What is the Antipruritic Market Size?

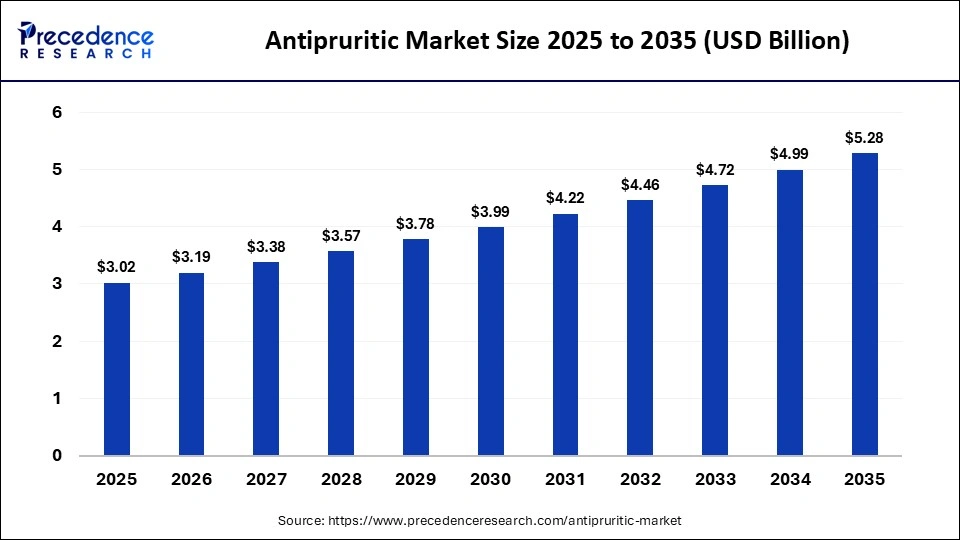

The global antipruritic market size accounted for USD 3.02 billion in 2025 and is predicted to increase from USD 3.19 billion in 2026 to approximately USD 5.28 billion by 2035, expanding at a CAGR of 5.74% from 2026 to 2035. This market is growing due to the rising prevalence of skin disorders, allergies, and chronic pruritus.

Market Highlights

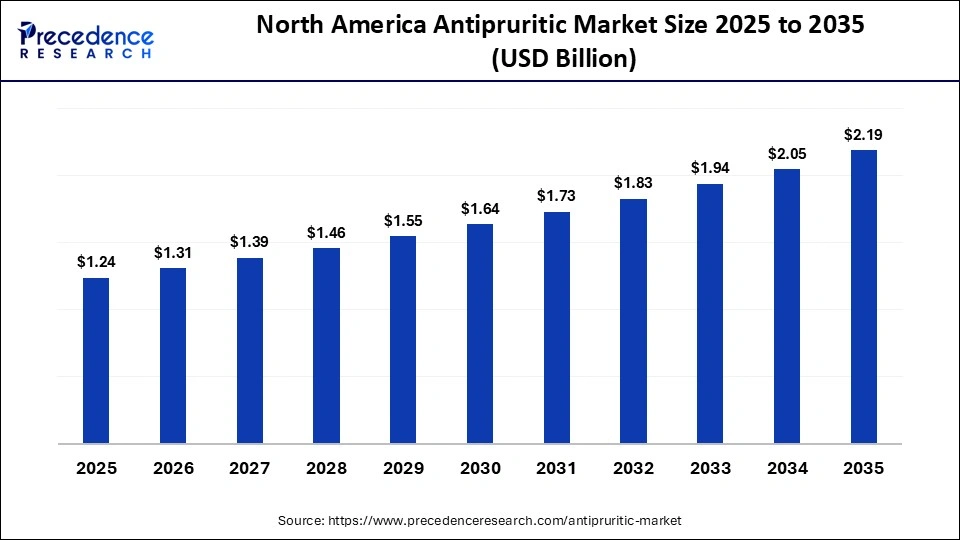

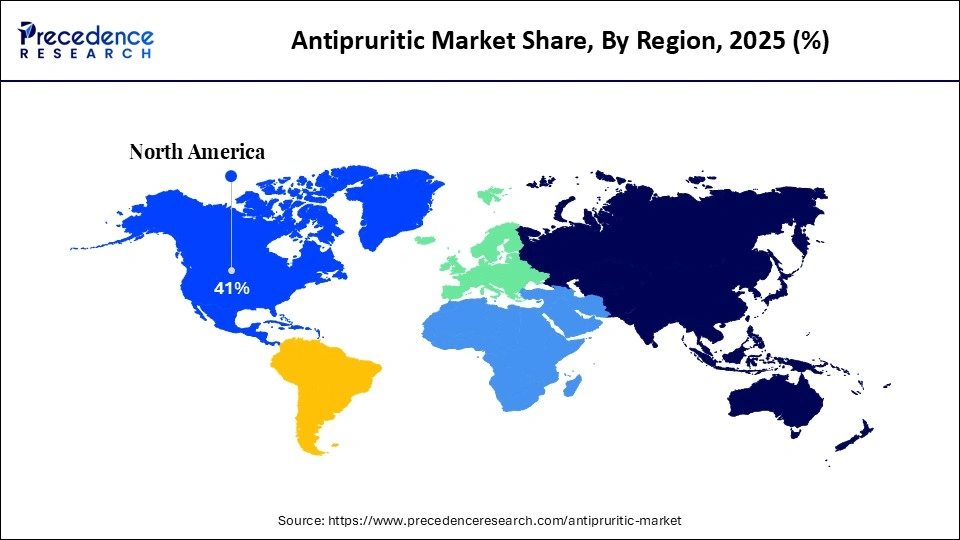

- North America dominated the global market with a major market share of 41% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By drug, the corticosteroids segment held the biggest market share in 2025.

- By drug, the antihistamines segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By disease, the atopic dermatitis segment contributed the highest market share in 2025.

- By disease, the allergic contact dermatitis segment is expected to grow at a strong CAGR between 2026 and 2035.

- By route of administration, the topical route segment held the largest share of the market in 2025.

- By route of administration, the oral segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By distribution channel, the hospital pharmacies segment generated the biggest market share in 2025.

- By end user, the online pharmacies segment is expected to expand at the fastest CAGR between 2026 and 2035.

Why is the Antipruritic Market Gaining Momentum?

The antipruritic market is experiencing significant growth, driven by rising awareness of skin health issues and the prevalence of skin conditions like dermatitis, eczema, psoriasis, and allergic reactions. Itching-related disorders in all age groups are being exacerbated by increased exposure to irritants, changing lifestyles, and rising pollution levels. Furthermore, the market is expanding due to the easy access to over-the-counter antipruritic lotions, creams, and oral medications, as well as improvements in dermatological formulations. Growing access to healthcare in developing nations and rising demand for quick-acting, long-lasting itch relief products are also driving market expansion.

How is Artificial Intelligence Transforming the Antipruritic Market?

Artificial intelligence is transforming the antipruritic market by enabling more accurate diagnosis of skin conditions, supporting personalized treatment recommendations, and accelerating the development of new product formulations. In product development, AI accelerates formulation optimization and ingredient screening, supporting the creation of safer and more effective products, including steroid-free and combination therapies. Additionally, AI-driven analytics help businesses improve patient outcomes and product performance by supporting targeted marketing and demand forecasting.

Antipruritic Market Trends

- Rising demand for over-the-counter (OTC) antipruritic products driven by easy accessibility and growing self-medication trends.

- Increasing preference for natural and herbal formulations, fueled by concerns over the long-term side effects of steroid-based treatments.

- Growing adoption of combination therapies that provide anti-itch, anti-inflammatory, and moisturizing benefits within a single product.

- Expansion of dermatology and tele-dermatology services, improving early diagnosis and extending treatment access to a wider patient population.

- Ongoing product innovation across creams, gels, sprays, and foams to enable faster absorption and longer-lasting itch relief.

- Heightened focus on pediatric- and geriatric-specific formulations, designed to meet the needs of sensitive and aging skin.

Future Market Outlook

- Rising prevalence of chronic skin disorders such as eczema, psoriasis, and atopic dermatitis worldwide is expected to create opportunities in the market.

- Untapped potential in emerging markets due to improving healthcare infrastructure and awareness.

- Growing scope for non-steroidal and biologic-based antipruritic solutions with fewer adverse effects.

- Increasing demand for personalized and targeted itch-relief treatments based on skin type and condition.

- Opportunity for digital marketing and e-pharmacy distribution channels to enhance product reach.

- Strong potential for R&D investments focused on long-acting, fast-acting, and multifunctional antipruritic formulations.

Government Initiatives Supporting the Antipruritic Market

The antipruritic market is benefiting from government initiatives that promote dermatological care and skin health. Public health programs are improving access to treatments by emphasizing early diagnosis, timely intervention, and inclusion of dermatology medications in essential drug lists. Market adoption is further supported by increased funding for healthcare infrastructure, awareness campaigns on allergies and chronic skin conditions, and policies encouraging affordable generic medications. Additionally, regulations promoting the availability of OTC drugs and domestic pharmaceutical production are helping to drive overall market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.02 Billion |

| Market Size in 2026 | USD 3.19 Billion |

| Market Size by 2035 | USD 5.28 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug, Disease, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Drug Insights

What made corticosteroids the dominant segment in the antipruritic market?

The corticosteroids segment dominated the market with the largest share in 2025, driven by its potent anti-inflammatory and immunosuppressive properties, making it very effective for moderate to severe pruritus. For ailments like psoriasis, chronic dermatitis, and eczema, these medications are frequently prescribed. They are now a first-line treatment option due to their quick symptom relief and demonstrate clinical effectiveness. Availability in a variety of formulations and strengths, such as topical and oral, further aided in their broad use. The segment's dominance is further strengthened by well-established treatment guidelines and strong physician familiarity.

The antihistamines segment is expected to grow at the fastest CAGR in the coming years, driven by an increase in urticaria, seasonal allergies, and allergic skin reactions. Demand for antihistamines is being driven by consumers' growing preference for non-steroidal treatments. Long-term use is being encouraged by improved safety profiles, particularly of second-generation antihistamines. In both urban and rural markets, easy OTS availability and affordability are increasing access. The growth of this segment is also driven by an increase in allergies linked to pollution.

Disease Insights

Why did the atopic dermatitis segment dominate the antipruritic market?

The atopic dermatitis segment dominated the market in 2025 because of its chronic nature and high prevalence worldwide. Regular disease flare-ups necessitate ongoing itching control, which keeps antipruritic medications in high demand. The segment's leading position is further reinforced by rising diagnosis rates in both adults and children. Early treatment initiation has resulted from increased awareness among patients and physicians. Furthermore, increasing treatment options, such as over-the-counter and prescription products, for this disease are expected to sustain the long-term dominance of the segment.

The allergic contact dermatitis segment is expected to grow at the fastest CAGR in the upcoming period, driven by increasing exposure to allergens found in industrial chemicals, personal care products, and cosmetics. Rising occupational skin disorders and rapid industrialization are key contributors to segmental growth. Greater consumer awareness of skin sensitivity and early symptom recognition, combined with urban lifestyle factors, is leading to earlier treatment adoption. Additionally, growing demand for fast-acting antipruritic products to provide immediate relief is further supporting the segment's expansion.

Route of Administration Insights

Why did the topical route segment dominate the antipruritic market?

The topical route segment dominated the market in 2025 because of its ability to deliver targeted relief directly at the affected site. Topical formulations offer a faster onset of action with a lower risk of systemic side effects, making them a preferred option for both patients and clinicians. High patient compliance, driven by ease of application, further supported demand. Additionally, availability in multiple formats, such as creams, gels, lotions, and ointments, enhanced usability and convenience. The segment's leadership is also reinforced by physicians' preference for localized therapy in managing pruritic conditions.

The oral segment is expected to grow at the fastest CAGR in the coming years, driven by its increasing use in the treatment of severe, widespread, or persistent pruritus. Oral antihistamines and corticosteroids are effective in managing systemic symptoms, particularly in allergy-related itching conditions. Rising prescriptions reflect the growing incidence of allergy-induced pruritus, while once-daily dosing improves patient adherence. Additionally, the expanding availability of safer and better-tolerated oral formulations is further supporting the segment's growth.

Distribution Channel Insights

How did the hospital pharmacies segment lead the antipruritic market?

The hospital pharmacies segment led the market while holding the largest share in 2025 due to the high volume of patients seeking treatment for moderate to severe pruritic conditions that require physician supervision and prescription-based therapies. Hospitals serve as primary centers for the diagnosis and management of complex skin disorders, allergic reactions, and systemic diseases, driving consistent demand for both topical and oral antipruritic medications.

Under medical supervision, these pharmacies guarantee access to prescription-strength drugs. Patients' reliance on this channel is supported by high levels of trust in hospital-based dispensing. The accessibility of specialized dermatological treatments reinforced dominance even more. Distribution efficiency was improved by integration with inpatient and outpatient care services.

The online pharmacies segment is expected to grow at the fastest CAGR during the projection period, driven by increasing digital adoption and consumer preference for convenience. Patients are increasingly opting for home delivery and easy access to OTC antipruritic products, while competitive pricing and discounts attract cost-conscious buyers. The rapid expansion of tele-dermatology services is further boosting online prescription fulfillment. Additionally, rising internet penetration in emerging markets is accelerating the adoption of online pharmacy platforms.

Regional Insights

How Big is the North America Antipruritic Market Size?

The North America antipruritic market size is estimated at USD 1.24 billion in 2025 and is projected to reach approximately USD 2.19 billion by 2035, with a 5.85% CAGR from 2026 to 2035.

What made North America the dominant region in the antipruritic market?

North America dominated the antipruritic market by holding a major share in 2025. The region's leadership in the market is attributed to its well-established healthcare infrastructure, high patient awareness, and widespread access to prescription and OTC treatments. The region has a high prevalence of dermatological conditions, allergies, and chronic pruritus, driving consistent demand for antipruritic therapies. Additionally, favorable reimbursement policies, early adoption of new drug formulations, and strong presence of leading pharmaceutical companies have reinforced North America's market leadership.

What is the Size of the U.S. Antipruritic Market?

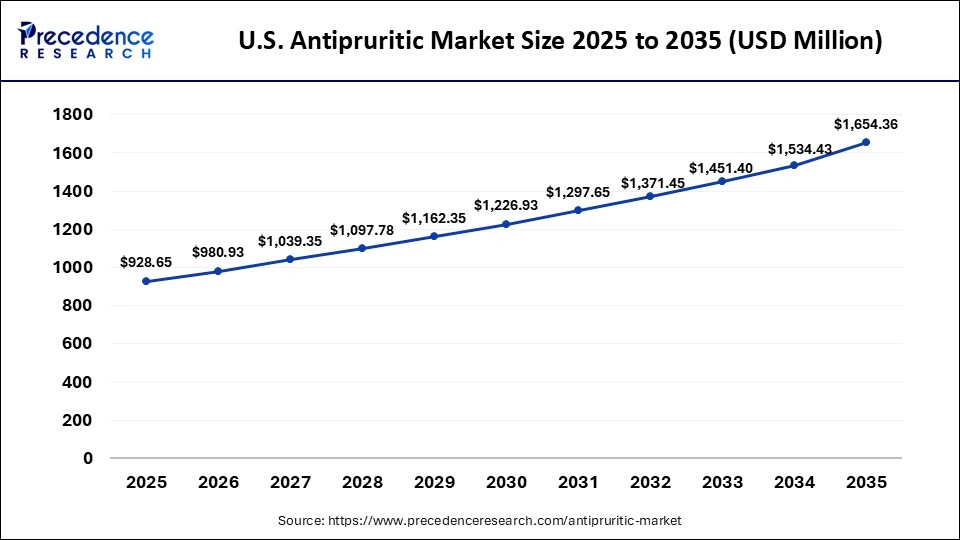

The U.S. antipruritic market size is calculated at USD 928.65 million in 2025 and is expected to reach nearly USD 1,654.36 million in 2035, accelerating at a strong CAGR of 5.94% between 2026 and 2035.

U.S. Antipruritic Market Trends

The market in the U.S. is driven by the high incidence of long-term skin disorders like psoriasis, allergic dermatitis, and eczema, as well as high awareness and early diagnosis rates. Timely treatment adoption is supported by sophisticated healthcare infrastructure and broad access to dermatology specialists. The presence of leading pharmaceutical firms and ongoing product innovation support market expansion. Furthermore, nationwide patient access to antipruritic treatments is being enhanced by high OTC product penetration and growing tele dermatology services.

How is the opportunistic rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest CAGR throughout the forecast period because skin allergies and illnesses linked to pollution are becoming more common. Increasing healthcare access and improving dermatology services are driving market expansion. The need for efficient skin care products is rising as the middle class grows. Pruritic conditions are getting worse due to rapid urbanization and lifestyle changes. Regional development is also being aided by a growing pharmaceutical distribution network.

India Antipruritic Market Trends

In India, the market is growing due to the increasing incidence of skin infections, allergies, and climate-related pruritic conditions. The need for itch-relieving products is growing because of pollution, urbanization, and lifestyle changes. Enhancing access to healthcare, growing pharmacy networks, and raising awareness of skin health are all factors contributing to market expansion. Furthermore, widespread adoption in both urban and rural areas is accelerated by the high demand for reasonably priced over-the-counter and herbal formulations.

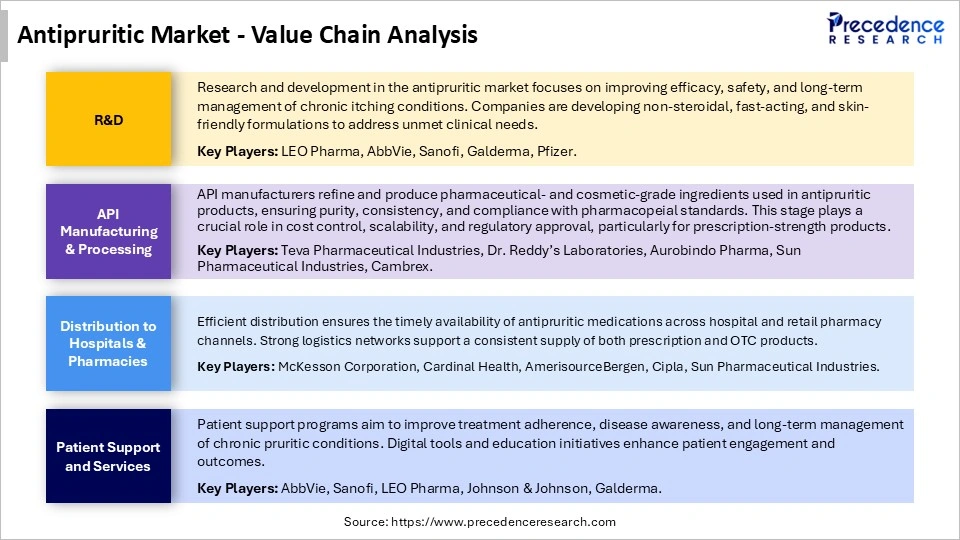

Antipruritic Market Value Chain Analysis

Who are the Major Players in the Global Antipruritic Market?

The major players in the antipruritic market include AbbVie Inc, Pfizer Inc, Sanofi S.A., Johnson & Johnson Services, Inc, Eli Lilly and Compan, Novartis AG, Amgen Inc, Incyte Corporation, Cara Therapeutics, Inc., Bayer AG, Regeneron Pharmaceuticals, Inc., Astellas Pharma Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Viatris Inc., Cipla Ltd., Glenmark Pharmaceuticals Ltd., Lupin Ltd., and Trevi Therapeutics, Inc.

Recent Developments

- In March 2025, Crown Laboratories introduced Sarna Eczema Relief Skin Protectant Lotion with 2% colloidal oatmeal to soothe eczema-prone and itchy skin. The product supports daily skin comfort, enhances hydration, and expands the Sarna antipruritic portfolio for OTC consumers.(Source: prnewswire.com)

- In September 2024, Sarna Calm + Cool Anti-Itch Lotion was recognized with a Self Healthy Beauty Award, highlighting its efficacy in soothing sensitive, itchy skin and reinforcing brand credibility among dermatologists and consumers.(Source: prnewswire.com)

- In March 2025, Codex Labs launched the Ditch the Itch collection, including plant-based topicals and a supplement aimed at managing eczema flare-ups and itch through a holistic skin-and-gut approach, broadening antipruritic solution options.(Source: medestheticsmag.com)

Segments Covered in the Report

By Drug

- Corticosteroids

- Antihistamines

- Local Anaesthetics

- Immunosuppressants

- Others

By Disease

- Atopic Dermatitis

- Allergic Contact Dermatitis

- Urticaria

- Psoriasis

By Route of Administration

- Oral

- Parenteral

- Topical

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting