret genetic information accurately. These instruments play a crucial role in various applications, from medical diagnostics to research and forensics. Some of the key instruments commonly used in DNA diagnostics are DNA sequencers, PCR machines, microarrays, mass spectrometers and others. DNA sequencers are central to the process of determining the order of nucleotides in a DNA molecule. Moreover, PCR machines are used to amplify specific DNA sequences, making them easier to detect and analyze.

Real-time PCR machines allow for quantitative analysis of DNA samples, making them essential for applications such as detecting genetic mutations and gene expression levels. Furthermore, DNA microarrays, also known as DNA chips or gene chips, are used to analyze the expression levels of thousands of genes simultaneously. Microarrays are valuable in research and diagnostics, allowing researchers to study gene expression patterns and detect genetic variations. Thus, these applications of instruments drive the market growth over the forecast period.

Technology Insights

The PCR segment is expected to dominate the market during the forecast period. Polymerase Chain Reaction (PCR) is a fundamental molecular biology technique that plays a crucial role in DNA diagnostics, research, and various applications. It enables the amplification of specific DNA sequences, making it possible to generate a large amount of DNA from a tiny sample. PCR has revolutionized genetics by enabling the detection of genetic variations, gene expression analysis, disease diagnosis, and much more.

The growing product launches are one of the significant factors that propel the segment expansion. For instance, in August 2022, the real-time polymerase chain reaction (RT-PCR) monkeypox test was introduced by GenScript USA for use in research labs. The kit was created in collaboration with Anbio Biotechnology and provided to diagnostic centers and suppliers of medical equipment for use in studies to find the monkeypox virus.

Application Insights

The oncology segment is expected to dominate the market during the forecast period. The segment expansion is attributed to the increasing prevalence of cancer across the globe. According to the data given by the Pan American Health Organization, Americas region would rise by 57%, reaching roughly 6.23 million by 2040. As the field of oncology continues to embrace genomic insights, DNA diagnostics play a critical role in tailoring cancer treatment to the individual's genetic makeup. This personalized approach improves treatment outcomes, reduces adverse effects, and fosters advancements in precision medicine for cancer patients. The integration of DNA diagnostics into oncology has the potential to revolutionize cancer care and management. Thereby, driving the segment growth.

End-user Insights

The diagnostic center segment is expected to hold the largest market share over the forecast period. Diagnostic centers leverage DNA diagnostics to provide personalized medicine solutions. By analyzing an individual's genetic makeup, diagnostic centers can offer insights into disease risks, treatment responses, and drug interactions, helping healthcare providers tailor treatments to individual patients.

Regional Insights

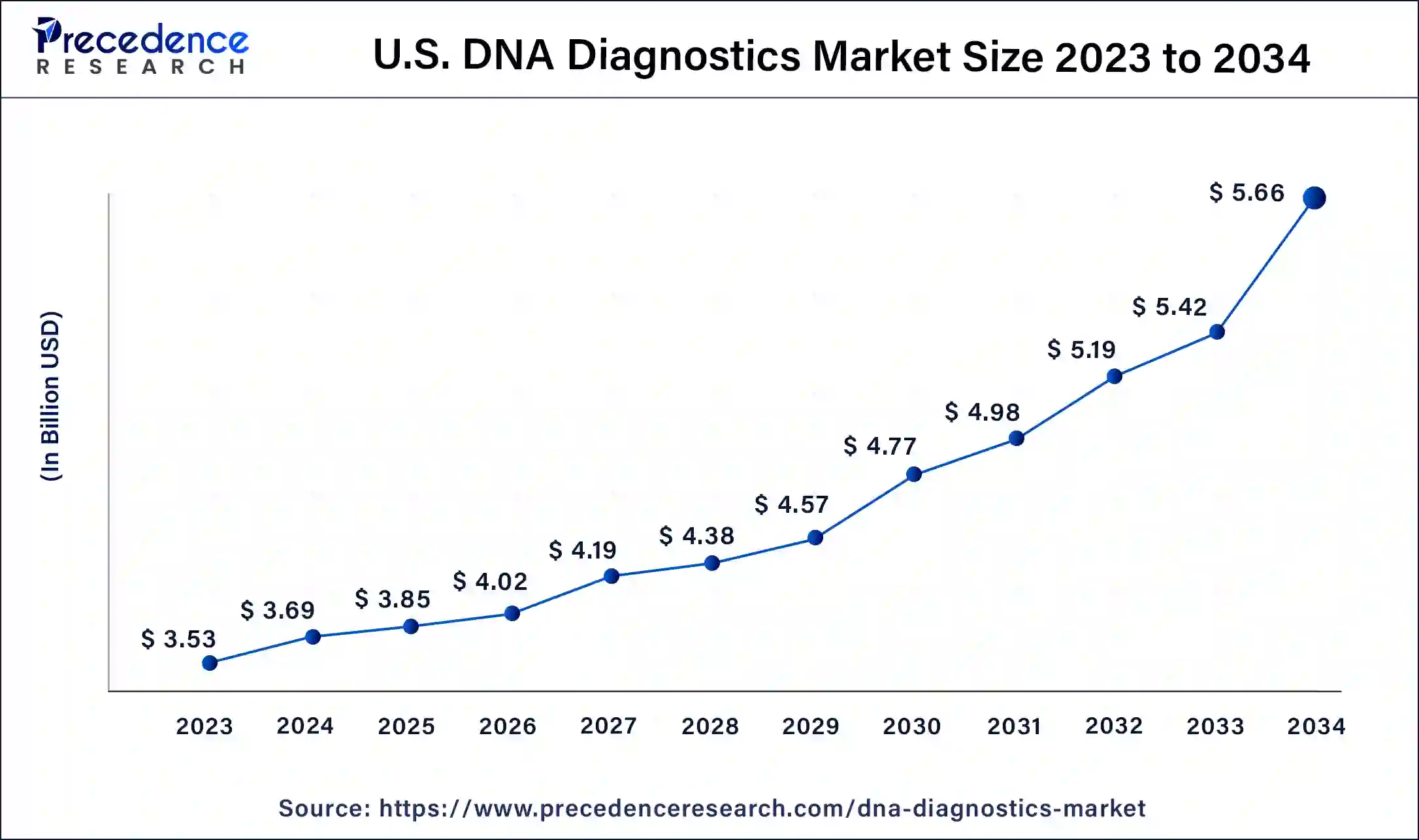

U.S. DNA Diagnostics Market Size and Growth 2026 to 2035

The U.S. DNA diagnostics market size is exhibited at USD 4.40 billion in 2025 and is projected to be worth around USD 6.95 billion by 2035, poised to grow at a CAGR of 4.68% from 2026 to 2035.

North America is expected to dominate the market over the forecast period.The region's large population, access to healthcare services, and high awareness of genetic testing contribute to a robust demand for DNA diagnostics. The market is expected to continue growing due to advancements in genetic technologies and increasing applications of DNA testing. Additionally, North America has a relatively high prevalence of genetic disorders and diseases such as cancer, cardiovascular diseases, and neurodegenerative conditions. This drives the demand for genetic testing to identify risks, facilitate early detection, and guide personalized treatment strategies. According to the data given by the Alzheimer's Association, more than 6 million Americans have Alzheimer's disease. This figure is anticipated to increase to around 13 million by 2050. Alzheimer's disease and other dementias will cost the country $345 billion in 2023. These expenses may reach about $1 trillion by 2050. Therefore, the aforementioned stats are expected to flourish the market expansion in the region during the forecast period.

U.S. Market Trends

The DNA diagnostics market in the U.S. is growing due to increasing demand for personalized medicine, early disease detection, and advanced genomic testing technologies. Additionally, supportive healthcare infrastructure, rising awareness of genetic testing, and strong investment in biotechnology and research are accelerating market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The market's expansion is driven by a large and diverse population, rising healthcare expenditure, and increasing demand for advanced medical technologies. Additionally, cancer is a major concern in Asia Pacific, and DNA diagnostics play a crucial role in early detection, treatment planning, and monitoring of cancer patients. Advances inDNA sequencingtechnologies have facilitated the identification of genetic mutations associated with various cancers. According to uro-oncology specialists addressing the Society of Genitourinary Oncologists (SOGO) annual conference, prostate cancer has overtakenbreast cancer as the second most frequent malignancy in India's major cities including Bengaluru, Delhi, and Pune. Thus, this is expected to drive the market growth in the region.

India Market Trends

India's DNA diagnostics market is driven by rising awareness of genetic testing, increasing prevalence of hereditary and chronic diseases, and growing demand for early disease detection. Additionally, improvements in healthcare infrastructure and greater accessibility of advanced genomic technologies are driving the adoption of DNA-based diagnostics across the country.

Top Companies in the DNA Diagnostics Market & Their Offerings

- Illumina Inc.: Illumina Inc. offers comprehensive next-generation sequencing (NGS) platforms, including sequencers (such as NextSeq, NovaSeq, MiSeq), consumables, and sophisticated informatics software to determine vast amounts of genetic data, allowing precise diagnosis and personalized treatments for genetic diseases, cancer, and reproductive health.

- Cepheid.: Cepheid provides fully automated DNA and RNA diagnostic systems (known as the GeneXpert platform) and even a broad menu of single-use, cartridge-driven real-time PCR tests which detect pathogens and genetic markers for abroad range of diseases.

- Hologic, Inc.: Hologic, Inc. offers scalable systems for labs, highly automated, plus AI-driven tools for cytology (Genius System) and even digital pathology, ensuring precision along with quality in detecting pathogens and genetic markers.

DNA Diagnostics Market Companies

- Thermo Fisher Scientific Inc.

- QIAGEN

- Beckman Coulter Inc.

- Agilent Technologies Inc.

- GE Healthcare

- Illumina Inc.

- Cepheid.

- Hologic, Inc.

- Siemens HealthcareGmbH

- F. Hoffmann-La Roche

- Abbott

- Bio-Rad Laboratories, Inc.

DNA Diagnostics Market Recent Developments

- In June 2023,Igenity BeefXDairy, a cutting-edge genetic test for beef-on-dairy calves, was introduced. The new Igenity BeefXDairy test gives producers insight into important traits like carcass quality, average daily gain, and the Igenity Terminal Index, which can then be used to market the calf's potential for growth to buyers.

Segments Covered in the Report

By Product Type

- Instruments

- Reagents

- Service & Software

By Technology

- PCR

- Microarray

- In-situ Hybridization

- Sequencing Technology

- Mass Spectrometry

- Others

By Application

- Oncology

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Others

- Infectious Disease

- Hepatitis B Virus

- Hepatitis C Virus

- HIV

- TB

- Chlamydia Trachomatic and Neisseria Gonorrhea (CT/NG)

- HPV

- Methiciline Resistant Staphylococcus Aureus (MRSA)

- Others

- Myogenic Disorder

- Clinical Diagnostic Confirmation

- Prenatal Diagnostics

- Pre-implantation Diagnostics

- Others

By End-user

- Point of Care

- Diagnostic Center

- Self Testing/OTC

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting