What is the Antitussive Drugs Market Size?

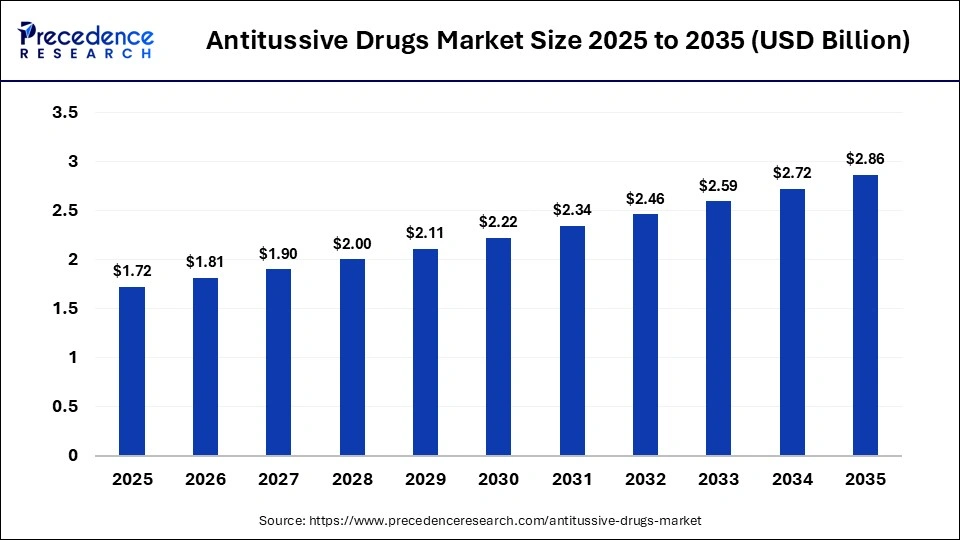

The global antitussive drugs market size was calculated at USD 1.72 billion in 2025 and is predicted to increase from USD 1.81 billion in 2026 to approximately USD 2.86 billion by 2035, expanding at a CAGR of 5.23% from 2026 to 2035.The market is growing due to the rising prevalence of acute and chronic respiratory disorders, an ageing population, and increasing preference for over-the-counter drugs due to convenience to consumers.

Market Highlights

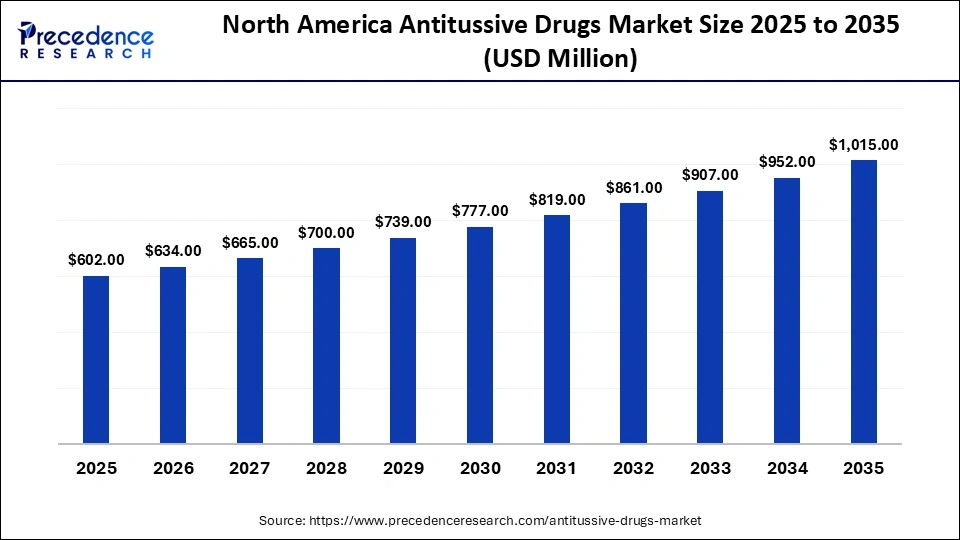

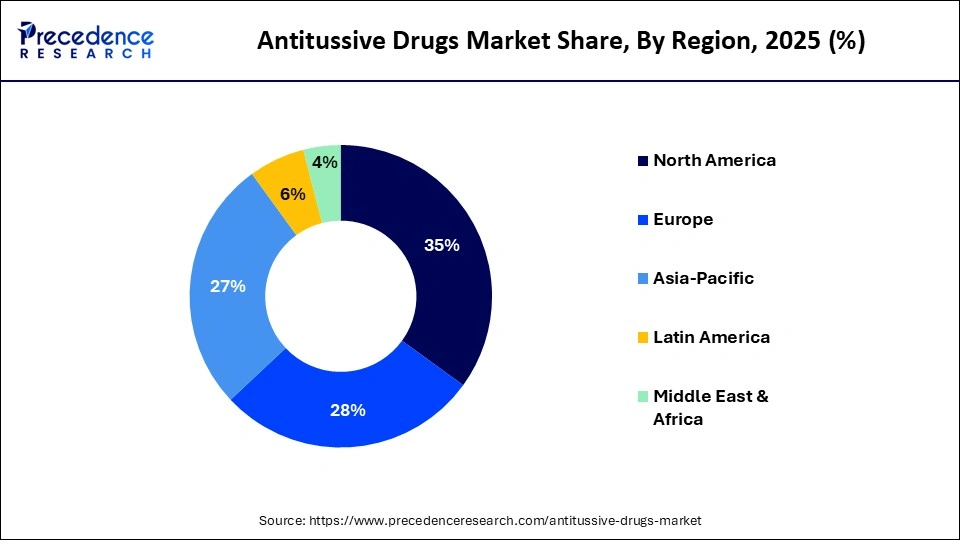

- North America dominated the antitussive drugs market in 2025, with approximately 35%.

- Asia Pacific is expected to be the fastest-growing region between 2026 and 2035.

- By drug class type, the non-opioid antitussives segment held a dominant position in the market with a share of approximately 38 % in 2025.

- By drug class type, the novel/emerging agent segment is expected to grow at the fastest share of 14 % during the forecast period.

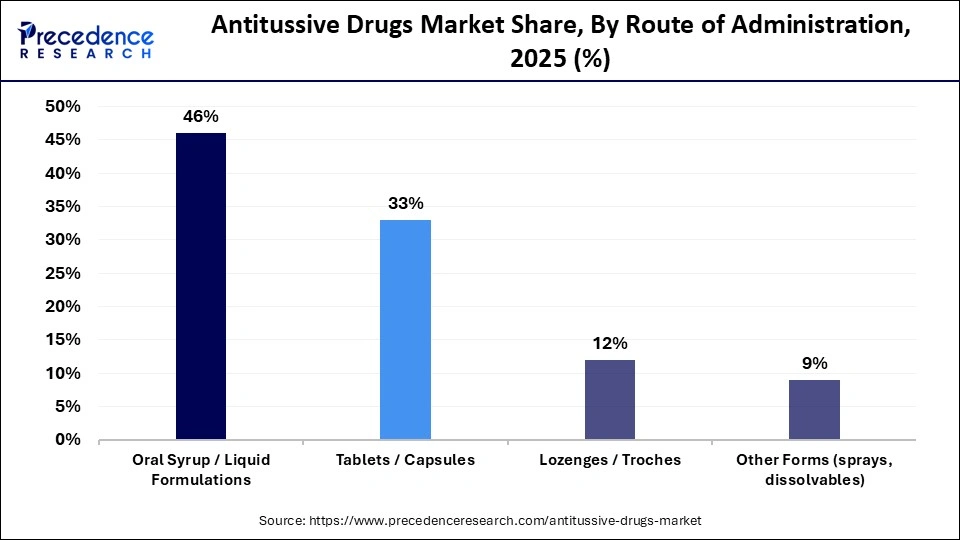

- By route of administration, the oral syrup/liquid formulations segment dominated the market with a share of approximately 46 % in 2025.

- By route of administration type, the other forms segment is expected to show the fastest growth over the forecast period.

- By distribution channel type, the over-the-counter (OTC) retail pharmacies segment led the global antitussive drugs market with a share of approximately 52% in 2025.

- By distribution channel type, the online pharmacies/e-commerce segment is expected to witness the fastest growth in the market with a share of 14 % over the forecast period.

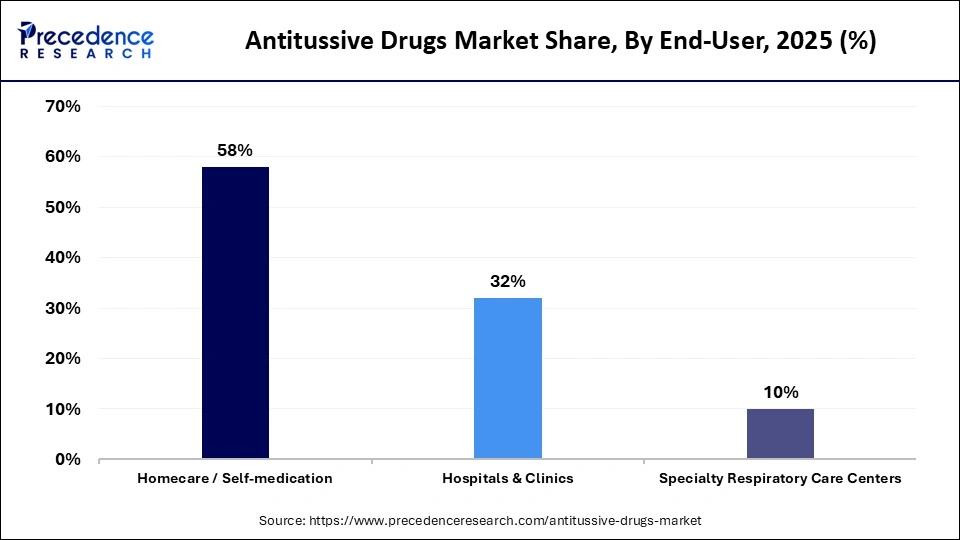

- By end-user, the homecare/self-medication segment registered its dominance over the global market with a share of approximately 58% in 2025.

- By end-user, the speciality respiratory care centres segment is expected to expand rapidly in the market in the coming years.

- By indication type, the acute cough segment held a major revenue share of approximately 49 % in the market in 2025.

- By indication type, the post-infectious cough segment is expected to witness the fastest growth in the antitussive drugs market over the forecast period.

Market Overview

The global antitussive drugs market comprises pharmaceuticals used to suppress coughing associated with respiratory conditions such as acute cough, chronic cough, upper respiratory infections, bronchitis, and other lower airway irritations. Drugs include opioid and non-opioid antitussives, combination cough formulations, and emerging novel agents. The market spans OTC and prescription products administered orally, in syrups, tablets, and lozenges. Growth is driven by high respiratory disease incidence, seasonal cough peaks, awareness of OTC remedies, and R&D into safer, non-sedative antitussive options.

How AI Is Transforming the Antitussive Drugs Market?

Artificial intelligence is changing how antitussive and other drugs are discovered and developed by analyzing large datasets of chemical and clinical data. AI can predict suitable molecules at an early research stage to reduce the time and cost of research. Pharma companies are using AI to improve clinical trial design by selecting suitable patient groups and predicting response patterns more accurately. While AI does not replace human expertise, it is becoming a key partner in finding and delivering antitussive and other therapeutic drugs more efficiently.

What are the Antitussive Drugs Market Trends?

- Rising prevalence of acute and chronic respiratory disorders like asthma, COPD, flu, and post-infection cough becomes more common, which demands a regular need for cough-relief medicines across all age groups.

- Use of non-opioid antitussive drugs is increasing as codeine-based products have strict regulations, and doctors and patients prefer safer options for everyday treatment.

- Over-the-counter antitussives is most used category because many patients treat mild cough at home, especially during seasonal infections, reducing the need for hospital visits.

- Online pharmacies are playing a bigger role in antitussive sales, as consumers prefer easy access, home delivery, and price comparison, encouraging manufacturers to strengthen digital distribution channels.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2026 | USD 57.92 Billion |

| Market Size by 2035 | USD 2.86Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Class, Route of Administration, Distribution Channel, End-User, Indicationand Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Drug Class Insights

Why Non-opioid Antitussives Segment Dominated the Antitussive Drugs Market?

The non-opioid antitussives segment held a dominant position in the market with a share of approximately 38% in 2025 because of safety concerns and strict regulations around opioid-based antitussives such as codeine. Non-opioid drugs like benzonatate and dextromethorphan are widely accepted because of their effectiveness, low risk, and suitability for both adult and paediatric use. Physicians strongly prefer non-opioids for long-term cough treatment due to their safety. In addition, over-the-counter availability further supports demand in the market.

The novel/emerging agent segment is expected to expand rapidly in the market in the coming years, because of unmet needs in chronic cough and respiratory disorders, where conventional medicines often fail to provide consistent or long-lasting relief. Pharmaceutical companies are investing in new mechanisms of action, including P2X3 receptor antagonists.

Route of Administration Insights

How the Oral Syrup/Liquid Formulations Segment Dominated the Antitussive Drugs Market?

The oral syrup/liquid formulations segment held the largest revenue share of approximately 46% in the market in 2025 because of its ease of use among children and elderly patients, and individuals who have difficulty swallowing tablets. Liquid formulation allows faster symptom relief, which makes them preferred choice for cough treatment. These products are widely available as over-the-counter medicines, which further supports high sales volumes.

The other forms segment is expected to grow with the highest CAGR in the market during the forecast period because of rising demand for targeted cough relief options that act locally in the throat and are convenient to use. Sprays offer quick action and are often used for dry cough, while dissolvable tablets are used by patients seeking portable and water-free dosing.

Distribution Channel Insights

Why the Over-the-Counter (OTC) Retail Pharmacies Segment Dominated the Antitussive Drugs Market?

The over-the-counter (OTC) retail pharmacies segment led the global market with a share of approximately 52% in 2025 because cough treatment is short-term and often does not require hospital visits. Patients prefer buying cough syrups, tablets, and lozenges directly from nearby pharmacies for quick relief. In both developed and developing regions, OTC pharmacies are the first point of contact for managing common respiratory symptoms.

The online pharmacies/e-commerce segment is expected to witness the fastest growth in the market over the forecast period, because of consumer preference for home delivery. Consumers managing recurring cough or chronic respiratory conditions can refill medicines by ordering online for convenience and price comparison. Online platforms are now available in remote areas, encouraging consumers to adopt online pharmacies.

End-user Insights

What Made the Homecare/Self-medication Segment Lead the Antitussive Drugs Market?

The homecare/self-medication segment dominated the global market with a share of approximately 58% in 2025 because most cough conditions are mild to moderate and can be managed at home using OTC medications. Consumers prefer treating symptoms without clinical intervention unless the condition worsens. Children and elderly patients also rely on homecare formulations such as syrups. Cough medications are easily available at retail pharmacies and online pharmacies, which makes it convenient to treat a cough at home.

The speciality respiratory care centres segment is expected to witness the fastest growth in the market over the forecast period because of the increasing prevalence of chronic cough, asthma, COPD, and chronic respiratory disorders requires special care and treatment and may not respond well to standard treatments. Patients with persistent symptoms are being referred to a specialist for advanced evaluation and targeted therapy.

Indication Insights

Why Acute Cough Dominated the Antitussive Drugs Market in 2025?

The acute cough segment registered its dominance over the global market with a share of approximately 49% in 2025 because acute cough is one of the most common symptoms related to flu, cold, and seasonal infections. These conditions affect all age groups and require short-term symptom relief rather than long-term therapy. Therefore, patients frequently rely on OTC antitussive syrups, lozenges, and tablets for cough management.

The post-infectious cough segment is expected to gain the highest share of the market between 2026 and 2035, because many patients continue to experience a persistent cough even after respiratory infections have treated. Standard cough treatments often provide limited relief in such cases, leading to repeat medication use and physician consultations.

Regional Insights

How Big is the North America Antitussive Drugs Market Size?

The North America antitussive drugs market size is estimated at USD 20.45 million in 2025 and is projected to reach approximately USD 43.22 million by 2035, with a 7.77% CAGR from 2026 to 2035.

What Factors Made the North America Region the Dominant Region in the Market?

North America dominated the global antitussive drugs market with a share of approximately 35% in 2025. The region's dominance is supported by a high prevalence of respiratory conditions such as asthma, seasonal flu, chronic bronchitis, and post-viral cough. Strong awareness of early symptom management encourages widespread use of OTC cough medications such as syrup, tablets, and lozenges. Consumers are preferring self-medication for short-term respiratory symptoms. In addition, pharmaceutical companies have a strong presence in the region, ensuring consistent product availability. The region has a well-established healthcare infrastructure, high diagnosis rates, and a preference for branded formulations supports dominance of North

America in the antitussive market.

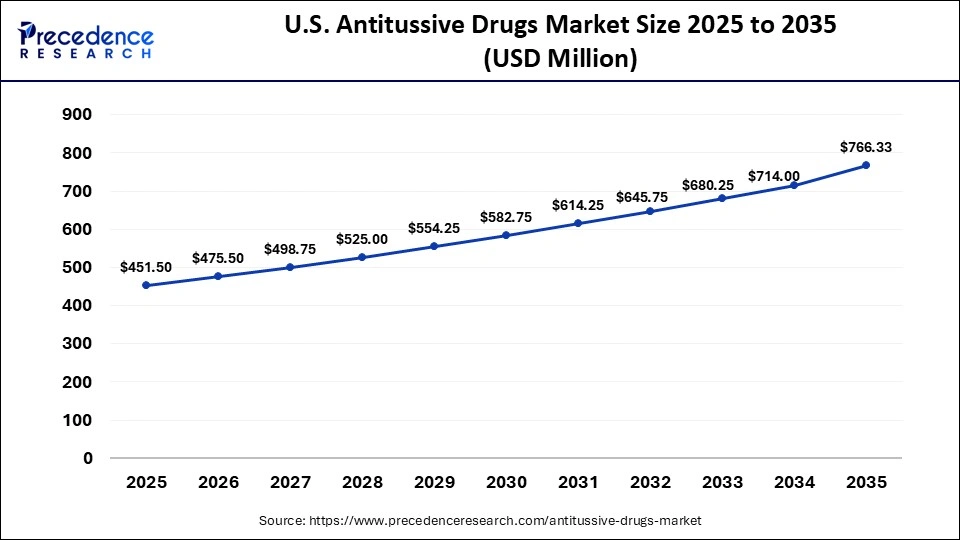

What is the Size of the U.S. Antitussive Drugs Market?

The U.S. antitussive drugs market size is calculated at USD 15.34 million in 2025 and is expected to reach nearly USD 32.63 million in 2035, accelerating at a strong CAGR of 7.84% between 2026 and 2035.

U.S. Antitussive Drugs Market Analysis

The U.S. represents the largest single-country market within North America, driven by consumers who strongly rely on OTC cough and cold products. Acute and post-infectious cough are common reasons for antitussive use, especially during flu seasons. Consumers prefer fast-acting syrups and tablets that can be purchased without prescriptions. High healthcare awareness, frequent physician consultations for persistent cough, and strong reliance on branded medicines. Retail pharmacies, supermarkets, and online pharmacies play an important role in the distribution and easy availability of medications.

Which Factors Influence the Fastest Growth of the Asia Pacific Market?

Asia Pacific is expected to grow at the fastest CAGR in the antitussive drugs market during the forecast period. Rapid urbanization, rising air pollution, smoking prevalence, and frequent seasonal infections are increasing the burden of respiratory symptoms across the region. Growing populations in countries such as China and India are driving volume demand for affordable cough treatments. In urban and semi-urban areas, healthcare is becoming more accessible, leading to higher diagnosis and treatment rates. Consumers are becoming more aware of OTC medications for cough management, and online pharmacies are expanding their access in remote areas, which supporting consumer's convenience.

India Market Trends

India's antitussive drugs market is driven by a high population, seasonal infections, and air pollution. Acute cough is the most common condition, which is treated by OTC syrup and combination formulations. Consumers mostly prefer liquid formulation due to its ease of use across all age groups. Retail pharmacies dominate distribution in urban regions, while online pharmacies attract younger consumers. Rising awareness of respiratory health and improved access to healthcare services are increasing diagnosis and treatment rates.

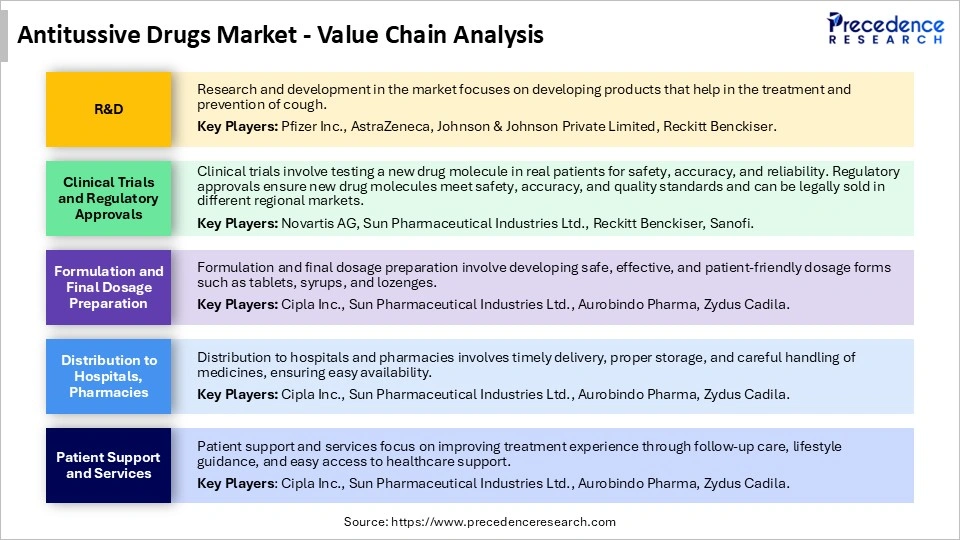

Antitussive Drugs Market Value Chain Analysis

Who are the Major Players in the Global Antitussive Drugs Market?

The major players in the antitussive drugs market include F. Hoffmann-La Roche Ltd. (Switzerland), Reckitt Benckiser (RB Health), Mylan N.V. (U.S.), Pfizer Inc., Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), GlaxoSmithKline plc (U.K.), Novartis AG (Switzerland), Sun Pharmaceutical Industries Ltd. (India), Amneal Pharmaceuticals LLC. (U.S.) Zydus Cadila (India) Aurobindo Pharma (India), Cipla Inc. (U.S.), Hikma Pharmaceuticals PLC (U.K.), AstraZeneca (U.K.) Johnson & Johnson Private Limited (U.S.) Intas Pharmaceuticals Ltd. (India) 3M (U.S.) Bayer AG (Germany) Ipca Laboratories Ltd. (India) Unique Pharmaceuticals Limited. (India), Aceto (U.S.)

Recent Developments

- In August 2025, PIQ-PHARMA LLC announces the commercial availability of Profitus (levodropropizine 6 mg/ml), supplied in 100 ml units. As a multi-action antitussive, Profitus targets the respiratory system to reduce cough frequency and intensity, supported by its supplemental antihistamine and anti-inflammatory properties.(Source : https://www.piqpharma.com)

- In July 2025, Cadila Pharmaceuticals Limited introduced Bilacad Dex Syrup to combat the rising prevalence of respiratory and allergic issues. This innovative fixed-dose combination features Bilastine, Dextromethorphan, and Phenylephrine. A key component, Dextromethorphan Hydrobromide (10 mg per 5ml), serves as a centrally acting antitussive that targets the brain's cough center to suppress dry, persistent coughs without compromising respiratory health. (Source: https://www.indianpharmapost.com)

Segments Covered in the Report

By Drug Class

- Non-opioid Antitussives

- Dextromethorphan

- Benzonatate

- Opioid Antitussives

- Codeine

- Hydrocodone

- Combination Cough Preparations

- Antitussive + Expectorant

- Antitussive + Antihistamine

- Novel/Emerging Agents

- New molecular entities

- Targeted receptor modulators

By Route of Administration

- Oral Syrup / Liquid Formulations

- Tablets / Capsules

- Lozenges / Troches

- Other Forms (sprays, dissolvables)

By Distribution Channel

- Over-the-Counter (OTC) Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies / E-commerce

- Others (clinics, specialty stores)

By End-User

- Homecare / Self-medication

- Hospitals & Clinics

- Specialty Respiratory Care Centers

By Indication

- Acute Cough (viral/common cold)

- Chronic Cough (COPD / asthma / GERD)

- Post-infectious Cough

- Other Indications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting